-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Appetite Fading Down A Hole

EXECUTIVE SUMMARY

- TOP CENTRAL BANKERS DELIVER HAWKISH MESSAGE AT JACKSON HOLE (BBG)

- ECB LACKING CONSENSUS FOR JUMBO RATE HIKE SOME OFFICIALS WANT (BBG)

- LIZ TRUSS WILL DECLARE CHINA AN OFFICIAL THREAT FOR THE FIRST TIME (THE TIMES)

- SICHUAN RESTORES MOST INDUSTRIAL POWER USE AFTER TWO-WEEK CRISIS (BBG)

- CHINESE PROVINCE BORDERING BEIJING EXPANDS COVID LOCKDOWN (BBG)

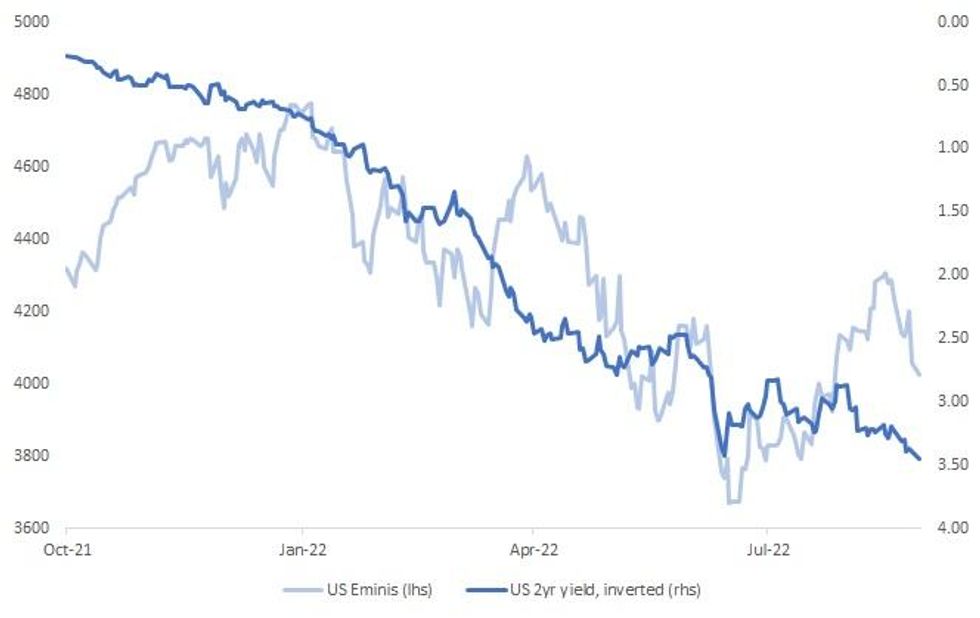

Fig. 1: U.S. E-Minis vs. U.S. 2-Year Yield, Inverted

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: British leadership frontrunner Liz Truss is considering cutting value added taxes (VAT) across the board by 5% if she becomes prime minister, to tackle the cost-of-living crisis, the Telegraph reported on Saturday. (RTRS)

FISCAL: Middle-income households will also need support with their energy bills this winter, Chancellor of the Exchequer Nadhim Zahawi said, as Britons face domestic power and gas bills this winter that will be almost triple last year’s level. (BBG)

FISCAL: The British government's options to support people facing sky-rocketing energy bills include handing loans to energy suppliers that could cut bills by up to 500 pounds ($587) a year, the Daily Telegraph newspaper reported on Saturday. (RTRS)

EUROPE

ECB: The European Central Bank (ECB) needs another significant interest rate hike in September and should hit the "neutral" level before the end of the year, French central bank chief Francois Villeroy de Galhau said on Saturday. (BBG)

ECB: European Central Bank Executive Board member Isabel Schnabel urged policy makers to act forcefully to bring stubbornly high inflation back under control and warned against retreating at the first sign that price pressures may ease. (BBG)

ECB: The European Central Bank needs to act forcefully and raise interest rates by at least a half-point next month to bring inflation back under control, according to Governing Council member Martins Kazaks. (BBG)

ECB: Some European Central Bank officials want to begin a debate by year-end on when and how to shrink the almost 5 trillion euros ($5 trillion) of bonds accumulated during recent crises. (BBG)

ECB: Some European Central Bank officials want a jumbo three-quarter-point hike in interest rates to be considered at next month’s meeting, though at present there doesn’t appear to be a majority backing such a move. (BBG)

GERMANY: Germany's gas storage facilities are filling up faster than planned, Economy Minister Robert Habeck said, giving hope that Europe's biggest economy could avoid acute gas shortages this winter. (RTRS)

FRANCE: French Prime Minister Elisabeth Borne is leaving open the possibility of a new tax on corporate “super profits” after lawmakers rejected the move last month. (BBG)

SWITZERLAND: The Swiss National Bank (SNB) sees no need to adjust its definition of price stability from its current target of "a rise in consumer prices of less than 2% per year", Chairman Thomas Jordan in a speech he is due to deliver in Jackson, Wyoming. (RTRS)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- S&P affirmed Austria at AA+; Outlook changed to Stable from Positive

- DBRS Morningstar upgraded Portugal to A (low); Trend changed to Stable from Positive

- DBRS Morningstar affirmed Slovakia at A (high); Trend changed to Negative from Stable

U.S.

FED: Federal Reserve Chair Jerome Powell on Friday pledged unconditionally to return inflation to 2%, saying this will likely mean taking policy into restrictive territory and holding it there for some time -- even if it means a slowing economy. (MNI)

FED: The Federal Reserve's next round of economic projections in September are likely to show more persistent inflation and higher unemployment to reflect the greater pain that will result from the central bank's aggressive monetary tightening campaign, former NY Fed President William Dudley told MNI. (MNI)

INFLATION: The Federal Reserve won’t be able to curb inflationary pressures because they are rooted in expansionary fiscal policy, according to a paper presented at the central bank’s annual Jackson Hole conference on Saturday. (BBG)

OTHER

CENTRAL BANKS: The world’s top central bankers delivered a stern and unified message on the need to curb inflation, declaring at Jackson Hole that it is broad based, here to stay and will require their forceful action. (BBG)

GEOPOLITICS: Australia's defence minister on Sunday said he aims to deepen defence ties with France, Germany and Britain during visits to the European partners this week, saying war in Ukraine has increased the importance of cooperation with likeminded nations. (RTRS)

UK/CHINA: China will be classed as a “threat” to national security for the first time under plans by Liz Truss for a tougher approach to Beijing. (The Times)

U.S/CHINA: Chinese state media outlet the Global Times on Saturday praised an agreement reached between Beijing and Washington over the auditing of U.S.-listed Chinese companies as a "symbolic case" and a "useful lesson" for both nations. (RTRS)

U.S./CHINA/TAIWAN: The passage of two U.S. warships on Sunday through international waters in the Taiwan Strait is "very consistent" with the U.S. "one China policy" and seeking a free and open Indo-Pacific, a White House official said. (RTRS)

CHINA/TAIWAN: Taiwan's defence ministry said it detected 23 Chinese aircraft and eight Chinese ships operating around Taiwan on Sunday, as Beijing continues its military activities near the island. (RTRS)

CHINA/JAPAN: Japan and China should be wary of risks as relations face “a new crossroads” amid “a new round of conflicts”, the Chinese envoy to Tokyo has warned. (SCMP)

BOJ: Bank of Japan Governor Haruhiko Kuroda said almost all of the country’s inflation is being caused by higher commodities prices and that the central bank must continue with easy monetary policy for now. (BBG)

JAPAN: Japan’s Economic Security Minister Sanae Takaichi says that she will be watching nations including China that could impact Japan’s economic security. (BBG)

AUSTRALIA: Australian Prime Minister Anthony Albanese has promised a shift to an era of “reform and renewal” for his government once the period of Covid-19 recovery is over, in a speech marking 100 days since he took the top job. (BBG)

AUSTRALIA: A new gauge of Australian advertised salaries showed a long-awaited acceleration in wage growth is taking hold as a tight labor market forces employers to pay more for staff. (BBG)

SOUTH KOREA: The Bank of Korea (BOK) must keep raising interest rates until the rate of inflation is in decline, but the central bank likely could not halt its tightening before the U.S. Federal Reserve, Governor Rhee Chang-yong said on Saturday. (RTRS)

SOUTH KOREA: South Korea’s main opposition picked a high-profile rival of the president as its new leader, adding to the government’s challenges as it struggles to build support after three months in office. (BBG)

BRAZIL: Brazil's main presidential candidates took their gloves off on Sunday and laid into each other in the first presidential debate for the October general election with accusations of corruption and threats to democracy. (RTRS)

RUSSIA: Baerbock warned that the war could drag on “for years” and pledged that the government in Berlin will continue to provide financial and military support to Ukraine “for as long as necessary.” (BBG)

RUSSIA: European Union foreign ministers meeting later this week, are unlikely to unanimously back a visa ban on all Russians, as would be needed to put in place such a ban, EU foreign policy chief Josep Borrell told Austria's ORF TV on Sunday. (RTRS)

IRAN: Iran said back-and-forth exchanges with the US over a European Union proposal to revive the nuclear deal will drag on into next month. (BBG)

ENERGY: Energy firms this week increased the number of U.S. oil and gas rigs but cut the count in August for the first time in 25 months, even as oil prices remain relatively high. (RTRS)

CHINA

ECONOMY/ENERGY: China’s southwestern province of Sichuan restored most power supplies for industries and businesses by Sunday noon after restrictions lasting about two weeks, according to state television. (BBG)

CREDIT/PROPERTY: Troubling news continues to flow from China's property market as a series of mainland developers report sharp slowdowns and even reversals from last year's robust first-half profits before the current crisis unfolded. As the government struggles to shore up the sector, the pain is starting to reveal in the banks' loan books, with potential implications for the health of the overall financial system. (Nikkei)

CORONAVIRUS: Another city near Beijing imposed a partial lockdown as Covid-19 infections climbed, taking extra precautions even as cases nationwide continued to ease. Chinese Province Bordering Beijing Expands Covid Lockdown. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9113% at 9:23 am local time from the close of 1.7067% on Friday.

- The CFETS-NEX money-market sentiment index closed at 47 on Friday vs 61 on Thursday.

PBOC SETS YUAN CE NTRAL PARITY AT 6.8698 MON VS 6.8486

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8698 on Monday, compared with 6.8486 set on Friday.

OVERNIGHT DATA

CHINA JUL INDUSTRIAL PROFITS YTD -1.1% Y/Y; JUN +1.0%

JAPAN JUN, F LEADING INDEX CI 100.9; FLASH 100.6

JAPAN JUN, F COINCIDENT INDEX CI 98.6; FLASH 99.0

AUSTRALIA JUL RETAIL SALES +1.3% M/M; MEDIAN +0.3%; JUN +0.2%

MARKETS

SNAPSHOT: Risk Appetite Fading Down A Hole

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 721.31 points at 27920.07

- ASX 200 down 136.162 points at 6967.898

- Shanghai Comp. down 7.595 points at 3228.628

- JGB 10-Yr future down 38 ticks at 149.24, yield 0.0bp at 0.211%

- Aussie 10-Yr future down 13 ticks at 96.280, yield down 12.3bp at 3.693%

- U.S. 10-Yr future -0-19+ at 116-32, yield up 6.9bp at 3.110%

- WTI crude up $1.07 at $94.13, Gold down $14.56 at $1723.58

- USD/JPY up 121 pips at Y138.85

- TOP CENTRAL BANKERS DELIVER HAWKISH MESSAGE AT JACKSON HOLE (BBG)

- ECB LACKING CONSENSUS FOR JUMBO RATE HIKE SOME OFFICIALS WANT (BBG)

- LIZ TRUSS WILL DECLARE CHINA AN OFFICIAL THREAT FOR THE FIRST TIME (THE TIMES)

- SICHUAN RESTORES MOST INDUSTRIAL POWER USE AFTER TWO-WEEK CRISIS (BBG)

- CHINESE PROVINCE BORDERING BEIJING EXPANDS COVID LOCKDOWN (BBG)

US TSYS: Tsys Cheapen In Asia; 2s Hit 15-Year Highs

Tsys are just off session lows, having cheapened throughout the Asia-Pac session as hawkish remarks from central bankers at Jackson Hole over the weekend took focus, adding to spillover from weakness observed in Tsys on Friday after Fed Chair Powell’s speech amidst a lack of meaningful macro headline drivers.

- Cash Tsys run 6.0-10.0bp cheaper across the curve, with 7s leading the way lower after driving Friday’s weakness. 2s are ~8.0bp cheaper, with 2-Year yields operating just shy of fresh 15-year highs above the 3.47% mark.

- TYU2 is -0-22+ at 116-28 on volume of ~95K lots, operating a shade above freshly-made two-month lows at typing.

- Looking ahead, ECB Chief Economist Lane will speak ahead of the release of Dallas Fed m’fing activity data, with Fedspeak from Fed Vice Chair Brainard (‘22 voter) due after.

- Note that markets in the UK will be closed for a bank holiday today.

JGBS: Futures Soften

JGB futures have extended their earlier weakness, printing -35 last, a little off worst levels as the impetus from the cheapening in core FI markets accelerated the move lower in futures during the Tokyo afternoon. Wider cash JGBs run 1.0-4.5bp cheaper across the curve, with 30s leading the way lower.

- Looking ahead, labour market data for July and 2-Year JGB supply will headline the domestic data docket for Tuesday.

AUSSIE BONDS: A Little Off Cheaps

ACGBs have edged lower as we have worked our way through the Sydney day, with better-than-expected retail sales data for July (+1.3% M/M vs. BBG median +0.3%) exacerbating pressure from a downtick in U.S. Tsys.

- Cash ACGBs run 8.0-17.5bp cheaper across the curve, with the 3- to 5-Year zone leading the way lower. YM is-18.5 and XM is -13.5, a little off their respective session lows. EFPs have narrowed a little, with the 3-/10-Year box steepening, while Bills run 4 to 21 ticks cheaper through the reds.

- Australian retail sales for July rose at the fastest pace in four months, with the ABS suggesting that households are continuing to spend “despite cost-of-living pressures”, raising expectations from some quarters re: further RBA tightening amidst resilient consumer spending.

- STIR market pricing re: tightening for the RBA’s Sep meeting have pared an earlier, limited blip higher, and now point to ~46bp of tightening at that meeting (an ~84% chance of a 50bp hike), a marginal change from the ~45bp observed prior to the domestic retail sales print for July.

- Looking ahead, July building approval data will headline the domestic data docket.

EQUITIES: China Outperforms, Tech Sensitive Markets Slump

Asia-Pac equities are in the red, with losses varying from less than -1% to close to -3%. This follows the Asia-Pac equities are in the red, with losses varying from less than -1% to close to -3%. This follows the sharp falls in US markets on Friday night, as US Fed Chair Powell struck a hawkish tone with markets (higher rates and for longer), which has filtered through into US fixed income moves today (US 2yr yield to 3.468%, +7bps, fresh highs since 2007) US futures are lower, albeit away from worst levels. Eminis were last at 4025, compared with earlier lows around 4005 (still -0.85% for the session). The 50-day MA comes in at 4005.38 at the moment.

- China and Hong Kong markets have outperformed on a relative basis. The Hang Seng is down around 0.65% currently, with the tech sub-index only down a touch (-0.05%). Positive spill-over from Friday's preliminary agreement, which will allow the US to audit China firms and possibly prevent delistings, has likely helped. The NASDAQ Golden Dragon China Index closed down 0.65% on Friday but outperformed the broader tech sell-off.

- The CSI 300 is down 0.40%, while the Shanghai Composite is around flat. China equities typically trade with a much lower beta to offshore moves, particularly on risk-off days. Still, the real estate sub-index remains a drag (off 1.88% for the CSI 300)

- The Kospi and Taiex are down sharply, by markets off by over 2.3%. This fits with the weaker tech lead from US markets on Friday night and the further gains in US yields today. The tech sector has shown strong sensitivity to US yield moves in 2022. The South Korean authorities have announced they will launch an investigation into short-selling of stocks this week.

- The ASX200 has also slumped, down over 2%. Outside of IT weakness, heavyweights in the materials and financial sub-sectors have fallen by slightly more than the headline index. Commodity prices have remained on the back foot (ex Oil). CMX copper is now off by 2%, iron ore down by 4% to $101.45/tonne. Gold is also down by 0.65% to $1727.

OIL: Higher In Asia As OPEC Production Cut Speculation Grows

WTI and Brent are $1.10 firmer apiece, building on a move off of their respective post-Powell lows observed on Friday.

- To recap Friday’s price action, both benchmarks reversed losses observed after Fed Chair Powell warned of “pain to households and businesses” ahead, ultimately closing ~$0.50 higher apiece amidst signs that OPEC may be considering output cuts.

- To elaborate on the latter, speculation over the prospect of output quota cuts continues to simmer as RTRS source reports have pointed to UAE support for such a measure, adding to recent, similar comments from the Saudi Energy Minister and the current OPEC President.

- A note that RTRS sources had suggested last week that OPEC production cuts would likely “coincide” with the return of Iranian crude to global supplies.

- On that topic, Iran will take until “at least” Sep 2 to respond to the latest U.S. reply re: a U.S.-Iran nuclear deal. Kpler and Vortexa have pointed to >70mn bbls of Iranian crude stored on vessels in various locations, ready for delivery upon a successful agreement.

- Elsewhere, Libya’s capital of Tripoli witnessed a surge in violence over the weekend (a result of ongoing political unrest as factions struggle for control of the capital), raising worry from some quarters re: the stability of recently-restored Libyan crude production (>1.2mn bpd).

GOLD: One-Month Lows In Asia As Dollar Rallies

Gold is ~$12/oz worse off to print $1,726/oz, sitting a little above freshly made one-month lows at writing after breaking below Friday’s trough earlier.

- The move lower comes amidst an uptick in nominal U.S. Tsy yields and the USD (DXY), with the latter hitting its own fresh cycle highs above the 109.00 mark.

- The precious metal remains firmly on track for a fifth consecutive lower monthly close, the longest such losing streak since 2018.

- To recap Friday’s price action, gold closed ~$20/oz lower following Fed Chair Powell’s hawkish (and relatively short) speech at the Jackson Hole Symposium, with participants focusing on comments re: keeping rates restrictive “for some time”.

- From a technical perspective, gold has broken initial support at $1,727.8/oz (Aug 22 low), exposing further support at $1,711.7/oz (Jul 27 low). Further declines will see gold approach support at $1,681.0/oz, the Jul 21 low and bear trigger. On the other hand, initial resistance is seen at ~$1,765.5/oz (20-Day EMA).

FOREX: USD Index To Fresh Cyclical Highs

The USD DXY index has touched fresh cyclical highs of close to 109.40. We have to go back to 2002 for higher levels. Dollar strength has been broad based against both the majors and Asian FX. JPY, GBP and NOK have been the weakest performers in the G10 space, although AUD is not far behind.

- Focus has rested on US yield moves, with the 2yr getting back to levels last seen in 2007 (+7% to 3.466% today). It has been slightly shaved on the day by the 10yr (+8bps to 3.12%).

- This remains a key source of USD support, while other cross asset signals have remained supportive as well. Asia Pac equities are a sea of red, with tech related bourses down sharply, while China has seen some outperformance in the equity space.

- US futures are in the red but away from worst levels (last 4030.25, versus earlier low of around 4005).

- The weaker equity backdrop has little to support the yen. USD/JPY is back to 138.60/65, highs back to July 21 of this year.

- GBP/USD is down to sub 1.1670, fresh lows going back to early 2020, while USD/NOK is back close 9.8200.

- Commodities are also weaker (ex Oil). This has weighed on AUD/USD, along with the factors outlined above. There is some support below 0.6850, with the strong retail sales beat of +1.3% versus +0.3% expected, helping at the margin. NZD/USD has seen support emerge around 0.6110.

- EUR/USD is lower, but stabilized after breaching 0.9920.

- Coming up, note that it is the UK Bank holiday today. Further out, a speech from ECB Chief Economist Lane is due, followed by the Dallas Fed m’fing activity data, and Fedspeak from Fed Vice Chair Brainard.

FX OPTIONS: Expiries for Aug29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000-10(E1.6bln), $1.0020-25(E502mln)

- USD/JPY: Y137.00-10($808mln), Y138.00($570mln)

- AUD/USD: $0.6940-50(A$737mln)

- USD/CNY: Cny6.7750($706mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/08/2022 | 0600/0800 | *** |  | SE | GDP |

| 29/08/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/08/2022 | 1300/1500 |  | EU | ECB Chief Economist Philip Lane Speaks at CEBRA | |

| 29/08/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 29/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 29/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 29/08/2022 | 1815/1415 |  | US | Fed Vice Chair Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.