-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Riksbank To Start This Week's Global Monetary Tightening

EXECUTIVE SUMMARY

- HUNGARY SUBMITS BILLS TO MEET COMMITMENTS MADE TO EU (RTRS)

- GERMANY EARMARKS BILLIONS FOR LNG TO SEVER RUSSIAN GAS RELIANCE (BBG)

- TOP EU DIPLOMAT BORRELL: NO CHANCE OF IRAN DEAL BREAKTHROUGH AT UN (POLITICO)

- CHINA LPR FIXINGS UNCHANGED

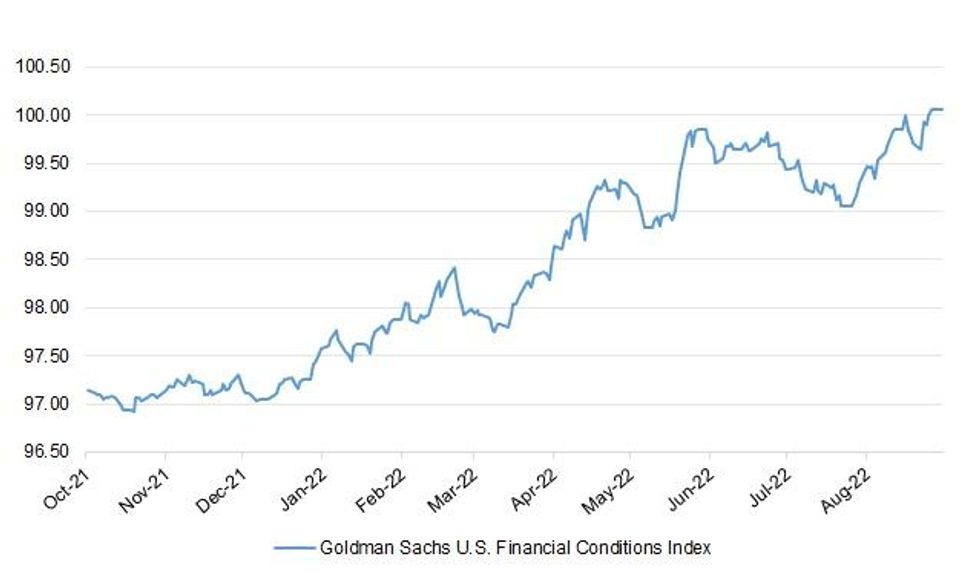

Fig. 1: Goldman Sachs U.S. Financial Conditions Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Britain's low headline rate of corporation tax has failed to boost business investment, which lags behind that of all its major peers, according to a report on Tuesday which comes as the government prepares to reverse a planned rise. (RTRS)

EUROPE

EU: Hungary's government submitted a batch of legislation to parliament late on Monday in order to unlock billions of euros of European Union funds, Justice Minister Judit Varga said on her official Facebook page. (RTRS)

GERMANY: The German government has set aside billions of euros for natural gas purchases in an effort to stave off an energy crisis since Russia cut off its supplies. (BBG)

ITALY: Matteo Salvini, a leader of the right-wing coalition expected to win Italy’s elections, wants a 30 billion-euro ($30 billion) state subsidy to cap the cost of energy for businesses in the run-up to winter. (BBG)

NETHERLANDS: The Dutch government is set to impose a price cap on energy contracts from Jan 1., 2023 to shield consumers from surging prices, Dutch broadcaster NOS reported on Monday. (RTRS)

OTHER

GLOBAL TRADE: The head of the second-biggest US port expects the pandemic-era surge in consumer demand that snarled supply chains will start to cool, with evidence of a deceleration already reflected in weaker inbound container arrivals. (BBG)

U.S./CHINA: The U.S. Public Company Accounting Oversight Board began reviewing the audit documents of Chinese companies traded on U.S. stock markets on Monday, with the first batch of companies including internet giant Alibaba, NetEase, Baidu and JD.com, Yicai.com reported. (MNI)

GEOPOLITICS: Taiwan Finance Minister Su Jain-rong and deputy central bank governor Chen Nan-kuang will join the annual board meeting of the Central American Bank for Economic Integration in Mexico from Sept. 21 to 24, according to a statement from Taiwan’s Finance Ministry. (BBG)

GEOPOLITICS: President Recep Tayyip Erdogan in a PBS interview accused the European Union for keeping Turkey at bay for decades and not admitting it as a full member, according to a transcript from Erdogan’s office. (BBG)

GEOPOLITICS: U.S. Secretary of State Antony Blinken will host an event related to the 'Blue Pacific' group of countries at the U.N. on Thursday, White House Indo-Pacific coordinator Kurt Campbell said on Monday. (RTRS)

GEOPOLITICS: U.S. Secretary of State Antony Blinken met with the foreign ministers of Armenia and Azerbaijan in New York on Monday, marking the first direct talks between the two sides since deadly border clashes this month, the State Department said. (RTRS)

BOJ: Japanese Finance Minister Shunichi Suzuki said on Tuesday he expected the Bank of Japan to steer monetary policy appropriately while taking economic and price conditions into account. (RTRS)

JAPAN: Japan's ruling Liberal Democratic Party (LDP) will release an updated list of members who have had connections with the controversial Unification Church, Kyodo news agency said on Tuesday, citing the party's secretary-general. (RTRS)

RBA: Australia’s central bank said interest rates are getting closer to “normal settings,” according to minutes of its Sept. 6 meeting when it raised the benchmark by a half-percentage point for a fourth straight month. (BBG)

AUSTRALIA: Treasurer Jim Chalmers has announced the budget reported a $50 billion improvement, but warned there will be difficult decisions ahead. (ABC)

HONG KONG: Hong Kong Chief Executive John Lee and his officials have reached a consensus on ending mandatory hotel quarantine for arrivals, the South China Morning Post reported. (BBG)

MEXICO: A powerful earthquake struck western Mexico on Monday on the anniversary of two devastating temblors, killing at least one person, damaging buildings, knocking out power and sending residents of Mexico City scrambling outside for safety. (RTRS)

MEXICO: Mexico is underestimating 2023 debt levels in its draft budget proposal, the first sign that government obligations could explode in coming years, President Andres Manuel Lopez Obrador’s first finance minister wrote in a newspaper commentary Monday. (BBG)

BRAZIL: Brazil presidential candidate Luiz Inacio Lula da Silva slightly extended his lead over President Jair Bolsonaro less than two weeks before the South American country's election, a poll by IPEC released on Monday showed. (RTRS)

BRAZIL: Brazilian state-run oil company Petrobras said on Monday it will lower refinery gate diesel prices by 5.8% to an average 4.89 reais ($0.93) per liter starting on Tuesday, the lowest level in roughly four months. (RTRS)

BRAZIL: Former Brazilian central bank chief Henrique Meirelles, who served under former President Luiz Inacio Lula da Silva, said on Monday he had not discussed joining the government if the leftist leader wins a third term in October's election. (RTRS)

RUSSIA: Russia is willing to end the conflict in Ukraine as soon as possible, Turkish President Recep Tayyip Erdogan told PBS in an interview on Monday. (TASS)

RUSSIA: Britain is to spend billions more arming Ukraine next year, Liz Truss will tell the United Nations in New York on her first overseas trip as prime minister. (The Times)

RUSSIA: A back-up power line used to supply the Zaporizhzhia nuclear power plant with electricity for essential operations from the Ukrainian grid was disconnected on Sunday, but the plant remained connected to one of the main power lines restored last week, the U.N. nuclear watchdog said on Monday. (RTRS)

RUSSIA: Denis Pushilin, head of the Russia-backed separatist Donetsk region of Ukraine, called on his fellow separatist leader of Luhansk province on Monday to combine efforts aimed at preparing a referendum on joining Russia. (RTRS)

RUSSIA: Russian government wants to collect additional 1.4t rubles ($23.3b) from commodity exporters in 2023 by increasing export duties and mineral extraction tax rates, Kommersant reports, citing unidentified people. (BBG)

RUSSIA: Gazprom said on Monday its subsidiary Gazprom Capital will issue new rouble-denominated bonds to replace sterling-denominated bonds worth 850 million pounds ($970.02 million) due in 2024. (RTRS)

IRAN: EU foreign policy chief Josep Borrell tamped down expectations of a breakthrough on the Iran nuclear deal at the United Nations General Assembly this week, saying he does not believe a meeting with Iranian President Ebrahim Raisi would be productive. (POLITICO)

ARGENTINA: International Monetary Fund (IMF) chief Kristalina Georgieva said on Monday she had an "excellent" meeting with Argentina's president Alberto Fernandez in New York. (RTRS)

ARGENTINA: Argentina’s central bank is banning soy exporters from accessing the country’s official currency market and from transactions using the blue-chip swap rate, according to a statement published Monday evening. (BBG)

WORLD BANK: A global economic slowdown may last well into 2023 and beyond, World Bank President David Malpass told Fox Business on Monday. (RTRS)

GAS: Russian gas giant Gazprom said on Monday that it expects to launch the giant east Siberian Kovykta field, crucial to its plans to boost gas sales to China, in the second half of December. (RTRS)

GAS: German utilities RWE and Uniper are close to striking long-term deals to buy liquefied natural gas (LNG) from Qatar's North Field Expansion project to help replace Russian gas, three sources familiar with the matter said. (RTRS)

OIL: The U.S. Energy Department said on Monday it will sell up to 10 million barrels of oil from the Strategic Petroleum Reserve, for delivery in November, extending the timing of a plan to sell 180 million barrels from the stockpile to tame fuel prices. (RTRS)

CHINA

PBOC: China’s benchmark Loan Prime Rates could be cut following the reduction of deposit interest rates by some Chinese banks, the China Securities Journal reported citing analysts. (MNI)

CORONAVIRUS: China's government issued draft rules aimed at making it easier for some foreigners to enter China for visits to tourism sites along the Chinese border. (RTRS)

CHINA MARKETS

PBOC NET DRAINS CNY24 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday injected CNY2 billion via 7-day reverse repos and CNY24 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operations have led to a net injection of CNY24 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at quarter-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7226% at 09:53 am local time from the close of 1.6730% on Monday.

- The CFETS-NEX money-market sentiment index closed at 48 on Monday vs 46 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9468 TUES VS 6.9396

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9468 on Tuesday, compared with 6.9396 set on Wednesday.

OVERNIGHT DATA

JAPAN AUG NATIONAL CPI +3.0% Y/Y; MEDIAN +2.9%; JUL +2.6%

JAPAN AUG NATIONAL CORE CPI +2.8% Y/Y; MEDIAN +2.7%; JUL +2.4%

JAPAN AUG NATIONAL CORE-CORE CPI +1.6%; Y/Y; MEDIAN +1.5%; JUL +1.2%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE 86.0; PREV 85.7

Consumer confidence increased by 0.4% last week, almost reversing the 0.5% decline of the week before. When we look at consumer confidence by housing status the confidence of people paying off their mortgage is greater than those renting for the first time since the RBA started raising interest rates in May after confidence of renters dropped by 8.7% last week. This may indicate that people with mortgages have taken comfort from recent commentary that the RBA might scale back the size of rate increases in October. We think that commentary is misplaced and expect another 50bp from the RBA in October. This might come as something of a shock for those with mortgages. Household inflation expectations jumped 0.3ppt to 5.6%, its highest since mid-August. (ANZ)

MARKETS

SNAPSHOT: Riksbank To Start This Week's Global Monetary Tightening

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 115.73 points at 27690.23

- ASX 200 up 82.481 points at 6804.70

- Shanghai Comp. up 14.266 points at 3129.868

- JGB 10-Yr future down 4 ticks at 148.43, JGB 10-Yr yield up 0.4bp at 0.261%

- Aussie 10-Yr future up 4 ticks at 96.33, Aussie 10-Yr yield down 4.3bp at 3.632%

- US 10-Yr future up 0-02+ at 114-14, 10-Yr yield down 0.59bp at 3.4807%

- WTI crude up $0.03 at $85.76, Gold down $2.73 at $1673.83

- USDJPY up 9 pips at 143.33

- HUNGARY SUBMITS BILLS TO MEET COMMITMENTS MADE TO EU (RTRS)

- GERMANY EARMARKS BILLIONS FOR LNG TO SEVER RUSSIAN GAS RELIANCE (BBG)

- TOP EU DIPLOMAT BORRELL: NO CHANCE OF IRAN DEAL BREAKTHROUGH AT UN (POLITICO)

- CHINA LPR FIXINGS UNCHANGED

US TSYS: Curve Flattening Maintained As Asia Looks Ahead To FOMC

Cash Tsys run 0.5 bp cheaper to 1.0bp richer across the curve into London hours, with twist flattening evident as the 7- to 10-Year zone leads the bid in 5+-Year paper, while TYZ2 deals in the middle of a narrow 0-06 range on limited volume of ~39K.

- It would seem that the proximity to Wednesday’s FOMC meeting and a lack of macro news flow kept many Asia-Pac participants sidelined.

- 10-Year Tsy yields continue to operate within the uptrend channel drawn off the August lows (as flagged here).

- This month’s Chinese LPR fixings were unch., matching wider expectations.

- Housing starts and building permits data headline the NY docket on Tuesday, with 20-Year Tsy supply also due.

- Note that the Riksbank is set to kick off this week’s monetary tightening, with no fewer than 9 central banks that we cover expected to deliver 487.5bp of cumulative tightening through Thursday, with the Fed headlining.

JGBS: Futures Struggle To Make Decisive Move, Curve Steepens

JGB futures are back from session highs observed after the Tokyo lunch break, dipping back into negative territory, -3 ticks as we move towards the close.

- Cash JGBs are little changed to 2bp cheaper across the curve, with super-long JGBs leading the weakness.

- The limited cheapening in paper out to 10s comes as 10-Year JGB yields continue to probe the BoJ’s yield cap, with participants seemingly mindful of the possibility of an unscheduled round of BoJ bond purchases.

- Japanese national CPI data printed 0.1 ppt above expectations on all three Y/Y metrics, incrementally raising the chances of the BoJ stepping in to defend its YCC settings via unscheduled methods (which hasn’t happened yet). The central bank is still expected to leave its major monetary policy settings unchanged at the end of its upcoming meeting (which concludes on Thursday).

- Japanese Finance Minister Suzuki noted that initial fiscal measures to combat inflation will be drawn from reserve funds, while subsequent action will require additional funding via a supplementary budget.

- Wednesday will see a liquidity enhancement auction for off-the-run 1-5 Year JGBs, while the domestic economic data docket is light at best.

AUSSIE BONDS: Firmer On Narrower Fiscal Deficit

ACGBs sit a little below session highs, having richened after Australian Treasurer Chalmers delivered a preview of Australia’s final 21/22 budget results.

- Chalmers highlighted that the budget deficit for 21/22 will improve by “almost A$50bn” vs. projections made in March, although he suggested that the bulk of the improvement was “driven by temporary factors.” The March forecasts projected a A$79.8bn deficit for 21/22, with Chalmers alluding to a wider deficit in 22/23 vs. actual 21/22 levels (March’s projections looked for a deficit of A$78.0bn in 22/23).

- Cash ACGBs run 4.5-6.5bp richer across the curve, with the super-long end leading the way higher. YM is +5.5 and XM is +3.5. EFPs are little changed, while Bills run 2 to 6 ticks richer through the reds.

- ACGBs looked through the release of the RBA’s Sep meeting minutes.

- RBA Oct dated OIS now price in ~42bp of tightening, unwinding the uptick to ~45bp that came after Westpac’s call for a 50bp Oct hike from the RBA (made late Monday).

- The Westpac leading index and a speech by RBA Deputy Gov. Bullock will headline the domestic docket on Wednesday.

EQUITIES: Following Wall St Higher; Easing Of Hong Kong COVID Rules Eyed

Major Asia-Pac equity indices deal between 0.3-1.3% firmer on a positive lead from Wall St., with the MSCI APEX 50 Index (+1.2%) of large caps unwinding virtually all of Monday’s losses at writing, and on track to snap a four-session streak of losses.

- The Hang Seng is 1.5% better off, rebounding from Monday’s six-month lows on gains across every sub-index. China-based tech outperformed (HSTECH: +2.5%), mirroring the bid in the NASDAQ Golden Dragon China index on Monday (+1.6%).

- Travel-related stocks extended Monday’s gains as SCMP sources pointed to Hong Kong leaders reaching consensus on lifting hotel quarantines. While no official announcement re: concrete measures has been made, China’s HK & Macau Affairs Office has stated that they have “no problem” with an adjustment in the city’s COVID rules.

- The ASX200 deals 1.3% firmer, with commodity and financials equities contributing the most to gains, offsetting a relatively lacklustre showing from tech stocks (S&P/ASX All Tech Index: +0.5%). Major miners sit between 0.9-5.5% better off, while the “Big 4” banks trade 1.2-1.7% firmer apiece.

- E-minis deal 0.2-0.3% apiece, off best levels, but holding on to the bulk of their Monday’s gains at typing.

OIL: Little Changed Ahead Of Central Bank Policy Decisions

WTI and Brent are $0.20 firmer apiece at writing, having struggled to breach Monday’s best levels in Asia-Pac dealing as worry re: central bank-led economic slowdowns remains elevated heading into a host of central monetary policy decisions due this week.

- Focus for the week will be on the FOMC on Wed, with recent Dollar strength providing headwinds for crude as the DXY continues to hover near recent cycle highs.

- Hope surrounding a U.S.-Iran nuclear deal remains scant, with France saying on Monday that there would “not be a better offer”, highlighting that no parallel efforts were underway to advance the talks, echoing remarks from the EU’s Borrell that he did not see a better solution.

- BBG source reports have pointed to the UAE bringing forward plans to raise crude output capacity to 5mn bpd by 2025 (from 2030 prev). The UAE’s current output is estimated at ~3.4mn bpd.

- Elsewhere, the U.S. announced the sale of 10mn bbls of crude from the SPR for delivery in Nov, representing an extension in the schedule for existing plans re: a 180mn bbl release from the SPR.

GOLD: Steadying Below $1,680/oz; Busy Central Bank Week Eyed

Gold deals $1/oz softer to print ~$1,675/oz at writing, edging away from best levels after failing to breach Monday’s session highs earlier.

- To recap, gold closed little changed on Monday, having pared losses throughout the session after falling by as much as $15, inversely tracking a move in the USD, with the DXY closing virtually unchanged after a brief show above the 110.00 mark.

- The precious metal has struggled to break above $1,680 in recent sessions and remains a short distance from recent 29-month lows ($1,654.2 Sep 15 low), with caution evident as this week will see various central banks around the world raise rates

- The week’s round of central bank action will begin with the Riksbank later on Tuesday, although focus for gold will likely centre around the Fed’s policy decision on Wednesday.

- From a technical perspective, gold remains in a clear downtrend, with last week’s extension lower reinforcing the bearish theme. Attention will be on support at $1,640.9 (Aug 8 2020 low), while initial resistance is seen at $1,688.9 (Sep 1 low).

FOREX: Kiwi Lags Behind With G10 FX Holding Tight Ranges

Major currency pairs treaded water with the market in a waiting mode ahead of a marathon of central bank meetings this week. The greenback slipped in early trade as U.S. e-minis crept higher in the wake of a positive Wall Street session, but clawed back losses as equity index futures trimmed gains.

- The kiwi underperformed for the second consecutive day, as NZ 2-Year swaps extended their move away from three-month highs, despite the absence of notable local catalysts. Spot NZD/USD shed a handful of pips, falling short of testing cycle lows printed Monday at $0.5930.

- AUD/NZD breached the NZ$1.1300 mark on its way to NZ$1.1328, the highest point since Mar 2016. The move in the spot rate was out of sync with a moderation in AU/NZ 2-Year swap spread, with the differential paring yesterday's advance.

- The yen ignored above-forecast Japanese inflation data released earlier. Core CPI accelerated to +2.8% Y/Y in Aug from +2.4% prior, exceeding the median estimate of +2.7%.

- USD/CNH held above CNH7.0 as the PBOC kept its Loan Prime Rates unchanged. The People's Bank also set a stronger-than-expected yuan reference rate for the 19th straight day.

- U.S. housing starts/building permits, Canadian CPI, comments from ECB's Lagarde & Muller, as well as Riksbank's monetary policy review take focus from here.

FX OPTIONS: Expiries for Sep20 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E1.5bln), $1.0000(E654mln), $1.0050(E546mln), $1.0100(E632mln)

- GBP/USD: $1.1425(Gbp647mln)

- EUR/JPY: Y138.00(E626mln)

- AUD/USD: $0.6719-25(A$580mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/09/2022 | 2330/0830 |  | JP | Natl CPI | |

| 20/09/2022 | 0115/0915 |  | CN | PBoC Rate Decision | |

| 20/09/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/09/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 20/09/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 20/09/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/09/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 20/09/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 20/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/09/2022 | 1700/1900 |  | EU | ECB Lagarde Lecture in Frankfurt | |

| 20/09/2022 | 1930/1530 |  | CA | BOC Deputy Beaudry speech "Pandemic macroeconomics: What we’ve learned, and what may lie ahead." |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.