-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI EUROPEAN OPEN: BoJ Leaves Major Policy Settings Unchanged, Triggering JPY Vol. & Intervention Talk

EXECUTIVE SUMMARY

- FED HAS 'WAYS TO GO' IN TIGHTENING POLICY (MNI)

- KURODA’S BOJ HOLDS GROUND ON ULTRALOW RATES, PUSHING YEN TO 145 (BBG)

- JAPAN’S KANDA SAYS WE COULD CONDUCT STEALTH FOREX INTERVENTION (BBG)

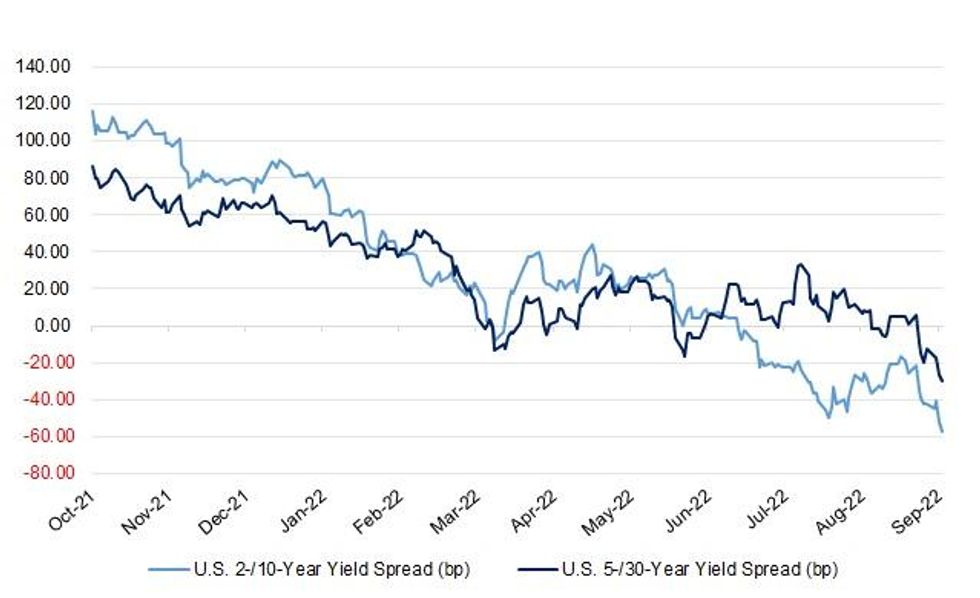

Fig. 1: U.S. 2-/10- & 5-/30-Year Yield Spreads

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Liz Truss is putting the public finances on a "unsustainable path" with her plans to slash taxes while capping energy bills, a leading economic think tank has warned. The Institute for Fiscal Studies (IFS) has calculated that the combination of higher spending and tax cuts means government borrowing is expected to hit £100bn a year - more than double the official forecasts last March. (Sky)

BREXIT: Liz Truss, the UK prime minister, wants to settle the post-Brexit row over Northern Ireland before the 25th anniversary of the Good Friday peace deal next Easter, as she seeks to calm tensions with US president Joe Biden on the issue. (FT)

BREXIT: President Joe Biden and Prime Minister Liz Truss have said they would discuss how to resolve tensions over post-Brexit trade arrangements in Northern Ireland ahead of their first talks. (BBC)

ENERGY: The UK is trying to lock in long-term supplies of liquefied natural gas from US producers ahead of a winter energy crunch that’s threatening to derail the country’s economy. (BBG)

EUROPE

GREECE: For a political leader caught up in a James Bond-style spy scandal, Greek Prime Minister Kyriakos Mitsotakis is confident he can ride it out and even rule alone in elections next year. “We have a pretty good chance of winning an absolute majority after the next elections,” the premier told Bloomberg during an interview in New York. (BBG)

U.S.

FED: The Federal Reserve strengthened its resolve to arrest accelerating prices Wednesday, pledging to keep raising interest rates toward 5% until growth is below trend, the labor market has cooled and clear evidence that inflation is moving back to 2%. "We are taking forceful and rapid steps to moderate demand so it comes into better alignment with supply," Fed Chair Jerome Powell said after the FOMC lifted its benchmark overnight rate by 75 basis points for the third time in as many meetings to a 3%-3.25% range. (MNI)

OTHER

GLOBAL TRADE: Senators from both parties on Wednesday asked the nation’s top intelligence official to lead a review of the security threat posed by Apple’s reported plan to use memory chips from a major Chinese chipmaker for its new iPhone 14. (The Washington Post)

GEOPOLITICS: Citigroup Inc.’s Jane Fraser was forced to answer if her bank would pull business from China if its military invaded Taiwan. Jamie Dimon was pressed on whether JPMorgan Chase & Co. would cut ties with Russian firms. (BBG)

U.S./SOUTH KOREA: South Korean President Yoon Suk-yeol asked U.S. President Joe Biden to help address Seoul's concerns that new U.S. rules on electric vehicle subsidies will hurt the country's automakers, Yoon's office said on Thursday. (RTRS)

BOJ: The Bank of Japan continued to stand by its ultralow interest rates just hours after the Federal Reserve’s latest rate hike, as it further isolated itself from a global wave of policy tightening and fueled a slide in the yen to a fresh 24-year low. Governor Haruhiko Kuroda and his fellow board members kept the central bank’s yield curve control program and its asset purchases unchanged Thursday. (BBG)

JAPAN: Japan’s top currency official Masato Kanda tells reporters that the government could conduct stealth intervention in the foreign exchange market. Won’t necessarily always confirm fx intervention but have not intervened in markets yet. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida says the government will further ease border controls as soon as Oct., speaking at an event in New York, TBS reports, without elaborating. (BBG)

RBNZ: The RBNZ is adjusting to broadening expectations of its role as a prudential regulator, Deputy Governor Christian Hawkesby says in a speech Thursday. (BBG)

BOK: Bank of Korea Governor Rhee Chang-yong tells reporters the Korean central bank will determine the extent of its interest-rate hike next month after reviewing the impact of the Fed hike on currency markets. (BBG)

SOUTH KOREA: Finance Minister Choo Kyung-ho says there has been a phenomenon in FX market that buyers purchase dollar in advance and sellers delay selling dollar. Choo says the nation’s FX reserves could be changed in the course of the nation taking market stabilization steps. Aug. current account data could be worrying level. (BBG)

SOUTH KOREA: BOK discussing currency swap with National Pension Service; the agreement may be announced soon. (BBG)

HONG KONG: The Hong Kong Monetary Authority raised its benchmark interest rate for a fifth time, moving in lockstep with the US Federal Reserve. (BBG)

HONG KONG: Anticipation is mounting that Hong Kong will scrap hotel quarantine for inbound travelers, with an announcement possible in the coming days, as the city tries to maintain its status as a global financial hub amid a Covid-induced economic slowdown and brain drain. (BBG)

NORTH KOREA: U.S. President Joe Biden and South Korean President Yoon Suk-yeol reaffirmed their commitment in a meeting on Wednesday to strengthen their countries' alliance and cooperate closely "to address the threat posed by North Korea", the White House said. (RTRS)

BRAZIL: Brazilian presidential candidate Luiz Inacio Lula da Silva said on Wednesday he should reach an agreement on a trade deal between South America's Mercosur trade bloc and the European Union within six months, if he wins October's presidential election. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy on Wednesday told the United Nations that a crime had been committed against his nation and Kyiv wanted "just punishment" for Russia. In a recorded address, Zelenskiy laid out what he said were five non-negotiable conditions for peace. (RTRS)

RUSSIA: US will continue to support the Ukrainian people for “as long as it takes,” Secretary of State Antony Blinken says in a statement. “President Putin is not operating from a position of strength”. (BBG)

RUSSIA: British Prime Minister Liz Truss and U.S. President Joe Biden agreed on Wednesday that Russian President Vladimir Putin's actions highlight the need for allies to continue their economic and military support to Ukraine, Truss's office said. (RTRS)

RUSSIA: Any threat from Russian President Vladimir Putin to use nuclear weapons is "unacceptable" but Germany will continue to support Ukraine and try to prevent an escalation in the war between Russia and Ukraine, German Chancellor Olaf Scholz told ARD television on Wednesday. (RTRS)

RUSSIA: European Union foreign ministers agreed on Wednesday to prepare new sanctions on Russia and increase weapons' deliveries to Kyiv after President Vladimir Putin ordered the country's first wartime mobilisation since World War Two to fight in Ukraine. (RTRS)

RUSSIA: The head of the U.N. atomic watchdog is hoping to go to Ukraine and Russia soon to push for an agreement to create a protection zone at the Zaporizhzhia nuclear power plant. (RTRS)

RUSSIA: North Korea on Thursday said it has never supplied weapons or ammunition to Russia and does not plan to do so in the future, according to a statement released by the state media KCNA. (RTRS)

RUSSIA: Security forces detained more than 1,300 people in Russia on Wednesday at protests denouncing mobilisation, a rights group said, hours after President Vladimir Putin ordered Russia's first military draft since World War Two. (RTRS)

IRAN: Outstanding issues between Iran and the U.N. nuclear watchdog will not be wished away, agency chief Rafael Grossi said on Wednesday, while Tehran insists on the closure of the agency's probes for revival of a 2015 nuclear pact. (RTRS)

ENERGY: The European Union’s executive arm plans to outline further actions to contain an unprecedented energy crunch by reducing markets swings, boosting liquidity and lowering natural gas costs. (BBG)

CHINA

PBOC: The People’s Bank of China is expected to cut policy rates and lower reserve requirement ratios further in the fourth quarter as it seeks to boost credit expansion by lowering banks’ funding costs, analysts said. (MNI)

PBOC: China’s real interest rates should not be significantly reduced in the short term as they are below the potential economic growth rate and any large reduction could cause unwanted side effects, the 21st Century Business Herald reported citing an unnamed state-owned bank bond trader. (MNI)

FISCAL: Issuance of China Government Bonds (CGBs) has grown rapidly this year, notably in ultra-short-term maturities, to help fund a fiscal deficit and stabilise economic growth, the Securities Daily reported. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY16 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY2 billion via 7-day reverse repos and CNY16 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operations have led to a net injection of CNY16 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at quarter-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6701% at 09:58 am local time from the close of 1.6748% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Wednesday vs 47 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9798 THURS VS 6.9536

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9798 on Thursday, compared with 6.9635 set on Wednesday.

OVERNIGHT DATA

CHINA AUG SWIFT GLOBAL PAYMENTS CNY 2.31%; JUL 2.20%

NEW ZEALAND AUG TRADE BALANCE -NZD2,447MN; JUL -NZD1,406MN

NEW ZEALAND AUG EXPORTS NZD5.48BN; JUL NZD6.35BN

NEW ZEALAND AUG IMPORTS NZD7.93BN; JUL NZD7.77BN

NEW ZEALAND AUG TRADE BALANCE 12 MTH YTD -NZD12,280BN; JUL -NZD11,640MN

NEW ZEALAND Q3 WESTPAC CONSUMER CONFIDENCE 87.6; Q2 78.7

MARKETS

SNAPSHOT: BoJ Leaves Major Policy Settings Unchanged, Triggering JPY Vol. & Intervention Talk

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 159.66 points at 27154.25

- Australian markets are closed.

- Shanghai Comp. down 9.55 points at 3107.627

- JGB 10-Yr future up 49 ticks at 148.76, JGB 10-Yr yield down 2bp at 0.239%

- US 10-Yr future -0-15 at 113-24, 10-Yr yield up 1.19bp at 3.5438%

- WTI crude up $0.25 at $83.19, Gold down $12.36 at $1661.61

- USDJPY up 78 pips at 144.83

- FED HAS 'WAYS TO GO' IN TIGHTENING POLICY (MNI)

- KURODA’S BOJ HOLDS GROUND ON ULTRALOW RATES, PUSHING YEN TO 145 (BBG)

- JAPAN’S KANDA SAYS WE COULD CONDUCT STEALTH FOREX INTERVENTION (BBG)

US TSYS: 2s10s Curve Threatens Cycle Low Post-Fed

Tsys bear flattened overnight, but operate off of extremes, with marginal support derived from the post-BoJ move in JGBs, leaving cash Tsy yields a little off of session highs. The major benchmarks run little changed to 6bp cheaper across the curve, bear flattening. TYZ2 deals m the middle of its 0-12 overnight range on solid volume of ~105K lots.

- The 2-/10-Year spread hovers close to the deepest levels of inversion witnessed in the current cycle, while the 5-/30-Year spread printed fresh cycle lows overnight.

- 2-Year Tsy yields hit fresh cycle highs as Asia-Pac participants reacted to the FOMC and faded the richening that was seen in late NY dealing.

- The above flattening has been aided by a shift higher in terminal rate pricing, which has nudged up to near 4.70%, per Fed dated OIS.

- Eurodollar futures run 3.5-17.5bp cheaper through the blues, with the reds leading the weakness.

- Overnight flow was headlined by 2x 5K block sales of FVX2 108.50 puts.

- Thursday will see weekly jobless claims data and the Kansas City Fed m’fing index reading cross during NY hours, while the BoE decision headlines a busy global central bank slate.

JGBS: Futures Bid As BoJ Stands Pat; 10-Year JGBs Back Away From Yield Cap

JGB futures are +50 ticks at 148.81 last, off best levels, but maintaining the bulk of their post-BoJ bid after the Bank chose to keep its monetary policy settings unchanged (as widely expected).

- Cash JGBs run 0.5-3.5bp richer across the curve, with 7s leading the way higher.

- 10-Year JGBs are ~2.0bp richer, backing away from the BoJ’s 0.25% yield cap after the week’s first trade in cash 10s was reported following the BoJ’s monetary policy decision.

- The BoJ also conducted an unscheduled round of fixed rate operations after the Tokyo lunch break, pointing to further resolve in maintaining their current YCC settings.

- While the BoJ’s major policy settings were unchanged, a phasing out of the COVID funding programme for SMEs (against wider expectations for a complete halt this month) provided a surprise, suggesting worry re: lingering economic weakness.

- The BoJ decision & fresh jawboning from Japanese officials resulted in some yen volatility with little by way of a meaningful reaction in JGBs observed, and USD/JPY hovering just below the Y145.00 mark at typing, after a brief show above.

- Japanese markets are closed for a holiday on Friday.

EQUITIES: Fresh Lows All Round In Asia

Asia-Pac equity indices have maintained the bulk of their early weakness, tracking a negative, tech-led decline on Wall St., with the MSCI Asia-Pacific index on track to close at levels last seen in May ‘20.

- The Hang Seng (-1.9%) leads losses, falling to levels not witnessed since Oct ‘11 on losses across most constituents. Tech struggled, with the Hang Seng Tech Index (-2.1%) hitting fresh six-month lows, just above all-time lows made in mid-March since its creation in Jul ‘20.

- The Nikkei 225 deals 0.8% softer at writing, hitting fresh two-month lows at writing. Index heavyweights Fast Retailing (-1.4%) and SoftBank Group (-2.2%) contributed the most to drag, adding to losses observed across every industry sector.

- E-minis deal between 0.4-0.8% softer apiece, back from as much as 0.8-1.4% lower earlier, but continuing to operate around multi-month lows at typing.

OIL: Working Away From Lows; Chinese Fuel Export Quota Eyed

WTI and Brent are $0.50 firmer apiece, consolidating a little above recent lows as the bearish impetus from Wednesday’s decline in crude has moderated.

- To recap, both benchmarks gave up early gains of as much as $2-3 apiece (derived from Russian Pres. Putin announcing a partial mobilisation of the Russian military), dipping below neutral levels after the Fed raised rates by 75bp (keeping in mind wider worry re: a Fed-led economic slowdown), before falling to fresh session lows on the EIA’s weekly inventory data.

- To elaborate on the latter, EIA data pointed to a below-expectations build in crude stocks, a surprise build in gasoline and distillate inventories, and an increase in Cushing hub stocks, largely corroborating reports of the API’s inventory estimates on Tuesday.

- Elsewhere, participants will be keeping an eye on news of fuel export quotas from the Chinese authorities as Chinese crude stockpiles have declined.

- The above comes amidst rising expectations from some quarters for a larger quota to support the flagging economic growth outlook, possibly improving the outlook for crude demand, while adding to global oil product supplies

GOLD: Just Off Wednesday’s Lows As Dollar Resumes Ascent

Gold deals ~$14/oz softer to print ~$1,659/oz, more than unwinding the ~$9/oz higher close on Wednesday, operating a little above its post-FOMC lows as the USD (DXY) has recorded fresh cycle highs while nominal U.S. Tsy yields have pushed higher in Asia.

- To recap, gold whipped from fresh two-year lows ($1,654.0) to session highs ($1,688.0) in the wake of the Fed’s policy decision, briefly breaking out of its pre-FOMC trading range (between $1,660-1,680) in the process.

- While the Fed raised rates by 75bp as widely expected, focus for gold has been on the Dot Plot, with a revision to the latter building on the “higher for longer” narrative re: rates.

- Elsewhere, the rise in tensions between Russia and the west continues to spur little by way of haven demand for gold, with this week’s crowded slate of central bank action likely taking precedence.

- From a technical perspective, gold remains in a clear downtrend. Initial support is seen at $1,640.9 (Aug 8 2020 low), with a breach of that level exposing further support at $1,610.5 (1.00 proj of the Jun13-Jul21-Aug10 swing), while initial resistance is seen at $1,688.9 (Sep 1 low).

FOREX: USD Firm Post-Fed, BoJ Dovishness & Intervention Risk Generate JPY Volatility

The greenback advanced on regional reaction to the 75bp rate hike/reaffirmation of hawkish bias by the Fed, with risk assets staying under pressure. Cash Tsy curve bear flattened and e-mini futures softened as the BBDXY index climbed to a fresh all-time high of 1,329. The U.S. dollar outperformed all its G10 peers save for the Swiss franc as risk aversion lingered.

- The yen was volatile after the BoJ kept its ultra-loose monetary policy settings and dovish forward guidance unchanged. Spot USD/JPY took out the Y145.00 mark on its way to a new multi-decade high of Y145.37, which was followed by a sharp reversal. This raised questions on whether the sharp pullback was driven by an FX intervention or profit taking amid heightened intervention risk. Japan's FX czar Kanda later clarified that the authorities have not stepped in yet, but could conduct a stealth intervention.

- Risk-off flows and a spillover from yuan weakness applied pressure to the Antipodeans, which sit at the bottom of the G10 pile. AUD/USD fell through the $0.6600 figure, while NZD/USD approached $0.5800, with both lodging fresh cyclical lows.

- Spot USD/CNH showed above CNH7.1 even as the PBOC extended its run of stronger-than-expected yuan fixings to a record, while today's strengthening bias (fixing vs. sell-side estimate) also broke a record.

- Regional liquidity is thinner towards the end of the week. Financial markets in Australia were closed for a national day of mourning to mark the death of Queen Elizabeth II. Japan is set to observe a public holiday tomorrow.

- A marathon of central bank meetings takes centre stage today. Data highlights include U.S. current account balance & jobless claims, while the speaker slate features ECB's Schnabel, BoE's Tenreyro, as well as Riksbank's Floden & Ohlsson.

FX OPTIONS: Expiries for Sep22 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900(E1.7bln), $0.9950-55(E963mln), $1.0000(E4.2bln), $1.0050(E1.2bln)

- USD/JPY: Y137.00($1.0bln), Y143.45($570mln)

- GBP/USD: $1.1490-05(Gbp1.2bln)

- USD/CAD: C$1.3150($840mln), C$1.3200($665mln), C$1.3420($740mln), C$1.3450($613mln)

- USD/CNY: Cny7.00($2.5bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/09/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/09/2022 | 0730/0930 |  | CH | SNB interest rate decision | |

| 22/09/2022 | 0730/0930 | *** |  | CH | SNB policy decision |

| 22/09/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 22/09/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 22/09/2022 | - | *** |  | JP | BOJ policy announcement |

| 22/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 22/09/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 22/09/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/09/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/09/2022 | 1400/1000 |  | US | Leading Index | |

| 22/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/09/2022 | 1500/1100 |  | US | Kansas City Fed Manufacturing Activity | |

| 22/09/2022 | 1500/1700 |  | EU | ECB Schnabel Keynote at Network Luxemburg | |

| 22/09/2022 | 1500/1600 |  | UK | BOE Tenreyro on Climate | |

| 22/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 22/09/2022 | 1830/1930 |  | UK | BOE Haskel Panellist at Lecture |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.