-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Multi-Asset Move Away From Extremes In Asia

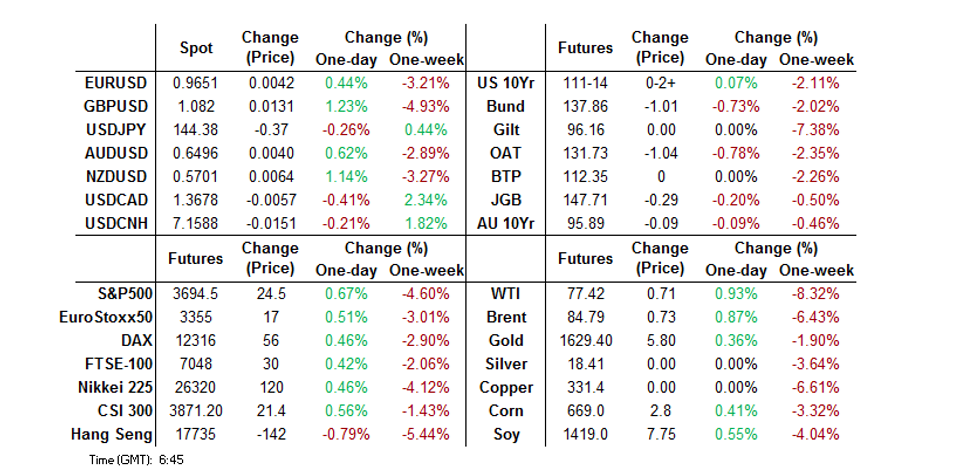

- Tsys, the DXY and e-minis moved away from their recent extremes during Asia-Pac hours. There was alack of meaningful headline flow, which suggested positioning and cross-asset influences probably played a part in the moves.

- Chinese equities lodged modest gains. Earlier reports of support from local fund managers and brokers (see this link for more details) helped the bid. However, weaker industrial profits data for August, amidst high operating costs, was a reminder of China's economic headwinds (as was the World Bank cutting it's immediate GDP growth forecast for the country) and likely curbed gains.

- Today's data highlights include U.S. Conf. Board Consumer Confidence, new home sales & flash durable goods orders. Central bank speaker activity remains in high gear, with a suite of Fed, ECB, BoE & Riksbank members set to take to the floor.

US TSYS: Some Demand Emerges In Asia

TYZ2 trades 0-02+ off the peak of its 0-14+ overnight range, on healthy volume of ~117K. Meanwhile cash Tsys run 3-5.5bp richer across the curve, with intermediates leading after they drove yesterday’s weakness.

- Yesterday’s move pulled the 2-/10-Year yield spread away from cycle flats, with the overnight move allowing the 5-/30-Year spread to edge away from its own cycle extremes.

- The Asia bid was likely on regional demand in light of the recent sizeable cheapening and/or short cover, with a lack of notable headline flow. It also came as the USD traded away from cycle highs and e-minis moved higher, introducing the potential for cross-market influences.

- Asia-Pac hours saw a block seller of the FV/UXY/WN butterfly, which seemed to represent profit taking after a corresponding long fly position was established during Asia-Pac hours back in August.

- Elsewhere, there was a block seller of TY futures (-3K) and a block seller of TYX2 110.00 puts (-5K), with the latter once again perhaps representing a profit taking move after a corresponding position was lodged yesterday.

- Tuesday’s NY session will be headlined by durable goods and consumer confidence data. 5-Year Tsy supply will also cross, while Fedspeak will come from Powell (on digital currencies), Bullard, Evans & Kashkari.

JGBS: Curve Steepens, BoJ Steps In To Defend YCC

JGB futures sit -28 as we work towards the Tokyo close, after the contract shifted lower at the open, in sympathy with the moves witnessed in wider core global FI markets on Monday, before stabilsiing.

- Bears now target the 20 Jun low (140.07) in the contract as the next meaningful point of support.

- Cash JGB trade has seen bearish steepening on the curve, with the major benchmarks running 1.0-8.5bp cheaper, with the long end suffering from the lack of relative BoJ control.

- Note that the BoJ stepped in to defend its YCC mechanism, with the latest round of off-schedule Rinban purchases covering 5- to 25-Year JGBs.

- At least some of the weakness in the longer end of the curve was owing to setup ahead of today’s 40-Year JGB auction. The high yield witnessed at the auction matched wider expectations, while the cover ratio fell back towards the lows seen at March’s 40-Year auction. It would seem that ongoing market volatility and fear surrounding a potential continued sell off dominated any outright or relative value propositions, limiting demand.

- Tomorrow’s local docket is limited, with the outdated minutes from the BoJ’s July meeting and lower tier domestic data due.

AUSSIE BONDS: Cheaper, But Off Lows On Tsy Bid

The bid in U.S. Tsys allowed Aussie bonds to stabilise after an early extension lower, with a lack of idiosyncratic drivers evident on Tuesday. The space has since pulled away from best levels

- That leaves YM & XM a little above their respective session bases, -3.0 & -9.0, respectively, although the recent break lower has allowed bears to switch their technical focus to the June lows in the respective contracts.

- 3-Year ACGB yields printed fresh cycle highs in early Sydney trade, but failed to follow through in a meaningful manner, with the aforementioned bid in Tsys lending some support after local participants adjusted to Monday’s moves in wider core global FI markets and post-Sydney moves in bond futures. Cah ACGBs run 2-9bp cheaper across the curve, with 10s providing the weakest point.

- Bills run flat to -7 through the reds.

- EFPs have seen a similar move to yesterday, with payside hedging flows likely pushing 3-Year EFP wider, while 10-Year EFP is essentially unchanged, flattening the 3-/10-Year EFP box.

- Looking ahead, retail sales data headlines the domestic docket on Wednesday, with A$800mn of ACGB Nov-33 supply also due.

NZGBS: Holding Cheaper, Tight Ranges After Early Catch Up

NZGBs saw 7-10bp of cheapening across the curve (with the weakness driven by 10s) after the long holiday weekend. While the move was not limited in isolation, it came on the heels of the much more notable moves in core global FI markets seen since Friday’s local market close.

- The adjustment higher in yields came shortly after the market open, on the back of global forces.

- Early Tuesday comments from RBNZ Governor Orr reiterated the idea that the Bank still has some work to do, but he did note that the tightening cycle is “already very mature.” A reminder that the peak in the Bank’s OCR track currently stands at ~4.10% (per the most recent MPS).

- TD Securities & BNZ become the latest to up their RBNZ terminal rate view (4.50% for the former & 4.25% for the latter).

- RBNZ OIS price a terminal rate of ~4.85%, ~10bp above that seen late on Friday.

- Looking ahead, Thursday will see the release of the latest ANZ business survey, while Friday will see the same collator present its consumer confidence readings. These are the last key data releases that will cross ahead of next week’s RBNZ decision, with markets pricing ~53-54bp of tightening for that event.

FOREX: Greenback Sags With G10 FX Unwinding Monday Moves

Profit taking was the main suspect as major FX pairs partially unwound yesterday's moves, with the wires flashing no apparent headline catalysts. The greenback retreated after its firm outperformance on Monday, while the sterling found poise after crashing in response to Cll'r Kwarteng's sweeping tax cut plans.

- The BBDXY pulled back from its all-time high of 1,355 to last trade at 1,348. U.S. Tsys were struck by richening impetus, facilitating greenback losses. A rebound in e-minis reduced demand for safe haven currencies.

- Cable added ~100 pips overnight after lodging a record low of $1.0350 on Monday. One-month option skews bounced from cyclical lows in tandem with the spot rate.

- The kiwi dollar was the second-best performer in G10 FX space, another laggard-turned-leader. NZD/USD moved away from a cycle low printed at NZ$0.5625 on Monday, while AUD/NZD faltered in sync with AU/NZ 2-Year swap spread.

- Hawkish revisions to sell-side RBNZ terminal-rate forecasts may have lent some support to the kiwi dollar as BNZ and TD Securities became the latest desks to pencil in additional rate hikes this cycle.

- Today's data highlights include U.S. Conf. Board Consumer Confidence, new home sales & flash durable goods orders. Central bank speaker activity remains on high gear, with a suite of Fed, ECB, BoE & Riksbank members set to take the floor.

FX OPTIONS: Expiries for Sep27 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E813mln), $0.9900(E1.2bln), $1.0000(E1.5bln)

- USD/JPY: Y140.00($810mln), Y141.50($720mln)

ASIA FX: USD Rally Cools

Some USD/Asia pairs are off recent highs, but dips have been fairly shallow in the likes of USD/CNH and USD/KRW. PHP weakened to a fresh record low, as onshore markets re-opened today. The Indonesian authorities have also intervened to curb IDR weakness. Tomorrow's focus rests with the BoT decision, a 25bps hike is expected. (see this link for more details).

- USD/CNH is down from recent highs, but dips remain supported. We saw another stronger CNY fix, but we are well above 7.00 now. Onshore spot USD/CNY caught up as well, closing the wedge with CNH. Both pairs remain just below 7.1650. Industrial profits continued to lose momentum in August (-2.1% y/y YTD).

- USD/KRW has tried to move lower, but hasn't got much beyond 1425. Lower equities (Kospi off by a further -0.80%), hasn't helped, while a further recovery in consumer sentiment (to 91.4 from 88.8) didn’t shift sentiment. The pair was last close to 1428.

- USD/TWD has been quiet. The CBC warned it could impose FX controls if outflows get out of hand. The pair was last just above 31.84.

- USD/IDR sits just under 15160, down from intra-day highs (15171). Comments from a BI official stated the central bank has intervened in the spot and DNFD markets. Indonesia's 5-Year CDS premium stabilises after an impressive surge over the past few days. It last sits at 156bp, operating in the vicinity of Jul 15 cycle high of 166bp.

- Spot USD/PHP has surged as Philippine markets restarted after a one-day pause caused by a typhoon. Spot USD/PHP last deals +0.450 at 58.99, a fresh all-time high. Head of IMF mission to the Philippines said the BSP has sufficient foreign reserves for an FX intervention, which could alleviate inflationary pressures and relieve some pressure on monetary policy.

- USD/THB is just shy of the 38.00 level (last 37.967). Equity outflows and yesterday's wider than expected trade deficit have weighed. Tomorrow the focus is on the BoT decision.

TWD: Sell-Off Rapid In The Past Month, CBC Warns On FX Controls If Severe Outflows Seen

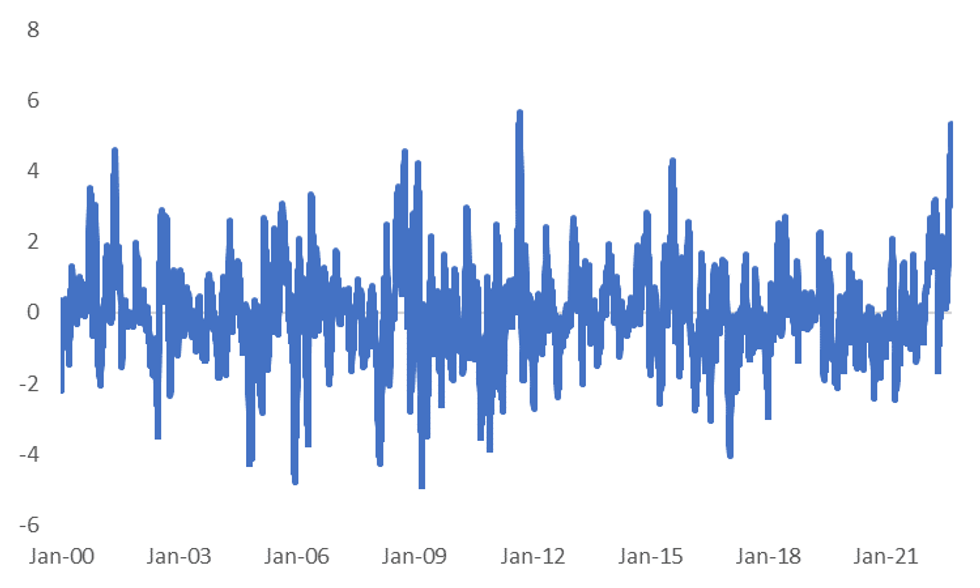

USD/TWD is just below early highs from yesterday's session, sitting at 31.84 currently. We couldn't get much beyond 31.90 yesterday. Beyond the 32.00 level, the next big level on the chart is highs from late 2016, just under 32.40. The rate of ascent in USD/TWD remains very strong, see the first chart below.

- Such rapid depreciation pressures in TWD may have prompted earlier comments from the CBC Governor, which stated in the case of severe foreign outflows, the authorities could adopt FX controls.

- The CBC Governor stated the most likely scenario would be large outflows due to tighter US policy or cross-strait tensions with China. He added that outflows to date have been under control.

- Any measures would also be consistent with those used for the stock market.

Fig 1: USD/TWD Spot - 1 month Rolling Change

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

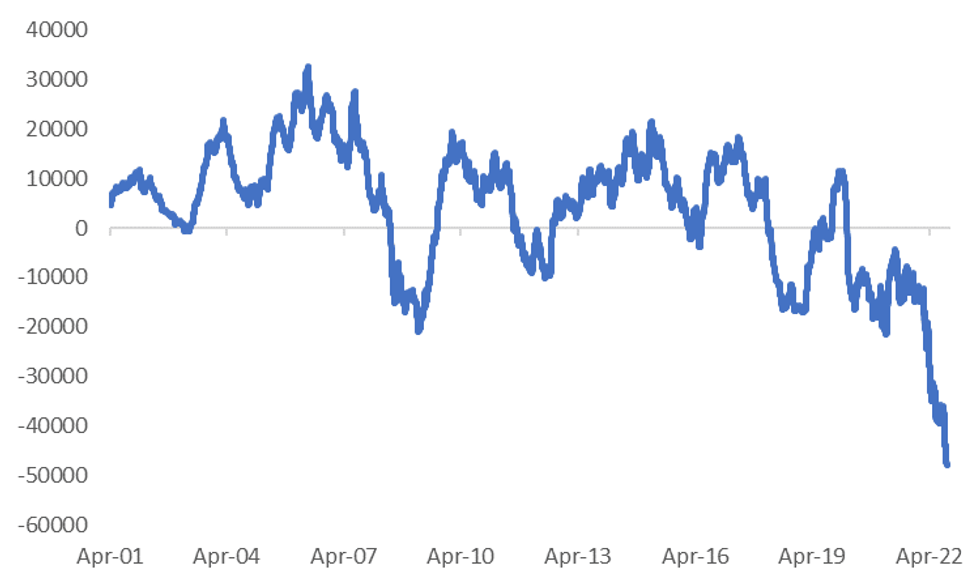

- In any event, Taiwan's external balance position still looks to be a healthy one. The country continues to run a trade surplus (averaging just under $5bn per month for the past year), FX reserves are barely off record highs as well ($545.48bn last).

- This is against a backdrop of very strong equity outflow momentum, see the chart below.

- Presumably any FX controls introduced would be in the context of market functioning rather than acute BoP pressures (outside of a conflict scenario).

Fig 2: Taiwan Net Equity Flows - 12 Month Rolling Sum (USDmn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Positive Sentiment Far From Uniform

There have been some pockets of green in Asia Pac equities, aided by higher US futures (last around +0.70% for Eminis). Cross asset signals from a lower USD/UST yields have helped as well. However, gains have been far from uniform.

- China stocks are smalls up (the Shanghai composite index around +0.25%). Earlier reports of support from local fund managers helped (see this linkfor more details). However, weaker industrial profits data for August (-2.1%), amidst high operating costs, was a reminder of China's soft economic backdrop and likely curbed gains.

- The HSI is down around 1%, continuing to trend lower. Japan stocks outperformed up around +0.50%.

- Taiwan shares (+0.40%) outperformed South Korea's Kospi (-0.60%), as the Taiwan regulator stated it would consider a ban on short-selling if needed.

- Philippines stocks are sharply lower, as markets returned from yesterday's holiday. The main bourse is off close to 4%. The brings the index down 20% from February highs.

- The ASX 200 is up by 0.30%, driven by higher mining/energy related stocks. Still this only unwinds part of yesterday's 1.60% fall.

OIL: Edges Higher On Positive Cross Asset Sentiment

Brent crude has edged away from fresh cyclical lows (~$83.60/65), last tracking just above $84.60. WTI is around $77.20. Oil has benefited from the relief in cross asset sentiment today, with the USD off its recent highs, while US equity futures have rebounded. For Brent we remain some distance from yesterday's highs close to $88/bbl though.

- Trafigura noted the demand/recessionary fear backdrop could dominate oil sentiment in the near term and prices likely face more downside pressure (comments were made at the APPEC conference in Singapore according to Bloomberg).

- Elsewhere there continues to be speculation as to how OPEC+ will react to the softer demand backdrop as we progress into Q4.

- In the US, we get the API weekly report on US oil inventories this evening.

- Focus will also be on Hurricane Ian. While it is expected the hurricane won't disrupt infrastructure in the Gulf of Mexico, a number of companies have still shut down production in the region (see this link for more details).

GOLD: Up Off Cyclical Lows

After touching fresh lows late in NY trading, just under $1622, gold is back to $1632, which is around +0.60% for the session so far. We are struggling to make much headway beyond this level, but the precious metal is enjoying the reprieve for now.

- Correlations with USD FX trends still appear strongest for gold. The DXY is back sub 113.70 today, around -0.40% from NY closing levels.

- Helping sentiment has been slightly lower UST yields. The 2yr is off 3bps to 4.30%, while the 10yr is down 5bps to 3.87% today.

- Note though the US real 10yr yield rose to 1.56% overnight, another fresh high. So, we may need to see relief on this front before the market takes gold meaningfully higher. Lows from yesterday around $1634/$1636 may offer some topside resistance.

- US equity futures are tracking higher as well, although this has done little to dent gold's rebound today.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/09/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/09/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/09/2022 | 1015/0615 |  | US | Chicago Fed's Charles Evans | |

| 27/09/2022 | 1100/1200 |  | UK | BOE Pill Panels CEPR Barclays Monetary Policy forum | |

| 27/09/2022 | 1130/1330 |  | EU | ECB Lagarde in Panel at Banque de France | |

| 27/09/2022 | 1130/0730 |  | US | Fed Chair Jerome Powell | |

| 27/09/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/09/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/09/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/09/2022 | 1300/1500 |  | EU | ECB de Guindos Speaks at Barclays-CEPR Forum | |

| 27/09/2022 | 1355/0955 |  | US | St. Louis Fed's James Bullard | |

| 27/09/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 27/09/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/09/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.