-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: No Let-Up For Truss

EXECUTIVE SUMMARY

- TORY PARTY CONFERENCE DOESN’T HERALD EASIER TIME FOR TRUSS, AS FISCAL PLAN CREATES UNREST

- UK RATING OUTLOOK CUT TO NEGATIVE AT S&P

- OPEC+ PLANS SUBSTANTIAL OIL PRODUCTION CUT TO PROP UP PRICES (FT)

- RUSSIAN TROOPS FORCED OUT OF EASTERN TOWN LYMAN (BBC)

- CREDIT SUISSE CEO SEEKS TO CALM MARKETS AS DEFAULT SWAPS CLIMB (BBG)

- BRAZIL ELECTION: LULA AND BOLSONARO TO FACE RUN-OFF (BBC)

- GAZPROM HALTS GAS SUPPLIES TO ITALY IN LATEST ENERGY BATTLE (BBG)

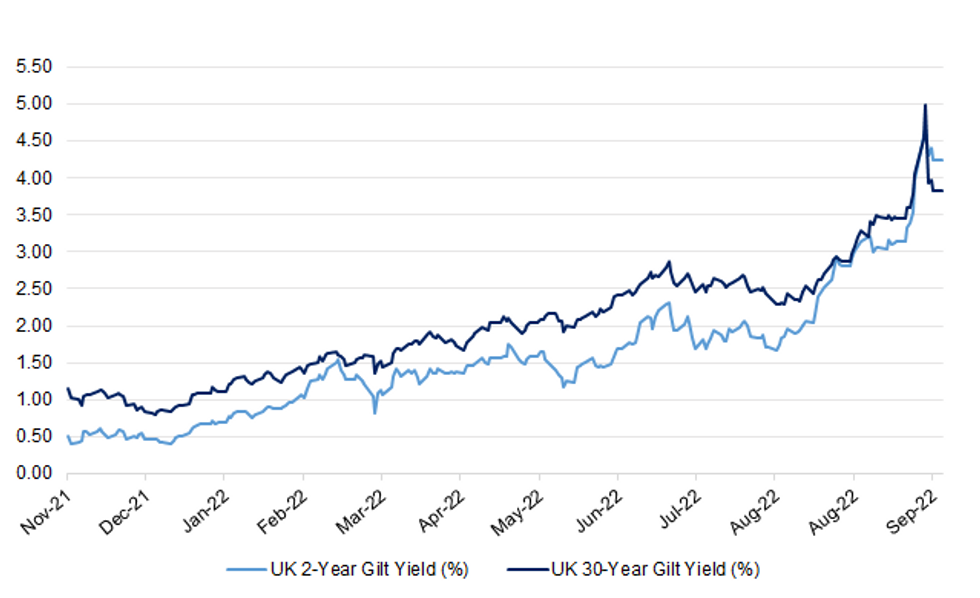

Fig. 1: UK 2-Year vs. 30-Year Gilt Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Liz Truss, prime minister, has admitted that mistakes were made in the controversial “mini” Budget that sparked market turmoil last week, as she braced herself for a fraught Conservative conference in Birmingham. (FT)

FISCAL/POLITICS: Liz Truss is to delay the vote on cutting the 45p rate of tax, after Michael Gove joined a growing rebellion among Tory MPs at the Conservative Party conference. (Telegraph)

FISCAL/POLITICS: Conservative MPs will lose the party whip if they vote against Chancellor Kwasi Kwarteng's tax-cutting mini-budget, a senior Tory has said. (Sky)

FISCAL/POLITICS: Kwasi Kwarteng will try to calm Tory party and market nerves over his tax-cutting budget and insist he has a “sound, credible” plan to return Britain to economic prosperity. In what his allies hope will be a risk-free speech, the chancellor will pledge on Monday to take the “responsible decisions” to reduce debt and say the government is “committed to fiscal sustainability”. (The Times)

FISCAL/POLITICS: Kwasi Kwarteng is privately trying to reassure Conservative Members of Parliament that his tax cuts can fix the UK economy, in a bid to head off a potential rebellion. (BBG)

FISCAL: Britain has lived in a “fool’s paradise” for too long and must reduce public spending to help to fund the government’s £45 billion worth of tax cuts, a senior cabinet minister has warned. (The Times)

FISCAL: Labour is seeking support from rebel Tory MPs to force Liz Truss’s government to speed up the release of the independent fiscal watchdog’s assessment of the impact of the recent “mini” Budget. (FT)

FISCAL: The devolved governments of the UK want an urgent meeting with Chancellor Kwasi Kwarteng to discuss immediate action to reverse the damaging effects of the mini-budget. (Sky)

FISCAL: Kwasi Kwarteng, chancellor, is set to appoint an outside candidate to replace Sir Tom Scholar as the Treasury’s chief civil servant, in a move that would mark another symbolic break with Whitehall orthodoxy. (FT)

FISCAL: The chair of the Labour party has written to her Conservative counterpart calling on him to provide a full list of attendees at a private champagne reception attended by Kwasi Kwarteng just hours after his controversial “mini” Budget. (FT)

GILTS/PENSIONS: The UK watchdogs responsible for the £1.5tn corner of the pensions sector that came close to imploding this week are holding daily talks with asset managers to stave off a fresh crisis when the Bank of England’s emergency bond buying ends. (FT)

POLITICS: Amid the plummeting markets and polls this week, a senior government figure approached No 10 and urged it to change course. They were summarily rebuffed. (The Times)

POLITICS: Liz Truss has a matter of days to row back on controversial tax and welfare cuts or face a parliamentary rebellion which could see her removed from Downing Street by Christmas, Conservative MPs have warned. (Independent)

POLITICS: Liz Truss’s personal popularity ratings are lower than those of Boris Johnson when his premiership came to an end, a new Observer poll has revealed. The latest Opinium poll shows a precipitous fall in Truss’s personal ratings after the fallout from her government’s mini-budget, and Labour surging ahead with voters across a whole range of issues. (Observer)

RATINGS: Sovereign rating reviews of note from after hours on Friday include:

- S&P affirmed the United Kingdom AA; Outlook revised to Negative

EUROPE

ECB: European Central Bank Executive Board member Isabel Schnabel said that even an economic slowdown in Europe may not be enough to tame inflation, urging more increases in borrowing costs. (BBG)

ECB: European Central Bank Governing Council member Klaas Knot pledged more increases in euro-zone interest rates after inflation in his homeland of the Netherlands jumped to the highest level on record. (BBG)

ECB: European Central Bank Governing Council member Ignazio Visco warned against his colleagues’ commitments to large interest-rate hikes, saying that acting too aggressively will heighten the danger of a recession. (BBG)

ECB: The European Central Bank is likely to raise rates at its “next few” meetings as it confronts “double digit” inflation, Governing Council member Bostjan Vasle told reporters in Montenegro on Saturday. (BBG)

GERMANY: Germany's 200 billion euro ($196 billion) plan to protect companies and households from soaring energy prices will be scrutinised by the European Commission, EU industry chief Thierry Breton said on Friday. (RTRS)

ENERGY: European Commission President Ursula von der Leyen urged the European Union’s members countries to act together to reign in soaring energy costs and avoid undermining the common market, the cornerstone of the bloc’s $17 trillion economy. (BBG)

RATINGS: Sovereign rating reviews of note from after hours on Friday include:

- S&P affirmed Poland A-; Outlook Stable

- DBRS Morningstar confirmed France at AA (high), Stable Trend

BANKS: Credit Suisse Group AG’s new chief has asked investors for less than 100 days to deliver a new turnaround strategy. Turbulent markets are making that feel like a long time. (BBG)

U.S.

FED: The Federal Reserve will keep raising interest rates and cutting its balance sheet until US inflation eases, Richmond Fed President Thomas Barkin said. (BBG)

INFLATION: The Trimmed Mean PCE inflation rate over the 12 months ending in August was 4.7 percent. According to the BEA, the overall PCE inflation rate was 6.2 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 4.9 percent on a 12-month basis. (Dallas Fed)

FISCAL: A bill funding the federal government through Dec. 16 passed the U.S. House of Representatives on Friday, avoiding an embarrassing partial shutdown less than six weeks before the midterm elections when control of Congress is at stake. (RTRS)

EQUITIES: Democratic Representative Abigail Spanberger lashed out at House Speaker Nancy Pelosi and other party leaders who she accused of dragging their feet on legislation to ban stock trading by lawmakers. (BBG)

OTHER

U.S./CHINA: A bipartisan group of US senators called for a coordinated American approach toward China that would combine initiatives under a “China Grand Strategy Commission” incorporating the executive and legislative branches as well as representatives from business. (BBG)

U.S./CHINA/TAIWAN: U.S. Defense Secretary Lloyd Austin said on Sunday he sees no imminent invasion of Taiwan by China but said China was trying to establish a "new normal" with its military activities around the island. (RTRS)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Monday the government was ready to take "decisive" steps in the foreign exchange market as needed. "Sharp currency moves are undesirable," Suzuki said in a post-cabinet meeting news conference, referring to the yen's recent sharp declines. (RTRS)

BOJ: Some Bank of Japan policymakers said inflation may overshoot initial expectations, with one member saying it was important to communicate an exit strategy from ultra-easy policy when the "right timing comes," a summary of opinions at the BOJ's September meeting showed on Monday. (RTRS)

BOJ: The Bank of Japan is unlikely to shift policy under a new Governor until at least the middle of the 2023 fiscal year, and even then it would be a “miracle”, former board member Goushi Kataoka told MNI. (MNI)

AUSTRALIA: Treasurer Jim Chalmers says the recession risk in many major economies had tipped from “possible to probable” as leading economists said the decline in global conditions, volatility in financial markets and rapidly rising interest rates would make it harder for Australia to escape a downturn. (AFR)

RBNZ: The broad view amongst the Shadow Board is that the Reserve Bank of New Zealand should raise the official cash rate (OCR) by another 50 basis points to 3.50 percent at the upcoming October meeting. Only one member does not recommend such a large increase due to concerns about business and consumer confidence and the increasing cost of finance. (NZIER)

NORTH KOREA: North Korea will face “a determined and overwhelming response” from South Korea and the United States if it attempts to use nuclear weapons, South Korea’s President Yoon Suk Yeol said Saturday. (CNN)

NORTH KOREA: North Korea fired two short-range ballistic missiles toward the sea off the east coast on Saturday (Oct 1), South Korea's military said, marking Pyongyang's fourth launch in a week as it ratchets up tension around the Korean peninsula. (CNA)

CANADA: Canadian Prime Minister Justin Trudeau was briefed in July that home construction will likely slow as a slump in prices reduces builder profitability, according to a document obtained by MNI, suggesting one of his key economic pledges will be even harder to reach. (MNI)

TURKEY: Turkey began rounding up suspects in an investigation into alleged stock market fraud that led to a plunge in equities last month, according to state media. (BBG)

TURKEY/RATINGS: Sovereign rating reviews of note from after hours on Friday include:

- S&P lowered Turkey to B; Outlook Stable

MEXICO: Mexico's financial system benefits from a "solid position" and resiliency, with capital levels and liquidity exceeding regulatory minimums, the country's financial stability council said in a statement on Friday. (RTRS)

BRAZIL: Brazil's election is going into a second round in which left-winger Luiz Inácio Lula da Silva will face far-right incumbent Jair Bolsonaro. (BBC)

BRAZIL: Brazil's central bank will persevere in its monetary policy strategy until market inflation expectations for 2024 go down, the central bank's director of international affairs, Fernanda Guardado, said on Friday. (RTRS)

RUSSIA: Russia has withdrawn its troops from the strategic Ukrainian town of Lyman, in a move seen as a significant setback for its campaign in the east. (BBC)

RUSSIA: Ramzan Kadyrov, head of Russia's region of Chechnya, said on Saturday that Moscow should consider using a low-yield nuclear weapon in Ukraine after a major new defeat on the battlefield. (RTRS)

RUSSIA: The International Atomic Energy Association is in touch with Russian authorities about what Ukraine has called the kidnapping of Ihor Murashov, director of the Zaporizhizhia nuclear power plant in Ukraine. (BBG)

RUSSIA: The United States has not yet seen Russia take any action that suggests it is contemplating the use of nuclear weapons amid its invasion of Ukraine, U.S. Secretary of State Antony Blinken said on Friday, despite what he called "loose talk" by Russian President Vladimir Putin about their possible use. (RTRS)

RUSSIA: Russia on Friday vetoed a UN Security Council resolution introduced by the United States and Albania condemning Moscow's proclaimed annexation of parts of Ukraine, with Russia's strategic partner China abstaining from the vote. (RTRS)

RUSSIA: The US sanctioned hundreds of Russian officials, lawmakers, family members and businesses Friday in what Treasury Secretary Janet Yellen called a “sweeping action,” but in reality the measures will have little practical effect on President Vladimir Putin’s ability to sustain his country’s economy with oil and gas revenue. (BBG)

SOUTH AFRICA: Power utility, Eskom, says electricity generation capacity remains constrained. Stage 3 load shedding will continue to be implemented until Thursday morning. (EWN)

IRAN: Iran has made “considerable progress” in recent weeks to secure the release of billions of dollars of funds trapped by sanctions in foreign accounts, the semi-official Iranian Students News Agency reported. (BBG)

ENERGY: Russia’s state-controlled Gazprom PJSC suspended natural gas deliveries to Italy, escalating the energy crisis in Europe. (BBG)

ENERGY: Russian Deputy Prime Minister Alexander Novak said on Sunday that it was technically possible to restore ruptured offshore infrastructure of Nord Streams pipelines, TASS news agency reported. (RTRS)

ENERGY: Denmark’s Energy Agency said on Sunday it had been informed by Nord Stream AG that stable pressure had been achieved in the damaged Nord Stream 1 pipeline and that this indicates the outflow of natural gas from the last leaks had now halted. (RTRS)

ENERGY: Gas is no longer flowing out of the Nord Stream 2 pipeline following a leak this week that spewed tonnes of methane into the Baltic Sea, a spokesperson for the operator said. (RTRS)

ENERGY: President Joe Biden declared that a massive leak from the Nord Stream gas pipeline system in the Baltic Sea was an intentional act, and that Russian statements about the incident shouldn’t be trusted. (BBG)

OIL: The Opec+ oil alliance is planning a substantial cut in production to prop up falling prices, according to people close to the discussions, as the group prepares to meet in person for the first time since March 2020. The oil group, which is led by Saudi Arabia and Russia, is expected to discuss a production cut that could total more than 1mn barrels a day at the meeting on Wednesday. This is by far the largest since early in the pandemic and equivalent to more than 1 per cent of global supplies. (FT)

OIL: The European Union proposed making so-called pilot services exempt from sanctions targeting the transfer of Russian oil that are set to kick in this year to punish Moscow for its invasion of Ukraine. (BBG)

OIL: Saudi Arabia is budgeting for Brent oil at around $76 a barrel next year, according to Al Rajhi Capital, an outlook in line with current forward prices but far more bearish than expected by analysts. (BBG)

OIL: Senior Biden administration officials pressed executives from some of the largest US gasoline producers to curtail overseas sales during a tense meeting Friday afternoon, suggesting that without voluntary action, the government could force the industry to stockpile more fuel in US tanks. (BBG)

OVERNIGHT DATA

JAPAN Q3 TANKAN LARGE MANUFACTURING INDEX +8; MEDIAN +10; Q2 +9

JAPAN Q3 LARGE MANUFACTURING OUTLOOK +9; MEDIAN +11; Q2 +10

JAPAN Q3 LARGE NON-MANUFACTURING INDEX +14; MEDIAN +13; Q2 +13

JAPAN Q3 LARGE NON-MANUFACTURING OUTLOOK +11; MEDIAN +15; Q2 +13

JAPAN Q3 TANKAN SMALL MANUFACTURING INDEX -4; MEDIAN -3; Q2 -4

JAPAN Q3 SMALL MANUFACTURING OUTLOOK -5; MEDIAN -4; Q2 -5

JAPAN Q3 SMALL NON-MANUFACTURING INDEX +2; MEDIAN -2; Q2 -1

JAPAN Q3 SMALL NON-MANUFACTURING OUTLOOK -3; MEDIAN -3; Q2 -5

JAPAN Q3 LARGE ALL INDUSTRY CAPEX +21.5%; MEDIAN +18.9%; Q2 18.6%

JAPAN SEP, F JIBUN BANK MANUFACTURING PMI 50.8; PRELIM 51.0; AUG 51.5

Weakness in Japan's manufacturing sector persisted in September and even turned worse. New orders fell at their sharpest rate in two years – high inflation is eroding client purchasing power, while slowing global economic growth is hurting exports. (S&P Global)

AUSTRALIA SEP, F S&P GLOBAL MANUFACTURING PMI 53.5; PRELIM 53.9; AUG 53.8

The sustained easing in inflationary pressures across the Australian manufacturing sector has been a particularly positive aspect of the latest survey data. Rates of input price and output cost inflation have softened from the survey peaks recorded over the past year, dipping to 19- and 8-month lows, respectively. (S&P Global)

AUSTRALIA SEP MELBOURNE INSTITUTE INFLATION +5.0% Y/Y; AUG +4.9%

AUSTRALIA SEP MELBOURNE INSTITUTE INFLATION +0.5% M/M; AUG -0.5%

AUSTRALIA SEP CORELOGIC HOUSE PRICE INDEX -1.4% M/M; AUG -1.6%

SOUTH KOREA SEP TRADE BALANCE -$3.770BN; MEDIAN -$3.000BN; AUG -$9.487BN

SOUTH KOREA SEP EXPORTS +2.8% Y/Y; MEDIAN +3.3%; AUG +6.6%

SOUTH KOREA SEP IMPORTS +18.6% Y/Y; MEDIAN +17.0%; AUG +28.2%

MARKETS

SNAPSHOT: No Let-Up For Truss

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 128.2 points at 26065.41

- ASX 200 down 17.3 points at 6456.9

- Shanghai Comp. is closed

- JGB 10-Yr future up 20 ticks at 148.50, yield down 0.3bp at 0.241%

- Aussie 10-Yr future down 4.0 ticks at 96.045, cash ACGBs are closed

- U.S. 10-Yr future up 0-01+ at 112-03+, yield down 4.81bp at 3.7805%

- WTI crude up $2.11 at $81.60, Gold up $3.08 at $1663.63

- USD/JPY up 13 pips at Y144.88

- TORY PARTY CONFERENCE DOESN’T HERALD EASIER TIME FOR TRUSS, AS FISCAL PLAN CREATES UNREST

- UK RATING OUTLOOK CUT TO NEGATIVE AT S&P

- OPEC+ PLANS SUBSTANTIAL OIL PRODUCTION CUT TO PROP UP PRICES (FT)

- RUSSIAN TROOPS FORCED OUT OF EASTERN TOWN LYMAN (BBC)

- CREDIT SUISSE CEO SEEKS TO CALM MARKETS AS DEFAULT SWAPS CLIMB (BBG)

- BRAZIL ELECTION: LULA AND BOLSONARO TO FACE RUN-OFF (BBC)

- GAZPROM HALTS GAS SUPPLIES TO ITALY IN LATEST ENERGY BATTLE (BBG)

US TSYS: Bull Steepening Evident In Asia

Tsys faded a portion of Friday’s late cheapening move, which came against a lack of month-/quarter-end related demand. The willingness of Asia-Pac participants to fade the move, alongside the continued struggle for global equities (e-minis are off worst levels after registering fresh cycle lows), allowed Tsys to bull steepen in overnight dealing.

- Some also pointed to the potential stagflationary nature of the latest bid in crude as a supportive factor for Tsys (with a large OPEC+ oil output cut seemingly in the offing).

- The bid in longer dated JGBs also supported the space.

- Cash Tsys run 4.5-7.5bp richer across the curve at typing, while TYZ2 deals 0-03 shy of the peak of its 0-12 overnight range, on volume of ~78K. Note that liquidity was limited by the start of a week-long holiday in China and partial holiday in Australia.

- We haven’t seen much in the way of meaningful headline/data flow during Asia-Pac hours, after continued headwinds for UK Truss in lieu of the unveiling of her fiscal plan and positive advances for the Ukrainian military were noted over the weekend.

- Gilt trade will likely shape wider core FI dealing in early London hours, with final manufacturing PMI readings from across Europe set to provide the data highlights in that window.

- The ISM m’fing survey and Fedspeak from Williams & Bostic headline the NY docket.

JGBS: Flatter, But Off Best Levels

The JGB curve flattened on Monday, with the super-long end drawing support from tweaks seen within the BoJ’s quarterly Rinban plan, released after hours on Friday.

- Upsized purchases covering 5- to 25+-Year paper will ultimately result in Y550bn/month of extra JGB purchases from the BoJ through year end (in scheduled terms, actual purchases may deviate from this if the BoJ is forced into defending its YCC settings).

- Still, the long end retraced from best levels as the major domestic equity indices more than reversed their early losses.

- This leaves the major JGB benchmarks running little changed to 4bp richer.

- Futures also pulled back from best levels after failing to better their overnight session high, printing +18 as we move towards the bell.

- Comments from PM Kishida have been in line with broader expectations, as he outlined his plan to boost tourism.

- Looking ahead, 10-Year JGB supply provides the focal point of tomorrow’s domestic docket, with Tokyo CPI data also due.

AUSSIE BONDS: Futures A Touch Steeper In Holiday Thinned Pre-RBA Trade

The observance of Labour Day holiday in NSW & the ACT limited wider liquidity in the Aussie bond space, as well as resulting in the closure of cash ACGB trade on Monday, making for a relatively limited round of futures trade ahead of tomorrow’s RBA decision.

- YM -0.5 with XM -3.0, with the early steepening impulse holding, as YM flicked between positive and negative territory.

- Tomorrow’s RBA decision provides the key domestic risk event this week. 22 of the 28 surveyed by BBG look for another 50bp step from the Bank, with 44bp of tightening priced by markets. We leans towards a 50bp hike, although this could be the final hike of that magnitude in the current hiking cycle (see our full preview of the event here).

- Elsewhere, Tuesday’s domestic docket will bring ANZ job ads, housing finance and building approvals data.

NZGBS: NZGBs Consolidate Most Of Early Richening, Winding Towards RBNZ Decision

NZGBs held onto the bulk of their early richening, leaning on Friday’s bid in Gilts and Asia-Pac richening in U.S. Tsys as sources of support in a headline-light session.

- That left the major NZGB benchmarks running 1.0-6.5bp richer across the curve at the close of Monday trade, with bull steepening in play.

- Focus remains on Wednesday’s RBNZ decision, with a 50bp hike widely universally expected and fully discounted by OIS. The Bank’s rhetoric will therefore be key for the space, with a terminal rate of ~4.85% currently priced (little changed on the day).

EQUITIES: Struggle Continues In Asia

Continued uncertainty surrounding UK policy added to the negative spill over from Friday’s NY session, making for a fairly sombre start to October trading for Asia-Pac equities.

- Still, there was a move away from worst levels for the bulk of the major regional equity indices that were dealing overnight, probably aided by an uptick in Chinese property developer names operating in Hong Kong (which benefitted from reports flagging regulator guidance re: state-owned bank lending targeting the sector).

- The Nikkei 225 was the only major regional equity index to trade higher, as Japanese exporters benefitted from a softer JPY.

- Elsewhere, the 3 major e-mini futures contracts registered fresh cycle lows before correcting from worst levels.

- Chinese & South Korean markets were closed on the back of national holidays.

OIL: Crude Jumps On Speculation Of Large OPEC+ Production Cut

WTI and Brent crude oil futures have clung on to the bulk of their early Asia-Pac gains, sitting ~$2.30 above their respective settlement levels at typing.

- Today’s early bid came on the back of various weekend press reports pointing to OPEC+ discussing cumulative output cuts of ~1mn bpd vs. current quota levels, with the potential for Saudi Arabia to conduct a unilateral output cut on top of that move.

- Note that this week’s OPEC+ meeting has been switched to an in-person gathering in Vienna, the first such instance since early ’20, adding fuel to the speculation that the group will conduct a sizeable production cut.

- Expect continued source reports across the wires ahead of the group’s Wednesday gathering as OPEC+ attempts to better balance oil market fundamentals.

- Bulls need to overcome initial resistance in the form of the respective 20-day EMAs in both WTI & Brent to start turning the technical tide back in their favour.

GOLD: Gold Consolidates Recent Move Away From Cycle Cheaps, Lower Tsy Yields Help

A relatively rangebound Asia-Pac session, with gold leaning on lower Tsy yields and jittery equity sentiment. Still, gold’s session range remains limited with spot +$5/oz at ~1,665/oz, failing to challenge Friday’s high, consolidating last week’s move away from a fresh cycle base in the process.

- Technically, the 20-day EMA now provides the next meaningful level of technical resistance. Conversely the cycle low ($1,615/oz) provides initial support and the bear trigger.

FOREX: Potential OPEC+ Output Cut Aids Oil-Tied FX, Pound Sinks On UK Fiscal Plans

Higher crude oil prices set the tone of price action across G10 FX space, triggering a rally in commodity-tied currencies. Oil advanced on reports flagging talks among OPEC+ members who are looking to deliver a collective output cut to the tune of 1mn barrels/day, which can be finalised at the group's summit this week.

- The Antipodeans outperformed in the G10 basket ahead of local central bank meetings this week. AUD/USD 1-week implied volatility jumped to its highest levels since Apr 2020, with the OIS strip pricing a ~60% chance of a 50bp hike to the cash rate target on Tuesday. NZD/USD 1-week implied volatility also climbed to a cyclical high, despite broad consensus that the RBNZ will raise the OCR by 50bp on Wednesday.

- Sterling resumed its decline as UK government keeps defending its controversial fiscal plans despite brewing rebellion from Tory backbenchers and a downward revision to the UK's credit rating outlook last Friday. Cable shed ~50 pips in the Asia-Pac session, snapping a four-day recovery.

- European currencies were relative underperformers as Russia's Gazprom suspended natural gas deliveries to Italy, raising fears of further escalation of tensions on the energy front.

- Public holidays in China, South Korea and some Australian states limited regional activity at the start to the week.

- Manufacturing PMI readings from across the world, as well as comments from Fed's Bostic & Williams, BoE's Mann & Riksbank's Floden will take focus after Asia hours.

FX OPTIONS: Expiries for Oct3 NY cut 1000ET (Source DTCC)

- USD/JPY: Y142.50($579mln), Y148.00($529mln)

- NZD/USD: $0.5780(N$495mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/10/2022 | 0630/0830 | *** |  | CH | CPI |

| 03/10/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/10/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/10/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/10/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 03/10/2022 | 1305/0905 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/10/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/10/2022 | 1400/1000 | * |  | US | Construction Spending |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/10/2022 | 1800/1900 |  | UK | BOE Mann Panellist at CD Howe Institute |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.