-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

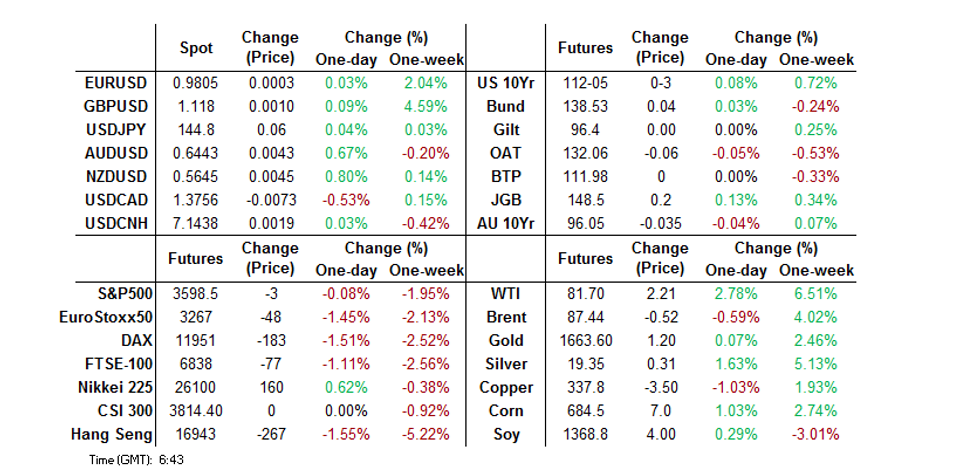

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Crude Bid As OPEC+ Cut Speculation Heats Up

- Tsys faded a portion of Friday’s late cheapening move, which came against a lack of month-/quarter-end related demand. The willingness of Asia-Pac participants to fade the move, alongside the continued struggle for global equities (e-minis are off worst levels after registering fresh cycle lows), allowed Tsys to bull steepen in overnight dealing. A bid in the longer end of the JGB curve also did Tsys no harm.

- Higher crude oil prices set the tone of price action across the G10 FX space, triggering a rally in commodity-tied currencies. Oil advanced on reports flagging talks among OPEC+ members who are looking to deliver a collective output cut to the tune of 1mn barrels/day, which can be finalised at the group's summit this week.

- Manufacturing PMI readings from across the world, as well as comments from Fed's Bostic & Williams, BoE's Mann & Riksbank's Floden will take focus from here.

MNI RBA Preview - October 2022: 50bp But A Very Close Call

EXECUTIVE SUMMARY

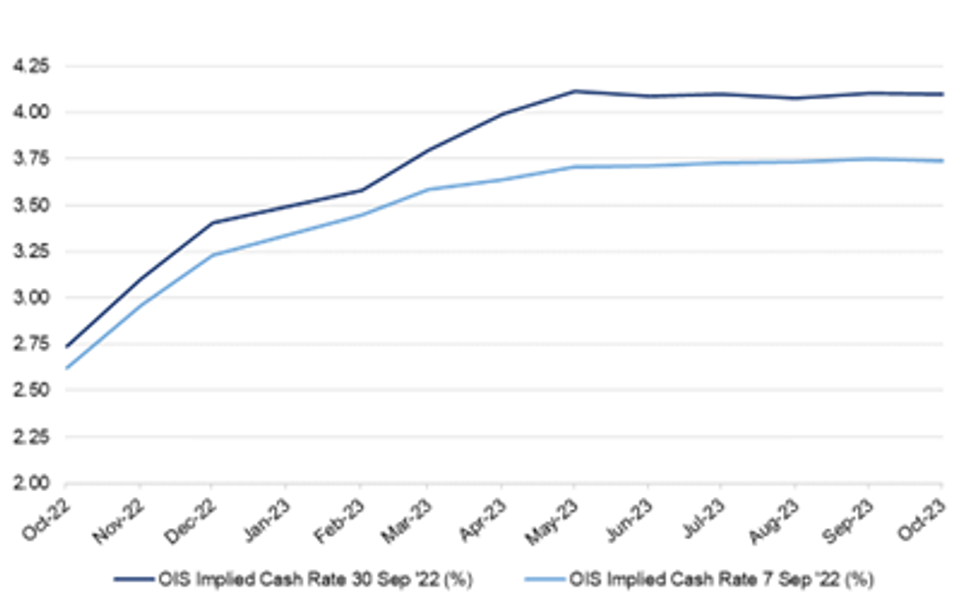

- We think that the data and RBA communique point to a final 50bp hike at the Bank’s October meeting, which would leave the cash rate target at 2.85%.

- Market pricing surrounding the terminal rate has shifted higher again in recent weeks’ although the June peak of ~4.50% has not been breached.

- The RBA has made it very clear that its decisions will be data dependent and this month’s data show that the economy continues to operate in a resilient manner.

- Click to view full preview: MNI RBA Preview - October 2022.pdf

Source: MNI – Market News/Bloomberg

Source: MNI – Market News/Bloomberg

US TSYS: Bull Steepening Evident In Asia

Tsys faded a portion of Friday’s late cheapening move, which came against a lack of month-/quarter-end related demand. The willingness of Asia-Pac participants to fade the move, alongside the continued struggle for global equities (e-minis are off worst levels after registering fresh cycle lows), allowed Tsys to bull steepen in overnight dealing.

- Some also pointed to the potential stagflationary nature of the latest bid in crude as a supportive factor for Tsys (with a large OPEC+ oil output cut seemingly in the offing).

- The bid in longer dated JGBs also supported the space.

- Cash Tsys run 4.5-7.5bp richer across the curve at typing, while TYZ2 deals 0-03 shy of the peak of its 0-12 overnight range, on volume of ~78K. Note that liquidity was limited by the start of a week-long holiday in China and partial holiday in Australia.

- We haven’t seen much in the way of meaningful headline/data flow during Asia-Pac hours, after continued headwinds for UK Truss in lieu of the unveiling of her fiscal plan and positive advances for the Ukrainian military were noted over the weekend.

- Gilt trade will likely shape wider core FI dealing in early London hours, with final manufacturing PMI readings from across Europe set to provide the data highlights in that window.

- The ISM m’fing survey and Fedspeak from Williams & Bostic headline the NY docket.

JGBS: Flatter, But Off Best Levels

The JGB curve flattened on Monday, with the super-long end drawing support from tweaks seen within the BoJ’s quarterly Rinban plan, released after hours on Friday.

- Upsized purchases covering 5- to 25+-Year paper will ultimately result in Y550bn/month of extra JGB purchases from the BoJ through year end (in scheduled terms, actual purchases may deviate from this if the BoJ is forced into defending its YCC settings).

- Still, the long end retraced from best levels as the major domestic equity indices more than reversed their early losses.

- This leaves the major JGB benchmarks running little changed to 4bp richer.

- Futures also pulled back from best levels after failing to better their overnight session high, printing +18 as we move towards the bell.

- Comments from PM Kishida have been in line with broader expectations, as he outlined his plan to boost tourism.

- Looking ahead, 10-Year JGB supply provides the focal point of tomorrow’s domestic docket, with Tokyo CPI data also due.

AUSSIE BONDS: Futures A Touch Steeper In Holiday Thinned Pre-RBA Trade

The observance of Labour Day holiday in NSW & the ACT limited wider liquidity in the Aussie bond space, as well as resulting in the closure of cash ACGB trade on Monday, making for a relatively limited round of futures trade ahead of tomorrow’s RBA decision.

- YM -0.5 with XM -3.0, with the early steepening impulse holding, as YM flicked between positive and negative territory.

- Tomorrow’s RBA decision provides the key domestic risk event this week. 22 of the 28 surveyed by BBG look for another 50bp step from the Bank, with 44bp of tightening priced by markets. We leans towards a 50bp hike, although this could be the final hike of that magnitude in the current hiking cycle (see our full preview of the event here).

- Elsewhere, Tuesday’s domestic docket will bring ANZ job ads, housing finance and building approvals data.

NZGBS: NZGBs Consolidate Most Of Early Richening, Winding Towards RBNZ Decision

NZGBs held onto the bulk of their early richening, leaning on Friday’s bid in Gilts and Asia-Pac richening in U.S. Tsys as sources of support in a headline-light session.

- That left the major NZGB benchmarks running 1.0-6.5bp richer across the curve at the close of Monday trade, with bull steepening in play.

- Focus remains on Wednesday’s RBNZ decision, with a 50bp hike widely universally expected and fully discounted by OIS. The Bank’s rhetoric will therefore be key for the space, with a terminal rate of ~4.85% currently priced (little changed on the day).

FOREX: Potential OPEC+ Output Cut Aids Oil-Tied FX, Pound Sinks On UK Fiscal Plans

Higher crude oil prices set the tone of price action across G10 FX space, triggering a rally in commodity-tied currencies. Oil advanced on reports flagging talks among OPEC+ members who are looking to deliver a collective output cut to the tune of 1mn barrels/day, which can be finalised at the group's summit this week.

- The Antipodeans outperformed in the G10 basket ahead of local central bank meetings this week. AUD/USD 1-week implied volatility jumped to its highest levels since Apr 2020, with the OIS strip pricing a ~60% chance of a 50bp hike to the cash rate target on Tuesday. NZD/USD 1-week implied volatility also climbed to a cyclical high, despite broad consensus that the RBNZ will raise the OCR by 50bp on Wednesday.

- Sterling resumed its decline as UK government keeps defending its controversial fiscal plans despite brewing rebellion from Tory backbenchers and a downward revision to the UK's credit rating outlook last Friday. Cable shed ~50 pips in the Asia-Pac session, snapping a four-day recovery.

- European currencies were relative underperformers as Russia's Gazprom suspended natural gas deliveries to Italy, raising fears of further escalation of tensions on the energy front.

- Public holidays in China, South Korea and some Australian states limited regional activity at the start to the week.

- Manufacturing PMI readings from across the world, as well as comments from Fed's Bostic & Williams, BoE's Mann & Riksbank's Floden will take focus after Asia hours.

FX OPTIONS: Expiries for Oct3 NY cut 1000ET (Source DTCC)

- USD/JPY: Y142.50($579mln), Y148.00($529mln)

- NZD/USD: $0.5780(N$495mln)

ASIA FX: Emerging Asian FX On Softer Footing, China & South Korea Out On Holidays

The Bloomberg/J.P. Morgan Asia Dollar Index faltered, with overhang risk-off impetus from Friday's after-Asia hours applying pressure to regional currencies. Financial markets were closed in China and South Korea, the former of which begins its Golden Week holiday.

- IDR: Spot USD/IDR ripped through recent cyclical highs, running as highs as to IDR15,290 in anticipation of local CPI data. Headline inflation accelerated to +5.95% Y/Y in September, printing close to the +6.00% median estimate, which keeps pressure on Bank Indonesia to raise interest rates further.

- MYR: The ringgit refreshed its worst levels versus the greenback since the Asian financial crisis. Prime Minister Ismail Sabri said he would seek an audience with the King after the ruling party called for a quick dissolution of parliament, which began its sitting to debate Budget 2023. Data showed that Malaysia's manufacturing sector slipped into contraction.

- PHP: Spot USD/PHP remained capped by its record highs printed last week near PHP59.000. The generally optimistic results of the local S&P Global M'fing PMI failed to provide much support to the peso.

- THB: The Thai baht was among the worst performers in emerging Asia as the BoT's reluctance to tighten monetary policy at a faster clip keeps the currency vulnerable. Thailand's S&P Global M'fing PMI soared to its highest point on record.

EQUITIES: Struggle Continues In Asia

Continued uncertainty surrounding UK policy added to the negative spill over from Friday’s NY session, making for a fairly sombre start to October trading for Asia-Pac equities.

- Still, there was a move away from worst levels for the bulk of the major regional equity indices that were dealing overnight, probably aided by an uptick in Chinese property developer names operating in Hong Kong (which benefitted from reports flagging regulator guidance re: state-owned bank lending targeting the sector).

- The Nikkei 225 was the only major regional equity index to trade higher, as Japanese exporters benefitted from a softer JPY.

- Elsewhere, the 3 major e-mini futures contracts registered fresh cycle lows before correcting from worst levels.

- Chinese & South Korean markets were closed on the back of national holidays.

GOLD: Gold Consolidates Recent Move Away From Cycle Cheaps, Lower Tsy Yields Help

A relatively rangebound Asia-Pac session, with gold leaning on lower Tsy yields and jittery equity sentiment. Still, gold’s session range remains limited with spot +$5/oz at ~1,665/oz, failing to challenge Friday’s high, consolidating last week’s move away from a fresh cycle base in the process.

- Technically, the 20-day EMA now provides the next meaningful level of technical resistance. Conversely the cycle low ($1,615/oz) provides initial support and the bear trigger.

OIL: Crude Jumps On Speculation Of Large OPEC+ Production Cut

WTI and Brent crude oil futures have clung on to the bulk of their early Asia-Pac gains, sitting ~$2.30 above their respective settlement levels at typing.

- Today’s early bid came on the back of various weekend press reports pointing to OPEC+ discussing cumulative output cuts of ~1mn bpd vs. current quota levels, with the potential for Saudi Arabia to conduct a unilateral output cut on top of that move.

- Note that this week’s OPEC+ meeting has been switched to an in-person gathering in Vienna, the first such instance since early ’20, adding fuel to the speculation that the group will conduct a sizeable production cut.

- Expect continued source reports across the wires ahead of the group’s Wednesday gathering as OPEC+ attempts to better balance oil market fundamentals.

- Bulls need to overcome initial resistance in the form of the respective 20-day EMAs in both WTI & Brent to start turning the technical tide back in their favour.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/10/2022 | 0630/0830 | *** |  | CH | CPI |

| 03/10/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/10/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/10/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/10/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 03/10/2022 | 1305/0905 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/10/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/10/2022 | 1400/1000 | * |  | US | Construction Spending |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/10/2022 | 1800/1900 |  | UK | BOE Mann Panellist at CD Howe Institute |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.