-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI EUROPEAN OPEN:

EXECUTIVE SUMMARY

- FED'S WILLIAMS SAYS CREDIT CONDITIONS TO DAMPEN SPENDING (MNI)

- FED’S GOOLSBEE SAYS HE’S WATCHING TIGHTER CREDIT ECONOMY IMPACT (BBG)

- FED TO DELIVER 25-BASIS-POINT HIKE IN MAY, STAY ON HOLD REST OF YEAR (RTRS POLL)

- FED BEIGE BOOK: INFLATION SLOWS, CREDIT TIGHTENS (MNI)

- U.S. TREASURY'S TAX DEADLINE DAY TAKE TOTALS $129.8BN (RTRS)

- ECB’S SCHNABEL SAYS TOO HARD TO CALL OUTCOME OF MAY MEETING (BBG)

- RBA SET FOR BIGGEST OVERHAUL IN DECADES AFTER REVIEW CALLS FOR MORE EXTERNAL LEADERS (ABC)

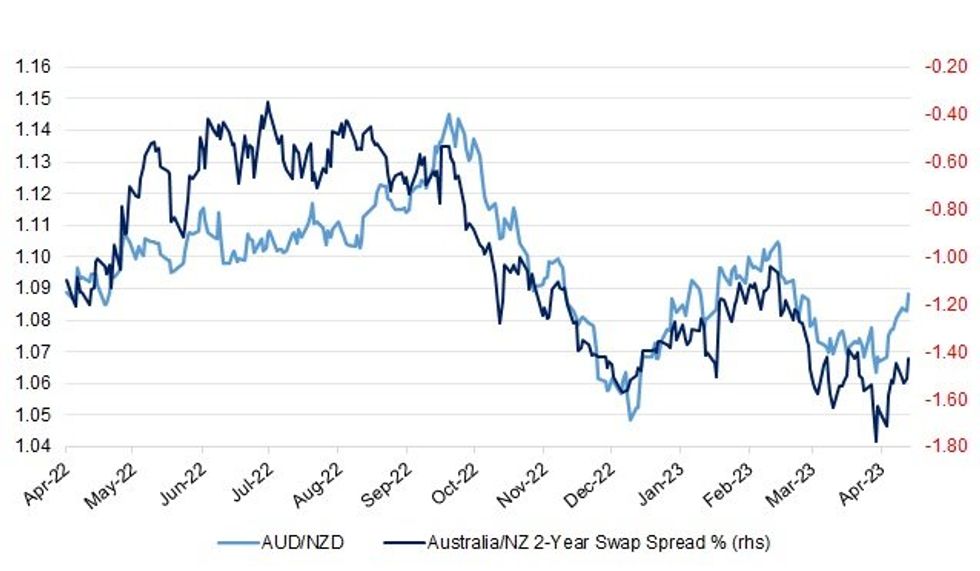

Fig. 1: AUD/NZD Vs. Australia/New Zealand 2-Year Swap Spread

Source: MNI - Market News/Bloomberg

UK

INFLATION: British finance minister Jeremy Hunt said on Wednesday that inflation running above 10% was destabilising for the economy and the government had a plan to bring it down. (RTRS)

PENSIONS: Chancellor Jeremy Hunt has been urged by the UK pensions industry not to force retirement schemes to invest in riskier and complex assets including fast-growing young British companies, and infrastructure. (FT)

EUROPE

ECB: European Central Bank Executive Board member Isabel Schnabel said elevated uncertainty makes it hard to predict the outcome when officials next set interest rates. “I can’t tell you what we’ll decide at the next meeting, and especially at the following meetings,” Schnabel said Wednesday at the ZEW research institute in Mannheim, Germany. (BBG)

SNB: Swiss inflation may be low compared to other countries but is still too high, Swiss National Bank Vice Chairman Martin Schlegel said on Wednesday, hinting at possible further interest rates ahead. (RTRS)

BANKS: Credit Suisse Group AG's dealmakers, hoping to secure jobs after UBS Group AG's rescue takeover, are struggling to dispel fears about a culture clash and many will be disappointed, sources familiar with the talks told Reuters. (RTRS)

BANKS/BONDS: At least 80 Credit Suisse investors in Singapore are in talks to sue the Swiss government over its decision to write down $17bn of Credit Suisse bonds on the grounds it violates a free trade agreement. (FT)

U.S.

FED: Federal Reserve Bank of New York President John Williams Wednesday suggested the U.S. economy remains overheated and policymakers have more tightening to do, even as tougher credit conditions may dampen spending. (MNI)

FED: Federal Reserve Bank of Chicago President Austan Goolsbee said he was still waiting to see if the fallout from the recent failure of two US banks could cause the economy to slow more than expected. (BBG)

FED: The U.S. Federal Reserve will deliver a final 25-basis-point interest rate increase in May and then hold rates steady for the rest of 2023, according to economists in a Reuters poll, which also showed a short and shallow recession this year was likely. (RTRS)

FED: The Fed's latest Beige Book report Wednesday said price increases appear to be slowing, overall economic activity was little changed in recent weeks and several regions reported tighter lending standards following SVB's collapse. (MNI)

FISCAL: The U.S. Treasury brought in $129.82 billion in total tax receipts on Tuesday, the annual tax filing deadline, compared with $75.53 billion a day earlier, the department's daily financial statement showed on Wednesday. (RTRS)

FISCAL: President Joe Biden accused Republicans of trying to “squeeze out more of America’s middle class,” painting the debt ceiling and spending cut proposal unveiled Wednesday by House Speaker Kevin McCarthy as lacking detail and benefiting the wealthy. (BBG)

FISCAL: House Speaker Kevin McCarthy proposed a debt ceiling increase on Wednesday of $1.5 trillion — paired with a package of spending cuts. (Axios)

BANKS: The evolution of "open banking" in the U.S. could impact how regulators supervise banks, as seamless account portability between financial institutions could lead to increased deposit outflows, a top banking regulator said on Wednesday. (RTRS)

EQUITIES: Shares in electric vehicle maker Tesla dropped more than 4% after the company reported first-quarter earnings after the bell. Here are the results. (CNBC)

OTHER

GLOBAL TRADE: Brussels is preparing emergency curbs on Ukrainian grain imports to five member states close to the war-torn country, bowing to pressure from Poland and Hungary after they took unilateral action to pacify local farmers. (FT)

GLOBAL TRADE: Ukrainian authorities have asked Turkey to seize a ship carrying what prosecutors in Kyiv say is thousands of tons of grain stolen from areas of Ukraine occupied by Russia, according to correspondence reviewed by The Wall Street Journal. (WSJ)

GLOBAL TRADE: Britain needs to cut its reliance on semiconductor imports from geopolitically sensitive parts of the world such as Taiwan, the government will argue when it publishes a long-delayed review of the sector. (FT)

GLOBAL TRADE: Italian officials hinted in private talks with Taiwan that they may be willing to pull out of a controversial pact with China as they sought to secure help with semiconductors, according to people familiar with the issue. (BBG)

GLOBAL TRADE: Negotiations over a US-led Indo-Pacific trade pact are likely to yield results this year, US Trade Representative Katherine Tai said. (BBG)

EU/CHINA: Relations with China will continue to be an important feature of how the global economy develops in spite of pressure from the US to decouple from Beijing, said Paschal Donohoe, president of the Eurogroup, which brings together euro-area finance ministers. (BBG)

BOJ: Bank of Japan Governor Kazuo Ueda will leave monetary stimulus unchanged at his first policy meeting next week, according to a Bloomberg survey. (BBG)

BOJ: The Bank of Japan (BOJ) should alter its massive monetary stimulus even though it may be painful for an economy accustomed to decades of ultra-low interest rates, the country's former top currency diplomat Rintaro Tamaki said. (RTRS)

BOJ: While Bank of Japan officials are increasingly hopeful that an uptick in wage growth will prove sustainable, they remain uncertain whether it will lift medium- to long-term inflation expectations above the subdued norm of recent years and allow a change in the easy policy settings aimed at driving the economy towards its 2% price target, MNI understands. (MNI)

RBA: The Reserve Bank is set for its biggest overhaul in decades, after a review into the central bank found it needed major changes to ensure it is "fit for the future". Treasurer Jim Chalmers has given in-principle support to the 51 recommendations, which largely seek to ensure decisions about the cash rate are made with a broader input, and the reasons for its decisions are made clearer to the public. (ABC)

RBA: Shadow treasurer Angus Taylor has flagged early support for expected major changes to the Reserve Bank of Australia. (Sky)

RBA: The Australian Prudential and Regulation Authority notes the release today of the review of the Reserve Bank of Australia (RBA) and the responses by the Government and RBA. APRA welcomes the recommendations of the report that relate to APRA. (APRA)

RBA: RBA Governor Philip Lowe says he is “happy to stay” in his role if the government would like him to. “If they want to have somebody else … I’d perfectly understand that and have other things to do with my life,” Mr Lowe told Sky News Business Editor Ross Greenwood during a media conference on Thursday. (Sky)

NEW ZEALAND: "The Government is committed to bringing down the cost of living and supporting New Zealanders through these difficult times," Grant Robertson said. "While lower than expected, today’s result is still elevated by the impact of flooding and cyclone events on food prices, with prices increasing 8.6 percent for vegetables. The prices of second hand cars and insurance were also elevated. The effects of the cyclone will flow through into the June quarter results as well. (Voxy)

SOUTH KOREA: As bullish retail investor bets on South Korean electric-vehicle battery-related stocks drive one of the world’s best equity rallies, daily short-selling turnover has climbed to record levels. (BBG)

BRAZIL: Ricardo Cappelli takes over GDI on an interim basis after dismissal of Dias (Globo)

RUSSIA: The chief of the Justice Department unit charged with seizing assets connected to violators of sanctions against Russia said the program “cuts the purse strings from the Kremlin,” and that Congress could help it do more. (BBG)

RUSSIA: Costs in Russia's manufacturing sector rose for the second month running in March, data from the state statistics service Rosstat showed on Wednesday, driven by a sharp jump in the cost of mining, extraction and some petroleum product production. (RTRS)

SOUTH AFRICA: South African President Cyril Ramaphosa’s approval rating plunged more than eight percentage points in the nine months through March amid the worst power cuts the country has seen, two Social Research Foundation polls show. (BBG)

SOUTH AFRICA: South Africa’s state-owned power producer, Eskom, offered workers a pay increase of 3.75% on the first day of talks, National Union of Metalworkers of South Africa said in an emailed statement on Wednesday. (BBG)

MARKETS: Japan's Sumitomo Life Insurance expects currency hedging costs for foreign bond investments to remain elevated based on the interest rate outlook, putting a drag on earnings in the next three years, CEO Yukinori Takada said. (Nikkei)

METALS: Rio Tinto reported a near 15% jump in first-quarter iron ore shipments on Thursday, as it ramped up production at its Gudai-Darri mine in Western Australia. (RTRS)

METALS: Total throughput volumes at ports of Port Hedland and Dampier increased last month. Pilbara Ports Authority said its ports handled a total of 62.1 million tonnes in March, a 3% increase compared with figures reported in March 2022. Port of Port Hedland posted a monthly throughput of 46.5 million tonnes. Of this figure, iron ore exports accounted 45.8 million tonnes. PPA said this marked a 2% decrease in total throughput compared with March 2022. (daily cargo News)

OIL: Canada's main oil-producing province Alberta on Wednesday released a climate plan aiming for net-zero carbon emissions by 2050, but did not announce any interim targets in a move that puts it at odds with the federal government's strategy. (RTRS)

CHINA

PBOC: China's Loan Prime Rate remained unchanged on Thursday, according to a People's Bank of China statement, in line with market expectation following the PBOC's decision to keep a key policy rate steady on April 17 due to the robust credit expansion and economic rebound. (MNI)

ECONOMY: Authorities are urgently drafting policy documents aimed at restoring and expanding consumption, according to the National Development and Reform Commission (NDRC). (MNI)

ECONOMY: Shanghai’s economy made a strong start to Q1 but the foundation has not yet solidified, according to Shanghai Mayor Gong Zheng speaking at a recent meeting. (MNI)

ECONOMY: China’s excess savings level should return to normal after reaching a record last year as individuals gain confidence in consumption and investment, the Economic Daily said in a report. (BBG)

YUAN: China’s trading partners' efforts to de-dollarise and expand the use of renminbi will take time, according to local analysts interviewed by the Securities Daily. (MNI)

CREDIT: New loans provided by many banks hit a record high for them in the first quarter, exceeding the original plans, according to a Securities Daily report Thursday, citing interviews with unidentified banks.(BBG)

BONDS: Chinese authorities plan to further "reshape" the country's bond market but have learnt lessons from the chaos that ensued when a data feed ban was abruptly imposed last month, two regulatory sources with knowledge of the matter said. (RTRS)

CHINA MARKETS

PBOC NET INJECTS CNY25 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY34 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY25 billion after offsetting the maturity of CNY9 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0000% at 09:25 am local time from the close of 2.1340% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 50 on Wednesday, compared with the close of 45 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8987 THURS VS 6.8731 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8987 on Thursday, compared with 6.8731 set on Wednesday.

OVERNIGHT DATA

JAPAN MAR TRADE BALANCE -Y754.5BN; MEDIAN -Y1.2948TN; FEB -Y898.1BN

JAPAN MAR ADJUSTED TRADE BALANCE -Y1.2099TN; MEDIAN -Y1.7198TN; FEB -Y1.2530TN

JAPAN MAR EXPORTS +4.3% Y/Y; MEDIAN +2.4%; FEB +6.5%

JAPAN MAR IMPORTS +7.3%Y/Y; MEDIAN +11.6%; FEB +8.3%

JAPAN FEB TERTIARY INDEX +0.7% M/M; MEDIAN +0.4%; JAN +0.7%

AUSTRALIA Q1 NAB BUSINESS CONFIDENCE -4; Q4 -1

Most businesses continued to report facing constraints on output in Q1 of 2023. Labour shortages eased only slightly, despite the strong rebound in migration, with some 87% of firms reporting availability of labour as a constraint on output (down from a peak of 91% in 2022). There was somewhat more improvement on inputs as supply chains improved, with 43% of firms reporting materials as a constraint (down from a peak of 53%). (NAB)

NEW ZEALAND Q1 CPI +6.7% Y/Y; MEDIAN +6.9%; Q4 +7.2%

NEW ZEALAND Q1 CPI +1.2% Q/Q; MEDIAN +1.5%; Q4 +1.4%

NEW ZEALAND Q1 RBNZ SECTORAL FACTOR MODEL INFLATION +5.7% Y/Y; Q4 +5.8%

NEW ZEALAND MAR NON-RESIDENT BOND HOLDINGS 60.3%; FEB 60.0%

MARKETS

US TSYS: Little Changed In Asia

TYM3 deals at 114-09, +0-03, with a narrow 0-03+ range observed on volume of ~45k.

- Cash tsys sit little changed across the major benchmarks

- Tsys have traded in narrow ranges in today's Asian session with little follow through on moves.

- The space looked through weaker than expected CPI from New Zealand. The headline and non-tradeable components were both below the RBNZs's forecast.

- Fedspeak from NY Fed President Williams crossed early in the session. He noted that the US economy remains overheated and policymakers have more tightening to do.

- FOMC dated OIS price ~23bp hike into the May meeting with a terminal rate of ~5.13% in June. There are ~60bps of cuts priced for 2023.

- In Europe today German PPI headlines, further out we have Initial Jobless Claims, Existing Home Sales and Philadelphia Fed Manf Index. There are a number of Fedspeakers including Governor Waller and Cleveland Fed President Mester. We also have the latest 5 Year TIPS supply.

JGBS: Futures Holder Stronger Despite Poor 20-Year Auction

JGB futures sit off session bests, +9 versus settlement levels, after a soft auction of 20-year JGBs. In terms of auction specifics, the cover ratio barely topped the level seen at the previous 20-year auction, which represented the lowest level seen at a 20-Year auction going back to 2012.

- Nonetheless, JGB futures (147.51) sit comfortably in the range of 147.40-147.92, which it has generally traded in since early April, barring a few probes through the lower limit over the past few days. According to MNI's technical analyst, if prices break below this week’s low of 147.27, it may indicate a deeper retracement to 145.80, the March 13 low.

- Cash JGBs curve steepened after the 20-year auction unwinding the morning session’s twist flattening. Yields are -1.4bp to +0.8bp across the curve, pivoting around the 20s.

- Swap spreads are tighter out to the 30-year zone, with swaps also twist steepening.

- Looking ahead, March CPI and Jibun Bank PMIs for April are scheduled for release tomorrow.

- Friday will also see BoJ Rinban operations covering 1- to 25-Year JGBs.

JGBS AUCTION: 20-Year Auction Results

The Japanese Ministry Of Finance (MOF) sells Y971.0bn 20-year JGBs:

- Average Yield: 1.085% (prev. 1.079%)

- Average Price: 100.23 (prev. 105.22)

- High Yield: 1.096% (prev. 1.118%)

- Low price: 100.05 (prev. 104.55)

- % Allocated At High Yield: 26.6910% (prev. 41.4285%)

- Bid/Cover: 2.9628x (prev. 2.846x)

AUSSIE BONDS: Sits Flat, RBA Review Fails To Move The Market

ACGBs sit flat after the formal release of the review of the RBA and the widely accepted recommendations fail to provide any reason for market participants to change views on the near-term outlook for interest rates. The decline in Q1 NAB Business Confidence also failed to provide a domestic catalyst for the market. US Tsys have been trading little changed versus the NY close in Asia-Pac trade.

- Cash ACGBs are unchanged on the day with the AU-US 10-year yield differential +2bp at -8bp.

- Swap rates are 2-3bp lower with EFPs 2bp tighter.

- Bills strip twist flattens with pricing -4 to flat.

- RBA dated OIS pricing is 2-6bp firmer across meetings with 27bp of cumulative tightening priced by August.

- With no domestic data on the calendar, the local participants will likely be guided by US Tsys as they navigate a raft of second-tier data releases. US earnings season results and Fedspeak are also likely in play.

NZGBS: Sharply Richer, At Bests After CPI Miss

NZGBs closed at session bests with benchmark yields 7-9bp lower as Q1 CPI surprised on the downside. The 2/10 cash curve steepened 2bp after the data.

- Overall demand for today's supply was good, with cover ratios ranging from 3.02x to 4.27x, consistent with last week's auction. However, the bid for the May-26 bond fell short of the robust demand (cover ratio of 6.25x) seen at the April 6th auction when the bond was last offered. Short-term bonds were in particularly high demand in early April, possibly reflecting concerns over potential over-tightening by the RBNZ, which unexpectedly raised interest rates by 50bp the day before. Today’s CPI data may allay some of those concerns.

- Swap rates are 7-9bp richer.

- RBNZ dated OIS closed flat to 7bp softer across meetings with 22bp of tightening priced for the May meeting versus 24bp pre-data. Easing expectations for Feb-24, off the expected terminal OCR of 5.56% (July), are currently 42bp.

- With the Antipodean calendar light for the rest of the week, the local market will likely be guided by US Tsys as they navigate US earnings season, Fedspeak and a raft of second-tier data releases. US jobless claims and April Philly Fed Index are today’s highlights.

EQUITIES: Major Indices Mostly Lower Or Close To Flat

Regional equities are mixed, albeit with the markets in the red outweighing those bourses which are higher. China shares are tracking lower, while HK is proving more resilient. US futures have stayed in the red through the session, with tech slightly weaker. This has likely kept a cap on markets around the region that have tried to push higher.

- The CSI 300 is off by 0.64%, the Shanghai Composite by 0.70% at this stage. Lower banking stocks are weighing, while the CSI 300 has pulled back from a test of the 4200 level.

- Still, Northbound stock connect flows remain positive at this stage, +2.72bn yuan.

- The HSI is +0.19% at this stage, so outperforming at the margins.

- The Topix is around flat, while South Korean (-0.50%) and Taiwan (-0.12%) shares are tracking modestly lower. This is line with weakness in tech related indices through US trade on Wednesday. Offshore investors have sold -$226.5mn of local Korean shares today.

- Indian shares are a touch higher, but lower in Malaysia, Singapore and Thailand. Philippines shares are one of the few bright spots, +0.59%. Shares of BDO, the nation's largest bank continued to rally after strong Q1 results yesterday.

GOLD: Bears Target Another Test Of the 20-Day EMA

Gold is down a touch in the first part of Thursday trade, although has largely been range bound. We are just near $1994 currently, versus a NY close to $1995. For Wednesday's session we got near $1969 amid broad USD strength. Whilst we stabilized from there, it was still a fresh low going back to the start of April. This has arguably dented the technical backdrop for the precious metal to some degree.

- The 20-day EMA comes in at $1985.45, so bears will target a renewed break of this level. Bulls will aim to recapture the $2000 handle, although may have to wait until US yield momentum cools.

OIL: Loses Further Ground

Brent crude has continued to slip, down nearly 1% so far today, to be back at the $82.30/40/bbl region. This follows Wednesday's near 2% loss. We are very close to the simple 50 and 100-day MAs, which come in between $82.00 and $82.40/bbl. A move below these levels would traget a test of the $80/bbl handle.

- WTI is following a similar trajectory, albeit underperforming Brent at the margins. The WTI benchmark was last in the $78.30/40/bbl region.

- These moves come despite a further run down in US oil inventories, as reported by EIA during Wednesday's session. Demand fears seemingly outweighing supply concerns at this stage.

- There have also been reports of weaker demand conditions out of Asia, stockpiles of distillates in Singapore at highs going back to 1995. Increased fuel exports out of China are also easing supply concerns.

FOREX: NZD Pressured In Asia After CPI Below Expectations

Kiwi is the weakest performer in the G-10 space at the margins today. New Zealand CPI for Q1 printed below market expectations and also below the RBNZ's forecasts.

- NZD/USD prints at $0.6150/55, the pair is down ~0.7% and printed its lowest level since 16 March. Bears now target year to date lows at $0.6085. AUD/NZD is ~0.6% firmer, printing its highest level since early March. The 200-Day EMA ($1.0871) was breached after the CPI print and we have held above the measure through the Asian session.

- AUD is marginally pressured. Spillover from the New Zealand CPI print and weaker US equity futures have weighed on AUD/USD, however support has been seen below $0.67. The pair sits at $0.6705/10 ~0.1% softer today.

- Yen is little changed from yesterday's closing levels, ranges have been narrow with little follow through on moves. Japans Mar Trade Balance printed narrower than expected at -Y754.5bn.

- Elsewhere in G-10 EUR is little changed and GBP is marginally pressured.

- Cross asset wise; US equity futures are lower. E-minis are down ~0.2%. BBDXY is a touch firmer and US Treasury Yields are little changed across the curve.

- In Europe today German PPI headlines, further out we have Initial Jobless Claims, Existing Home Sales and Philadelphia Fed Manf Index.

FX OPTIONS: Expiries for Apr20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0870-85(E1.6bln), $1.0895-00(E1.1bln), $1.0920-25(E1.9bln), $1.0975-80(E948mln), $1.1000-10(E1.3bln), $1.1100(E1.1bln)

- GBP/USD: $1.2350(Gbp865mln)

- USD/JPY: Y132.00-15($1.4bln), Y134.30($738mln)

- EUR/JPY: Y142.65-75(E1.1bln)

- AUD/USD: $0.6695-00(A$1.2bln)

- AUD/NZD: N$1.0800(A$602mln)

- USD/CAD: C$1.3290($550mln), C$1.3510($668mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/04/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/04/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/04/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 20/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/04/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/04/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/04/2023 | 1415/1015 |  | US | Secretary Yellen on U.S.-China economic relationship | |

| 20/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/04/2023 | 1530/1130 |  | CA | BOC Governor testifies at Senate committee | |

| 20/04/2023 | 1530/1630 |  | UK | BOE Tenreyro Panels National Bureau of Economics Research Conf | |

| 20/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/04/2023 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 20/04/2023 | 1620/1220 |  | US | Cleveland Fed's Loretta Mester | |

| 20/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/04/2023 | 1900/1500 |  | US | Dallas Fed's Lorie Logan | |

| 20/04/2023 | 1900/1500 |  | US | Fed Governor Michelle Bowman | |

| 20/04/2023 | 2015/2215 |  | EU | ECB Schnabel Lecture at Stanford Graduate School of Business | |

| 20/04/2023 | 2100/1700 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/04/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.