-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A$ & Local Yields Surge Post May CPI Beat

EXECUTIVE SUMMARY

- FED’S COOK SEES RATE CUTS ‘AT SOME POINT’ - MNI

- 16 NOBEL PRIZE-WINNING ECONOMISTS SAY TRUMP POLICIES WILL FUEL INFLATION - RTRS

- ECB’S REHN SEES BETS FOR TWO MORE CUTS IN 2024 AS ‘REASONABLE’ - BBG

- AUSSIE MONTHLY CPI AT 4%, HIGHER THAN EXPECTED - MNI BRIEF

- NEUTRAL RATE BELOW CASH RATE - RBA’S KENT - MNI

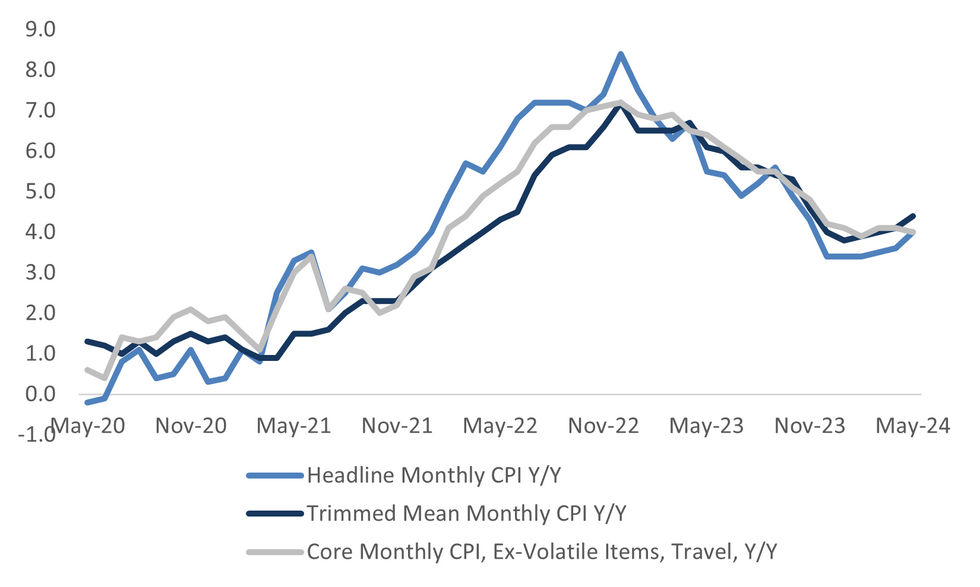

Fig. 1: Australian Monthly CPI Trends - Y/Y

Source: MNI - Market News/Bloomberg

UK

ECONOMY (BBG): “Keir Starmer, who polls show is on course to be Britain’s next prime minister, said his Labour Party would target an economic growth of at least 2.5% if it came to power at the July 4 general election.”

EUROPE

ECB (BBG): “Investor expectations for the European Central Bank to loosen monetary policy twice more this year — and bring borrowing costs to as low as 2.25% in 2025 — are fair, according to Governing Council member Olli Rehn.”

UKRAINE (RTRS): “Two key advisers to Donald Trump have presented him with a plan to end Russia's war in Ukraine - if he wins the Nov. 5 presidential election - that involves telling Ukraine it will only get more U.S. weapons if it enters peace talks.”

ITALY (BBG): “Italy will be offered the chance to fill a senior role in the next European Commission as centrist parties look to wrap up a deal on the bloc’s top jobs before a summit later this week.”

US

FED (MNI): The Federal Reserve will lower interest rates "at some point" as long as inflation continues to slow and the labor market cools gradually, Fed Governor Lisa Cook said Tuesday.

POLITICS (RTRS): “Sixteen Nobel prize-winning economists signed a letter on Tuesday warning that the U.S. and world economy will suffer if Republican presidential candidate Donald Trump wins the U.S. presidential election in November.”

OTHER

JAPAN (BBG): “The Bank of Japan will raise its interest rate in July in addition to unveiling a roadmap for its path toward quantitative tightening, according to one-third of economists surveyed by Bloomberg.”

AUSTRALIA (MNI BRIEF): Australia’s monthly Consumer Price Index (CPI) indicator rose 4.0% y/y in May, up from April’s 3.6% and 20 basis points higher than expected, according to the latest data from the Australian Bureau of Statistics (ABS).

AUSTRALIA (MNI): The Reserve Bank of Australia believes the 4.35% cash rate above its nominal neutral rate estimate, which it judges to be in a range below 4.0%, according to Assistant Governor Financial Markets Chris Kent.

NEW ZELAND (BBG): “New Zealand’s Treasury Department is examining further measures to reduce government spending and increase revenue as the weak economy continues to erode tax receipts, Secretary Caralee McLiesh said.”

CHINA

ECONOMY (MNI INTERVIEW): German firms' optimism in China's H2 has increased.

BONDS (BBG): The yield on China’s benchmark bond fell to a more than two decade low as investors continued to flock to the notes amid lingering concerns about the domestic economy and expectations for further stimulus.

ECONOMY (21ST CENTURY BUSINESS HERALD): Officials will accelerate trade-in schemes for old products after China recycled 55.6% more cars in May year-on-year, according to Xu Xingfeng, director at the Ministry of Commerce's Consumer Promotion Department.

LGFVs (CSJ): Local-government bond issuance will peak in Q3 with over CNY2 trillion deals planned to be issued, which will greatly support infrastructure investment, China Securities Journal reported. A total of CNY2.36 trillion bonds are planned to be issued by 27 regions, with Sichuan, Guangdong, and Hunan provinces all exceeding CNY100 billion, the newspaper said.

DEBT (CAIXIN): Local governments have made phased progress in resolving implicit debts, but illegal borrowing has not been completely curbed, Caixin reported citing a report by the National Audit Office. Some regions with high debt levels still relied on high-interest, non-standard borrowing, or overseas bonds to sustain payment of previous non-standard private placement bonds issued by local-government financing vehicles, Caixin said.

TRADE (MNI INTERVIEW): China Green Exports To Maintain Strong Growth.

CHINA MARKETS

MNI: PBOC Net Drains CNY28 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY250 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY28 after offsetting the CNY278 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:27 am local time from the close of 2.0460% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 50 on Tuesday, compared with the close of 47 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1248 on Wednesday, compared with 7.1225 set on Tuesday. The fixing was estimated at 7.2674 by Bloomberg survey today.

MARKET DATA

AUSTRALIA MAY WESTPAC LEADING INDEX M/M -0.01%; PRIOR -0.03%

AUSTRALIA MAY CPI Y/Y 4.0%; MEDIAN 3.8%; PRIOR 3.6%

MARKETS

US TSYS: Treasury Futures Slip, AU CPI Above Estimates, US Home Sales Later

- Treasury futures are lower today, with the curve slightly flatter. The TUU4 at -0-02⅛ at 102-03+ breaking below the overnight lows with the June 18th lows now in play, while TYU4 is -0-06+ at 110-12+ and now testing Monday's lows.

- Volumes: TU 49k, FV 71k, TY122k slightly up on Tuesdays volumes

- Tsys flows: Earlier there was a Block Fly, buyer belly, DV01 310k - similar to prior days blocks

- Cash treasury curve is slightly flatter today, yields are 1-2bps higher with the 2Y +1.5bps at 4.757%, 5Y +1.6bps at 4.291% while the 10Y is -1.2bps at 4.259%, the 2y10y gapped higher earlier and is now +3.789 at -45.892.

- APAC markets have been focused on Australia where CPI came in above expectations, ACGBs are 8-18bps higher, with the curve bear flattening, the 2Y is +17.3bps at 4.187%, NZGBs have also bear-flattened, yields are 3-6bps higher, while in Japan the curve has bear-steepened, yields are flat to 4bps higher.

- Looking ahead, New Home Sales, 5Y Auction on Wednesday, main focus on PCE inflation data in the latter half of the week.

JGBS: Futures Near Session’s Worst Levels, Retail Sales & 2Y Supply Tomorrow

JGB futures were weaker and near Tokyo session lows, -19 compared to the settlement levels.

- The local calendar is empty today, ahead of Retail Sales and weekly International Investment Flow data tomorrow. Thursday also sees 2-year supply.

- Cash JGBs are dealing mixed, with yield changes bounded by -0.5bp (4-year) to +2.9bps (40-year). The benchmark 10-year yield is 1.1bp higher at 1.015% versus the cycle high of 1.101%. This is the first time the 10-year yield has pushed above 1% since June 12 as traders continue to mull the central bank’s plan to cut its debt purchases.

- (Bloomberg) “The supply dynamics favor a steeper yield curve for Japan’s government bonds and for super-long tenors to underperform relative to swaps. The nervousness of JGB investors about planned reductions in the Bank of Japan’s bond purchases can be easily understood when we look into the supply of debt.” (See link)

- The swaps curve has bear-steepened, with rates flat to 5bps higher. Swap spreads are mostly wider.

- Tomorrow, the local calendar will see Retail Sales and weekly International Investment Flow data alongside 2-year supply.

AUSSIE BONDS: Holding Sharply Cheaper After Higher-Than-Expected CPI Data

ACGBs (YM -18.0 & XM -12.0) are sharply cheaper after a higher-than-expected CPI Monthly print.

- May CPI printed +4.0% versus +3.8% est. and +3.6% prior. This was the firmest y/y print since Nov last year. While base effects played a role in May’s reading, the underlying inflation trend isn’t favourable for a near-term dovish RBA policy pivot. Annual trimmed mean inflation was 4.4% in May, up from 4.1% in April.

- In terms of detail, the ABS noted: "The most significant contributors to the annual rise to May were Housing (+5.2%), Food and non-alcoholic beverages (+3.3%), Transport (+4.9%), and Alcohol and tobacco (+6.7%)."

- Cash ACGBs are 12-18bps cheaper on the day, with the AU-US 10-year yield differential at +6bps. This is the first time the differential has been positive since early February.

- Swap rates are 10-17bps higher on the day, with the 3s10s curve flatter.

- The bills strip has shunted cheaper, with pricing -13 to -22.

- RBA-dated OIS pricing is 7-21bps firmer across meetings after the data, with 2025 meetings leading. A cumulative 5bps of easing is priced by year-end from an expected terminal rate of 4.48%. Terminal rate expectations were 4.37% before the data.

- Tomorrow, the local calendar will see Consumer Inflation Expectations and Job Vacancies data, and a speech from RBA Hauser aftermarket.

NZGBS: Closed On A Weak Note, Negative Spillover From ACGBs

NZGBs closed near the session’s worst levels, 4-6bps cheaper, after negative spillover from a post-CPI sell-off in ACGBs.

- ACGB benchmarks are 11-17bps cheaper after May’s CPI Monthly printed +4.0% y/y versus +3.8% est. and +3.6% prior. Annual trimmed mean inflation was 4.4% in May, up from 4.1% in April. RBA Dated OIS shunted 7-21bps firmer across meetings, with the market giving a 25bp hike in August a 47% chance.

- Cash US tsys are also ~2bps cheaper in today’s Asia-Pac session after a similar-sized move yesterday.

- The local calendar was empty today, although NZ Treasury’s Secretary Caralee McLiesh said the department is “examining further measures to reduce government spending and increase revenue as the weak economy continues to erode tax receipts” (as per BBG).

- Swap rates closed 4-5bps.

- RBNZ dated OIS pricing closed 1-2bps firmer for 2025 meetings. A cumulative 30bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Consumer and Business Confidence data alongside NZ Treasury’s planned sale of NZ$250mn of the 4.5% May-30 bond, NZ$200mn of the 3.5% Apr-33 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: A$ Dominates Post May CPI Beat

The BBDXY USD index sits little changed, last around 1266.50. Earlier we got above 1267, but couldn't sustain these levels. This also left us short of intra-session highs from Tuesday's session. The main focus today has been the sharp rise in AUD following the May CPI beat.

- The headline CPI printed at 4.0%y/y above market expectations (3.8%) (and versus 3.6%y/y prior), while a core trimmed mean measure also firmed in y/y terms. Earlier comments from RBA Assistant Governor Kent reiterated the central bank's mantra that nothing is being ruled in or out. Kent added they wanted to see softer underlying core inflation momentum before easing (note the remarks were made before the May CPI print).

- From 0.6645, AUD/USD got to 0.6679 post the print. We hold near these levels in latest trade. Market pricing for the August RBA meeting is now close to 50/50 in terms of a 25bps hike. The A$ has outperformed on crosses. AUD/JPY got to fresh highs back to 2007, printing 106.77. USD/JPY has firmed a touch but didn't breach Monday highs above 159.90.

- AUD/NZD gapped higher on stronger-than-expected AU CPI. The cross hit a low of 1.0852 before surging to 1.0917 and back to May 22 levels. The AU-NZ 2yr swap is 11bps higher at -54bps and is now at the tightest levels since Sept 2022.

- NZD/USD is down a touch, last near 0.6115.

- Looking ahead, we have German consumer confidence and US home sales data out later.

ASIA STOCKS: Hong Kong & China Equities Mixed, Yuan Continues Its Slide

Hong Kong and China equity markets traded mixed today, with HSI edging slightly lower and the CSI300 slipping 0.25%. Chinese shares were weighed down by persistent trade tensions and a lack of new stimulus measures, with traders awaiting the upcoming Communist Party's third plenary session for potential economic reform announcements. Meanwhile, Chinese weight loss-related stocks saw gains after Novo Nordisk received approval for its Wegovy weight management drug. China loosened its grip on the yuan, trading near its lowest against the dollar since November.

- Hong Kong equities are mixed today as investors keep their eye on the release of key US data at the end of the week. The wider HSI is little changed, while the HSTech Index is 0.29% higher, property Indices are mixed with the Mainland Property Index down 0.33% and the HS Property Index is 0.18% higher.

- Chinese stocks opened lower, influenced by the Fed’s cautious stance on interest rates. The yuan is trading near its weakest level against the dollar since November, but there is optimism about the improvement in China’s export outlook. Beijing's more constructive approach to real estate is expected to bolster domestic confidence. HSBC maintains an overweight position on Chinese stocks, predicting that they could benefit from policy adjustments aimed at stimulating growth. The CSI 300 is 0.25% lower, the small-cap indices CSI 1000 is 0.29% higher, the CSI 2000 is 0.42% higher, the CSI 300 Real Estate Index is 1.80% lower while the ChiNext is 0.45% higher

- Property space, Shimao Group Holdings Ltd is set to defend against a creditor's liquidation demand in Hong Kong court, a crucial moment in its ongoing debt struggles, following a winding-up petition by China Construction Bank over a HK$1.6 billion obligation. The outcome hinges on Shimao's progress in debt negotiations, including lowering the conversion price for convertible bonds, amidst broader industry turmoil and other liquidation hearings this week. China’s Ministry of Natural Resources is exploring ways to support local governments in buying back unused land with special bonds to help real estate companies reduce debt and promote more efficient land use.

- OpenAI is taking steps to block access to its AI tools in unsupported regions, including China, starting in July, amidst growing US pressure to restrict Chinese access to advanced AI technology. This move follows the company's actions against covert influence operations and aligns with broader US efforts to limit China's development of critical technologies.

- Looking ahead, calendar is empty this week

ASIA PAC STOCKS: Equities Mostly Higher, Aus Equities Lower On Higher CPI

Asian markets are mostly higher today, influenced by a rotation into value stocks and the ongoing sell-off in US tech shares. The MSCI Asia Pacific Index is fluctuating as investors await key economic data and assess the impact of global economic trends on regional markets. While sectors like banking and energy are seeing gains, technology shares are under pressure, reflecting broader market uncertainties and investor sentiment.

- Japanese equities are mostly higher today with the Nikkei 225 index rising by 1.25%, bolstered by gains in chip-related stocks like Disco and Tokyo Electron. The Topix index has underperformed the Nikkei and trade up 0.35%, as automakers weighed down the gauge. Investors are adjusting portfolios at the end of June, with expectations of profit-taking as the Nikkei approaches 39,500. The BoJ is expected to raise interest rates in July and introduce quantitative tightening. This shift is in response to rising inflation risks and the need to adjust the current monetary policy.

- South Korean stocks are slightly higher this morning, small-cap stocks are underperforming with the Kosdaq is little changed, while the Kospi is up 0.60%. This was attributed to weak starts from major tech and auto companies, including Samsung Electronics, which fell 0.87%, and SK Hynix, which gained 3.33% following Nvidia's positive performance. HSBC recently upgraded South Korean stocks to overweight, citing growth opportunities in the memory sector and the "Value-Up" program.

- Taiwanese stocks experienced a rise in early trading, following gains in the tech sector and influenced by Nvidia’s rebound. Despite this, HSBC remains underweight on Taiwan, citing limited comfort in valuations after the AI-led rally. The overall market sentiment is cautious, reflecting global economic uncertainties and valuation concerns. The Taiex is up 0.26%.

- Australian shares fell 0.85%, driven by concerns over the Fed’s interest rate stance and a faster-than-expected inflation reading in May. This inflation data supports the case for the Reserve Bank of Australia to resume raising interest rates. The Australian market is also reacting to global economic trends and local economic data, which together create a cautious investment environment.

- Elsewhere, New Zealand equities are 0.56% higher, Indonesian equities are 0.57% higher today although HSBC downgraded stocks to neutral due to high interest rates, weak foreign exchange, and uncertainty around government policies amid potential cabinet changes, Singapore & Indian equities are little changed, Malaysian equities are 0.20% higher, Philippines are 0.16% lower.

OIL: Reversing Some Of Tuesday's Losses, US EIA Inventory Data Coming Up Later

Oil benchmarks have spent the first part of Wednesday trade paring some of Tuesday's losses. Brent was last near $85.40/bbl in terms of the front month contract, up nearly 0.50%, after Tuesday's 1.16% dip. More broadly we remain little changed versus end levels from last week. WTI front month was last around $81.20/bbl, having followed a similar trajectory.

- Looking ahead, focus will rest on the EIA energy inventory data, released later on Wednesday. Bloomberg notes API data pointed to a 900k build in terms of US crude inventories.

- Otherwise, even with Monday's pullback the broader supply/demand balance is seen as supportive of prices. Notably, the OPEC production cut extension into Q3 and a potential summer boost to fuel demand are supporting prices despite the disappointing early summer demand data.

- For WTI, the recent move higher has resulted in a break of $80.11, the May 29 high and a key resistance. This paves the way for $82.24, a Fibonacci retracement point. Initial firm support to watch is $78.87, the 20-day EMA.

GOLD: Hawkish Fedspeak & Canadian CPI Weigh

Gold is flat in the Asia-Pac session, after closing 0.6% lower at $2319.62 on Tuesday.

- Yesterday’s drop in bullion appeared driven by the latest hawkish Fedspeak. Federal Reserve Governor Michelle Bowman indicated it would likely be "some time" before the FOMC could begin lowering interest rates and warned that U.S. monetary policy might diverge from that of other advanced economies in the coming months.

- Additionally, Canadian CPI inflation data for May came in higher than expected, ending a four-month streak of declining figures. Annual headline inflation rose by 0.2 percentage points to 2.9%, while the average of the median and trim core measures increased by 0.1 percentage points to 2.85%.

- Higher rates are typically negative for gold, which doesn’t pay interest.

- According to MNI’s technicals team, gold continues to trade below resistance and a bear threat remains. The yellow metal has pierced the 50-day EMA at $2,318.3, below which a clear break would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

- Meanwhile, silver underperformed on the day, with the gold-silver cross rising to its highest level since May 17.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/06/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/06/2024 | 0600/1400 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 26/06/2024 | 0600/0800 | ** |  | SE | PPI |

| 26/06/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/06/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/06/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/06/2024 | 1040/1240 |  | EU | ECB's Lane speech at Bank of Finland MonPol conference | |

| 26/06/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/06/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 26/06/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/06/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/06/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/06/2024 | 2000/2100 |  | UK | BBC Leaders Head-to-Head debate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.