-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A$ & Local Yields Surge Post RBA Hike

EXECUTIVE SUMMARY

- RBA: SOME FRUTHER TIGHTENING OF MONETARY POLICY MAY BE REQUIRED - BBG

- JAPAN APR WAGES RISE, REAL PAY STAYS NEGATIVE - (MNI)

- CHINA PAPER SEES LENDING RECOVERY IN MAY, RRR AND RATE CUT IN 2H - (CSJ)

- US, CHINA HOLD ‘CANDID’ TALKS DAYS AFTER SECURITY FORUM SPAT - (BBG)

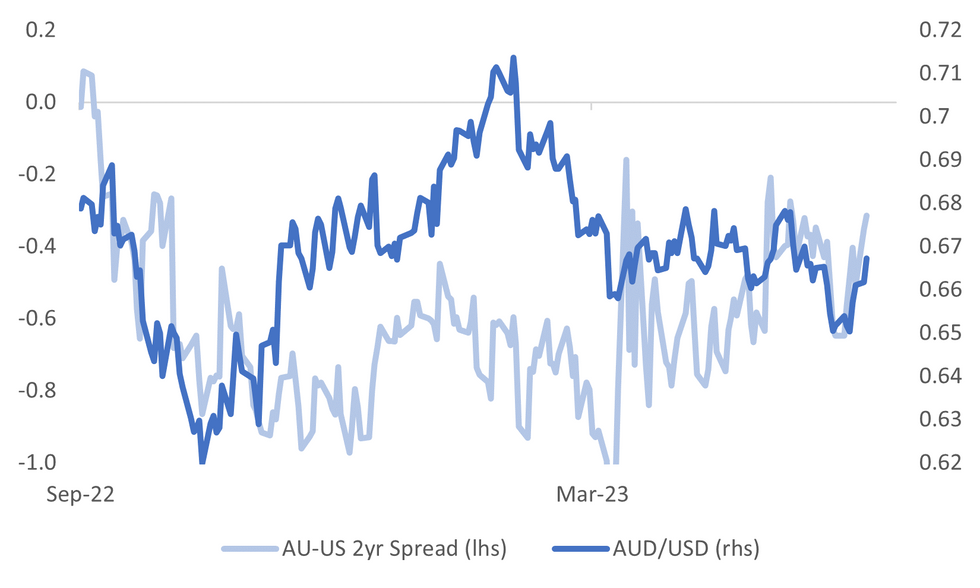

Fig. 1: AUD/USD Versus AU-US 2yr Swap Rate Differential

Source: MNI - Market News/Bloomberg

EUROPE

RUSSIA: Moscow said on Tuesday it had thwarted another major offensive by Ukraine in Donetsk, destroying military equipment and inflicting huge personnel losses, a statement that the powerful head of Russia's Wagner mercenary group dismissed as "absurd science fiction." Russia's defence ministry said that its forces had repelled Ukraine's second major offensive in two days, destroying, among other military equipment, eight main battle Leopard tanks supplied to Ukraine by its Western allies and 109 armoured vehicles. (RTRS)

RUSSIA: Ukraine and Russia accused each other on Tuesday of blowing up a dam and causing widespread flooding in southern Ukraine, while Russia said it had thwarted another Ukrainian offensive in eastern Donetsk and inflicted heavy losses. Russia launched a new wave of overnight air strikes on Kyiv and Ukraine said its air defence systems downed more than 20 cruise missiles on their approach to the city. (RTRS )

U.S.

ECONOMY: Groups representing major retailers and manufacturers urged the White House on Monday to intervene in contentious West Coast port labor negotiations, citing worries about shipping disruptions during critical holiday shopping seasons. (RTRS)

POLITICS: Former U.S. Vice President Mike Pence on Monday declared himself a candidate in the 2024 Republican race for the White House, setting up a fight against former President Donald Trump. Pence's campaign filed a declaration of candidacy with the Federal Election Commission. (RTRS)

US/CHINA: Military interception maneuvers by Chinese ships and planes suggest a “growing aggressiveness” from Beijing and risk an accident that could result in injury, the White House said Monday. “It won’t be long before somebody gets hurt,” National Security Council spokesman John Kirby told reporters at the White House. “That’s the concern with these unsafe and unprofessional intercepts. They can lead to misunderstandings, they can lead to miscalculations.” (BBG)

US/CHINA: Senior US and Chinese officials held “candid” talks in Beijing, days after the two countries’ defense chiefs squared off at a fraught security forum exposing limits in mending the bilateral relationship. Daniel Kritenbrink, the top US State Department official for Asia, met with Vice Foreign Minister Ma Zhaoxu on Monday, becoming the most senior US official to publicly travel to Beijing since an alleged Chinese spy balloon derailed ties in February. (BBG)

OTHER

AUSTRALIA: Australia’s central bank unexpectedly raised its key interest rate and kept the door ajar to further hikes as inflation remains well above target and labor costs jump. The Reserve Bank raised its cash rate by a quarter-percentage point to 4.1%, the highest level since April 2012, bringing its cumulative tightening to 4 percentage points since May last year. Only 10 of 30 economists surveyed by Bloomberg predicted the rate rise while money markets saw about a one-in-three chance of a hike. (BBG)

JAPAN: (MNI) TOKYO - Inflation-adjusted real wages, a barometer of household purchasing power, fell by 3% y/y in April following a 2.3% fall in March due to higher consumer price index,Ministry of Internal Affairs and Communications data showed Tuesday. Real wages stayed in negative territory for the 13th straight month in April, impeding consumer consumption, although pent-up demand has supported spending linked to services. Total CPI excluding imputed rents rose 4.1% y/y in April after a 3.8% increase in March. Total cash earnings, or nominal wages, posted a 1% y/y gain in April, slowing from 1.3% in March. (MNI)

SOUTH KOREA: President Yoon Suk Yeol said South Korea and the US have elevated their alliance to “nuclear based,” as he praised a deal struck with Washington on the deployment of America’s atomic arsenal to deter North Korea. (BBG)

SOUTH KOREA: South Korea’s exports to trade partners other than China are increasing, indicating that market diversification is underway due to a slump in shipments to China, according to a report published by the Korea International Trade Association (KITA) on Monday. “Exports to China have been affected because it has been trying to become more self-reliant and caused an increase in imports from China,” the KITA said in its recent analysis of the nation’s exports trends. (Pulse)

NZ: Bank of New Zealand now sees NZ house price growth resuming in the 2H of 2023, Chief Economist Mike Jones says in emailed note. Expects modest quarterly growth of 1 - 1.5% a quarter. “Still-high mortgage rates, stretched affordability and sluggish economic conditions will all constrain the extent of the upturn”: Jones (BBG)

CHINA

DEBT: China’s debt ratio rose to 281.8% at the end of the first quarter from 273.2% at the end of 2022, with the leverage of residential sector resuming an uptrend and non-financial corporate leverage hitting a record high, says a report in the Economic Daily. (Economic Daily)

POLICY: China’s new yuan loans likely recovered last month from April, with mid to long-term corporate lending a key driver of growth, China Securities Journal reports Tuesday, citing experts. But the data will likely show a decline on a year-on-year basis: paper. The country’s central bank is expected to continue mainly relying on structural tools for monetary expansion in the foreseeable future. PBOC is likely to cut reserve requirement ratio for banks as well as interest rates in the second half of this year. (BBG)

PROPERTY: There are over a dozen property developers now facing delisting from the A-share market as their shares have been trading around the 1-yuan danger mark, according to a report in the Securities Daily Tuesday. (Securities Daily)

MARKETS: China will introduce measures to unify its domestic market as it seeks high quality development, the State Council announced. At a recent meeting, State Council leaders said they will deepen reforms to improve market access and fair competition, as well as dismantle invisible local barriers and monopolies. The meeting was attended by Li Chunlin, deputy director at the National Development and Reform Commission (NDRC). He said the unified market would improve efficiency of resource allocation and release market potential. (21st Century Herald)

FISCAL: China’s fiscal revenue should expand this year but factors such as long-term epidemic impacts and tax reduction policies bring uncertainty, according to Wang Zecai, a researcher at the Chinese Academy of Fiscal Sciences. A Ministry of Finance spokesperson said local government debt risks were distributed unevenly, but the overall financial situation remained healthy. In future, local governments will benefit from the economic recovery, self-help reforms and national support. (Yicai)

CHINA MARKETS

PBOC Net Drains CNY35 Bln Via OMOs Tuesday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY35 billion after offsetting the maturity of CNY37 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9339% at 09:22 am local time from the close of 1.7950% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday, same as the close on Friday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1075 TUES VS 7.0904 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1075 on Tuesday, compared with 7.0904 set on Monday.

OVERNIGHT DATA

UK MAY BRC SALES Y/Y 3.7%; MEDIAN 5.2%; PRIOR 5.2%

JAPAN APR LABOR CASH EARNINGS Y/Y 1.0%; MEDIAN 1.8%; PRIOR 1.3%

JAPAN APR REAL CASH EARNINGS Y/Y -3.0%; MEDIAN -2.0%; PRIOR -2.3%

JAPAN APR HOUSEHOLD SPENDING Y/Y -4.4%; MEDIAN -2.4%; PRIOR -1.9%

NZ MAY ANZ COMMODITY PRICE M/M 0.3%; PRIOR -1.7%

AU BoP CURRENT A/C BALANCE A$12.3bn; MEDIAN A$15.0bn; PRIOR A$11.7bn

AU NET EXPORTS OF GDP -0.2ppts; MEDIAN -0.5; PRIOR 1.1

AU RBA CASH RATE TARGET 4.10%; MEDIAN 3.85%; PRIOR 3.85%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 113-26, -0-02+, a touch off the base of the 0-06 range on volume of ~52k.

- Cash tsys sit 1-3bps cheaper across the major benchmarks, the curve has bear flattened.

- Spillover pressure from ACGBs as the RBA lifted the cash rate 25bps to 4.15%, the market had been split between a hold at 3.85% or a 25bp hike, saw tsys marginally extend losses.

- Earlier in the session, tsys had ticked lower as better risk sentiment as Hong Kong equities advanced on speculation regarding fresh stimulus measures and the USD was marginally pressured.

- FOMC dated OIS price ~7bps hike into next week's meeting, the terminal rate is seen at ~5.3% in June. There are ~30bps of cuts priced for 2023.

- There is a thin data calendar in Europe today, further out Fedspeak from Cleveland Fed President Mester will cross.

JGBS: Futures At Session Highs, Smooth Absorption Of 30-Year Supply

JGB futures are sitting at session highs in afternoon Tokyo trade at 148.76, +18 versus settlement levels, after 30-year supply is smoothly absorbed but with less demand evident than in the May auction.

- JGB futures continue to operate close to recent lows, with 148.48 marking the near-term support. According to MNI's technicals team, the recent bounce off the lows helped stall a more protracted pullback, although the gap with key resistance at 149.17 remains.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined April labour cash earnings and household spending data, which surprised on the downside.

- Cash US tsys are trading above Asia-Pac cheaps but yields remain 1.2bp to 2.7bp higher.

- Cash JGBs are flat to slightly richer across the curve beyond the 1-year zone. The benchmark 10-year yield is 0.6bp lower at 0.428%.

- The 30-year zone is outperforming on the curve with its yield 1.8bp lower at 1.262% after today’s auction showed smooth digestion, albeit with slightly less demand exhibited than at the previous auction. While the low price met dealer expectations the cover ratio ticked down and the tail widened.

- Swap rates are 0.3-2.2bp lower across the curve with swap spreads tighter.

AUSSIE BONDS: Sharply Cheaper As The RBA Surprises With A 25bp Hike

ACGBs are sharply cheaper (YM -9.0 & XM -4.0) after the RBA surprise the market again with a 25bp rate hike to 4.10%. The market had priced a 30% chance of a hike going into the meeting.

- According to the statement, the decision was made to address high inflation, which, although it has peaked, remains at 7%, necessitating further measures to ensure its return to the target range. Recent data indicates increased upside risks to the inflation outlook, leading to the Board's response. Services price inflation remains high, while unit labour costs are rising, and productivity growth remains subdued.

- The Board stated that Australian economic growth has slowed, and while labour market conditions have eased slightly, they remain tight. The unemployment rate rose to 3.7% in April, and employment growth has moderated.

- The board added that further tightening of monetary policy may be necessary to achieve inflation target returns, contingent upon economic and inflation developments.

- Cash ACGBs are 6-9bp cheaper after the RBA decision to be 4-7bp cheaper on the day. The AU-US 10-year yield differential +7bp at +12bp.

- RBA-dated OIS pricing is 1214bp firmer for meetings beyond June with terminal rate expectations at 4.30%.

- Swap rates are 1-6bp higher on the day with EFPs 2bp lower and the curve 5bp flatter.

- The bills strip bear flattens with pricing -10 to -3.

NZGBS: Yields Higher, Played Catch-Up To Global Bond Cheapening

NZGBs closed 6-11bp cheaper with the 2/10 curve 5bp steeper after it resumed trading after a long weekend.

- Swap rates are 4-6bp higher with implied swap spreads significantly tighter.

- RBNZ dated OIS opened 1-3bp firmer across meetings with May’24 leading.

- On the data front, NZ's commodity export prices rose 0.3% m/m in May versus -1.7% in April, according to ANZ Bank. The index falls 13.3% y/y and 9.9% y/y in NZD terms.

- Bloomberg reports that ASB Bank now expects the NZ economy will avoid a recession this year amid a surge in immigration. ASB expects Q1 economic growth to be flat subject to final partial indicators this week, whereas it previously projected a 0.6% contraction. (link)

- The local calendar tomorrow delivers Mfg Activity (Q1) along with the NZ Government’s 10-month Financial Statement.

- The global calendar is light today with Euro Area Retail Sales (Apr) as the highlight.

- Given that the local market has closed ahead of the RBA policy decision, tomorrow's opening is expected to reflect not only the Australian market's response to the announcement but also any fluctuations in the US tsys overnight.

FOREX: AUD Firms After RBA Raises Cash Rate 25bps

The AUD is ~0.7% firmer in Asia today after the RBA raised the cash rate 25bps to 4.1%. Some forecasters had expected a hike however the majority rested with no change.

- AUD/USD prints at $0.6660/65, the pair is ~0.7% firmer. The pair sits above the 50-Day EMA ($0.6654) and the next upside target for bulls is $0.6710 the high from May 16.

- AUD/NZD is ~0.5% firmer, the pair printed its highest level since late February at $1.0959 before marginally paring gains. Bulls target the high from 20 Feb at $1.1088.

- Kiwi is moderately firmer as the bid in AUD spills over, NZD/USD prints at $0.6085/90 up ~0.3% from yesterday's closing levels.

- Yen is a touch firmer, USD/JPY is down ~0.1% however ranges have been narrow with little follow through for the most part.

- Elsewhere in G-10 BBDXY is down ~0.1%. NOK and SEK are ~0.4% higher however liquidity is generally poor for the currencies in the Asian session.

- Cross asset wise; e-minis are a touch firmer and 2 Year Us Treasury Yields are ~3bps higher.

- In Europe today the data calendar is thin, German Factory Orders and Eurozone Retail Sales provide the highlights.

EQUITIES: HK/China Shares Higher Again On Stimulus Hopes But Not Much Follow Through

Hong Kong and China stocks are in focus today. Hong Kong stocks have seen the greatest degree of volatility, starting weaker, before rebounding strongly on fresh stimulus hopes. Regional equity trends have been mixed elsewhere. US futures are close to flat, following Monday losses. We did see a small blip higher as HK shares rose, but there wasn't much follow through. Eminis were last around 4281/82.

- The HSI got close to 19400, but we now sit back near 19200 at the break, around 0.50% higher for the session. The HS Property sub-index is +1.59%, we were closer to +3% in earlier trade.

- Onshore China media ran reports, which stated new loans should rebound in May, whilst also stating RRR and interest rate cuts were possible for H2, quoting policy experts. This follows reports from last Friday of potential property market stimulus, per Bloomberg.

- The HK equity moves dragged mainland China stocks higher after a weaker start, but at the break, the CSI 300 is only 0.09% higher at this stage. The property sub index is +1.50% higher though.

- Elsewhere, trends are mixed. Japan stocks are modestly higher, +0.40% for the Nikkei 225, while the Taiex is +0.10% Onshore South Korean markets are closed today.

- The ASX 200 is down 0.50%, financials have been a weak point.

OIL: Crude Gives Up Monday’s Gains As Demand Outlook Drives Prices

Oil prices are down slightly today giving up most of the early gains post the Saudi announcement that it would cut its own production a further 1mbd from July, as the market became more cautious. The decision may put a floor under prices but while the demand outlook is uncertain, is unlikely to drive any sustained increase in prices. The USD is down slightly.

- Brent is 0.3% lower to $76.45 after reaching an intraday low of $76.14 before the high of $76.64. It is now up only 0.4% since Friday’s close. WTI is down 0.5% today to $71.82 with a high of $72.03 and a low of $71.54. It is now only 0.1% above Friday’s close.

- Later there is US June IBD/TIPP economic optimism, euro area April retail sales and consumer expectations. The API US inventory data is also due.

GOLD: Stronger But Remains In A Bear Cycle

Gold has experienced a slight weakening (-0.1%) during the Asia-Pacific session, following a 0.7% advance on Monday. The previous increase in gold prices occurred as tsy yields and the value of the dollar declined in response to disappointing US service-sector data. This data prompted traders to reassess their expectations regarding the Federal Reserve's path for interest rate hikes

- The May ISM Services report revealed the lowest level since December 2022, and the Prices Paid index dropped to its lowest point since May 2020. Additionally, the Employment component fell below 50 (49.2), marking the first time since December.

- FOMC dated OIS price ~6bp hike into next week's meeting with a terminal rate of ~5.25% in July. There are ~25bps of cuts priced for 2023.

- According to MNI’s technical team, the bear cycle in gold remains intact and recent short-term gains appear to have been corrective. A break of trendline support, drawn from November 3, at 1946.90 would reinforce bearish conditions and open $1903.50, a Fibonacci retracement.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/06/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/06/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/06/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/06/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/06/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/06/2023 | 1230/0830 | * |  | CA | Building Permits |

| 06/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/06/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/06/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.