-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Another Pre-Meeting Test Of The BoJ’s Will

EXECUTIVE SUMMARY

- FED PATH RELIES ON ACTUAL PRICE DECLINES - GOV COOK (MNI)

- UK PREMIER MAY BE DECIDED MONDAY AS TORIES SET CONTEST RULES (BBG)

- UK LIKELY TO DELAY RELEASE OF FISCAL PLAN (THE TIMES)

- US EYES EXPANDING CHINA TECH BAN TO QUANTUM COMPUTING AND AI (BBG)

- PBOC SEEN ALLOWING WEAKER YUAN FIX AFTER CONGRESS, SURVEY SHOWS (BBG)

- GERMANY CONCEDES MOVE TO CAP GAS PRICES AS EU WRESTLES WITH ENERGY CRISIS (FT)

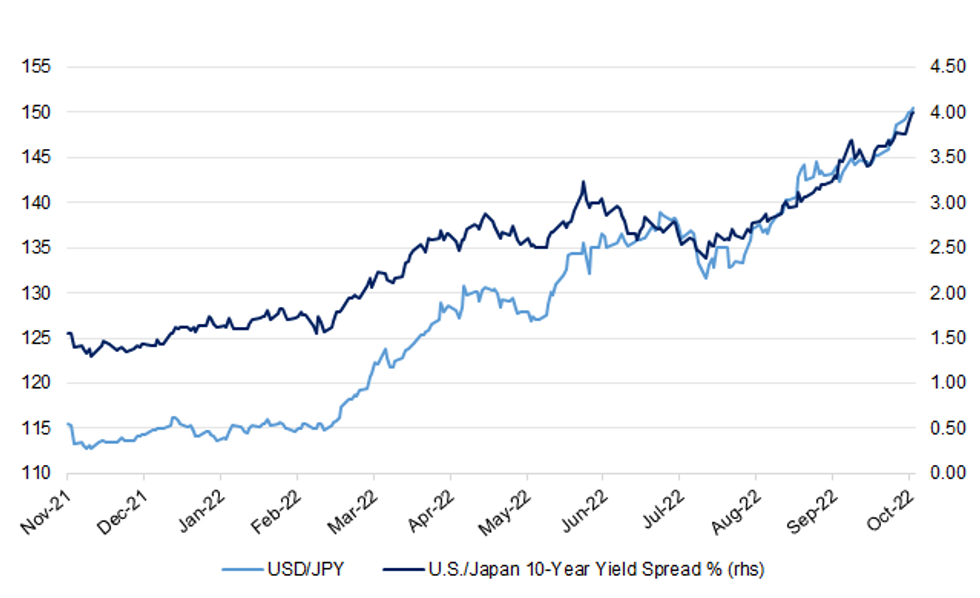

Fig. 1: USD/JPY Vs. U.S./Japan 10-Year Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: The new prime minister is likely to delay the announcement of plans to fill a £40 billion black hole in the public finances, The Times has been told. (The Times)

POLITICS: The Conservative Party is trying to end a period of extreme political turmoil by setting a high threshold for candidates trying to succeed Liz Truss, meaning the UK could have a new prime minister as soon as Monday. (BBG)

POLITICS: Penny Mordaunt does not want to “play second fiddle” and will not join Rishi Sunak’s leadership campaign, The Telegraph understands, despite calls from his supporters for the pair to run on a joint ticket. (Telegraph)

POLITICS: Boris Johnson is privately urging Conservative MPs to back him for a dramatic return to Downing Street with a pledge that only he can win the Tories the next election. (Telegraph)

BOE: The Bank of England will sell £6 billion ($6.75 billion) of the bonds it built up during quantitative easing before the end of this year, according to statement Thursday. (BBG)

ECONOMY: UK consumer confidence may have bottomed out in October, with some early signs of improved household sentiment, but the headline index remains close to historic lows and there are still tremendous headwinds to overcome, the head of the GfK monthly survey told MNI. (MNI)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody’s on the United Kingdom (current rating: Aa3; Outlook Stable)

- S&P on the United Kingdom (current rating: AA; Outlook Negative)

EUROPE

ECB: The European Central Bank will act much more forcefully than previously anticipated to rein in record inflation, even as the euro zone succumbs to a recession, according to a survey of economists. (BBG)

EU: Italy’s outgoing prime minister, Mario Draghi, told his fellow European Union leaders that the region was in a recession and that divisions in the bloc would be a victory for Russian President Vladimir Putin, according to people familiar with his remarks. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on the Czech Republic (current rating: AA-; Outlook Negative) & Germany (current rating: AAA; Outlook Stable)

- Moody’s on Slovenia & (current rating: A3; Outlook Stable).

- S&P on Greece (current rating: BB+; Outlook Stable), Italy (current rating: BBB; Outlook Stable) & the Netherlands (current rating: AAA; Outlook Stable).

U.S.

FED: Federal Reserve Governor Lisa Cook said Thursday the path for the central bank's fed funds rate must be based on whether inflation actually falls in the data rather than just in forecasts, adding that she expects ongoing rate hikes. (MNI)

FED: Philadelphia Federal Reserve President Patrick Harker on Thursday said higher interest rates have done little to keep inflation in check, so more increases will be needed. (CNBC)

FED: The beginning of peak pandemic-era inflation is likely to arrive in the first half of 2023, while five or six months of data on falling inflation are needed before the Fed can say with any certainty how quickly price growth will moderate, St. Louis Fed research director Carlos Garriga told MNI. (MNI)

FED: The St. Louis Federal Reserve said it would "think differently" about appearances by its president James Bullard at non-public events after news reports of his attendance at a private policy forum last week sponsored by Citigroup. (RTRS)

EQUITIES/ECONOMY: Intel Corp. is planning on announcing "targeted" layoffs in November, according to a report late Thursday, citing an internal video shared with employees. (MarketWatch)

EQUITIES/ECONOMY: Elon Musk told prospective investors in his deal to buy the company that he planned to get rid of nearly 75 percent of Twitter’s 7,500 workers, whittling the company down to a skeleton staff of just over 2,000. (WaPo)

EQUITIES: Biden administration officials are discussing whether the US should subject some of Elon Musk’s ventures to national security reviews, including the deal for Twitter Inc. and SpaceX’s Starlink satellite network, according to people familiar with the matter. (BBG)

OTHER

U.S./CHINA: The Biden administration is exploring the possibility of new export controls that would limit China’s access to some of the most powerful emerging computing technologies, according to people familiar with the situation. (BBG)

U.S./CHINA: Chinese chip maker Yangtze Memory Technologies Co (YMTC) Ltd denied a media report that it had participated in emergency meetings convened by China's industry ministry to discuss the impact of U.S. sanctions. (RTRS)

U.S./CHINA: President Xi Jinping’s call for greater technology self-reliance will require policy and financial support to accelerate the domestic innovation needed to blunt the impact of new restrictions on U.S tech exports that threaten to derail China’s ambitions to move into advanced manufacturing, advisors and analysts said. (MNI)

BOJ: Bank of Japan Governor Haruhiko Kuroda will keep monetary stimulus unchanged next week as he stays largely unfazed by the yen’s slide to its lowest level in over three decades, according to economists surveyed by Bloomberg. (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Friday that authorities were dealing with currency speculators "strictly", as an extended sell-off of the yen kept markets on heightened alert for further dollar-selling intervention by Tokyo. (RTRS)

AUSTRALIA: Widespread floods that have inundated large parts of Australia's southeast will dent the country's economic growth and increase inflation, Treasurer Jim Chalmers said on Friday, ahead of next week's federal budget. (RTRS)

CANADA: Former Bank of Canada Governor Mark Carney said Thursday his country is likely to follow other major economies into a recession as interest rates rise, using a word current officials have been reluctant to use to describe the slowdown. (MNI)

BRAZIL: Senator Simone Tebet, who came in third in Brazil’s presidential election, has taken upon herself an urgent mission: to convince about one-third of her 4.9 million supporters to shift their votes for leftist leader Luiz Inacio Lula da Silva. (BBG)

BRAZIL: Brazil’s economic team is considering measures to free up the budget and make room for additional social spending next year, including ending inflation-linked increases to the minimum wage and pensions. (BBG)

RUSSIA/IRAN: The United States has determined that Iranian military personnel were on the ground in Crimea helping the Russian military operate drones provided by Tehran to conduct strikes across Ukraine, State Department spokesman Ned Price said on Thursday. (RTRS)

SOUTH AFRICA: Eskom has announced that stage 3 power cuts will be implemented until further notice. Initially, the power utility had announced that stage 3 would be in place until Friday. (ENCA)

COLOMBIA: Intervention to defend Colombia’s peso “wouldn’t make any sense,” Finance Minister Jose Antonio Ocampo said Thursday, after the currency weakened to a fresh record low. (BBG)

COMMODITIES: How much has chaotic commodity-futures trading contributed to inflation? Sens. Elizabeth Warren and Cory Booker have asked the Commodity Futures Trading Commission to find out. (WSJ)

METALS: Global copper stocks have fallen to perilously low levels, one of the world’s largest commodity traders Trafigura has warned. (FT)

METALS: Peru’s Espinar communities reached a truce with the government to lift a blockade in a mining corridor used by Chinese MMG’s Las Bambas copper mine until Oct. 25, according to a document sent to Bloomberg News by a person with knowledge of the matter. (BBG)

ENERGY: German chancellor Olaf Scholz dropped his opposition to an EU gas price cap after late-night summit talks aimed at quelling the energy crisis hanging over the union’s economy. (FT)

ENERGY: Hungary will not agree to an EU price cap on imported gas because it would end Russian deliveries, a senior aide to Prime Minister Viktor Orban said, adding that if the EU decides on a cap it would have to exempt Hungary, as it did for oil. (RTRS)

OIL: Mexico has been requesting prices for its oil hedging program year round to make it harder for banks and oil majors, which sit on the other side of the mega deal, to hike prices, said Mexican Deputy Finance Minister Gabriel Yorio. (RTRS)

CHINA

YUAN: There is no reason for the yuan to depreciate over the long-term as it will be supported by the stable growth of the Chinese economy, the Securities Daily reported citing analysts after the offshore yuan breached the 7.27 mark against the U.S. dollar this week. (MNI)

PBOC: The People’s Bank of China will implement prudent monetary policy and strengthen cross- and counter-cyclical adjustments, the PBOC-run newspaper Financial News reported citing PBOC Deputy Governor Pan Gongsheng. (MNI)

PBOC: There’s still room for China’s Loan Prime Rates (LPR) to be lowered by end-2022, Shanghai Securities News reports, citing Wang Qing, an analyst at Golden Credit Rating, after the rates have been kept unchanged in Sept. and Oct. (BBG)

PBOC: China's key reference lending rate for loans of over five years is expected to be cut to help lower mortgage rates as the government steps up efforts to support the ailing property market -- on MNI Policy MainWire now, for more details please contact sales@marketnews.com (MNI)

PBOC: An update on the People’s Bank of China website showed Xuan Changneng had been appointed as a new deputy governor on Thursday, Caixin reported. (MNI)

YUAN: China’s yuan is expected to weaken further after the Communist Party Congress ends this weekend, as the central bank loosens its grip on the currency, according to market watchers. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8623% at 9:33 am local time from the close of 1.5186% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 56 on Thursday vs 48 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1186 FRI VS 7.1188 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1186 on Friday, compared with 7.1188 set on Thursday.

OVERNIGHT DATA

JAPAN SEP CPI +3.0% Y/Y; MEDIAN +2.9%; AUG +3.0%

JAPAN SEP CPI EX FRESH FOOD +3.0% Y/Y; MEDIAN +3.0%; AUG +2.8%

JAPAN SEP CPI EX FRESH FOOD & ENERGY +1.8% Y/Y; MEDIAN +1.8%; AUG +1.6%

NEW ZEALAND SEP TRADE BALANCE -NZ$1.615BN; AUG -NZ$2.625BN

NEW ZEALAND SEP EXPORTS NZ$6.03BN; AUG NZ$5.29BN

NEW ZEALAND SEP IMPORTS NZ$7.64BN; AUG NZ$7.92BN

NEW ZEALAND SEP TRADE BALANCE 12-MONTH YTD -NZ$11.945BN; AUG -NZ$12.496BN

NEW ZEALAND SEP CREDIT CARD SPENDING +0.7% M/M; AUG +4.6%

NEW ZEALAND SEP CREDIT CARD SPENDING +34.1% Y/Y; AUG +29.3%

SOUTH KOREA SEP PPI +8.0% Y/Y; AUG +8.2%

SOUTH KOREA OCT FIRST 20 DAYS TRADE BALANCE -$4.9540BN; SEP 1-20 -$4.1050

SOUTH KOREA OCT FIRST 20 DAYS EXPORTS -5.5% Y/Y; SEP 1-20 -8.7%

SOUTH KOREA OCT FIRST 20 DAYS IMPORTS +1.9% Y/Y; SEP 1-20 +6.1%

UK OCT GFK CONSUMER CONFIDENCE INDEX -47; MEDIAN -52; SEP -49

MARKETS

SNAPSHOT: Another Pre-Meeting Test Of The BoJ’s Will

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 98.39 points at 26908.57

- ASX 200 down 53.932 points at 6676.8

- Shanghai Comp. up 8.338 points at 3043.388

- JGB 10-Yr future down 34 ticks at 147.55, yield down 0.4bp at 0.251%

- Aussie 10-Yr future down 14.5 ticks at 95.78, yield up 14bp at 4.2%

- US 10-Yr future down 0-03+ at 109-08, yield up 2.22bp at 4.2505%

- WTI crude up $0.40 at $84.91, Gold down $6.95 at $1621.07

- USD/JPY up 24 pips at Y150.39

- FED PATH RELIES ON ACTUAL PRICE DECLINES - GOV COOK (MNI)

- UK PREMIER MAY BE DECIDED MONDAY AS TORIES SET CONTEST RULES (BBG)

- UK LIKELY TO DELAY RELEASE OF FISCAL PLAN (THE TIMES)

- US EYES EXPANDING CHINA TECH BAN TO QUANTUM COMPUTING AND AI (BBG)

- PBOC SEEN ALLOWING WEAKER YUAN FIX AFTER CONGRESS, SURVEY SHOWS (BBG)

- GERMANY CONCEDES MOVE TO CAP GAS PRICES AS EU WRESTLES WITH ENERGY CRISIS (FT)

US TSYS: Another Round Of Fresh Cycle Cheaps

Cash Tsys saw fresh cycle highs in yields across the major benchmarks during Asia-Pac hours, with the cheapening aided by a couple of block sales in TY futures (-1.4K apiece) and spill over from weakness in the longer end of the JGB curve.

- Cash Tsys run 1.5-3.5bp cheaper across the curve, bear steepening into London trade. 10-Year Tsy yields have printed above 4.25% for the first time since ’08.

- TYZ2 is -0-06 at 109-05+, 0-02 off the base of its 0-11+ overnight range, on healthy volume of ~97K. The next level of meaningful technical support isn’t seen until 108-20, the 1.00 projection of the Oct 4-10-13 price swing.

- The space didn’t show much reaction to a BBG source report which suggested that “the Biden administration is exploring the possibility of new export controls that would limit China’s access to some of the most powerful emerging computing technologies,” only managing to register a modest bid in early Asia trade.

- Friday’s NY docket is thin, headlined by Fedspeak from Williams, Evans & Daly, ahead of the pre-FOMC blackout which goes into play this weekend.

JGBS: Cheaper As Test Of BoJ’s Will Ramps Up Again

JGB futures have stabilised after an aggressive pull lower in the early rounds of Tokyo afternoon trade, which saw the contract through Sep lows. It last deals -30 on the day, ~20 ticks off session lows. Bears will now look to the June cycle lows as the next meaningful point of technical support, although a move to those levels would require a somewhat serious challenge of the BoJ’s YCC settings ahead of next week’s monetary policy decision (with no change in policy settings from the BoJ expected until at least Spring ‘23).

- The move came as U.S. Tsys registered fresh cyclical highs in yield terms across the curve and after this morning’s upsized, and in one case unscheduled, BoJ Rinban operations did little to placate markets.

- The major cash JGB benchmarks run 1-7bp cheaper across the curve, bear steepening. 20- to 40-Year yields have registered fresh cycle highs.

- The move has been accompanied by fresh payside flow in 10-Year swaps, with the 10-Year swap spread pushing further above its mid-June peak, as participants use this channel as another method of testing the BoJ’s will.

- There was no reaction to virtually in line with exp. Japanese CPI data, given the BoJ’s insistence that it will not act on cost-push driven inflation.

- USD/JPY registered fresh cycle highs.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.86453tn 3-Month Bills:

- Average Yield: -0.1492% (prev. -0.1511%)

- Average Price: 100.0401 (prev. 100.0406)

- High Yield: -0.1358% (prev. -0.1358%)

- Low Price: 100.0365 (prev. 100.0365)

- % Allotted At High Yield: 33.2481% (prev. 34.0350%)

- Bid/Cover: 3.036x (prev. 3.042x)

AUSSIE BONDS: RBA Terminal Rate Pricing Increases, ACGBs Pressured

The Aussie bond space came under pressure alongside the steepening in JGBs and as U.S. Tsys registered fresh cycle cheaps, with the major cash ACGB benchmarks running 12-15bp cheaper on the day ahead of the close, bear steepening, but operating a little above worst levels of the session. YM prints -12.0 & XM is -14.0, with the latter printing through its September lows, allowing bears to focus on the cycle lows which were printed back in June.

- The move accelerated as XM pressed through its September base.

- 3-Year yields registered fresh cycle highs on the move.

- Payside swap flows also helped, with EFPs pushing wider on the day.

- Local news flow saw Treasurer Chalmers outline the expected GDP & inflation impact from the recent floods, which will be manageable, but served as preparatory remarks ahead of the release of the Federal Budget (due next Tuesday).

- Bills run 3-25bp cheaper through the reds, with RBA terminal rate pricing extending above 4.40% in dated OIS.

- Outside of the Budget, next week will also bring the quarterly CPI data (Wednesday) and an address from RBA’s Kent (Monday). Flash PMIs (Monday), terms of trade data (Thursday) & PPI readings (Friday) will also cross.

AUSSIE BONDS: ACGB Apr-25 Auction Results

The Australian Office of Financial Management (AOFM) sells A$700mn of the 3.25% 21 April 2025 Bond, issue #TB139.

- Average Yield: 3.6070% (prev. 3.4785%)

- High Yield: 3.6100% (prev. 3.4800%)

- Bid/Cover: 3.8500x (prev. 3.1650x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 40.7% (prev. 90.9%)

- Bidders 46 (prev. 47), successful 13 (prev. 9), allocated in full 8 (prev. 4)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 24 October it plans to sell A$300mn of the 1.75% 21 June 2051 Bond.

- On Thursday 27 October it plans to sell A$1.0bn of the 10 February 2023 Note, A$500mn of the 24 February 2023 Note and A$500mn of the 14 April 2023 Note.

- On Friday 28 October it plans to sell A$800mn of the 1.75% 21 November 2032 Bond.

NZGBS: Outperformance Noted, Index Inclusion Eyed

NZGBs richened on Friday, outperforming their major global counterparts, with focus on next month’s WGBI index inclusion seemingly at the fore.

- An element of short covering ahead of the long NZ weekend may also have been in play, with NZ markets closed on Monday as the country observes the Labor Day holiday.

- Note that a move lower in core global FI markets (higher yields) came after the local close.

- Swap spreads were generally a little wider across the curve, with some receiver side flows in swaps probably helping the bid in NZGBs in the second half of the day.

- RBNZ dated OIS continue to price a terminal rate of just over 5.40%.

- Local data had little impact on the space, with a marginal monthly uptick in credit card spending observed, while Sep trade balance data revealed a fourth consecutive monthly trade deficit, albeit narrowing a touch from the record deficit witnessed in August.

EQUITIES: Modest Losses, As Weaker US Lead & Higher Yields Weigh

Asia Pac equities are mixed, although major bourses are struggling for a positive footing. US futures are lower, roughly -0.3% for the S&P, -0.70% for the Nasdaq at the time of writing. Weaker tech sentiment has been led by Snap, which again delivered a disappointing earnings update late in the US session.

- Higher yields, a continuation from the overnight session, has also added pressure. The US remains the focus point (10yr to 4.26%, +3bps for the session), but JGB futures have sold off sharply as well.

- A report the US is considering extended its tech ban to China to include quantum computing and AI has weighed on sentiment, although overall losses for HK stocks are modest at this stage.

- The HSI is down around 0.2%, while the tech sub index is around flat, still we are down a further 5% for the week, following last week's 10.30% dip.

- China tech names are lower, although aggregate indices are slightly higher. The CSI 300 +0.15%, the Shanghai Composite +0.50%. The property sub-index is up 1.50%, its first gain for the week. This came after the China regulator announced companies less involved in the real estate market can raise funds in the A-share market.

- The Kospi, Nikkei 225 and Taiex are all lower, with the latter off by 0.75%. South Korean export data for the first 20-days of October, showed a further deterioration in external demand, led by China.

- The ASX 200 is down 0.70%, with bank names the main drag.

OIL: Tight Supply Keeps Dips Supported

Brent crude is modestly up on NY closing levels, last around $92.70/bbl (+0.30% for the session so far). We remain below overnight highs, near $95/bbl, with the simple 50-day MA also at 93.21/bbl likely offering some resistance. Some support is evident ahead of the $92/bbl though, while beyond that is the $89-$90//bbl lows from earlier in the week. For WTI, we were last just under $85/bbl.

- Overall supply conditions remain tight. The Brent prompt spread is back to +1.88, versus +1.48 this time last week.

- US refiner Phillips 66 also warned that 3 crude suppliers are at risk of breaching oil supply contracts for October. While Goldman Sachs analysts don't expect a large impact from further incremental SPR sales. The SPR is also likely to restock if oil prices reach the $67-72/bbl range (or lower).

- On the demand side, yesterday's spike in oil, started by reports China is considering lowering the quarantine period for international arrivals, hasn't had great follow through momentum.

- Higher frequency indicators of China domestic demand conditions (road and subway traffic volumes) remain off recent highs. We may also get China Q3 GDP released next week, after this week's delay. Note also US Q3 GDP is also out next week.

GOLD: Range Bound In Asia Pac Session, But Outflows From Gold ETFs Persist

Gold has had a very quiet session so far today, sticking to tight ranges. The precious metal was last around $1626, down slightly on NY closing levels (-0.10%). This is in line with a modest uptick in the USD BBDXY (+0.10%).

- This follows a fairly volatile overnight session, where we spiked above $1645 only to close slightly lower for the session as a whole. Higher US yields and a rebounding USD weighed, particularly through the NY session.

- Some support is still evident ahead of the $1625.00 level, & we haven't breached yesterday's lows near $1622.50.

- Gold is keeping its inverse correlation with US real yields, although the rate of increase slowed overnight (the 10yr real yield only up 1bp to 1.73%).

- Outflows from gold ETF funds continue and are on track to be slightly larger this week, compared to last (-20.65 tons so far, versus -16.6 tons last week).

FOREX: General Risk Aversion Lingers, USD/JPY Moves Further Past Y150

Modest defensive feel lingered after Bloomberg reported that the White House is considering export controls to limit China's access to quantum computing and AI, another step in a series of measures designed to stifle Beijing's ability to use cutting-edge technology.

- The BBDXY index crept higher and the U.S. dollar topped the G10 pile, with all three e-mini contracts having a look below yesterday's lows amid risk-negative environment. An upswing in U.S. Tsy yields put a fresh bid into the greenback.

- USD/JPY advanced, adding 25 pips through the session, after the psychological Y150 level gave way Thursday. Intervention talk continued to do the rounds, with FinMin Suzuki noting that "right now we're in a firm confrontation with speculators in the market." The yen was resilient against most other currencies amid reduced appetite for risk.

- The BoJ conducted upsized & unscheduled bond-purchase operations in defence of its 10-Year JGB yield target, to little effect. The Bank's flagship YCC framework is put to a test ahead of next week's monetary policy review, which sent USD/JPY 1-week implied volatility soaring past 16% for the first time in a month.

- The Antipodeans went offered, only the NOK fared worse. AUD/NZD crept higher in tandem with Australia/New Zealand 2-year swap spread, with meeting-dated OIS pricing ~80bp worth of rate hikes at the next RBNZ policy review, down from the ~91bp peak from earlier this week.

- Focus turns to UK retail sales, as well as comments from NY Fed Pres Williams and Chicago Fed Pres Evans.

FX OPTIONS: Expiries for Oct21 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9595-00(E2.5bln), $0.9700(E2.0bln), $0.9725(E996mln), $0.9745-50(E997mln), $0.9770-75(E656mln), $0.9800(E1.8bln), $0.9845-50(E1.6bln)

- USD/JPY: Y147.50-55($1.1bln)

- AUD/USD: $0.6500(A$526mln)

- USD/CAD: C$1.3700-10($525mln), C$1.3750($675mln)

- USD/CNY: Cny7.1000($2.3bln), Cny7.2000($1.0bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/10/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/10/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/10/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 21/10/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/10/2022 | 1310/0910 |  | US | New York Fed's John Williams | |

| 21/10/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/10/2022 | 1530/1130 |  | US | San Francisco Fed's Mary Daly | |

| 21/10/2022 | 1600/1200 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.