-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Australia's CPI Slows In May

EXECUTIVE SUMMARY

- AUSTRALIA INFLATION SLOWS MORE THAN EXPECTED IN MAY - BBG

- KANDA SAYS AUTHORITIES WILL RESPOND IF THERE ARE EXCESSIVE FX MOVES - BBG

- WUNSCH SAYS ECB NEEDS EVIDENCE THAT INFLATION IS FIRMLY IN RETREAT BEFORE PAUSING HIKES - BBG

- PANETTA TAPPED AS NEXT BANK OF ITALY GOVERNOR - BBG

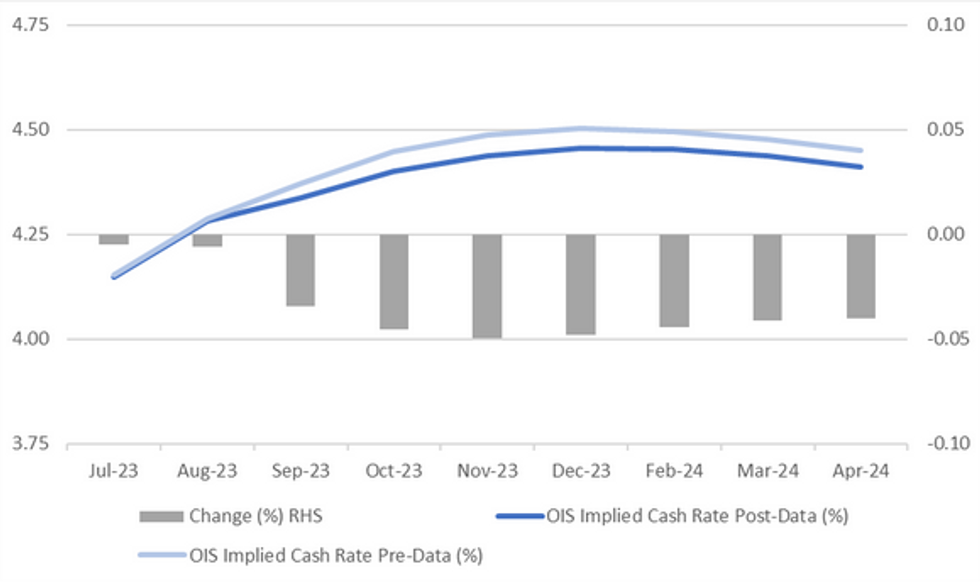

Fig. 1: RBA Dated OIS Pre- and Post-CPI

Source: MNI - Market News/Bloomberg

U.K.

INFLATION: Rishi Sunak’s efforts to ensure companies are passing on cost cuts to UK consumers and banks are relaying interest rate rises to savers appear unlikely to yield significant results, because the government is relatively powerless to act. The pace of price rises has proved sticky at more than four times the official target for the past 14 months, putting in danger the British prime minister’s promise to cut inflation in half this year. (BBG)

INFLATION: he cost-of-living crisis in the UK has led to an increase in abusive customers and in theft by retail staff, according to a new report. Eight in 10 retail workers said their mental health has deteriorated due to the strain of working in stores and 50% of retail managers said staff absences are rising, in a survey of more than 1,500 employees by the charity Retail Trust. (BBG)

HOUSE PRICES: Almost half of British house sellers were forced to cut their prices by more than 5% last month as surging mortgage costs put further strain on buyers, according to research by Zoopla Ltd. About 15% of sellers accepted at least 10% off the initial asking price, with discounting at its most widespread since 2018, the property portal said. While house prices still grew 1.2% year-on-year in May, momentum is slowing sharply and values are expected to decline as much as 5% over the course of the year, according to Zoopla. (BBG)

TAXES: The UK tax system is still hindering economic growth and equality with the total collected by the government on course to top £1 trillion ($1.3 trillion) in the next few years, according to the Resolution Foundation. In a report published Wednesday, the think tank called for a radical overhaul of the tax structure to boost business investment, encourage dynamism and protect the living standards of low and middle-income families. (BBG)

EUROPE

ECB: The European Central Bank needs evidence that underlying inflation is firmly in retreat before it can considering pausing interest-rate increases, according to Governing Council member Pierre Wunsch. Speaking to Bloomberg TV, the hawkish Belgian central bank chief said July’s meeting — when another hike is all but assured — is too soon but the following one, in September, is possible. (BBG)

ECB: Some hawkish European Central Bank officials are pondering options to speed up the reduction of the institution’s €5 trillion ($5.5 trillion) stash of bonds, according to people familiar with the debate. (BBG)

ITALY: Italian Prime Minister Giorgia Meloni’s government has selected European Central Bank Executive Board member Fabio Panetta to succeed Ignazio Visco as the next Bank of Italy governor. His nomination was decided at a cabinet meeting in Rome on Tuesday, according to people familiar with their thinking. The plan to pick him today was previously reported by Bloomberg. (BBG)

U.S.

CHIPS: Nvidia Corp. led declines in tech stocks after a report Washington could close loopholes in the sale to China of powerful chips used to train artificial intelligence, potentially denting sales in the world’s top semiconductor market. (BBG)

ECONOMY: A flurry of data showed surprising strength in several corners of the US economy, painting a picture of resilience and further delaying any likelihood of recession. Purchases of new homes climbed to the fastest annual rate in more than a year, durable goods orders topped estimates and consumer confidence reached the highest level since the start of 2022, according to the Tuesday reports. Another release showed housing prices in the US rose for a third-straight month. (BBG)

UKRAINE: President Joe Biden says it’s too early to tell what the turmoil in Moscow will mean for Vladimir Putin. But the 24-hour mutiny by mercenaries is likely to bolster those in Washington seeking to boost support for Ukraine’s war effort. (BBG)

OTHER

AUSTRALIA: Monthly consumer price inflation slowed over the 12 months to May to 5.6% from Aprils’ 6.8%, while CPI excluding volatile items printed at 6.4%, 10bp down from the previous month, according to Australian Bureau of Statistics data published Wednesday. (MNI)

AUSTRALIA: Australia’s inflation slowed more than expected in May, bolstering the case for the Reserve Bank to pause its 14-month tightening cycle at next week’s policy meeting and sending the currency lower. The consumer price indicator rose 5.6% in May from a year earlier, the smallest increase since April 2022, Australian Bureau of Statistics data showed Wednesday. That was well below economists’ estimate of 6.1%, with Barrenjoey Markets Pty Ltd. the sole forecaster to predict the reading. (BBG)

JAPAN: The yen’s decline toward 145 per dollar reversed after Japan’s top currency official Masato Kanda said authorities will respond if there are excessive FX moves. (BBG)

OIL: Moscow accounted for 46% of India’s oil imports last month, according to data from analytics firm Kpler, a staggering leap from less than 2% before the invasion of Ukraine. In absolute terms, May marked a high. Granted, China too has taken far more Russian crude over the past year, with imports hitting records, but it is India, a strategic US partner, that has stepped in from the wings to prop up the Russian economy. (BBG)

CHINA

FISCAL SUPPORT: Experts expect the government to increase the intensity and expand fiscal support in H2 following Minister of Finance Liu Kun’s recent report to the State Council. Tian Lihui, dean at Nankai University, expects authorities to use fiscal support to stabilise growth and employment in H2 and improve household incomes. Another expert mentioned the government will accelerate the use of special bonds in Q3 and might increase the yearly quota in efforts to stabilise demand. Beijing may also increase the use of quasi-fiscal tools, such as subsidised loans for industries with spillover public welfare effects, like technological innovation. (MNI)

BELT AND ROAD: China plans to use more equity to finance Belt and Road (BRI) projects in the future, according to Zhou Xiaochuan, former governor at the People’s Bank of China. Speaking at Fudan University, Zhou said authorities must do more to manage debt, including debt reductions and extensions, as well as expanding the scope of bond subscription and using more regional and development banks. Zhou rejected foreign criticism that BRI was a sovereign debt trap, saying loans were closer to commercial and corporate investment than sovereign debt. (MNI)

SOE REFORMS: The State Council will accelerate SOE reforms to stabilise China’s economic development, according to Zhang Yuzhuo, director at the State-owned Assets Supervision and Administration Commission. Zhang, speaking at the World Economic Forum, said SOEs can play an active role in strategic emerging industries and lead technological research. Authorities should implement policy to improve SOE market mechanisms and corporate governance and make effort to boost internationalisation of state firms through the Belt and Road Initiative, Zhang said. (MNI)

ECONOMY: Chinese leader Xi Jinping pledged that his nation would do right by foreign investors, underscoring his government’s attempts to assuage worries about the economy and unpredictable policymaking. (BBG)

INDUSTRIAL PROFITS: Annual profits at China's industrial firms extended a double-digit decline in the first five months as softening demand squeezed margins, reinforcing hopes of more policy support to bolster a stuttering post-COVID economic recovery. (RTRS)

CHINA MARKETS

PBOC Injects Net CNY69 Bln Via OMOs Wednesday

The People's Bank of China (PBOC) conducted CNY214 billion via 7-day reverse repos on Wednesday, with the rates at 1.90%. The operation has led to a net injection of CNY69 billion after offsetting the maturity of CNY145 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8561% at 10:09 am local time from the close of 1.9027% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday, compared with the close of 45 on Monday.

PBOC Yuan Parity Higher At 7.2101 Wednesday VS 7.2098 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2101 on Wednesday, compared with 7.2098 set on Tuesday.

OVERNIGHT DATA

South Korea June Consumer Confidence 100.7; Prior 98.0

South Korea May Retail Sales 5.7% Y/Y; Prior 4.0%

Australia May CPI 5.6% Y/Y; Prior 6.8%

China May Industrial Profits -12.6% Y/Y; Prior -18.2%

MARKETS

US TSYS: Curve Marginally Steeper In Asia

TYU3 deals at 112-28, +0-01+, a narrow 0-03+ range has been observed on volume of ~50k.

- Cash tsys sit 2bps richer to flat across the major benchmarks, light bull steepening is apparent.

- Tsys briefly firmed after a rally in ACGB's, in lieu of weaker than forecast inflation, spillover over. However there was little follow through on the move and tsys ticked away from session highs.

- Narrow ranges were observed for the remainder of the session and little meaningful macro news flow crossed.

- The data calendar is light in Europe, today's session is highlighted by a panel with Fed Chair Powell, ECB's Lagarde, BOJ's Ueda and BOE's Bailey at the Sintra conference. We also have the latest 7-Year Supply.

JGBs: Futures At Cheaps, Gov. Ueda On ECB Panel Later Today

In the Tokyo afternoon session, JGB futures are trading lower by 28 points compared to settlement levels. With a lack of significant domestic catalysts, it seems that the domestic market has been influenced by movements in US Treasury yields. In Asia-Pacific trade, cash Treasury yields have remained relatively stable across the major benchmarks after retracing their earlier gains.

- However, it is worth noting that there seems to be some follow-through selling following yesterday's 20-year supply, which saw a lower-than-expected cut-off price, a wider tail, and a lower cover ratio.

- The cash JGBs curve bear steepens led by the futures-linked 7-year zone (2.1bp cheaper). The benchmark 10-year yield is 1.6bp higher at 0.390%.

- The benchmark 20-year is 1.6bp cheaper at 0.974. The yield on 20-year debt advanced 1.5bp to 0.958% yesterday.

- Swap rates are higher across the curve with the 7-year zone leading (+1.4bp). Swap spreads are wider out to the 5-year zone and generally tighter beyond.

- Later today BOJ's Ueda is on a panel at the ECB Forum with Fed Chair Powell, ECB's Lagarde, and BOE's Bailey.

- The local calendar tomorrow sees Retail Sales (May), International Investment Flows (June 23) and Consumer Confidence (June).

- The MoF also plans to sell Y2.9tn 2-year JGBs.

AUSSIE BONDS: Richer But Off Bests, As Core CPI Measures See Smaller Declines

ACGBs sit stronger (YM +4.0 & XM +4.0) but well off session bests seen immediately following the release of lower-than-expected CPI monthly data for May. A closer inspection of the data revealed much smaller declines for the CPI ex-volatile items & holiday travel and the trimmed mean series. This assisted the move from market highs.

- Cash ACGBs are 1bp richer after the data to be 4-5bp richer on the day. The AU-US 10-year yield differential is -7bp on the day at +13bp.

- Swap rates are 6bp richer on the day with EFPs tighter.

- Bills are richer across the strip with pricing +4 to +7.

- RBA-dated OIS pricing is 4-6bp softer for meetings beyond August after the CPI data. The market now attaches a 31% chance of a 25bp hike in July.

- Tomorrow's local calendar sees the release of Retail Sales for May, which is anticipated to provide additional confirmation of the ongoing consumer slowdown.

- Australia’s first budget surplus in 15 years will be larger than the A$4.2 billion seen just last month, Treasurer Jim Chalmers said, as elevated commodity prices and a tight labour market bolster revenue. (See link)

- Australia is bound for a recession after rapid interest-rate increases, so its sovereign bonds offer a “fantastic opportunity” with many investors underpricing that risk, according to PIMCO. (See link)

NZGBS: At Cheaps, NZDM Announcement Weighs, NZ/AU 10-Year Differential Wider

NZGBs closed at or just off session cheaps, 1-4bp cheaper on the day. News that NZ Treasury plans weekly auction offerings NZ$500m bonds in July appears to have weighed. Recent weekly auctions have been NZ$400mn.

- The local market was also guided by US tsys and ACGBs. Cash tsys are dealing little changed across the major benchmarks in Asia-Pac trade after giving back early strength.

- ACGBs gapped higher after May's CPI Monthly printed lower than expected. The revelation that the core measures saw much smaller declines saw the gains pared. The NZ/AU 10-year yield differential widened by 7bp on the day.

- Swap rates closed 3bp lower with implied swap spreads 7-8bp tighter.

- RBNZ dated OIS pricing closed little changed.

- NZ Prime Minister Hipkins discussed his country’s interest in boosting economic ties with China during a meeting with Chinese President Xi Jinping in Beijing on Tuesday. (See link)

- The local calendar sees the release of the latest ANZ Business Outlook survey tomorrow. On Friday, Consumer Sentiment is expected to continue to signal ongoing recessionary conditions, as households deal with the headwinds of high inflation and interest rates.

- Later today BOJ's Ueda is on a panel at the ECB Forum with Fed Chair Powell, ECB's Lagarde, and BOE's Bailey.

OIL: Crude Bounces, Unusual Negative Brent-Dubai spread

Oil prices trended down earlier in the APAC session because of continued demand worries, but have bounced off their intraday low to be higher on the day helped by the US crude stock drawdown and the USD index coming off its highs. WTI is up 0.7% to around $68.20/bbl after a low of $67.74 earlier. Brent is also 0.7% higher at $73.05 following a low of $72.57.

- In an unusual move, Brent traded at a discount of around 10c to Dubai earlier, due to concerns re OECD rate hikes and the impact it will have on oil demand, according to Bloomberg. This means that lower grade crude was trading at a premium. If Brent closes lower, then this is the first time this has happened since November 2020. The spread has been narrowing due to reductions in output from the Middle East, whereas large US crude shipments (lighter, sweeter oil) to Europe have weighed on Brent.

- There have also been huge opposing positions in Middle East crude taken by China’s largest oil company and refiner which have clouded the market.

- Bloomberg is reporting that the Brent-Dubai exchange of futures for swaps for August has narrowed to 4c/bbl from $2 at the start of June. It is an indicator of flows from west to east.

- Later EIA US inventory data prints. Fed’s Powell, ECB’s Lagarde, BoJ’s Ueda and BoE’s Bailey all speak at the ECB Sintra conference. US May trade and inventories are released as well as the Fed’s bank stress test report.

GOLD: Lower After US Data Pushes Yields Higher

Gold is slightly higher (+0.1%) in Asia-Pac trading after closing at a three-month low as a flurry of data showed a surprisingly strong US economy, giving the Federal Reserve more scope to keep raising rates.

- In May, durable goods orders experienced a 1.7% m/m increase, surpassing expectations of -0.9%. Additionally, new home sales saw a substantial 12.2% m/m rise in May, contrary to the expected -1.2% decline. Furthermore, the US Conference Board Consumer Confidence Index exceeded expectations and reached its highest level since January 2022.

- Bullion faced downward pressure as tsy yields increased, which is a disadvantage for gold due to its lack of interest-bearing characteristics.

- The prospect of further tightening measures in the US and other countries is adding downward pressure on the precious metal, which has declined approximately 7% since its peak in early May.

- However, there is still some concern that a hawkish stance by the Federal Reserve could potentially push the world's largest economy into a recession, providing some support for gold.

FOREX: AUD Off Post-CPI Lows

AUD has trimmed some of its post CPI losses, the AUD was down as much as 1% as May CPI was weaker than forecast, before paring losses to sit ~0.6% softer.

- AUD/USD prints at $0.6640/45, the pair found support below $0.6627, 61.8% retracement of May 31 to Jun 16 rally. The next support level is $0.6610 the Jun 6 low. AUD/NZD sits unchanged, the cross found support ahead of the $1.08 handle and erased losses of as much as 0.4%.

- Kiwi is the weakest performer in the G-10 space at the margins. NZD/USD is down ~0.7% and last prints at $0.6120/25. The pair sits a touch above the support at the low from 23 June ($0.6117), a break through here opens the low from June 8 ($0.6031).

- Yen is a touch firmer, however ranges have been narrow with little follow through. Early in the session Japan's Kanda said that Japan will respond appropriately to excessive FX moves.

- Elsewhere in G-10, EUR and GBP are down ~0.1%. NOK is ~0.3% softer, however liquidity is generally poor in Asia.

- Cross asset wise; US equity futures are pressured coming after the WSJ reported that the US is considering new curbs on chip exports to China. E-minis are down ~0.2% and NASDAQ futures are down ~0.4%. BBDXY is ~0.1% firmer and US Tsy Yields are a touch softer across the curve.

- The data calendar is light in Europe, today's session is highlighted by a panel with Fed Chair Powell, ECB's Lagarde, BOJ's Ueda and BOE's Bailey at the Sintra conference.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/06/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/06/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 28/06/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/06/2023 | 0800/1000 | ** |  | EU | M3 |

| 28/06/2023 | 0800/1000 | ** |  | IT | PPI |

| 28/06/2023 | 0800/1000 |  | EU | ECB de Guindos Panels ECB Forum | |

| 28/06/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 28/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 28/06/2023 | 0900/1100 |  | EU | ECB de Guindos Panels ECB Forum | |

| 28/06/2023 | 1030/1130 |  | UK | BOE Pill Panels ECB Forum | |

| 28/06/2023 | 1030/1230 |  | EU | ECB Lane Panels ECB Forum | |

| 28/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/06/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2023 | 1330/1430 |  | UK | BOE Bailey Panels ECB Forum | |

| 28/06/2023 | 1330/1530 |  | EU | ECB Lagarde Panels ECB Forum | |

| 28/06/2023 | 1330/0930 |  | US | Fed Chair Jerome Powell | |

| 28/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 28/06/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/06/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.