-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN OPEN: Australian CPI Moving Towards RBA Forecast, Rates On Hold

EXECUTIVE SUMMARY

- CHINA FDI OUTLOOK DOWN AS ECONOMY WEAKENS - CHAMBERS - MNI

- CHINA MUST ADDRESS INVESTOR CONCERNS TO BOOST A-SHARES - MNI

- AUSSIE MONTHLY CPI FALLS TO 4.9% - MNI BRIEF

- 2% TARGET IN VIEW, MORE TIME NEEDED - BOJ’S TAMURA - MNI BRIEF

- RAIMONDO SAYS US BUSINESSES SEE CHINA BECOMING ‘UNINVESTIBLE’ - BBG

- CHINA SAYS EASING MARKET ACCESS IN RESPONSE TO ‘UNINESTIBLE’ COMMENT FROM US - RTRS

- RBNZ SOLD KIWI DOLLAR IN JULY TO BUILD FOREIGN RESERVES - BBG

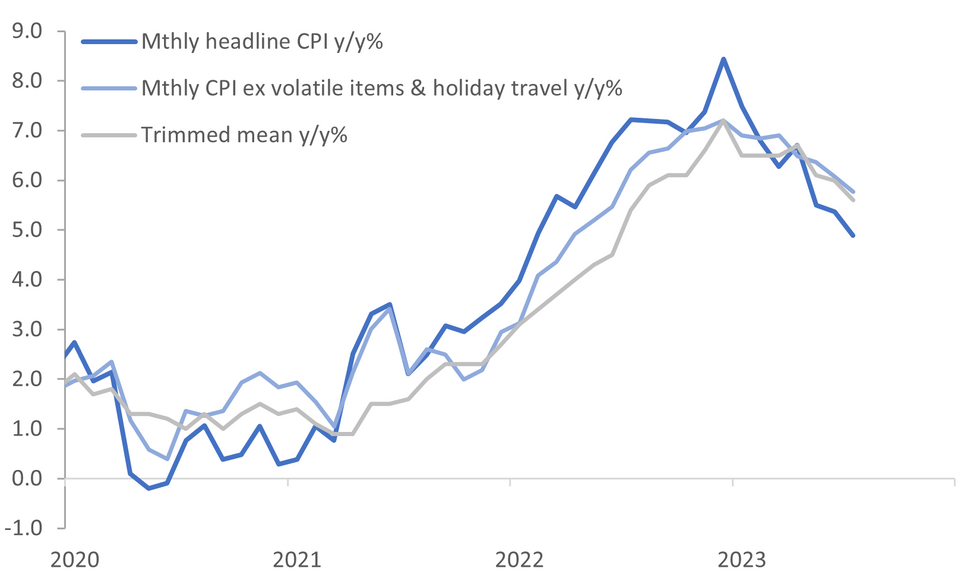

Fig. 1: Australian Monthly CPI

Source: MNI - Market News/Bloomberg

U.K.

PROPERTY: UK home sales are on track to drop to the lowest since 2012 this year as stubbornly high mortgage rates grip the housing market. Residential transactions are set to fall over 20% from 2022, according to an estimate from property portal Zoopla based on the number of homes being sold “subject to contract” so far this year. That’s on the back of a plunge in deals funded by home loans, with mortgaged sales projected to drop 28% this year. (BBG)

EUROPE

RUSSIA/CHINA: Russian President Vladimir Putin has agreed to make his first foreign trip since a warrant for his arrest on alleged war crimes was issued by the International Criminal Court. The Kremlin is preparing Putin’s visit to China for the Belt and Road Forum in October, according to three people with knowledge of the matter, who asked not to be identified because the issue is sensitive. Putin has accepted the invitation from Chinese President Xi Jinping to attend the event, one of the people said. (BBG)

U.S.

US/CHINA: US Commerce Secretary Gina Raimondo argued that China is driving away American companies by making investments in the world’s second-biggest economy increasingly hazardous. “Increasingly I hear from businesses, ‘China is uninvestible because it’s become too risky,’” Raimondo told reporters Tuesday aboard a high-speed train from Beijing to Shanghai. (BBG)

WEATHER: Hurricane Idalia gained fury over the Gulf of Mexico on Tuesday as it crawled toward Florida's Gulf Coast, forcing evacuations in low-lying coastal areas expected to be swamped when the powerful storm hits on Wednesday morning. (RTRS)

OTHER

JAPAN: Bank of Japan Board Member Naoki Tamura said on Wednesday the achievement of the bank's 2% price target was clearly in view, however, the continuation of easy policy was appropriate as more time is needed. He told business leaders in Kushiro City the 2% target should become clearer between Jan-March 2024 when wage hike momentum, including actual price moves in 2H 2023, become clearer. Corporate price-setting behavior has changed from the deflationary period, he added. (MNI BRIEF)

AUSTRALIA: Australia’s monthly Consumer Price Index (CPI) indicator rose 4.9% y/y to July 2023, lower than the expected 5.2% and down from June’s 5.4% print, according to Australian Bureau of Statistics (ABS) data released today. (MNI BRIEF)

AUSTRALIA: Australia’s monthly inflation gauge eased more than expected, reflecting global trends and bolstering the case for the Reserve Bank to extend a pause in tightening at next week’s policy meeting. (BBG)

NEW ZEALAND: New Zealand’s central bank sold close to NZ$4 billion ($2.4 billion) in July to build its reserves of foreign currencies. The Reserve Bank sold a net NZ$3.96 billion, according to data posted on its website, the largest sale in records dating to 2004. “This is not intervention,” an RBNZ spokesman said Wednesday in Wellington. “It relates to the new foreign currency reserves framework announced in January.” (BBG)

NEW ZEALAND: New Zealand’s main opposition National Party is offering tax cuts to families and middle-income voters, hoping to woo them away from the ruling Labour Party at the October election. Among a range of measures National pledged to introduce if it wins office, the party will lift income tax thresholds to compensate for inflation and boost tax credits for families, leader Christopher Luxon said Wednesday in Wellington. An average-income household with children would be as much as NZ$250 ($150) per fortnight better off, he said. (BBG)

NEW ZEALAND: Foreigners will be able to purchase property in New Zealand worth more than NZ$2 million ($1.2 million) if the country’s main opposition National Party wins the October election. National, which is ahead in opinion polls, has pledged to partially repeal a ban on foreign buyers if it wins office. It would retain the ban on properties valued under NZ$2 million and apply a 15% foreign buyer tax on purchases above that, leader Christopher Luxon said Wednesday in Wellington. (BBG)

NEW ZEALAND: New Zealand house prices are forecast to rise again next year due to an ongoing supply shortage and expectations for interest rate cuts, according to a Reuters poll of property market analysts. The Reserve Bank of New Zealand (RBNZ) likely ended a 20-month tightening cycle in May after taking the overnight cash rate from near-zero to 5.50%, a campaign that helped bring down the average house price by 15% compared with the price peak in November 2021. (RTRS)

THAILAND: Thailand is likely to ease visa rules for Chinese and Indian travelers and allow longer stays for visitors from all nations as new Prime Minister Srettha Thavisin looks for ways to boost tourism revenue to nearly $100 billion next year. (BBG)

CHINA

FDI: Recent government measures that address intellectual property and market access concerns may prove ineffective at boosting foreign direct investment (FDI), as international corporations operating in Mainland China grow increasingly worried over the country's economy and lack of policy response, international business leaders in China have told MNI. (MNI)

CHINA/US: China has defended its business practices after U.S. Commerce Secretary Gina Raimondo said American firms had told her that China had become "uninvestible" and "too risky." Asked to respond to the comments Raimondo made in China, the spokesperson for the Chinese embassy in Washington, Liu Pengyu said that most of the 70,000 U.S. firms doing business in China wanted to stay, that nearly 90% were profitable, and that Beijing was working to further ease market access for foreign companies. (RTRS)

EQUITY: Chinese authorities should prioritise legal investor protections and increase information access to retail investors among other reforms to improve the A-share market and stabalise economic growth, advisors and analysts told MNI, following recent moves to stimulate China's equity market. (MNI)

EQUITY: Continued rebounds in Chinese equities this week show investor sentiment is improving, state-backed newspapers reported, citing analysts as saying A shares have more room to run in near term. Slew of recent policies introduced by regulators — like stock sale restrictions, cut in deposit ratios for margin financing, pledge to slow pace of IPOs — has reduced selling pressure in the market: Securities Times says. (BBG)

ETF: China’s largest exchange-traded fund focused on stocks is poised to see its biggest monthly inflow on record, a sign that some investors are buying the dip and betting on a turnaround amid enhanced policy support. Huatai-Pinebridge CSI 300 ETF has attracted 32 billion yuan ($4.4 billion) of funds so far in August, the most since the product was launched in 2012. (BBG)

YUAN: The yuan will receive backing from the government’s determination to prevent excessive movement in its exchange rate and an expected improvement in the economy as pro-growth measures take effect, the China Securities Journal reports, citing analysts. (CSJ)

RATES: Agricultural Bank of China and China Merchants Bank are drafting plans to cut interest rates of existing mortgage loans, Shanghai Securities News cited banking executives as saying at their results briefing with media this week. (BBG)

PROPERTY: Country Garden Holdings Co. aims to issue HK$270 million ($34.4 million) of new shares, as the distressed developer tries to pay off money it owes to other companies. (BBG)

REGULATIONS: China issues regulations on data services provided by money brokers, according to a joint notice released by the National Administration of Financial Regulation, the People’s Bank of China, China Securities Regulatory Commission, Cyberspace Administration of China and the State Administration of Foreign Exchange. (BBG)

CHINA MARKETS

MNI: PBOC Net Injects CNY81 Bln Wednesday via OMO

The People's Bank of China (PBOC) conducted CNY382 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY81 billion after offsetting the maturity of CNY301 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at the end of the month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:26 am local time from the close of 2.1819% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Tuesday, compared with 44 on Monday.

PBOC Yuan Parity Lower At 7.1816 Wednesday Vs 7.1851 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1816 on Wednesday, compared with 7.1851 set on Tuesday. The fixing was estimated at 7.2741 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND JULY BUILDING PERMITS M/M -5.2%; PRIOR 3.4%

AUSTRALIA JULY CPI Y/Y 4.9%; MEDIAN 5.2%; PRIOR 5.4%

AUSTRALIA Q2 CONSTRUCTION WORK DONE Q/Q 0.4%; MEDIAN 0.9%; PRIOR 3.8%

AUSTRALIA JULY BUILDING APPROVALS M/M -8.1%; MEDIAN -0.5%; PRIOR -7.9%

AUSTRALIA JULY PRIVATE SECTOR HOUSES M/m 0.1%; PRIOR -1.0%

JAPAN AUGUST CONSUMER CONFIDENCE INDEX 36.2; MEDIAN 37.4; PRIOR 37.1

MARKETS

US TSYS: Marginally Cheaper In Muted Asian Session

TYZ3 deals at 110-23, -0-03, a narrow 0-06+ range has been observed on volume of ~100k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Asia-Pac participants faded yesterday's richening in early trade perhaps using the opportunity to close long positions/enter fresh shorts.

- Losses were briefly pared after a bid in ACGB's, in lieu of weaker than forecast CPI ,spilled over.

- The move didn't follow through, tsys ticked lower dealing in a narrow range for the remainder of the session.

- In Europe today regional German CPI provides the highlight. Further out we have US GDP, wholesale inventories and pending home sales.

JGBS: Futures Weaker & At Session Lows, Heavy Local Calendar Tomorrow

JGB futures are weaker and at Tokyo session lows, -14 compared to settlement levels.

- With the data calendar empty so far today, the local market’s focus has been comments from BoJ Board Member Naoki Tamura. He stated that the achievement of stable and sustainable 2% inflation is finally and clearly within sight (See link ICYMI)

- US tsys in Asia-Pac trade also likely weighed on JGBs. Cash tsys sit ~1bp cheaper across the major benchmarks. Asia-Pac participants faded yesterday's richening perhaps using the opportunity to close long positions/enter fresh shorts.

- Cash JGBs are cheaper across the curve, with yields 0.1bp (1-year) to 0.7bp higher (3-year). The benchmark 10-year yield is 0.1bp higher at 0.654%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- As suggested previously, BoJ Rinban operations, which saw higher and flat to positive spreads and higher cover ratios for the 5-10-year and 25-year+ buckets did generate slight pressure, particularly for the 5-10 bucket and longer-dated JGBs, in the early rounds of the Tokyo afternoon session.

- The swaps curve has bear steepened, with rates 0.1-1.6bp higher. Swap spreads are wider beyond the 3-year.

- Tomorrow the local calendar is heavy, with Retail Sales (Jul), Industrial Production (Jul P), International Investment Flows (Aug 25) and Housing Starts (Jul). We also hear from BoJ Board Member Nakamura.

AUSSIE BONDS: Richer After CPI Monthly Undershoot, Q2 Capex Data Tomorrow

ACGBs (YM +4.0 & XM +2.5) sit richer after the CPI monthly data for July prints better than expected at 4.9% y/y versus 5.2% expected and 5.4% prior. The ABS also released the monthly goods/services and tradeable/non-tradeable components, which is likely useful for the RBA given its focus on services. Goods/tradeables are driving the moderation in headline CPI. However, services inflation eased to 5.6% y/y in July, after a sharp rise to 6.3% in June.

- Construction work done for Q2 and building approvals for July released today also surprised on the downside.

- Cash ACGBs are 3-4bp richer with the AU-US 10-year yield differential 1bp wider at -6bp.

- Swap rates are 2-4bp lower, with the curve steeper.

- The bills strip has bull flattened, with pricing flat to +6.

- (AFR) Inflation cools to 4.9pc, cementing interest rate pause. (See link)

- Qantas debacle helps explain why Future Fund is staying bearish. (See link)

- RBA-dated OIS pricing is 2-4bp softer for ’24 meetings. A 2% chance of a 25bp hike is priced for September.

- Tomorrow the local calendar sees Q2 Capex and the third estimate of 2023-24 Capex plans. Tax incentives, which expired on 30 June 2023, should boost Q2 capex.

NZGBS: Closed At Session Bests, Business Confidence Tomorrow

NZGBs concluded the session near their best levels, with benchmark yields declining 5-6bp. While weaker dwelling approvals likely contributed to the bid, the more likely factor behind the through-session strengthening seems to be a partial unwind of weakness earlier in the week triggered by fiscal deterioration concerns.

- Despite some cheapening in US tsys in the Asia-Pac trading, the local market’s resilience allowed the NZ-US 10-year yield differential to close unchanged at +80bp. The NZGB 10-year outperformed its ACGB counterpart by 2bp on the day, despite favourable AU inflation data.

- Swap rates are 6-8bp lower, with implied swap spreads little changed.

- RBNZ dated OIS pricing is flat to 4bp softer across meetings. Terminal OCR expectations sit at 5.61%, the lower bound of its recent range.

- Dwelling approvals fell 5.2% m/m in July versus a revised +3.4% in June. House approvals fell 18.8% m/m in July versus +8.8% in June.

- The RBNZ sold close to NZ$4 billion ($2.4 billion) in July to build its reserves of foreign currencies. (See link)

- Tomorrow the local calendar sees ANZ Business Confidence.

- Tomorrow the NZ Treasury plans to sell NZ$225mn of the 0.25% May-28 bond, NZ$175mn of the 1.50% May-31 bond and NZ$100mn of the 1.75% May-41 bond.

FOREX: USD Trims Tuesday's Losses In Asia

The greenback has trimmed some of yesterday's losses in Asia today, the Antipodeans are the weakest performers in the G-10 space at the margins.

- AUD/USD is down ~0.2%, the pair last prints at $0.6470/75. CPI rose 4.9% Y/Y in July, below the estimate of 5.2%. July building approvals fell 8.1% m/m versus an estimated 0.5% contraction. The pair found support at $0.6450 and marginally pared losses through the session.

- Kiwi is the weakest performer in the G-10 space, NZD/USD is down ~0.2%. The RBNZ sold a net of $4bn NZD to build its reserves of foreign currencies. The Reserve Bank sold a net NZ$3.96 billion, according to data posted on its website, the largest sale in records dating to 2004. Early in the session July Building Permits fell 5.2% M/M, the prior read was revised lower to 3.4%.

- The Yen is also marginally pressured, USD/JPY has firmed above the ¥146 handle as US Tsy Yields tick higher. The uptrend remains intact, resistance comes in at ¥147.37 (yesterday's high) whilst support is at ¥144.77 (20-Day EMA).

- Elsewhere in G-10 EUR and GBP are both following broader USD flows and are down ~0.1%.

- Cross asset wise; BBDXY is up ~0.1% and US Tsy Yields are ~1bp higher across the curve. US Equity futures are firmer; e-minis are up ~0.2% and NASDAQ futures are up ~0.3%.

- In Europe today regional German CPI provides the highlight

EQUITIES: Lower Inflation Aids Australian Stock Outperformance

Regional equities are tracking higher in Asia Pac trade for Wednesday. Gains are quite uniform across the major indices, albeit with varying betas with respect to US gains from Tuesday's session. Australian stocks are the standout, while most other indices are less than 1% firmer at this stage. US equity futures are maintaining a positive trend, with Eminis last near 4514, which is levels last seen back in mid August. Nasdaq futures are slightly outperforming, last +0.24% to 15453.

- The ASX 200 is tracking +1.4% firmer in Australia, comfortably the best performer in the region. Financial stocks have led the way, post the July CPI miss, which may see the RBA pause further. Gains were also evident elsewhere, with 10 out of 11 sectors rising.

- China stocks were firmer earlier but couldn't sustain gains. The CSI 300 is +0.06% at the break after being as high as +0.60% earlier. The index sits below the 3800 level. Prospects for further bank interest rate cuts on mortgages and deposits has weighed on the banking sector. Still, Bloomberg notes China's largest ETF is on track for record inflows in August (see this link for more details).

- The HSI is +0.59% at the break, but also sub earlier highs. Tomorrow, we get official China PMI prints for August, which are expected to show a further loss of growth momentum.

- The Kospi and Taiex are tracking higher (around +0.60%), in line with better tech tones from Tuesday's US session.

- In SEA, Philippine stocks are up 0.90%, reversing some of the recent underperformance.

OIL: Crude Higher Again As Stocks Decline & Market More Optimistic On Demand

Oil prices are up another 0.4% after rising around 1.5% on Tuesday after API data showed a large US stock drawdown. Better risk sentiment is also supporting crude. WTI is up 0.4% to $81.50/bbl, close to the intraday high of $81.61. It is approaching resistance at $81.75. Brent is 0.3% higher at $85.75, which has opened up the bull trigger at $88.10. Oil has rallied despite the stronger dollar (USD index +0.2%).

- Bloomberg reported that API data showed a massive 11.5mn barrel US inventory drawdown in the latest week after -2.4mn, according to people familiar with the numbers. Distillate rose 2.5mn and gasoline +1.4mn. The official EIA data is out later today.

- Markets are generally more optimistic as they speculate that there will be more economic stimulus in China and that the Fed has done tightening. Key US payrolls are out Friday and China PMIs on Thursday.

- While markets are more positive this week on the demand outlook, Bloomberg is reporting that Russian seaborne crude shipments may have reached their highest in 8 weeks. Also talks continue to ease sanctions on Iran and Venezuela’s oil.

- US ADP employment for August, July trade balance and updated Q2 GDP are released today as well as the European Commission August survey and preliminary August German and Spanish CPIs.

GOLD: Strong Gain After Weak US Data

Gold is little changed in the Asia-Pac session, following a notable +0.9% increase on Tuesday that propelled it to its highest point in three weeks.

- The surge in the precious metal can be directly attributed to the decline of the USD and a substantial drop in US treasury yields. These shifts were instigated by underwhelming consumer confidence and JOLTS data, which further substantiated the notion that the Federal Reserve is drawing closer to concluding its phase of monetary tightening.

- The Conference Board's report on consumer confidence revealed figures lower than anticipated, encompassing key labour market indicators. Notably, the disparity between the indices for "plentiful" jobs and "hard-to-get" jobs dwindled to its lowest level since the early months of 2021.

- JOLTS data unveiled a more significant decrease in job openings than expected, reaching a point that hasn't been witnessed in over two years. Job openings have experienced declines in six out of the last seven months. Furthermore, the rate of employees voluntarily leaving their jobs reverted to levels observed before the pandemic took hold.

- This valuable metal has successfully surpassed the 50-day EMA ($1930.4), subsequently ushering in the possibility of reaching $1946.8 (the high point from August 4), as suggested by MNI's team of technical experts.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/08/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/08/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Survey |

| 30/08/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/08/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/08/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/08/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 30/08/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 30/08/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/08/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/08/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/08/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/08/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/08/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/08/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/08/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 30/08/2023 | 1230/0830 | *** |  | US | GDP |

| 30/08/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 30/08/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 30/08/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.