-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Awaiting A Day Of Fedspeak

EXECUTIVE SUMMARY

- BIDEN'S TEAM CONTINUE TO STRESS NEED FOR INFRASTRUCTURE INVESTMENT

- BIDEN, TOUTING FED INDEPENDENCE, YET TO SPEAK WITH POWELL (BBG)

- U.S. STATE DEPARTMENT BACKS AWAY FROM THE IDEA OF A BEIJING OLYMPICS BOYCOTT (CNBC)

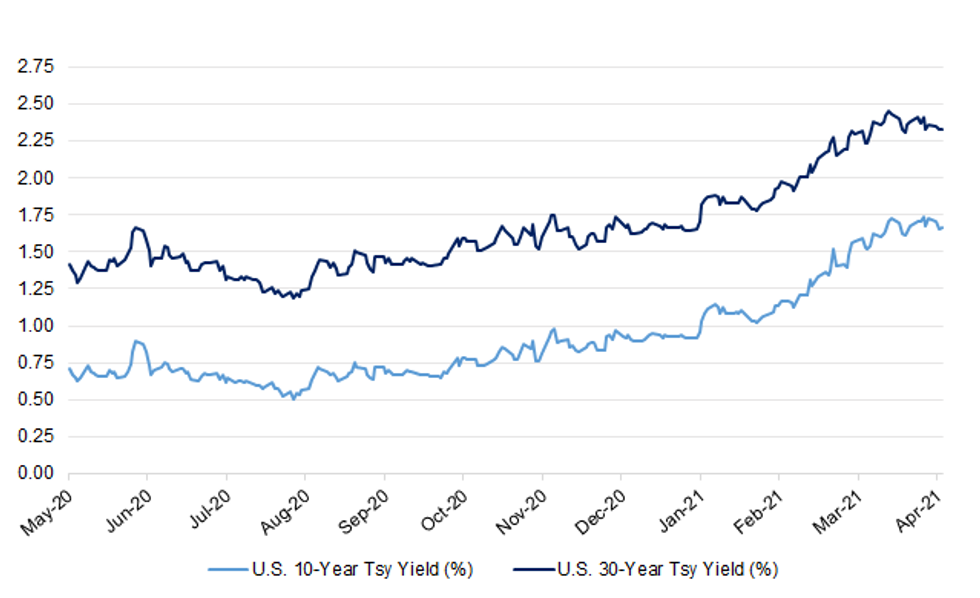

Fig. 1: U.S. 10- & 30-Year Tsy Yields

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: The Moderna vaccine will be rolled out for the first time in the UK to residents in west Wales from Wednesday, the Welsh government has announced. The UK government has ordered 17m doses of the Moderna vaccine, which will be the third to be administered in the UK, since the rollout began in December last year. The vaccine was first approved by the medicines regulator, the Medicines and Healthcare products Regulatory Agency, in January. The announcement follows growing concern surrounding the possible link between the Oxford/AstraZeneca vaccine and rare blood clots. (FT)

CORONAVIRUS: The vaccine rollout for younger people should be paused until regulators have issued firm guidance on the safety of the Oxford/AstraZeneca vaccine, a senior government adviser has suggested. (Telegraph)

EUROPE

ITALY: Italy's government has decided that Rome's Olympic stadium can be re-opened to the public for European Championship matches, the Italian football federation (FIGC) said in a statement on Tuesday. The Euro 2020 tournament was postponed last year due to the COVID-19 pandemic and UEFA, European soccer's governing body, had asked the 12 host nations to submit plans for allowing fans inside stadiums by early April. (RTRS)

NETHERLANDS: The Dutch government will begin opening museums and zoos this month by offering coronavirus tests before entry, ANP news reported on Tuesday, citing the Health Ministry, in a first easing of far-reaching lockdown measures. Under current measures, public gatherings of more than two people are banned, restaurants are allowed to serve only takeaway food, and there is an evening curfew. (RTRS)

IRELAND: Employment in the services sector rose for only the second time since the start of the Covid-19 pandemic last month, while confidence was at its highest since mid-2018 on the back of hopes that vaccinations will enable the lifting of lockdown restrictions. The latest PMI survey data from AIB signalled a rebound in Irish services output in March, driven by renewed growth in new business and exports. The overall index rose sharply to 54.6 in March, from 41.2 in February. This signalled the first expansion in services activity since December, and the strongest rate of growth since February 2020. (Irish Times)

U.S.

FED: "You've got excess savings. You've got fiscal stimulus funding pent-up demand from consumers like me who're exhausted from isolation and freed up by vaccines and warmer weather," says Federal Reserve Bank of Richmond President Thomas Barkin. "I expect to see a really strong spring and summer." (BBG)

FED: President Joe Biden said he hasn't spoken with Federal Reserve Chair Jerome Powell since taking office more than two months ago, citing respect for the central bank's independence and marking a sharp turn from his predecessor, Donald Trump. "The Federal Reserve is an independent operation and, starting off my presidency, I want to be real clear that I'm not going to do the kinds of things that have been done in the last administration," Biden said on Tuesday in response to a question. "I've been very fastidious about not talking to them, but I do talk to the secretary of the Treasury," Janet Yellen, he said. (BBG)

FED: MNI INTERVIEW: Inflation Fears Premature -- Boston Fed Staffer

- Rising worries on Wall Street about the prospect of runaway inflation are so far misplaced because there is still ample slack in the economy according to a wide range of key metrics, though supply chain disruptions bear watching, Boston Fed Senior Economist Viacheslav Sheremirov told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Biden to speak on infrastructure plan at 1:45pm on Wednesday. (BBG)

FISCAL: The White House said on Tuesday that it is aiming to get President Joe Biden's multitrillion-dollar infrastructure package approved within months, an ambitious timeline that underscores the administration's desire to quickly muscle a plan through Congress. "We'd like to see progress by May and certainly a package through by the summer," White House Press Secretary Jen Psaki said at a daily news conference. "At the end of the day, the president's red line is inaction," she said. "He won't tolerate inaction on rebuilding our nation's infrastructure, something that has long been outdated. He believes we need to invest in that so we can improve the lives of ordinary Americans and make it easier to do business." (Business Insider)

FISCAL: U.S. Treasury Secretary Janet Yellen said a rapid recovery in the United States would boost overall global growth, but more work was needed to shore up weaknesses the COVID-19 crisis exposed in the non-bank financial sector, global supply chains and the social safety net. Yellen on Tuesday told leaders of the International Monetary Fund and the World Bank that the Biden administration had decided to "go big" with its COVID-19 response to avert the negative "scarring" impact of long-lasting unemployment, adding that she hoped the U.S. economy would return to full employment next year. (RTRS)

FISCAL: The United States must invest heavily in its workforce, infrastructure, research and development remain competitive and stay the world's largest economy, Cecilia Rouse, chair of the White House Council of Economic Advisers said on Tuesday. U.S. investments in R&D had fallen by a third as a percentage of economic output since 1960, while spending on infrastructure had been halved over the last 50 years, Rouse told an online event hosted by the Washington Center for Equitable Growth and Groundwork Collaborative. (RTRS)

FISCAL: Amazon boss Jeff Bezos has said he supports raising taxes on US companies. The comments by the world's richest man come as US President Joe Biden is pushing to raise the corporate rate from 21% to 28%. The rise would help pay for a massive spending plan to upgrade America's roads, ports, water pipes and internet. In his speech unveiling the proposal, Mr Biden singled out Amazon as an example of a company that pays too little. The statement by Mr Bezos said Amazon supported Mr Biden's "focus on infrastructure" and called on Democrats and Republicans to "work together" and reach a compromise. (BBC)

CORONAVIRUS: President Joe Biden said he wants all American adults eligible for a coronavirus vaccine by April 19, two weeks earlier than his previous goal. All but two states are already set to meet that goal, with only Oregon and Hawaii having planned to have opened up vaccines to all non-minors on May 1. Biden said there will be no more confusing restrictions. But the president added it's not time to celebrate yet and the fight against the virus isn't over because new variants are still spreading quickly. "The pandemic remains dangerous," Biden said. (BBG)

CORONAVIRUS: The U.S. government won't issue so-called vaccine passports, White House Press Secretary Jen Psaki said, though the Biden administration plans guidance for companies developing the credentials. The administration doesn't want vaccine passports "used against people unfairly" and will provide guidance "that will look like an FAQ" for private-sector development of the credentials, she said at a briefing. Several Republican-led states have moved to limit development and use of the passports. Earlier Tuesday, Texas Governor Greg Abbott issued an order forbidding state agencies or any entity receiving public money from requiring them. (BBG)

CORONAVIRUS: Dr. Anthony Fauci says the country is back in a precarious situation, with daily COVID-19 case averages increasing in the past few weeks — signaling a potential surge that could mimic what is happening in Europe. Throughout the pandemic, the U.S. has regularly lagged a few weeks behind Europe and could continue to follow suit, Fauci told Yahoo Finance. Getting Americans vaccinated is key in preventing another surge, he said. (Yahoo Finance)

CORONAVIRUS: California is aiming to fully reopen its economy June 15 — the clearest end date eyed for restrictions that have besieged businesses and upended daily life throughout the COVID-19 pandemic. Officials emphasize that getting to the point where California can widely reopen for the first time in more than a year will hinge on two factors: a sufficient vaccine supply to inoculate all those who are eligible and stable and low numbers of people hospitalized with the disease. (Los Angeles Times)

CORONAVIRUS: U.S. cruises could resume by mid-summer with restrictions, the Centers for Disease Control and Prevention said Tuesday after Carnival Corp., the largest operator, threatened to relocate ships to other markets. The industry has been pressuring the agency, saying it's restricting their return to the seas even as other hospitality industries like hotels and theme parks reopen. Earlier Tuesday, Carnival threatened to move some U.S. ships to other ports, more than a year after the industry essentially went on hiatus. (BBG)

EQUITIES: The night before the Archegos Capital story burst into public view late last month, the fund's biggest prime broker quietly unloaded some of its risky positions to hedge funds, people with knowledge of the trades told CNBC. Morgan Stanley sold about $5 billion in shares from Archegos' doomed bets on U.S. media and Chinese tech names to a small group of hedge funds late Thursday, March 25, according to the people, who requested anonymity to speak frankly about the transaction. (CNBC)

OTHER

U.S./CHINA: The State Department denied Tuesday evening that it was considering a joint boycott alongside allies of the 2022 Winter Olympics in Beijing. "Our position on the 2022 Olympics has not changed. We have not discussed and are not discussing any joint boycott with allies and partners," a senior State Department official wrote in an emailed statement to CNBC. (CNBC)

U.S./CHINA: China will not be coerced by the possible threat of a U.S.-dominated semiconductor supply chain, according to the Global Times. Commenting in response to the Biden administration's intention to strengthen U.S. chip production, the newspaper said the move raises concerns of a "chip war" in which the U.S. will use its "hegemony" to crack down on Chinese companies. While it may take China a long time to develop its own cutting-edge semiconductor supply chain, the fact that it is the largest market for the global semiconductor industry will allow China to develop the technologies and pursue cooperation with global players, the Times said. (MNI)

CORONAVIRUS: Vaccinations of children in a study of the Covid-19 shot developed by AstraZeneca Plc and the University of Oxford have been paused while the U.K.'s drug regulator investigates rare cases of blood clots in adults. The vaccine researchers are awaiting the results of a review by the Medicines and Healthcare Products Regulatory Agency, the U.K.'s drug watchdog, "before further vaccinations," the university said in an emailed statement. No safety issues have arisen in the children's trial, Oxford said. The action comes after a growing number of reports of rare brain blood clots in younger adults have led some countries, including several in the European Union, to suspend use of the vaccine in certain age groups. Germany halted use of the Astra-Oxford vaccine for people younger than 60 last week, while Canada has limited its use to those more than 55 years old. (BBG)

CORONAVIRUS: Scott Morrison denies his government has presented the public with overly rosy assessments about the state of its Covid-19 vaccine rollout, as he steps up calls for the European Union to allow 3.1m outstanding AstraZeneca doses to be shipped to Australia. While declaring that vaccine supply issues were a matter of "straightforward maths", the prime minister also attempted to calm a growing diplomatic dispute between Australia and the EU, insisting he had not made any criticism of Brussels over its handling of the matter. (Guardian)

NEW ZEALAND: Auckland's biggest real estate agency says it had the strongest trading month in its history in March. Barfoot & Thompson sold 1844 properties in March, which was the most it has ever sold in the month of March. That figure was up 68.2 per cent on the 1096 properties sold in March last year. It was also up by 64.1 per cent on the 1124 properties sold in February. The agency sold 4054 properties for in the first three months of this year, a third higher than the previous first quarter peak in 2015. (Stuff NZ)

SOUTH KOREA: South Korea added 668 new coronavirus cases, the largest daily increase in 13 weeks, raising its total to 106,898. The number of people given a first dose of vaccine topped 1 million, with only 33,000 having received the second shot in a nation of more than 50 million people. The government may tighten social distancing rules when it reviews the measures later this week. (BBG)

CANADA: Canada's hospitalisations are surging, intensive care beds are filling up and COVID-19 variants are spreading as a third wave of the pandemic sweeps across much of the country, Prime Minister Justin Trudeau said on Tuesday (Apr 6). "Around the world, countries are facing a very serious third wave of this pandemic," Trudeau told a news conference. "And right now, so is Canada." (CNA)

CANADA: Toronto will cancel all in-person learning at elementary and secondary schools as of Wednesday, health authorities said as Canada deals with a variant-driven third wave of the coronavirus pandemic, which has hit the younger population hard. (RTRS)

CANADA: Ontario will implement further Covid-19 restrictions soon,with a focus on areas being hardest hit as a deadlier strain of coronavirus surges through Canada's most populous province. The new measures will aim to curb the spread of the virus in Toronto and suburban regions of Peel and York, which represent about 60% of new infections, Ontario Premier Doug Ford said Tuesday at a news conference. Details will be disclosed on Wednesday, he said. (BBG)

BRAZIL: Brazil reported more than 4,000 Covid-19 daily deaths for the first time as the pandemic continues to rage across the vast nation. The Health Ministry registered 4,195 fatalities on Tuesday, bringing the total since the virus first arrived to 336,947. It's the second highest tally globally, trailing only the U.S. Cases surged by 86,979 in the past 24 hours, pushing the toll to 13.1 million. "If Brazil keeps the current pace, the country will probably reach 5,000 daily deaths in April," said Christovam Barcellos, a researcher at Fiocruz. (BBG)

BRAZIL: Brazilian Economy Minister Paulo Guedes said on Tuesday he expects the economy will be back on track in two to three months, as an accelerating nationwide COVID-19 vaccination program gets people back to work and revives activity. (RTRS)

BRAZIL: Brazil's new justice minister on Tuesday replaced the heads of the federal police and federal highway police with candidates backed by President Jair Bolsonaro, amid concerns the right-wing leader seeks more direct influence over law enforcement. Named last week as part of Bolsonaro's largest Cabinet shakeup to date, Justice Minister Anderson Torres said on Twitter that Paulo Maiurino would replace federal police chief Rolando de Souza. Torres additionally named Silvinei Vasques to take the position of Eduardo Aggio, the head of Brazil's federal highway police. (RTRS)

RUSSIA: Russian inflation jumped to the highest level in more than four years in March, adding pressure on the central bank to keep raising interest rates. Annual inflation accelerated to 5.8% in March, the Federal Statistics Service reported Tuesday, in line with forecasts but well above the central bank's 4% target. "Inflation risks are quite substantial and they are not only driven by external inflation, but also by domestic inflation," Bank of Russia First Deputy Governor Ksenia Yudaeva told a conference Tuesday before the latest report was released. As in several other major emerging markets, Russia's central bank has begun "slow" tightening of monetary policy in response, she said. (BBG)

IRAN: The Biden administration is not anticipating any changes on Iran policy amid negotiations over reinstating the 2015 nuclear deal severed by former U.S. President Donald Trump, White House spokeswoman Jen Psaki said on Tuesday. (RTRS)

IRAN: The United States on Tuesday described indirect talks with Iran in Vienna as a constructive, and potentially useful, step toward both sides resuming compliance with the 2015 nuclear deal that Washington abandoned three years ago. "These discussions in Vienna, even though we are not meeting directly with the Iranians, as we have said, it is a welcome step, it is a constructive step, it is a potentially useful step as we seek to determine what it is that the Iranians are prepared to do to return to compliance ... and, as a result, what we might need to do to return to compliance ourselves," State Department spokesman Ned Price told reporters at his daily briefing. (RTRS)

IRAN: Iran said talks in Vienna on Tuesday aimed at restoring its 2015 nuclear deal with world powers had been "constructive," but stuck to its demand that the U.S. first remove all sanctions for real progress to be possible. Speaking after the discussions, lead Iranian negotiator Abbas Araghchi said diplomats will meet again in the Austrian capital on Friday to continue negotiations. But he said Tehran had rejected a "ridiculous" U.S. proposal to release $1 billion of frozen Iranian oil revenues in exchange for Iran suspending its production of 20% enriched uranium. (BBG)

MIDDLE EAST: An Iranian-flagged vessel called the Saviz was hit with limpet mines while stationed in the Red Sea, the semi-official Tasnim news agency reported, citing unnamed sources. According to Tasnim, the vessel has been based in the area for several years and often deploys Iranian commando boats that are used to escort commercial vessels. It was in the waterway on Tuesday when the mines exploded, the report said, without identifying the sources or saying where it got the information. Iranian officials haven't yet acknowledged the incident, Tasnim added. (BBG)

MIDDLE EAST: The Saudi-led coalition fighting in Yemen intercepted and destroyed an explosive-laden drone launched by Iran-aligned Houthis towards the Saudi city of Khamis Mushait on Tuesday, Saudi state TV reported. Houthi military spokesman Yahya Sarea said on Twitter that Houthis have targeted "sensitive sites" at King Khalid air base in Khamis Mushait with two drones. He added that the "hit was precise", but there hasn't been a confirmation from Saudi authorities. (RTRS)

BONDS: Taiwan's life insurers, flush with $56 billion in cash as U.S. Treasury yields rise, are planning to increase their exposure to overseas corporate bonds, especially from the U.S. Taiwanese life insurers, traditionally heavy investors in overseas credit, accumulated lots of cash last year as they started selling off ahead of a Treasury yield surge. Adding to their war chest, they held off regular buying of overseas corporate bonds, put off by low recurrent yields. By the end of February, they were sitting on domestic and foreign cash holdings of NT$1.6 trillion ($56 billion), according to Financial Supervisory Commission data. That cash pile is prompting Taiwan's largest life insurers -- from Fubon Life Insurance Ltd. to the island's biggest, Cathay Life Insurance Co. – to announce plans to ramp up their exposure to overseas bonds. (BBG)

OIL: U.S. crude oil production in 2022 is forecast at 11.86m b/d, compared with 12.02m b/d projected in March, EIA says in monthly Short-Term Energy Outlook. 2021 output estimated at 11.04m b/d vs 11.15m b/d. Output to grow annually in 2022 at an average rate of 820k b/d vs prior forecast of 870k b/d. (BBG)

OIL: Saudi Arabia's energy giant is in advanced talks to sell up to a 49% stake in its oil pipelines to a consortium of U.S., Chinese and local investors for between $10 billion and $15 billion, according to people familiar with the matter. Saudi Arabian Oil Co. , known as Aramco, is in talks to sell the minority stake to a group of investors that could include U.S. buyout giant Apollo Global Management Inc., energy investment firm EIG Global Energy Partners, Chinese infrastructure fund Silk Road Fund, and China Reform Fund Management Co., a Chinese private-equity fund, along with Saudi pension funds, the people said. (WSJ)

CHINA

YUAN: The yuan's recent fall against the dollar is a normal and healthy recalibration and has eased the pressure on companies that receive revenue in dollars, Guan Tao, a former official at China's State Administration of Foreign Exchange, wrote in a commentary in the Economic Daily. The recent Chinese yuan depreciation was driven by risk aversion as the pandemic regained momentum in Europe and inflation expectations rose in the U.S., which narrowed interest rate spreads with China, Guan wrote. The weakening yuan also resulted from greater expectations for the U.S. recovery due to the fast rate of vaccination and concerns about tightening policies, Guan wrote. (MNI)

PBOC: The People's Bank of China may refrain from monetary easing and any changes to reserve-deposit ratios or interest rates given expectations of a mild increase in consumer prices, the China Securities Journal commented. Overall inflation may remain benign given the slow growth in infrastructure investment and because real estate development has been strictly regulated, the Journal said. The market expects the CPI will post a positive increase from 0.3% to 0.5%, MNI noted. Policy advisors have previously told MNI that CPI may average 2% throughout 2021. China will publish March CPI on Friday. (MNI)

OVERNIGHT DATA

AUSTRALIA MAR, F MARKIT SERVICES PMI 55.5, PRELIM 56.2

AUSTRALIA MAR, F MARKIT COMPOSITE PMI 55.5, PRELIM 56.2

March PMI data pointed to an ongoing upturn in business condition in the Australian service sector throughout the first quarter of 2021. Both activity and new business recorded further sharp expansions in March, with firms noting that the continued easing of COVID-19 restrictions had boosted client confidence across much of the services economy. Businesses in the sector were buoyed to continue expanding employment levels, with the latest rise the fifth in as many months. The pace of job creation remained solid, although softened from the record increase recorded in February. Business sentiment also remained elevated in the latest survey period, supported by expectations that the pandemic situation would continue to improve, as the final restrictions related to international borders were lifted. Moreover, businesses were hopeful that a successful vaccination program would further boost service sector activity and the wider economy. (IHS Markit)

AUSTRALIA MAR AIG PCI 61.8; FEB 57.4

The Australian Industry Group and HIA Australian Performance of Construction Index (Australian PCI®) rose by 4.4 points to 61.8 points in March 2021 (seasonally adjusted). This was the strongest monthly result in the history of this data series (commencing in 2005). Results above 50 points indicate expansion in the month, with higher results indicating a stronger pace of expansion. All four components of activity in the Australian PCI® expanded strongly in March 2021 (results well above 50 points, seasonally adjusted), even though the activity index moderated by 3.7 points to 57.7 points. The indexes for new orders, employment and supplier deliveries all hit record highs, as house builders nationwide scrambled to commence residential projects as soon as possible in order to meet the final HomeBuilder deadline. Capacity utilisation surged up to 81.3% in March, towards its recent high in December. Residential builders continued to report high levels of customer inquiries, orders and requests to 'commence as soon as possible' through March. Conditions were positive but slower in apartment building, commercial building and engineering construction. (AiG)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 107.7; PREV. 112.3

New COVID-19 cases, the snap Brisbane lockdown and the end of JobKeeper combined to drag consumer confidence down 4.6pts. This was the largest fall sincelate-March2020. Not even the Easter long weekend could cheer us up; in fact, in four of the five years pre-COVID, confidence declined over Easter. Queensland recorded the sharpest drop of 11.2pts, even though the3-dayBrisbane lockdown ended on Thursday, but all other states bar South Australia also recorded declines. History shows that confidence tends to bounce back quickly once lockdowns lift though, so we should see confidence improve overcoming weeks. It's possible, however, that the end of JobKeeper on 28 March will have a more prolonged effect on confidence. (ANZ)

NEW ZEALAND MAR ANZ COMMODITY PRICE INDEX +6.1% M/M; FEB +3.3%

SOUTH KOREA FEB BOP CURRENT ACCOUNT BALANCE +$8.0342BN; JAN $7.0600BN

SOUTH KOREA FEB BOP GOODS TRADE BALANCE +$6.0471BN; JAN $5.7338BN

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS WED, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. This keeps liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information. The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

PBOC SETS YUAN CENTRAL PARITY AT 6.5384 WEDS VS 6.5527 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5384 on Wednesday, compared with the 6.5527 set on Tuesday.

MARKETS

BOND SUMMARY: Mixed Core FI Trade In Asia

T-Notes dealt around unchanged levels for the duration of Asia-Pac trade, operating around late NY highs, last -0-01+ at 131-20+. Cash Tsys print around 0.5bp cheaper across the curve. Flow was headlined by a 10.0K block seller of the TYM1 133.00 calls, with a lack of notable headlines evident. The minutes from the most recent FOMC decision and a deluge of Fedspeak headline locally on Wednesday.

- A fairly sedate Tokyo session saw the super-long end of the curve experience some outperformance, with the bull flattening theme extending during the afternoon session. The move initially came on the back of the spill over from U.S. Tsy trade during NY hours. Futures traded either side of unchanged, with the firming of the super long end adding support during the Tokyo afternoon, the contract last deals +4. 5-25 Year BoJ Rinban operations were upsized, in line with the Bank's already delivered April Rinban outline, with the offer to cover ratios sliding vs. the previous operations in the respective buckets (which would have provided another leg of support). 5-Year JGB supply headlines locally on Thursday.

- YM unchanged, XM +2.5 as we head towards the Sydney close. There was a little bit of pre-auction auction concession for XM, before it became apparent that the pricing component of the ACGB Dec '30 auction was firm, with the weighted average yield printing 0.74bp through prevailing mids at the time of supply, although the cover ratio softened vs. the previous offering, even as the notional amount on offer moderated. The 7- to 12-Year sector of the ACGB curve has outperformed in cash trade.

BOJ: Rinban Conducted

The BoJ offers to buy a total of Y710bn of JGB's from the market, sizes adjusted from the previous operations to reflect the purchase plan laid out for the month of April.

- Y450bn worth of JGBs with 5-10 Years until maturity

- Y200bn worth of JGBs with 10-25 Years until maturity

- Y60bn worth of JGBis

AUSSIE BONDS: ACGB Dec '30 Auction Result

The Australian Office of Financial Management (AOFM) sells A$1.2bn of the 1.00% 21 December 2030 Bond, issue TB#160

- Average Yield: 1.6636% (prev. 1.3713%)

- High Yield: 1.6650% (prev. 1.3750%)

- Bid/Cover: 2.5333x (prev. 3.9567x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 71.0% (prev. 12.9%)

- •bidders 41 (prev. 48), successful 17 (prev. 27), allocated in full 8 (prev. 18)

EQUITIES: Some Up, Some Down

A mixed picture in Asia-Pac markets after a negative lead from the US in lacklustre trade with the lowest volumes of 2021 so far despite the IMF upgrading global growth forecasts. Indices in Japan are in minor positive territory, recouping some of yesterday's losses, tech sector leads the way higher after Toshiba said it had received a proposal to go private in a $20 billion deal. Chinese bourses are the laggards, the CSI 300 nursing losses of over 1% for the second session, consumer staples weigh. Hang Seng Index lower as markets reopen after a three-day trading pause. US futures are mixed, Dow & S&P futures in minor positive territory, Nasdaq lower.

GOLD: No Decisive Move

A slightly lower DXY and mixed U.S. real yields have allowed bullion to nudge higher over the last 24 hours or so, although bulls haven't been able to force a test of key resistance in the form of the Mar 18 high. Spot last deals just shy of $1,740/oz, a little off of Tuesday's best levels.

OIL: Treading Water

WTI & Brent have added $0.30 during Asia-Pac hours, after retreating from highs into the US close yesterday.

- There are a number of factors that could engender optimism for bulls; the IMF upgraded its global economic growth forecast for the second time in three months predicting growth of 6% this year, up from the 5.5% pace estimated in January. Meanwhile US API stockpile data yesterday showed a decline in inventories. Headline crude stocks fell 2.62m bbls in the latest period, though downstream products saw builds, a 4.85m bbl gasoline stockpile increase and a 2.81m bbls gain in distillate stocks tempered optimism following the report. Markets also digest a cordial first round of discussions between the US and Iran over the nuclear deal, the two sides will meet again on Friday.

FOREX: Rangey After Big Moves

Narrow ranges for major FX in the Asia-Pac time zone, a brief dip lower in the greenback was reversed, DXY emerges from the Asia session marginally higher.

- AUD and NZD both lost some ground, Australian data earlier saw IHS Markit Australia March Services PM rise to 55.5 vs 53.4 in Feb, while Australia ANZ Consumer Confidence fell to 107.7 from 112.3 previously. AUD down around 9 pips. NZD was slightly more resilient, shedding 5 pips, supported by a gain in GDT prices overnight.

- JPY heads in to Europe slightly weaker, unable to maintain earlier strength. USD/JPY dropped as low as 109.58 before recovering. The pair last up 6 pips but still holding most of yesterday's decline. Japan PM Suga says a snap election before the end of September is a possibility.

- GBP is higher, GBP/USD gaining around 5 pips after reports that UK will start the rollout of the Moderna COVID-19 vaccine from today.

- PBOC fixed USD/CNY at 6.5384, 7 pips below sell side estimates. Offshore yuan has weakened but holds most of yesterday's gains. USD/CNH last up 26 pips, recovering after breaking below yesterday's nadir.

FOREX OPTIONS: Expiries for Apr07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-10(E775mln), $1.1825-35(E1.3bln), $1.1850(E1.1bln-EUR puts), $1.1925-35(E915mln), $1.1940-50(E743mln)

- USD/JPY: Y107.95-05($893mln), Y108.15-25($1.2bln), Y109.00($1.4bln), Y109.75($500mln), Y109.80-85($510mln), Y109.95-110.00($2.9bln, mainly USD puts)

- EUR/GBP: Gbp0.8550-55(E950mln-EUR puts)

- AUD/USD: $0.7450(A$709mln), $0.7610-20(A$591mln), $0.7705-20(A$732mln)

- USD/CNY: Cny6.60($1.7bln-USD puts)

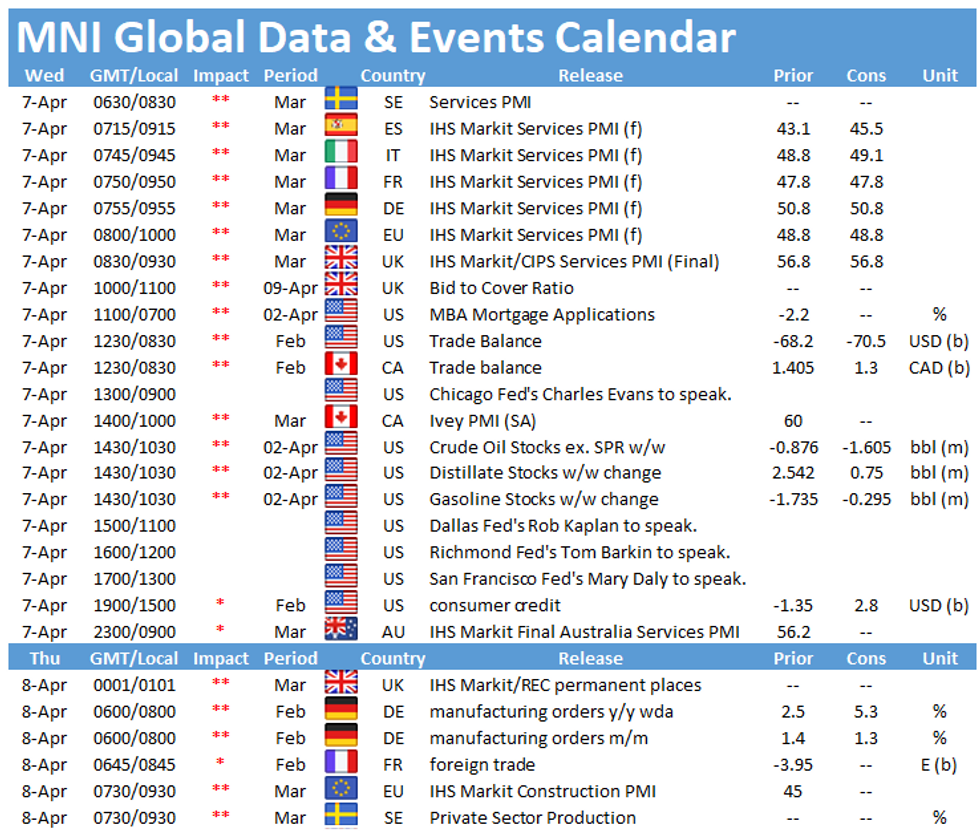

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.