-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Biden Exits Presidential Race, Endorses Harris

EXECUTIVE SUMMARY

- BIDEN ENDS FAILING REELECTION CAMPAIGN, BACKS HARRIS AS NOMINEE - RTRS

- PBOC CUTS 7-DAY REPO RATE BY 10BPS - MNI BRIEF

- CHINA JULY LOAN PRIME RATE REDUCED BY 10BP - MNI BRIEF

- RBA TARGETS MORE REAL TIME DATA - MNI INTERVIEW

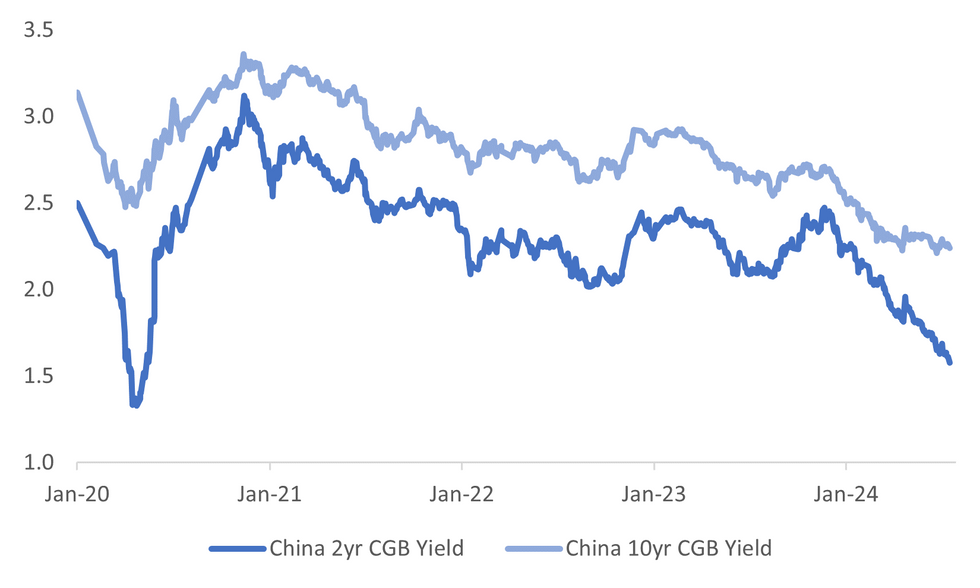

Fig. 1: China 10yr & 2yr Government Bond Yields

Source: MNI - Market News/Bloomberg

UK

FISCAL (BBG): “Just over two weeks into the job, UK Chancellor of the Exchequer Rachel Reeves is facing growing demands to loosen the Treasury’s purse strings to raise pay for public sector workers and eliminate an unpopular Conservative cap on child benefits.”

POLITICS (BBC): “The chancellor has hinted that she may give public sector workers above-inflation pay rises this summer. Rachel Reeves' comments come after it is understood independent pay review bodies recommended an increase of 5.5% for teachers and some NHS workers.”

INVESTMENT (POLITICO): “The U.K. government launched a pensions review that it claims could unlock billions of pounds for investments in the British economy. The landmark review into the pensions and investment market, announced by the U.K.’s Chancellery late Saturday, seeks ways to boost the investment potential of support schemes while equally optimizing savings for pensioners.”

EUROPE

ECB (BBG): “ Rapid interest-rate action from the European Central Bank isn’t required, according to Governing Council member Gabriel Makhlouf. “There’s no need to actually rush to make decisions,” he told the Irish Examiner in an interview published on Sunday.”

GEOPOLITICS (POLITICO): “German Foreign Minister Annalena Baerbock spoke out in support of U.S. long-range missiles being stationed in Germany, countering criticism from within her government coalition. "We must protect ourselves and our Baltic partners against this, including through increased deterrence and additional stand-off weapons," Baerbock said in an interview with the Funke Media Group's Sunday newspapers.”

EU (POLITICO): “Italian Prime Minister Giorgia Meloni says she can still work with European Commission President Ursula von der Leyen despite Meloni’s party voting against von der Leyen for a second term as head of the EU executive.”

FRANCE (FRANCE24): “French lawmakers called for an investigation on Friday amid suspicions of ballot-stuffing in a vote for deputy speakers in the National Assembly. A re-vote led to the election of deputies from the hard left to the centre right, but none from the far right.”

RUSSIA (FRANCE24): “Russia on Sunday said two US bomber planes had approached its border in the Arctic and that it had scrambled fighter jets to make them turn away. Moscow has previously accused the United States of making reconnaissance drone flights over neutral waters in the Black Sea to help Ukraine, and has said it could lead to "direct confrontation" between Russia and NATO.”

US

POLITICS (RTRS): U.S. President Joe Biden abandoned his reelection bid on Sunday under growing pressure from his fellow Democrats and endorsed Vice President Kamala Harris as the party's candidate to face Republican Donald Trump in the November election.

POLITICS (BBG): “Within hours of Joe Biden’s decision to bow out of the presidential race, many of the biggest names in Democratic politics — from Hillary Clinton to Gavin Newsom to megadonor George Soros — rushed to join him in backing Vice President Kamala Harris at the top of the ticket. Some prominent Democratic donors are questioning the hurry.”

POLITICS (RTRS): “U.S. Vice President Kamala Harris's campaign officials and allies made hundreds of phone calls on Sunday, locking in delegates' support for her presidential nomination ahead of the Democratic National Convention in August while seeking to block any would-be challengers, multiple sources said. At the same time, Democratic state party chairs held a Sunday afternoon call to discuss backing Harris as the party's nominee. Several participants said Harris has the chairs' full support.”

OTHER

AUSTRALIA (MNI INTERVIEW): RBA Targets More Real-time Data

NEW ZEALAND (BBG): “New Zealand's trade surplus widened to NZ$699m in June from revised +NZ$54m in May, according to Statistics New Zealand.”

CHINA

REPO RATE (MNI BRIEF): The People’s Bank of China revealed it would cut the 7-day reverse repo rate by 10 basis points on Monday to boost the economy, according to a statement on the central bank’s website.

LOAN PRIME RATE (MNI BRIEF): China's Loan Prime Rate was cut by 10bps on Monday according to a People's Bank of China statement, following the central bank's unexpected move to reduce the 7-day reverse repo rate by 10 basis points early this morning.

HOUSING (Chinese Academy of Social Sciences): “First-tier cities will further relax housing policies to boost demand following the Third Plenum’s decision to “give cities full autonomy in regulating the real-estate market and reducing home purchase restrictions,” the Paper reported citing analysts. The government will retain adherence to the "housing for living, not for speculation" concept, and reform developer financing and the pre-sale system to make housing a normal commodity more accessible to consumers, said Chen Jie, professor at Shanghai Jiao Tong University.”

FISCAL REFORMS (SECURITIES TIMES): China’s planned fiscal reform announced at the Third Plenum will expand local governments’ tax sources while raising central governments’ fiscal expenditures to ease local spending pressure, Securities Times reports on Monday, citing experts.

MARKETS (SHANGHAI SECURITIES NEWS): “Increased ETF purchases by Central Huijin have stabilized the market and improved investor confidence, Shanghai Securities News reports on Monday, citing Huaan Funds.”

CONSUMPTION (SHANGHAI SECURITIES NEWS): “ China’s use of ultra-long special government bonds to support more sectors will spur consumption growth and the national economic recovery, Shanghai Securities News reports, citing Wen Laicheng, a professor at Central University of Finance and Economics.”

OIL (MNI INTERVIEW): China crude oil demand to slow in 2024

CHINA MARKETS

MNI: PBOC Conducts CNY58.2 Bln Via OMO Mon; 7day Repo Rate Cut

The People's Bank of China (PBOC) conducted CNY58.2 billion via 7-day reverse repo on Monday, with rate cut to 1.70% from the previous1.80%. The 7-day reverse repo operation will be adjusted to a fixed rate and quantity bidding to optimize the open market operation mechanism. Meantime, the interest rate of the 7-day repo will be cut to 1.70% from the previous 1.80% to further strengthen counter-cyclical regulation and increase financial support for the real economy, PBOC announced Monday morning. The operation has led to a net drain of CNY70.8 billion after offsetting the CNY129 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7155% at 09:41 am local time from the close of 1.8682% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, close at 45 on Friday, the same as the close on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1335 on Monday, compared with 7.1315 set on Friday. The fixing was estimated at 7.2644 by Bloomberg survey today.

The CFETS Weekly RMB Index was 99.19 on Jul 19, down 0.05% compared with 99.24 as of Jul 12.

The gauge, which compares the yuan to a basket of currencies from China's 24 major trading partners, has increased 1.82% this year, when compares with 97.42 on Dec. 29, 2023.

MARKET DATA

CHINA 1-YEAR LOAN PRIME RATE -10BP TO 3.35%; EST. 3.45% ; PRIOR 3.45%

CHINA 5-YEAR LOAN PRIME RATE -10BP TO 3.85%; EST. 3.95%; PRIOR 3.95%

SOUTH KOREA JULY FIRST 20 DAYS EXPORTS +18.8% Y/Y; PRIOR +8.5%

SOUTH KOREA JULY FIRST 20 DAYS IMPORTS +14.2% Y/Y; PRIOR -0.6%

NEW ZEALAND JUNE TRADE SURPLUS NZ$699M; PRIOR NZ$54M

NEW ZEALAND JUNE 12-MONTHS YTD TRADE DEFICIT NZ$9.40B; PRIOR NZ$10.21B

NEW ZEALAND JUNE EXPORTS NZ$6.17B; PRIOR NZ$7.0B

NEW ZEALAND JUNE IMPORTS NZ$5.47B; PRIOR NZ$6.94B

MARKETS

US Tsys: Futures Steady, Curve Flattens As Market Rethinks "Trump Trade"

- Treasury futures initially sold off a touch after China lower the LPR, although we have since recovered that move to trade little changed today. TUU4 trades - 00⅛ at 102-15, while TYU4 is + 02+ at 110-29, ranges have been tight today, while volumes have been below average.

- The treasury curve has flatten, reversing some of the curve steepening that has occurred as a part of the "Trump Trade", although it should be noted that betting markets have not really swung back in favor of the democrats. This morning the 2y is -0.7bps at 4.504%, while the 10yr is trading -1.6bps at 4.223%

- Projected rate cut pricing into year end look steady to mixed vs. late Thursday levels (*) -- Sep gains while Nov and Dec decline: July'24 at -4.5% w/ cumulative at -1.1bp at 5.318%, Sep'24 cumulative -25.9bp (-25.2bp), Nov'24 cumulative -40.6bp (-41.1bp), Dec'24 -62.9bp (-64.6bp)

- looking ahead today we have Chicago Fed Nat Activity Index, the Fed is in a policy blackout until August 1.

JGBS: Subdued Session, Futures Fail To Hold Early Gains, BoJ Rinban Operations Tomorrow

JGB futures have slipped back into negative territory, -6 compared to the settlement levels, after failing to hold strength sparked by gains in cash US tsys following news that President Biden would not contest the November election.

- Early strength may also have received support from the surprise monetary easing by the PBoC. The PBoC announced a 10bp cut to the 7-day reverse repo rate, along with lower 1yr and 5yr LPRs.

- Today, the local calendar will see Tokyo Condominiums for Sale data shortly alongside an Enhanced Liquidity Auction covering OTR 1-5-year JGBs later.

- Cash JGBs are flat (2-3-year) to 3bps cheaper (40-year). The benchmark 10-year yield is 0.9bp lower at 1.053% versus the cycle high of 1.108%.

- The swaps curve has twist-steepened, pivoting at the 20-year, with rates 1.3bps lower to 2.2bps higher. Swap spreads are tighter.

- Tomorrow, the local calendar will see Machine Tool Orders data alongside BoJ Rinban Operations covering 1-10-year JGBs.

AUSSIE BONDS: Holding Weaker, AU-CA 10Y Diff. Widest Since December

ACGBs (YM -2.0 & XM -3.5) sit weaker but off Sydney session cheaps. The local calendar was news flow light today.

- Nevertheless, ACGBs largely looked through potentially constructive developments abroad, namely richer cash US tsys following President Biden’s announcement that he would not contest the November election and the surprise monetary easing by the PBoC.

- At 94bps, the AU-CA cash 10-year yield differential sits at its highest level since last December. (See link)

- (MNI) The Reserve Bank of Australia wants to make greater use of real-time metrics and would benefit greatly from more immediate services-sector data in future as it works to more accurately gauge the state of the economy and inform its monetary-policy decisions, a former RBA economist told MNI. (See link)

- Cash ACGBs are 2-3bps cheaper, with the AU-US 10-year yield differential at +10bps

- Swap rates are 2-4bps higher.

- The bill strip pricing is -2 to -3.

- RBA-dated OIS pricing is 1-3bps firmer for 2025 meetings. Terminal rate expectations sit at 4.44%.

- ICYMI, the AOFM announced on Friday that a new Dec-35 bond is planned to be issued via syndication this week (subject to market conditions).

- This week, the local calendar is empty apart from Preliminary Judo Bank PMIs on Wednesday.

NZGBS: Closed Cheaper, NZ_US10Y Diff Wider, Light Local Calendar Again Tomorrow

NZGBs closed with benchmarks near session cheaps, yields 2-4bps higher.

- The NZ-US 10-year yield differential widened by 3bps, reversing some of the narrowing that followed the RBNZ’s policy announcement on July 10. This recent narrowing had brought the NZ-US differential to its tightest level since late 2022.

- Outside of the previously outlined Trade balance data, there hasn't been much in the way of domestic drivers to flag.

- NZGBs largely looked through potentially constructive developments abroad, namely richer cash US tsys following President Biden’s announcement that he would not contest the November election and the surprise monetary easing by the PBoC. The PBoC announced a 10bp cut to the 7-day reverse repo rate, along with lower 1yr and 5yr LPRs.

- Swap rates closed 1-2bps higher, with implied swap spreads tighter.

- RBNZ dated OIS pricing closed slightly mixed across meetings, with 2024 meetings little changed and 2025 meetings 2bps softer to 3bps firmer. A cumulative 68bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

- On Thursday, the NZ Treasury plans to sell NZ$300mn of the 3.0% Apr-29 bond and NZ$200mn of the 4.50% May-35 bond.

FOREX: USD Weakness Limited As Biden Exits Race, NZD Tests Sub 0.6000, Multi Month Lows

The USD was soft in early trade, as late US Sunday news saw President Biden drop out of the Presidential race. This saw some early pressure on the Trump reflation theme, as election odds for the Republicans have moved away from cycle highs seen through last week. Still, the USD has recovered most of these losses.

- The BBDXY USD index got to 1253.37 in the first part of trade, before rebounding to 1256. We sit slightly lower in latest dealings. EUR sits marginally higher against the USD, but remains comfortably within recent ranges. USD/JPY is around 157.50, little changed for the session.

- Both US Tsy and equity futures opened higher, but sit away from best levels now. Cash Tsy yields sit slightly lower, more so at the back end, the 10yr back to the low 4.22% region (off 1.6bps).

- AUD and NZD have both fallen around 0.20%, underperforming the major moves. Weaker yuan levels post a surprise revere repo and loan prime rate cuts has weighed and likely driven some negative spill over. Broader China sentiment still remains cautious around the growth outlook, with incremental policy changes not seen as dramatically shifting the growth outlook.

- Regional equity markets are mostly weaker as well, led by tech sensitive plays, which has likely hurt FX risk appetite at the margins as well.

- NZD/USD is now sub 0.6000, fresh lows back to the first half of May. AUD/USD at 0.6670 is back towards early July levels.

- The data calendar is very light through Monday offshore markets.

ASIA STOCKS: HK Equities Out-Perform, China Lowers LPRs 0.10%

Chinese and Hong Kong equities are mixed today, with Hong Kong equities playing catch-up after underperforming on Friday. The PBoC cut interest rates this morning in order to boost sentiment, however onshore markets have largely ignored this. It was largely suspected that Friday out-performance from onshore markets was tied to the China National team stepping in to support the market, with those moves being erased today. Investors have growing concerns around a lack of any major support announced for the struggling property sector out of the Third Plenum last week.

- Hong Kong equities are mostly higher today, with the exception of property indices which are trading slightly lower (Mainland, -0.37%, HS Property, unchanged), while the HSTech Index is trading 1.67% higher and the HSI is up 0.86%.

- China onshore markets have erased most of Friday's gains, with the CSI 300 down 0.85%, small-cap indices are faring better with the CSI 1000 up 0.10% and the CSI 2000 up 0.45%

- China has pledged to accelerate a housing model emphasizing renting and affordable homes following a record property slump, with plans to support local government efforts to upgrade housing and ease property ownership restrictions. While it was reported by BBG that China Fortune Land Development is attempting to resolve its debt by working with a buyer to purchase bonds at deeply discounted prices and then canceling them. The company has been negotiating private contracts with bondholders and a third party, offering 10 yuan for every 100 yuan of bond principal, the companies USD bonds were last trading at between 2-4c on the dollar.

- Trump has expressed support for Chinese automakers building factories in the US to boost the economy, in contrast to President Biden's approach of blocking cars linked to China. Trump suggested imposing tariffs up to 200% on cars made in Mexico by Chinese companies if they don't build plants in the US, while the Biden administration has scrutinized vehicles with Chinese ties and sought to exclude Chinese government-owned firms from tax credits.

- Later today with have Hong Kong CPI Composite.

ASIA PAC STOCKS: Equities Lower As Investor Dump Tech, Weigh Up Biden Dropping Out

Regional Asian equities are lower today, driven by various factors including political uncertainties, foreign investors flows and the PBoC lowering LPRs. Asian tech stocks continue to see heavy selling, especially in Taiwan this is largely tied to comments made last week by Trump and the Biden administration, while investors weigh up the implications of Joe Biden ending his re-election campaign and endorsing Kamala Harris. The VIX spiked on Friday hitting 17, levels not seen since late April.

- Japanese equities are lower today, growth stocks are the worst hit, while investors have continued selling tech stocks after the Biden administration announced potential trade restrictions on companies selling to China, investors are also looking to cut positions as we head into earnings season which kicks off on Tuesday with motor maker Nidec releasing earnings. Both the Topix and Nikkei are trading about 1% lower, while the TSE Growth 250 is down 2.50%, banking stocks are the best performing with the Topix Bank Index down just 0.70%.

- South Korean equities are continuing to be hit hard by the weakness int he semiconductor sector, with the likes of SK Hynix down 1.90%. Foreign investors continue to sell local stocks with $327m outflow on Friday, foreign investors have continued that theme today with tech stocks again being sold, although there is a bit of a rotation into financials. The Kospi is currently trading 1.20% lower, while the small-cap focus Kosdaq is down 2.45% and now trading towards the ytd lows made in Feb.

- Taiwan equities are the worst performing market today as heavy selling continues in semiconductor names with TSMC off 3%. Foreign investors sold about $5.5b in Taiwanese stocks last week and have now erased all inflows for the year. The selling pressure is largely on the back of Trump's comments on Taiwan protecting themselves from China, and dominance in the semiconductor space, plus the Biden Administrations comments on trade restrictions. The Taiex is trading down 2.50%.

- Australian equities are largely tracking global prices lower, metals and miners are the worst performing sector as global commodity prices trade lower this morning, the ASX200 is 0.70% lower. New Zealand equities are slightly higher this morning after healthcare stocks surged on the back of Arvida making a bid for Stonepeak at over a 50% premium to last traded price, pulling the sector up with it, the NZX 50 is 0.20% higher.

- In EM Asia markets are mixed, Indonesia's JCI is 0.15% higher, Philippine's PSEi is up 0.40% & India's Nifty 50 is 0.10% higher, while Singapore's Strait Times is 0.10% lower and Malaysia's Malay KLCI is 1.10% lower.

OIL: Crude Higher As China Cuts Rates

After falling around 3% on Friday due to demand concerns, especially from China, and the stronger USD, oil prices are moderately higher today following the PBoC cutting rates to support the economy and President Biden standing aside from the 2024 election campaign. The USD index is off its intraday low but is still down around 0.1% today.

- Brent is up 0.6% to $83.11/bbl, close to the intraday high of $83.22, while WTI is up 0.5% to $79.04/bbl after a high of $79.13. On Friday the two benchmarks fell to lows of $82.56 and $78.59 respectively.

- The PBoC unexpectedly cut the 7-day repo rate, 1-year & 5-year LPRs by 10bp today to support the economy after Q2 GDP disappointed and the Third Plenum meeting took place.

- In an interview with MNI, an energy expert said that China’s consumption and imports of oil will slow to single digit growth in 2024 from 11.5% y/y due to increased EV usage and base effects.

- Although oil prices have risen, VP Harris is seen as less supportive of the sector and may be more likely to challenge its environmental record. She sued oil companies when she was California’s attorney general and has been more critical of fracking than Biden, according to Bloomberg.

- Wildfires in Alberta Canada continue to threaten the oil sands with around 348kbd of output at risk, according to the Alberta Energy Regulator.

- There are few events today with only the US Chicago Fed June index and May German retail sales the main releases.

GOLD: Gold Stronger As Biden Ends His Re-Election Bid

Gold is 0.3% higher in today’s Asia-Pac session, after closing 1.8% lower at $2400.83 on Friday. Bullion is currently over 3% lower than its fresh record high set last Wednesday.

- Gold gained today as markets weighed President Joe Biden’s decision to end his re-election bid, which sparked fresh questions over whether the move will help or hinder Donald Trump’s chances of returning to the White House.

- There have been reports that former President Obama and senior leader Pelosi told him privately that it was time. Biden has endorsed VP Harris, but it is not a given that she will automatically be the party’s candidate. She will still need to have the endorsement of at least 1976 delegates at August’s Democratic Convention.

- According to MNI’s technicals team, the trend condition in gold remains bullish, despite the fade off the mid-week highs and the medium-term trend still points higher. The breach of key resistance at $2,450.1, the May 20 high, opens the $2500.00 handle next. Initial support is at $2,389.5, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 22/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/07/2024 | 0700/0900 |  | EU | ECB's Lane at ECB/IMF conference in Frankfurt | |

| 23/07/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/07/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 23/07/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/07/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/07/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/07/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 23/07/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/07/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/07/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.