-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoE Ahead; Weaker China Inflation Dictates AsiaPac Session

EXECUTIVE SUMMARY

- BIDEN DIALS UP PRESSURE: ‘WORLD IS IN TROUBLE’ IF WE DEFAULT (BBG)

- BoJ DEBATED PROGRESS IN HITTING PRICE GOAL AT UEDA’S DEBUT MEETING (RTRS)

- CHINA’S SLOW CONSUMER INFLATION, DEEPENING FACTORY GATE DEFLATION TO TEST POLICY (RTRS)

- CHINA POURS COLD WATER ON BILATERAL MEETING WITH US DEFENCE MINISTER (FT)

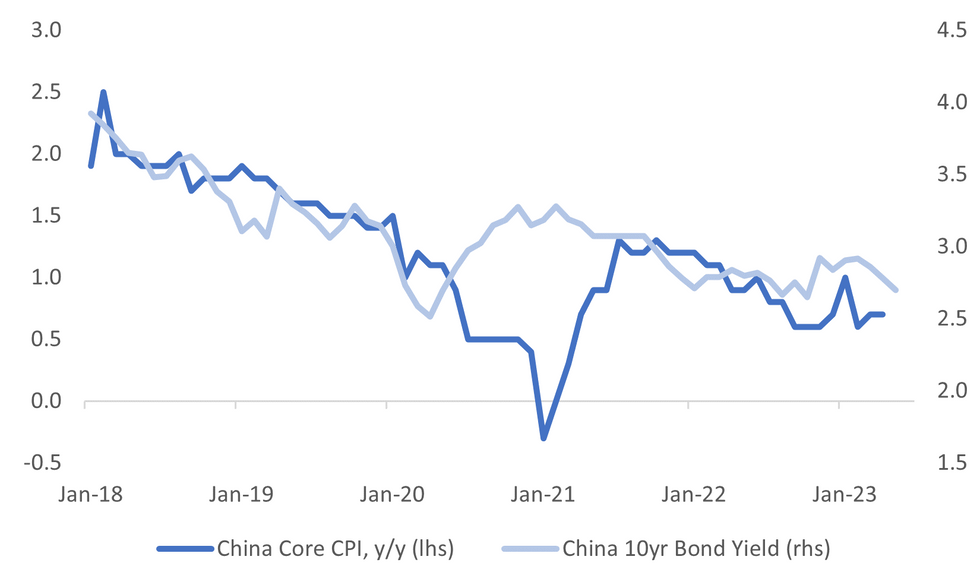

Fig. 1: China 10yr Bond Yield & Core Inflation

Source: MNI - Market News/Bloomberg

U.K.

BOE: The Bank of England is set for its 12th straight interest rate rise (BBG)

HOUSING: Signs are emerging that the dip in the UK housing market may soon reverse (BBG)

BREXIT: UK PM Sunak plans to scrap some 600 laws stemming from the country’s EU membership, a retreat from his previous goal to revoke almost all EU law (BBG)

EUROPE:

EU/CHINA: Germany is eyeing stricter controls on companies’ businesses in China, Economy Minister Robert Habeck was cited by Handelsblatt as saying in Berlin on Wednesday. (BBG)

ECB: ECB officials are starting to accept that interest rate increases may need to continue in September to bring inflation under control. (BBG)

U.S.

DEBT: Detailed talks on raising the U.S. government's $31.4 trillion debt ceiling kicked off on Wednesday with Republicans continuing to insist on spending cuts, the day after Democratic President Joe Biden and top congressional Republican Kevin McCarthy's first meeting in three months. (RTRS)

DEBT: President Joe Biden said a US default would drag the country into a recession and have devastating repercussions across the global economy as he sought to ramp up pressure on Republicans to strike a deal to raise the US debt limit. (BBG)

DEBT: JPMorgan Chase & Co's (JPM.N) CEO Jamie Dimon said the congressional standoff over the U.S. debt ceiling, and a potential U.S. default, could create a financial panic, according to an interview with Punchbowl News published on Wednesday. (RTRS)

DEBT: Former President Donald Trump urged Republicans to either extract concessions from President Joe Biden to reduce spending or push the US into its first-ever default in a Wednesday interview with CNN. (BBG)

US/CHINA: China has told the US there is little chance of a meeting between the countries’ defence ministers at a security forum in Singapore due to a dispute over sanctions, the latest obstacle to top-level dialogue between the two powers. (FT)

US/CHINA: The biggest US business lobby group urged Washington to take “targeted and responsible steps” to restrict Chinese access to sensitive technologies that could undermine national security, yet cautioned not to see all interactions as a threat. (BBG)

US/CHINA: President Biden tells reporters a call with President Xi Jinping is in the works. (BBG)

US/CHINA: The Biden administration is trying to make it hard for China to say no to engagement by seeking a flurry of meetings and phone calls, a strategy aimed at easing tensions and painting President Xi Jinping as recalcitrant if he refuses. (BBG)

OTHER

G7: A standoff over raising the U.S. debt ceiling overshadowed a meeting of Group of Seven (G7) finance leaders set to begin on Thursday, heightening U.S. recession fears as central banks seek a soft landing for the global economy. (RTRS)

JAPAN: Bank of Japan policymakers debated the country's progress towards achieving their inflation target and the pace at which they could roll back stimulus at new governor Kazuo Ueda's debut meeting in April, a summary of opinions at the meeting showed. (RTRS)

AUSTRALIA: Australian Trade Minister Don Farrell will head to China on Thursday for the first in-person meeting between the two countries’ top trade officials since 2019 in yet another sign of warming relations between Beijing and Canberra. (BBG)

SOUTH KOREA: US is considering applying separate and relaxed standards to South Korean chipmakers’ plants in China to enhance their business predictability, Korea Economic Daily reports, citing sources. (KED)

SOUTH KOREA: South Korea lowers Covid-19 crisis level to “alert” from “serious” as World Health Organization declared global health emergency is over, President Yoon Suk Yeol says in a meeting. (BBG)

SOUTH KOREA: Exports down 10.1 % during first 10 days of May (Korea Herald)

SOUTH KOREA: Korean investors flock to Japanese stocks for foreign exchange gains. (Pulse News)

THAILAND: Adored by millions and reviled by many, Thai billionaire ex-Prime Minister Thaksin Shinawatra has towered over his country's turbulent politics for more than two decades - even though he's lived mostly in self-exile since the army overthrew him in 2006. (RTRS)

CHINA

ECONOMY: China's consumer prices rose at the slowest pace in more than two years in April, while factory gate deflation deepened, data showed on Thursday, suggesting more stimulus may be needed to boost a patchy post-COVID economic recovery. (RTRS)

ECONOMY: China should prioritise reforms to open its economy and boost confidence to secure the rebound, according to Lu Ting, member of the China Chief Economist Forum. The economy has benefited from the post Covid-19 service rebound, but could face headwinds in H2. As a result, authorities should maintain easing policies and enact market-oriented and legal adjustments to boost confidence and stimulate foreign investment. (MNI)

PROPERTY: The real-estate sector can expect declines in wages this year, as many property companies face pressure and the recovery remains slow, according to Zhang Bo, the director of Anjuke Real Estate Research Institute. Recent data from the Population and Employment Statistics Department showed real estate was the only sector where wages fell during 2022, with urban workers seeing a 3.2% decline overall. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY31BN VIA OMOs THURSDAY

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY31 billion after setting off the maturity of CNY33 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 09:26 am local time from the close of 1.8444% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 52 on Wednesday, compared with the close of 49 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 6.9101 THURS VS 6.9299 WED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9101 on Thursday, compared with 6.9299 set on Wednesday.

OVERNIGHT DATA

NZ APR REINZ HOUSE SALES -15.3% Y/Y; PRIOR -15.0%

NZ APR FOOD PRICES 0.5% M/M; PRIOR 0.8%

UK APR RICS HOUSE PRICE INDEX -39%; MEDIAN -40%; PRIOR -43%

JAPAN MAR BoP C/A BALANCE ¥2278.1bn; MEDIAN ¥2890.7bn; Prior ¥2197.2bn

JAPAN MAR BoP C/A ADJUSTED ¥1009.0bn; MEDIAN ¥1311bn; Prior ¥1227.9bn

JAPAN APR BANK LENDING INCL TRUSTS Y/Y 3.2%; PRIOR 3.0%

JAPAN APR BANK LENDING EX TRUSTS Y/Y 3.5%; PRIOR 3.3%

JAPAN MAY 5 FOREIGN BUYING JAPAN STOCKS ¥373.1bn; PRIOR ¥342.9bn

JAPAN MAY 5 FOREIGN BUYING JAPAN BONDS -¥216.5bn; PRIOR ¥41.6bn

JAPAN MAY 5 JAPAN BUYING FOREIGN BONDS -¥635.2bn; PRIOR -¥1059.5bn

JAPAN MAY 5 JAPAN BUYING FOREIGN STOCKS -¥455.4bn; PRIOR ¥173.1bn

JAPAN APR TOKYO AVG OFFICE VACANCIES 6.11; PRIOR 6.41

JAPAN ECO WATCHERS SURVEY CURRENT SA 54.6; MEDIAN 54.1; PRIOR 53.3

JAPAN ECO WATCHERS SURVEY OUTLOOK SA 55.7; MEDIAN 55.1; PRIOR 54.1

CHINA APR CPI Y/Y 0.1%; MEDIAN 0.3%; PRIOR 0.7%

CHINA APR PPI Y/Y -3.6%; MEDIAN -3.3%; PRIOR -2.5%

MARKETS

US TSYS: Marginally Pressured In Asia

TYM3 deals at 115-25, -0-04, with a narrow 0-05 range observed on volume of ~56k.

- Cash tsys sit 2bps cheaper to flat across the major benchmarks, the curve has bear flattened.

- Tsys have been marginally pressured ticking away from early session highs, however moves have been limited thus far and ranges narrow.

- Chinese CPI and PPI data was softer than expected and WTI futures have firmed ~0.8% in Asia today.

- FOMC dated OIS have ~75bps of cuts priced for 2023.

- The latest monetary policy decision from the Bank of England is the highlight in Europe today. Further out we have US PPI and Initial Jobless Claims. Fedspeak from Minneapolis Fed President Kashkari and Fed Governor Waller will cross. We also have the latest 30 Year supply.

JGBS: Futures Back To Overnight Highs After Smooth Digestion Of 30-Year Supply

JGB futures move back towards overnight highs, +15 Vs. settlement levels, after the 30-year supply sees smooth digestion. The JGB 30-year has richened 2.0bp in post-auction trade, taking out the morning’s best level, to be 2.8bp lower on the day at 1.242%. Local participants adjusting portfolios out of hedged offshore debt in Yen bond holdings may have proved to be a supportive factor, although it didn’t play heavily at this week’s 10-year auction.

- There hasn’t been much in the way of domestic drivers to flag, outside of the BoJ Summary of Opinions for the April meeting. One member said the bank needs to humbly monitor developments in wages and inflation and respond to them at the right moment.

- At 148.74, JBM3 is still positioned within a range of 147.92 (the upper limit of April's trading range) and 149.53 (the high point of March 22).

- The cash JGB curve twist flattens with yields at session bests, 0.6bp higher (1-year) to 3.5bp lower (40-year). The benchmark 10-year yield is 2.1bp lower at 0.404%, below the BoJ's YCC limit of 0.50%.

- Swap rates are lower across the curve with swap spreads wider, other than for the 1-year zone.

- The local calendar is slated to release tomorrow Money Stock (M2 & M3) data and with 3-month bank bill supply and BoJ Rinban Purchase Offer for 1–3-year, 5-10-year, 10-25-year, and 25-year+ JGBs.

AUSSIE BONDS: Richer, Off Bests, Underperforms US Tsys

ACGBs are holding firmer (YM +3.0 & XM +3.5) but off session bests as US tsys give up early Asia-Pac trade strength. With the local calendar light, local participants were on headline watch ahead of US PPI data later today. China’s inflation misses failed to provide a lasting positive impact on the local market. The release of FOI documents that revealed the RBA had considered alternative scenarios with a peak cash rate of 4.8% also didn’t spark a notable market reaction.

- Cash ACGBs are 4bp richer with the AU-US 10-year yield differential +4bp at -2bp.

- Swap rates are 5bp lower with EFPs slightly tighter.

- The bills strip twist flattens with pricing -2 to +9.

- RBA-dated OIS pricing is flat to 1bp firmer out to November, but 2-5bp softer for early ’24 meetings. Terminal rate expectations are at 3.91% (August).

- There is no local data slated for tomorrow.

- The global calendar sees the BoE Rate Decision, with a 25bp hike expected, ahead of April’s US PPI data.

NZGBS: Richer, Solid Takedown of Weekly Supply

NZGBs closed 3-4bp richer, well off session cheaps, as this week’s NZ$400 supply shows solid demand, particularly for the May-51 bond (cover ratio of 4.42x). The cash lines in the auction were 3-5bp lower in post-auction trading.

- In contrast to cash NZGBs, swap rates closed flat to 3bp lower with 10-year outpeforming.

- RBNZ dated OIS closed 1-5bp softer across meetings with 23bp of tightening priced for the upcoming May 24 meeting.

- REINZ House Price Index falls 12% y/y but showed some tentative signs of stabilisation.

- April Food Prices printed a relatively small increase of 0.5% m/m in April but the annual rate accelerated to +12.5% from 12.1%. The monthly increase was pulled lower by a 2.9% m/m decline in fruit and vegetable prices.

- Tomorrow sees the local calendar release April's Manufacturing PMI and March's Net Migration with the former likely to remain weak and the latter continuing to show post-border opening strength.

- The highlight however is likely to be the RBNZ’s Q2 Inflation Expectations. A lower-than-expected reading in Q1 saw RBNZ dated OIS scale back terminal OCR expectations.

- The global calendar delivers the BoE Rate Decision ahead of April’s US PPI data.

FOREX: Greenback Little Changed In Asia

The USD sits little changed in Asia, ranges have been narrow with little follow through on moves. BBDXY is unchanged from Wednesday's closing levels.

- AUD/USD is marginally pressured, the pair sits at $0.6770/75 down ~0.1% today. The pair briefly firmed as reports crossed that the RBA has considered a scenario of the cash rate rising to 4.8% however gains were pared and pressured marginally extended as Chinese inflation figures were softer than expected.

- Kiwi is little changed from yesterday's closing levels. NZD/USD briefly broke Wednesday's high however there was little follow through on the move and gains were pared.

- Yen firmed in early dealing with USD/JPY down as much as 0.3% dealing below the ¥134 handle. However JPY couldn't hold its gains and we now sit at ¥134.20/30. There is little reaction to the BoJ Summary of Opinions from the April meeting.

- Elsewhere in the G-10 space EUR and GBP are a touch lower. SEK is the weakest performer at the margins however liquidity is generally poor in Asia.

- Cross asset wise; e-minis are ~0.2% firmer and 2 Year US Treasury Yields are ~2bps firmer.

- The latest monetary policy decision from the Bank of England is the highlight in Europe today. Further out we have US PPI and Initial Jobless Claims.

EQUITIES: Most Major Indices Modestly Lower

(MNI Australia) Asian equities are mostly lower, albeit with losses being fairly modest across the major indices. Japan and HK indices are down around 0.2%, while China stocks are mixed. South Korea is one of the few bright spots. US equities futures are around 0.20/0.25% higher at this stage.

- The CSI 300 is tracking around +0.10% firmer at this stage, but the Shanghai Composite is off by a similar amount. China Apr inflation data came in weaker than expected, weighing on the recovery theme, whilst fresh concerns around additional restrictions on cross-broader data flows is another headwind, amid China's expansion of its anti-espionage laws.

- The HSI opened up firmer but couldn't sustain positive gains. The headline index back to -0.20%. We were +0.40% higher at the open. Some of the factors outlined above may be weighing on sentiment at the margins.

- The Topix is down 0.20%, with transportation stocks lower. The Kospi is doing better, +0.30% after firm tech related gains in US trade on Wed. Still, this is doing little for Taiwan stocks, the Taiex down 0.75% at this stage, with TSMC the main source of weakness.

- The ASX 200 is off by 0.15%. Lower iron ore prices likely weighing at the margins.

- In SEA, the JCI is off 1.30% in Indonesia, the index is now back to late Mar levels.

OIL: Crude Higher On Sustained USD Weakness And Supply Disruptions

Oil prices are up 0.8% during APAC trading after falling over 1% on Wednesday. They fell sharply following the weak China CPI data for April but have rebounded since, as the greenback held onto its post-US CPI weakness. The USD has been flat today but is still down 0.2% from Wednesday’s close.

- WTI is close to its intraday high at $73.11/bbl after reaching a low of $72.73 following China’s CPI. Resistance is at $73.93. Brent is trading around $77.00, but has struggled during the session to hold onto gains above this level. The intraday high was $77.07 and the low $76.54. Resistance is $78.49, the 20-day EMA.

- Supply continues to be interrupted by wildfires in Alberta, Canada. In addition, Iraq has reported that exports from the Turkish port of Ceyhan are yet to resume in a dispute that has been ongoing for a number of months. But the US reported a significant crude inventory build.

- On the demand side, the market is worried that demand from China won’t increase as expected following a 0.1% y/y CPI read but in the other direction, the US announced this week that it will refill the SPR towards the end of the year.

- OPEC+ releases its monthly outlook report later on Thursday. The Fed’s Kashkari and Waller also speak and there are US jobless claims and April PPI data. The PPI is forecast to rise around 0.3% m/m resulting in a moderate easing of the annual rates. The BoE meets later and another 25bp rate hike is expected.

GOLD: Gains In Early APAC Trading Unwound Post China CPI

After finishing Wednesday down 0.2%, gold has been range bound during APAC trading today and is currently around $2031.65, close to the intraday low but off the high of $2036.40. Bullion fell again following China’s CPI for April printing below expectations and close to zero. The USD index is flat.

- Gold has spent most of May above $2000 as expectations of a pause in monetary tightening grew and markets became more nervous regarding the US debt ceiling impasse. It rose to a high of $2048.19/oz yesterday on the back of the US CPI data, which showed the annual headline rate slightly below expectations but the other key components as expected. The spike was only brief and bullion fell again reaching a low of $2021.62 despite lower US Treasury yields. Resistance is at $2063, the May 4 high.

- The Fed’s Kaskari and Waller speak later and there are also US jobless claims and April PPI data. The PPI is forecast to rise around 0.3% m/m resulting in a moderate easing of the annual rates. The BoE meets later and another 25bp rate hike is expected.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/05/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 11/05/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 11/05/2023 | 1200/1400 |  | EU | ECB Schnabel Talk at Federal Ministry of Finance | |

| 11/05/2023 | - |  | EU | ECB Lagarde & Panetta in G7 Finance Meeting | |

| 11/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/05/2023 | 1230/0830 | *** |  | US | PPI |

| 11/05/2023 | 1245/0845 |  | US | Minneapolis Fed's Neel Kashkari | |

| 11/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/05/2023 | 1430/1030 |  | US | Fed Governor Christopher Waller | |

| 11/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/05/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 11/05/2023 | 1730/1930 |  | EU | ECB de Guindos Panels Diario Madrid Foundation Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.