-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoE Day Is Finally Here After A Frantic Few Weeks For UK Markets

EXECUTIVE SUMMARY

- POWELL NODS TO SLOWER HIKES, HIGHER RATE PEAK (MNI)

- WHITE HOUSE SAYS FED RATE HIKE WILL HELP LOWER INFLATION, TAME HOUSING MARKET (RTRS)

- ECB WILL NEED MORE RATE HIKES TO FIGHT OFF INFLATION, DE COS SAYS (RTRS)

- RISHI SUNAK TO REVIEW PLEDGES MADE IN TORY LEADERSHIP CONTEST (FT)

- CHINA TELLS OFFICIALS TO ‘RESOLUTELY ADHERE’ TO COVID ZERO (BBG)

- PYONGYANG FIRES SUSPECTED ICBM (BBC)

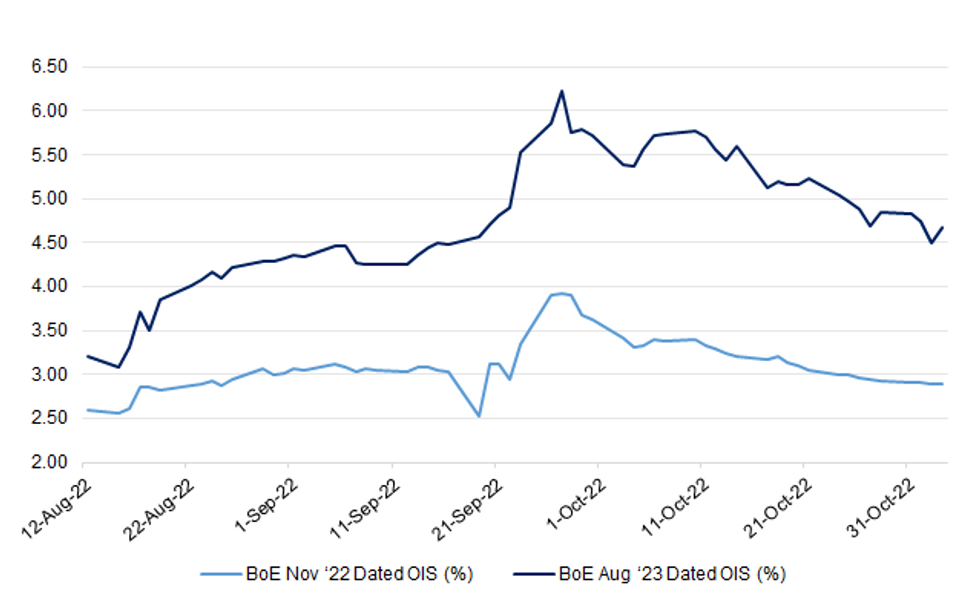

Fig. 1: BoE Nov ‘22 & Aug ‘23 Dated OIS

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL/POLITICS: Rishi Sunak has paved the way to drop pledges he made during the Conservative party leadership contest last summer, arguing that economic conditions have changed since then. (FT)

FISCAL: Rishi Sunak and Jeremy Hunt are planning to extend windfall taxes on oil and gas companies to raise an estimated £40 billion over five years. (The Times)

FISCAL: The UK Treasury would be more likely to favour a tax on banks to compensate for rising debt interest costs than for the Bank of England to cut the interest it pays on reserves, former BOE Deputy Governor Charles Bean told MNI, adding that the increasingly mooted option of tiered remuneration would risk the appearance of fiscal dominance if introduced now. (MNI)

EUROPE

ECB: The European Central Bank "will need additional interest rate increases" to fight off inflation even considering the growing likelihood of a euro zone recession, policymaker Pablo Hernandez de Cos said on Wednesday. (RTRS)

ITALY: Italy plans to reset months of talks to find a buyer for its troubled airline ITA Airways, a decision that reopens a possible involvement of Germany’s Deutsche Lufthansa AG in the deal, according to people familiar with the matter. (BBG)

IRELAND: Business group Ibec has downgraded its forecast for domestic demand due to rising costs and a weaker outlook for the global economy. (RTE)

IRELAND: Irish corporate tax receipts surged yet again in October, pushing the overall tax take for the first ten months of the year 26% higher than the same period in 2021, finance ministry data showed on Wednesday. (RTRS)

U.S.

FED: The Federal Reserve opened the door to slowing its torrid pace of interest-rate increases Wednesday but also indicated it will raise them more than previously anticipated and perhaps keep them there longer. The time to slow rate hikes “is coming and it may come as soon as the next meeting or the one after that,” Chair Jerome Powell told reporters after hiking 75bps, the fourth consecutive move of that magnitude. (MNI)

FED: The U.S. Federal Reserve's latest move to raise its benchmark interest rate will help to bring down inflation, and a rise in mortgage rates should cool inflation in the housing market, White House press secretary Karine Jean-Pierre said on Wednesday. (RTRS)

POLITICS: President Joe Biden said Wednesday the midterms are a “defining moment” for democracy as threats of political violence and voter intimidation loom over the upcoming elections. (NBC)

POLITICS: House GOP Leader Kevin McCarthy is telling U.S. Chamber of Commerce board members and state leaders the organization must undertake a complete leadership change and replace current president and CEO Suzanne Clark, Axios has learned. (Axios)

EQUITIES/ECONOMY: Since the summer, Apple has touted its "deliberate" decisions about investment and hiring, including on its most recent quarterly earnings call last week. But three sources with close knowledge of conversations at the company told Insider it has paused almost all hiring. (Business Insider)

EQUITIES/ECONOMY: Elon Musk plans to eliminate about 3,700 jobs at Twitter Inc., or half of the social media company’s workforce, in a bid to drive down costs following his $44 billion acquisition, according to people with knowledge of the matter. (BBG)

OTHER

GLOBAL TRADE: A Russian jet on Wednesday fired two cruise missiles that flew over the Black Sea corridor being used to export Ukrainian grain, President Volodymyr Zelenskiy said in a video address. (RTRS)

GLOBAL TRADE: Turkish President Tayyip Erdogan said on Wednesday he and Ukrainian President Volodymyr Zelenskiy discussed sending grain to African countries after Russia said it would resume participation in the Ukraine grain deal. (RTRS)

GLOBAL TRADE: China’s decision to maintain Covid controls is pushing companies to look to factories outside the country, according to The Economist Intelligence Unit. (CNBC)

U.S./CHINA: The United States “strongly suggested” that there be no controlling interest by China in a Hamburg port terminal, a senior U.S. State Department official said, adding that the final deal was adjusted in the end with a smaller share for Beijing. (RTRS)

GEOPOLITICS: Germany seeks cooperation with China, “where it is in the interests of both sides,” but will not ignore controversies, according to the country’s chancellor, Olaf Scholz. (BBG)

GEOPOLITICS: The US and Netherlands are expected to hold a new round of talks this month on restricting China’s access to advanced chip technologies, during which Washington will ramp up pressure on its ally to block ASML Holding NV from supplying the Asian nation. (BBG)

JAPAN: The Japan Business Federation, or Keidanren, will urge member companies to raise pay next spring to offset the impact of rising prices on workers, Nikkei has learned. (Nikkei)

RBNZ: New Zealand central bank Governor Adrian Orr said on Thursday he was confident the central bank can get inflation under control as the country battles a tight labour market. (RTRS)

SOUTH KOREA: South Korea's finance ministry said Thursday it is closely monitoring the potential impact of the U.S. Federal Reserve's overnight rate hike and North Korean provocations on the country's economy. (Yonhap)

SOUTH KOREA: In a separate meeting hosted by Bank of Korea Deputy Gov. Lee Seung-heon on the same day, the central bank said the Fed’s latest decision on the rate raises caution on the side of Korea’s financial and foreign exchange markets. Lee said the bank will strengthen the monitoring of the currency exchange rate and the inflow and outflow of capital. (Korea JoongAng Daily)

NORTH KOREA: North Korea has fired an intercontinental ballistic missile (ICBM) designed to hit targets on the other side of the world, say South Korean officials. (BBC)

HONG KONG: The Hong Kong Monetary Authority (HKMA) raised its benchmark interest rate for a sixth time, moving in lockstep with the US Federal Reserve. (Business Times)

BRAZIL: Brazilian President Jair Bolsonaro for the first time on Wednesday asked protesters blocking roads nationwide to lift blockades as demonstrations are restricting people's right to come and go and bringing losses to the economy. (RTRS)

RUSSIA: German Chancellor Olaf Scholz has altered his stance and now supports finding common ground with Russian President Vladimir Putin, Turkish President Recep Tayyip Erdogan said in a televised interview with the A Haber channel on Wednesday. (TASS)

RUSSIA: Russia's economy shrank by 5% on an annualised basis in September, the economy ministry said on Thursday, a sharper contraction than the 4% recorded a month earlier. (RTRS)

RUSSIA: Russia's central bank said on Wednesday it expected the banking sector's structural liquidity surplus to be between 3.3 trillion and 3.9 trillion roubles ($53.3 billion-63.0 billion) by the end of 2022. (RTRS)

IRAN: High Representative of the EU for Foreign Affairs Borrell tweeted the following: “In call with Iranian FM @Amirabdolahian, I stressed that Europe stands united in condemning #Iran’s crack down on ongoing protests. I reiterated urgent need for Iran’s credible cooperation with @iaeaorg towards tangible outcomes.” (Twitter)

CHILE: Chile’s President Gabriel Boric unveiled a pension reform plan that seeks to meet one of the key social demands nationwide, and “finish” with the existing private pension managers, known as AFPs. (BBG)

METALS: Hochschild Mining said Wednesday that protesters in Peru lifted a blockade of a key mine after agreeing to resume talks with the company. (RTRS)

ENERGY: Italy is attempting to weaken a pledge 10 European governments intend to make on Thursday to stop export credit support for fossil fuel projects, according to draft documents and sources familiar with the matter. (RTRS)

ENERGY: Turkey’s President Recep Tayyip Erdogan said on Wednesday that exploration for natural gas in the Black Sea continues, hinting at possible upward revisions to the 540 billion cubic meters of reserves announced last year. (BBG)

EQUITIES: One of the world’s biggest stock exchanges has a special policy for bad weather – it halts trade whenever authorities issue a typhoon warning of Signal 8, the third highest level, or higher. Nicolas Aguzin, the CEO of Hong Kong Exchanges and Clearing, said the bourse is “constantly” looking into reviewing this protocol that halts trade in its $3.9 trillion stock market alongside other structural issues that investors face in Hong Kong. (CNBC)

CHINA

XI: Chinese President Xi Jinping will deliver a speech via video at the opening ceremony of the fifth China International Import Expo (CIIE) and the Hongqiao International Economic Forum on Friday in Shanghai. The speech by Xi, also general secretary of the Communist Party of China Central Committee and chairman of the Central Military Commission, will be broadcast live by China Media Group and relayed simultaneously on major news websites and new media platforms. (Xinhua)

FISCAL: China will curb the increase in off-balance sheet debts by local governments, resolve outstanding debts and gradually realise the consolidated supervision of all local debts with unified rules, Caixin reported citing an article by Finance Minister Liu Kun. (MNI)

FISCAL: China's local governments issued a net 24.1 billion yuan ($3.30 billion) in special bonds in September, the finance ministry said on Thursday, slowing from 51.6 billion yuan in August. (RTRS)

POLICY: It is necessary to strengthen financial services to the real economy and manage monetary supply to prevent the macro-leverage ratio from rising rapidly, Securities Times reported, citing an article by Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission. (MNI)

POLICY: China will pursue economic globalisation, open regionalism and ensure supply chain resilience, while opposing "building walls, decoupling and breaking chains", 21st Century Business Herald reported, citing Lin Nianxiu, deputy director of the National Development and Reform Commission. (MNI)

CORONAVIRUS: China’s top health body said the nation’s zero-tolerance approach remains the overall strategy to fighting Covid-19 after unverified social media posts buoyed hopes the policy would be eased. (BBG)

PROPERTY: A mansion belonging to embattled China Evergrande Group's chairman in Hong Kong's prestigious The Peak residential enclave has been seized by lender China Construction Bank (Asia), local online news outlet HK01 reported on Thursday. (RTRS)

CHINA MARKETS

PBOC NET DRAINS CNY233 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY7 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY233 billion after offsetting the maturity of CNY240 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 9:31 am local time from the close of 1.7104% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Wednesday vs 43 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.2472 THURS VS 7.2197 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a fifth day at 7.2472 on Thursday, compared with 7.2197 set on Wednesday.

OVERNIGHT DATA

CHINA OCT CAIXIN SERVICES PMI 48.4; MEDIAN 49.0; SEP 49.3

CHINA OCT CAIXIN COMPOSITE PMI 48.3; SEP 48.5

The Caixin China General Services Business Activity Index (services PMI) in October dropped 0.9 points from the previous month to 48.4. With Covid prevention and containment measures tightened in the face of sporadic outbreaks in many areas, services activity remained in contractionary territory for the second consecutive month. (Caixin)

AUSTRALIA SEP TRADE BALANCE +A$12.444BN; MEDIAN +A$8.750BN; AUG +A$8.664BN

AUSTRALIA SEP EXPORTS +7% M/M; MEDIAN +1%, AUG +3%

AUSTRALIA SEP IMPORTS 0% M/M; MEDIAN +3%, AUG +4%

AUSTRALIA OCT, F S&P GLOBAL SERVICES PMI 49.3; PRELIM 49.0

AUSTRALIA OCT, F S&P GLOBAL COMPOSITE PMI 49.8; PRELIM 49.6

The latest RBA interest rate decision and ongoing global inflationary pressures appeared to have weighed on economic conditions and affected the Australian private sector economy’s performance according to the latest PMI data. Demand declined at the fastest rate since September 2021, which led to weaker overall business activity. (S&P Global)

NEW ZEALAND OCT ANZ COMMODITY PRICE INDEX -3.4% M/M; SEP -0.6%

The ANZ World Commodity Price Index fell 3.4% in October, as dairy and meat prices eased. In local currency terms the index eked out a 0.3% gain, as the NZD depreciated a further 2.0% against the Trade Weighted Index. (ANZ)

SOUTH KOREA OCT FOREIGN RESERVES $414.01BN; SEP $416.77BN

MARKETS

SNAPSHOT: BoE Day Is Finally Here After A Frantic Few Weeks For UK Markets

Below gives key levels of markets in the second half of the Asia-Pac session:

- Japanese equities are closed

- ASX 200 down 128.76 points at 6857.9

- Shanghai Comp. down 13.485 points at 2989.885

- JGBs are closed

- Aussie 10-Yr future down 11.5 ticks at 96.070, yield up 11bp at 3.92%

- U.S. 10-Yr future down 0-15+ at 110-04, cash Tsys are closed

- WTI crude down $0.56 at $89.41, Gold up $2.78 at $1638.02

- USD/JPY down 59 pips at Y147.31

- POWELL NODS TO SLOWER HIKES, HIGHER RATE PEAK (MNI)

- WHITE HOUSE SAYS FED RATE HIKE WILL HELP LOWER INFLATION, TAME HOUSING MARKET (RTRS)

- ECB WILL NEED MORE RATE HIKES TO FIGHT OFF INFLATION, DE COS SAYS (RTRS)

- RISHI SUNAK TO REVIEW PLEDGES MADE IN TORY LEADERSHIP CONTEST (FT)

- CHINA TELLS OFFICIALS TO ‘RESOLUTELY ADHERE’ TO COVID ZERO (BBG)

- PYONGYANG FIRES SUSPECTED ICBM (BBC)

US TSYS: Futures Cheapen As Asia Reacts To Fed, Regional News Flow Helps Limit Losses

The major Tsy futures contracts showed through their respective Wednesday bases during early Asia-Pac trade as regional participants reacted to the latest FOMC decision.

- To recap, the Fed delivered the widely expected, unanimous 75bp rate hike yesterday, although the statement pointed to a Fed that would assess “the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation,” even as it looks to attain a sufficiently restrictive stance of monetary policy. This gave the statement a dovish feel, although Chair Powell’s press conference was more hawkish, resulting in some late NY vol. as he flagged a “ways to go” for the Fed, in addition to expectations for a higher than previously foreseen terminal rate level, even as he pointed to likely discussions re: the potential slowing of the pace of hikes over the next couple of meetings.

- Asia-Pac news flow (including the latest round of North Korean missile launches, China’s continued focus on its zero COVID policy and softer than expected Chinese Caixin services PMI data) allowed the space to stabilise, before drifting lower again into London hours.

- TYZ2 is -0-16+ at 110-03+, just off the base of its 0-06+ range on light volume of ~65K. Cash Tsys are closed until London hours, owing to the observance of a Japanese national holiday, which thinned out liquidity in Asia

- Thursday’s London docket is headlined by the latest BoE decision (with consensus looking for a 75bp hike after the recent fiscal saga and related vol. surrounding UK markets & BoE pricing.), with the NY docket including the ISM services survey, Challenger job cuts, weekly jobless claims data and factory goods orders.

AUSSIE BONDS: Bear Flattening, With Offshore Drivers Front & Centre

Aussie bonds took their cues from offshore matters on Thursday, with the major bond futures initially cheapening through their respective overnight session bases as Sydney reacted to the latest U.S. FOMC monetary policy decision.

- The space then stabilised off lows on the back of risk-negative Asia-Pac macro news flow, which centred on the latest North Korean missile launch, China’s focus on continuing with its zero COVID strategy and a slightly softer than expected Chinese Caixin services PMI print.

- That left YM -12.0 & XM -11.0 at the close, with wider cash ACGB trade seeing 9.5-11.5bp of cheapening as the curve bear flattened.

- EFPs pushed wider at the open before more than reversing the move to narrow sharply, pointing to receiver side flows aiding the stabilsation in ACGBs.

- Bills finished flat to -9, with RBA dated OIS now pricing a terminal rate of just under 4.20%, adjusting higher in sympathy with U.S. Fed terminal rate pricing post-FOMC.

- Local data failed to move the needle for ACGBs.

- Looking ahead, Friday will see the release of the RBA’s SoMP (although most of the major adjustments to the Bank’s economic forecasts were pre-released in Tuesday’s post-meeting statement, as is the norm) and the weekly AOFM issuance slate. A reminder that the AOFM has now announced JLMs for the syndication of the new ACGB May-34, which is set to come to market next week.

NZGBS: Off Lows But Still Cheaper, Swap Spreads Narrow Again

NZGBs found a base after the initial cheapening witnessed on Thursday, with early trade driven by the space’s reaction to Wednesday’s monetary policy decision from the U.S. Federal Reserve and some pre-NZGB auction concession.

- Asia-Pac macro news flow (centred on the latest North Korean missile launch, weaker than expected Caixin services PMI data out of China and China’s continued focus on pursuing its zero COVID strategy) then allowed the broader core global FI space to find a little bit of a base as the session wore on, with the smooth passage of today’s NZGB supply (covering ’28, ’33 & ’51 paper) also helping the space correct from session cheaps.

- Swap spreads were narrower on the day as the push higher in swap rates lagged the move in NZGB yields, with the spread narrowing theme seen since the official inclusion of NZGBs in the WGBI extending.

- The pricing for the terminal OCR rate observed via RBNZ dated OIS edged higher today, in sympathy with moves in U.S. Fed terminal rate pricing post-FOMC, to print around 5.25%.

- RBNZ Governor Orr’s appearance in front of parliament after the release of the FSR had no tangible impact on the space, with familiar rhetoric deployed.

- Friday’s local docket is empty.

EQUITIES: China/HK Equity Rebound Stumbles Again

Asia Pac equities are mostly lower, following sharp falls on Wall St into the close, as Fed Chair Powell delivered a hawkish press conference. US futures are trading modestly higher, +0.20% to 0.30% at this stage, which is helping keep some markets away from worst levels. China health officials an adherence to covid zero policy has also weighed on sentiment.

- HSI is off by close to 3%, unwinding part of the previous two sessions near 8% rally. The tech sub-index has slightly underperformed, down just over 4% at this stage.

- The CSI 300 is down by over 1.2%, the Shanghai Composite by 0.63%. Daily covid case numbers are now above 3k, while as outlined above, China health authorities appeared to push back on recent social media posts that suggested a shift in the covid policy could be coming. The Caixin services PMI also came in weaker than expected, 48.4, versus 49.0 forecast and 49.3 prior.

- The Kospi was down sharply at the open, but dips sub 2300 have been supported, with the index last at 2330 (-0.30% for the session). A barrage of missile launches yesterday, plus a possible ICBM test launch today, hasn't dented sentiment. The Taiex has underperformed the Kospi, down over 1.1% at this stage, but in line with tech losses overnight.

- Japan markets are closed today, while the ASX 200 is off by nearly 1.8%.

OIL: Tight Supplies Underpinning Prices

Oil prices reached a trough in early trading today after giving up gains on hawkish comments from Fed Chairman Powell. WTI is down 0.5% from its close to around $89.50/bbl and Brent -0.3% to $95.85. The drawdown in crude (-3.115mn barrels) inventories in the US reported by the EIA confirmed the tightness of the market, which has been underpinning prices.

- WTI is now trading above its 10-, 20- and 50-day moving averages.

- The demand outlook for oil remains uncertain with central banks still hawkish and the top health body in China saying that its Zero-Covid Policy remains its strategy to fight the virus.

- EIA inventories of gasoline fell 1.26mn barrels, the lowest since November 2014, and distillate (used in heating oil and transport fuels) stocks were still at a record low in the US going into winter.

GOLD: Steadies As USD Rally Pauses

Gold is slightly above NY closing levels, last around $1637.5 (+0.10-0.15% for the session). We got to fresh lows in the early part of trading, amid a firmer USD trend. However, support was evident ahead of $1632, which was also the low at the start of the month. We rebounded back above $1640 before running out of momentum.

- Gold continues to move with broader USD sentiment, although there appears to be decent support between current spot levels and recent lows sub $1620.

- The topside remains capped by moves into the $1670/$1680 region. The overnight high came close to $1670, while the simple 50-day MA comes in just above $1676.

- The hawkish backdrop presented by Powell didn't help gold overnight, but real yields remain below recent highs (last 1.57%), which is likely helping keep dips in the precious metal supported.

FOREX: USD/JPY Main G10 Mover On Tokyo Holiday

The yen remained best G10 performer, amid fluctuating risk sentiment and post-FOMC musings, in thinner-liquidity environment due to a public holiday in Japan. The Fed's monetary policy decision sparked a volatile reaction in USD/JPY, with participants on constant intervention watch after officials repeatedly emphasised their round-the-clock FX monitoring policy.

- Heightened geopolitical tensions in Asia may have increased the yen's safe-haven allure after North Korea test-launched a suspected ICBM, triggering the J-Alert warning system in three Japanese prefectures.

- USD/JPY sales underpinned broader greenback weakness, with the BBDXY pulling back into negative territory and away from post-FOMC highs. Profit-taking may have facilitated the move, with the U.S. dollar paring gains registered on the back of higher terminal rate expectations articulated by Fed Chair Powell.

- China's Caixin Services PMI printed below expectations (48.4 versus 49.0 consensus forecast), which comes on the heels of a beat in Caixin M'fing gauge earlier this week. Both remained in contractionary territory last month.

- The central bank marathon continues, with the Bank of England and Norges Bank set to decide on rates. There is plenty of central bank rhetoric scheduled on top of that, particularly from a slew of ECB members, including President Lagarde.

- Weekly jobless claims, trade balance, factory orders and final durable goods orders are due out of the U.S. today.

FX OPTIONS: Expiries for Nov03 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E1.0bln), $0.9775(E614mln), $0.9850-55(E790mln), $0.9900-05(E2.2bln), $1.0000(E1.1bln)

- USD/JPY: Y144.00-25($1.6bln), Y147.60($1.1bln)

- GBP/USD: $1.1290-00(Gbp870mln), $1.1700(Gbp536mln)

- EUR/GBP: Gbp0.8625-30(E584mln), Gbp0.8695-00(E521mln)

- EUR/JPY: Y144.00(E504mln)

- AUD/USD: $0.6325(A$520mln)

- NZD/USD: $0.5835-38(N$584mln)

- USD/CNY: Cny7.2450($935mln), Cny7.2500($555mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/11/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/11/2022 | 0730/0830 | *** |  | CH | CPI |

| 03/11/2022 | 0805/0905 |  | EU | ECB Lagarde Panels Latvijas Banka Conference | |

| 03/11/2022 | 0810/0910 |  | EU | ECB Panetta Speech at ECB Money Market Conference | |

| 03/11/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 03/11/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/11/2022 | 0950/1050 |  | EU | ECB Elderson Panels Latvijas Banka Conference | |

| 03/11/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 03/11/2022 | - |  | DE | G7 Foreign Ministers summit in Germany | |

| 03/11/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/11/2022 | 1230/0830 | * |  | CA | Building Permits |

| 03/11/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 03/11/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 03/11/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/11/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/11/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/11/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/11/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/11/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 03/11/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 03/11/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 03/11/2022 | 1730/1330 |  | CA | BOC Deputy Beaudry gives opening remarks before academic lecture | |

| 03/11/2022 | 2000/1600 |  | CA | Canada FM Freeland presents fiscal update | |

| 03/11/2022 | 2030/2030 |  | UK | BOE Mann Panels American Enterprise Institute |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.