-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoE Remains Acutely Focused On Inflation

EXECUTIVE SUMMARY

- JEFFERSON: FED STILL GAUGING EFFECTS OF TIGHTENING (MNI)

- FED'S BARR: WILL USE ALL TOOLS TO KEEP BANKS SAFE

- TREASURY: U.S. WILL KEEP USING TOOLS TO PREVENT BANKING CONTAGION AS NEEDED (RTRS)

- FDIC TO CONDUCT REVIEW OF DEPOSIT INSURANCE (MNI)

- AFTER SVB SALE, WHITE HOUSE SAYS BANKING SYSTEM IS 'SAFE' (RTRS)

- SCHNABEL: ECB MAY COPY BANK OF ENGLAND'S WAY OF STEERING RATES (RTRS)

- MONEY PULLED FROM EUROZONE BANKS AT RECORD RATE IN FEBRUARY (FT)

- BOE'S BAILEY SAYS RATE-SETTERS CAN PUT INFLATION BEFORE BANK WORRIES (RTRS)

- INDIAN DEMAND FOR URALS CRUDE KEEPS RUSSIA'S EXPORTS UP (REFINITIV SOURCES)

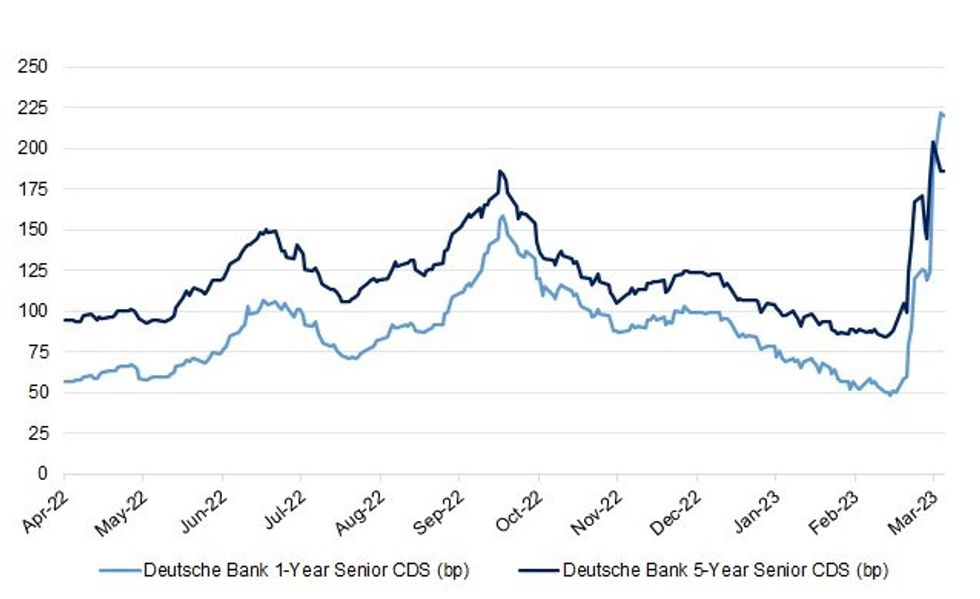

Fig. 1: Deutsche Bank 1- & 5-Year Senior CDS

Source: MNI - Market News/Bloomberg

UK

BOE: Economic activity recently has been stronger and nominal wage growth weaker than the Bank of England had expected, Bank of England Governor Andrew Bailey said Monday. although he offered no fresh steer on whether a further rate hike was likely to be needed. (MNI)

BOE: Bank of England Governor Andrew Bailey signalled on Monday that the central bank's Monetary Policy Committee would focus on fighting inflation and would not be swayed unduly by worries about the health of the global banking system. (RTRS)

BOE/BANKS: Bank of England Governor Andrew Bailey said on Monday it was striking how quickly runs on banks could gain momentum in the age of social media, adding it was something regulators needed to heed. (RTRS)

POLITICS: Backers of Boris Johnson aiming to “take back control” and “save” the Tory party will hold an inaugural conference in May. (Telegraph)

POLITICS: Rishi Sunak has struck a “temporary ceasefire” with Tory rebels after agreeing to their demands to revisit his small boats plan. (Telegraph)

PENSIONS: The UK’s largest private-sector retirement plan and hundreds of universities have warned the pensions watchdog that its shake-up of rules risks damaging economic growth and the education sector. (FT)

EUROPE

ECB: The European Central Bank could take a leaf from the Bank of England's book as it looks for new ways of managing liquidity in the banking sector and steering short-term interest rates on the market, ECB board member Isabel Schnabel said on Monday. (RTRS)

FRANCE: France's public sector budget deficit fell more than the government expected last year as tax income came in strong, business newspaper Les Echos reported on Monday. (RTRS)

ITALY: The European Commission delayed the disbursement of €19 billion ($20.5 billion) of pandemic recovery aid to Italy amid skepticism about it reaching the targets required to unlock the funding. (BBG)

ITALY: Italy’s state-backed lender is working on a higher bid for Telecom Italia SpA’s landline network, in a move aimed at winning the control of an asset considered of national interest, according to people familiar with the matter. (BBG)

IRELAND: Ireland is likely to implement a top-up tax, which would apply to major companies with Irish bases, rather than a new 15 per cent headline tax rate, according to a feedback statement from the Department of Finance to be published shortly. (Irish Times)

BANKS: Depositors have withdrawn €214bn from eurozone banks over the past five months, with outflows hitting a record level in February, according to data published by the European Central Bank on Monday. (FT)

BANKS: UBS's CEO Ralph Hamers on Monday said the Swiss bank sees its government-orchestrated takeover of Credit Suisse as a growth opportunity, in an internal memo seen by Reuters. (RTRS)

BANKS: Deutsche Bank AG shares rebounded and the cost of insuring its debt against default eased on Monday after sell-side analysts sought to reassure that the German lender’s financial health was sound. (BBG)

U.S.

FED: The Federal Reserve is still figuring out how much of the inflation slowdown can be attributed to the central bank's sharp interest-rate hikes, Board Governor Philip Jefferson said Monday. (MNI)

FED: Federal Reserve bank supervision chief Michael Barr pledged Monday to use "all of our tools for any size institution, as needed, to keep the system safe and sound," ahead of testimony to the Senate Banking Committee on oversight of failed Silicon Valley Bank. (MNI)

BANKS: The U.S. government will continue using its tools to prevent contagion in the banking sector, as warranted, to ensure Americans' deposits are safe, Treasury Undersecretary for Domestic Finance Nellie Liang will tell the U.S. Congress on Tuesday. (RTRS)

BANKS: The Federal Deposit Insurance Corporation will undertake a comprehensive review of the deposit insurance system and will release a report by May 1, according to testimony to be given by chair Martin Gruenberg. (MNI)

BANKS: A top US banking regulator has launched investigations into managers’ conduct in the Silicon Valley Bank and Signature Bank failures. (BBG)

BANKS: First Citizens BancShares Inc.’s acquisition of SVB Financial Group came with an unusual provision: a $70 billion line of credit, courtesy of the Federal Deposit Insurance Corp. (BBG)

BANKS: The White House said on Monday that the U.S. banking system is safe despite stress on some institutions after two American banks collapsed, ratcheting up fears of a contagion that prompted U.S. officials to respond. (RTRS)

OTHER

U.S./CHINA: The head of the U.S. National Security Agency's cybersecurity directorate on Monday said TikTok represents a "strategic issue" rather than an immediate "tactical" threat to the United States. (RTRS)

NATO: Hungary's parliament on Monday approved a bill to allow Finland to join NATO once its application has been ratified by all 30 members of the alliance, ending months of foot-dragging by the ruling Fidesz party on the matter. (RTRS)

GEOPOLITICS: Over the course of a generation China has become the world’s biggest sovereign lender to developing economies as part of a push for business and influence that mirrors the 20th century spread of US economic power. Now comes the next chapter: With a growing list of poor countries facing debt problems, China is drawing on its enormous central bank reserves to establish itself as a source of emergency funds to bail out some of the very nations it spent years lending to. (BBG)

BOJ: Sustainable inflation has yet to be achieved in Japan, but the nation is no longer in a deflationary state, Bank of Japan Governor Haruhiko Kuroda says in parliament. (BBG)

BOJ: The fall in bond yields and more stable yen affords incoming Bank of Japan governor Kazuo Ueda time to consider modifications to yield curve control, but no change is likely before July as policymakers monitor domestic and global growth and the outcome of wage negotiations, a former BOJ board member told MNI. (MNI)

JAPAN: Japan’s cabinet approved the use of 2.2t yen in reserve funds from the fiscal 2022 budget for measures to cushion the impact of inflation, Chief Cabinet Secretary Hirokazu Matsuno says in a regular press briefing. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida said on Tuesday he is carefully monitoring developments in Japanese financial institutions in the wake of Western banking problems. (RTRS)

JAPAN: Finance Minister Shunichi Suzuki said on Tuesday the scale of investment in Additional Tier 1 (AT1) bonds by Japanese financial institutions was small and the direct impact of turmoil linked to AT1 bonds overseas on Japanese financial institutions is limited. (MNI)

AUSTRALIA: Australian Treasurer Jim Chalmers to convene a meeting of Council of Financial Regulators on Thursday as part of monitoring of the global banking situation and any potential impact to Australia. (BBG)

AUSTRALIA: The head of Australia's prudential regulator said on Tuesday the country's banks were among the best placed in the world to handle a financial crisis, following the collapse of Silicon Valley Bank that roiled international markets. (RTRS)

AUSTRALIA: Australian law would not allow regulators to wipe out AT1 tier credit holders as occurred with Credit Suisse, the country's assistant treasurer said on Tuesday. "Our banks are unquestionably strong, very different legal framework. We don't need to go into the 'what if' rabbit hole. It's an entirely different set of circumstances here in Australia." "We are in a very different world to what's occurred out there." (RTRS)

NEW ZEALAND: New Zealand’s government welcomes the Public Sector Pay Adjustment agreement and new public service pay guidance, Minister for the Public Service Andrew Little says in emailed statement. (BBG)

SOUTH KOREA: South Korea's finance ministry said on Tuesday there was a strong downward risk to the government's budget revenue projection this year mainly from a slowing economy, both at home and abroad. (RTRS)

NORTH KOREA: North Korean leader Kim Jong Un called for scaling up the production of weapons-grade nuclear materials to increase the country's nuclear arsenal, saying it should be fully ready to use the weapons at any time, state media KCNA said on Tuesday. (RTRS)

ASIA: Asia is expected to record weighted real GDP growth of 4.5% this year, up from the 4.2% last year, the Boao Forum for Asia said in its annual report summary on Tuesday. (RTRS)

BRAZIL: Brazil's Vice President Geraldo Alckmin said on Monday the government needs to convince the country's central bank that it is not feasible to have the world's highest interest rate. (RTRS)

BRAZIL: Brazil Supreme Court Justice Ricardo Lewandowski could remain in office until May 11, but has already informed some people that he will leave the chair in mid-April, reports local newspaper O Globo citing the Justice’s interlocutors. (BBG)

RUSSIA: Russia failed on Monday to get the United Nations Security Council to ask for an independent inquiry into explosions in September on the Nord Stream gas pipelines, connecting Russia and Germany, that spewed gas into the Baltic Sea. (RTRS)

RUSSIA: Russia's navy fired supersonic anti-ship missiles at a mock target in the Sea of Japan, the Russian defence ministry said on Tuesday. (RTRS)

SOUTH AFRICA: South Africa’s Minister of Finance, Enoch Godongwana, says in reply to a question from lawmakers that the latest weaker than expected 2022 GDP outcome will warrant a re-assessment of the GDP growth outlook and the associated risks, including almost continuous power outages. (BBG)

ISRAEL: An uneasy calm is returning to Israel after Prime Minister Benjamin Netanyahu announced he would delay a key part of controversial plans to overhaul the justice system. On Monday night he said he would pause the legislation to prevent a "rupture among our people". (BBC)

ISRAEL: A key right-wing partner in Prime Minister Benjamin Netanyahu's ruling coalition said it opposed delaying the government's judicial reform plan but still respected his decision to do so. (RTRS)

ISRAEL: Israeli opposition parties gave a cautious welcome to Prime Minister Benjamin Netanyahu's decision to delay his flagship judicial reform package and said they would work to reach an agreement if the government was sincere. (RTRS)

ARGENTINA: Argentina Economy Minister Sergio Massa said “exceptional measures” were needed to help agriculture producers in emergency zones during the worst drought in the country’s history, according to messages posted on Twitter. (BBG)

ENERGY: The European Union is targeting a way to let member states have the option to effectively ban Russian shipments of liquefied natural gas without implementing new energy sanctions. (BBG)

OIL: India was the biggest buyer of seaborne Urals oil in March and the country's demand for the grade means Russia has to maintain high exports, two traders said and Refinitiv Eikon data showed on Monday. (RTRS)

CHINA

ECONOMY: China will align with international trade rules to create a world class business environment, according to China's Premier Li Qiang. (MNI)

ECONOMY: China's nationalist newspaper the Global Times has called on the country's multinational companies to promote cooperation and resist economic decoupling with the west. (MNI)

BELT & ROAD: China has significantly expanded its bailout lending as its Belt and Road Initiative blows up following a series of debt write-offs, scandal-ridden projects and allegations of corruption. A study published on Tuesday shows China granted $104bn worth of rescue loans to developing countries between 2019 and the end of 2021. The figure for these years is almost as large as the country’s bailout lending over the previous two decades. (FT)

PROPERTY: Chinese builder Logan is set to deliver more detailed restructuring proposals to creditor groups in about two weeks, the firm’s advisors told bondholders in a Monday conference call, according to people who attended the meeting. (BBG)

BANKS: China's banks face tighter margins in the near term as the government's focus on high quality development means lenders cannot rely on fast GDP growth to sustain their business, China Merchants Bank chairman Miao Jianmin told a conference. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY225 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) conducted CNY278 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY96 billion after offsetting the maturity of CNY182 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9152% at 09:23 am local time from the close of 2.0561% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday, compare with the close of 58 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8749 TUES VS 6.8714 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8749 on Tuesday, compared with 6.8714 set on Monday.

OVERNIGHT DATA

AUSTRALIA FEB RETAIL SALES +0.2% M/M; MEDIAN +0.2%; JAN +1.8%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 76.6; PREV 76.5

Consumer confidence was practically unchanged last week and remained below the 80 level for a fourth consecutive week. The index, in six of the past seven weeks, was among the 12 worst results since the COVID outbreak. Confidence among those paying off their mortgage rebounded 2.9pts after a 4.3pts fall the week before. Confidence among renters and outright homeowners declined 0.5pts and 1.8pts respectively after increases last week. Confidence in ‘current economic conditions’ and whether ‘it is a good time to buy a major household item’ have been below 70 for the last seven weeks. Confidence in ‘future finances’ rose a little as ‘inflation expectations‘ eased. (ANZ)

SOUTH KOREA FEB RETAIL SALES +7.9% Y/Y; JAN +4.0%

SOUTH KOREA FEB DEPARTMENT STORE SALES +8.6%; JAN -3.7%

SOUTH KOREA FEB DISCOUNT STORE SALES +5.8%; JAN -3.8%

UK MAR BRC SHOP PRICE INDEX +8.9% Y/Y; FEB +8.4%

MARKETS

US TSYS: Richer In Asia

TYM3 deals at 115-04, +0-04+, observing a 0-10 range on volume of ~86k.

- Cash tsys sit 2-4bps richer across the major benchmarks, the curve has bull steepened.

- In early dealing tsys were marginally richer, as Asia-Pac participants used yesterday's cheapening as an opportunity to close short positions/enter fresh long positions in early dealing.

- Pressure on the USD, as an offer in USD/JPY spilled over, saw tsys continue to richen through the session.

- Despite the absence of a headline driver, gains briefly extended, 2 Year Yield showed below 3.9%. Gains moderated and tsys held richer observing narrow ranges with little follow through on moves for the remainder of the Asian session.

- Fed Governor Jefferson was on the wires early in the session, he didn't comment directly on the outlook for Fed policy, noting that the bank is still learning the full effects of tightening.

- On the docket today we have ECB speak from Lagarde, US Wholesale Inventories and Consumer Confidence. Fed VC Barr testifies before the Senate Banking Committee. We also have the latest 5-Year supply.

JGBS: Strong 40-Year Auction Pricing Promotes Twist Flattening

JGB futures hold on to their post-40-Year auction bid after some light richening in U.S. Tsys allowed the contract to tick away from session lows ahead of the Tokyo lunch break. That leaves the contract -23 as we head into the final hour of Tokyo trade, albeit nowhere near fully reversing the overnight weakness generated by a reduction (not a removal) in fear surrounding the global banking sphere. The well-received auction has prompted twist flattening of the wider JGB curve, with the major benchmarks now running 1.5bp cheaper to 8.5bp richer, pivoting between 10s and 20s. The swap curve has also twist flattened, with swap spreads generally flat through 10s and wider beyond there.

- Various policymakers have stressed the relative soundness of the Japanese banking sector, while soon to be departing BoJ Governor Kuroda has gone over old ground re: inflation and the need for continued easing.

- Japanese investing giant Dai-Ichi Life flagged a shift in capital allocation to JGBs from U.S. Tsys and other foreign securities, given the well-documented, elevated currency hedging costs imposed on the Japanese investor base at present. ALM duration matching activity sees Dai-Ichi preferring 30- & 40-Year JGBs, per the BBG interview. The firm also flagged a want to deploy capital in alternative assets as it looks to boost returns (private equity, real assets and hedge funds are potential destinations for their capital).

- Looking ahead, BoJ Rinban operations (covering 3- to 25-Year JGBs) headline domestically on Wednesday.

JGBS AUCTION: 40-Year Auction Results

The Japanese Ministry of Finance (MOF) sells Y699.9bn 40-Year JGBs:

- High Yield: 1.465% (prev. 1.625%)

- Low Price: 86.23 (prev. 81.95)

- % Allotted At High Yield: 92.5781% (prev. 5.0549%)

- Bid/Cover: 2.694x (prev. 2.554x)

AUSSIE BONDS: Cheaper With A Tight Range

ACGBs are weaker (YM -11.0 & XM -11.0) ahead of the bell after trading in a relatively tight range in the Asia-Pac session. Once retail sales data printed at consensus and failed to provide a local driver, the market largely tracked movements in U.S. Tsys, which recouped a portion of NY session losses in Asia-Pac trade.

- Cash ACGBs are 10-11bp cheaper with the AU-US 10-year yield differential -2bp at -21bp.

- Swaps rates are 9-10bp higher with the 3s10s curve 1bp steeper and EFPs 1bp tighter.

- Bills strip pricing is -6 to -11 with reds leading.

- RBA dated OIS is 6-11bp firmer for meetings beyond May with expected year-end easing at 25bp.

- Locally, attention now shifts to the scheduled release of CPI Monthly for February tomorrow. BBG consensus is expecting another slowing in the Y/Y rate to 7.2% from 7.4% in January and 8.4% in December. It is important to note however that the series can be volatile from month to month given not all components are updated.

- With the global calendar relatively light until Friday when Euro Area CPI (Mar) and US PCE deflator (Feb) are released, the markets will be closely watching to see if the recent improvement in risk sentiment, and upward pressure on global yields, can extend further.

AUSSIE BONDS: Nov-27 I/L Auction Results

The Australian Office of Financial Management (AOFM) sells A$150mn of the 0.75% 21 November 2027 Indexed Bond, issue #CAIN414:

- Average Yield: 0.4249% (prev. 0.9175%)

- High Yield: 0.4325% (prev. 0.9200%)

- Bid/Cover: 4.3467x (prev. 5.8500x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 7.7% (prev. 50.0%)

- Bidders 39 (prev. 47), successful 10 (prev. 7), allocated in full 8 (prev. 5)

NZGBS: Off Cheaps, Outperforming $-Bloc

NZGBs closed mid-range 5-8bp cheaper with the 2/10 curve 3bp flatter after U.S. Tsys recouped a portion of NY session losses in Asia-Pac trade. NZGBs nonetheless outperformed its $-Bloc peers with the NZ/US and NZ/AU 10-year yield differentials respectively -9bp and -7bp on the day.

- Swaps closed at session bests 2-4bp weaker, implying tighter swap spreads.

- RBNZ dated OIS closed 4-8bp firmer for meetings beyond April with October leading. 24bp of tightening was priced for April with terminal OCR expectations pushed out to 5.20%.

- The NZ calendar remains light until later in the week with the next major release, not until ANZ Business Confidence and Building Consents on Thursday.

- Before then, Australia is scheduled to release CPI Monthly for February tomorrow. BBG consensus is expecting another slowing in the Y/Y rate to 7.2% from 7.4% in January and 8.4% in December.

- With the global calendar relatively light until Friday when Euro Area CPI (Mar) and US PCE deflator (Feb) are released, the markets will be closely watching to see if the recent improvement in risk sentiment, and upward pressure on global yields, can extend further.

EQUITIES: Most Regional Indices Higher, China Lags

Regional equity markets are mostly higher, following the positive lead from EU/US markets during Monday's session. US futures are also tracking higher, with 0.15/0.20% gains across eminis and Nasdaq futures. China shares are lagging, while gains elsewhere are under the 1% mark at this stage.

- The CSI 300 is off modestly, down 0.16%, while the Shanghai Composite Index is close to flat. This comes despite better trends from energy related names, which follows higher oil prices. Saudi Aramco has also taken a 10% stake in Rongsheng Petrochemical, which has likely helped at the margins as well.

- Northbound stock connect flows have been modestly negative again today (1.67bn yuan so far in the session).

- The HSI has been volatile, up 1.2% earlier in the session, before getting back close too flat. We now sit around ~0.70% higher.

- Elsewhere, the Topix is close to flat, while the Kospi is +0.60%, outperforming the Taiex, which is down -0.70%. This follows weakness in the semiconductor space during Monday's session (the SOX off more than 1%).

- The ASX 200 is up close to 1%, aided by broad based commodity price gains. Most SEA bourses are higher but gains are mostly under 0.50%.

GOLD: Bullion Stabilising After Safe Haven Flows Pulled Back

Gold fell 1% on Monday reaching a low of $1944.07/oz as banking fears eased, equities rallied and safe haven flows moved out of the precious metal. It has been range trading during APAC trading today and is up 0.1% to $1959.00, between the intraday high and low, even though the USD index is down 0.3% and US yields are lower.

- Trend conditions for bullion remain in place and recent downward moves are seen as corrective. The break above $1959.70, the February 2 high, confirmed the resumption of the bull trend that started in late September 2022. Prices continue to hold above this level and are only down 2.2% from their March 23 high.

- The Fed’s Barr appears before the Senate banking panel later and there is also US trade and house price data released. The focus of the week though is Friday’s US core PCE price index, the Fed’s preferred measure. It is expected to remain stable at 4.7% y/y in February.

OIL: Crude Eases Today But Brent Over 10% Above March Low

Oil prices are moderately lower during the APAC session with Brent down 0.4% to $77.78/bbl but WTI is only down 0.1% to around $72.75. The USD index is down 0.3%. Crude rose sharply on Monday as risk appetite improved on hopes that a broader banking crisis would be avoided, supply disruptions and a weaker dollar.

- WTI reached a high today of $73.05 and a low or $72.64, while Brent hit $78.27 followed by a low of $77.70.

- Bloomberg reported, that crude consumers, especially airlines, used the sharp drop in prices seen in March as an opportunity to boost protection against a rally expected later in 2023. Swap dealers reported the second-largest increase in long Brent positions on record for last week. As an example Lufthansa increased its hedging of planned consumption to 85%. Brent reached a monthly low of $70.12 on March 20 but is now 10.9% above that level.

- The Fed’s Barr appears before the Senate banking panel later and there is also US trade and house price data released. API inventory data also prints. The focus of the week though is Friday’s US core PCE price index, the Fed’s preferred measure. It is expected to remain stable at 4.7% y/y in February.

FOREX: USD Pressured In Asia

The greenback is pressured in Asia today, regional equities are firmer and US Treasury Yields are lower. Yen is the strongest performer in G-10 space at the margins.

- USD/JPY prints at ¥130.50/130.60, ~0.8% softer today. Downside support comes in at ¥129.75, 76.4% retracement of the Jan 16 to Mar 8 rally.

- AUD/USD is also firmer, last printing at $0.6690/95. Australian retail sales for February printed as expected at 0.2%. Resistance is seen at 50-Day EMA ($0.6764). Firmer Iron Ore has aided AUD at the margins, futures in Singapore are up ~1.5% as we move back above $120/tonne.

- Kiwi has firmed above its 20-Day EMA ($0.6216), NZD/USD prints at $0.6230/35. Bulls first target a break of $0.6263 (200-Day EMA).

- Elsewhere in G-10 NOK is ~0.4% firmer. EUR is lagging gains seen elsewhere in G-10, EUR/USD is up ~0.1%.

- US Treasury Yields are lower, 2 year yields are down ~5bps. E-minis are ~0.2% firmer and Hang Seng is up ~0.7%. BBDXY is down ~0.3%.

- On the docket today we have ECB speak from Lagarde, US Wholesale Inventories and Consumer Confidence. Fed VC Barr testifies before the Senate Banking Committee.

FX OPTIONS: Expiries for Mar28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0875-80(E1.1bln), $1.0945-55(E1.8bln)

- USD/JPY: Y128.50-70($875mln)

- AUD/USD: $0.6500(A$575mln), $0.6750(A$652mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 28/03/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/03/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/03/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/03/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/03/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/03/2023 | 1315/1515 |  | EU | ECB Lagarde Speech at BIS Innovation Hub Opening | |

| 28/03/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/03/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 28/03/2023 | 1400/1000 |  | US | Senate Banking Committee Hearing | |

| 28/03/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 28/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/03/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/03/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/03/2023 | 2000/1600 |  | CA | Federal budget (Release around 4pm, as finance minister delivers it to Parliament) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.