-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN OPEN: BOJ Discuss Potential Timing of End Of YCC

EXECUTIVE SUMMARY

- BOJ DISCUSSED POTENTIAL TIMING OF ENDING OF NEGATIVE RATE POLICY - BBG - BBG

- PBOC APPOINTS LU LEI AS DEP. GOVERNOR - 21st CBH - 21st CBH

- US MILITARY LAUNCHES IRAQ STRIKES - BBG - BBG

- EU PREPARING BACK UP PLAN TO FUND UKRAINE - BBG

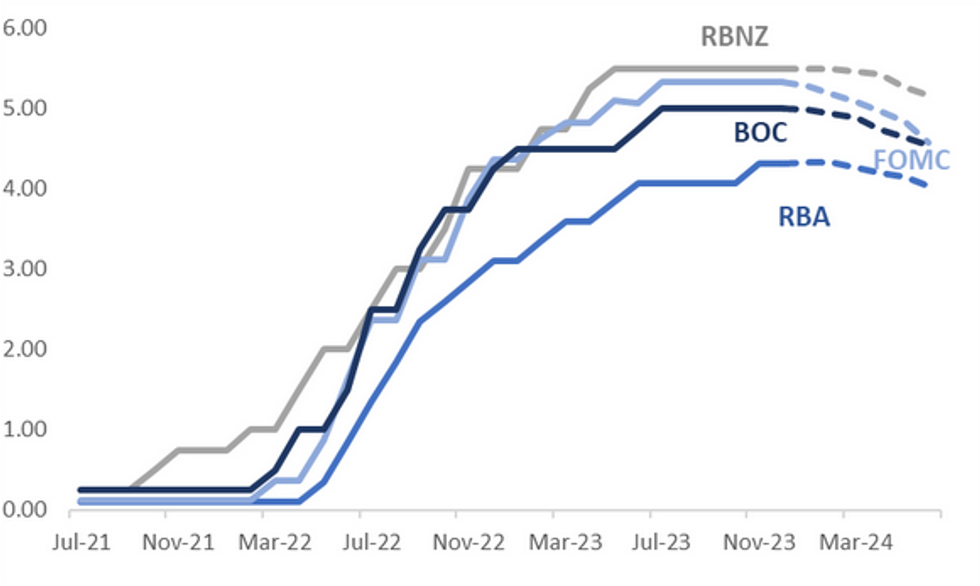

Fig. 1: $-Bloc STIR

Source: MNI - Market News/Bloomberg

EUROPE

UKRAINE (BBG): The European Union is preparing a back-up plan worth up to €20b to help fund Ukraine, the Financial Times reports, citing unidentified officials involved in the talks.

UKRAINE (BBG): The Ukrainian cabinet submitted a draft law to parliament that lays out a new mobilization plan for the army, in the latest attempt to resolve disagreements between the political and military leadership over conscription as Russia’s invasion enters its 23rd month.

U.S.

MIDDLE EAST (BBG): The US military launched strikes on three installations in Iraq targeting what it said is a terrorist group backed by Iran that Washington has accused of a series of attacks on American personnel, including one Monday that left three people injured.

MIDDLE EAST (BBG): US strikes on targets in Iraq and fresh attacks by Houthi militants on shipping in the Red Sea provided the latest warning signs that the war in Gaza risks expanding into a wider conflict destabilizing the Middle East.

APPLE (BBG): Apple Inc., seeking to defend a business that generates roughly $17 billion a year, is appealing a US sales ban of its smartwatches after the White House refused to overturn the measure.

OTHER

BOJ (BBG): Bank of Japan board members discussed the potential timing of ending the negative rate policy during their meeting last week, with several members indicating they see no rush to make the move.

OIL (BBG): Oil held its largest gain in more than a week on rising tensions in the Middle East, with a fresh attack on shipping in the Red Sea prompting vessels to avoid the key shipping route.

NORTH KOREA (BBG): A dormant North Korean port near the border with Russia has sprung back to life, fueling what experts say is a burgeoning trade in arms destined for the frontlines in Ukraine that is simultaneously bolstering the anemic economy managed by Kim Jong Un.

CHINA

PBOC (21st Century Business Herald): China has appointed Lu Lei as deputy governor of the People's Bank of China (PBOC), replacing Liu Guoqiang, according to a statement from the Ministry of Human Resources and Social Security on Tuesday. Lu, 53, steps down as deputy director of the State Administration of Foreign Exchange (SAFE), a post he has held since 2017. Lu served previously as director of the PBOC’s financial stability bureau and research bureau. Lu said in a recent speech it is necessary to revitalise inefficient financial resources, as 80% of all loans in China need to be recycled and reinvested every year, and there are considerable resources to resolve local-debt risks given to the lower leverage of the central government.

DEPOSIT RATES: Chinese banks will likely continue to cut deposit interest rates further to reduce funding costs, even after the third round of deposit rate cuts this year starting last week, Financial News reported citing analysts. The rates of time deposits for one-year, two-year, as well as three- and five-year were cut by 0.1, 0.2, and 0.25 percentage points by six major state-owned banks. This provides downward space for loan interest rates next year, and banks’ net-interest margins, which have been under continuous pressure, are also expected to stabilise. The average net-interest margin of commercial banks was 1.73% by end-Q3, a decrease of 0.21 pp from the same period last year, data by National Administration of Financial Regulation showed.

CGBs (21st Century Business Herald): China’s infrastructure investment growth will likely pick up as projects accelerate to kick start following government bond sales. The National Development and Reform Commission in mid-December has issued two batches of a total 12,500 projects for the issuance of over CNY800 billion out of the CNY1 trillion additional China Government Bonds announced in October. The growth rate of infrastructure investment slowed to 5.8% in the Jan-Nov period, falling from 9% in the first two months, data by National Bureau of Statistics showed.

CHINA MARKETS

MNI: PBOC Injects Net CNY287 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY421 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net injection of CNY287 billion reverse repos after offsetting CNY134 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8594% at 09:40 am local time from the close of 1.8510% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 41 on Tuesday, compared with the close of 47 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.0953 Friday vs 7.1010 set on Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1002 on Wednesday, compared with 7.1010 set on Monday. The fixing was estimated at 7.1398 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA DEC CONSUMER CONFIDENCE 99.5; PRIOR 97.2

CHINA NOV INDUSTRIAL PROFITS 29.5% Y/Y; PRIOR 2.7%

MARKETS

US TSYS: Marginally Richer In Asia

TYH4 deals at 112-22+, -0-00+, a 0-05+ range has been observed on volume of 27k.

- Cash tsys sit 1-2bps richer across the major benchmarks, light bull flattening is apparent.

- Tsys are a touch firmer in Asia today, support in the space was seen after a bid in JGBs spilled over however the move didn't follow through. Tsys held richer dealing in narrow ranges for the majority of the session.

- FOMC dated OIS now price ~90bps of cuts by November 2024.

- Due today are the Richmond Fed Mfg Index and Dallas Fed Services Activity, we also have the latest 5-Year supply.

JGBs: Futures Richer & At Session Highs, Retail Sales & IP Data Tomorrow

JGB futures are richer and at session highs, +28 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined BoJ Opinion Summary for the December MPM. November Housing Starts are due later today.

- Cash US tsys are dealing 1-2bps richer across the major benchmarks in muted Asia-Pac dealing.

- Cash JGBs are richer across benchmarks, with yields -0.3bp (1-year) to -2.7bps (7-year). The benchmark 10-year yield is 2.0bps lower at 0.615% versus the recent low of 0.555% (20 Dec).

- Swaps are richer across maturities, with rates 1.5bp to 2.9bps lower. Swap spreads are tighter.

- Tomorrow, the local calendar sees November Retail Sales, Industrial Production (flash reading) and Weekly International Investment Flows.

AUSSIE BONDS: Richer, Off Best Levels, Light Local Calendar

ACGBs (YM +1.0 & XM +2.0) are richer but off Sydney session highs on a light data day. With the local market lacking news flow, domestic participants appear to have used US tsy dealings in today’s Asia-Pac session for directional guidance after being closed on Monday and Tuesday for the Christmas holiday period.

- Cash US tsys are dealing 1-2bps richer across the major benchmarks in a relatively muted start to Wednesday's dealing.

- Cash ACGBs are 2-3bps richer, with the AU-US 10-year yield differential at +10bps.

- Swap rates are 3-4bps lower.

- The bills strip is firmer, with pricing flat to +4. Early reds are leading.

- RBA-dated OIS pricing is flat to 3bps softer across meetings, with Nov’24 leading.

- Tomorrow, the local calendar is empty again.

- Details on issuance plans (including any new planned bond lines) for the second half of 2023-24 will be provided on 5 January 2024 by the AOFM.

NZGBS: Richer In A Data-Light Session, Local Calendar Empty Again Tomorrow

NZGBs closed with a twist-flattening of the 2/10 curve. Benchmark yields were 1bp higher to 6bps lower. With the local calendar empty today, domestic participants have likely used US tsy dealings in today’s Asia-Pac session for directional guidance.

- As a reminder, the local market was closed Monday and Tuesday this week for the Christmas holiday period.

- Cash US tsys are dealing flat to 3bps richer across the major benchmarks, with a flattening bias, in muted Asia-Pac dealing.

- Swap rates closed 5-8bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 2bps softer across meetings.

- (Bloomberg) The RBNZ was unable to publish some data to its website at 3 pm local due to technical difficulties, according to an emailed statement. It will publish data, including Exchange Rates and TWI, as soon as the issue is resolved.

- Tomorrow, the local calendar is empty again.

GOLD: Higher & Looking At Its First Annual Gain In Three

Gold is slightly weaker in the Asia-Pac session, after closing 0.7% higher at $2067.81 on Tuesday.

- Tuesday’s move came despite a slight shift higher in US Treasury yields, led by the short end. The session was however data-light, with volumes subdued. European exchanges were closed for the Boxing Day holiday.

- Nevertheless, FOMC-dated OIS is pricing in a nearly 80% chance of a cut by March, with ~90bps of easing by November 2024.

- Typically rate cuts are bullish for non-interest-bearing assets like bullion.

- Bullion is trading near a record high, up 13% for the year and on track for its first annual increase in three years.

OIL: Crude Holds Onto Tuesday’s Gains, API Data Out Later

Oil prices have held onto most of their gains from yesterday. On Tuesday they rose around 2.5% and today are little changed. WTI has moved in a narrow range during APAC trading today and is 0.1% lower at $75.47/bbl, off the low of $75.15. Brent is flat at $81.06, close to the intraday high. The USD index is slightly higher.

- There are increasing concerns that tensions are spreading in the Middle East with the Iran-backed Houthis firing on shipping in the key Red Sea and the US striking targets in Iraq. Danish shipping giant Maersk has said that it will resume cargoes through the Red Sea/Suez Canal given the naval protection now provided, which may have helped put a lid on oil prices today.

- Brent’s 200-day moving average is at $80.11 with the 50-day trending down and currently at $81.33. It will be seen as bearish if it falls below the 200-day average, a so-called death cross, according to Bloomberg.

- US API crude inventory and product data are released later. Apart from that there are only the US’ Richmond and Dallas Fed indices for December.

Equities: Higher During APAC Trading Helped By Rate Cut Optimism

Equity markets have generally followed the US higher in APAC trading today driven by optimism that the start of the Fed’s easing cycle is not too far away. The S&P and Nasdaq e-minis are unchanged in thin trading. The MSCI APEX 50 is up 1.7%.

- Japan’s Nikkei is 1.2% higher and the Topix +1.1%. While Korea’s KOSPI is +0.1% (held back by the finance sector), the KOSDAQ is +1.1%. Taiwan’s TAIEX is up 0.6%.

- HK’s Hang Seng is up 1.5% with the tech index rallying 2.3%. China’s CSI 300 has underperformed rising only 0.4% (property +0.3%). China signalled that it may ease restrictions on gaming and that it would create an “initial comprehensive computing power infrastructure system” by end-2025, according to Bloomberg.

- Australia’s ASX 200 is up 0.9% but down off the intraday high. The NZX 50 did not do as well rising 0.4%.

- ASEAN is mixed with Indonesia’s Jakarta comp up 0.6%, Singapore’s Straits Times +0.4%, the Malay KLCI +0.2% but the SE Thai flat and the Philippines PSEi down 0.5%.

- India’s Nifty 50 is 0.5% stronger.

- There is little on the upcoming US calendar with only the Richmond and Dallas Fed indices for December later.

FOREX: Muted Session Across G-10 In Asia

There has been a muted session across G-10 FX in Asia; the Yen is a touch pressured however ranges remain narrow, and the Antipodeans are marginally firmer. Cross asset flows remain subdued this morning.

- USD/JPY sits at ¥142.60/65 ~0.2% higher today, the ¥143 handle remains intact. Trend conditions remain bearish, immediate support is at ¥141.87 (22 Dec low) and ¥140.97, low from Dec 14. Resistance comes in at ¥144.96, high from Dec 19.

- AUD/USD is ~0.2% firmer, the Aussie is marginally outperforming in the space, and is consolidating above the $0.68 handle.

- Kiwi is ~0.1%, ranges have been narrow as NZD/USD holds above the $0.63 handle this morning.

- Elsewhere in G-10 there are no moves of note to report.

- The docket in Europe is thin today.

UP TODAY (TIMES GMT/LOCAL)

- US Data/Speaker Calendar (prior, estimate)

- Dec-27 1000 Richmond Fed Mfg Index (-5, --)

- Dec-27 1000 Richmond Fed Business Conditions (-9, --)

- Dec-27 1030 Dallas Fed Services Activity (-11.6, --)

- Dec-27 1130 US Tsy 17W Bill and $70B 42D CMB Bill auctions

- Dec-27 1300 US Tsy $26B 2Y FRN Note and $58B 5Y Note auctions

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.