-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Leaves YCC Unchanged, Beefs Up Background Provisions

EXECUTIVE SUMMARY

- BOJ ON HOLD; KEEPS FORWARD GUIDANCE; EXPANDS OPS (MNI)

- BARKIN: FED NEEDS TO AVOID THE MISTAKE OF DECLARING VICTORY OVER INFLATION TOO SOON (MARKETWATCH)

- WHITE HOUSE SAYS NO DEBT BARGAINING AS MCCARTHY URGES TALKS

- ECB’S VILLEROY SAYS RESILIENT ECONOMY MAKES RATE HIKES EASIER (BBG)

- ECB STAFF’S TRUST IN LEADERSHIP HURT AMID INFLATION, PAY DISPUTE (BBG)

- SCHOLZ SEES GERMANY RIDING OUT WAR IN UKRAINE WITHOUT RECESSION (BBG)

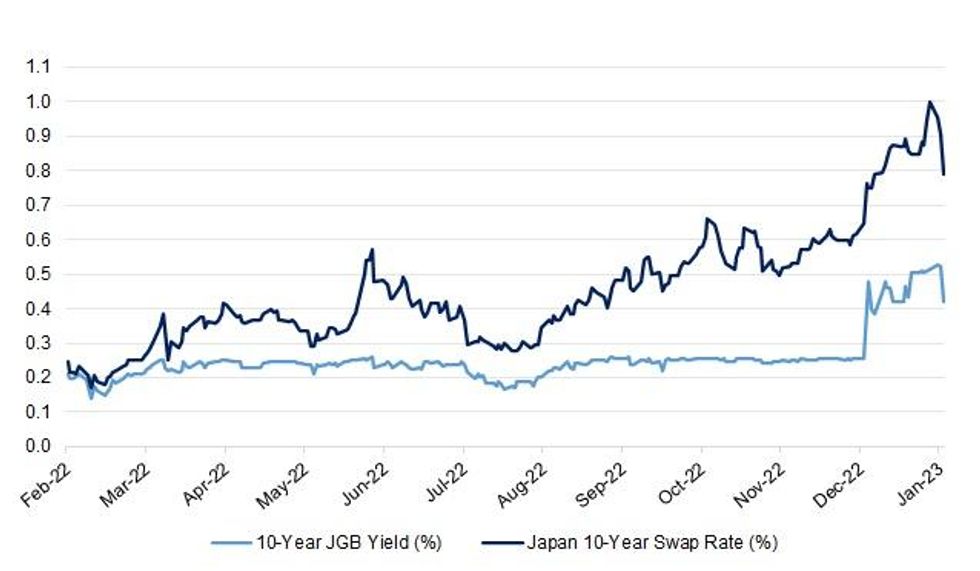

Fig. 1: 10-Year JGB Yield Vs. Japan 10-Year Swap Rate (%)

Source: MNI - Market News/Bloomberg

UK

ECONOMY: XpertHR's latest pay data found pay awards were up +5.0% in the three months ending December. This is over double last year's December figure as firms experience growing pressure from a tight labour market and the higher cost of living. (MNI)

EUROPE

ECB: European Central Bank Governing Council member Francois Villeroy de Galhau said the resilience of the continent’s economy in the face of the energy crisis makes ramping up interest rates less complicated. (BBG)

ECB: Staff at the European Central Bank said trust in President Christine Lagarde and the rest of the Executive Board had been damaged amid a standoff over pay and the institution’s struggles to tame inflation, a recent survey showed. (BBG)

EUROPEAN PARLIAMENT: An alleged leader of a criminal network involved in an EU corruption scandal has agreed to reveal which countries were involved and how it operated. (BBC)

GERMANY: Chancellor Olaf Scholz said he’s sure Germany will avoid a recession this year, offering reassurance for Europe’s largest economy as it faces down Russia’s energy squeeze. (BBG)

ITALY: Italy's cabinet is likely to decide on Jan. 19 the fate of two influential Treasury officials, sources said, with nationalist Prime Minister Giorgia Meloni seen as pushing to appoint figures closer to her right-wing administration in key jobs. (RTRS)

U.S.

FED: The Federal Reserve must avoid the mistake of declaring victory over inflation too soon, said Richmond Fed President Tom Barkin on Tuesday. (MarketWatch)

FED: Federal Reserve Bank of New York leader John Williams said on Tuesday that the economy does better when everyone gets a shot at participating. (RTRS)

FED: U.S. inflation is seen only very gradually falling back to 2% and is projected to still be nearly 2.7% by the end of 2025, far above the Fed's December SEP median projection of 2.1%, Cleveland Fed economists wrote in a paper published Friday. (MNI)

FISCAL: House Speaker Kevin McCarthy called on Democrats to engage in talks with Republicans over a fiscal plan including an increase in the federal debt limit, while the White House reiterated its rejection of such negotiations, highlighting the risk of a market-rattling battle over the ceiling later this year. (BBG)

FISCAL: Senate Majority Leader Charles E. Schumer laid into House Republicans Tuesday for demanding spending cuts in exchange for raising the debt limit to avoid the U.S. defaulting on its debt. (Washington Times)

POLITICS: The White House counsel’s office reiterated on Tuesday President Joe Biden’s commitment to cooperating with the Justice Department’s investigation into the discovery that he improperly removed and stored classified documents from the White House that he obtained while serving as vice president under former President Barack Obama. (CNBC)

EQUITIES: Apple Inc. is still planning to unveil its first mixed-reality headset this year, but an even more important follow-up product — lightweight augmented-reality glasses — has been postponed due to technical challenges. (BBG)

EQUITIES: Microsoft is preparing to axe thousands of jobs in the latest move by one of the world's biggest technology companies to reduce its workforce in the face of a slowing global economy. (Sky)

BANKS: The U.S. Office of the Comptroller of the Currency (OCC) is weighing how it might provide more transparency into the escalation framework it uses to address supervisory concerns and deficiencies at large banks, the acting head of the regulator said on Tuesday. (RTRS)

BANKS: The Federal Reserve is asking the six largest U.S. banks to figure out how they would react to climate-related shocks to gain a better understanding of how global warming will affect the financial system. (MNI)

OTHER

GLOBAL TRADE: The United States has placed the highest priority on addressing European Union fears that the U.S. green subsidies law will lure clean tech businesses to United States at Europe's expense, U.S. Trade Representative Katherine Tai said on Tuesday. The United States and the European Union have also signed a tariff rate quota agreement regarding agricultural products, Tai's office said in a separate statement. (RTRS)

GLOBAL TRADE: President Joe Biden said the US and Netherlands were working in “lockstep” over their approach to China and would discuss ways to secure global supply chains during a meeting with Dutch Prime Minister Mark Rutte at the White House. (BBG)

GLOBAL TRADE: German Chancellor Olaf Scholz said he’s convinced that a trade war can be avoided between the European Union and the US over a recent package of green subsidies introduced by Joe Biden’s administration. (BBG)

BOJ: The Bank of Japan board decided to keep monetary policy unchanged on Wednesday as the policymakers examine the impact of last month's decision to widen the range of its 10-year yield target aimed at restoring the functioning of financial markets. (MNI)

JAPAN: Japan’s Finance Ministry projects debt-servicing cost of 29.8t yen in fiscal 2026, a rise of ~4.5t yen from fiscal 2023 estimates, Nikkei reports. (BBG)

JAPAN: Japan plans to remove indoor mask guidelines in public areas as it lowers its classification of Covid, Nikkei reports, without attribution. (BBG)

SOUTH KOREA: South Korea Financial Supervisory Service Governor Lee Bok-hyun asks local banks to play a “more active role” so that a systemic risk from a credit crunch doesn’t solidify, according to a speech text delivered at a meeting with heads of 17 local banks. (BBG)

MEXICO: The Mexican government's nominee to join the Bank of Mexico's governing board, Omar Mejia, said Tuesday that maintaining autonomy, transparency and independence would be a priority if chosen for the role. (RTRS)

BRAZIL: Brazil’s Finance minister Fernando Haddad said the govt’s plan to approve the new fiscal rule and tax reform is due to the expectation of investments to be made in Brazil once the economic perspectives become clearer. (BBG)

RUSSIA: The Pentagon is tapping into a vast but little-known stockpile of American ammunition in Israel to help meet Ukraine’s dire need for artillery shells in the war with Russia, American and Israeli officials say. (New York Times)

RUSSIA: Ukrainian troops began training in Oklahoma on Tuesday, as top U.S. military official Gen. Mark Milley traveled to Poland, near the border with Ukraine. (Axios)

RUSSIA: German Chancellor Olaf Scholz said he’s in talks with allies over potentially supplying heavy tanks to Ukraine, but cautioned that any announcements would have to come in lockstep with others. (BBG)

RUSSIA: The Netherlands will send a Patriot missile defence system to Ukraine, Dutch news agency ANP reported on Tuesday, citing Prime Minister Mark Rutte. (RTRS)

SOUTH AFRICA: Details of the package for small, medium, informal and micro sectors will be announced soon, Minister of the Department of Small Business Development Stella Ndabeni Abrahams says in a statement. (BBG)

METALS: Glencore Plc's huge Antapaccay copper mine in Peru is operating at "restricted" capacity due to anti-government protests that saw an attack on the facility last week, a company source told Reuters on Tuesday. (RTRS)

METALS: China has warned iron ore trading companies and iron ore futures companies against price gouging and speculation, according to a note published by the National Development and Reform Commission on Wednesday. (RTRS)

OIL: Oil output from top shale regions in the United States is due to rise by about 77,300 barrels per day (bpd) to a record 9.38 million bpd in February, the U.S. Energy Information Administration (EIA) said in its productivity report on Tuesday. (RTRS)

OIL: The new head of Venezuela's state oil company PDVSA has suspended most oil export contracts while his team reviews them in a move to avoid payment defaults, according to an internal document seen by Reuters and people familiar with the matter. (RTRS)

CHINA

ECONOMY: China’s 31 provinces have announced an average GDP growth target of 5.9% in 2023, 0.4 pp lower than the average target of 6.3% in 2022, according to Yicai.com. The news outlet said expanding domestic demand and industrial transformation were seen as priorities, when it analysed the outcome of recent local two-session meetings. (MNI)

ECONOMY: Beijing’s hopes for an economic revival after recording slowing growth last year will depend in large part on the animal spirits of small and medium-sized enterprises, which account for the majority of output, urban employment and tax revenues but were hit hard by the pandemic. (FT)

ECONOMY: China's power consumption rose 3.6% in 2022 to 8.64 trillion kilowatt hours (kWh), the National Energy Administration said on Wednesday. (RTRS)

FISCAL: China will “moderately” front-load infrastructure investment this year as it aims to expand domestic demand, according to Luo Guosan, an official with China’s National Development and Reform Commission. (BBG)

FDI: Inbound foreign direct investment in China rose to 1.23t yuan in Jan.-Dec., Ministry of Commerce says at a briefing. (BBG)

PROPERTY: Authorities will take measures that improve housing demand and boost market confidence in 2023, but avoid speculative practices, the Ministry of Housing and Urban-Rural Development said at its recent Work Conference. (MNI)

PROPERTY: Beijing's support for the country's beleaguered property sector is broadening. S&P Global Ratings believe steps to stimulate demand and allow equity raising will help developers repair balance sheets. (S&P)

BANKS: China's "big four" banks have to raise a substantial amount of total loss-absorbing capital (TLAC) to meet international requirements for global systemically important banks. (S&P)

CHINA MARKETS

PBOC NET INJECTS CNY515 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday conducted CNY133 billion via 7-day reverse repos and CNY447 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY515 billion after offsetting the maturity of CNY65 billion reverse repos today, according to Wind Information.

- The operation aims to hedge the impact of tax paying and cash injection peak to keep banking system liquidity stable before Chinese New Year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0000% at 9:24 am local time from the close of 2.3221% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 50 on Tuesday, compared with the close of 59 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7602 WEDS VS 6.7222 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7602 on Wednesday, compared with 6.7222 set on Tuesday.

OVERNIGHT DATA

JAPAN NOV, F INDUSTRIAL PRODUCTION +0.2% M/M; PRELIM -0.1%; OCT -3.2%

JAPAN NOV, F INDUSTRIAL PRODUCTION -0.9% Y/Y; PRELIM -1.3%; OCT +3.0%

JAPAN NOV CAPACITY UTILISATION -1.4% M/M; OCT +2.2%

JAPAN NOV CORE MACHINE ORDERS -8.3% M/M; MEDIAN -1.0%; OCT +5.4%

JAPAN NOV CORE MACHINE ORDERS -3.7% Y/Y; MEDIAN +1.6%; OCT +0.4%

NEW ZEALAND DEC REINZ HOUSE SALES -39.0% Y/Y; NOV -36.1%

The Real Estate Institute of New Zealand’s (REINZ) December 2022 figures show house prices are still declining, with properties taking longer to sell across New Zealand. REINZ Chief Executive, Jen Baird says prices continue to ease but the pace of the decline is slower, and the market has settled at its new pace. (REINZ)

NEW ZEALAND DEC RETAIL CARD SPENDING -2.5% M/M; NOV +0.3%

NEW ZEALAND DEC TOTAL CARD SPENDING -1.2% M/M; NOV -0.6%

MARKETS

US TSYS: Richer, BoJ-Related Flows Dominate

TYH3 deals at 114-29+, +0-08, as it retreats from the top of a 0-20 range, on very strong volume of ~259K.

- Cash Tsys are running 2-6bp richer across major benchmarks, with 7s and 10s leading the bid.

- Any early round of modest cheapening was observed in Asia trade, in the absence of any headline driver there was perhaps some pre-BoJ positioning in Tsys (albeit with JGB futures bid).

- Tsys then firmed in the immediate aftermath of the BoJ decision, as the Bank left all major policy parameters unchanged. The BoJ's decision was in line with the view of most economists, although it was at odds with well-documented JGB market pricing.

- JGBs are off best levels late in Tokyo trade, facilitating a similar move in Tsys.

- In Europe today CPI data from the UK and the Eurozone (final) provide the highlights. Further out we have a slew of US data including Retail Sales, PPI and Industrial Production as well as the Fed' s Beige Book. There will be Fedspeak from Atlanta Fed President Bostic, Philadelphia Fed President Harker and St Louis Fed President Bullard. We also have the latest round of 20-Year supply and a meeting between Yellen & Liu He.

JGBS: Futures Lead Post-BoJ Bid, As The Bank Sticks With YCC Settings

The BoJ played a straight bat and left its core monetary policy settings unchanged, matching the view of almost all sell-side economists, albeit being at odds with the recent, well-documented developments in Japanese markets.

- There was a tweak to the BoJ’s "Principal Terms and Conditions for Funds-Supplying Operations against Pooled Collateral," allowing it to “determine the duration of each loan taking account of conditions in financial markets and the duration shall not exceed ten years.” This was seemingly a bid to promote market functioning and further backstop its YCC settings that it seems keen to stick with, at least for now (the BoJ promptly deployed a 5-Year loan in the afternoon).

- The decision was backed by 9-0 votes across the board, with forward guidance also unchanged.

- When it comes to the Bank's underlying CPI projection’s there was a mark higher for the current FY, along with some tweaks further out, but crucially, there was no indication that the Bank expects to achieve its inflation target over the medium term (although it may be a little more confident of doing so, based on the adjustments).

- This triggered a notable firming in JGBs, with futures +130 ticks into the bell, ~50 ticks off best levels, while cash JGBs run flat to 11bp richer on the day with 7s leading the bid owing to the move in futures. The super-long end lagged but unwound the morning cheapening (which was seemingly linked to flattener unwinds pre BoJ). 10-Year JGB yields are set to close around 0.42%, after once again printing above the BoJ’s YCC cap (0.50%) ahead of the monetary policy decision. 10-Year swap rates are 12bp lower on the day, printing at 0.78%, extending the pullback from last week’s foray above 1.00%.

- Governor Kuroda’s post-meeting press conference will start in just under 30 minutes.

AUSSIE BONDS: Unchanged BoJ Triggers About Face In ACGBs, Bull Flattening On The Day

The BoJ’s choice to leave its YCC parameters unchanged, despite market speculation to the contrary (even though the majority of the sell-side economists looked for no change in monetary policy settings, with varying degrees of conviction) put a bid into ACGBs on Wednesday.

- That left YM +4.0 & XM +6.0 at the bell, with the early bear steepening impulse (derived from wider core global FI trade on Tuesday) flipping to bull flattening. The major cash ACGB benchmarks run 4-6bp richer, with the 7- to 12-Year zone outperforming on the curve.

- The early EFP narrowing reversed on the move, suggesting that bonds led the swings in both directions.

- Bills finished 1-3bp firmer through the reds, once again reversing the overnight/early Sydney cheapening. RBA dated OIS was little changed on the day, showing ~20bp of tightening for next month’s gathering and a terminal cash rate of somewhere between 3.70-3.75%.

- Looking ahead, the monthly labour market report and consumer inflation expectations print headline local matters on Thursday.

NZGBS: BoJ Sees Space Away From Session Cheaps, Swaps Flat To Lower

NZGBs richened into the close, with the lack of movement in the BoJ’s YCC settings taking the edge off the early session cheapening. The early move was seemingly linked to the weakness in U.S. Tsys observed into the NY close and perhaps an element of some last minute pre-BoJ positioning in the NZGB market.

- That left the major benchmarks running 2-3bp cheaper at the close, with some very modest bear steepening in play.

- Swap rates followed the general gyrations in NZGBs, albeit with slightly longer trading hours, which allowed a flattening bias to develop, as swap rates finished unchanged to 3bp lower across the curve.

- There could be a further adjustment to the post-BoJ decision moves in early Thursday dealing, but that will be contingent on the global reaction to the matter.

- RBNZ dated OIS is showing 62bp of tightening for next month’s meeting after nearly fully pricing in a 75bp step in recent weeks, while the terminal OCR print shows in familiar territory, between 5.40-5.45%.

- On the local data front, card spending data saw a M/M fall in Dec, while the latest REINZ house price reading pulled lower once again as the impact of the RBNZ’s expeditious tightening cycle continues to filter through.

- Looking ahead, supply in the form of NZGB-28, -32 & -41 is due tomorrow, with food prices and non-resident bond holding data also set to cross.

EQUITIES: Little Spill Over From Japan Equity Surge Post BoJ

Outside of Japan equities, regional moves have been fairly modest. US futures currently sit close to flat, up from earlier lows, with eminis last near 4011 in index terms. Futures spiked post the BOJ decision, which left major policy parameters unchanged, but we are away from highs for the major indices.

- Post the lunch time break, Japan equities have surged as markets digest the BoJ outcome. The Nikkei 225 is up around 2.25% stage, as Japan bonds surge and the FX has fallen sharply. We still remain sub levels that prevailed prior to the last BoJ meeting (around 27250, versus 26725 current).

- Elsewhere, Hong Kong and China markets appear to be winding down ahead of next week's LNY break. The CSI 300 is down slightly at this stage, off 0.22%, while the HSI has trimmed 0.13% in the first part of the session.

- South Korean shares are seeing some underperformance, off 0.80%, amidst modest offshore outflows. Losses for Samsung have been a key driver of weakness.

- The ASX is close to flat, while SEA bourses - Malaysia and Indonesia are nursing modest losses.

GOLD: Bullion Falls Again As USD Rallies

Gold prices are down again during the APAC session by 0.4% to around $1900.40/oz, close to the intraday low of $1899.33. Earlier in the session bullion reached a high of $1910.38. The pullback has been driven by a stronger USD (DXY +0.4%) in response to unchanged core BoJ monetary policy settings.

- Gold is off 1.4% from Monday’s high of $1929.03/oz but still well above support at $1874.40, the January 12 low. It remains in a bullish trend and higher highs and higher lows are expected.

- There is a busy data schedule in the US today with the focus likely to be US December retail sales and PPI. Retail sales are expected to post another monthly decline, while the core PPI is also projected to decline on the month. December IP is forecast to fall again while inventories are should rise. The NAHB housing market index and the Fed’s Beige Book are also scheduled to be released.

OIL: Crude Continues To Rally On Demand Optimism

MNI (Australia) - Oil prices are higher today but have been trading in a narrow range of less than a dollar. Optimism regarding the outlook for the Chinese economy drove the market and prices reached their highest since the start of January, despite a stronger USD (DXY +0.5%). WTI is currently around $80.75/bbl and Brent $86.45.

- The January rally means that crude is now around its 100-day simple moving average. A short-term bullish trend continues with key resistance and bull trigger for WTI at $81.50.

- OPEC released its monthly outlook on Tuesday and expects the market to be balanced in Q1 2023. The Secretary General also said that he’s “cautiously optimistic” about the global growth outlook. The IEA will issue its monthly report later today, which should contain information on the impact of sanctions on Russian supply and the demand outlook. A Bloomberg survey showed that analysts expect Chinese oil demand to reach a record high this year.

- There is a busy data schedule in the US today with the focus likely to be US December retail sales and PPI. Retail sales are expected to post another monthly decline, while the core PPI is also projected to decline on the month. IP, API fuel inventory data and the Fed’s Beige Book are also scheduled to be released.

FOREX: USD/JPY Up 2.5% Post BoJ, Eyeing 20-Day EMA Test, NZD Outperforms Elsewhere

USD indices are higher in large part to the 2.5% surge in USD/JPY post today's BoJ outcome. The BBDXY is back to 1230, +0.40% for the session and highs back to Thursday last week. The DXY is up by a similar amount.

- USD/JPY was modestly higher ahead of the BoJ, but still found selling interest ahead of 129.00. Post the meeting, which left all major policy parameters unchanged, we surged higher. Yen bulls will be disappointed there was no further changes, particularly to YCC dynamics. We met some resistance ahead of 131.00, but ultimately pushed close to 131.60. The pair last tracked around 131.45/50.

- The 20-day EMA is not too far away at 131.68, a resistance level we have spent little time above since early November last year. 1 week implied vol is down off highs, last at 16.27%.

- Elsewhere, NZD/USD has outperformed, last tracking close to 0.6450, +0.40% for the session. There haven't been any headline drivers, however yesterday's NZD/USD close above $0.64, which emerged as a key level recently, may be aiding technical flows. Q4 CPI is coming into focus as well, the print is next Wednesday and looms as a key input into February's RBNZ meeting. the AUD/NZD cross has also weakened, back sub the 100 & 200 day Mas this past week.

- AUD/USD is a touch above NY closing levels, last near 0.6990, but is still facing resistance ahead of 0.7000.

- Coming up, UK CPI for Dec prints, while the final EU CPI is due for Dec. There is also a busy data schedule in the US today with the focus likely to be US December retail sales and PPI.

FX OPTIONS: Expiries for Jan18 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2080(E522mln-EUR puts), $1.2100-05(E627mln-EUR puts)

USD/JPY: Y103.50-60($551mln), Y104.15-25($549mln)

EUR/GBP: Gbp0.8840-50(E780mln-EUR puts)

AUD/USD: $0.7345(A$836mln-AUD calls)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/01/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 18/01/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 18/01/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 18/01/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 18/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/01/2023 | - |  | JP | Bank of Japan policy decision | |

| 18/01/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/01/2023 | 1330/0830 | *** |  | US | PPI |

| 18/01/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 18/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/01/2023 | 1400/0900 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/01/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 18/01/2023 | 1500/1000 | * |  | US | Business Inventories |

| 18/01/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/01/2023 | 1800/1300 |  | US | Kansas City Fed's Esther George | |

| 18/01/2023 | 1900/1400 |  | US | Fed Beige Book | |

| 18/01/2023 | 2015/1515 |  | US | Philadelphia Fed's Pat Harker | |

| 18/01/2023 | 2100/1600 | ** |  | US | TICS |

| 18/01/2023 | 2200/1700 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.