-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Maintains The Status Quo

EXECUTIVE SUMMARY

- BOJ KEEPS YCC, ECONOMIC ASSESSMENT UNCHANGED - MNI

- HIGH TECH FOCUS WON’T SUPPORT H2 GROWTH - CHINA ECONOMISTS - MNI

- CHINA MEDIA SEE ASYMMETRIC CUT IN BANKS’ BENCHMARK LENDING RATES - BBG

- AUSTRALIA SIGN-ON BONUSES HIGHLIGHT RBA’S LABOUR MARKET FEARS - BBG

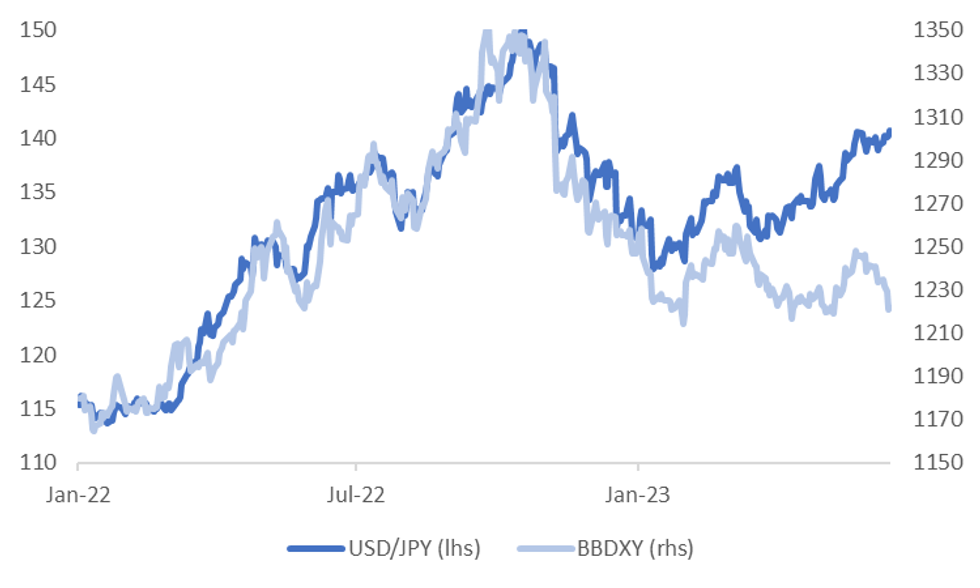

Fig. 1: Still Accommodative BoJ Sees Yen Miss Out On USD Weakness

Source: MNI - Market News/Bloomberg

U.K.

FISCAL: Britain’s tax system is so complicated it has become an “obstacle to economic dynamism” and needs to be simplified, an influential committee in Parliament concluded. A review by the Treasury Committee found that there are more than 1,180 separate tax reliefs that can cause such perverse outcomes some people may end up poorer by taking a job or getting a pay rise. (BBG)

EUROPE

TECH: The European Commission is planning to ban equipment from Chinese vendors Huawei Technologies Co. and ZTE Corp. from its own internal telecommunications networks, people familiar with the matter said. (BBG)

UKRAINE: The F-16s that NATO is sending to Ukraine aren’t likely to arrive in time to help with Kyiv’s current offensive. The used planes won’t be enough to turn the tide in the air war against Russia, either. The alliance has a different message in mind. (BBG)

U.S.

FED: Former Treasury Secretary Lawrence Summers said that Federal Reserve policymakers seemed to settle on an inconsistent set of actions this week based on internal dynamics at the US central bank. (BBG)

GEOPOLITICS: Former US Secretary of State Henry Kissinger said he believes military conflict between China and Taiwan is likely if tensions continue on their current course, though he still holds out for dialogue that will lead to deescalation — as he’s been urging. (BBG)

OTHER

JAPAN: The Bank of Japan board on Friday decided unanimously to keep yield curve control policy and pledged to continue patiently with monetary easing amid high economic and financial market uncertainty. The BOJ also kept the forward guidance for the policy rates and pledged to take additional easing measures if necessary. "The BOJ will patiently continue with monetary easing while nimbly responding to developments in economic activity and prices as well as financial conditions,” the Board said in a statement. “By doing so, it will aim to achieve the price stability target of 2% in a sustainable and stable manner, accompanied by wage increases,” it said. (MNI)

JAPAN: The Bank of Japan board Friday left its overall economic assessment unchanged, noting the country's economy had picked up, "despite being affected by factors such as past high commodity prices.” The BOJ also maintained the near-term economic recovery scenario, but warned it expects downward pressure due to past high commodity prices and a slowdown in the pace of recovery overseas. The Bank repeated that the y/y rate of increase in CPI (all items less fresh food) will likely decelerate toward the middle of fiscal 2023, but did not say the rise would fall below its 2% target. It also left its near-term outlook unhanged, noting the economy will likely recover moderately toward around the middle of fiscal 2023. (MNI)

AUSTRALIA: Australian employers are offering signing bonuses to entice workers, with companies like Wesfarmers Ltd. and Ramsay Health Care Ltd. reporting up to 8% in wage growth, highlighting a tight labor market and complicating the Reserve Bank’s inflation fight. (BBG)

TAIWAN: The top US liaison to Taiwan asked the opposition’s presidential candidate about how he would navigate relations with Beijing if he wins next year’s election, according to people familiar with the meeting, as polls show a tight race between the key parties. (BBG)

CHINA

GROWTH: hina’s economy continued an unbalanced recovery in May, with economists telling MNI that policymakers' focus on flagship high-tech industrial upgrading may not offset weakness in the private sector and real estate during the second half of the year, as the country targets GDP growth of about 5%. High-tech industrial fixed-asset investment rose by 12.8% y/y in May, with medical and communication equipment up 18.8% and 16.1%, according to National Bureau of Statistics data on Thursday. (MNI)

POLICY: China’s banks are likely to see a deeper cut in their 5-year benchmark lending rate next week as policymakers seek to lower medium to long-term borrowing costs for corporates as well as mortgage rates, Securities Times cites Li Chao, economist from Zheshang Securities, as saying in a front-page report. (Securities Times)

POLICY: China will roll out more stimulus to support a slowing economy this year, but concerns over debt and capital flight will keep measures targeted at shoring up weak demand in the consumer and private sectors, sources involved in policy discussions said. (RTRS)

YUAN: China’s yuan will likely buck its weakening trend in the second half of this year as the economy continues to recover and the Fed’s rate hikes are expected to end, Securities Daily reported. (BBG)

SOEs: The Government will encourage state-owned enterprises to use capital markets to improve competitiveness, enhance allocation of resources and achieve high-quality development, according to a notice from the State-owned Assets Supervision and Administration Commission. The notice said SOEs should use mergers and acquisitions to enhance business models and asset value. Investors are expecting SOEs to focus M&A activity on industrial integration of strategic emerging industries, according to one analyst. (Securities Daily)

CONSUMPTION: The Ministry of Commerce (MOFCOM) will coordinate policy support for home appliance consumption, according to MOFCOM Spokesperson Shu Jueting. Speaking at a recent press conference, Shu said local governments planned to invest over CNY2.5 billion to promote consumption, with a focus on rural households replacing and upgrading older appliances. Nationwide, officials are planning 300 large-scale promotion activities and will make efforts to upgrade the after sales service industry. Shu added consumers that upgrade to newer appliances will contribute to the green-energy transition. (MNI)

CHINA MARKETS

PBOC Injects Net CNY40 Bln Via OMOs Friday

The People's Bank of China (PBOC) conducted CNY42 billion via 7-day reverse repos on Friday, with the rates at 1.90%. The operation has led to a net injection of CNY40 billion after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to hedge the impact of tax payment and keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9167% at 09:43 am local time from the close of 1.8167% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Thursday, the same as the close on Wednesday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1289 FRI VS 7.1489 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1289 on Friday, compared with 7.1489 set on Thursday.

OVERNIGHT DATA

NZ MAY BUSINESS NZ MANUFACTURING PMI 48.9; PRIOR 48.8

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 113-11+, -0-03, a 0-08 range has been observed on volume of ~80k.

- Cash tsys sit 1-3bps cheaper across the major benchmarks, the curve has bear flattened.

- Tsys cheapened in early dealing as local participants faded yesterday's richening perhaps using the opportunity to enter fresh shorts/close out long positions.

- Pressure marginally extended as e-minis fell and the USD firmed. However there was little follow through on the move and tsys ticked away from session lows dealing in narrow ranges for the remainder of the session.

- The space looked through the latest BOJ monetary policy decision, the bank held policy steady as expected.

- The final print of Eurozone CPI provides the highlight in Europe today. Further out we have UofMich Consumer Sentiment, as well as Fedspeak from St Louis Fed President Bullard, Gov Waller and Richmond Fed President Barkin.

JGBS: Futures Off Post BoJ Highs

Futures are around mid range in terms of post lunch break moves. We last sat at 148.27, +19, after a range of 148.18/39 post the break, The positive bias is consistent with an unchanged BoJ stance (which hit the wires during the break), but we haven't breached earlier highs from Wednesday this week (148.39).

- JGB futures are outperforming US Tsy futures, with TYU3 last sitting a touch heavier at 113-12, -02.

- In the cash JGB space, we remain well within recent ranges. Post BoJ extremes have been faded in yield terms. The 10yr currently sits close to 0.415%, while the 40yr is back near 1.39%, we got sub 1.36% earlier.

- For swaps, yields are still lower across the benchmark, the 10yr back under 0.58%.

- Looking ahead, the focus will be on Ueda's press conference at 07:30BST.

AUSSIE BONDS: Little Changed On Friday

ACGB's sit little changed from Thursdays closing levels across the major benchmarks after ticking away from early session highs, coming alongside a moderate cheapening in US Tsys.

- Cash ACGB's have opened dealing 2-4bps richer across the major benchmarks, however spillover from US Tsys saw gains pared through the session.

- Futures have also ticked away from session highs, XM is flat and YM sits +0.010.

- RBA dated OIS remain stable, a terminal rate of 4.56% is seen in December.

- Looking ahead the data calendar is thin next week with the RBA minutes of the June policy meeting on Tuesday and Judo Bank PMIs on Friday the only data of note.

NZGB's: Richer On Friday

NZGB's have finished 3-4bps richer across the major benchmarks on Friday, the curve has bull flattened.

- NZGB's ticked away from best levels seen early dealing as much a 6bps richer across the curve before marginally paring gains.

- RBNZ dated OIS have remained stable through the session, a terminal rate of 5.61% is seen in October.

- On the wires early this morning May BusinessNZ Mfg PMI printed at 48.9, the prior read was revised lower to 48.8 from 49.1.

- Looking ahead; May PSI crosses on Monday, May Trade Balance is due on Thursday and the latest ANZ Heavy Truckometer crosses on Friday.

FOREX: USD Marginally Firmer, USD/JPY Higher As BoJ Holds Steady

The BBDXY saw support in the first part of trade on moves towards the 1220 level. We got above 1222, but last tracked near 1221.70, only +0.10% on NY closing levels from Thursday. Some support has emerged from the firmer US yield backdrop (+1.4-3.4bps higher), but outside of yen, moves have been marginal.

- USD/JPY has seen the greatest degree of volatility, dipping to 139.85 pre BoJ, but ultimately rebounding as the central bank left policy settings unchanged. We currently track close to session highs in the 140.60/65 region, +0.25%.

- The BOJ stated FX markets will need to be monitored, which may be a topic of Ueda's press conference later, as FinMin Suzuki also gave some verbal jawboning this morning.

- Ranges have been relatively tight elsewhere, albeit with modest USD support. EUR/USD sits back at 1.0940.

- AUD/USD is at 0.6875/80, slightly down from Thursday session highs, while NZD tracks around the 0.6230 level.

- Looking ahead, the European morning's focus will be the final, detailed Eurozone readings of CPI, along with several ECB speakers including Holzmann, Rehn, Muller, Centeno, and Villeroy. For the US side, we have Fed speakers, Bullard speaking early, then Waller and Barkin, later on. U. of Mich Sentiment also prints.

FOREX: Japan Stocks Recover As BoJ Stays On Hold, CSI 300 Nears 200-day MA Upside Test

Most Asia Pac equity indices are tracking higher for the Friday session. Japan equities have recovered from lows pre the lunchtime break, as the BoJ held steady in terms of policy settings. China and Hong Kong equities are also firmer, but trends in SEA are more mixed. US futures are weaker, but away from session lows (Eminis last near 4466.50, -0.10%).

- The Nikkei saw support prior to the lunch break near 33200, but post the break haves't been able to rebound beyond 33600. This leaves us below highs from earlier in the week near 33800. The BoJ left policy settings unchanged, but there will be focus on Ueda's press conference later.

- The HSI is up 0.73% to the break, while the CSI 300 is up 0.44% at the stage. In index terms we just below 3943, which is multi-week highs. The simple 200-day MA, around 3952, is not too far away. We may see a China State Council meeting later today to discuss further stimulus options.

- The Kospi has rebounded 0.55% so far today, but the Taiex is down 0.25%, in line with a weaker SOX trend from US Thursday trade.

- In SEA markets, Malaysia stocks are weaker -0.50%, maintaining a recent underperformance trend. Indonesia stocks are also down, -0.45%.

OIL: Largely Holding Onto Thursday's Bounce

Brent crude has largely tracked sideways through the first part of the Friday session. We were last near $75.50/bbl, not far off yesterday's session highs close to $76/bbl. This leaves us only 0.25% lower for the session so far, after a 3.37% gain for Thursday. WTI was last around

$70.40-50/bbl, tracing a similar trajectory.

- The Thursday rally was largely on the back of China stimulus hopes. A State Council meeting may take place today, the market will be looking for additional signs that China will improve domestic demand outside of the recent rate cuts announced.

- Earlier headlines crossed from China's NDRC, stating the authorities will ensure coal/gas supply to meet summer demand. This could be seen as a positive at the margin for broader commodities, and comes after China's oil import quota bump earlier in the week.

- Still, elevated Russian supply and US inventory builds are working against upside price momentum. The prompt spread continues to fall.

- For Brent, support is still evident on moves sub $71.50/bbl, while on the topside the 50-day MA is near $77.75/bbl.

GOLD: Drifting Down From Thursday Session Highs

Gold is tracking a touch below NY closing levels, last near $1956.30/50 (range of $1955.23-$1962.07 so far today). Current levels area below closing levels from the end of last week, but only just. At this stage, gold is largely holding onto gains from the Thursday session, which owed mostly to weaker USD indices.

- The simple 100-day MA around $1942, has been an important support point in recent weeks. We did break sharply sub this support level earlier in the week, but it wasn't sustained. On the topside, the 50-day MA sits near $1985.

- The downtrend in gold ETF holdings persists from late May highs.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/06/2023 | 0700/0300 |  | US | St. Louis Fed's James Bullard | |

| 16/06/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/06/2023 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 16/06/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 16/06/2023 | 1145/0745 |  | US | Fed Governor Christopher Waller | |

| 16/06/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 16/06/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/06/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/06/2023 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 16/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.