-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: BoJ Rumour Mill Continues To Work Overtime

EXECUTIVE SUMMARY

- ECB DOVES EYE SMALLER HIKES AS INFLATION FALLS (MNI SOURCES)

- ECB’S DE COS SEES ‘SIGNIFICANT’ RATE HIKES AT COMING MEETINGS (BBG)

- BOJ TO REVIEW SIDE-EFFECTS OF MASSIVE EASING AT NEXT WEEK'S MEETING (YOMIURI)

- 'SERIOUSLY DOUBT' IMMINENT INVASION OF TAIWAN BY CHINA -PENTAGON CHIEF (RTRS)

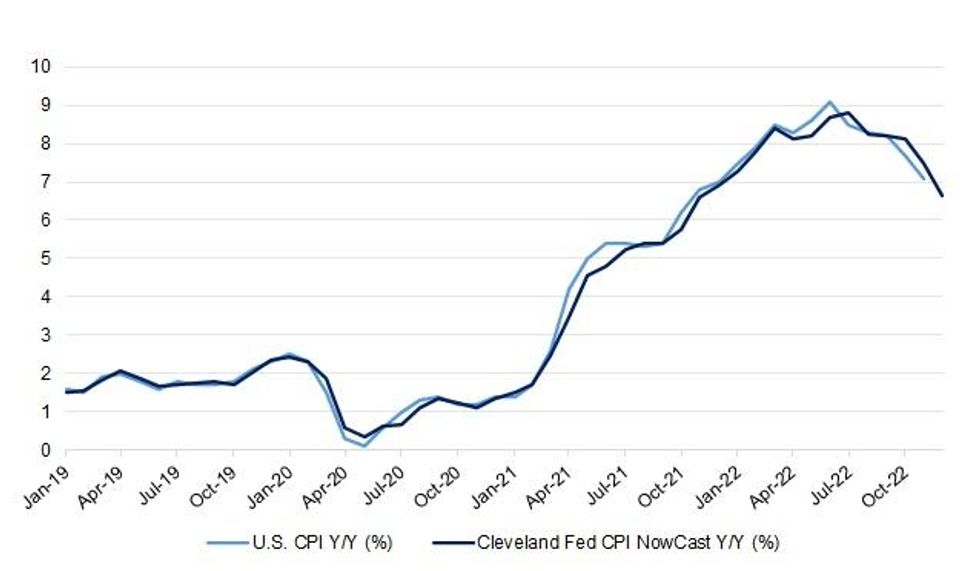

Fig. 1: U.S. CPI Vs. Cleveland Fed CPI NowCast (Y/Y)

Source: MNI - Market News/Bloomberg

UK

ECONOMY/FISCAL/POLITICS: Some 100,000 UK civil servants announced plans to strike next month after health care and rail unions signaled they’re far from resolving their disputes with employers and the government, piling further pressure on Prime Minister Rishi Sunak’s administration. (BBG)

ECONOMY: An increasing number of the UK’s financial services firms expect a rise in loan defaults in the next three months, the latest reminder of a gloomy economic outlook. (BBG)

ECONOMY: More than half of London’s business leaders expect the city’s economy to get worse this year, according to a survey, as companies are squeezed by rising costs and a shortage of workers. (BBG)

PROPERTY: More than 750,000 households are at risk of defaulting on their mortgages over the next two years as soaring borrowing costs make payments unaffordable, Britain's financial regulator has warned. (Telegraph)

EUROPE

ECB: While 50-basis-point rate increases are set to be the starting point for discussion at the next two European Central Bank meetings at least, more dovish officials are prepared to seize on an expected slide in headline inflation from the spring to argue for a slowdown in the pace of tightening, Eurosystem officials told MNI. (MNI)

ECB: The European Central Bank will deliver big increases in borrowing costs at its upcoming meetings, according to Governing Council member Pablo Hernandez De Cos. (BBG)

ECB: Euro-zone banks are expected to return less cheap long-term funding to the European Central Bank this month compared with at their last two opportunities, according to economists. (BBG)

ESM: Italy has indicated it is prepared to push for its parliament to vote a long-delayed ratification of changes to the treaty governing the European Stability Mechanism, unblocking a major reform of the European Union’s financial architecture, sources told MNI after a meeting between Finance Minister Giancarlo Giorgetti and Eurogroup president Paschal Donohoe. (MNI)

SPAIN: Spain wants the European Union to temporarily ease state-aid rules to accelerate investments under the continent-wide recovery fund. (BBG)

U.S.

FED: Susan M. Collins, president of the Federal Reserve Bank of Boston, said she was leaning toward a quarter-point move at the central bank’s Feb. 1 meeting. (New York Times)

FED: The Federal Reserve is likely to further reduce its rate hike pace to a quarter point at its Feb. 1 decision and could be on track to pause rate increases altogether after that as inflation shows further signs of softening, former Fed board economist Claudia Sham told MNI. (MNI)

FED: WSJ Fed reporter Timiraos tweeted the following on Wednesday “Fed research presented at the recent AEA meetings suggests average underlying job growth ran at around 300,000 per month last year, not quite as strong as reported in the monthly BLS payroll reports.” (MNI)

INFLATION: Rent inflation is likely to ease in the December CPI report due Thursday and potentially turn negative by the second quarter of this year, online rental marketplace Apartment List's senior housing economist Chris Salviati told MNI. (MNI)

INFLATION/MARKETS: Traders from New York to Chicago to London will be glued to their screens Thursday morning waiting for the latest consumer price index reading from the Labor Department, which is due at 8:30 a.m. in Washington. In fact, many will be watching trading closely before the numbers even hit — because of what happened last month. (BBG)

INFLATION/MARKETS: A survey conducted by 22V Research showed that 67% of respondents expect core CPI to come in lower than consensus — with 63% betting the report will be “risk-on” for markets. (BBG)

POLITICS: President Biden’s aides found a new batch of classified documents at a second location associated with Mr. Biden, according to a person familiar with the situation — the second disclosure in three days of his retention of government files dating from his vice presidency. (New York Times)

EQUITIES: President Joe Biden called on Republicans and Democrats in Congress to unite and pass legislation that places new guardrails on the tech industry, writing in a Wall Street Journal op-ed Wednesday that the administration’s current authority to rein in Big Tech isn’t enough. (CNBC)

OTHER

U.S./CHINA/TAIWAN: U.S. Defense Secretary Lloyd Austin said on Wednesday he seriously doubted that ramped up Chinese military activities near the Taiwan Strait were a sign of an imminent invasion of the island by Beijing. (RTRS)

U.S./CHINA/TAIWAN: The U.S. and Taiwan intend to focus on five areas this weekend during their first round of negotiations toward a trade agreement and indicated readiness to break out subset deals as the sides make progress, according to U.S. and Taiwan officials. (WSJ)

U.S./JAPAN: The United States and Japan on Wednesday announced stepped-up security cooperation in the face of shared worries about China, and Washington strongly endorsed a major military buildup Tokyo announced last month. (RTRS)

GEOPOLITICS: Chinese business leaders are more optimistic about geopolitical risks in 2023 than their Japanese and South Korean counterparts, a Nikkei survey has found. (Nikkei)

BOJ: The Bank of Japan will review the side-effects of its monetary easing at next week's policy meetings and may take additional steps to correct distortions in the yield curve, the Yomiuri newspaper reported on Thursday. (RTRS)

AUSTRALIA: SEEK Job Ads fell 2.6% in December, its seventh consecutive month of decline, with the level of ads now 21.1% below their May 2022 peak. That represents a rapid normalisation in job advertising with that normalisation most concentrated in Sydney and Melbourne. Overall, the level of job advertising remains elevated, still some 34% above pre-pandemic levels. (NAB)

NEW ZEALAND: Far from being an aberration, the 8.3% drop in November’s job ads proved to be a pretty good pointer to further weakness in December. Job ads fell 6.3% in the final month of 2022. This took the cumulative fall over the last four months to around 20%, based on the seasonally adjusted series. (BNZ)

NEW ZEALAND: New Zealand house sales fell to a record low in the three months through September as a slump in prices spooked buyers. (BBG)

SOUTH KOREA: South Korea will unveil a wide range of measures in the coming months to open wider local financial markets, including plans to extend trading hours on the foreign exchange market, its finance minister said on Thursday. (RTRS)

BOC: The Bank of Canada will lose up to CAD8.8 billion on its QE bond purchase program over the next three years, an unprecedented situation that may undermine its message to the public about bringing inflation back to target, the author of a new study on the issue told MNI on Wednesday. (MNI)

USMCA: Canada and Mexico have won their challenge to the U.S. interpretation of content rules for autos under the new North American trade pact, a dispute panel ruled on Wednesday, a decision that favors parts makers north and south of the U.S. border. (RTRS)

USMCA: Prime Minister Justin Trudeau said he’s optimistic that Canadian companies with complaints about Mexico’s nationalist energy policies can get their issues resolved through meetings with the Mexican government. (BBG)

BRAZIL: The United States has not received any specific requests from Brazil over the storming of Brazil's top institutions in Brasilia by supporters of former President Jair Bolsonaro, U.S. Secretary of State Antony Blinken said on Wednesday. (RTRS)

BRAZIL: U.S. and Brazilian lawmakers are looking for ways to cooperate on an investigation into violent protests that rampaged through Brasilia this weekend, sharing lessons from inquiries into the attack on the U.S. Capitol, people familiar with the talks said. (RTRS)

BRAZIL: Brazil’s Lula Administration intends to postpone an additional minimum wage raise to avoid an extra cost of up to 7.7b reais, reports local newspaper Folha de S.Paulo. (BBG)

RUSSIA: Russian Defense Minister Sergei Shoigu changed the military leadership in Ukraine, appointing Valery Gerasimov, the chief of the General Staff, as head of the nation’s combined forces. (BBG)

RUSSIA: The Royal Navy on Wednesday confirmed it was tracking the movements of a Russian warship armed with missiles, sailing in the North Sea close to Britain. (Evening Standard)

RUSSIA/IRAN: Russian President Vladimir Putin discussed energy and transport projects with Iran's President Ebrahim Raisi in a telephone call on Wednesday, the Kremlin said. (RTRS)

CHILE: Chile’s congress gave its final approval to legislation kicking off a new rewrite of the nation’s constitution as lawmakers seek to turn the page after voters overwhelmingly rejected a prior attempt last year. (BBG)

METALS: Britain's financial watchdog is blocking the restart of London Metal Exchange nickel trade in Asian hours due to doubts about the LME's ability to run an orderly market in that time zone, three sources with knowledge of the matter said. (RTRS)

ENERGY: Top U.S. gas exporter, Freeport LNG, is expected to further extend the seven-month-long outage of its liquefied natural gas (LNG) export plant in Texas to February, as it awaits regulatory approvals, three sources told Reuters on Wednesday. (RTRS)

OIL: Russia’s oil revenues are decreasing because of the price cap put on crude by Western countries, a senior U.S. Treasury official told reporters on Wednesday. (RTRS)

OIL: One of the global oil market’s key swing suppliers is signaling a pickup a demand. West Africa’s sales of crude for loading next month have increased in recent days, according to two traders who specialize in the region’s crude. (BBG)

OIL: Norway's Johan Sverdrup oilfield, the North Sea's largest producer, suffered a partial production outage on Wednesday following a loss of power, a spokesperson for operator Equinor said. (RTRS)

CHINA

CORONAVIRUS: China hasn’t updated its daily Covid reports for three days, adding to global concerns that the information vacuum is masking the true impact of the world’s biggest outbreak. (BBG)

YUAN: Banks in China will be encouraged to carry out overseas yuan loans, lower transaction financing costs, and support the settlement of bulk commodities and trade of all types in the yuan, according to a circular jointly issued by the People’s Bank Of China and Ministry of Commerce. (MNI)

FISCAL: Tax reduction policies in 2023 are expected to focus on promoting R&D and boosting consumption, according to analysts cited by Securities Daily. (MNI)

INFLATION: At a regular press briefing in Beijing on Thursday, China's state planner said that, although international commodity prices might fluctuate and imported inflationary pressures remained, China had full confidence that it could keep prices stable this year. (RTRS)

CHINA MARKETS

PBOC NET INJECTS CNY115 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday conducted CNY65 billion via 7-day reverse repos and CNY 52 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY115 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable before Chinese New Year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0024% at 9:37 am local time from the close of 2.0207% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Wednesday, compared with the close of 58 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7680 THURS VS 6.7756 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 67680 on Thursday, compared with 6.7756 set on Wednesday.

OVERNIGHT DATA

CHINA DEC CPI +1.8% Y/Y; MEDIAN +1.8%; NOV +1.6%

CHINA DEC PPI -0.7% Y/Y; MEDIAN -0.1%; NOV -1.3%

JAPAN NOV BOP CURRENT ACCOUNT BALANCE +Y1.8036TN; MEDIAN +Y481.0BN; OCT -Y64.1BN

JAPAN NOV BOP CURRENT ACCOUNT BALANCE SA +Y1.9185TN; MEDIAN +Y657.5BN; OCT -Y609.4BN

JAPAN NOV BOP TRADE BALANCE -Y1.5378TN; MEDIAN -Y1.6200TN; OCT -Y1.8754TN

JAPAN DEC ECONOMY WATCHERS SURVEY CURRENT 47.9; MEDIAN 47.7; NOV 48.1

JAPAN DEC ECONOMY WATCHERS SURVEY OUTLOOK 47.0; MEDIAN 45.0; NOV 45.1

JAPAN DEC BANK LENDING INCLUDING TRUSTS +2.7%; NOV +2.7%

JAPAN DEC BANK LENDING EXCLUDING TRUSTS +3.0%; NOV +3.0%

AUSTRALIA NOV TRADE BALANCE +A$13.201BN; MEDIAN +A$11.300BN; OCT +A$12.743BN

AUSTRALIA NOV EXPORTS 0% M/M; OCT -1%

AUSTRALIA NOV IMPORTS -1% M/M OCT -2%

NEW ZEALAND NOV BUILDING PERMITS +7.0% M/M; OCT -10.7%

SOUTH KOREA DEC TOTAL BANK LENDING TO HOUSEHOLDS KRW1,058.1TN; NOV KRW1,057.8TN

MARKETS

US TSYS: Richer, CPI In View

TYH3 deals at 114-18, +0-04, 0-04 off the top of its 0-11 range, on volume of ~97K.

- Cash Tsys have bull flattened, dealing 0.5-2.5bp firmer across the major benchmarks.

- Tsys were pressured in early Asia-Pac trade as speculation in the Japanese press re: a review of the side effects of the Bank's ultra-loose policy settings being conducted at next week's monetary policy meeting weighed.

- ACGBs then led a bid, allowing Tsys to turn richer on the day. There was no clear headline catalyst for the richening, with some pointing to softer than expected Chinese PPI data, but the nature of the move didn't back that idea up, in our view.

- TY dealt through Wednesday's high on the move.

- Tsys have ticked away from best levels as we approach the European session, as JGBs came under fresh pressure into the Tokyo close.

- The flow side was highlighted by a block buyer in UXY (908 lots).

- Dec's CPI print headlines the macro docket today (MNI’s preview is here), we also have weekly jobless claims as data as well as Dec real avg earnings. There is Fedspeak from Philadelphia Fed President Harker, St Louis Fed President Bullard and Richmond Fed President Barkin. On the supply side we have the latest 30-Year auction.

JGBS: BoJ Source Reports Weigh, More Than Negating Core Global FI Bid

JGBs were immune to the wider bid that has developed in core global FI markets since the start of Wednesday’s session, with domestic matters dominating the wider impulse.

- The latest Yomiuri source report suggested that the Bank will review the side-effects of its ultra-loose policy settings at next week's monetary policy meeting due to continued skew in market interest rates even after the surprise tweak to YCC in December.

- This continued to fan the flames re: the potential for another BoJ policy tweak, with Bank communication now changed and markets on alert for a wider review of the BoJ’s inflation targeting process in the coming months as BoJ Governor Kuroda’s term comes to an end.

- Futures managed to pull away from early Tokyo lows during the morning, as bears ran out of steam, before a drift lower restarted, leaving the contract just above late session lows into the bell -53, threatening a clean break of key technical support in the form of the mid-June cycle low.

- The early super-long end resilience quickly gave way in the afternoon, with the major benchmarks running flat to 7bp cheaper. The only flat point is 10s, which are capped by the upper boundary of the BoJ’s YCC parameters.

- Payside flows in 7+-Year swaps aided the cheapening.

- Note that the BoJ upped the size of 5- to 10-Year Rinban purchases to the maximum size permitted under its quarterly purchase plan (which met decent selling demand from the market).

- 5-Year JGB supply headlines Friday’s domestic calendar.

AUSSIE BONDS: Notably Firmer, With A Lack Of Meaningful Headline Observed

ACGBs firmed in Sydney dealing, adding to the bid derived from Tsys & EGBs on Wednesday.

- The initial bid came via a bull flattening motion, before the front end played catch up, leaving the major cash ACGB benchmarks 12-13bp richer across the curve, while YM was +13.0 & XM was +12.5 at the close.

- Note that 10-Year ACGBs have now reversed the notable cheapening witnessed since the start of trade on 20 Dec.

- There wasn’t a particular headline catalyst that promoted the two-step move seen in the Sydney session. Asofter than expected round of PPI data out of China was identified by some, but we aren’t necessarily in line with that train of thought, given the nature/timing of the two notable legs observed.

- The market appeared a little skittish ahead of the U.S. CPI release that will cross in NY hours.

- Bills were 5-14bp richer through the reds, bull flattening.

- Local news flow was limited, with a wider than expected monthly trade surplus flattering less than inspiring internals.

- Meanwhile, RBA dated OIS continues to price 20bp of tightening for the Feb ’23 meeting, while terminal cash rate pricing came in to just above 3.75%, in sympathy with moves in ECB pricing on Wednesday and the general bid core global FI (excluding JGBs).

- Looking ahead, housing finance data headlines the domestic docket on Friday, although adjustments to U.S. CPI will dominate any impulse from that data.

NZGBS: Firmer On Global Impetus

The benchmark NZGBs were 13bp richer across the curve come the close of Thursday’s session in what was a parallel shift, shifting firmer in lieu of Wednesday’s move in core global FI markets, before an ACGB-led bid provided fresh legs to the move as the day wore on.

- Swap rates were 10-13bp lower across the curve, moving in sympathy with NZGBs, leaving swap spreads a little wider to unchanged on the day, while the swap curve flattened.

- The major near-term RBNZ dated OIS pricing points were little changed to a touch softer, showing 65bp of tightening for the Feb ’23 meeting, alongside a terminal OCR of just below 5.50%.

- Local headline flow was particularly limited, with a continued pullback in the BNZ/SEEK job advertisements metric probably providing the highlight.

- Looking ahead, the local docket is empty for the remainder of the week, with focus squarely on the U.S. CPI release that will cross in Thursday’s NY session.

EQUITIES: Major Indices Consolidate, Resource Plays Outperform

Major indices have to a large extent consolidated today, ahead of key event risk in the US session with the CPI print. US futures are slightly higher, eminis last near 3995, but unable to crack the 4000 level.

- HK and China mainland stocks are down slightly. The HSI off 0.30%, with tech names underperforming in what looks like profit taking flows after the recent rally.

- The CSI 300 is off by less than -0.10%. Inflation data suggests we may be past the downtrend in price indicators.

- The Kospi is +0.50%, back to mid-Dec highs, with offshore investors continuing to add to local shares. The Taiex is down slightly at -0.20%, despite a TSMC profit beat.

- The ASX 200 is +1.20%, again buoyed by mining related stocks.

- The Philippines bourse is +1.2%, with the BSP Governor hinting of a RRR cut in the first half, which has aided financial names. JCI in Indonesia is also 1% higher, unwinding some of the recent underperformance trend. Higher commodity prices likely helping at the margin.

GOLD: Eyeing Higher Levels

Gold is tracking higher, last near $1884, for a +0.40% gain for the session. We remain below Wednesday session highs near $1887, but dips sub $1870 remain supported. Since the start of the year gold has only had 2 down sessions. Focus remains on upside targets, with $1896.5 (61.8% retrace of the Mar-Sep bear leg) potentially in play if we see a weaker than expected US CPI outcome later.

- Positioning may already be somewhat skewed for a softer outcome though given recent gold trends and USD indices sitting close to recent lows.

OIL: Largely Holding Wednesday's Impressive Gains

Brent crude is not too far away from Wednesday session highs, holding close to $83/bbl currently. We found early selling interest on the move above $83/bbl but oil has largely held onto impressive gains from yesterday's session. Having cleared the 20-day EMA of $81.59, the next upside target is $83.68 (50-day EMA). WTI is just near $77.50 currently.

- The sharp rise in oil inventories, reported in the US session, did little to dampen sentiment. The API data from Tuesday already hinted at the outcome, while weather related disruptions were also reportedly a factor, which may have limited the impact of release.

- Oil may also be playing some catch up to other commodities in terms of renewed optimism around the China demand outlook. Goldman's stated Brent could reach $110/bbl by Q3 if China fully moves away from Covid related restrictions.

- Focus shifts to the US CPI print due later.

FOREX: USD Lagging Ahead Of CPI Print

USD indices remain on the backfoot ahead of the US CPI print due later. The BBDXY index has tested sub 1235, fresh lows since the first half of June 2022, before finding some support. The DXY is near the 103.00 level. JPY gains have been the major driver of dollar underperformance, although AUD is also seeing some outperformance.

- Cross-asset signals are fairly muted, with US equity futures slightly higher (+0.10%), while regional equities mixed. Commodities are mostly holding recent gains. US cash Tsy yields are down, again led at the back end (30y off -2.8bps, 10yr -1.5bps).

- These moves have likely helped yen, although fresh speculation ahead of next week's BoJ meeting is a bigger driver. Early headlines that the central bank would review the side effects of massive monetary policy stimulus aided yen. We currently sit just above lows for the pair, last around 131.45/50 (low was 131.37).

- AUD/USD is holding close to 0.6920, close to recent highs. The Nov trade figures were slightly better than expected from a surplus standpoint. The currency has largely shrugged off waning yield spreads, the 2yr AU-US back out to -106bps.

- NZD/USD is still lagging somewhat, last around 0.6375.

FX OPTIONS: Expiries for Jan12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E1.2bln), $1.0670-90(E3.9bln), $1.0750(E2.4bln), $1.0770-75(E1.5bln)

- USD/JPY: Y140.00($1.3bln)

- AUD/USD: $0.6825($511mln)

- USD/CAD: C$1.2900($1.8bln), C$1.3650($1.4bln), C$1.4000($1.3bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 12/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 12/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/01/2023 | 1330/0830 | *** |  | US | CPI |

| 12/01/2023 | 1345/0845 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 12/01/2023 | 1630/1130 |  | US | St. Louis Fed's James Bullard | |

| 12/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2023 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2023 | 1700/1700 |  | UK | BOE Mann Lecture at University of Manchester | |

| 12/01/2023 | 1740/1240 |  | US | Richmond Fed President Tom Barkin | |

| 12/01/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/01/2023 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.