-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI EUROPEAN OPEN: China Authorities See USD Strength As Unsustainable

EXECUTIVE SUMMARY

- JAPAN Q1 GDP REVISED HIGHER ON STRONGER CAPEX - MNI

- AUSTRALIA THREE-YEAR YIELD RISES TO HIGHEST SINCE 2012- BBG

- UK PROPERTY SURVEYORS TURN MORE POSITIVE DESPITE RISING RATES - BBG

- CHINA’s STATE BANKS CUT DEPOSIT RATES TO BOOST ECONOMY - BBG

- CHINA FOREX REGULATOR SAYS DOLLAR STRENGTH UNSUSTAINABLE - BBG

- CHINA PLANS EXPORT POLICY SUPPORT - NFRA HEAD - MNI

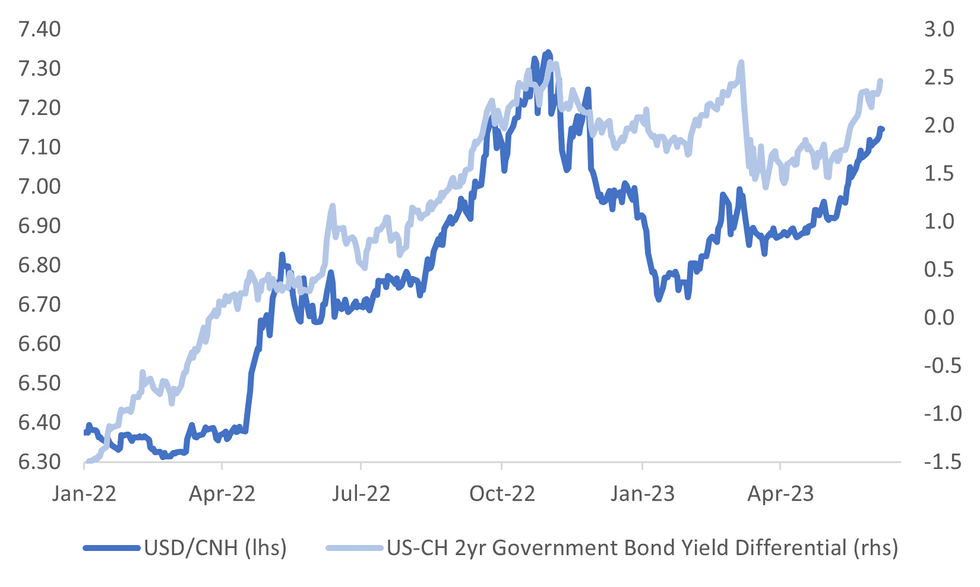

Fig. 1: USD/CNH Versus US-China 2yr Government Bond Yield Differential

Source: MNI - Market News/Bloomberg

U.K.

ECONOMY: UK property surveyors turned more positive about the outlook for house prices despite soaring interest rates that they expect will hurt the ability of buyers to afford purchases. The Royal Institution for Chartered Surveyors said its measures tracking new buyer inquiries, prices and expectations for where the market is heading all were less negative in May than in previous months. (BBG)

U.S.

GEOPOLITICS: US, Taiwan and Japan will share real-time data from naval reconnaissance drones, the Financial Times reports, citing four unidentified people familiar with the project. US defense contractor General Atomics to deliver four MQ-9B Sea Guardian drones to Taiwan beginning in 2025. (FT)

US/CHINA: The US and China have only just started renewing diplomatic exchanges after tensions led to a rupture in communications and the trajectory of any rapprochement remains “uncertain,” the White House’s top Asia official said. “We are still relatively early in the process of this round of re-engagement in terms of dialog and diplomacy,” Kurt Campbell, the White House’s Indo-Pacific coordinator, said at an event hosted by the Center for Strategic and International Studies. The US believes competition will remain the “dominant frame” of the relationship, he said. (BBG)

OTHER

JAPAN: Japan's economy grew 0.7% q/q or 2.7% annualised in Q1, a faster pace than expectations as capital investment revised up from initial estimates, according to second preliminary data released by the Cabinet Office Thursday. The first preliminary estimates had Q1 GDP at 0.4% q/q and 1.6% annualised. In the revised data, capital investment rose 1.4% q/q, revised up from 0.9% in the preliminary release. The positive contribution from capital investments was unrevised at 0.2pp. (MNI)

JAPAN: Bank of Japan watchers have pushed back their forecasts for the timing of policy adjustments after Governor Kazuo Ueda’s repeated signaling of the continued need for monetary stimulus, a Bloomberg survey showed. Only 3 out of 47 polled economists expect a tightening move at a two-day policy meeting ending June 16, sharply down from 18 who flagged action this month in the previous survey in April. Instead of June, July is now seen as the most likely month for a change by just over a third of respondents. (BBG)

JAPAN: Japan is committed to putting economic growth before fiscal reform, Prime Minister Fumio Kishida's government said in its draft mid-year policy framework, while signalling an end to crisis-mode stimulus spending to return to one in "peacetime". (RTRS)

JAPAN: Japanese investors bought the largest amount of French sovereign bonds since July 2019 in April, according to the Asian nation’s latest balance-of-payments data released Thursday. Buying of Australia’s sovereign debt climbed to the highest since April 2021. Japanese funds turned net sellers of US sovereign bonds for the first time since December. (BBG)

AUSTRALIA: The Reserve Bank of Australia (RBA) will hike its key interest rate once more by the end of September to 4.35% following a surprise hike on Tuesday and then hold policy for the rest of the year, according to economists in a snap Reuters poll. (RTRS)

AUSTRALIA: Aussie bonds are having a bad week thanks to surprise hikes by the RBA and the Bank of Canada. Now bond bears will hope next week’s Fed dot plot adds to hawkish surprises, even if the US central bank pauses rates, which it may well. Markets are pricing in just one more Fed hike this year, but the chance of two can not be ruled out. Fed Bank of St. Louis President James Bullard has already mentioned this possibility and it’s unlikely he’s alone. (BBG)

CHINA

YUAN: The strength of US dollar is unsustainable as Fed hiking cycle is nearing an end, Pan Gongsheng, head of State Administration of Foreign Exchange, says at Lujiazui Forum in Shanghai. US economy is likely facing recession, which will support yuan. China has increasingly ample forex policy tools, and the country’s forex market has become more resilient. (BBG)

POLICY: Cuts in banks’ deposit rates, effective today, may pave the way for them to further lower their benchmark Loan Pime Rates (LPR) to reduce funding costs for individuals and businesses, according to a report in the Securities Times Thursday. (SECURITIES TIMES)

BANKS: Some of China’s biggest banks lowered rates on a range of deposit products, responding to the government’s call for help in boosting growth in the world’s second-largest economy. Industrial & Commercial Bank of China Ltd., Agricultural Bank of China Ltd., Bank of China ltd. and Bank of Communications Co. cut rates on three-year and five-year deposits by 15 basis points, respectively, and annualized rates for demand deposits by 5 basis points, according to their websites. The changes, which come into effect Thursday, will also see two-year deposit rates drop by 10 basis points. (BBG)

ECONOMY: Car buyers in China purchased 1.76 million units in May, up 30% y/y and 8% m/m, according to the Passenger Association of China. Within the data, the market for new energy vehicles also expanded, with buyers purchasing 557,000 units, up 55% y/y and 6% m/m. The public increased buying in May following government policies to boost consumption and the resumption of auto-shows, the association said. Major manufacturers sold 16,809 excavators in May, down 18.5% y/y, according to the China Construction Machinery Industry Association. Within the data, domestic buyers purchased 6,592, down 45.9% y/y, while exports totalled 10,217 units up 21% y/y. (Yicai)

EXPORTS: China’s exports will remain depressed for some time following May’s decrease of 7.5%, as the global demand for electronic products remains sluggish, according to the 21st Century Herald. However automobile exporters will continue to sell strongly abroad, with the Passenger Association of China predicting exports will reach 4 million units by the end of 2023 to overtake Japan as the world's largest auto exporter. (21st Century Herald)

EXPORTS: Authorities will improve access to credit and insurance services to help exporters stabilise orders, said Li Yunze, head of the National Financial Regulatory Administration. Li, speaking at the Lu Jia Zui Forum on Thursday, said China’s economy was still recovering but had shown strong resilience. Looking forward, the NFRA will take proactive measures to prevent financial risks and China should remain vigilant following the recent international banking crisis, Li said. (MNI)

CHINA MARKETS

PBOC Injects CNY2 Bln Via OMOs Thurs; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation kept the liquidity unchanged after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9709% at 09:36 am local time from the close of 1.8250% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Wednesday, compared with the close of 47 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1280 THURS VS 7.1196 WED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1280 on Thursday, compared with 7.1196 set on Wednesday.

OVERNIGHT DATA

NZ Q1 MFG ACTIVITY VOLUME Q/Q -2.1%; PRIOR -4.6%

NZ Q1 MFG ACTIVITY SA Q/Q -2.8%; PRIOR -1.0%

UK MAY RICS HOUSE PRICE BALANCE -30%; MEDIAN -39% PRIOR -39%

JAPAN Q1 GDP F SA Q/Q 0.7%; MEDIAN 0.5%; PRIOR 0.4%

JAPAN Q1 GDP F ANNUALIZED SA Q/Q 2.7%; MEDIAN 1.9%; PRIOR 1.6%

JAPAN Q1 GDP F DEFLATOR Y/Y 2.0%; MEDIAN 2.0%; PRIOR 2.0%

JAPAN Q1 PRIVATE CONSUMPTION Q/Q 0.5%; MEDIAN 0.6%; PRIOR 0.6%

JAPAN Q1 BUSINESS SPENDING Q/Q 1.4%; MEDIAN 1.3%; PRIOR 0.9%

JAPAN Q1 INVENTORY CONTRIBUTION % GDP 0.4%; MEDIAN 0.1%; PRIOR 0.1%

JAPAN Q1 NET EXPORTS CONTRIBUTION % GDP -0.3%; MEDIAN -0.3%; PRIOR -0.3%

JAPAN APR TRADE BALANCE BoP BASIS -¥113.1bn; MEDIAN -¥287.9bn; PRIOR -¥454.4bn

JAPAN APR BoP CURRENT ACCOUNT ADJUSTED ¥1899.6bn; MEDIAN ¥1384.4bn; PRIOR ¥1009.0bn

JAPAN APR BANK LENDING INCL TRUSTS Y/Y 3.4%; PRIOR 3.2%

JAPAN APR BANK LENDING EX-TRUSTS Y/Y 3.8%; PRIOR 3.5%

JAPAN MAY TOKYO AVG OFFICE VACANCIES 6.16; PRIOR 6.11

JAPAN ECO WATCHERS SURVEY CURRENT SA 55.0; MEDIAN 55.0; PRIOR 54.6

JAPAN ECO WATCHERS SURVEY OUTLOOK SA 54.4; MEDIAN 56.1; PRIOR 55.7

AU APR EXPORTS M/M -5%; PRIOR 4%

AU APR IMPORTS M/M 2%; PRIOR 4%

AU APR TRADE BALANCE A$11.2bn; MEDIAN A$13.65bn; PRIOR A$14.8bn

MARKETS

US TSYS: Narrow Ranges In Asia

TYU3 deals at 113-04+, -0-02+, with a 0-05 range observed on volume of ~65k.

- Cash tsys sit little changed from opening levels across the major benchmarks.

- Tsys were a touch firmer in early dealing as Asia-Pac participants faded yesterday's cheapening, which was driven by spillover from the Bank of Canada's rate hike, perhaps using the opportunity to close short positions/enter fresh longs.

- Spillover pressure from ACGB's saw tsys retreat from session highs however there was little follow through on the move. Narrow ranges were observed for the remainder of the session and little meaningful macro newsflow crossed.

- FOMC dated OIS price ~9bps hike into next week's meeting with a terminal rate of ~5.30% in July. There are ~25bps of cuts priced for 2023.

- In Europe today the final read of Eurozone GDP and Employment crosses. Further out we have Initial Jobless Claims and Wholesale Trade crosses.

JGBS: Futures Weaker In Afternoon Trade

JGB futures weaken in Tokyo afternoon trade with pricing, -15 compared to settlement levels, after today’s 5-15.5 years until maturity liquidity enhancement auction showed less demand than the previous outing with mixed internals (better spread dynamics but a lower cover ratio).

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Q1 GDP (Final) data, which surprised on the upside.

- JGB futures continue to operate close to recent lows, with 148.48 marking the near-term support. According to MNI's technicals team, the recent bounce off the lows helped stall a more protracted pullback, although the gap with key resistance at 149.17 remains.

- In the afternoon Tokyo session, cash JGBs are trading cheaper across the curve apart from the 1-year and 7-year zone which are respectively 0.4bp and 0.7bp richer. The benchmark 10-year yield is 0.6bp higher at 0.433%. The underperformer on the curve is the 40-year zone which sees its yield 1.3bp higher at 1.462%.

- Swap rates are higher across the curve apart from the 10-year rate, with yield movements ranging from 0.3bp to 2.1bp higher. The 10-year rate is 0.3bp lower. Swap spreads are wider across the curve.

- The local calendar tomorrow is light with M2 & M3 data as the only releases.

- Tomorrow will also see BoJ Rinban operations covering 1-5-year, 5-10-years and 25-year+ JGBs.

AUSSIE BONDS: Sitting Near Cheaps, Light Local Calendar, On US Tsys Watch

ACGBs are sitting cheaper on the day (YM -16.0 & XM -15.0) after April trade data fails to generate a domestic driver. Accordingly, local participants are likely to have been on headlines and US tsys watch through Sydney's afternoon.

- Cash US tsys are sitting slightly richer in Asia-Pac after paring early gains. However, ranges do remain narrow thus far.

- Cash ACGBs are just off session cheaps, 15-16bp weaker, with the AU-US 10-year yield differential 4bp higher at +19bp.

- Swap rates are 15bp higher on the day.

- The bills strip continues to bear steepen with pricing -2 to -18.

- RBA dated OIS is 5-16bp firmer for meetings beyond July, with early ’24 meetings leading.

- Australia’s major cities posted the largest annual rent increase on record in May, fueled by rapid population growth and a significant shortfall in property listings that highlight powerful inflation pressures in the economy, according to CoreLogic data. (link)

- The local calendar is light tomorrow. The next key data is on Tuesday with the release of Westpac Consumer Confidence (June) and NAB Business Confidence (May). Next week’s highlight undoubtedly will be the May Employment Report on Thursday.

- Later today sees Q1 GDP (Final) in the Euro Area, ahead of US Jobless Claims.

NZGBS: Cheaper But Outperforms ACGBs

NZGBs closed on a low note with the benchmarks 11-13bp cheaper and the 2/10 cash curve steeper. Weekly supply sees solid demand (cover ratio above 3.00x) for the Apr-33 and Apr-37 bonds, but a somewhat weaker bid for the May-30 bond (cover ratio at 2.64x). The lines richened around 0.5bp post-auction in line with the broader market.

- NZGBs have shown stronger performance compared to ACGBs, with the NZ/AU 10-year yield differential -4bp. At +59bp, the NZ/AU differential is back near its tightest level since mid-February. The 10-year differential hit a 20-year+ high in March at around +100bp.

- Swap rates closed 11-14bp higher with the 2s10s curve 3bp steeper.

- RBNZ dated OIS pricing closed 6-10bp firmer for meetings beyond October with May’24 leading. Terminal rate expectations sit at 5.64% (October).

- Q1 manufacturing volumes fell 2.1% q/q after -4.6% in Q4. Statistics NZ said that the data has been impacted by recent severe weather events but that it is difficult to isolate that from other special factors. Q1 GDP is published on June 15.

- The local calendar is light tomorrow with Retail Card Spending for May slated for Monday. The highlight of next week, however, will be Q1 GDP on Thursday.

FOREX: USD Edges Lower In Asia

BBDXY is ~0.1% lower in Asia paring some of Wednesday's gains. The Antipodeans and the Yen are all marginally outperforming in the G-10 space at the margins.

- USD/JPY is ~0.2% lower, and sits at session lows. The pair last prints at ¥139.80/90, support comes in at ¥138.45 the low from June 1 and 20-Day EMA. The final read of Q1 GDP printed this morning at 0.7% Q/Q a rise of 0.5% had been expected.

- Kiwi is paring some of Wednesday's losses, NZD/USD is up ~0.2% however the pair has met resistance above $0.6250. Early in the session Q1 Mfg Activity printed at -2.1% Q/Q (volume) and -2.8% Q/Q (sales), there was little reaction in FX markets.

- AUD/USD is also ~0.2% higher, last printing at $0.6660/65. April's Trade Surplus was narrower than expected printing at $11.158bn vs $13.65bn.

- Elsewhere in G-10 ranges have been narrow with little follow through on moves.

- Cross asset wise; e-minis are ~0.1% lower and US Treasury Yields are little changed. WTI futures are marginally lower.

- On the wires today we have the final read of Eurozone GDP and US Initial Jobless Claims.

EQUITIES: Japan Stocks Lose Further Altitude, US Futures Tracking Lower

Equity sentiment has softened throughout the region as the Thursday session progressed, although China markets were more mixed as we heard from a host of regulators at a forum in Shanghai. Japan markets have been among the weakest performers. US equity futures are also tracking lower, with Eminis down 0.25% (last near 4264), while Nasdaq futures have dipped -0.45%, sitting around session lows currently.

- In Japan, the Nikkei 225 is off by around 1% continuing its recent pull back. This has perhaps weighed on US futures moves. Deutsche Bank cut its Japan stock weight to 5% from 25%, amid waning Asia momentum from a strategy standpoint. Mizuho also cut its long term prime rate to 1.3%, effective tomorrow. Tech related plays have been another source of weakness for Japan bourses.

- We heard from a host of China officials, including the head of NFRA and the PBoC Governor. A lot of focus was regulation and reducing financial risks, whilst also encouraging innovation and greater access to foreign firms. They pledged that the financial sector would support the real economy.

- Property equities rebounded from earlier losses, the CSI 300 property index up 1.25% at the break. Li, the head of the NFRA, stated China will push redevelopment of urban villages in big cities. Aggregate China equity indices are more muted though. Earlier we got confirmation of the major bank deposit rate cut.

- The Taiex lost 1% and the Kospi is down 0.65% at this stage.

- SEA markets are mixed.

OIL: Market Demand Worries Outweigh Output Cuts

Oil prices are marginally lower during APAC trading today, as demand worries came to the fore again, but are off their intraday low. Crude is finding some support from mixed US inventory data. The USD has been trending down and is around 0.1% lower, which hasn’t boosted oil prices.

- Crude has been moving in a narrow range. Brent is down 0.3% to around $76.72/bbl, off the low of $76.61. It reached an intraday high of $77 earlier. WTI is also 0.3% lower at $72.34 following a low of $72.23 and a high of $72.61.

- A large increase in US refinery utilisation to the highest since August 2019 drove an unexpected drawdown in US crude inventories. But they remain below the 5-year seasonal average. Refiners are expecting strong demand through the summer. The DOE reported a 1.6% increase in US oil production to a 3-year high.

- The calendar is light over the rest of today with US jobless claims the main release. The ECB has a public holiday, and the Fed is in the blackout period ahead of the June 14 meeting.

GOLD: Back At 3-Month Lows After BoC’s Surprise Hike

Gold is 0.3% higher in the Asia-Pac session, after closing at 1940.02 (-1.2%) on Wednesday as global bond yields surged after a surprise BoC rate hike fueled bets that global central banks are not yet done with tightening.

- Treasury yields rose 8-13bp across major benchmarks and the dollar erased earlier losses on Wednesday after the BoC decision.

- The BoC's 25bp increase brought the policy rate to 4.75% and marked a significant shift in direction, considering rates were left unchanged at the previous two meetings. The decision was attributed to stronger-than-expected GDP growth in Q1, a recent upturn in housing market activity, persistent excess demand in the economy, and a higher-than-anticipated CPI in April. Prior to the announcement, the market had assigned a 45% probability of a 25bp rate hike.

- In recent weeks, the price of the precious metal has remained relatively stable in a range centred on $1,950 per ounce, as investors eagerly await clearer signals regarding the future direction of US monetary policy.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/06/2023 | 0900/1100 | *** |  | EU | GDP (final) |

| 08/06/2023 | 0900/1100 | * |  | EU | Employment |

| 08/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 08/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/06/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 08/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/06/2023 | 1920/1520 |  | CA | BOC Deputy Beadury speech |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.