-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: China Inflation Weaker Than Expected, Factory Price Fall Steepest in 7yrs

EXECUTIVE SUMMARY

- CHINA-US SHOULD SET GREEN WHITELIST - MA - MNI

- CHINA’S FACTORY GATE PRICES FALL AT FASTEST PACE IN 7 YEARS - RTRS

- YELLEN’s CHINA TRIP OFFERS ECONOMIC GUARDRAILS - BBG

- NZ OCR LIKELY TO HOLD AT 5.5% AFTER MAY STEER - MNI RBNZ WATCH

- UK JOBS MARKET COOLS AGAIN, PAY GROWTH WEAKEST SINCE APRIL 2021; REC - RTRS

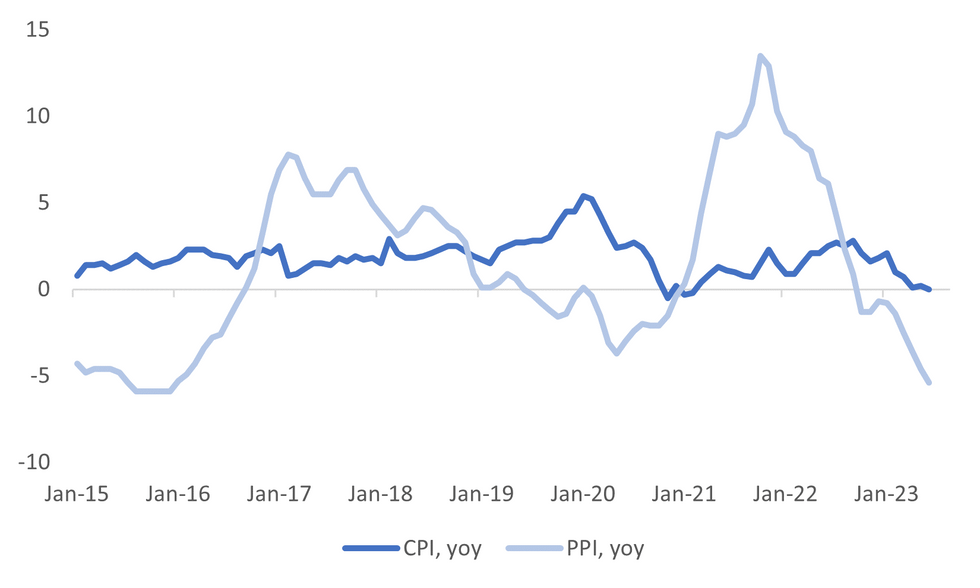

Fig. 1: China CPI and PPI Trending Lower

Source: MNI - Market News/Bloomberg

U.K.

WAGES: Pay pressures in Britain's labour market cooled further in June, according to a survey of recruiters published on Monday that could help ease some of the Bank of England's (BoE) concerns about inflation pressure. (RTRS)

ECONOMY: British companies were the most upbeat about their trading prospects in 10 months in June and their hiring plans increased again but rising interest rates could prompt consumers to rein in spending, according to a survey published on Sunday. (RTRS)

JOBS: The number of job candidates in the UK rose at the fastest pace in 2 1/2 years and wage pressures eased, according to a survey that suggests the red-hot labor market is cooling. The poll of recruiters by KPMG and the Recruitment and Employment Confederation found firms scaling back hiring and increasing redundancies in June due to jitters about the economic outlook, while cost-of-living pressures motivated people to find work. (BBG)

BOE: Bank of England Governor Andrew Bailey rejected the need for an inflation target higher than 2%, warning that changing the goal could damage the bank’s credibility and “unpick expectations.” He told a conference in Aix-en-Provence in France that the BOE can be flexible about timing but that it’s “absolutely critical that that flexibility isn’t confused with people thinking we are not pursing 2% any more.” (BBG)

EUROPE

UKRAINE: Ukrainian troops pressed on with their campaign to recapture Russian-held areas in the southeast on Sunday as President Volodymyr Zelenskiy said in broadcast comments that his country's forces had "taken the initiative" after an earlier slowdown. Russian accounts said heavy fighting gripped areas outside the eastern city of Bakhmut, captured by Russian mercenary Wagner forces in May after months of battles. Chechen leader Ramzan Kadyrov said one of his units was deployed in the area. (RTRS)

UKRAINE: U.S. President Joe Biden arrived in Britain on Sunday, starting a three-nation trip that will be dominated by a NATO summit in Lithuania aimed at showing solidarity with Ukraine in its fight against Russia while not yet accepting Kyiv as a member of the alliance. (RTRS)

SWEDEN: U.S. President Joe Biden expressed a desire to see Sweden join NATO "as soon as possible" in a phone call with Turkish President Tayyip Erdogan in which they discussed Sweden's bid to become a member of the Western alliance, the White House said on Sunday. (RTRS)

ECB: The European Central Bank is nearly finished raising interest rates, but will then keep them at a “high plateau” to ensure they fully impact the economy, Governing Council member Francois Villeroy de Galhau said. The ECB’s record cycle of tightening will bring inflation toward its target of 2% by 2025, the Bank of France governor said. Price growth in France has already passed its peak, slowing to 5.3% from above 7% earlier this year, he added. (BBG)

ECB: European Central Bank Governing Council member Mario Centeno said he’s confident inflation has peaked and is quickly receding, and suggested underlying price growth will follow with a lag. Interviewed on Bloomberg Television in the French city of Aix-en-Provence on Sunday, the Bank of Portugal governor suggested that colleagues shouldn’t doubt that their monetary policy is working. (BBG)

U.S.

US/CHINA: Treasury Secretary Janet Yellen’s two-day engagement with top officials in Beijing offered a way for the US and China to contain damage in their economies from the two nations’ intensifying rivalry. While on the military side, there’s been no resumption of bilateral communication — amid risky encounters between the two sides’ air and maritime forces — Yellen’s high-profile visit suggested hope for guardrails in economic competition. (BBG)

ECONOMY: Treasury Secretary Janet Yellen wouldn’t rule out the threat of a US recession, saying it’s “appropriate and normal” for growth to moderate and that inflation remains too high. The risk of recession is “not completely off the table,” Yellen said in an interview with CBS’s Face the Nation broadcast Sunday. Monthly job growth is slowing as expected after holding at a “high level,” she said from Beijing after meeting with Chinese leaders. (BBG)

OTHER

NZ: The Reserve Bank of New Zealand is set to keep its Official Cash Rate on hold at 5.5% at its July 12 meeting, as inflation and the country’s economy continues to slow. The RBNZ has hiked rates continuously since August 2022, however, the May Monetary Policy Statement noted the OCR had likely peaked when it last decided to increase rates 25bp on 24 May and the economic landscape has only helped solidify that view since. (MNI)

NZ: A majority of nine members of the RBNZ Shadow Board recommend no change in the Official Cash Rate at the July 12 decision given slowing demand, the NZ Institute of Economic Research says in statement. One member recommends a 25 bps increase to 5.75%. (BBG)

AUSTRALIA: Australia’s Trade Minister Don Farrell is traveling to Brussels for talks with European Union counterparts aimed at reaching a free trade accord. Senator Farrell will engage in advance discussions on an agreement and meet the European Commissioner for Trade, Valdis Dombrovskis, as well as the EU Commissioner for Agriculture, Janusz Wojciechowski, according to a statement from the Australian government. (BBG)

HONG KONG: Hong Kong shares of Alibaba Group opened 5.5% higher on Monday after China fined its affiliate, Ant Group, $984 million for violating laws and regulations, fuelling hopes that a years-long regulatory crackdown on the fintech has ended. (RTRS)

CHINA

INFLATION: China's factory-gate prices fell at the fastest pace in over seven-and-a-half years in June, while consumer inflation was at its slowest since 2021, adding to the case for policymakers to use more stimulus to revive sluggish demand. Momentum in China's post-pandemic economic recovery has slowed from a brisk pickup seen in the first quarter amid faltering manufacturing and lacklustre consumer confidence. (RTRS)

INFLATION: Beijing (MNI) - China's Consumer Price Index decelerated at a faster pace than expected, registering 0.0% y/y in June, compared with the 0.2% market consensus and down from May’s 0.2% print, data from the National Bureau of Statistics showed Monday.Food costs increased 2.3% y/y in June, up from May’s 1.0% print, with the prices of vegetables, fruits and poultry mainly rising. Pork prices, the main CPI driver, declined further by 7.2% y/y, compared to a 3.2% fall in May. Service prices increased 0.7% y/y, down from the 0.9% in May, the NBS said. On a monthly basis, CPI fell 0.2% m/m compared to May’s 0.2% decline. (MNI)

POLICY: China’s consumer inflation rate was flat in June while factory-gate prices fell further, fueling concerns about deflation risks and adding to speculation about potential economic stimulus. The consumer price index was unchanged last month from a year earlier — the weakest rate since prices fell in February 2021, according to data released by the National Bureau of Statistics on Monday. (BBG)

US/CHINA: (MNI)Beijing - China and the U.S should introduce a “whitelist” mechanism to protect green investment from sanctions and promote climate collaboration, Ma Jun, former chief economist at the People’s Bank of China, told MNI in an interview. Ma, current president at the Beijing-based Institute of Finance and Sustainability and chairman at the Green Finance Committee of the China Society for Finance and Banking, suggested the two countries take concrete steps to work together on climate, including the creation of a “whitelist” that includes climate-positive activities for bilateral investment, trade and technology cooperation. (MNI)

ECONOMY: China’s economy is on track to achieve its 5% economic growth target despite headwinds in H2, according to the latest Yicai Chief Economist Survey. The participants on average estimated GDP grew 6.97% in Q2 y/y, with CPI for June forecast at 0.18% and PPI down 4.89% y/y. The headline index fell to 50.21 in June, down from 50.27 in May, the fourth consecutive monthly decline, but still above the 50 mark which indicates expansion. The economists said the People’s Bank of China will likely not cut the LPR in July and the yuan will appreciate to CNY6.97 against the U.S. dollar by year's end. (Yicai)

ECONOMY: MNI (Beijing) - China’s small- and medium-sized enterprises reported a slight business sentiment improvement in June, as measures to promote recovery continue to take effect, a leading industry body said Monday.China's SME development index reached 89.1 in June up from May’s 88.9, ending three consecutive months of decline, but remained below the 100 mark which indicates prosperity, according to the China Association of Small and Medium-Sized enterprises. The association said the industrial and construction sectors showed positive trends, offset by declines in the service industry. (MNI)

US/CHINA: China expects the U.S. will take practical actions to stabilise relations after U.S. Treasury Secretary Janet Yellen’s visit to Beijing last week, according to state-owned television network CCTV News in a commentary. The U.S. should remove the tariffs imposed on China as soon as possible, relax export controls and lift sanctions on Chinese companies to create conditions for companies of both countries to expand trade and investment cooperation. Though Yellen said the visit was “direct and productive," CCTV noted Yellen still talked about “national security” and the formulation of “fair” economic rules. This shows differences over improving economic and trade cooperation between the two countries still exists and the U.S. has more to do, CCTV said. (CCTV News)

MARKETS: More than a dozen major mutual fund companies in China cut fees in roughly 1,500 fund products on Monday as regulators started reforming fee practices in the $3.7 trillion industry in an effort to reduce costs to investors. (RTRS)

CHINA MARKETS

PBOC Drains Net CNY3 Bln Via OMOs Monday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Monday, with the rates at 1.90%. The operation has led to a net drain of CNY3 billion after offsetting the maturity of CNY5 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7720% at 09:35 am local time from the close of 1.7632% on Friday.

- The CFETS-NEX money-market sentiment index closed at 45 on Friday, compared with the close of 44 on Thursday.

PBOC Yuan Parity Lower At 7.1926 Monday Vs 7.2054 Friday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1926 on Monday, compared with 7.2054 set on Friday. The fixing was estimated at 7.2122 by BBG survey today.

OVERNIGHT DATA

JAPAN MAY BOP CURRENT ACCOUNT BALANCE ¥1862.4bn; MEDIAN ¥1910.8bn; PRIOR ¥1895.1bn

JAPAN MAY BOP CURRENT ACCOUNT ADJUSTED ¥1702.7bn; MEDIAN ¥1867.8bn; PRIOR ¥1899.6bn

JAPAN TRADE BALANCE BOP BASIS -¥1186.7bn; MEDIAN -¥950.3bn; PRIOR -¥113.1bn

JAPAN JUNE BANK LENDING INCL TRUSTS Y/Y 3.2%; PRIOR 3.4%

JAPAN JUNE BANK LENDING EX-TRUSTS Y/Y 3.5%; PRIOR 3.7%

JAPAN JUNE ECO WATCHERS SURVEY CURRENT SA 53.6; MEDIAN 54.7; PRIOR 55.0

JAPAN JUNE ECO WATCHERS SURVEY OUTLOOK SA 52.8; MEDIAN 54.2; PRIOR 54.4

CHINA JUNE CPI Y/Y 0.0%; MEDIAN 0.2%; PRIOR 0.2%

CHINA JUNE PPI Y/Y -5.4%; MEDIAN -5.0%; PRIOR -4.6%

MARKETS

US TSYS: Narrow Ranges In Asia

TYU3 deals at 110-15+, -0-06, a narrow 0-06 range has persisted on volume of ~65k.

- Cash tsys sit 1bp richer to 1bp cheaper, the curve has twist flattened pivoting on 7s.

- Tsys were pressured in early dealing, there was no overt headline driver as participants perhaps focused on the stronger than expected AHE from Friday's NFP report.

- Losses marginally extended as Chinese inflation was weaker than forecast which weighed on risk sentiment and saw the USD firm off session lows.

- There was little follow through and narrow ranges persisted for the remainder for the session.

- In Europe the docket is thin, further out the final print of May Wholesale Inventories crosses. Fedspeak from VC Barr, SF Fed President Daly, Cleveland Fed President Mester and Atlanta Fed President Bostic is also due.

JGBS: Futures Weaker, At Session Cheaps, 5-Year Supply Tomorrow

In the Tokyo afternoon session, JGB futures are trading on a negative note, -49 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined balance of payments and bank lending data.

- Accordingly, local participants have been on headlines and US tsys watch.

- Tsys have been pressured in recent dealing and sit a touch-off session lows despite weaker-than-expected China CPI data.

- The bear steepening of cash JGBs curve extends in Tokyo afternoon trade in line with the higher and positive spreads seen at today’s BoJ Rinban operations. Yields are 0.4bp lower to 6.4bp higher with the 20-year zone as the underperformer ahead of Thursday's supply. The benchmark 10-year yield is 4.0bp higher at 0.468%, below the BoJ's YCC limit of 0.50%. The benchmark 5-year is 2.0bp cheaper at 0.122%, outperforming on the curve, ahead of tomorrow’s supply.

- Swap rates are higher across the curve with rates 0.2bp to 5.7bp higher. Swap spreads are mixed.

- Tomorrow the local calendar sees M2 & M3 Money Supply (Jun) and Machine Tool Orders (Jun P) along with 5-year supply.

- The global calendar is relatively light today with US Wholesale Inventories and US Consumer Credit as the highlights.

AUSSIE BONDS: Narrow Range, Twist Steepening, Confidence Data Highlights Tomorrow

ACGBs remain mixed (YM +1.0 & XM -2.5) after trading in a relatively narrow range in the Sydney session. In the absence of domestic data, local participants have been on headlines and US tsys watch.

- Tsys have been pressured in Asia-Pac dealing and sit a touch-off session lows. There has been no obvious headline driver for the move.

- Cash ACGBs are 2bp richer to 3bp cheaper with the AU-US 10-year yield differential +1bp at +21bp.

- The swap curve has twist steepened with rates -3bp to +4bp.

- Bills are richer across the strip with pricing +3 to +6, early reds leading.

- RBA dated OIS are 4-8bp softer across meetings beyond October with early to mid'24 leading.

- (AFR) Westpac’s Bill Evans will move on from his role of chief economist from January next year, to be replaced by RBA assistant governor Luci Ellis.

- Tomorrow the local calendar sees CBA Household Spending data for June, Westpac Consumer Sentiment for July, and NAB Business Confidence for June. Additionally, on Wednesday, market attention will be focused on Governor Lowe's speech, as investors hope to gain insights into the central bank's level of concern regarding inflation.

- The global calendar is relatively light today with US Wholesale Inventories and US Consumer Credit as the highlights.

NZGBS: Twist Steepening, 10Y Performs In Line With US Tsys & ACGBs

NZGBs closed with benchmark yields 2bp richer to 4bp cheaper. After opening the local session with a material outperformance versus US Tsys and ACGBs, NZGBs closed with the NZ/US and NZ/AU 10-year yield differentials unchanged.

- The swap curve closed with the rates -2bp to +4bp and the 2s10s curve 6bp steeper.

- The local calendar is light again tomorrow, ahead of the RBNZ policy decision on Wednesday. BBG consensus is unanimous in expecting a no-change outcome after the RBNZ steered the market in its May Monetary Policy Statement that it expected that no further increases in the OCR would be required and that now is the time to “watch, worry and wait”. (See link)

- RBNZ dated OIS pricing closed little changed across meetings. A 14% chance of a 25bp hike is priced for this week’s policy meeting. Terminal OCR expectations are sitting at 5.79%.

- A majority of nine members of the RBNZ Shadow Board recommend no change in the OCR at the July 12 decision given slowing demand, the NZIER says in a statement. One member recommends a 25bp increase to 5.75%. Looking ahead a year, the Shadow Board views centre on an unchanged 5.5% but with a range from 4.5% to 6%. (See link)

FOREX: USD Firms In Asia

The greenback is firmer in Asia, paring some of Friday's post NFP losses. Inflation data from China was weaker than forecast which weighed on risk sentiment in the Asian session, seeing the USD firm from session lows and US equity futures fall from session highs alongside regional equities.

- Kiwi is the weakest performer in the G-10 space, NZD/USD is down ~0.5%. The pair has broken below the $0.62 handle and last prints at $0.6180/85. Bears look to sustain a break of $0.62 to target the 20-Day EMA ($0.6163).

- AUD/USD is also pressured, the pair is down ~0.4% and last prints at $0.6660/65. The pair remains well above support at $0.6596 the low from June 29.

- Yen has also fallen, giving back some of Friday's outperformance. USD/JPY is up ~0.4%, we remain under the ¥143 handle for now, last printing at ¥142.75/85. Resistance comes in at ¥145.07, June 30 high and bull trigger. Support is at ¥142.11, the 20-Day EMA.

- Elsewhere in G-10, EUR is down ~0.1% as the broad based US strength weighs. GBP is down ~0.2%.

- Cross asset wise; e-minis are down ~0.3% and the Hang Seng is up ~0.8% having been up over 2% in early dealing. BBDXY is ~0.2% firmer, and the US Tsy curve is marginally steeper.

- There is a thin docket on Monday, the next macro risk event is on Wednesday when the latest US CPI figures cross.

EQUITIES: Most Regional Markets Tracking Higher, HK/China Shares Down From Early Highs

Regional equities are mixed. The early focus was on HK and China market gains, which were led by the tech sector, on hopes that worst of the tech regulatory crackdown is now behind us. However, gains have been pared as the session progressed. Other markets are mostly higher, with Japan and Australia, NZ, the exceptions. US equity futures are in the red, Eminis last down ~0.15% to be around 4428.

- Eminis bottomed out around the 4422 level in earlier trade, not too far from lows last Thursday around 4420.

- The HS Tech index was up 3.2% at one stage, but now sits up 1.2% at the break, still tracking higher for the first time since last Tuesday. The HSI is +0.78%. Fines for Ant and Tencent are giving hope that the regulatory crackdown on the tech sector is now behind us.

- The CSI 300 was up strongly in early trade, but now sits +0.52% firmer at the break. June inflation data was weaker than expected, underscoring a still soft economic backdrop but raising hopes of fresh stimulus.

- Japan shares are tracking weaker, the Topix -0.50% at this stage, while the Nikkei has lost around 0.70%. The ASX 200 is also weaker, down by 0.25% at this stage.

- SEA stocks are mostly higher, although gains are generally sub 0.50%. Malaysian stocks are slightly outperforming, up 0.60%.

OIL: Edging Down From Recent Highs

Brent crude has edged away from recent highs as Monday's Asia Pac session has progressed. We were last just under $78.00/bbl. Against highs just above $78.50/bbl from late in NY dealing on Friday. This puts Brent 0.64% lower for the session so far. However, this is unwinding only a modest proportion of Friday's +2.55% gain. WTI was last around $73.35/bbl off by a similar amount for the session so far (-0.69%).

- Weaker oil levels are in line with a firmer USD during the course of the session so far, whilst risk aversion has also been evident in terms of weaker US equity futures.

- Lower than expected China inflation outcomes have also likely weighed at the margin, in terms of painting a less supportive China outlook.

- Still, we are only modestly off recent highs, and Brent remains comfortably above the 20 and 50-day EMAs at this stage. The 100-day EMA (around $78.40/bbl) remains a resistance point on the topside.

GOLD: Higher As Attention Turns To Wednesday's US CPI Data

Gold is slightly weaker in the Asia-Pac session, after closing +0.7% at $1926.05 on Friday, boosted by a weaker USD following the US payrolls report.

- Non-farm payrolls increased 209k which was marginally less than the 225k expected but there were large downward revisions of 110k to previous months. US tsys gapped higher initially after the data dropped but reversed support as attention turned to the unemployment rate falling back to 3.6%, from 3.7% in May, and wage growth printing stronger than expected, rising 4.4% on an annual basis.

- Traders are currently anticipating the release of inflation data scheduled for Wednesday, which will greatly influence expectations regarding the next actions of the Federal Reserve.

- According to forecasts, the inflation report is expected to reveal a 3.1% increase in the CPI compared to the previous year, marking the smallest rise since March 2021. This is primarily attributed to the decrease in gasoline prices. Core CPI, excluding volatile items, is predicted to show a year-on-year increase of 5.0%, slightly lower than the previous reading of 5.3%.

- Despite these figures, the majority of traders still anticipate another interest rate hike by the Fed later this month, which could reduce the attractiveness of non-interest-bearing gold.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/07/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 10/07/2023 | - | *** |  | CN | Money Supply |

| 10/07/2023 | - | *** |  | CN | New Loans |

| 10/07/2023 | - | *** |  | CN | Social Financing |

| 10/07/2023 | 1230/0830 | * |  | CA | Building Permits |

| 10/07/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/07/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 10/07/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/07/2023 | 1500/1100 |  | US | Cleveland Fed's Loretta Mester | |

| 10/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 10/07/2023 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 10/07/2023 | 1900/1500 | * |  | US | Consumer Credit |

| 10/07/2023 | 1900/2000 |  | UK | BOE Bailey Speech at Financial & Professional Services Dinner |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.