-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Riksbank Dec Cut On If Things Hold - Jansson

MNI EUROPEAN OPEN: Chinese Inflation Misses, U.S. CPI Eyed

EXECUTIVE SUMMARY

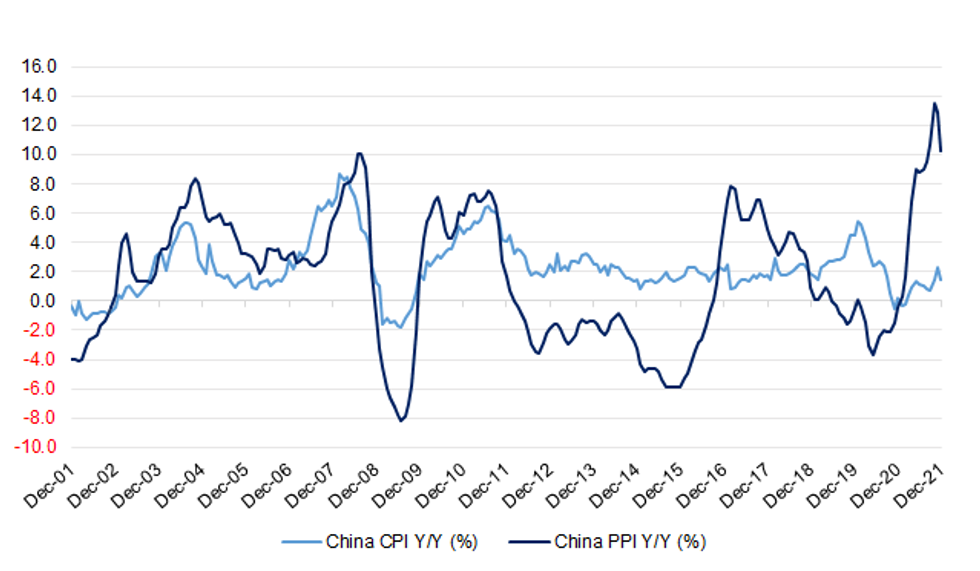

- CHINESE CPI & PPI PROVIDE DOWNSIDE SURPRISE, LIFTING PROSPECT OF PBOC EASING

- HEADLINE & MARKET FLOW THINS OUT AHEAD OF U.S. CPI

Fig. 1: China CPI & PPI Y/Y (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: UK households have suffered the sharpest fall in the amount of cash they have available to spend for almost eight years, amid a worsening cost of living crisis driven by high inflation and rising energy bills. According to a report by the insurer Scottish Widows, increasing living costs at the end of last year hit people’s pockets and led to the steepest decline in cash availability since the start of 2014. It said people were increasingly pessimistic about their future finances in 2022, according to the latest reading from its quarterly household finance index. The poll of 1,500 individuals, compiled by Ipsos Mori and IHS Markit on behalf of the insurer, found that pressure intensified on savings and disposable income in the final months of 2021, with both declining quicker than at anytime in over the past seven years. (Guardian)

ECONOMY: Senior professionals can expect pay increases of up to 25% in the first quarter of 2022, as the economy begins to open up following the lifting of Omicron-related restrictions and companies fight to hold on to their best staff. Experienced staff with salaries of £80,000 and above across a wide range of disciplines from marketing to finance and IT are already beginning to enjoy rises of £20,000 a year or more, according to recruitment firm Robert Walters. The hunt for talent also extends further down the pay scales as professional services companies budget for an increase in their wage bill of between 10% and 15% – the largest increase seen since 2008 and almost three times the inflation rate, the recruiter said in its 2022 UK Salary Guide. (Guardian)

POLITICS: "We should get rid of him…. We should own the situation. We are the Tory party. We are not delivering good governance." That stinging verdict from a Conservative MP does not, at least not yet, seem to represent the consensus among the party's ranks on what to do about the current situation in Downing Street. But the goodwill-to-all-men moment the Christmas holidays promised is very much over. The subject of conversation among Tories on Tuesday was not the government's planned menu of policy fare for the week, but whether or not the moment had arrived when Boris Johnson, election-winner, had become Boris Johnson, discredited liability. Whether or not, in the words of that senior MP, the party should "get rid of him". (BBC)

POLITICS: Boris Johnson must resign if he broke lockdown rules, Tory politicians warned on Tuesday as support for the Prime Minister ebbed away over new Downing Street party allegations. A poll found that 66 per cent of voters want Mr Johnson to quit after it emerged that a Number 10 garden party had been organised in May 2020 – at the height of the first lockdown. Prominent Conservatives said it was "appalling" and "utterly indefensible" that the event took place, while Douglas Ross, the Scottish Tory leader, said Mr Johnson should quit if he broke the rules or misled Parliament. (Telegraph)

POLITICS: Boris Johnson has been urged by ministers and Tory MPs to apologise for a party in the Downing Street garden during the first lockdown at which he is said to have “gladhanded” guests. Johnson and Carrie Symonds, his fiancée at the time, are both said to have attended the event in May 2020 and mingled with 40 Downing Street officials and advisers as people drank wine, gin and beer. The Times has been told that one member of the government at the party joked about being caught breaking lockdown rules, asking how it would look if a drone photographed the garden. At the time people in England could meet only one other person outside and large gatherings were banned. (The Times)

EUROPE

FRANCE: France’s economic recovery is proving almost immune to disruption from the wave of omicron infections and is set to get extra support as supply constraints start to ease, according the central bank’s monthly business report. Activity in the euro area’s second largest economy will stabilize in January at 0.75% above pre-pandemic levels, based on results of the survey of 8,500 firms that was conducted just as the daily count of Covid cases hit record highs. Supply snarls are becoming less of an issue with fewer business leaders in both industry and construction reporting an impact on their operations.(BBG)

U.S.

FED: MNI BRIEF: Fed Boards Say Rate Hikes Warranted Soon - Minutes

- A number of directors at the Federal Reserve's 12 regional banks said in early December it might soon become appropriate to begin a process of removing policy accommodation, minutes from the discussion of the discount rate showed on Tuesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Pat Toomey, the top Republican on the Senate Banking Committee, said he has “serious concerns” about the possible nomination of former Fed governor Sarah Bloom Raskin as vice chair of supervision at the Federal Reserve. “Sarah Bloom Raskin has specifically called for the Fed to pressure banks to choke off credit to traditional energy companies and to exclude those employers from any Fed emergency lending facilities,” Toomey said in a statement to Bloomberg News. “I have serious concerns that, if nominated, she would abuse the Fed’s narrow statutory mandates on monetary policy to have the central bank actively engaged in capital allocation. Such actions not only threaten both the Fed’s independence and effectiveness, but would also weaken economic growth.” (BBG)

ECONOMY: Psaki reiterates the administration’s expectation that inflation will come down this year: “We expect month-over-month inflation to moderate in the months ahead, and forecasters generally expect the year-over-year measures to come down to more historically typical levels by the end of the year.” (BBG)

CORONAVIRUS: The omicron-fueled Covid surge in New York appears to be “cresting over that peak” as the rate of increase slows, New York Governor Kathy Hochul said. The percentage of New Yorkers that tested positive has dropped to 18.6% from more than 22% in recent days. In New York City, Covid rates are “plateauing,” while upstate figures are tracking behind the city by a couple of weeks, Hochul said in a virus briefing. (BBG)

CORONAVIRUS: A “limited public health emergency” has been declared in D.C. until Jan. 26. “This will allow DC Health to modify procedures, deadlines, and standards authorized during the declared emergency. By declaring a public health emergency, the District and healthcare partners can continue to respond expeditiously and safely to COVID-19 and its ongoing and changing impacts,” a statement from Mayor Muriel Bowser’s office said. The District joins Maryland and Virginia, both of which have declared a 30-day state of emergency to combat the growing number of hospitalizations driven by the spike in COVID-19 cases. (WTOP)

OTHER

GLOBAL TRADE: China's Huawei Technologies is aggressively ramping up its chip packaging capabilities to lessen the impact of a U.S. clampdown that has cut the company's access to vital semiconductor production technologies, sources briefed on the matter told Nikkei Asia. (Nikkei)

JAPAN: NHK's latest poll shows the Cabinet of Prime Minister Kishida Fumio has an approval rating of 57 percent, up 7 percentage points from the previous survey last month. The disapproval rating stands at 20 percent, down 6 points. (NHK)

BOJ: MNI BRIEF: BOJ Kuroda Reiterates Consumer Prices Up As A Trend

- Bank of Japan Governor Haruhiko Kuroda on Wednesday said consumer prices are picking up gradually as a trend and reiterated the outlook for Japan's economic recovery at a quarterly branch managers' meeting - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australia’s Covid case numbers continue to surge but deaths and hospitalization rates are gaining much more slowly than overall infections, as omicron becomes the dominant variant. Omicron represents about 90% of cases in New South Wales state, Chief Health Officer Kerry Chant told reporters Wednesday, the remainder being delta variant. Omicron is now responsible for about 67% of Covid-19 cases in intensive care units across the state, she said. On Tuesday, there were 90,847 new cases reported in Australia, according to covidlive.com.au, though the real number in the community could be much higher owing to strain on the testing system. That’s 33 times higher than the 2,752 cases reported at the peak of the delta wave on Oct. 14, 2021. (BBG)

NEW ZEALAND: Statistics NZ publishes filled-jobs data for November (BBG). Seasonally adjusted filled jobs rise 0.4% from October. Series has increased for 10 straight months. (BBG)

NORTH KOREA: North Korea said Wednesday it has successfully conducted the final test-firing of a new hypersonic missile a day earlier, as it continues to develop new weapons systems amid stalled nuclear negotiations with the United States. On Tuesday, South Korea's defense ministry said the North fired what appeared to be a ballistic missile into the East Sea which flew over 700 kilometers at a maximum altitude of 60 km and a top speed of Mach 10, or 10 times the speed of sound. "The test-fire was aimed at the final verification of overall technical specifications of the developed hypersonic weapon system," the Korean Central News Agency (KCNA) said. (Yonhap)

NORTH KOREA: North Korean leader Kim Jong Un called for boosting the country's strategic military forces as he observed the test of a hypersonic missile, state media said on Wednesday, officially attending a missile launch for the first time in nearly two years. After watching the test, Kim urged military scientists to "further accelerate the efforts to steadily build up the country's strategic military muscle both in quality and quantity and further modernize the army," KCNA news agency reported. (RTRS)

CANADA: MNI INTERVIEW: Omicron Underpins Canada Price Pressures - CFIB

- Recent restrictions triggered by the spread of the Omicron variant will keep record wage and price inflation at elevated levels in coming months, and those pressures will likely be reflected in the late January Canadian Federation of Independent Business "Barometer," according to the analyst behind the influential survey - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: Brazil’s central bank signaled inflation will end 2022 above target while saying a “significantly restrictive” cycle of interest rate hikes will help pull cost of living increases below 5%. Inflation is converging to target over the relevant time horizon, which includes 2022 and 2023, bank chief Roberto Campos Neto wrote in a letter published on Tuesday. “In this scenario, in 2022 inflation remains above target but within the tolerance range given the inertial factors seen in 2021,” he wrote.(BBG)

IRAN: Iran and world powers are still far from any agreement to revive their 2015 nuclear deal despite making some progress at the end of December, France's foreign minister said on Tuesday. "The discussions are ongoing. They are slow, too slow and that creates a gap that jeopardises the chance of finding a solution that respects the interests of all sides," Jean-Yves le Drian told a parliamentary hearing. (RTRS)

OIL: U.S. crude oil output is expected to rise 610,000 barrels per day to 12.41 million bpd in 2023, the government said in its first forecast for next year. U.S. gasoline demand is expected to rise 90,000 bpd to 9.15 million bpd in 2023, according to the same monthly report from the Energy Information Administration. Total U.S. oil demand is expected to rise 330,000 bpd to 20.92 million barrels in 2023, the report said. (RTRS)

OIL: Haitham al-Ghais tells Energy Intelligence that he will make cooperation with the group's non-Opec allies beyond 2022 a key priority in order to preserve oil market stability. "I believe the more imminent objective is very clear: It is to preserve the market balance, the state of the market and the health of the market," he told Energy Intelligence Tuesday in his first media interview since being elected earlier this month. "I think this is critical for all of us and also for the wider global economy, to be honest with you, especially coming out of the pandemic," said al-Ghais, who will take over as Opec secretary-general on Aug. 1. (Energy Intelligence)

CHINA

YUAN: The Chinese yuan is expected to further strengthen and exceed 6.3 against the U.S. dollar this year, despite the prospect of U.S. interest rate hikes, should China’s exports continue to perform, the 21st Century Business Herald reported citing traders. The yuan is relatively stable at 6.37 against the dollar, despite that the China-U.S. interest rate spread had narrowed to 106 bps, the least since 2021. Regulators should tame be on guard and prevent excessive bets on the yuan gaining, the newspaper said citing Guan Tao, a former FX regulatory official. (MNI)

ECONOMY: China’s Q4 GDP may have slowed to about 4% from 4.9% in the previous quarter, rounding out whole-year growth to 8%, Yicai.com reported citing analysts. The average forecast for fixed-asset investment growth in 2021 is 5.29%, among which real estate investment may slow to 5.71% with new projects and home sales dropping significantly amid tight regulations on funding and land supply, the newspaper said. The robust exports helped offset sluggish domestic demand, it said. The increase in imports and exports in 2021 will be about USD1.3 trillion, equivalent to the total increase in the past 10 years, the newspaper said. China releases 2021 GDP data on Monday. (MNI)

ECONOMY: China’s economic development recovered to pre-pandemic levels last year, with GDP expansion expected at more than 8%, China Securities Journal reports, citing Zhang Liqun, a researcher at the Development Research Center of the State Council. Fully unleashing economic growth potential and maintaining a reasonable rate of expansion would be China’s focus in the future, Zhang said. GDP growth in 1Q 2022 is expected to be 5.7%, the CSJ reported, citing Li Chao, chief economist at Zheshang Securities. (BBG)

POLICY: China's State Council introduced a new set of policies to boost exports, including improving export credit insurance to help small and medium exporters offset the risk of order cancellations, increase lending and accelerate export tax rebates, the Shanghai Securities News reported. Regulators will keep the yuan basically stable, enhance enterprises’ ability to hedge against forex risks, and actively promote cross-border trade settlement using yuan, the newspaper said. (MNI)

CORONAVIRUS: Tianjin government will launch a second round of mass Covid-19 testing in the city from Jan. 12, according to a Weibo post of Xinhua News Agency. People in Tianjin are expected to stay at home until they receive negative test results. 77 positive cases have been detected from the first round of mass testing as the city continues to process collected samples. (BBG)

CORONAVIRUS: Vice Premier Sun Chunlan called on authorities in Henan province in central China to adopt more targeted measures to curb Covid after virus flareups there in recent days, the official Xinhua News Agency reported late Tuesday. Sun told officials to speed up epidemiological surveys, screening and quarantine, saying local epidemic control was still at “a crucial stage”. (BBG)

OVERNIGHT DATA

CHINA DEC PPI +10.3% Y/Y; MEDIAN +11.3%; NOV +12.9%

CHINA DEC CPI +1.5% Y/Y; MEDIAN +1.7%; NOV +2.3%

JAPAN DEC BANK LENDING INCL TRUSTS +0.6% Y/Y; NOV +0.6%

JAPAN DEC BANK LENDING EX-TRUSTS +0.5% Y/Y; NOV +0.5%

JAPAN NOV BOP CURRENT ACCOUNT BALANCE +Y897.3BN; MEDIAN +Y589.8BN; OCT +Y1.180.1TN

JAPAN NOV BOP CURRENT ACCOUNT BALANCE ADJ +Y1.369.5TN; MEDIAN +Y1.052.7TN; OCT +Y1.025.9TN

JAPAN NOV TRADE BALANCE BOP -Y432.3BN; MEDIAN -Y650.5BN; OCT +Y166.7BN

JAPAN DEC ECO WATCHERS SURVEY CURRENT 56.4; MEDIAN 56.0; NOV 56.3

JAPAN DEC ECO WATCHERS SURVEY OUTLOOK 49.4; MEDIAN 52.0; NOV 53.4

AUSTRALIA NOV JOB VACANCIES +18.5% Q/Q; OCT -9.7%

NEW ZEALAND DEC ANZ COMMODITY PRICE INDEX -0.2% M/M; NOV +2.8%

The ANZ World Commodity Price Index eased 0.2% in December, as stronger prices for dairy, meat and aluminium were not sufficient to offset lower returns from the forestry and horticultural sectors. The index still finished the year up 24% y/y. In local currency terms, the index gained 3.1%, to extend its record high, bolstered by a 2.8% reduction in the trade weighted index (TWI). (ANZ)

SOUTH KOREA NOV MONEY SUPPLY L +1.0% M/M; OCT +0.7%

SOUTH KOREA NOV MONEY SUPPLY M2 +1.1% M/M; OCT +1.1%

SOUTH KOREA DEC UNEMPLOYMENT 3.8%; MEDIAN 3.2%; NOV 3.1%

CHINA MARKETS

PBOC INJECTS CNY10 BILIION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday.

- This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1832% at 09:35 am local time from the close of 2.0938% on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3658 WEDS VS 6.3684 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3658 on Wednesday, compared with 6.3684 set on Tuesday.

MARKETS

SNAPSHOT: Chinese Inflation Misses, U.S. CPI Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 545.06 points at 28767.54

- ASX 200 up 48.775 points at 7438.9

- Shanghai Comp. up 22.792 points at 3590.305

- JGB 10-Yr future up 29 ticks at 151.05, yield down 2.8bp at 0.126%

- Aussie 10-Yr future up 4.5 ticks at 98.120, yield down 4.3bp at 1.851%

- U.S. 10-Yr future +0-04 at 128-16+, yield down 0.89bp at 1.727%

- WTI crude up $0.19 at $81.42, Gold down $0.47 at $1821.14

- USD/JPY up 2 pips at Y115.32

- CHINESE CPI & PPI PROVIDE DOWNSIDE SURPRISE, LIFTING PROSPECT OF PBOC EASING

- HEADLINE & MARKET FLOW THINS OUT AHEAD OF U.S. CPI

BONDS: JGB Futures Pop, Core FI Limited Elsewhere Ahead Of U.S. CPI

Core FI markets struggled to find much in the way of clear impetus during Asia-Pac hours, with focus on the impending U.S. CPI release. Chinese inflation data provided a downside miss. As we noted ahead of that dataset, a decrease in inflationary pressures leaves more room for policy easing (with Beijing already tipping their hat towards more pro-growth policy moves in recent months), but that didn’t do much for the space.

- TYH2 struggled to make headway above Tuesday’s high, last dealing +0-04 at 128-16+, while cash Tsys run within -/+0.5bp of Tuesday’s closing levels. The aforementioned CPI release headlines the NY docket on Wednesday, with average hourly earnings also due. Supply comes in the form of 10-Year Tsys, while Fedspeak from Minneapolis Fed President Kashkari (’23 voter, dove) also on the slate.

- JGB futures popped higher, with nothing in the way of overt catalysts observed (a reminder that speculation surrounding the potential for CTA a/c selling weighed on futures on Tuesday). The contract reclaimed the 151.00 level, finishing +29. Futures were in the driving seat when it came to cash JGB trade, with 7s outperforming, as benchmark JGBs printed little changed to ~3.0bp richer across the curve. 5-Year JGB supply wasn’t the firmest in recent history. The cover ratio slipped to print at the lowest level witnessed at a 5-Year JGB auction since May ’21, comfortably below the 6-auction average, although the price tail only experienced an incremental widening, holding tight. The low price met broader dealer expectations. BoJ Governor Kuroda stuck to the well-worn script in his latest address, while the BoJ upgraded its economic assessment of all nine of the Japanese geographical regions that it covers.

- Aussie bond futures seemed to benefit from the bid in JGBs and a solid round of ACGB supply. In terms of specifics, the latest ACGB Nov ’32 auction passed smoothly enough, with the weighted average yield printing 0.42bp through prevailing mids (per Yieldbroker), while the cover ratio was comfortably above 3.50x. YM +2.5 & XM +4.5 come the close, with a limited round of Sydney trade noted.

JGBS AUCTION: Japanese MOF sells Y2.0257tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0257tn 5-Year JGBs:

- Average Yield -0.041% (prev. -0.086%)

- Average Price 100.23 (prev. 100.44)

- High Yield: -0.037% (prev. -0.084%)

- Low Price 100.21 (prev. 100.43)

- % Allotted At High Yield: 73.6701% (prev. 85.6453%)

- Bid/Cover: 3.336x (prev. 3.626x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 1.8898% (prev. 1.9690%)

- High Yield: 1.8925% (prev. 1.9700%)

- Bid/Cover: 3.6550x (prev. 3.3900x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 4.9% (prev. 89.0%)

- Bidders 48 (prev. 45), successful 26 (prev. 17), allocated in full 15 (prev. 7)

EQUITIES: Powell & Chinese Inflation Support Stocks

The positive lead from Wall St. provided upside impetus for the major regional Asia-Pac equity indices, while weaker than expected inflation data out of China provided another leg of support, as the dataset lifted the prospect of deeper monetary easing from the PBoC.,

- •Chinese tech benefitted from Tuesday’s outperformance in the NASDAQ, which was a product of the stabilisation/downtick in U.S. Tsy yields. This allowed the Hang Seng to outperform its major regional counterparts, adding a little over 2.0% as of typing.

- U.S. e-mini futures were little changed, consolidating Tuesday’s rally which came on the back of Fed Chair Powell’s failure to introduce any fresh, meaningful hawkish information in his latest testimony on the hill.

GOLD: Rangebound Ahead Of U.S. CPI

Tuesday’s downtick in U.S. real yields & the DXY supported bullion, with spot subsequently dealing little changed around the $1,820/oz mark during Asia-Pac hours.

- A reminder that the technical bull channel and recent range remain well and truly in play, with key resistance located at the Jan 3 high ($1,831.9/oz).

- Note that ETF holdings of gold are off the recent trough, but only incrementally so.

- The latest U.S. CPI release, due later today, provides the most notable immediate risk event for participants to digest.

OIL: Crude Little Changed In Asia

WTI and Brent crude futures are essentially unchanged vs. Tuesday’s settlement levels as of typing, after a brief look above Tuesday’s high during Asia hours. A reminder that a lack of fresh, meaningful hawkish inferences from Fed Chair Powell supported broader risk assets during the second half of NY trade on Tuesday, as the major oil benchmarks added the best part of $3.00 apiece.

- •Reports pointed to a smaller than expected drawdown in headline crude stocks in the latest round of API inventory estimates, which was coupled with a drawdown in stocks at the Cushing hub. Meanwhile, gasoline stocks saw a far sharper than expected build, per the same reports. Distillate stocks rounded off the report, experiencing a slightly wider than expected build. The net impact of the report was marginally bearish when it came to the immediate reaction in crude prices, with the builds on the product side dominating the drawdowns outlined above.

- •Weekly DoE inventory data out of the U.S provides the focal point for participants on Wednesday.

FOREX: Sentiment Stays Buoyant With Inflation Musings Front And Centre

The yen extended losses in muted Asia-Pac trade amid a broadly positive showing from regional equity markets, with participants digesting Tuesday's congressional testimony from Fed Chair Powell. Oil-tied CAD and NOK were in demand, building on yesterday's strength, even as crude prices stabilised.

- Market sentiment was further buoyed by Chinese data, which showed that inflation (both CPI and PPI) slowed more than expected into the year-end, opening up space for local policymakers to take more stimulatory steps. Spot USD/CNH fell to a one-week low in reaction to the release.

- The DXY showed at its lowest point since Nov 30, as selling pressure hit the greenback ahead of the release of U.S. CPI. The data will inform the ongoing discussion about the most likely Fed policy tightening path.

- While U.S. inflation data will certainly take centre stage today, it is worth noting that there are speeches coming up from Fed's Kashkari & BoE's Cunliffe.

FOREX OPTIONS: Expiries for Jan12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1275-85(E618mln), $1.1300-05(E2.4bln), $1.1400(E542mln)

- USD/JPY: Y112.90-10($784mln), Y113.50-70($1.2bln), Y115.50($638mln), Y116.00-05($750mln)

- GBP/USD: $1.3595-00(Gbp797mln)

- EUR/GBP: Gbp0.8494-00(E1.2bln)

- USD/CAD: C$1.2690($1.0bln), C$1.2750-60($1.2bln), C$1.2790($1.8bln)

- USD/CNY: Cny6.4500($1.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2022 | 1000/1100 | ** |  | EU | Industrial Production |

| 12/01/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/01/2022 | 1330/0830 | *** |  | US | CPI |

| 12/01/2022 | 1415/1415 |  | UK | BOE Cunliffe at Crypto Fin Conference | |

| 12/01/2022 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/01/2022 | 1630/1130 | * |  | US | US Treasury Cash Management Bill Auction Result |

| 12/01/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2022 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2022 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2022 | 1800/1300 | ** |  | US | US 10 Year Treasury Auction Result |

| 12/01/2022 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/01/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 12/01/2022 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.