-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: Markets Coil In Asia, Catalyst Required, NFP Eyed

- A lack of meaningful headline flow and the proximity to Friday's NFP report made for a limited round of Asia-Pac trade.

- Chinese regulatory matters and speculation surrounding PBoC liquidity provisions provided the focal points.

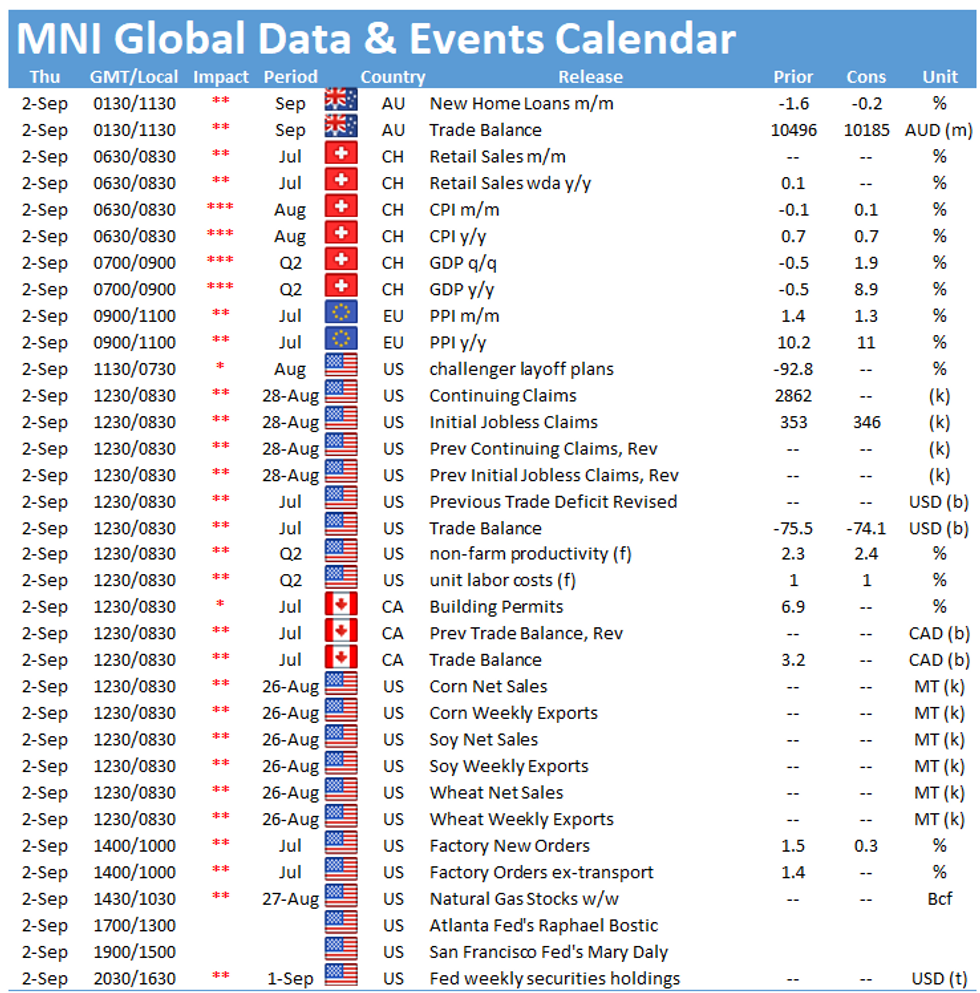

- Weekly jobless claims data out of the U.S. and central bank speak from Fed's Bostic & Daly as well as Riksbank's Floden & Ingves will hit on Thursday.

BOND SUMMARY: Familiar Themes In Play Across The Board In Asian Hours

T-Notes have stuck to the 0-02+ range that was established early on in Asia, last dealing +0-00+ at 133-15, while cash Tsys trade little changed to ~1.0bp cheaper on the day. Asia-Pac hours have been light on both macro headlines and broader market flow, leaving participants on the sidelines. Weekly jobless claims data, challenger job cuts and final durable goods data will hit during NY hours. Elsewhere, we will hear from Fed's Bostic & Daly, while the Tsy will make its mid-month supply announcement. Broader focus remains on Friday's NFP release.

- JGB futures failed to build on their overnight gains, last +2 vs. settlement, a little shy of overnight closing levels. The major cash JGB benchmarks sit little changed to 1.0bp richer after catching up to the overnight move in futures/U.S. Tsys. Swaps generally lagged JGBs, resulting in some very modest swap spread widening from 5-Years to further out the curve. Domestic news flow has seen the political sabre rattling continue. Elsewhere, BoJ dovish dissenter Kataoka reiterated his well-known stance re: a requirement for deeper monetary easing. The latest round of 10-Year JGB supply saw the low price match broader dealer exp. (per the BBG poll), while the price tail narrowed incrementally vs. the prev. auction and the cover ratio held steady, a touch above the 6-auction average (3.26x). A reminder that several desks suggested that 10s lacked any true outright appeal under the current market regime ahead of supply.

- Aussie bond futures have settled into a narrow range after the impetus from the early Sydney uptick faded, with YM +1.5 and XM +4.0 at typing, while the broader cash ACGB curve saw the 10- to 15-Year sector of the curve outperform. The space has looked through the latest round of local data releases, with July's trade balance registering a record surplus, while the broad headline housing finance print provided a surprise, albeit modest, uptick. Local COVID case numbers haven't had any impact on the space, with vaccinations & a new living with COVID mentality at the fore for policymakers in recent weeks. Finally, ANZ became the latest notable name to outline their expectations for the RBA to delay its tapering move come the end of next week's monetary policy decision.

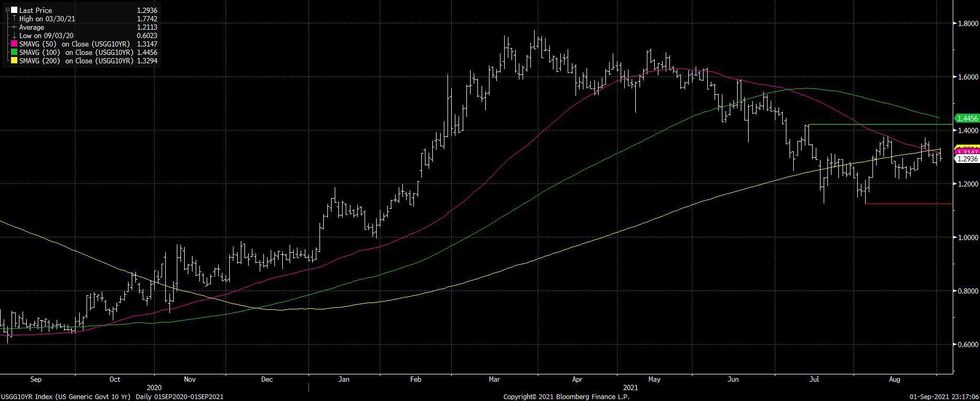

US TSYS: Death Cross Formed In 10-Year Yields

10-Year Tsy yields have crossed the 200-DMA on several occasions in recent weeks, watering down its importance as a technical indicator. Still, 10s held below the metric (in yields terms) on a closing basis on Wednesday, with the fixed income benchmark hovering around the middle of its summer range. We should also point out the formation of a death cross in recent days, with the 50-DMA crossing below the 200-DMA, a potentially bearish technical signal for yields.

- Looking ahead, BMO have noted that "in terms of the implications for U.S. rates coming out of Friday's jobs numbers and into the September FOMC, we're apprehensive that the August payrolls data holds the needed weight to inspire a break of the top of the trading range in 10-Year yields at 1.42%. Even the 1 million jobs added in July's release was only enough to bring 10s to 1.378% in an environment defined by hiring plans that did not yet reflect variant uncertainty and delayed return to office plans. There will eventually come a time when yields are higher and the curve is steeper - but that will need to be a function on the passage of time and ongoing progress in undoing the pandemic's damage."

Fig. 1: U.S. 10-Year Tsy Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

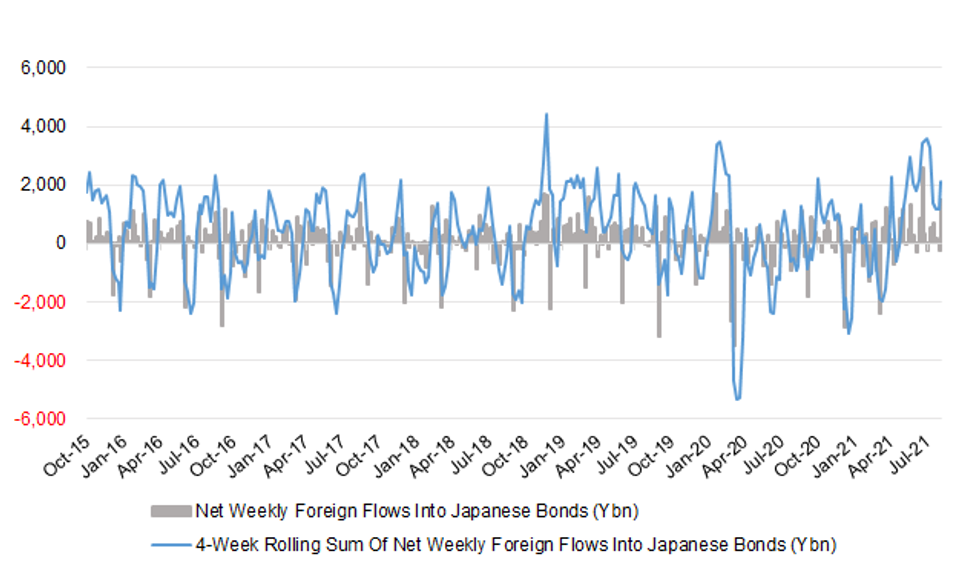

JAPAN: Foreigners Register Large Weekly Net Purchase Of Japanese Paper

Bond flows dominated the latest weekly round of Japanese international security flow data, with near enough neutral net equity flows observed.

- Japanese investors registered a 2nd consecutive week of net foreign bond sales, but it was foreign flows surrounding Japanese bonds that caught the eye. Foreign investors net purchased ~Y1.48tn of Japanese bonds last week, a level only topped in 5 weeks over the past 5 years.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -545.5 | -182.5 | -1171.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -42.6 | 55.9 | 542.0 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1480.7 | -225.2 | 2098.8 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 25.3 | -550.2 | -220.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Fig. 1: Net Weekly Foreign Flows Into Japanese Bonds (Ybn)

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Caution Seen In Muted Asia-Pac Trade

Defensive feel dominated in muted Asia-Pac trade, as participants prepared for Friday's NFP report out of the U.S. Risk aversion applied a modicum of pressure to commodity-tied FX amid softer crude oil prices.

- USD/CNH crept higher but remained within the confines of yesterday's range. The PBOC set their central USD/CNY mid-point at CNY6.4594, 10 pips above sell-side estimate.

- The data calendar is fairly U.S.-centric today, weekly jobless claims, factory orders & durable goods orders will grab attention. Comments are due from Fed's Bostic & Daly as well as Riksbank's Floden & Ingves.

FOREX OPTIONS: Expiries for Sep02 NY cut 1000ET (Source DTCC)

- USD/JPY: Y109.50-70($897mln)

- USD/CAD: C$1.2600($560mln), C$1.2640-50($556mln)

- USD/CNY: Cny6.4570($960mln)

ASIA FX: Mixed

A mixed day for Asia EM currencies amid uncertain risk sentiment with markets in a holding pattern ahead of US NFP data on Friday.

- CNH: Offshore yuan slightly weaker, USD/CNH crept higher but remained within the confines of yesterday's range. The PBOC set their central USD/CNY mid-point at CNY6.4594, 10 pips above sell-side estimate.

- SGD: Singapore dollar slightly weaker, but USD/SGD still within yesterday's range. Markets look ahead to PMI data which is expected to slow to 50.9 in August from 51.0 in July.

- KRW: Won is weaker, shrugging off higher than expected CPI and GDP data. On the coronavirus front there were 1,961 new cases in the past 24 hours, down from 2,025 yesterday.

- TWD: Taiwan dollar is stronger again, on track for a fourth straight session of lower closes with the rate rising just once in the past nine sessions. The first batch of BioNTech's COVID-19 vaccine arrived in Taiwan on Thursday.

- MYR: Ringgit is weaker, Health Min Khairy told reporters that the government have set up an expert committee, who are looking into the need for giving booster Covid-19 jabs.

- IDR: Rupiah rose slightly, Indonesia has reached a milestone of administering 100mn doses of Covid-19 vaccines, albeit this means that just 23% of the country's population have received at least one dose so far.

- PHP: Peso is stronger, Davao City Mayor Sara Duterte revealed that two senators, Bong Go and Sherwin Gatchalian, have personally offered to be her running mate in the 2022 presidential election. She also denied her father's recent claim that Senator Imee Marcos wanted to become her VP.

- THB: Baht is weaker, the parliamentary censure debate resumes today ahead of no-confidence votes slated for Saturday. There has been speculation about an alleged plot to unseat PM Prayuth.

ASIA RATES: South Korea Short End Bid After CPI Target Overshoot

- INDIA: Yields lower in early trade, bonds are expected to find support today, tracking a move in US tsys and as oil continues its decline. Oil is under pressure after Russian oil min Novak said the country could raise oil output above the OPEC+. The OPEC+ group agreed to go ahead with the planned 400k bpd increase scheduled for October, wagering that the spread of the delta variant won't derail demand.

- SOUTH KOREA: Futures are mixed, 10-Year future slightly higher tracking a move in US tsys overnight, while the 3-Year has come under pressure after an overshoot in August CPI inflation which has led to increased speculation of a steeper rate hike path for the BoK. CPI rose faster than expected, the Y/Y August print coming in at 2.6%, in line with the July figure but faster than the 2.4% expected. The core Y/Y print came in at 1.8% against 1.6% expected and 1.7% last time out. The annual reading puts inflation over the BoK's 2% target for the fifth straight month, the BoK expected 2.1% inflation for 2021.

- CHINA: The PBOC drained another CNY 40bn of liquidity via OMO's today, totaling a withdrawal of CNY 80bn in September so far of the CNY 200bn added heading into August month-end. Overnight repo rate up 43bps after plunging into yesterday's close, at 2.075% the rate is below highs of over 2.40% seen in August. The overnight and the 7-day repo rates remain inverted with the latter hovering around 2.0243%. Futures are lower, the 10-Year dropping after a 41 tick rise in the wake of weak PMI data yesterday. At these levels the 10-Year is still just shy of its contract high with renewed speculation of another RRR cut.

- INDONESIA: Yields lower, curve sees some bear flattening. Indonesia has reached a milestone of administering 100mn doses of Covid-19 vaccines, albeit this means that just 23% of the country's population have received at least one dose so far. Elsewhere Bank Indonesia issued a macroprudential inclusive financing rule which is designed to boost loan disbursement toward micro and SME's. As a reminder data yesterday showed CPI rose broadly inline with estimates at 1.59% in August, up from 1.52% in July.

EQUITIES: Subdued

Equity markets moved in narrow ranges in Asia, following a broadly flat finish in the US as markets await US NFP data on Friday. The Hang Seng has seen small gains, buoyed by another record finish for the Nasdaq and a continued rebound in Chinese tech stocks. Markets in mainland China have seen small gains, helped by the PBOC's announcement that it will provide CNY 300bn of low-cost funding to banks to spur lending to SME's. In the US futures are marginally lower, treading water ahead of US labour market data on Friday, Alphabet dropped in after market trading after reports that the US Justice Department is preparing a second antitrust lawsuit.

GOLD: Trading The Range

Bullion traded either side of unchanged on Wednesday, with the broader USD and our weighted U.S. real yield monitor nudging lower on the day. Still, participants lacked any real conviction ahead of Friday's U.S. NFP print, even as the ADP employment reading markedly missed expectations (triggering the usual round of debate re: the short-term correlation between the ADP & NFP readings). That means spot is virtually where it was 24 hours ago, last dealing just shy of $1,815/oz, with the technical overlay unchanged.

OIL: Remains Under Pressure After OPEC+ & Inventory Data

Crude futures are lower in Asia-Pac trade on Thursday, adding to Wednesday's losses. After a positive start to the session, WTI and Brent crude futures dipped into negative territory shortly after US trade, with Russia's Novak quoted in IFX as saying the country could raise oil output above the OPEC+ quotas -pressing WTI futures to new weekly lows just above $67/bbl support before recovering some of the losses. . The OPEC+ group agreed to go ahead with the planned 400k bpd increase scheduled for October, wagering that the spread of the delta variant won't derail demand. The downside persisted headed into the weekly DoE crude oil inventories numbers, which showed a far larger draw on headline stockpiles than expected, with a drawdown of over 7mln bbls - twice that of expectations.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.