-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese PMIs Pressured By COVID Spread

EXECUTIVE SUMMARY

- BULLARD REPEATS CALL FOR FED HIKES, LOOKS FOR RETURN TO NORMAL

- BOE’S BAILEY: SIGNS RECRUITMENT PRESSURES EASING (MNI)

- CHINA ENLISTS ALIBABA, TENCENT TO OVERCOME US CHIP SANCTIONS (FT)

- CHINESE PMIS REVEAL FASTER THAN EXPECTED RATE OF CONTRACTION

- HALF OF CHINA FIRMS HAD COVID CASES THIS MONTH, BEIGE BOOKS SAYS (BBG)

- OPEC+ VIRTUAL MEETING SIGNALS LITTLE LIKELIHOOD OF POLICY CHANGE AHEAD OF RUSSIAN OIL PRICE CAP DECISION (RTRS SOURCE)

- EU INCHES TOWARDS DEAL ON RUSSIAN OIL PRICE CAP THIS WEEK (RTRS)

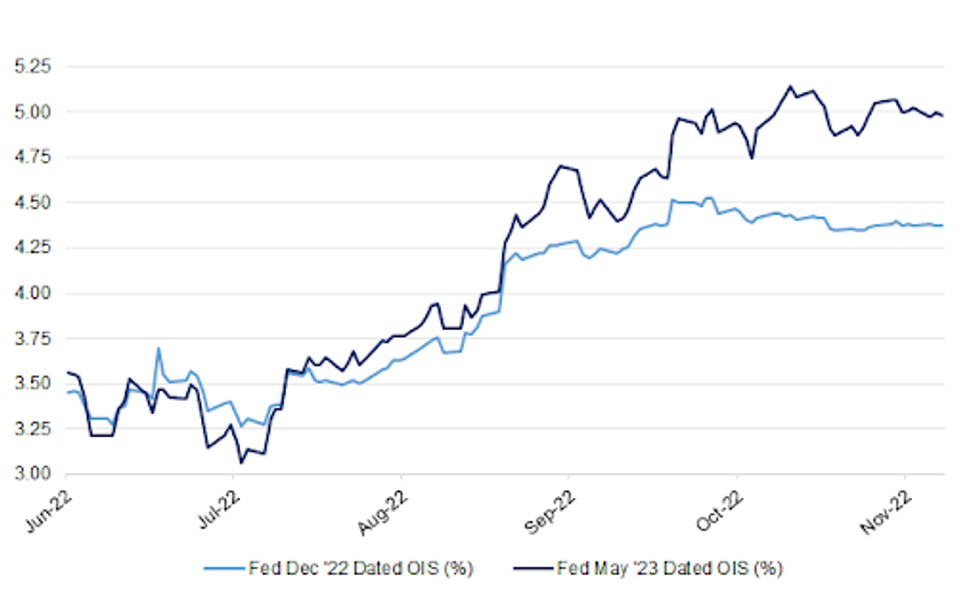

Fig. 1: Fed Dec ‘22 & May ‘23 Dated OIS

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Governor Andrew Bailey told the House of Lords Economic Affairs Committee that "our expectation is there will be more to do" on rate hikes but that he saw signs of labour market pressures easing. (MNI)

FISCAL/ENERGY: More energy suppliers could go bust this winter potentially taking government payments intended for customers with them, the chief executive of British Gas owner Centrica has warned. (Sky)

BANKS: Britain is poised to relax one of the biggest restrictions on the banking sector as part of “Big Bang 2.0”, the long promised liberalisation of post-Brexit financial services rules. (FT)

EUROPE

FISCAL: The European Commission is expected to approve Hungary’s EUR5.8 billion NextGenerationEU plan Wednesday but also maintain its proposal to European leaders to freeze EUR7.5 billion of the country’s cohesion funds, MNI understands. (MNI)

SNB: Swiss National Bank Vice President Martin Schlegel hinted his institution will raise borrowing costs again next month, highlighting the need to fight strong consumer-price growth. (BBG)

NORWAY: A deal between Norway's minority cabinet and a left-wing party to pass through the 2023 fiscal budget through parliament will not hike the state's spending from the country's wealth fund, Prime Minister Jonas Gahr Stoere told reporters on Tuesday. (RTRS)

U.S.

FED: Federal Reserve Bank of St. Louis President James Bullard repeated his call for additional interest-rate hikes to a level that will restrict economic growth, which he said sets the stage for a return to more ordinary monetary policy in 2023. (BBG)

FED: Directors at three of the Federal Reserve's 12 regional banks supported a smaller increase in a key emergency borrowing rate than the 75-basis point rate hike the U.S. central bank ultimately approved in early November, minutes of Fed discount rate meetings showed on Tuesday. (RTRS)

ECONOMY: The U.S. is likely to see continued strong wage pressures even if an economic slowdown raises unemployment over the next year, barring a recovery in labor force participation closer to pre-Covid levels, Yale University professor and visiting scholar at the Federal Reserve Bank of Philadelphia Giuseppe Moscarini told MNI. (MNI)

ECONOMY: Congress is poised to end the threat of a rail strike after President Biden called on lawmakers to force through a tentative contract agreement that some railroad workers rejected. (The Hill)

POLITICS: U.S. President Joe Biden's public approval rating rose to 40% this week, boosted by increased support within his Democratic Party, according to a Reuters/Ipsos poll finished on Tuesday. (RTRS)

POLITICS: Georgia’s early-voter turnout is accelerating in the high-profile Senate runoff race between Democratic Sen. Raphael Warnock and Trump-backed Republican Herschel Walker — even after voters already crushed the state’s in-person record for early voting the previous day. (CNBC)

POLITICS: The chairman of the House select committee investigating the January 6, 2021, attack on the US Capitol said Tuesday that the panel is “close to putting pens down” on its final report, which is slated for release by the end of this Congress. (CNN)

PROPERTY: The federal government is about to backstop mortgages of more than $1 million for the first time in high-cost markets, such as parts of California and New York. (WSJ)

EQUITIES: Apple Inc. Chief Executive Officer Tim Cook is in Washington to meet with top Republican lawmakers, according to people familiar with his visit, as the company seeks to forge ties with the GOP ahead of the party’s takeover of the House early next year. (BBG)

OTHER

GLOBAL TRADE: China has recruited Alibaba and Tencent to help its efforts in designing semiconductor chips as it prepares for further US-led sanctions, the Financial Times reports. (BBG)

GEOPOLITICS: Japan’s self defense forces scrambled jets after detected two Chinese bombers and two planes suspected to belong to Russia this morning, Kyodo reports, citing the defense ministry. (BBG)

RBA: Rising interest rates are impacting Australia’s securitization markets by reducing the performance of home loans, the underlying collateral for residential mortgage-backed securities, a senior Reserve Bank official said. (BBG)

RBNZ: New Zealand’s central bank doesn’t support changing its Monetary Policy Remit to specify a time-frame within which it should return inflation to target, arguing potential costs overshadow possible benefits. (BBG)

SOUTH KOREA: Rate hikes by the US Federal Reserve are significantly increasing the cost of capital for South Korea’s startups, elevating the chance many may face bankruptcy in coming months, according to the nation’s Minister for SMEs and Startups. (BBG)

HONG KONG: Hedge fund speculators do not understand how Hong Kong’s currency board system works and will lose money trying to break the peg, Hong Kong Monetary Authority chief executive Eddie Yue told a Legislative Council panel on Wednesday. (MNI)

BRAZIL: Brazilian President-elect Luiz Inacio Lula da Silva is expected to tap former Sao Paulo Mayor Fernando Haddad in coming days to be his finance minister, people familiar with the deliberations told Reuters on Tuesday. (RTRS)

BRAZIL: Brazilian central bank director Diogo Guillen stressed on Tuesday that markets are more sensitive to fiscal news and that fiscal developments enter into policymakers' decisions through the balance of risks for inflation. (RTRS)

RUSSIA: Ukraine President Volodymyr Zelenskiy on Tuesday said that the situation at the frontline remains difficult, with Russian forces attempting to advance in the Donbas region and Kharkiv. (RTRS)

RUSSIA: Former Russian President Dmitry Medvedev warned NATO on Tuesday against providing Ukraine with Patriot missile defence systems, denouncing the alliance as a "criminal entity" for delivering arms to what he called "extremist regimes". (RTRS)

EQUITIES: The global economy needs to find a more solid footing before most stock markets to break out of their torpor, according to market strategists polled by Reuters who have broadly cut their 2023 forecasts compared with three months ago. (RTRS)

ENERGY: Norway will not issue licences for energy companies to explore for oil and gas in frontier areas during the life of the current parliament, which ends in 2025, its oil and energy minister told Reuters on Tuesday. (RTRS)

OIL: The Opec and Opec+ ministerial meetings that were to take place in person in Vienna this coming weekend will be held online, according to six Opec+ sources. (Argus Media)

OIL: The OPEC+ decision to hold its Dec. 4 meeting virtually signals little likelihood of a policy change, a source with direct knowledge of the matter told Reuters on Wednesday. (RTRS)

OIL: OPEC and other big oil producers are likely to decide to keep output levels flat at their meeting Sunday, the group’s delegates said, amid mounting concerns over returning Covid-related lockdowns in China and lingering uncertainty over Russia’s ability to pump. (WSJ)

OIL: Iraq to increase oil output by 250,000 b/d in 2H next year to reach 3.6 million b/d, state-run Iraq News Agency reported, citing SOMO official Mohammed Saadoon. (BBG)

OIL: European Union countries are inching towards a deal this week on a price cap on Russian oil, a way to adjust the cap in future, and on linking it to a package of new sanctions against Moscow over its invasion of Ukraine, diplomats said on Tuesday. (RTRS)

OIL: “Restricting” Vladimir Putin’s profits while still ensuring Russian crude reaches the market and provides adequate supply is a “delicate balance,” said US energy security adviser Amos Hochstein told David Westin on "Balance of Power." He also spoke about OPEC+ possibly cutting production and he says he expects gas prices to keep coming down. (BBG)

OIL: Chevron Corp. is preparing to make its first shipment of Venezuelan crude to the US by late December under a license issued by the Biden administration, according to a person familiar with the matter. (BBG)

OIL: U.S. Energy Security Advisor Amos Hochstein said on Tuesday that the White House would look to refill the nation’s Strategic Petroleum Reserves when oil prices were “consistently” at $70 per barrel, Bloomberg said. (Oil Price)

CHINA

CORONAVIRUS: Health commission at Shanghai’s Huangpu district requires its affiliates to stockpile anti-Covid materials that can be used for at least 60 days, Caixin reports, citing a notice from the commission Tuesday. (BBG)

CORONAVIRUS/ECONOMY: The coronavirus is rapidly spreading across China and hitting production further, with more than half of firms reporting a case among their employees this month, according to a new survey. (BBG)

ECONOMY: The ongoing COVID-19 pandemic and problems in China's real estate sector pose continued risks to China's economy, the head of the International Monetary Fund said on Tuesday, adding that the fund may have to revise its growth projection downwards. (RTRS)

ECONOMY: China is accelerating the start of new infrastructure projects, with the growth in infrastructure investment expected to reach about 12% this year, Yicai.com reported citing Wang Qing, chief macro analyst with Golden Credit Rating. (MNI)

ECONOMY/YUAN: China needs to ensure a strong domestic economy, improve financial supervision, and reform institutional opening-up to promote the long-term international use of the yuan, reports Shanghai Securities News citing Guan Tao, a former senior State Administration of Foreign Exchange official (MNI)

PROPERTY: China’s move to lift a ban on equity refinancing for listed real estate firms will help ease developers’ cash flow pressures without increasing their debt burden, with high-quality leading private developers and state-owned developers capable of mergers and acquisitions likely to be the main beneficiaries, 21st Century Business Herald reported citing Chen Mengjie, analyst of Yuekai Securities. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY168 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY170 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY168 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8956% at 9:27 am local time from the close of 1.8788% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Tuesday vs 50 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1769 WEDS VS 7.1989 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1769 on Wednesday, compared with 7.1989 set on Tuesday.

OVERNIGHT DATA

CHINA NOV OFFICIAL MANUFACTURING PMI 48.0; MEDIAN 49.0; OCT 49.2

CHINA NOV OFFICIAL NON-MANUFACTURING PMI 46.7; MEDIAN 48.0; OCT 48.7

CHINA NOV OFFICIAL COMPOSITE PMI 47.1; OCT 49.0

JAPAN OCT, P INDUSTRIAL PRODUCTION -2.6% M/M; MEDIAN -1.8%; SEP -1.7%

JAPAN OCT, P INDUSTRIAL PRODUCTION +3.7% Y/Y; MEDIAN +5.1%; SEP +9.6%

JAPAN OCT HOUSING STARTS -1.8% Y/Y; MEDIAN -1.0%; SEP +1.1%

JAPAN OCT ANNUALISED HOUSING STARTS 0.871MN; MEDIAN 0.866MN; SEP 0.858MN

AUSTRALIA OCT CPI +6.9% Y/Y; MEDIAN +7.6%; SEP +7.3%

AUSTRALIA OCT TRIMMED MEAN CPI +5.3% Y/Y; MEDIAN +5.7%; SEP +5.4%

AUSTRALIA Q3 COMPLETED CONSTRUCTION WORK +2.2%; MEDIAN +1.5%; Q2 -2.0%

AUSTRALIA OCT BUILDING APPROVALS -6.0% M/M; MEDIAN -2.0%; SEP -8.1%

AUSTRALIA PRIVATE SECTOR CREDIT +0.6% M/M; MEDIAN +0.6%; SEP +0.7%

AUSTRALIA PRIVATE SECTOR CREDIT +9.5% Y/Y; MEDIAN +9.5%; SEP +9.4%

NEW ZEALAND NOV ANZ BUSINESS CONFIDENCE -57.1; OCT -42.7

NEW ZEALAND NOV ANZ BUSINESS ACTIVITY OUTLOOK -13.7; OCT -2.5

Business confidence fell 14 points in November to -57, while expected own activity fell 11 points to -14, only 8 points shy of 2009 lows. Activity indicators fell. Residential construction intentions tanked. Employment intentions were negative for the first time since Oct 2020. Inflation pressures remain intense, though pricing intentions eased. (ANZ)

NEW ZEALAND OCT BUILDING PERMITS -10.7% M/M; SEP +3.6%

SOUTH KOREA OCT INDUSTRIAL PRODUCTION -3.5% M/M; MEDIAN -1.0%; SEP -1.9%

SOUTH KOREA OCT INDUSTRIAL PRODUCTION -1.1% Y/Y; MEDIAN +0.1%; SEP +0.7%

SOUTH KOREA OCT CYCLICAL LEADING INDEX -0.1 PT M/M; SEP -0.1

UK NOV BRC SHOP PRICE INDEX +7.4% Y/Y; OCT 6.6%

UK NOV LLOYDS BUSINESS BAROMETER 10; OCT 15

MARKETS

SNAPSHOT: Chinese PMIs Pressured By COVID Spread

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 93.86 points at 27934.65

- ASX 200 up 30.891 points at 7284.2

- Shanghai Comp. up 1.464 points at 3150.986

- JGB 10-Yr future up 2 ticks at 148.80, yield up 0.1bp at 0.254%

- Aussie 10-Yr future up 7.0 ticks at 96.465, yield down 7.3bp at 3.531%

- U.S. 10-Yr future up 0-05 at 113-04+, yield down 2.04bp at 3.7237%

- WTI crude up $0.89 at $79.09, Gold up $5.26 at $1755.17

- USD/JPY down 12 pips at Y138.50

- BULLARD REPEATS CALL FOR FED HIKES, LOOKS FOR RETURN TO NORMAL

- BOE’S BAILEY: SIGNS RECRUITMENT PRESSURES EASING (MNI)

- CHINA ENLISTS ALIBABA, TENCENT TO OVERCOME US CHIP SANCTIONS (FT)

- CHINESE PMIS REVEAL FASTER THAN EXPECTED RATE OF CONTRACTION

- HALF OF CHINA FIRMS HAD COVID CASES THIS MONTH, BEIGE BOOKS SAYS (BBG)

- OPEC+ VIRTUAL MEETING SIGNALS LITTLE LIKELIHOOD OF POLICY CHANGE AHEAD OF RUSSIAN OIL PRICE CAP DECISION (RTRS SOURCE)

- EU INCHES TOWARDS DEAL ON RUSSIAN OIL PRICE CAP THIS WEEK (RTRS)

US TSYS: Powell Headlines Busy Docket

TYH3 deals 113-00 +0-01 in early trade, a touch above levels seen in late NY trading.

- Cash treasuries bear steepened on Tuesday, running 4-8bp cheaper at the bell. 2s10s inversion continues to ease after printing a fresh cycle extreme last week, now dealing at -72bp.

- Tsys rallied ahead of NY trade on softer than expected CPI data out of Europe, before unwinding gains as the German harmonsied CPI measure was more stubborn than the state CPI readings suggested.

- An active IG issuance slate, punctuated by a multi-tranche deal from Amazon, also weighed.

- Fedspeak from Bullard repeated his call for additional interest rate hikes to a level that will restrict economic growth, setting the stage for a return to more ordinary monetary policy in 2023.

- In Asia-Pac today we have Australia CPI and China PMIs. Further out we have Eurozone, French and Italian CPI as well as a slew of US data including wholesale inventories, GDP, MNI Chicago PMI and Fed Beige Book. Fedspeak from Bowman and Cook before Chair Powell speaks on the economic outlook and the labour market.

JGBS: Oscillating In Narrow Range

The broader bid in core global FI markets (fleshed out elsewhere) allowed JGBs to briefly firm during the Tokyo afternoon, before some weakness crept in ahead of the bell. Futures now print -7 ahead of the close, while cash JGBs are little changed to 1.5bp cheaper across the curve.

- That was after a sedate round of morning dealing saw a modest uptick in JGB yields, while JGB futures traded on the backfoot. This was perhaps a catch-up play to Tuesday’s cheapening in U.S. Tsys.

- Softer than expected domestic industrial production data failed to inspire price action.

- Broader domestic headline flow was limited at best, with no meaningful market reaction to news of a brief joint incursion by Russian & Chinese military aircraft into Japanese airspace.

- Looking ahead, Thursday’s local docket includes capex & final manufacturing PMI data and 10-Year JGB supply. We will also hear from BoJ’s Noguchi.

AUSSIE BONDS: Firmer & Flatter On Domestic CPI & China PMIs

Aussie bonds have firmed, with softer than expected domestic CPI data and weak official PMI prints out of China facilitating the bid.

- The richening in the long end extended into the close, even with sub-average projections for month-end index extensions noted, while YM was capped by its post-CPI Sydney peak.

- That left YM +7.0 at the close, while XM was +7.5. Cash ACGBs ran 6.5-10.5bp richer on the day, bull flattening, after the previously flagged data releases more than reversed the early bear steepening.

- The latest round of ACGB Apr-33 supply went well. The recent stabilisation of the space away from cycle cheaps and edging of the line towards 10-Year benchmark status likely aided takedown.

- Bills were 3-10bp richer through the reds, while RBA dated OIS nudged lower post-data. Just under 20bp of tightening is now priced for the Bank’s Dec ’22 meeting, while terminal cash rate pricing is in to ~3.75%.

- Looking ahead, Thursday’s local docket includes capex data, the final m’fing PMI survey from S&P Global and the CoreLogic house price print.

AUSSIE BONDS: ACGB Apr-33 Auction Results

The Australian Office of Financial Management (AOFM) sells A$700mn of the 4.50% 21 April 2033 Bond, issue #TB140:

- Average Yield: 3.6213% (prev. 3.7270%)

- High Yield: 3.6225% (prev. 3.7300%)

- Bid/Cover: 3.3571x (prev. 2.4562x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 100.0% (prev. 27.8%)

- Bidders 35 (prev. 39), successful 10 (prev. 23), allocated in full 10 (prev. 15)

NZGBS: Curve Twist Steepens, Off Cheaps On Data & Receiver-Side Swap Flows

Cash NZGBs twist steepened on Wednesday, with the major benchmarks running 0.5bp richer to 3bp cheaper, pivoting around 5s. Receiver-side swap flow in lieu of weak domestic business confidence data, as well as softer than expected Australian CPI data and Chinese PMI readings, seemingly aided a move away from session cheaps, with swap spreads tightening across the curve as swap rates finished little changed to 5bp lower on the day (with the swap curve steepening).

- RBNZ dated OIS continue to price just under 70bp of tightening for the first RBNZ meeting of ’23, while terminal OCR pricing continues to hover around 5.40%.

- The RBNZ “launched a second consultation as part of the five-yearly review of the Monetary Policy Committee’s (MPC) Remit that guides monetary policy decisions.” The Bank noted that “this second consultation seeks feedback on the recommendations we are intending to provide to the Government about possible changes to the Remit.” When it comes to the return of inflation to target, the RBNZ has noted that “the Reserve Bank considers the Remit best supports wellbeing by leaving the time horizon undefined.”

- Looking ahead, tomorrow’s local docket includes CoreLogic house price data and the weekly round of NZGB auctions (covering NZGB-27, -33 & -51).

EQUITIES: Positive Momentum Persists

Asia Pac equities (ex Japan) are mostly higher. Markets have shrugged off generally poor economic data throughout the Asia Pac region. US futures are up slightly, with the major bourses firmer by +0.10/+0.20%.

- Onshore China markets have ticked higher, although gains are more modest compared to yesterday's session, with the CSI 300 and Shanghai Composite +0.10% higher at this stage.

- Covid cases ticked modestly lower again, while the market appeared to interpret the weaker official PMI prints as a sign that Covid restrictions need to be eased further to turn economic momentum around. This is likely to remain a delicate balancing act though, as we head into the winter months.

- The HSI is up 1%, while the Kospi (+1%) and Taiex (+0.85%) have performed strongly as well.

- The ASX 200 is firmer by 0.43%, as resource names lead the move higher. Japan stocks remain laggards, the Nikkei 225 down 0.40%.

GOLD: Prices Up Again Ahead Of Fed Chairman Powell

Gold prices are up again today by 0.3% to $1754.50/oz supported by a weaker USD (DXY -0.3%). Bullion has been trading above $1750 for most of the session.

- Trend conditions for gold remain bullish but prices have not made much progress to the bull trigger at $1786.50, the November 15 high.

- November has been a good month for gold prices driven by signals that the Fed will slow its tightening pace at its December meeting. A clear communication from China that it is going to ease restrictions should boost gold prices further.

- Tonight Fed Chairman Powell speaks and is expected to signal the size of the next rate move. Gold prices are likely to react inversely to the USD. Fed Governors Cook and Bowman are also scheduled to speak. On the data front there is US trade, JOLTS and ADP job data.

OIL: Oil Prices Up Again Today But Waiting For EU And OPEC+ Announcements

Oil prices are 1.1% higher during trading today with WTI now around $79.10/bbl, close to resistance of $79.90, and Brent $84 supported by a lower USD. Overall oil has been in tight ranges, as the market awaits the EU’s decision on the oil price cap and the weekend’s OPEC+ meeting.

- Overnight the US API data showed a crude inventory drawdown of 7.9mn barrels after a 4.8mn drop last week showing the tightness of the market. However, distillate stocks rose 4mn and gasoline +2.9mn.

- There continues to be speculation that OPEC+ will agree to an output cut this weekend despite denials from members overnight.

- Markets remain concerned about the demand outlook, especially from China.

FOREX: USD Weighed By Firmer Risk Appetite

The USD has remained on the back foot for much of the session. The BBDXY is down 0.25%, back to the low 1276/77 region. Generally positive equity market sentiment, coupled with a slight downtick in UST yields, has weighed on the dollar.

- Data outcomes have generally been disappointing, particularly the China PMI trends, which fell further into contractionary territory. This had no lasting impact on sentiment though.

- AUD/USD dipped post a decent monthly CPI miss, but the pull back to 0.6670 was supported, the pair last at 0.6700. AU bond yields are lower, the 2yr off by 6bps. AUD/NZD is lower, last around 1.0760, but we are yet to test recent lows around 1.0750.

- NZD/USD is the best performer within the G10 space, up 0.40% since the open to 0.6225. Weaker domestic confidence figures didn't weigh on the Kiwi.

- The yen generally lagged the rest of the G10, in line with firmer risk appetite. USD/JPY is still slightly lower, last at 138.50. EUR and GBP are both around +0.30% firmer for the session.

- Coming up, we have Eurozone, French and Italian CPI as well as a slew of US data including ADP employment, MNI Chicago PMI and the release of the Fed’s Beige Book. Fedspeak from Bowman and Cook is also due, although Chair Powell also speaks on the economic outlook and the labour market, which will likely be the main focus.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/11/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 30/11/2022 | 0730/0730 |  | UK | DMO Publishes FQ4 Issuance Calendar | |

| 30/11/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 30/11/2022 | 0745/0845 | ** |  | FR | PPI |

| 30/11/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 30/11/2022 | 0745/0845 | *** |  | FR | GDP (f) |

| 30/11/2022 | 0800/0900 |  | ES | Retail Sales | |

| 30/11/2022 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/11/2022 | 0830/0830 |  | UK | BOE Pill Speech at ICAEW Summit | |

| 30/11/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 30/11/2022 | 0900/1000 | *** |  | IT | GDP (f) |

| 30/11/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 30/11/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 30/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/11/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 30/11/2022 | 1330/0830 | *** |  | US | GDP (2nd) |

| 30/11/2022 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 30/11/2022 | 1350/0850 |  | US | Fed Governor Michelle Bowman | |

| 30/11/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 30/11/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 30/11/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 30/11/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 30/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 30/11/2022 | 1735/1235 |  | US | Fed Governor Lisa Cook | |

| 30/11/2022 | 1830/1330 |  | US | Fed Chair Jerome Powell | |

| 30/11/2022 | 1900/1400 |  | US | Fed Beige Book | |

| 01/12/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.