-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Powell To Set The Tone

- Markets coil in Asia ahead of Jackson Hole, with Fed Chair Powell's address set to provide the major source of event risk ahead of the weekend.

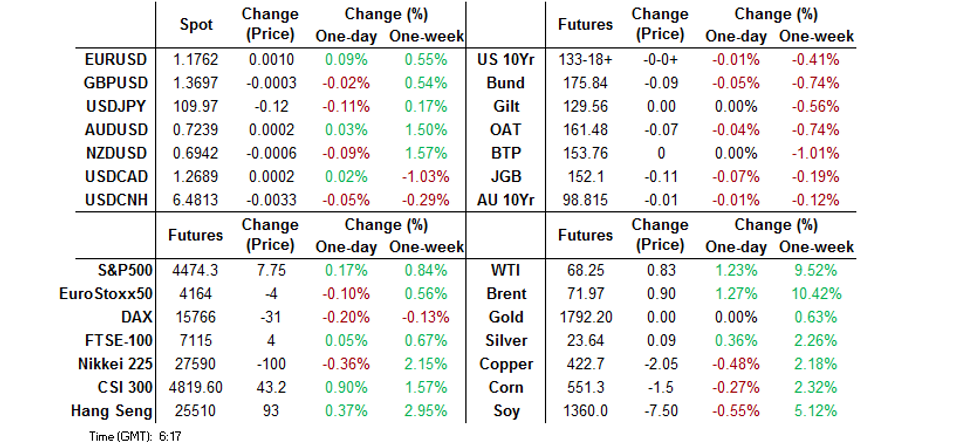

- DXY a touch lower, U.S. Tsy yields steady & equities marginally mixed overnight.

- A raft of Fedspeak pads out the broader economic docket on Friday

BOND SUMMARY: Core FI Coils Ahead Of Jackson Hole

It was a relatively lethargic Asia-Pac session for core FI markets, with a distinct lack of meaningful headline flow evident ahead of the virtual Jackson Hole event.

- T-Notes last dealing -0-01 at 132-18, sticking to a 0-04 range thus far. Cash Tsys deal little changed to 1.0bp richer across the curve. Broader flow has been subdued once you net off the impact of rolls in the futures space. Upside exposure has provided the only real highlight on the flow side, with a 10K screen buyer of TYV1 135.50 calls seen. Fed Chair Powell's Friday address headlines the aforementioned Jackson Hole event. NY hours will also see the release of July's PCE data suite and the final UoM sentiment reading for August. A raft of Fedspeak surrounding Jackson Hole fills out the docket.

- Fairly sideways Tokyo trade for JGB futures, with the contract last -10 ticks after a very modest uptick at the re-open, which faded. Benchmark cash JGB yields are virtually unchanged across the curve. The only real local headlines of note saw Japanese Finance Minister Aso play down an "urgent need" to raise funds via a supplementary budget.

- Aussie bond futures continue to hold to tight ranges, with YM -1.0 and XM -1.5 at typing. There were no surprises in the release of the AOFM's weekly issuance slate, meanwhile the latest round of ACGB Nov '24 supply saw a steady cover ratio as the weighted average yield printed 0.67bp through prevailing mids at the time of supply (per Yieldbroker). Elsewhere, the daily COVID case count out of NSW moderated back below 1.0K, pulling back from yesterday's all-time highs. On the data front July's retail sales print was marginally softer than expected. Still, these events haven't impacted the space.

FOREX: Cautiously Awaiting Powell's Speech

Modest risk-off flows emerged in early Asia-Pac trade as regional participants reacted to headline flow surrounding deadly attacks by the Afghan affiliate of ISIS outside Kabul airport and U.S. Pres Biden's pledge to retaliate. This initial impetus moderated thereafter, as the Asia-Pac session failed to provide much in the way of notable catalysts ahead of a much awaited speech from Fed Chair Powell.

- NZD underperformed at the margin with the local outbreak of Covid-19 under scrutiny. PM Ardern extended the national level 4 lockdown through the month-end and said that Auckland will likely remain in level 4 for another two weeks. The alert level for the rest of the country may be lowered to 3 from next Wednesday.

- The yen led gains in G10 FX space, looking through marginally mixed Tokyo CPI data. Japanese FinMin Aso said that there is no urgent need to put together another extra budget.

- The virtual Jackson Hole symposium takes centre stage today, with the address from Fed Chair Powell set to provide most interest.

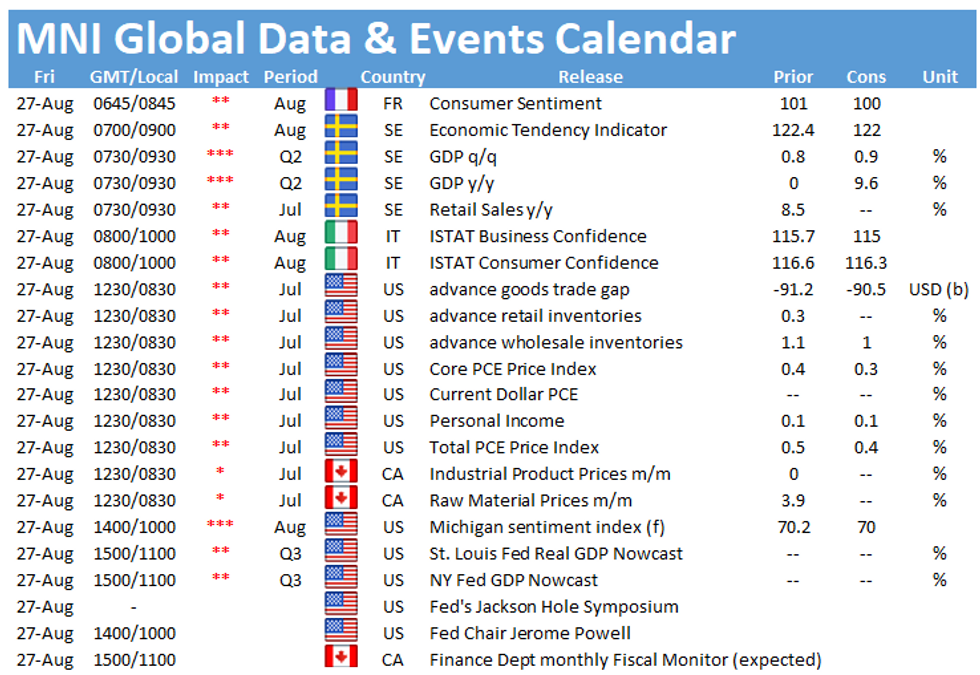

- Also due today are U.S. personal income/spending & final University of Michigan Sentiment as well as Swedish GDP & retail sales.

ASIA FX: Baht Set To Remain Best Asia EM Performer This Week

Most USD/Asia crosses ebbed lower as the greenback gave up its initial gains. Most pairs were happy to hold tight ranges in quiet Asia-Pac trade.

- CNH: Spot USD/CNH ground lower only in late Asia-Pac trade as the greenback faltered. The yuan earlier ignored an in-line PBOC fix and a CSJ report noting that China's central bank is expected to boost credit supply and will likely cut RRR rates. The PBOC earlier said that they will use monetary policy tools, including the RRR, to support rural development.

- KRW: The won kicked off on a softer footing before recouping losses, with participants assessing BoK rate outlook after yesterday's hike.

- IDR: The rupiah was the worst performer in Asia EM basket amid thin local headline flow.

- MYR: The ringgit firmed as PM Ismail Sabri unveiled his new Cabinet. FinMin Zafrul and four Senior Ministers retained their posts, while Ismail Sabri did not appoint a Deputy Premier.

- THB: The baht fared well and is poised to finish the week as the strongest Asia EM currency. Signs that the latest wave of Covid-19 infections is cresting lent support to the currency, with Thailand's Covid-19 task force set to announce decision on relaxing curbs today.

- PHP: The peso struggled for any momentum after Philippine economic officials warned Thursday that the economic output may not reach its pre-pandemic levels before late 2022/early 2023.

- SGD: USD/SGD slipped on the back of broader USD weakness as local headline flow failed to rock the boat.

- TWD: USD/TWD gave up its opening gains. Taiwan and Japan said they expect to deepen cooperation on security matters.

EQUITIES: Asian Equities Marginally Mixed, E-Minis Edge Higher Overnight

The negative lead from Wall St., which centred on Thursday's attack on Kabul airport, applied some pressure to the major local indices during early Asia-Pac dealing, although that impulse faded a little with the focus moving to the potential for an uptick in Chinese credit provisions and perceptions surrounding the chances for a targeted RRR cut. This allowed Chinese/HK indices to outperform, lodging marginal gains, although the broader ranges were generally limited ahead of Fed Chair Powell's Friday address. E-minis were marginally higher after yesterday's modest dip.

GOLD: Back Near $1,800/oz

Bullion continues to operate within the recently observed range after yesterday's attack on Kabul airport allowed spot to recover from $1,780/oz, with the $1,800/oz mark now within touching distance once again. Fed Chair Powell's Friday address is keenly awaited, with the technical parameters unchanged ahead of the event.

OIL: Bouncing Back In Asia

WTI and Brent futures sit ~$0.70 above their respective settlement levels after shedding somewhere in the neighbourhood of ~$1.00 come settlement time on Thursday. In terms of idiosyncratic news flow, the potential for a slower than expected resumption of a PEMEX production outage has become apparent, per RTRs sources. Elsewhere, U.S. energy companies have started airlifting workers from their Gulf of Mexico oil production platforms and shutting in production owing to the well-documented hurricane situation in the region. Speculation surrounding the potential for a looser credit situation in China may also be providing some support during Asia-Pac trade.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.