-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: CNH & China Equities Weaken Despite Slightly Better August Trade Data

EXECUTIVE SUMMARY

- EASY POLICY STILL NEEDED - BOJ’S NAKAGAWA - MNI BRIEF

- RBA’S LOWE CALLS FOR MONETARY AND FISCAL ALIGNMENT - MNI BRIEF

- AUSTRALIAN PM TO VISIT CHINA THIS YEAR AFTER ‘PROGRESS’ ON TIES - RTRS

- THREE MAJOR CHINA BANKS TO LOWER RATES ON EXISTING FIRST-HOME MORTGAGES - RTRS

- CHINA’S EXPORT SLUMP EASES AS ECONOMY SEARCHES FOR STABILITY - BBG

- SUPPORT NEEDED TO BOOST FUTURES CHINA GDP - ADVISOR - MNI

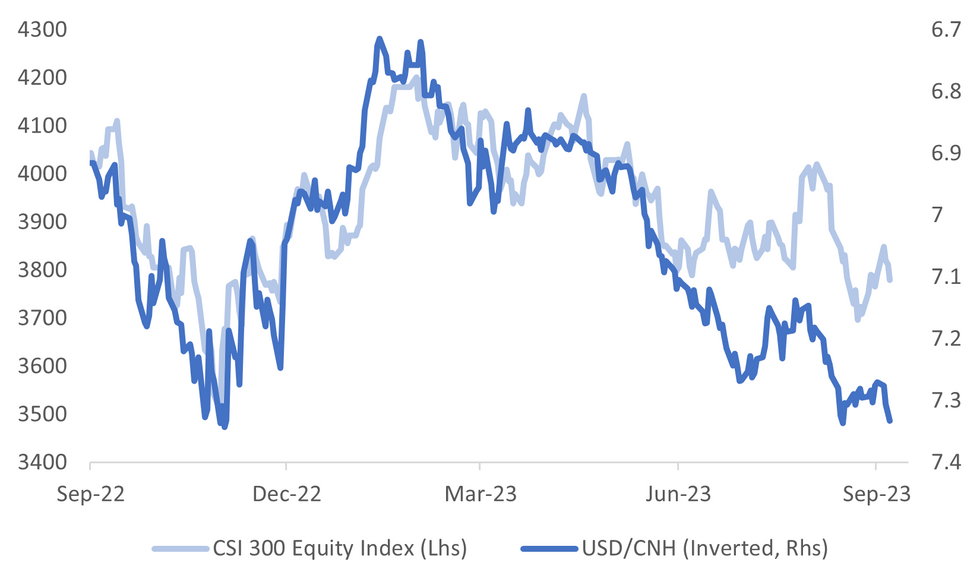

Fig. 1: CSI 300 Equity Index & USD/CNH (Inverted)

Source: MNI - Market News/Bloomberg

U.K.

BOE: Bank of England governor Andrew Bailey said UK interest rates are probably “near the top of the cycle” because a further “marked” drop in inflation is likely this year, a sign that the central bank may bring to an end its quickest tightening cycle in three decades. Testifying to Parliament, Bailey and two colleagues from the nine-member Monetary Policy Committee sent the clearest signal yet that the BOE is worried that further tightening could cause an unnecessarily harsh recession. (BBG)

EUROPE:

GREECE: A Greek shipping company admitted to violating US sanctions on Iran by transporting oil from the Middle East country in an agreement with the US that was kept under wraps for almost five months amid fears of Iranian retaliation. (BBG)

U.S.

US/CHINA: As the United States on Wednesday further extended tariff exclusions on some Chinese imports until the end of 2023, China's embassy spokesperson and analysts said that all the remaining additional duties should be removed altogether. The Office of the United States Trade Representative (USTR) announced the further extension of China "Section 301" tariff exclusions on 352 Chinese import and 77 COVID-19-related categories that were set to expire on Sept 30. (China Daily)

OIL & GAS: The U.S. Interior Department on Wednesday said it would cancel oil and gas leases in a federal wildlife refuge that were bought by an Alaska state development agency in the final days of former President Donald Trump's administration. Trump's Republican administration issued the Alaska Industrial Development and Export Authority (AIDEA) seven leases in the Arctic National Wildlife Refuge a day before the inauguration of President Joe Biden, a Democrat who had pledged to protect the 19.6 million-acre (7.7 million hectares) habitat for polar bears and caribou. (RTRS)

FED: The US Senate confirmed Federal Reserve Governor Lisa Cook to a full 14-year term on a 51-47 vote Wednesday, with most Republicans again withholding their support. Cook, the first Black woman governor in the Fed’s history, needed Vice President Kamala Harris to break a 50-50 tie to win confirmation last year, with Republicans then questioning her monetary policy qualifications despite her work as an economist at Michigan State University. (BBG)

OTHER

JAPAN: Bank of Japan board member Junko Nakagawa said on Thursday the Bank's must continue with easy policy as the Japanese economy has not reached the 2% inflation target, although a shift in wage- and price-setting behavior is observed. ‘’If the synergies between actual price rises and the expected inflation rate rise strengthened, Japan’s inflation rate could rise upwardly,” Nakagawa told business leaders in Kochi City. (MNI)

JAPAN: The slide in the yen isn’t over, despite expectations the dollar may not be quite so strong in coming months, said the top forecaster for the currency. The yen will probably weaken to 152 against the dollar this year, and 155 in 2024, Tohru Sasaki, JPMorgan Chase & Co.’s head of Japan markets research, said in an interview. Even a potential abandonment of the Bank of Japan’s yield curve control policy this year will not provide much hope in the long-term, he said. (BBG)

AUSTRALIA: The outgoing Reserve Bank of Australia Governor Philip Lowe has called for greater coordination between monetary and fiscal policy, noting better outcomes were possible if the two were well-aligned. Speaking at an industry lunch Thursday in Sydney, Lowe noted monetary policy was a powerful, yet limited, instrument. “In principle, fiscal policy could provide a stronger helping hand, although this would require some rethinking of the existing policy architecture,” he noted. (MNI)

AUSTRALIA/CHINA: Australia and China have made progress in returning to "unimpeded trade" but more progress is needed, Australian Prime Minister Anthony Albanese said on Thursday as he met Chinese Premier Li Qiang at a regional summit in Indonesia. "The progress we have made in resuming unimpeded trade is good for both countries and we want to see that progress continue," Albanese said in his opening comments at the meeting. (RTRS)

LNG: Contract talks between Chevron Corp. and labor unions in Australia will continue another day, prompting workers at two liquefied natural gas terminals to put their threatened strikes on hold. European gas prices fell as much as 11% to the lowest in two weeks on optimism a deal can be reached. The new deadline for industrial action at the Gorgon and Wheatstone plants is 6 a.m. local time Friday, a Chevron Australia spokesperson said in an emailed statement. The unions previously threatened to start partial strikes Sept. 7 and then escalate to full stoppages that would begin Sept. 14 and last two weeks. (BBG)

NEW ZEALAND: New Zealand’s central bank is getting more capital from the government to allow it to meet balance sheet risks and enable it to deploy tools to ensure financial stability. Finance Minister Grant Robertson took a proposal to boost the Reserve Bank’s capital by NZ$1.3 billion ($760 million) to his cabinet colleagues last month, according to documents released by the Treasury Department on Thursday in Wellington. He also intended to provide the RBNZ with an indemnity to cover losses of as much as NZ$5 billion. (BBG)

CHINA

RATES: China can further cut interest rates, but should strike a balance to avoid too much pressure on banks’ interest margin and yuan exchange rate, Lian Ping, president of China Chief Economist Forum, was cited by a report of Shanghai Securities News as saying. (BBG)

RATES: Three of China's major state banks said on Thursday they will start to lower interest rates on existing mortgages for first-home loans. The move is one of several support measures flagged by Beijing in recent weeks for the country's crisis-ridden property sector amid mounting concerns over the health of the world's second-largest economy. (RTRS)

ECONOMY: China’s export slump eased in August, adding to early signals the worst may be over for some parts of the world’s second-largest economy as it tries to regain momentum. (BBG)

ECONOMY: The Chinese economy will need further accommodative policy to maintain a potential growth rate between 5.5-6% over the next 10 years, while recent house-buying relaxations will help the country recover, with GDP tipped to reach around 5.3% this year, a policy advisor told MNI in an interview. (MNI)

TECH: China plans to expand a ban on the use of iPhones in sensitive departments to government-backed agencies and state companies, a sign of growing challenges for Apple Inc. in its biggest foreign market and global production base. (BBG)

HOUSING: Housing markets in first-tier cities including Beijing and Shanghai have recorded active transactions with homebuyer confidence boosted following the recent easing of mortgage rules. On the first weekend after the new policy was introduced, the number of single-day visits and transactions increased by 2.5-3 times on the week, said a sales manager in Shanghai.(Xinhua News Agency)

PORK: Chinese demand for pork may increase in Q3 but prices are unlikely to rise significantly due to an abundance of supply, according to Yicai. Huatai Securities noted major pork producers had suffered significant losses in Q2 due to low prices, with the asset-liability ratio of listed companies remaining high and fixed-asset investment slowing.(MNI)

NEV: Buyers in China purchased 698,000 new energy vehicles in August, an increase of 32% y/y and 9% m/m, according to statistics from the China Association of Automobile Manufacturers. The association said the market has recorded 5.1 million unit sales year-to-date, up 39% y/y. (Yicai)

CHINA MARKETS

MNI: PBOC Net Drains CNY356 Bln Wednesday via OMO

The People's Bank of China (PBOC) conducted CNY26 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY356 billion after offsetting the maturity of CNY382 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:25 am local time from the close of 1.7411% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Tuesday, the same as the close on Monday.

PBOC Yuan Parity Higher At 7.1969 Wednesday Vs 7.1783 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1969 on Wednesday, compared with 7.1783 set on Tuesday. The fixing was estimated at 7.3108 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND Q2 MANUFACTURING ACTIVITY VOLUME Q/Q 2.9%; PRIOR -1.8%

NEW ZEALAND Q2 MANUFACTURING ACTIVITY SA Q/Q 0.2%; PRIOR -2.5%

AUSTRALIA JULY EXPORTS M/M -2; PRIOR -3%

AUSTRALIA JULY IMPORT M/M 3; PRIOR -3%

AUSTRALIA JULY TRADE BALANCE A$8.0BN; MEDIAN A$10BN; PRIOR A$11.32BN

CHINA AUGUST EXPORTS Y/Y -8.8%; MEDAIN -9.0%; PRIOR 14.5%

CHINA AUGUST IMPORTS Y/Y -7.3; MEDAIN -9.0%; PRIOR 12.4%

CHINA AUGUST TRADE BALANCE $68.36BN; MEDIAN $73.90BN; PRIOR $80.60BN

MARKETS

US TSYS: Narrow Ranges In Muted Asian Session

TYZ3 deals at 109-24+, +0-02+, a 0-04+ range has been observed on volume of ~56k.

- Cash tsys sit 1 bp richer to 1bp cheaper across the major benchmarks, light twist steepening is apparent as the curve pivots on 5s.

- Tsys were marginally pressured in early dealing as a bid in USD/JPY, which printed its highest level since Nov 2022, spilled over into a wider USD strength. The move didn't follow through and the pair ticked away from session lows.

- Narrow ranges were observed for the remainder of the session, little meaningful macro newsflow crossed.

- German Industrial Production and Eurozone GDP provide the highlights in Europe today. Further out we have Initial Jobless Claims. There are a number of Fed speakers including Atlanta Fed President Bostic and New York Fed President Williams.

JGBS: Futures and 30Y JGBs Cheaper After Poor 30Y Supply Digestion, GDP & Labor Earning Tomorrow

JGB futures unwind early afternoon strength to be -1 compared to settlement levels.

- JGB futures and 30-year JGBs initially gained value in early post-auction trading but later relinquished those gains. This reversal aligned with the lacklustre reception for 30-year supply today. The low price fell short of dealer expectations and the cover ratio was lower than the previous month. Notably, the auction tail was the longest observed since April 2020, excluding the July auction.

- Today’s result was consistent with other recent JGB auctions and appears to suggest that local investors seek higher yields and/or more time to assess the new YCC framework and the BoJ's policy outlook before significantly increasing their allocations to the JGB market.

- Cash JGBs are mixed, with yields 1.1bp higher (20-year) to 0.9bp lower (40-year). The benchmark 10-year yield is unchanged at 0.660%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- The 30-year JGB yield is 0.2bp lower on the day at 1.653%, 1bp higher than pre-auction levels.

- Swap rates are also mixed, pricing 0.1bp lower to 1.4bp higher. Swap spreads are wider beyond the 3-year.

- Tomorrow the local calendar sees Labor Cash Earnings (Jul), GDP (Q2 F), BoP (Jul) and Bank Lending (Aug), along with BoJ Rinban operations covering 1- to 25-year JGBs.

AUSSIE BONDS: Weaker, At Session Cheaps, US Jobless Claims & Fedspeak Later

ACGBs (YM -7.0 & XM -4.5) are weaker and at or near Sydney session lows. July trade balance data and a speech by outgoing RBA Governor Lowe failed to provide a market-moving domestic catalyst.

- (AFR) In his speech, Lowe said the government should hand over some of its taxing and spending powers to an independent body to reduce the reliance on the Reserve Bank in managing the economy. He added that there was a “material risk” that Australia’s living standards would stagnate without urgent action by governments to address the “political problem” of low productivity, which has fallen to its lowest level in seven years. (See link)

- Cash ACGBs are 4-6bp cheaper, with the AU-US 10-year yield differential unchanged at -12bp.

- Swap rates are 4-6bp higher.

- The bills strip has bear steepened, with pricing flat to -9.

- RBA-dated OIS pricing is mixed across meetings. Flat to 2bp firmer out to Aug’24 and 1-3bp softer beyond.

- Tomorrow the local calendar is empty tomorrow.

- Q2 (F) GDP and employment highlight in the European session, along with German July industrial production. Further out, US jobless claims will be looked for signs of a cooling in the labour market. Fedspeak includes Williams, Goolsbee, Harker, Logan and Bostic.

NZGBS: Closed At Best Levels, Narrow Range, Local Calendar Light Until Tuesday

NZGBs closed near the session’s best levels, with benchmark yields 1bp lower. However, the local session range was narrow. With the domestic drivers light on the ground, local participants have likely been guided by US tsys in the Asia-Pac session. US tsys are currently 1bp lower to 1bp higher across benchmarks, with the curve steeper.

- That said, solid demand seen at the weekly NZGB auction, particularly for the longer-dated lines (cover ratios of 4.045x for the May-32 bond and 3.15x for the Apr-37 bond) likely assisted the local market’s bid tone.

- The swap curve has twist flattened, with rates 1bp higher to 2bp lower.

- RBNZ dated OIS pricing is little changed for meeting out to May’24 and 3-4bp firmer beyond.

- Manufacturing volumes rose 2.9% q/q in Q2 versus a revised -1.8% in Q1. Manufacturing sales rose 0.2% q/q versus a revised -2.5% in Q1.

- Tomorrow the local calendar is empty. The next release of significance will be Retail Card Spending for August on Tuesday.

- US jobless claims will be looked at later today for signs of the heat coming out of the labour market. A few FOMC speakers are on the wires including Williams, Goolsbee, Harker, Logan and Bostic.

EQUITIES: China Seeks To Broaden Iphone Ban, Nasdaq Futures Lower

Regional equities are mostly tracking lower in Asia Pac markets, which is line with losses seen in US and EU bourses through Wednesday trade. Only a few markets in South East Asia (SEA) are tracking higher at this stage. US futures are lower, Eminis last near 4463, down -0.18%. Nasdaq futures are slightly weaker, down 0.26% at this stage.

- Headlines have crossed that China is seeking to broaden the iPhone ban to state firms and agencies. This is likely weighing on tech sentiment.

- Elsewhere. China property related stocks have been volatile. The CSI 300 real estate sub index got above 5200 in early trade, but now sits back at 5145.55, down -0.30% at the break. This sub-index has largely gone sideways in recent weeks. China banks will cut mortgage rates on existing loans for first buyers from September 25th, although this move was already touted.

- The broader CSI 300 is down -0.86% at the break, the index back below the 3800 level.

- The HSI is off by 0.95% at the break. The tech sub-index is down 1.48%, tracking lower for the 3rd straight session.

- Japan stocks are modestly lower at this stage, the Topix off -0.15%. Tech sensitive markets like Taiwan (Taiex -0.40%) and South Korea (Kospi -0.70%) are down, in line with weakness in tech indices in Wednesday US trade and the above mentioned US futures backdrop.

- The ASX 200 remains a weaker performer, down over 1.3%, with weakness evident in the materials sector. Metal prices have softened in recent sessions.

- In SEA Thai stocks are firmer, +0.45%, but the Philippines bourse is weaker at -1.10%.

FOREX: Narrow Ranges In Asia, Fresh YTD High For USD/JPY

Narrow ranges have persisted across much of G-10 FX on Thursday in Asia. USD/JPY firmed in early dealing printing a fresh YTD high however gains were pared and the pair sits little changed.

- USD/JPY printed its highest level since Nov 2022 at ¥147.87 in early dealing before ticking away from session highs as US Tsy Yields unwound a marginal move higher. The trend condition in USD/JPY remains bullish resistance is at ¥148.40, high Nov 4 2022. Support comes in at ¥145.52 the 20-Day EMA.

- AUD/USD is marginally lower down ~0.2%, however recent lows remain intact for now as ranges have been narrow today. Support comes in at $0.6357, yesterday's low and $0.6287, 2.00 projection of Jun 16-Jun29-Jul 13 price swings.

- Kiwi is little changed, NZD/USD was pressured alongside the move higher in USD/JPY however support came in ahead of YTD lows and NZD/USD now prints close to opening levels at $0.5870/75. A $0.5865/85 range has been observed.

- Elsewhere in G-10; EUR and GBP are little changed, there has been little follow through on moves thus far.

- Cross asset wise; E-minis are a touch lower and the Hang Seng is down ~1%. US Tsy Yields are little changed across the curve.

- German Industrial Production and Eurozone GDP provide the highlights in Europe today.

OIL: Benchmarks Ease Away From Recent Highs, China Oil Imports Up Strongly In August

Oil has ticked down modestly in Thursday trade so far. Brent sits back near $90.35/bbl, slightly above session lows of $90.32/bbl. This is down 0.25% versus NY closing levels on Wednesday. If maintained this would be the first loss for the benchmark since the start of last week. WTI has followed a similar trajectory, last near $87.25/bbl, off by ~0.30%. If maintained this would end WTI's 9 sessions of straight gains, the longest stretch going back to Jan 2019. Both benchmarks remain comfortably higher for the week to date.

- Official US weekly inventories are due later on Thursday. The API reported earlier that crude inventories fell by 5.5 mln barrels last week. This is likely to be the main macros focus in the space for today's session.

- We had China August trade data earlier, with oil imports strengthening in August, up 20.9% versus August levels. This represented 52.80mln tonnes of crude oil. Oil product imports were weaker, but are much smaller in tonne terms.

- For Brent, bulls remain focused on recent highs above $91/bbl, recent lows rest near $88/bbl.

GOLD: Another Decline Driven By Higher US Treasury Yields

Gold is 0.2% higher in the Asia-Pac session, after closing -0.5% at $1917.25 on Wednesday. Bullion was pressured by an increase in front end US Treasury yields rather than USD strength with the latter seeing relatively modest gains considering the surprise strength in ISM Services.

- The ISM Services Index printed more robustly than expected (54.5 vs. 52.5 est. & 52.7 prior), with Prices Paid (58.9 vs. 56.8 prior). Reacceleration to the highest reading since February added further evidence that the US economy has been resilient through Q3.

- US Treasuries finished 2-7bp cheaper, with the curve flatter. Implied Fed funds repriced for a slightly better than 50-50 chance for a 25bp tightening in November, though eased back to 42% by the close. The market attached a 7% chance of a hike on 20 September.

- While little changed on Wednesday, the USD Index looks to have resumed the primary uptrend off the mid-July low, potentially exerting sustained downward pressure on precious metals, according to MNI's technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/09/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/09/2023 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 07/09/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/09/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 07/09/2023 | 0830/0930 |  | UK | BOE DMP Survey | |

| 07/09/2023 | 0830/1030 |  | EU | ECB's Elderson speaks at Event | |

| 07/09/2023 | 0900/1100 | *** |  | EU | GDP (final) |

| 07/09/2023 | 0900/1100 | * |  | EU | Employment |

| 07/09/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/09/2023 | 1230/0830 | * |  | CA | Building Permits |

| 07/09/2023 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 07/09/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/09/2023 | 1400/1000 | * |  | US | Services Revenues |

| 07/09/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/09/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/09/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/09/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/09/2023 | 1755/1355 |  | CA | BOC Governor Macklem gives "Economic Progress Report" speech in Calgary | |

| 07/09/2023 | 1930/1530 |  | US | New York Fed's John Williams | |

| 07/09/2023 | 1945/1545 |  | US | Atlanta Fed's Raphael Bostic | |

| 07/09/2023 | 2055/1655 |  | US | Fed Governor Michelle Bowman | |

| 07/09/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.