-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI EUROPEAN MARKETS ANALYSIS: Markets Look Through Geopolitical Tension

- Sources of geopolitical tension and reports of the PBoC leaning against increases in credit supply fail to dent broader risk appetite in Asia.

- Market liquidity set to remain thinned on Monday, given widespread holidays in Europe.

BOND SUMMARY: Core FI Mixed Amid Thinner Markets

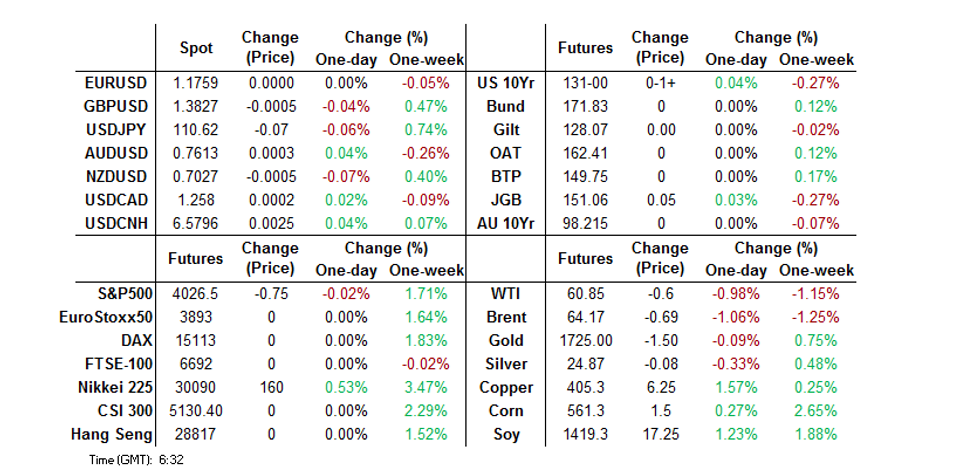

The Tsy complex has unwound most of its early Asia bid (and more in some instances), in what was a holiday thinned Asia-Pac session, with thinner liquidity also set to be evident during Monday's European session. Participants pointed to various sources of geopolitical tension, an FT source report suggesting that the PBoC is leaning on lenders to restrain credit growth and continued GOP pushback vs. the size of U.S. President Biden's fiscal scheme as potential sources of support in early trade. Still, the moves were relatively shallow, with T-Notes last +0-01 at 130-31+, with the cash curve twist steepening (30s now print ~2bp cheaper on the day) as resolute equity markets and follow through from Friday's NFP print added some pressure to the longer end after the early richening.

- JGB futures have unwound their overnight losses, last printing +5 on the day, with cash JGBs experiencing very marginal richening (participants likely had one eye on tomorrow's 30-Year supply, which would have limited the firming). BoJ Rinban operations, which covered 1- to 5-Year JGBs, saw marginal upticks in the offer to cover ratios, even with the purchase offers increasing in size, as the Bank started to enact its tweaked purchase schedule. Elsewhere, a Chinese aircraft carrier has been spotted in waters near Okinawa, although this had little in the way of tangible impact on the space.

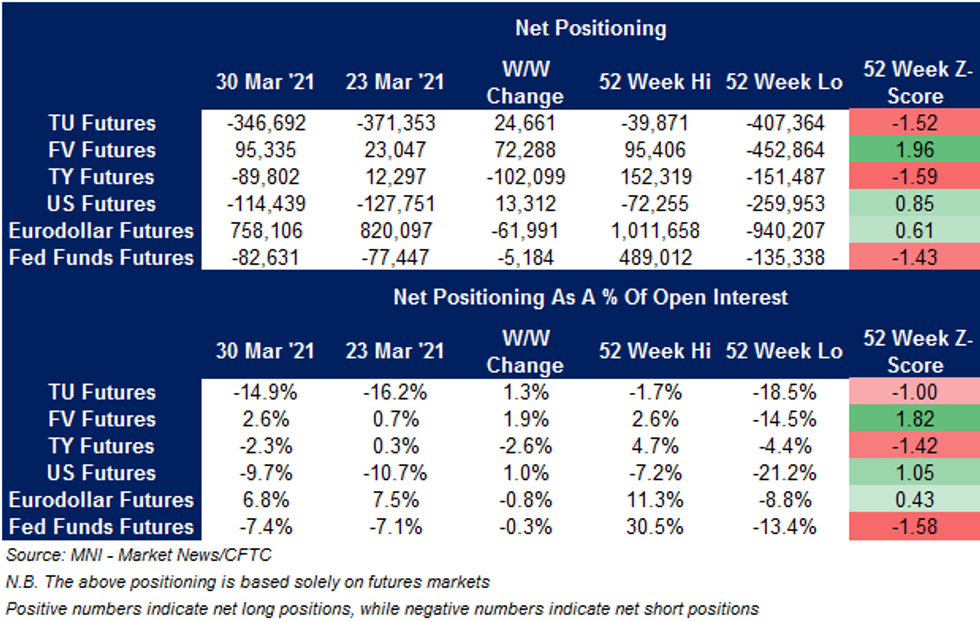

US TSY FUTURES: Mixed Moves In CFTC CoT Positioning

TU, FV and US futures saw net long positioning build/net short positioning trimmed in the latest CFTC CoT report, but the standout positioning move came in TY futures, with positioning moving net short, bucking the broader trend.

FOREX: Antipodean Divergence

Widespread holidays in Europe and Asia kept liquidity thin throughout the session in Asia, with little in the way of news flow to drive price action. The greenback softened slightly, giving back some of its post-NFP gains; the US economy gained 916k jobs in March, the most in seven months, and came alongside an upward revision to the February data.

- AUD was the outperformer, around 13 pips higher at 0.7621 ahead of the RBA meeting this week. NZD is bottom of the G10 pile so far, dropping after holding its ground on Friday.

- The yen has gained a handful of pips in Asia, USD/JPY last down 15 pips at 110.55. Japan Jibun Bank March Final Services PMI, the figure came in at 48.3 from 46.5 previously. Combined with the manufacturing PMI of 52.7 released last week, this brings the composite PMI to 49.9

- The yuan is slightly weaker, but broadly unchanged from Friday, USD/CNH last up 5 pips at 6.5775. There were reports over the weekend that the PBOC has asked lenders to reduce credit supply in order to cool the property boom amid concerns over asset bubbles. Chinese markets are closed for a holiday.

ASIA FX: Mixed In Thin Trade

Mixed performance in thin holiday trade, with the greenback softening slightly after rallying post-NFP on Friday.

- CNH: The yuan is slightly weaker, but broadly unchanged from Friday. There were reports over the weekend that the PBOC has asked lenders to reduce credit supply in order to cool the property boom amid concerns over asset bubbles. Chinese markets are closed for a holiday.

- SGD: Singapore dollar slightly stronger, markets await retail sales data that is expected to decline again in February on a monthly basis.

- KRW: Won is weaker, there is some coronavirus concern in the country with new cases still elevated and government talk of a potential fourth wave.

- IDR: Rupiah is stronger, despite the decision by the government to extend movement curbs in several areas for two weeks in an effort to contain the spread of coronavirus.

- THB: Baht weakened, moving into negative territory after CPI missed estimates. CPI fell 0.08% Y/Y, against expectations for a 0.21% rise.

- PHP: Peso is stronger, IHS Markit Philippines' March manufacturing PMI falls to 52.2 from 52.5 in February, third consecutive month of expansion.

- MYR: Ringgit is weaker, oil prices also pulled back slightly which weighed on MYR.

ASIA RATES: India Lockdown Hits Bonds Ahead Of RBI

Yields mostly higher, widespread market closures across Europe and Asia are keeping liquidity thin, while markets await key events later in the week.

- INDIA: Yields higher, The RBI reportedly sold INR 38.8bn of debt in the secondary market last week, a surprise move as the RBI is usually an active buyer in the market to suppress yields. Elsewhere, there is still concern of coronavirus cases. India announced 103,558 new infections in the past 24 hours, a record increase. Mumbai has imposed lockdown measures. Markets await the RBI meeting

- SOUTH KOREA: Bonds are under pressure, futures ground lower throughout the session despite elevated Covid-19 cases and losses in equity markets. Losses accelerated post-auction, demand was decent but the MOF sold an additional KRW 500m which prompted some over supply concerns. The government plan predicts KRW 14.5tn supply in April, but March went over by some KRW 3.2tn.

- INDONESIA: Yields mostly lower across the curve, some flattening seen. The government has announced a decision to extend movement curbs in several areas for two weeks in an effort to contain the spread of coronavirus.

- CHINA: Closed for a holiday.

EQUITIES: Mixed Amid Market Closures

A mixed session, with several markets still closed for holidays. Japanese markets are in the green, Softbank are the biggest gainer on talk it will lead the investment round for home fitness provider Tempo. South Korean markets spent the session moving between minor positive and minor negative territory, there is some coronavirus concern in the country with new cases still elevated and government talk of a potential fourth wave. Markets in mainland China and Hong Kong were closed.

- US equity futures are higher, supported by Friday's job report, the indices could make fresh record highs if they post gains today.

GOLD: Confined

Gold remains confined, with holiday thinned markets limiting participation. Spot last deals at $1,725/oz, with a familiar technical backdrop in play.

OIL: Holding Most Post-OPEC+ Gains

After being closed on Friday, crude futures are slightly lower to start the week but still holding the majority of the post-OPEC+ gain. WTI & Brent sit ~$0.50 shy of their respective settlement levels.

- At the meeting on April 1 the OPEC+ group decided to bring back 350k bpd in May, 350 k bpd in June, and 441k bpd in July. Additionally, Saudi Arabia said it will unwind its voluntary 1m bpd in extra cuts by 250k bpd in May, 350k bpd in June and 400k bpd in July. Despite the increase in supply, oil rose after the announcement with market participants showing faith in the demand recovery.

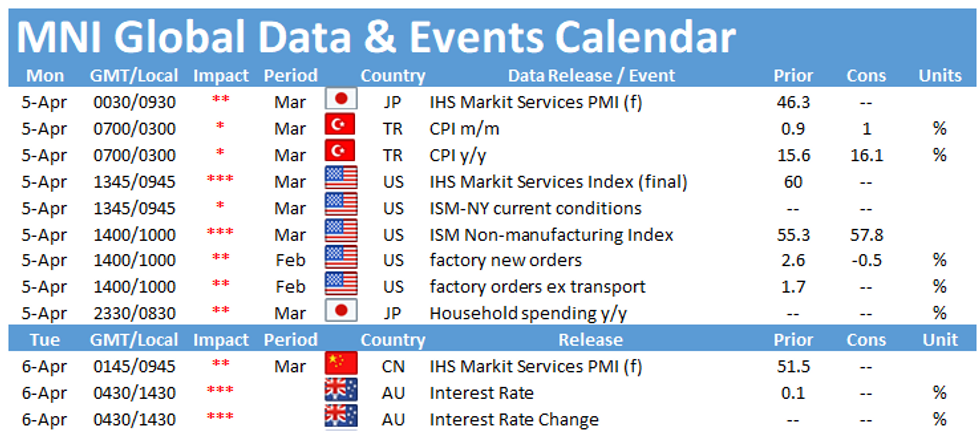

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.