-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Down 0.36% In Week of Dec 6

MNI: PBOC Net Injects CNY13.8 Bln via OMO Monday

MNI BRIEF: PBOC Increases Gold Reserves

MNI EUROPEAN OPEN: Core Yield Pullback Buoys Asia-Pac Risk Mood

EXECUTIVE SUMMARY

- YELLEN SAYS SOFT-LANDING SKEPTICS ARE NOW ‘EATING THEIR WORDS’ - BBG

- UKRAINE SEES ‘BIG RISK’ Of LOSING WAR IF CONGRESS POSTPONES VITAL AID - RTRS

- IRON ORE MOMENTUM TO STALL WITHOUT CONSTRUCTION REBOUND - MNI

- CHINA PLANS EUROZONE EV PRODCUTION TO AVOID A TRADE WAR - MNI

- BOJ TO CAREFULLY MULL EXIT - DEP GOV HIMINO - MNI

- AUSSIE GDP MISSES EXPECTATIONS - MNI BRIEF

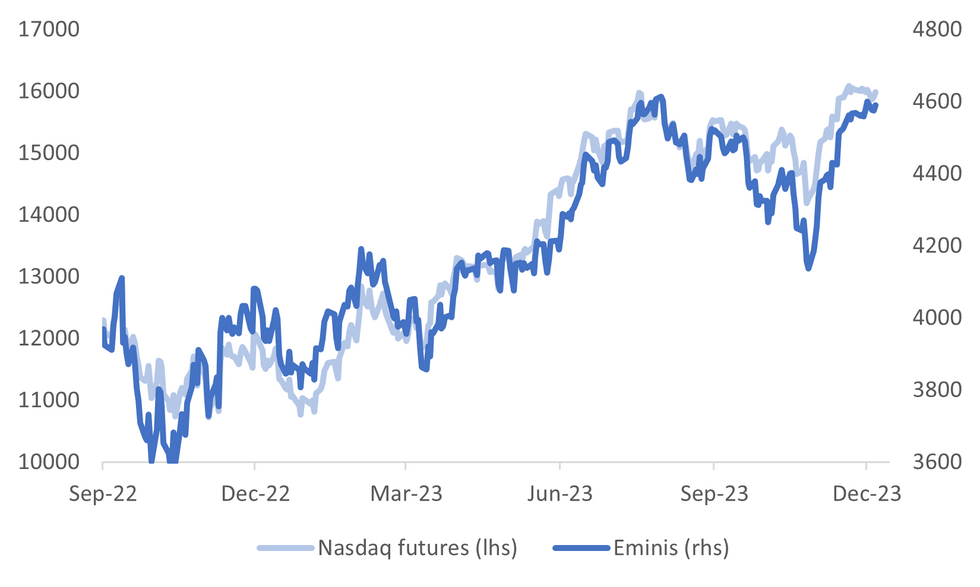

Fig. 1: US Equity Futures

Source: MNI - Market News/Bloomberg

EUROPE

UKRAINE (RTRS): Ukrainian President Volodymyr Zelenskiy's chief of staff said on Tuesday that the postponement of U.S. assistance for Kyiv being debated in Congress would create a "big risk" of Ukraine losing the war with Russia.

ITALY (MNI): The Italian government anticipates a tough challenge to meet deadlines to qualify for future tranches of its EUR200 billion in NextGenerationEU funding, after gaining only partial concessions from the European Commission in talks on overhauling the National Recovery Plan which sets out spending under the programme, officials told MNI.

GERMANY (BBC): On Wednesday Germany's cabinet meets for the last time this year. A revised budget would have to be put to parliament in next week's final sessions before Christmas, so ministers should agree this week on how to balance next year's budget, while sticking to the law.

ECB (MNI): The European Central Bank will need to see a consistent fall in core inflation below 3% before it considers rate cuts, officials told MNI, with several in broad agreement with market pricing for the first cuts by the end of the first quarter.

FISCAL (BBG): European Union finance ministers are expected to discuss a set of guardrails aimed at making governments rein in deficits and debt while leaving room for green and defense investment as they push for an agreement on new fiscal rules this week.

GAS (BBG): European natural gas prices slumped, shrugging off a cold snap across much of the continent in a sign that traders are starting to shift their focus to the next season.

EU/UK (BBG): The European Commission is set to recommend delaying tariffs on electric vehicles traded with the UK by three years, according to people familiar with the matter.

POLAND (BBG): Poland’s incoming government has suspended plans to make it easier to build onshore wind farms following criticism that the proposed changes were too favorable to industry.

U.S.

ECONOMY (BBG): In comments on the US economic outlook, Yellen took at swipe at economists who predicted only a recession would tame inflation and criticized her for continually saying she saw a path to a so-called soft landing. “Economists who’ve said it’s going to require very high unemployment to get this done are eating their words,” she said. “It doesn’t seem at all like it’s requiring higher unemployment.”

ECONOMY (MNI INTERVIEW): U.S. service sector activity remains consistent with below-trend economic growth despite a pickup in November, and will likely stay moderate for the foreseeable future, Institute for Supply Management chair Anthony Nieves told MNI. "With what the composite is right now, that would be 1% growth annualized," he said. "I think we're going to stay here and I don't think we're going to break past the mid 50s anytime soon but overall composite will continue to get a little better than just sideways here."

FED (MNI INTERVIEW): The Federal Reserve should abandon its policy of targeting averaging inflation over some undefined period of time and restore a simpler 2% goal, Markus Brunnermeier, former adviser to the U.S. central bank and co-author of a new G30 paper, told MNI.

POLITICS (RTRS): Republican former U.S. Representative Liz Cheney, an outspoken critic of ex-President Donald Trump who co-chaired the congressional probe of the Jan. 6, 2021, attack on the Capitol, said she is weighing a third-party bid for the White House in 2024.

POLITICS (BBG): President Joe Biden said he may have decided to serve just one term if Donald Trump were not seeking to return to the White House, arguing the former president poses a grave threat to American democracy.

OTHER

ISRAEL (BBG): Israeli leaders rebuffed mounting pressure to halt the military campaign in the southern Gaza Strip, vowing to press on until Hamas is eradicated even as the death toll rose and the United Nations warned that civilians had no safe harbor amid the bombing.

JAPAN (MNI): The Bank of Japan must carefully consider the timing of any exit to easy policy and monitor the evolution of wages and prices, said BOJ Deputy Governor Ryozo Himino on Wednesday.

AUSTRALIA (MNI BRIEF): Australian GDP rose 0.2% in Q3, down from Q2’s 0.4% and below the market’s 0.4% expectation, according to data released by the Australian Bureau of Statistics today. “Government spending and capital investment were the main drivers of GDP growth this quarter,” said Katherine Keenan, head of national accounts. “This was the eighth straight rise in quarterly GDP, but growth has slowed over 2023.”

ARGENTINA (RTRS): Argentine economist Santiago Bausili is set to become the governor of the country's central bank after President-elect Javier Milei takes office on Dec. 10, according to three people with direct knowledge.

CHINA

IRON ORE (MNI): Iron ore prices have likely peaked and will require a substantial rebound in steel demand – such as from a turnaround in the construction sector – to rise further, while more government intervention via “window guidance” could also weigh on the market, policy advisors and market analysts told MNI.

CHINA/EU (MNI): Beijing will likely offer to move some electric-vehicle production to the European Union as part of a long-term deal to avert a trade war, a key issue ahead of this week's China-EU summit, a Chinese policy advisor and international affairs experts have told MNI.

LOCAL DEBT (21ST CENTURY BUSINESS): Authorities have asked local governments to report their demand for refinancing bonds to roll over maturing statutory debts, with the scale of maturity expected to reach close to CNY3 trillion in 2024, 21st Century Business Herald reported citing unnamed local officials.

TRADE (SECURITIES DAILY): China Bulk Merchandise Index fell by 1.5 percentage points to 101.3% in November from October, the second consecutive monthly drop, indicating insufficient upward momentum in demand, Securities Daily reported citing data by the China Logistics Information Center (CLIC).

RATING (STATE COUNCIL/BBG): Moody’s decision to cut China’s credit outlook reflects outdated property market conditions and fails to take into account a new shift toward more rounded growth, according to a State Council official cited in a local report.

EQUITIES (SECURITIES TIMES/BBG): China stocks may experience a “mild bull market” in 2024 as policies to stabilize growth lead to a GDP figure of around 5%, Securities Times reports, citing analysts at China Securities Finance.

CHINA MARKETS

MNI: PBOC Drains Net CNY198 Bln Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY240 billion via 7-day reverse repo on Wednesday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY198 billion after offsetting the maturity of CNY438 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7594% at 09:29 am local time from the close of 1.8342% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 51 on Tuesday, compared with the close of 42 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1140 Wednesday vs 7.1127 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1140 on Wednesday, compared with 7.1127 set on Tuesday. The fixing was estimated at 7.1486 by Bloomberg survey today.

MARKET DATA

AUSTRALIA 3Q GDP Q/Q 0.2%; MEDIAN 0.5%; PRIOR 0.4%

AUSTRALIA 3Q GDP Y/Y 2.1%; MEDIAN 1.9%; PRIOR 2.0%

MARKETS

US TSYS: Trim Tuesdays Gain In Asia, Narrow Ranges

TYH4 deals at 110-24, -0-05+, a 0-09 range has been observed on volume of ~109k.

- Cash tsys sit 1-3bps cheaper across the major benchmarks, light bear flattening is apparent.

- Tsys trimmed Tuesday's gains in early dealing, Asia-Pac participants perhaps used the richening as an opportunity to square positions ahead of Friday's NFP print.

- Ranges remained narrow and the move lower didn't follow through, tsys pared losses ticked away from session lows.

- In Europe today German Factory Orders and Eurozone Retail Sales headline, further out we have ADP private payrolls and trade balance.

JGBS: Richer, Off Best Levels, 30Y Supply Tomorrow

In Tokyo afternoon dealings, JGB futures are holding richer, +27 compared to settlement levels, but off the session’s best levels.

- In an otherwise quiet calendar, BOJ Deputy Governor Himino said the central bank can make a smooth exit from monetary easing once sustainable 2% inflation is achieved, but it needs to keep policy loose for now. "The BOJ should carefully monitor the evolution of wages and prices, judge the timing of the exit and design its process," Himino said. (See Bloomberg link ICYMI)

- The move away from the session’s best level for the futures contract can therefore be traced back to the 1-3bps cheapening in cash US tsys in today’s Asia-Pac session. After the strong rally overnight, local participants may be using it as an opportunity to square long positions ahead of Friday’s NFP data.

- The cash JGB curve has bull-flattened beyond the 1-year (+1.8bps), with yields 0.2bp to 8.4bps lower. The benchmark 10-year yield is 2.7bps lower at 0.643% versus the new low of 0.622% for the decline that started in early November.

- Swaps curve has bull-flattened too, with rates 0.1 to 4.4bps lower. Swap spreads are wider beyond the 4-year.

- Tomorrow, the local calendar sees International Investment Flow and Tokyo Average Office Vacancies data, along with the Leading and Coincident Indices.

- The MOF also plans to sell Y900bn of 30-year JGBs.

AUSSIE BONDS: Richer But Off Best Levels Despite Q3 GDP Miss

ACGBs (YM +8.0 & XM +11.0) sit richer but 3bps cheaper than pre-GDP data levels. This came even though Q3 GDP surprised on the downside in terms of headline growth and its composition.

- Q3 GDP came in lower-than-expected at 0.2% q/q but the annual rate was higher at 2.1% y/y, in line with Q2. The composition of growth was soft given it was driven by government spending/investment and inventories. Non-dwelling construction was a bright spot though in the private sector.

- The move away from the best levels was assisted by the 1-3bps cheapening in cash US tsys in today’s Asia-Pac session. After the strong rally overnight, local participants may have used it as an opportunity to square long positions ahead of Friday’s NFP data.

- Cash ACGBs are 8-11bps richer on the day, 3-4bps cheaper in post-data dealings, with the AU-US 10-year yield differential 7bps tighter at +12bps. The differential was +19bps before the RBA decision yesterday.

- Swap rates are 6-9bps lower on the day, with EFPs little changed.

- The bills strip is holdings its bull-flattening, with pricing flat to +9.

- RBA-dated OIS pricing is 3-10bps softer on the day across meetings. This brings the post-RBA softening across meetings to 6-17bps.

- Tomorrow, the local calendar sees Trade Balance data for October.

NZGBS: Richer, Off Best Levels, Flatter Curve, US ADP Employment Data Due

NZGBs closed 1-10bps richer across benchmarks after paring morning strength. The initial strength had been induced by a strong rally in US tsys during yesterday’s NY session following lower-than-expected JOLTS job openings data. It also reflected spillover from post-RBA decision strength in ACGBs. The local market was closed at the time of the RBA policy decision.

- With the local data calendar light today, the move away from the best levels likely reflected the 1-3bps cheapening in cash US tsys in today’s Asia-Pac session. After the strong rally overnight, local participants may have used it as an opportunity to square long positions ahead of Friday’s NFP data. Later today the US calendar shows ADP private payrolls.

- Swap rates closed flat to 9bps lower, with the 2s10s curve flatter and implied swap spreads wider.

- RBNZ dated OIS pricing closed little changed, with the expected terminal OCR 1bp firmer at 5.55%.

- Tomorrow, the local calendar is empty, ahead of Q3 Manufacturing Activity on Friday.

- Tomorrow, the NZ Treasury plans to sell NZ$250mn of the 4.5% Apr-27 bond, NZ$200mn of the 1.5% May-31 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: Antipodeans Firm In Asia

AUD and NZD are leading the bid in the G-10 space today, the move higher has been seen alongside firmer regional equities and US equity futures. US Tsy Yields are a touch higher and Oil is little changed.

- AUD/USD looked through a miss on the Q3 GDP data and sits ~0.6% higher. The $0.66 handle remains intact and resistance comes in at $0.6623, high from Dec 5.

- Kiwi is up ~0.6%, NZD/USD last prints at $0.6165/70. Bulls immediate focus is on the $0.62 handle.

- Yen is a touch pressured, higher US Tsy Yields are weighing, however USD/JPY has sat in a narrow range for the most part in Asia. The Japanese data docket was empty today.

- Elsewhere in G-10 GBP and CAD are a touch higher, the EUR is flat. BBDXY is ~0.1% lower.

- In Europe today German Factory Orders and Eurozone Retail Sales headline the docket.

EQUITIES: China Markets Lag Broader Rebound, Australian Shares Outperform

MNI (AUSTRALIA) Regional equities are mostly higher, except for some pockets of weakness in South East Asia. A core yield pull back through Tuesday has been a factor aiding sentiment, although US nominal cash Tsy yields are higher in the first part of Wednesday trade. US equity futures sit higher though after an indifferent Tuesday cash session. Eminis last +0.30% at 4588.5, while Nasdaq futures are slightly higher at +0.43%.

- Hong Kong markets have pushed higher, with the HSI up 0.73% at the break. The tech sub index is outperforming, +1.3%.

- China markets are only modestly higher though in terms of the CSI 300, +0.15% at the break, while the Shanghai Composite sits down slightly (-0.11%). This follows sharp losses and Moody's credit rating outlook downgrade yesterday.

- Onshore media has pushed back against this today, while also stating that the stock market hit a mild bull market in 2024 (Securities Times/BBG). Headlines have also cross from the NDRC that China has scope for macro adjustments to support the economy (NDRC).

- In Australia, the ASX 200 is up strongly, +1.7%, despite a disappointing Q3 GDP update. Financials and resource names have been the outperformers.

- Japan stocks are higher, +1.8% for the Nikkei 225, with lower core yields buoying tech related plays. The Kospi and Taiex have seen more modest rises, up around 0.30%.

- In SEA trends are more mixed, the Philippines and Malaysia bourse are down modestly.

- In India, we continue to see upside momentum, the Nifty up a further 0.50% in early dealings. This is fresh record highs for the index.

OIL: Crude Steady But Oversupply Remains Key Concern

Oil prices haven’t been able to make up any of Tuesday’s losses. Crude is little changed helped by a marginal decline in the greenback with WTI at $72.29/bbl and Brent $77.22.

- Oversupply remains a key concern for the market with US crude exports expected to reach a record high and continued scepticism that OPEC’s output will be cut as announced last week.

- Bloomberg reported that US crude stocks rose 594k barrels in the latest week, according to people familiar with the API data. Gasoline rose 2.8mn and distillate 1.9mn. The official EIA data is released later today.

- Prices are down around 7% since OPEC but technical measures are suggesting that crude could be oversold and it may also be impacted by declining liquidity, according to Bloomberg. The Russians have been trying to support the market with Deputy PM Novak saying that OPEC could do more if last week’s decision is not enough to stabilise prices. He and President Putin will travel to Saudi Arabia and the UAE this week.

- Venezuela is posing further risks as it is granting licenses to extract oil in a disputed region of Guyana and has warned foreign oil companies to leave. It also hasn’t released US prisoners as agreed. Both actions risk the cancellation of licenses granted by the US in October.

- Ahead of Friday’s US payroll report, ADP employment prints today and is expected to be slightly higher at 130k. There are also the October trade balance and final Q3 productivity/ULC. The Bank of Canada meets and is expected to be on hold.

GOLD: Pullback From The All-Time High Continues

Gold is little changed in the Asia-Pac session, after closing 0.5% lower at $2019.36 on Tuesday.

- The firmer dollar weighed on precious metals, with spot gold extending the pullback from Monday’s fresh all-time high. Bullion has retraced some 5.5% since Monday’s intraday high of $2135.

- Tuesday’s softness came despite a decline in US Treasury yields following weaker-than-expected JOLTs job openings data. The decline in job openings was the biggest monthly drop since May 2023 and marked the lowest level since 2021. Moreover, the ratio of openings/unemployed dropped to 1.34, the lowest since August 2021. Lower rates tend to be positive for bullion, which doesn’t yield any interest.

- Later today the US calendar shows ADP private payrolls, ahead of Non-Farm Payrolls on Friday.

- While the overall price action signalled the potential for a climb towards 2177.58 next, a Fibonacci projection, recent price action conveys a short-term pullback, which should be considered corrective, according to MNI’s technicals team. Initial support is $2004.1, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/12/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/12/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/12/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/12/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/12/2023 | 1030/1030 |  | UK | BOE FPC Summary and Record | |

| 06/12/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/12/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 06/12/2023 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/12/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 06/12/2023 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 06/12/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 06/12/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/12/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.