-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Covid Matters Take Focus In Muted Asia Trade

EXECUTIVE SUMMARY

- BIDEN EYES RASKIN AS TOP FED BANKING REGULATOR (WSJ)

- CDC REVISE DOWN ESTIMATES FOR U.S. OMICRON INFECTIONS

- GLOBAL COVID CASES TOP 1 MILLION FOR SECOND STRAIGHT DAY (BBG)

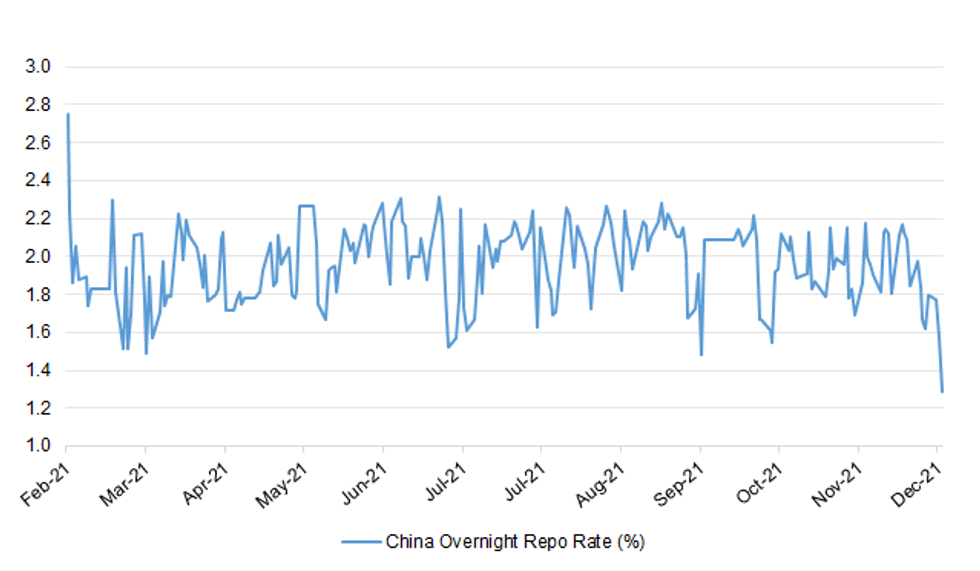

- CHINA KEY FUNDING RATE FALLS TO 11-MONTH LOW AMID CASH BOOST (BBG)

Fig. 1: China Overnight Repo Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Hospitals are reporting high numbers of “incidental Covid” patients who are admitted for unrelated reasons, an NHS chief has said, warning hospitalisation data should be treated with caution. Chris Hopson, the NHS Providers chief executive, stressed that Covid figures do not distinguish between those hospitalised because of the virus and other patients who test positive asymptomatically after arrival. The number of people in hospital with coronavirus in England is less than half what it was this time last year, despite three times as many infections amid the omicron variant surge. (Telegraph)

CORONAVIRUS: Boris Johnson is facing pressure to stave off an NHS staffing crisis by reducing the coronavirus self-isolation period as infections hit a record high yesterday. Health service chiefs warned that staff absences caused by the requirement to isolate for seven days after a positive test risked causing a bigger problem than the number of Covid-19 patients being admitted to hospitals. (Times)

EUROPE

EU/UK: Continuous British threats to exit post-Brexit trade rules for Northern Ireland are "enormously disruptive," European Commission Vice President Maroš Šefčovič said, warning the entire deal with the U.K. would collapse if such rules were canceled. In an interview published Tuesday, Šefčovič, the European Commissioner overseeing talks with the U.K. and Switzerland, warned that a British decision to activate Article 16 of the Northern Ireland Protocol would have "serious consequences" for Northern Ireland's economy, endanger peace in the region and constitute an "enormous setback" for EU-U.K. relations. (Politico)

EUROPE: Countries across Europe have reported a record high number of infections as authorities scramble to stem the surge. On Tuesday, the UK saw a record 129,471 new Covid cases, up from 98,515 reported yesterday. France reported 179,807 new cases, by far the highest number since the start of the pandemic. Greece also reported a new daily record of 21,657 Covid cases, more than double the number the day before. Denmark and Iceland similarly broke pandemic records with Denmark recording the world’s highest infection rate at 1,612 cases per 100,000 people. (Guardian)

U.S.

FED: President Biden is considering Sarah Bloom Raskin for a top role at the Federal Reserve as part of a slate of three nominees for central bank board seats, according to people familiar with the matter. The administration is eyeing Ms. Raskin, a former Fed governor and former Treasury Department official, to become the central bank's vice chairwoman of supervision, the government's most influential overseer of the American banking system, the people said. Mr. Biden is also considering two economists for other Fed board seats that will soon be vacant: Lisa Cook, a professor of economics and international relations at Michigan State University; and Philip Jefferson, a professor and administrator at Davidson College in North Carolina. (WSJ)

CORONAVIRUS: The Omicron variant was estimated to be 58.6% of the coronavirus variants circulating in the United States as of Dec. 25, according to data from the U.S. Centers for Disease Control and Prevention (CDC) on Tuesday. The agency also revised down the Omicron proportion of cases for the week ending Dec. 18 to 22% from 73%, citing additional data and the rapid spread of the variant that in part caused the discrepancy. (RTRS)

CORONAVIRUS: American shoppers flocked to brick-and-mortar stores this holiday season, with especially strong sales in several states where the rate of full vaccinations against the COVID-19 virus is less than 60%, according to an analysis of Mastercard SpendingPulse holiday sales data. Arkansas, Kentucky and West Virginia, all of which are less than 55% fully-vaccinated against the COVID-19 virus, were among the states with the highest sales growth between Nov. 1 and Dec. 24 versus last year, according to the Mastercard data provided exclusively to Reuters. In each of these states, in-store holiday sales rose by more than 10%. Overall, in-store sales rose 8.1%, according to Mastercard. (RTRS)

OTHER

CORONAVIRUS: Research by South African scientists suggests that Omicron could displace the Delta variant of the coronavirus because infection with the new variant boosts immunity to the older one. The study only covered a small group of people and has not been peer-reviewed, but it found that people who were infected with Omicron, especially those who were vaccinated, developed enhanced immunity to the Delta variant. The analysis enrolled 33 vaccinated and unvaccinated people who were infected with the Omicron variant in South Africa. (RTRS)

U.S./CHINA: Talks are underway between the U.S. and China on possible changes to the Chinese government’s new aircraft-cleaning requirements that prompted a Delta Air Lines Inc. flight to turn back to Seattle and that could trigger the cancellation of some flights to the Asian nation. The discussions were confirmed Tuesday by a State Department official who spoke on condition of anonymity. The new sanitation mandates -- spurred by the spread of Covid-19 -- significantly extend the time planes are on the ground and largely copy steps that U.S. airlines already take to clean between flights, representatives for the industry said. There also is a shortage of available workers to carry out the added steps, they said. (BBG)

U.S./RUSSIA: U.S. and Russian officials will hold security talks on Jan. 10 to discuss concerns about their respective military activity and confront rising tensions over Ukraine, the two countries said. (RTRS)

RUSSIA: Russia’s Supreme Court on Tuesday ordered the closure of Memorial, the country’s oldest civil rights group, after prosecutors accused the organisation of failing to properly label itself a “foreign agent” and suggested it was depicting the Soviet Union too negatively. The legal action against the group caps a year of an unprecedented crackdown on dissent by the Kremlin, including the jailing of opposition leader Alexei Navalny and pressure on activists and independent journalists as well as other political opponents of President Vladimir Putin. Two former local leaders of Navalny’s movement were detained on Tuesday. (FT)

MIDDLE EAST: Defense Minister Benny Gantz hosted Palestinian Authority President Mahmoud Abbas at his home in Rosh Ha’ayin on Tuesday night. It marked the first time the Palestinian leader met with a senior Israeli official inside Israeli territory since 2010. The meeting was Gantz and Abbas’s second since the new Israeli government was formed in June. According to the Defense Ministry, it lasted two and a half hours; part of it was between Abbas and Gantz alone. “The Defense Minister emphasized the shared interest in strengthening security cooperation, preserving security stability, and preventing terrorism and violation,” Gantz’s office said in a statement. (Times of Israel)

AUSTRALIA: Only people living with confirmed coronavirus cases will be considered close contacts as the country goes through a “gear change” to deal with the surging Omicron outbreaks across most states and territories. National cabinet will also urgently discuss coronavirus testing requirements on Thursday as Australia moves away from its reliance on PCR tests towards widespread rapid antigen test use - but the responsibility for purchasing the tests will remain with state governments. Prime Minister Scott Morrison said it was important to adjust the country’s approach to the pandemic as Omicron takes hold. “We’re going through a gear change when it comes to how we manage testing arrangements, the definition of close contacts, how we furlough staff and isolate people who are impacted by cases,” he told reporters on Wednesday. (SMH)

SOUTH KOREA: About 42 percent of South Koreans think that President Moon Jae-in did a good job in handling state affairs over the past five years, an approval rating slighly higher than the vote he received in the 2017 presidential election, a poll showed Wednesday. (Yonhap)

SOUTH KOREA: South Korea needs to allow overseas trading in won in efforts to give a boost to its growing trade and the economy, said a former Bank of Korea official and an adviser to the government. The “current system needs to be more efficient, or at least less burdensome for foreign investors acquiring and trading the Korean won,” Lee Seungho, head of the International Finance Research Center at the Korea Capital Market Institute in Seoul, said in an interview last week. “There is a pressing need to reform the law.” (BBG)

HONG KONG: The current and former chief editors of Stand News, an online outlet popular among Hong Kong opposition activists, were arrested alongside four former board members and a journalist by national security police on Wednesday morning. Six were arrested at their homes at about 6am under a colonial-era law covering conspiracy to print or distribute seditious materials, police said in a statement, an offence punishable by up to two years in prison and a fine of HK$5,000 (US$641). (SCMP)

RUSSIA: Russia believes that the Nord Stream 2 gas pipeline will get the necessary certification and eventually start working, Russian Deputy Prime Minister Alexander Novak told RBC media on Wednesday. (RTRS)

CANADA: Quebec, the second most populous Canadian province, has "no choice" but to allow some essential workers to continue working even after testing positive for COVID-19 to prevent staff shortages from impeding its healthcare services, Health Minister Christian Dube said Tuesday. (RTRS)

MEXICO: Mexico plans to halt crude oil exports in 2023 as part of President Andres Manuel Lopez Obrador’s nationalist goal of self-sufficiency in fuel production. Petroleos Mexicanos, the Mexican state-owned producer known as Pemex, will reduce daily crude exports next year by more than half to 435,000 barrels before phasing out sales to foreign customers the following year, Chief Executive Officer Octavio Romero said during a press conference in Mexico City on Tuesday. (BBG)

PAKISTAN: Imran Khan’s government is set to present Pakistan’s parliament with a series of unpopular austerity measures in an effort to resume a stalled $6bn IMF loan programme, risking a fierce political backlash at a time of deep economic pain. A finance bill is expected to be introduced to the lower house on Wednesday that would cut development spending, end subsidies for areas including electricity and gas and remove sales tax concessions on raw materials and pharmaceuticals. (FT)

CHINA

CORONAVIRUS: Covid-19 cases in the western Chinese city of Xi’an eased a bit on Wednesday after hitting a record high a day earlier, when repeat testing of its 13 million residents identified previously undetected chains of transmission. Xi’an reported 151 infections on Wednesday, down from 175 on Tuesday, as residents have been asked to stay indoors and driving is banned. The outbreak spread from a few dozen cases in early December to roughly 150 a day after the city was locked down last Thursday, the most dramatic curb China has enacted to stymie Covid since closing off Wuhan and the broader Hubei province in January 2020. (BBG)

PBOC: The People’s Bank of China will issue a first batch of low-cost loans to financial institutions by the end of this year, to promote carbon emission reduction and clean coal use, Xinhua News Agency reported citing PBOC Governor Yi Gang. The PBOC can increase the quota for refinancing to small and micro enterprises as necessary, and the central bank will encourage banks to increase SME loans by offering 1% of newly added loans, the newspaper said. In terms of the Evergrande risks, it should be deal with market-based methods, clarify the responsibilities of shareholders and local governments, so to prudently resolve risks, Xinhua cited Yi as saying, noting that China’s financial risks are convergent and controllable. (MNI)

FISCAL: China will accelerate fiscal spending and advance infrastructure projects in the first half of 2022, with a focus on safeguarding social security and employment as well as water projects, the Economic Information Daily reported citing Lian Ping, chief economist at Zhixin Investment Research Institute. The infrastructure-backed local government special bonds may rise to about CNY4 trillion next year, the daily said. Monetary policy should tilt to loosening with RRR cuts and structural tools to drive down the benchmark Loan Prime Rate, said Lian. The PBOC should release longer term liquidity to improve banks’ ability to purchase government bonds, while also increasing money supply to lower market interest rates, Lian said. (MNI)

LOANS: New yuan loans in China should see a slight increase next year, reaching CNY21 trillion, as the central bank aims to boost credit growth to help stabilise the economy, the 21st Century Business Herald reported citing analysts. M2 growth may also accelerate from this year to around 8.7%, while the scale of total social financing around CNY34 trillion, the newspaper said citing Bank of Communications Financial Research Center. The tight credit environment for the real estate sector will be improved, while banks will lend to small and micro enterprises and support green development and technology innovation, the newspaper said. (MNI)

EXPORTS: China issued Wednesday its first white paper on export controls to provide a full picture of related policies and help the international community better understand its position. The document, titled "China's Export Controls" and released by the State Council Information Office, elaborated on China's position, institutions, and practices in improving export control governance, as well as its commitments and actions to safeguard world peace and development, and security at national and international level. The white paper stressed that fair, reasonable, and non-discriminatory export control measures are increasingly important to addressing international and regional security risks and challenges and safeguarding world peace and development. (Xinhua)

EVERGRANDE: China Evergrande Group passed another debt deadline with no sign of payment, after coupon payments came due Tuesday on two dollar notes, both with a 30-day grace period before a default can be declared. (BBG)

OVERNIGHT DATA

SOUTH KOREA JAN BUSINESS SURVEY M’FING 92; DEC 88

SOUTH KOREA JAN BUSINESS SURVEY NON-M’FING 78; DEC 83

CHINA MARKETS

PBOC INJECTS NET CNY120BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY200 billion via seven-day reverse repos with the rate unchanged at 2.2% on Wednesday. This operation has injected net CNY120 billion after offsetting the maturity of CNY10 billion repos and CNY70 billion of Treasury's cash deposits at commercial banks, according to Wind Information.

- The operation aims to maintain the liquidity stable towards year-end, the PBOC said on its website.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2242% at 9:34 am local time from the close of 2.2870% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Tuesday vs 54 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3735 WEDS VS 6.3728

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3735 on Wednesday, compared with 6.3728 set on Tuesday.

MARKETS

SNAPSHOT: Covid Matters Take Focus In Muted Asia Trade

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 223.52 points at 28845.45

- ASX 200 up 89.506 points at 7509.8

- Shanghai Comp. down 26.662 points at 3603.45

- JGB 10-Yr future unch. at 151.85, yield down 0.2bp at 0.061%

- Aussie 10-Yr future up 4 ticks at 98.41, yield down 4.3bp at 1.534%

- U.S. 10-Yr future +0-03 at 130-22+, yield down 1.03bp at 1.470%

- WTI crude up $0.01 at $75.99, Gold up $0.86 at $1807.05

- USD/JPY up 4 pips at Y114.86

- BIDEN EYES RASKIN AS TOP FED BANKING REGULATOR (WSJ)

- CDC REVISE DOWN ESTIMATES FOR U.S. OMICRON INFECTIONS

- GLOBAL COVID CASES TOP 1 MILLION FOR SECOND STRAIGHT DAY (BBG)

- CHINA KEY FUNDING RATE FALLS TO 11-MONTH LOW AMID CASH BOOST (BBG)

BOND SUMMARY: Core FI Garner Some Strength, Steepening Hits U.S. Tsy & JGB Yield Curves

Fresh headlines failed to offer much of real note, leaving participants to reflect on the most recent updates on the global Omicron situation. Resultant defensive feel provided some support to core bond markets in Asia.

- T-Notes inched higher after the re-open but stabilised thereafter. The contract changes hands +0-03 at 130-22+ as we type, after topping out at 130-23+ earlier in the Tokyo session. U.S. Tsy curve bull steepened, with yields last seen 0.7-1.5bp lower. Eurodollar futures run 0.25-2.0 ticks higher through the reds. Wholesale inventories headline the thin domestic data docket today. On the issuance front, today's sale of 7-Year Tsys will mark the final U.S. bond offering this week.

- JGB futures wavered in a relatively tight range and last operate at 151.87, 2 ticks above previous settlement and slightly below their session high of 151.90. Cash JGB yield curve bull steepened, albeit 5s outperformed (note that this came after Wednesday's strong offering of U.S. 5-Year Tsys). The local headline flow was rather uninspiring.

- Aussie bonds climbed as Antipodean markets re-opened after a four-day Christmas break. Futures were bid, with YM last +3.5 & XM +3.5, both within touching distance from respective session highs. Cash ACGBs also firmed; yields last operate 2.5-3.8bp lower across a flatter curve. Bills trade unch. to +6 ticks through the reds. The space may have drawn some support from domestic Covid-19 developments, as NSW recorded a record daily case count and PM Morrison called a National Cabinet meeting for Thursday to discuss tweaking the country's re-opening strategy.

FOREX: Festive Season Lull

Volatility across G10 FX space was particularly limited as latest headline flow provided little of real note, leaving participants to assess most recent updates on the global Omicron situation.

- The DXY held yesterday's range. The dollar index holds below neutral levels as we are heading for the London session.

- Activity is set to remain subdued into the year-end. The global data docket is fairly empty today, with little beyond U.S. wholesale inventories due for release.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.