-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Insight – November 2024

MNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

MNI EUROPEAN OPEN: Credit Tightening Factoring Into FOMC Outlook

EXECUTIVE SUMMARY

- CREDIT TIGHTENING CAPS FOMC'S TERMINAL RATE (MNI)

- CITI’S FRASER WARNS MOBILE MONEY IS ‘GAME CHANGER’ FOR BANK RUNS (BBG)

- BANK SHARES SLIDE AS JANET YELLEN PLAYS DOWN ‘BLANKET’ DEPOSIT GUARANTEE (FT)

- ECB OFFICIALS VIEWING INFLATION THREAT FEEL VINDICATED ON HIKE (BBG)

- NAGEL: ECB MUST ACT 'DECISIVELY' ON INFLATION (MNI)

- ECB’S MULLER SAYS THE FIGHT AGAINST INFLATION ISN’T OVER YET (BBG)

- ECB’S KAZAKS SAYS EUROPEAN BANKING SECTOR CAN HANDLE TURMOIL (BBG)

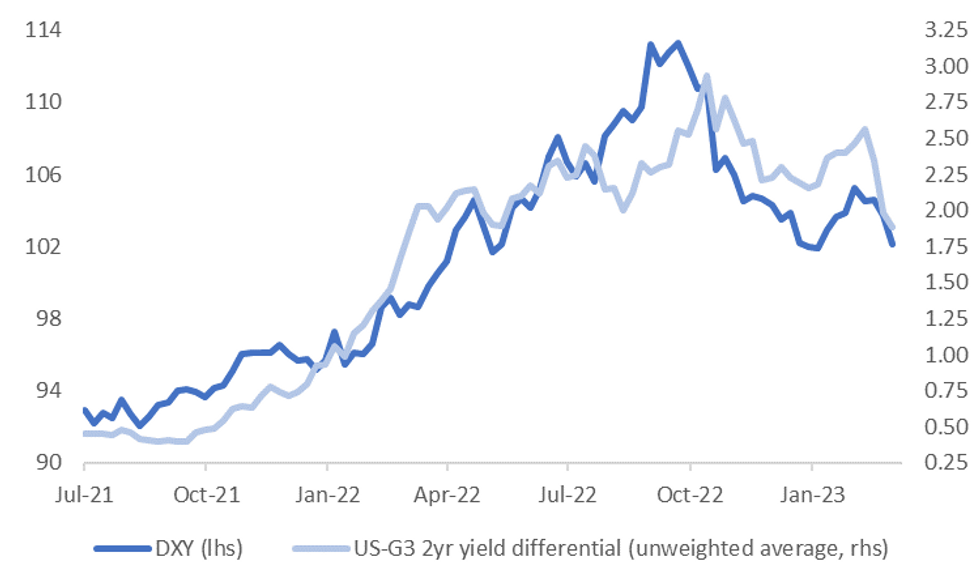

Fig. 1: U.S. Dollar Index (DXY) Vs. U.S. - G3 2-Year Yield Differential

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England said on Wednesday that more volatility and sharp moves in asset prices could expose weaknesses in Britain's market-based finance system. "Should there be further volatility and/or sharp moves in asset prices, there are risks it could trigger the crystallisation of previously identified vulnerabilities in market-based finance, amplifying any tightening in credit conditions," BoE Governor Andrew Bailey said in a letter to parliament's Treasury Committee. (RTRS)

ECONOMY: Productivity in manufacturing industry has dragged down growth in productivity across the economy, which has been meagre since the financial crisis, new analysis has found. (The Times)

EUROPE

ECB: European Central Bank officials are growing increasingly confident that the euro-zone banking system has withstood financial turmoil, allowing them to envisage resuming interest-rate hikes in due course, according to people with knowledge of the matter. (BBG)

ECB: Contagion risks to euro area banks from recent market instability “appear to be low,” although it could have a negative effect on growth, Bundesbank chief Joachim Nagel said in a speech Wednesday, in which he also called for continued “decisive” action to tackle above-target inflation. (MNI)

ECB: The European Central Bank isn’t finished fighting inflation, which remains too high in the euro area, according to Governing Council member Madis Muller. (BBG)

ECB: The European banking sector is well-capitalized, and the European Central Bank and the region’s financial watchdogs have plenty of instruments available to handle any issues, according to Governing Council member Martins Kazaks. (BBG)

BANKS: The collapse of several banks over the past weeks has created nervousness in Europe’s banking markets, even though there’s not direct risk to the system, Germany’s top banking regulator said. (BBG)

BANKS: UBS Group AG likely will shrink the $10 billion shipping portfolio it inherited from Credit Suisse Group AG after its emergency takeover on Sunday, according to people familiar with the matter. (WSJ)

BANKS: Julius Baer Group Ltd., the Zurich-based private bank, said it’s on sound financial footing and isn’t facing the same kinds of risks that other banks face after the collapse of Credit Suisse Group AG on Sunday. (BBG)

BANKS/BONDS: US distressed debt investors and corporate litigators are preparing to fight the Swiss government over its decision to write down $17bn of Credit Suisse bonds as part of the bank’s shotgun marriage with UBS. (FT)

PORTUGAL: Bank of Portugal Vice Governor Clara Raposo said economies need financial stability to be able to keep inflation under control. (BBG)

U.S.

FED: Recent U.S. banking system turmoil will likely tighten credit conditions and help control inflation without much higher interest rates, Federal Reserve Chair Jerome Powell said Wednesday. The Fed raised the federal funds rate target range to 4.75% to 5%, the highest since 2007, but indicated future hikes might depend on the effects of the recent financial turmoil on the economic outlook. (MNI)

FED: President Joe Biden continues to believe in Jerome Powell, the White House press secretary said, as the Federal Reserve chairman faces criticism from politicians in the president’s party over the central bank’s oversight of Silicon Valley Bank. "The president still has confidence in Jerome Powell," Press Secretary Karine Jean-Pierre told reporters in response to a question at a daily briefing. She made a similar remark on Monday. (BArron’s)

FED: The Federal Reserve approved another quarter-percentage-point interest-rate increase but signaled that banking-system turmoil might end its rate-rise campaign sooner than seemed likely two weeks ago. The decision Wednesday marked the Fed’s ninth consecutive rate increase aimed at battling inflation over the past year. It will bring its benchmark federal-funds rate to a range between 4.75% and 5%, the highest level since September 2007. (WSJ)

FED: U.S. Senate Majority Leader Chuck Schumer told reporters on Wednesday he was concerned about the effect of a Federal Reserve decision to raise interest rates by a quarter of a percentage point. "There are competing equities on both sides," said Schumer. "I will say I am concerned about its effect on the economy." (RTRS)

FED/BANKS: Deposit flows in the U.S. banking system have stabilized in the last week after a historic run on deposits at Silicon Valley Bank prompted its collapse and forced finance officials to take emergency actions to shore up the system, Federal Reserve Chair Jerome Powell said on Wednesday. (RTRS)

BANKS: US Treasury secretary Janet Yellen ruled out a broad expansion of deposit insurance to protect savers with balances above $250,000 in the near term, comments that fuelled another sell-off in shares of smaller US banks. (FT)

BANKS: A proposal raising the Federal Deposit Insurance Corporation's $250,000 limit should be considered, U.S. Senate Majority Leader Chuck Schumer told reporters on Wednesday, adding that there should be stronger bank industry regulation. (RTRS)

BANKS: U.S. Treasury Secretary Janet Yellen said on Wednesday that her department was working to restore the Financial Stability Oversight Council's (FSOC) ability to designate non-bank financial institutions as systemically important. (RTRS)

BANKS: JPMorgan Chief Executive Jamie Dimon met Lael Brainard, the director of the White House National Economic Council on Wednesday, while in Washington this week, according to a person familiar with the situation. (RTRS)

BANKS: Citigroup Inc. Chief Executive Officer Jane Fraser said mobile apps and consumers’ ability to move millions of dollars with a few clicks of a button mark a sea change for how bankers manage and regulators respond to the risk of bank runs. (BBG)

BANKS: Pershing Square’s Bill Ackman said he expects an acceleration of deposit outflows from banks after US Treasury Secretary Janet Yellen “walked back” comments about guaranteeing all deposits and the Federal Reserve raised its benchmark rate. (BBG)

BANKS: PacWest Bancorp said it lost 20 per cent of its deposits this year but that it had shored up its access to cash by raising $1.4bn via a lending facility from Apollo-backed investment firm Atlas SP Partners. (FT)

BANKS: The Federal Deposit Insurance Corp. has moved the bid deadline to Friday for the failed Silicon Valley Bank’s wealth-management bank, according to people familiar with the matter. (BBG)

BANKS: Apollo Global Management Inc. and Carlyle Group Inc. are zeroing in on a book of loans up for grabs now that the former parent company of Silicon Valley Bank has filed for bankruptcy. (BBG)

BANKS: First Republic Bank said on Wednesday all its executive officers have decided to take no annual bonuses for 2023, and founder and Executive Chair Jim Herbert will draw no salary effective March 12. (RTRS)

BANKS/RATINGS: Fitch downgraded First Republic's IDR to B; maintained Rating Watch Negative

OTHER

GLOBAL TRADE: Turkish President Recep Tayyip Erdogan said Wednesday that he will speak by phone in the coming days with his Russian counterpart Vladimir Putin to discuss the Black Sea Grain Initiative. (Anadolu)

U.S./CHINA: China's military said on Thursday that it monitored and drove away a U.S. destroyer that entered the South China Sea near the Paracel Islands. (RTRS)

U.S./CHINA: Spy balloons over the American Midwest, warnings from Beijing of a clash if Washington “doesn’t hit the brakes” and intense congressional scrutiny of investment in China — there could hardly be a less auspicious time for US business to attend Beijing’s flagship investment conference. (FT)

U.S./CHINA: A U.S. judge said Alibaba Group Holding Ltd , the Chinese e-commerce giant founded by Jack Ma, must face claims it defrauded shareholders about its alleged monopolistic practices, but dismissed claims over a shelved initial public offering for its Ant Group affiliate. (RTRS)

U.S./CHINA/TAIWAN: Taiwan Foreign Minister Joseph Wu said on Thursday that President Tsai Ing-wen's meeting with U.S. House Speaker Kevin McCarthy in the United States is still in the process of being arranged. (RTRS)

GEOPOLITICS: The West dislikes Russia and China's independence and the coming decades will not be quiet as it will try to break Russia up into smaller and weaker states, former Russian president Dmitry Medvedev said on Thursday. (RTRS)

RBA: The US Federal Reserve’s decision to raise interest rates despite fears about the stability of the global banking system all but confirms the RBA will deliver an 11th consecutive rate rise next month, economists say. (AFR)

RBNZ: New Zealand’s aggressive monetary policy tightening is having the desired effect of slowing the economy, Reserve Bank Chief Economist Paul Conway said. (BBG)

NEW ZEALAND: Insurance claims after Cyclone Gabrielle have almost reached the $900 million mark. (NZ Herald)

SOUTH KOREA: South Korea's chief economic policymaker warned Thursday of the possibility of further instability in the global financial market, such as a recent bank turmoil sparked by the failure of American lenders, amid the continued monetary tightening moves by the United States and major economies. (Yonhap)

BOK: South Korea's financial firms have a low contagion risk from troubles at U.S. and Swiss banks, but some non-bank firms are facing increased stress from the sluggish property market, its central bank said in a report on Thursday. (RTRS)

HONG KONG: Hong Kong’s interbank borrowing cost may stay high and banks may adjust their lending rates, the city’s monetary authority said after a week which saw the overnight funding rate swing wildly. (BBG)

BOC: Bank of Canada officials worried about sticky price and wage gains and elevated inflation expectations even while pausing interest-rate hikes without actively debating a ninth straight increase, the March 8 decision minutes published Wednesday showed. (MNI)

BRAZIL: Brazil's central bank cited rising inflation expectations as it kept interest rates unchanged for the fifth consecutive policy meeting on Wednesday, drawing concern from the government and weakening bets of imminent monetary easing. (RTRS)

BRAZIL: Brazilian Finance Minister Fernando Haddad on Wednesday called a statement from the country's central bank on its interest rate decision "very concerning," hours after the monetary authority maintained its benchmark lending rate at 13.75%. (RTRS)

BRAZIL: Brazil's government forecast on Wednesday that this year's primary deficit will be significantly below the official target, helped by a jump in expected tax revenue. (RTRS)

RUSSIA: Major Japanese shipping company Nippon Yusen KK is seeking a government guarantee to insure vessels at risk from Russia’s war in Ukraine. (BBG)

SOUTH AFRICA: South Africa’s ruling party defeats an opposition motion to have a parliamentary committee investigate allegations of misconduct against President Cyril Ramaphosa for allegedly concealing a burglary at his game farm in 2020. (BBG)

SOUTH AFRICA: The government is offering public servants a 7.5% pay increase for the next financial year, unions that constitute a majority in the Public Sector Coordinating Bargaining Council say in a statement on Wednesday. (BBG)

CHILE: Chile’s lower house of congress fell short of the required majority to approve a bill that would enable people to tap between 15% and 100% of their retirement accounts, in a vote Wednesday. (BBG)

OIL: Khandouzi said Iran had last month achieved its highest level of oil exports for at least two years, overtaking the previous high of 1.3mn barrels a day, despite US sanctions. (FT)

CHINA MARKETS

ECONOMY: Shanghai will kick off a three-month campaign to boost investment in the city later this month, seeking to bolster investor confidence with policy support and project planning, the Shanghai Securities News reported, citing local officials. (BBG)

ECONOMY: Governments in the Chinese cities of Guangzhou, Yingkou, Kunming and Bazhong plan to roll out regulations aimed at boosting the private sector, Securities Times reports, citing their legislative work plans for 2023. (BBG)

INFLATION: China’s pork prices will likely remain at a low level as demand is weak when temperatures rise, Securities Times reports, citing analysts. (BBG)

CREDIT: China’s new loans in March will likely be higher than the same period last year, the China Securities Journal reports, citing analysts. (BBG)

FINANCIALS: The China Banking and Insurance Regulatory Commission plans to meet insurers on Thursday to gauge their asset-liability mismatch risks, the Shanghai Securities News reported, citing unnamed sources. (BBG)

ECONOMY: China’s manufacturing faces an important juncture in its development as it confronts complex and profound changes domestically and internationally, said China’s Premier Li Qiang. Speaking during a tour of advanced manufacturing, Li said the real economy, especially manufacturing, is the foundation of the economy. Beijing should focus on developing strategic emerging industries and accelerate the transformation of products produced in China into Chinese brands. He said support was needed for high-end manufacturing and the promotion of self-reliance in advanced technology. China should create a market orientated and international business environment based on the rule of law and promote the upgrading of traditional manufacturing, he said. (MNI)

CHINA

PBOC NET DRAINS CNY45 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY64 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY45 billion after offsetting the maturity of CNY109 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0000% at 09:23 am local time from the close of 2.0863% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Wednesday, compare with the close of 41 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8709 THURS VS 6.8715 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8709 on Thursday, compared with 6.8715 set on Wednesday.

OVERNIGHT DATA

JAPAN FEB NATIONWIDE DEPARTMENT STORE SALES +20.4% Y/Y; FEB +15.1%

JAPAN FEB TOKYO DEPARTMENT STORE SALES +20.4% Y/Y; FEB +19.6%

NEW ZEALAND FEB ANZ TRUCKOMETER HEAVY -0.7% M/M; JAN +0.8%

The Heavy Traffic Index fell 0.7% in February, while the LightTraffic Index lifted 2.9%.Traffic data captures supply disruptions to some extent as well as changes in demand. Supply disruptions certainly still exist (flood damage to North Island roads and bridges being the latest tranche).Over time, both the economy and traffic data should revert to the more normal state of affairs, of economic activity primarily reflecting the state of demand, but we’re not there yet.Given the cyclone impacts were so regional, there’s no reason to expect the mix of roads in the Truckometer to accurately reflect the economy-wide impact, meaning caution is appropriate when interpreting the data as a gauge of the effects. (ANZ)

MARKETS

US TSYS: Curve Steepens In Asia

TYM3 deals at 115-17, +0-14, 0-01 off the top of the contract’s 0-11 range on volume of ~112K.

- Cash Tsys sit 6bps richer to 2bps cheaper across the major benchmarks. The curve has twist steepened, pivoting around 10s.

- Asia-Pac participants initially faded the move seen in the aftermath of the latest Fed decision, perhaps using the opportunity to close out long positions.

- A bid in e-minis and pressure on the USD saw Tsys recover off session lows, before a break in 2-Year yields, through their post-FOMC trough, along with a similar move in year-end FOMC-dated OIS, triggered a fresh flurry of demand.

- Asia-Pac participants generally looked to the dovish elements of Wednesday’s post-FOMC statement and Chair Powell’s communique.

- Flow was headlined by a TU/UXY block steepener (DV01 ~$150K).

- Fed-dated OIS now prices ~10bps of tightening at the May FOMC meeting, with a terminal rate of ~4.90% observed. There are ~80bps of cuts priced for 2023.

- In Europe today we have SNB, Norges Bank and BOE monetary policy decisions. Further out New Home Sales, Initial Jobless Claims and Fedspeak from St Louis Fed President Bullard will cross, as will 10-Year TIPS supply.

JGBS: Futures Give Back Chunk Of Overnight Gains, Curve Twist Steepens

The early afternoon session impulse from the bid in U.S. Tsys subsided as U.S. fixed income consolidated a little off richest levels of the day, allowing JGB futures to drift lower, printing fresh Tokyo session lows in the process, before regaining some poise into the bell.

- That left the contract +20 ahead of the close, paring around half of the FOMC-inspired overnight session gains. The wider JGB curve has twist steepened, with the 7- to 10-Year zone outperforming on the move in futures since yesterday’s settlement, while 40s are the only major benchmark to sit cheaper on the day, as the major cash JGBs run 3bp richer to 1bp cheaper.

- Swap rates have also ticked away from session lows, in sympathy with the moves in JGB yields. Swap spreads are mixed across the curve.

- Local headline flow was essentially non-existent.

- The latest liquidity enhancement auction covering off-the-run 5- to 15.5-Year JGBs saw spreads print comfortably through prevailing market levels, although the cover ratio moderated a touch. This suggests that those that needed access to the line (maybe with short covering requirements) were willing to “pay up” to guarantee their access, while the recent richening left other prospective bidders on the sidelines.

- Looking ahead, national CPI and flash Jibun Bank PMI data will cross on Friday.

JGBS AUCTION: Liquidity Enhancement Auction For OTR 5- To 15.5-Year JGBs Results

The Japanese Ministry of Finance (MOF) sells Y499.2bn of 5- to 15.5-Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.037% (prev. -0.019%)

- High Spread: -0.031% (prev. -0.017%)

- % Allotted At High Spread: 86.0674% (prev. 49.4514%)

- Bid/Cover: 3.297x (prev. 3.444x)

AUSSIE BONDS: Stronger But Well Off Post-FOMC Bests

ACGBs closed richer (YM +8.0 & XM +7.5) but off session extremes as the U.S. Tsy curve twist steepened in Asia-Pac trade following the FOMC policy decision. At the Sydney close, the 2-year U.S. Tsy yield was 6bp lower and the 10-year 1bp higher. Cash ACGBs closed 8bp richer on the day with the 3/10 curve unchanged and the AU/US 10-year yield differential is +7bp at -15bp.

- Swaps closed 9-10bp stronger but similarly off Asia-Pac session extremes with the 3s10s curve unchanged and EFPs 1-2bp tighter.

- Bills strip flattened with pricing flat to +14.

- RBA dated OIS closed flat to 2bp firmer for meetings out to September and 3-7bp softer beyond. April meeting pricing firmed to an 11% chance of a 25bp hike. Year-end easing expectations closed at 26bp versus 34bp earlier in the session.

- The local calendar is light until next week when February retail sales (Tue) and monthly CPI (Wed) are scheduled for release. These two releases were highlighted in the RBA Minutes as important inputs to the April policy decision.

- Until then, the market will continue to track U.S. Tsys in the wake of yesterday's FOMC decision. The U.S. calendar is light today with U.S. Home Sales and Claims data as the highlights.

NZGBS: 10-Year NZGB Off Bests As U.S. Tsys Twist Steepen In Asia-Pac

NZGBs closed 4-11bp stronger on the day but well off bests as U.S. Tsys twist steepen in Asia-Pac trade. 2/10 cash curve bull steepened 6bp with the 10-year benchmark closing 5bp off best levels. The 2-year benchmark closed at yield lows. NZGBS underperformed U.S Tsys with the 10-year yield differential closing +8bp. NZ/AU 10-year yield differential closed unchanged suggesting ACGB weakness contributed to NZGBs underperformance versus U.S. Tsys today.

- Swaps richen 3-10bp, implying wider swap spreads, with the 2s10s curve 7bp steeper.

- In a speech today RBNZ Chief Economist Conway sounded the usual hawkish rhetoric but acknowledged that the OCR was near the peak and comfortably above neutral with the full contractionary effects yet to be felt.

- Little response from RBNZ dated OIS however which softened 2-7bp for meetings beyond April with terminal OCR expectations at 5.19%. April meeting pricing closed with 23bp of tightening.

- The Antipodean calendar is light until next week. The next major release in NZ is not until ANZ Business Confidence and Building consents on Thursday.

- Accordingly, the market will continue to track U.S. Tsys in the wake of yesterday's FOMC decision. U.S. calendar is light with U.S. Home Sales and Claims data the highlights.

EQUITIES: Tech Names & Higher US Futures Help Regional Sentiment

Regional equities are mixed, although those markets that are weaker, aren't down as much as implied by the US fall from Wednesday's session. Higher US futures through the course of today, with eminis and Nasdaq futures tracking around ~0.45% higher has helped. Cross asset wise, lower US yields, and a weaker USD have helped from a risk sentiment standpoint as well.

- The HSI is tracking close to 0.8% higher at this stage. The underlying tech index is +1.6%, the third straight session of gains. This came after Tencent earnings were better than expected. Alibaba shares were also higher. The HS China enterprise index is up 0.92% so far.

- Mainland shares are also firmer, the CSI 300 +0.36%, while the Shanghai Composite is flat. Northbound flows remain modestly positive so far today (+1.45bn yuan).

- The Topix is around 0.4% weaker at the stage, with bank sub-index down around 1.5%. The Taiex is faring better, up around 0.45%, with semiconductor stocks leading the move. The Kospi is around flat, but is comfortably up off session lows.

- The ASX 200 is down near 0.70%, with weakness in materials and financial stocks the main drags.

GOLD: Gold Moves Higher Again But Struggling To Break $2000

Gold is higher again today following its rally post the Fed decision on Wednesday. It reached a high of $1978.86/oz but couldn’t break through $2000 again. Bullion is 0.3% higher to $1975.78 today following +1.6%. It is close to its intraday high of $1977.68. The USD index is down a further 0.4% and US yields are lower, which are supportive of gold.

- The Fed hiked rates 25bp as expected, but considered pausing given recent banking troubles, which was dovish but it was made clear that a cut isn’t imminent, which limited the upside in gold. Inflation still needs to come down but the Fed is close to its terminal rate.

- Bullion is down slightly on the week. Resistance remains at $2009.70, the March 20 high.

- Goldman Sachs revised up its target for gold to $2050 over the next year. It believes that risks are skewed to the upside given that it sees a recession as more likely than a soft landing in the US.

- A number of European central banks meet later and are all expected to increase rates despite recent banking turmoil. The BoE is forecast to hike by 25bp, the SNB 50bp and the Norges bank 25bp. In the US jobless claims, new home sales and Kansas & Chicago activity indices print.

OIL: Oil Prices Pull Back As US Recession Fears Resurface

Oil prices are lower today after rising moderately on Wednesday. Brent is down 0.9% to $76.03 and WTI is down 1% to $70.16, down around $10 from end-2022. Both are off of their intraday lows but are facing whole number support levels. The USD index is 0.4% lower.

- Oil is struggling after the Fed said that there wouldn’t be any rate cuts this year and that it will hike further if needed to bring inflation down. Also, Treasury Secretary Yellen said there’s unlikely to be a “blanket” deposit insurance scheme. Crude markets have been nervous about a tightening-induced US recession which has been exacerbated by recent banking turmoil.

- In addition to demand worries, there is concern on the supply side too. US stocks continue to rise and there is uncertainty over Russian output cuts. However, Goldman Sachs remains bullish oil.

- A number of European central banks meet later and are all expected to increase rates despite recent banking turmoil. The BoE is forecast to hike by 25bp, the SNB 50bp and the Norges bank 25bp. In the US jobless claims, new home sales and Kansas & Chicago activity indices print.

FOREX: USD Pressured In Asia

The greenback is pressured in Asia, Asia-Pac participants looked to the dovish elements of Wednesday’s post-FOMC statement and Chair Powell’s communique. BBDXY breached lows seen in the aftermath of the FOMC rate decision, and now sits a touch off its lowest level since 14 Feb.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD sits above the 200-Day EMA ($0.6272). Earlier in the session RBNZ Chief Economist Conway spoke this morning, he noted that damaging effects of high inflation and that inflation remains too high in NZ. He also said the RBNZ will need to hike more to return inflation to target.

- AUD/USD prints at $0.6740/45, up ~0.8% today. The next resistance in AUD/USD is seen at the 50-Day EMA ($0.6771).

- Yen is also firmer, benefiting from a fall in 2 Year US Treasury Yields. USD/JPY prints at ¥130.60/70 and has breached yesterday's post FOMC lows. The pair found support below ¥130.54, low from March 20, and marginally pared losses.

- Elsewhere in G-10 broad based USD weakness has seen EUR rise ~0.4%. EUR/USD is within touching distance of yesterday's €1.0912 peak, a break through there would expose key resistance at €1.1033 Feb 2 high.

- Cross asset wise; 2 Year US Treasury yields are ~6bps lower at 3.87% having peaked in early trade at 3.97%. E-minis are ~0.5% firmer, and the Hang Seng is ~0.8% firmer.

- In Europe today we have SNB, Norges Bank and BOE rate decisions. Further out New Home Sales, Initial Jobless Claims and Fedspeak from St Louis Fed Bullard will also cross.

FX OPTIONS: Expiries for Mar23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0580-00(E1.8bln), $1.0650-52(E848mln), $1.0800(E874mln), $1.0890-05(E553mln), $1.0920-25(E541mln)

- USD/JPY: Y130.00($574mln), Y130.37-55($1.3bln), Y131.00($631mln), Y131.50($1.5bln), Y132.00($827mln)

- EUR/GBP: Gbp0.8900(E1.1bln)

- AUD/USD: $0.6640-50(A$643mln)

- USD/CNY: Cny6.7500($1.3bln), Cny6.9500($576mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/03/2023 | 0830/0930 |  | CH | SNB interest rate decision | |

| 23/03/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 23/03/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/03/2023 | 1230/0830 | * |  | US | Current Account Balance |

| 23/03/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/03/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/03/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2023 | 1500/1600 |  | EU | ECB Lane Panels Peterson Institute Conference | |

| 23/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.