-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Crude/US Bank Jitters Dominate Post FOMC

EXECUTIVE SUMMARY

- PACWEST SAID TO WEIGH STRATEGIC OPTIONS, INCLUDING A SALE (RTRS)

- WHITE HOUSE REPORT - DEBT LIMIT DEFAULT COULD COST 8.3mn JOBS (RTRS)

- BIDEN PICKS FED’S JEFFERSON FOR VICE CHAIR, KUGLER FOR GOVERNOR (BBG)

- REPAYING ECB’S CHEAP PANDEMIC LOANS RISKS FUNDING MARKET STRESS (BBG)

- CHINA’S FACTORY ACTIVITY SKIDS IN APRIL ON WEAK DEMAND (RTRS)

- OIL WHIPSAWED AS CHAOTIC OPENING SELLOFF GIVES WAY TO REBOUND

- OCR AT 5.5% BEFORE PAUSE - EX-RBNZ GOVERNOR (MNI)

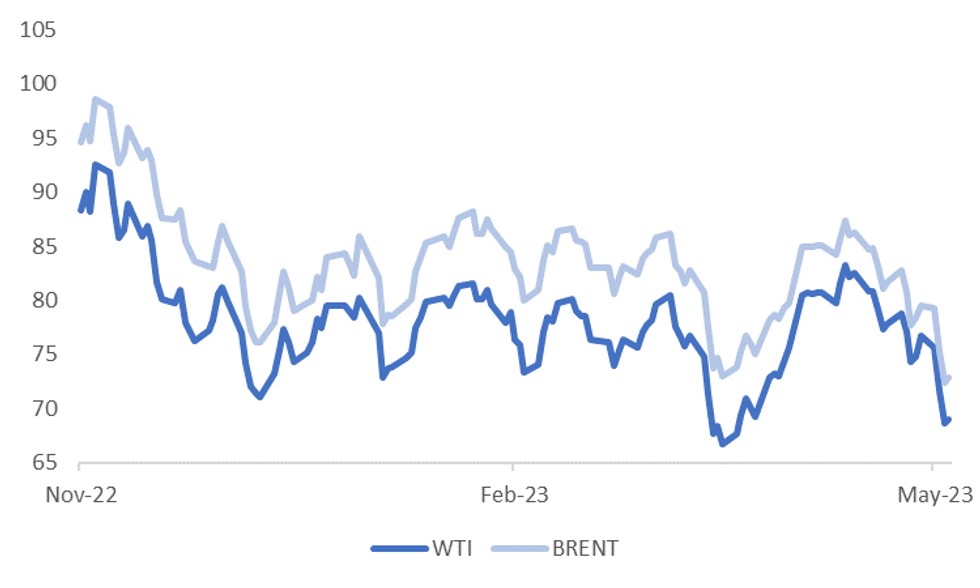

Fig. 1: Crude Jitters Ease During APAC Session

Source: MNI - Market News/Bloomberg

UK

MARKETS: Vodafone and CK Hutchison are close to agreeing a £15bn combination of their UK telecoms businesses that would create the country’s biggest mobile operator, with 28mn customers, three people close to the matter said. (FT)

EUROPE

ECB: Banks say the European Central Bank may need a new funding program to help lenders make large repayments on pandemic-era loans without roiling the region’s money markets. (BBG)

U.S.

FED: The Federal Reserve is closer to ending its historic tightening cycle with a potential pause in June but is leaving open the potential for more tightening as the length and extent of banking issues is uncertain and it is unclear how much credit will tighten. (MNI)

FED: President Joe Biden has picked Federal Reserve Governor Philip Jefferson for a promotion to vice chair and will nominate economist Adriana Kugler to an open board slot, according to people familiar with the matter. (BBG)

BANKING: PacWest Bancorp is exploring strategic optionsincluding a sale or capital raising, a source familiar with the matter said, sending the shares of the bank and several other U.S. regional lenders tumbling in after-market trading. (RTRS)

BANKING: Western Alliance Bancorp said on Wednesday it had not experienced unusual deposit outflows following the sale of collapsed lender First Republic Bank to JPMorgan Chase & Co, as the U.S. regional bank sought to reassure investors. (RTRS)

DEBT: A protracted default on U.S. payment obligations could result in the loss of 8.3 million jobs and a 6.1% reduction in economic output, according to an analysis by the White House Council of Economic Advisers released on Wednesday. (RTRS)

US/CHINA: U.S. Secretary of State Antony Blinken on Wednesday said he hoped to make a trip to China sometime in 2023, stressing the need to "reestablish regular lines of communication at all levels and across our government." "We're in a competition with China; there's no secret about that," said Blinken at an event hosted by The Washington Post. "But we have a strong interest in trying to make sure that that competition doesn't veer into conflict." (NIKKEI)

OTHER

JAPAN: The International Monetary Fund on Thursday warned of "uncertainty" around the direction of Japan's monetary policy, saying a possible shift from ultra-low interest rates could have a significant impact on global financial markets. (RTRS)

NZ: The Reserve Bank of New Zealand will likely pause further rate hikes after it lifts the Official Cash Rate 25bp to 5.5% at the upcoming May 24 meeting, according to Grant Spencer, adjunct professor at the Victoria University of Wellington and former deputy governor at the RBNZ. (MNI)

NZ: The makeup of the Reserve Bank of New Zealand’s Monetary Policy Committee and its dual mandate would face change if October’s general election leads to a change of government with the opposition National Party signalling desire for reform, former RBNZ staff and industry insiders told MNI. (MNI)

OIL: Oil futures endured a roller-coaster ride as Chinese traders returned after a break, first collapsing to the lowest level since 2021 in a chaotic opening spell before erasing losses to trade higher. West Texas Intermediate futures initially tanked by as much as 7.2% at the start of trading amid concerns that a looming US recession would hurt demand. The steep drop was pared, then overturned by mid-morning in Asia. (BBG)

CHINA

ECONOMY: China's factory activity unexpectedly dipped in April, a private sector survey showed on Thursday, due to softer domestic demand and suggesting the manufacturing sector is losing momentum amid a bumpy post-COVID economic recovery. (RTRS)

ECONOMY: China’s expected strong Q2 economic growth will stabilise the yuan's exchange rate, according to analysts interviewed by Yicai.com. CNY/USD had become overvalued during January, when it strengthened from CNY7.3 to CNY6.7, and the subsequent correction to CNY6.9 was closer to equilibrium, one analyst said. Traders expect Q2 GDP to grow by 7%, due to low base effects from last year, which will stabilise the exchange rate further against a backdrop of U.S. rate hikes. (MNI)

TOURISM: The tourism sector recovered strongly over the May holidays, according to the Ministry of Culture and Tourism. Domestic trips increased 70.83% y/y – 19% higher than 2019. Revenue was up 128.9% y/y and was about equal to 2019 levels. Beijing and Chongqing continue to be popular, but new niche destinations such as Changxing and Xianju gained attraction. (MNI)

TOURISM: China's tourism rebounded to pre-COVID 19 levels in the May Day holiday as the number of domestic trips rose by more than two-thirds from a year earlier, government data showed on Wednesday, a welcome boost for the world's second-biggest economy. (RTRS)

TOURISM: Chinese airlines will be allowed to expand their flights to the US, in a small concession from Washington to Beijing that comes as the two countries struggle to stabilize their turbulent relationship. (FT)

BANKING: Regionally-owned small- and mid-sized Chinese banks have filled capital gaps with a jump in local government bond issuance, but a squeeze on net-interest margins and vested shortages in operations of the local banks could make repayment of the debt harder, putting pressure on provincial finances as calls grow for industry consolidation to reduce risk, policy advisors and economists said. (MNI)

YUAN: China is putting the yuan front and center in its fight back against the US's unique influence over global money. President Xi Jinping's government has been busy striking deals over the past year to expand the ways in which the currency is used, with new agreements linked to the renminbi stretching from Russia and Saudi Arabia to Brazil and even France. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY529 BILLION VIA OMOs THURSDAY

The People's Bank of China (PBOC) conducted CNY33 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY529 billion after offsetting the maturity of CNY562 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0000% at 09:42 am local time from the close of 2.3163% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 43 on last trading day before May Day holiday, compared with the close of 46 on Thursday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 6.9054 THURS VS 6.9240 (LAST FRIDAY)

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9054 on Thursday, compared with 6.9240 set before May Day holiday.

OVERNIGHT DATA

SOUTH KOREA APR FOREIGN RESERVES $426.68bn; PRIOR $426.07bn

NZ MAR BUILDING PERMITS 7.0% M/M; PRIOR -9.4%

NZ APR ANZ COMMODITY PRICE M/M -1.7%; PRIOR 1.3%

AU MAR EXPORTS M/M 4%; PRIOR -3%

AU MAR IMPORTS M/M 2%; PRIOR -10%

AU MAR TRADE BALANCE A$15.269bn; MEDIAN A$13BN; PRIOR A$14.15BN

CHINA APR CAIXIN MANUFACTURING PMI 49.5; MEDIAN 50.0; PRIOR 50.0

MARKETS

US TSYS: Pares Early Gains, Cash Closed In Asia Today

TYM3 deals at 116-11, +0-14, a touch off the base of the 0-15 range on volume of ~120k.

- Cash tsys were closed in Asia today due to the observance of a national holiday in Japan. They will reopen in the London session.

- Tsy futures gapped higher in early dealing, concerns about regional US banks escalated as PacWest fell as much as 60% in post market trade following a report that it's said to weigh strategic options including a sale. Oil fell ~7%, and e-minis were pressured.

- There was no follow through on the early move higher, tsys ticked away from session highs as WTI and e-minis erased losses to trade marginally firmer.

- Further PacWest headlines have crossed this afternoon, with the bank stating it has not experienced out of the ordinary deposit flows and that its planned sale remains on track.

- President Joe Biden has picked Federal Reserve Governor Philip Jefferson for a promotion to vice chair and will nominate economist Adriana Kugler to an open board slot, reports suggested.

- In Europe today the latest monetary policy decision from the ECB provides the highlight. Further out we have Initial Jobless Claims and Trade Balance.

AUSSIE BONDS: Richer, Curve Steeper, Awaits RBA SoMP Tomorrow

ACGBs are stronger (YM +12.0 & XM +7.0) with the 3-year futures contract close to session bests. The 10-year contract tracked US tsy futures which pared early post-NY session gains in Asia-Pac trade. Cash tsys are closed until the London session due to the observance of a national holiday in Japan. Cash ACGBs are 7-12bp richer with the 3/10 curve 5bp steeper.

- Swap rates are 7-13bp lower with 3-year EFP slightly tighter.

- The bills strip bull flattened with pricing +3 to +16.

- RBA dated OIS is 6-17bp softer across meetings beyond August with early '24 leading. A 7% chance of a 25bp rate hike at the June meeting is priced with a cumulative tightening of 8bp priced by August. Terminal rate expectations sit at 3.90% with year-end easing at 24bp.

- The local calendar will release March Housing Finance data tomorrow. The highlight however will be the Statement on Monetary Policy. After the RBA’s surprise rate hike, the market will pour over the forecast update for clues about the policy outlook. Attention will also be paid to the discussion on services inflation given its emphasis in yesterday's decision statement.

- The US calendar sees the release of the March Trade balance and initial jobless claims data.

NZGBS: Curve Bull Steepens, Solid Auction Demand

NZGBs closed with the 2/10 cash curve 5bp steeper with 2-year and 10-year benchmarks respectively 7bp and 1bp richer. The 2-year closed at session bests. The 10-year shifted weaker through the session in sympathy with US tsy futures in Asia-Pac trade.

- Today’s supply saw overall good demand (cover ratios 2.64x to 3.46x) consistent with last week’s auction. The May-26 bid, however, fell well short of the robust demand (cover ratio of 6.25x) displayed at the April 6th auction. Demand for short-end bonds was particularly strong, which could be attributed to concerns over potential over-tightening by the RBNZ, which had unexpectedly raised interest rates by 50bp the day before. The 2/10 cash curve nonetheless steepened around 2bp post-auction.

- Swap rates closed 4-10bp lower with implied swap spreads around 2bp tighter.

- RBNZ dated OIS closed 3-11bp softer with Apr’24 leading. 24bp of tightening is priced for the May 24 meeting with terminal OCR expectations at 5.57%.

- Building approvals rose 7% m/m in March as the impact of cyclone Gabrielle was partially unwound. ANZ commodity export prices fell 1.7% m/m in April.

- The local calendar is light tomorrow with the RBA Statement on Monetary Policy as the Antipodean highlight.

- The US calendar sees the release of the March Trade balance and initial jobless claims data.

OIL: Crude Jitters Ease During APAC Session

After declining over 4% on Wednesday to be down around 13% on the week on the back of deteriorating risk appetite and recession fears, oil prices slumped early in the APAC session with WTI reaching a low of $63.64. But with risk appetite stabilising oil prices are now off these lows with WTI up 0.5% to $68.98/bbl and Brent +0.7% to $72.85. The USD index is down 0.3% today.

- Oil prices are off of their intraday highs of $73.32 for Brent and $69.32 for WTI. Brent broke through $72.34, the March 24 low, on Wednesday which has opened up key support at $70.10, the March 20 low.

- It is unclear why WTI oil prices plunged at today’s open and there is speculation that it was due to the unwinding of speculators’ bullish positions, human error, algorithmic selling or panic selling, according to Bloomberg. Trade at that time is usually thin and Bloomberg is reporting that over 3000 June futures contracts changed hands in the fifth minute of the session. Brent didn’t follow the move when it opened a couple of hours later.

- Later the ECB meets (see MNI ECB Preview - May 2023) and is expected to hike rates 25bp. In the US, there are Q1 unit labour costs, March trade and April Challenger job cuts data.

Source: MNI - Market News/Bloomberg

GOLD: Bullion Moving Closer To $2075.47 Record High

After declining over 4% on Wednesday to be down around 13% on the week on the back of deteriorating risk appetite and recession fears, oil prices slumped early in the APAC session with WTI reaching a low of $63.64. But with risk appetite stabilising oil prices are now off these lows with WTI up 0.5% to $68.95/bbl and Brent +0.7% to $72.85. The USD index is down a further 0.3%.

- Oil prices are off of their intraday highs of $73.32 for Brent and $69.32 for WTI. Brent broke through $72.34, the March 24 low, on Wednesday which has opened up key support at $70.10, the March 20 low.

- It is unclear why WTI oil prices plunged at today’s open and there is speculation that it was due to the unwinding of speculators’ bullish positions, human error, algorithmic selling or panic selling, according to Bloomberg. Trade at that time is usually thin and Bloomberg is reporting that over 3000 June futures contracts changed hands in the fifth minute of the session. Brent didn’t follow the move when it opened a couple of hours later.

- Later the ECB meets (see MNI ECB Preview - May 2023) and is expected to hike rates 25bp. In the US, there are Q1 unit labour costs, March trade and April Challenger job cuts data.

FOREX: BBDXY Through Post Fed Lows

The greenback has been pressured in Asia, BBDXY has ticked through Wednesday's post FOMC lows printing its lowest level since Apr 14. Escalating concerns about regional banks, as PacWest fell as much as 60% in post market trade following a report that it's said to weigh strategic options including a sale, saw risk assets pressured however losses were pared through the session.

- AUD/USD is ~0.2% firmer, the pair firmed off session lows with US Equity futures. We last print at $0.6685/90 after rising ~0.7% from trough to peak. March Trade Balance printed a stronger than forecast surplus of $15.269bn.

- Kiwi is also ~0.2% firmer, NZD/USD found support at $0.62 rising ~0.6% from session lows to print $0.6240/45. March Building Permits rose 7.0% M/M, and April ANZ Commodity Prices fell 1.7%.

- Yen firmed through the session, post Fed lows were breached and JPY held its gains through the session. Support was seen at the 20-Day EMA (¥134.40).

- Elsewhere in G-10 NOK and SEK are ~0.3% firmer however Asia-Pac liquidity is generally poor. EUR and GBP are both ~0.2% firmer following the broader USD trend.

- Cross asset wise; WTI futures are ~0.5% firmer after being down 7% in early dealing. E-minis are marginally firmer erasing an early 0.5% loss. BBDXY is down ~0.3%.

- The ECBs monetary policy decision provides the highlight today, the bank is expected to raise its key policy rates 25bps. The MNI preview of the event is here.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/05/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 04/05/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 04/05/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/05/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/05/2023 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 04/05/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/05/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 04/05/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/05/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 04/05/2023 | 0900/1100 | ** |  | EU | PPI |

| 04/05/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 04/05/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 04/05/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 04/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 04/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 04/05/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/05/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 04/05/2023 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 04/05/2023 | 1245/1445 |  | EU | ECB Post-Meeting Press Conference | |

| 04/05/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 04/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 04/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/05/2023 | 1650/1250 |  | CA | BOC Governor speech/press conference. |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.