-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Dollar Index Tracking Higher For 7th Straight Week

EXECUTIVE SUMMARY

- FED'S BOSTIC WANTS MORE CERTAINTY IN INFLATION FIGHT - MNI

- BIDEN AGAIN TELLS NETANYAHU THAT RAFAH CIVILIANS MUST BE PROTECTED - RTRS

- VILLEROY SAYS ECB SHOULD FAVOR GRADUAL CUTS OVER ACTING TOO LATE - BBG

- BOJ TO MULL NEW POLICY FRAMEWORK - EX-BOJ KAMEDA - MNI INTERVIEW

- BLINKEN TO MEET WITH CHINA'S WANG YI IN MUNICH ON FRIDAY - BBG

- ORR SAYS RBNZ STILL NEEDS TO ANCHOR INFLATION EXPECTATIONS - BBG

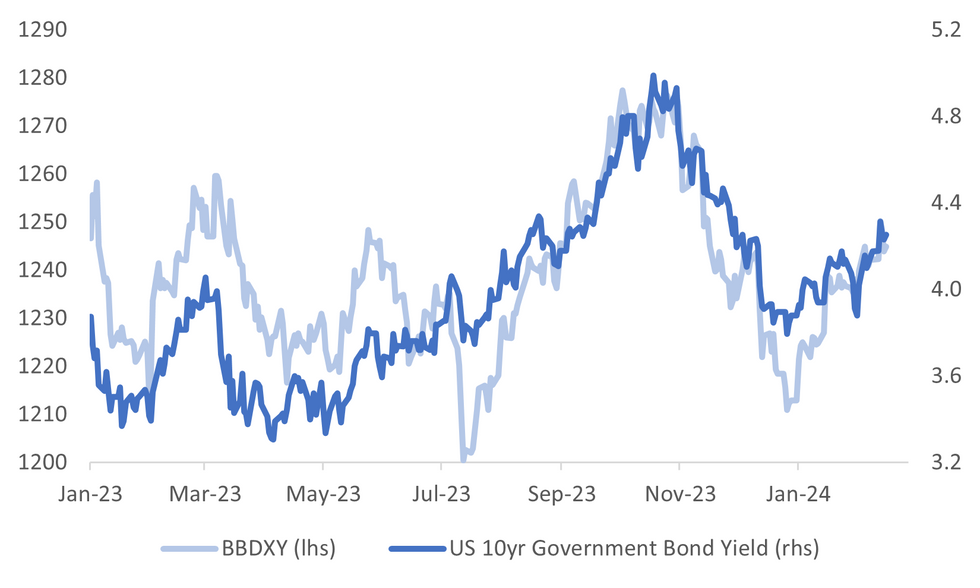

Fig. 1: USD BBDXY Versus US Tsy Nominal 10yr Yield

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): Keir Starmer’s poll-leading UK Labour Party took another parliamentary seat from Rishi Sunak’s governing Conservatives, overturning a significant majority and denting the prime minister’s hopes of wrestling back momentum ahead of a nationwide vote expected in the second half of the year.

POLITICS (BBG): Labour scored wins in Wellingborough, central England, and Kingswood, outside the southwest city of Bristol — the latest in a string of by-election victories that suggest the party is on course to take power after 14 years in opposition. The results also mean Sunak’s administration has now accrued more defeats in a single term of office than any government since the 1960s.

BOE (MNI BRIEF): Bank of England policymaker Catherine Mann said Thursday she sees services inflation staying sticky in a tight labor market, while data showing the UK slipped into technical recession at the end of 2023 matched her expectations.

EUROPE

ECB (BBG): The European Central Bank should avoid waiting too long to cut rates as it will still have flexibility over the pace and degree of policy loosening after its first move, Governing Council member Francois Villeroy de Galhau said.

ECB (BBG): The European Central Bank should acknowledge that inflation is retreating, stop making excuses and consider interest-rate cuts as early as March, according to Governing Council member Edward Scicluna.

DEBT (MNI): Excessive Deficit Procedures against a group of eight to 10 European Union countries to be launched on June 26 will be defined under the terms of reformed and more flexible fiscal rules finalised in Trilogue talks with the European Commission and Parliament last week, officials in Brussels told MNI.

U.S.

FED (MNI): Atlanta Federal Reserve President Raphael Bostic said Thursday he is still not thoroughly convinced inflation is on track to the central bank's 2% target and will need to see continuing evidence of ebbing prices pressures to build greater confidence.

FED (MNI BRIEF): Lawmakers in the House of Representatives Thursday debated how to solve issues with the Fed's discount window and whether to adjust emergency lending practices, with some bipartisan criticism of Federal Home Loan Banks' emergency lending to banks.

DOLLAR (MNI): Federal Reserve Governor Christopher Waller on Thursday said he doesn't see the U.S. dollar being dethroned anytime soon despite frequent questions about a decline, because it continues to dominate as a store of value, a medium of exchange and as a unit of account.

US/CHINA (BBG): US Secretary of State Antony Blinken will meet with China’s foreign minister Wang Yi in Munich, Germany Friday at 3:30pm local time, according to his daily public schedule from the State Department.

OTHER

US/ISRAEL (RTRS): U.S. President Joe Biden on Thursday again told Israel's Prime Minister Benjamin Netanyahu that he should not proceed with military action in Rafah without a credible and executable plan to protect Palestinian civilians, the White House said.

MIDEAST (RTRS): U.S. Secretary of State Antony Blinken said on Thursday that a deal on the release of hostages held by Hamas remains possible but "very hard" issues remain to be resolved.

JAPAN (MNI INTERVIEW): The Bank of Japan will consider a new policy framework after it exits negative interest rates to avoid market disruption and will refrain from signalling its hiking intentions to maintain maximum flexibility, former BOJ Chief Economist Seisaku Kameda told MNI.

JAPAN (MNI BRIEF): Bank of Japan Governor Kazuo Ueda said on Friday that the possibility is high that accommodative financial conditions will likely continue after the Bank removes its negative interest rate policy.

NORTH KOREA/JAPAN (RTRS): The influential sister of North Korean leader Kim Jong Un said that there is no impediment to closer ties with Japan and that there may come a day Japanese Prime Minister Fumio Kishida visits Pyongyang, state news agency KCNA said on Thursday.

NEW ZEALAND (BBG): New Zealand central bank governor Adrian Orr said policymakers still need to ensure that inflation expectations are contained, suggesting they won’t be signaling a pivot to interest-rate cuts anytime soon.

CHINA

TRAVEL (BBG): A resurgence in travel over China’s Lunar New Year holiday is offering some signs of a consumer spending pickup in the world’s second-largest economy as it struggles with low confidence and deflation.

PROPERTY (BBG): Logan Group Co. bought more time to push through its debt restructuring plan, after a Hong Kong court batted down creditor petitions to liquidate the Chinese developer’s two key units.

MARKET DATA

NEW ZEALAND JAN BUSINESSNZ MANUFACTURING PMI 47.3; PRIOR 43.4

JAPAN DEC TERTIARY INDUSTRY INDEX M/M 0.7%; MEDIAN 0.2%; PRIOR -0.7%

SOUTH KOREA JAN IMPORT PRICES Y/Y 0.2%; PRIOR -4.0%

SOUTH KOREA JAN EXPORT PRICES Y/Y 3.7%; PRIOR -2.4%

SOUTH KOREA JAN UNEMPLOYMENT RATE 3.0%; MEDIAN 3.2%; PRIOR 3.2%

SOUTH KOREA DEC MONEY SUPPLY M2 SA M/M 0.8%; PRIOR 0.9%

MARKETS

US TSYS: Treasuries Weaken on Fed's Bostic's Comments, US PPI Later

TYH4 is currently trading at 110-01, down - 04+ from New York closing levels.

Treasuries open Asia trading slightly firmer, however weakened after Atlanta Fed Bostic's comments, where he mentioned there is no rush to cut rates, but sees two rate cuts this year.

- Treasury futures are testing lows as Asia breaks for lunch, the move lower was driven by Fed's Bostic comments. Mar'24 10y futures hit a low of 110-00+, currently just above there at 110-01, while Mar'24 2Y futures broke through US session lows to trade at 102-01+.

- Ahead of another day of US data, key technical levels to watch include initial support at 109-17/16+ (50.0% of the Oct 19 - Dec 27 bull phase/Low Feb 14), a break below here could open up new yearly lows and a test of 109-05+ (lows of Nov 28). To the upside, initial resistance lies at 110-17.5 (the highs from Feb 15th), while a break above opens up a move to 111-02+ (20-day EMA).

- Cash yields are 1-3bps higher across the curve, the 2Y yield +2.3bp higher at 4.597%, 10Y yield +2.3bps higher at 4.253%.

- Headlines have been on the quiet side during the Asia today, with a meeting between US Secretary Of State and China's Wang Yi later the only thing to note.

- Looking ahead: Friday data calendar includes PPI, House Starts/Build Permits, UoM Inflation

JGBS: Futures Cheaper & At Session Lows, Enhanced-Liquidity Auction Due

In the afternoon session, JGB futures sit in negative territory and at session lows, -8 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag today. December’s Tertiary Industry Index has just been released showing a rise of 0.7% m/m versus +0.2% est.

- Later today, the MoF will conduct an Enhanced-Liquidity Auction for OTR 15.5-39-year JGBs.

- BoJ Governor Ueda, in Parliament today, said the BoJ will consider whether it will keep its large-scale monetary easing policies including the negative rate once its price goal comes into sight. That said, financial conditions are likely to stay accommodative for the time being even if the negative rate is ended given the current economic outlook.

- Cash US tsys are dealing 2-3bps cheaper in today’s Asia-Pac session after Atlanta Federal Reserve President Raphael Bostic said after market that he is still not thoroughly convinced inflation is on track to the central bank's 2% target (MNI)

- Cash JGBs are dealing mixed, with yield movements across the curve bounded by +/- 2bps. The benchmark 10-year yield is 0.9bp higher at 0.735% versus the February low of 0.665%.

- The swaps curve has slightly bear-steepened out to the 20-year, with rates unchanged beyond. Swap spreads are wider.

- The local calendar sees Core Machine Orders on Monday, ahead of 20-year supply on Tuesday.

AUSSIE BONDS: Cheaper, Near Weakest Levels, Narrow Ranges

ACGBs (YM -3.0 & XM -4.5) are cheaper and at/or near Sydney session lows. With the domestic calendar empty today, the local market has drifted cheaper with US tsys in today’s Asia-Pac session. Cash US tsys are dealing ~2bps cheaper compared to the NY close.

- Cash ACGBs are 3-4bps cheaper, with the AU-US 10-year yield differential 2bps higher at -7bps. At -7bps, the 10-year yield differential currently sits in the bottom half of the range of +/-30bps which has been observed since November 2022.

- However, a simple regression of the AU-US cash 10-year yield differential against the AU-US 1Y3M swap spread over the current tightening cycle indicates that the 10-year yield differential is currently 13bps too low versus its fair value (i.e., -7bps versus +6bps).

- Swap rates are 3-5bps higher, with EFPs little changed.

- The bills strip has bear-steepened, with pricing -1 to -4.

- RBA-dated OIS pricing is flat to 3bps firmer across meetings. A cumulative 36bps of easing is priced by year-end.

- Next week, the local calendar is empty on Monday, ahead of the RBA Minutes of the Feb. Policy Meeting on Tuesday.

- Next Wednesday, the AOFM plans to sell A$800mn of 3.75% Apr-37 bond.

NZGBS: Closed On A Weak Note

NZGBs closed on a weak note, with benchmark yields 1-5bps cheaper and the 2/10 curve steeper. The local highlight today was a speech from RBNZ Governor Orr. He didn't, however, touch on the rates outlook. The Governor stated: "Tackling these persistent inflationary pressures and bringing levels of ‘core’ inflation in line with our 1 to 3% target is an important part of bringing inflation back down to the 2% midpoint." You can see the full speech at this link.

- The NZ-AU 10-year yield differential closed unchanged at +63bps, with the NZ-US differential 2bps tighter at +56bps.

- The previously outlined BusinessNZ Manufacturing PMI was the only data today. It didn’t move the market.

- (Bloomberg) -- NZ posted its biggest calendar-year jump in population since the end of World War Two, reinforcing the scale of the potential impact on demand and inflation from record immigration. The estimated population increased by 2.8% in 2023. (See link)

- Swap rates are 1-5bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is 1-4bps softer across meetings, with May-July leading. A cumulative 45bps of easing is priced by year-end.

- Next week, the local calendar sees the Performance Services Index and Non-Resident Bond Holdings on Monday, ahead of Q4 PPI on Wednesday.

FOREX: USD Firms, Tracking Higher For The 7th Straight Week

The USD index has firmed in the first part of Friday trade the BBDXY up 0.10% to be tracking above 1245. We are comfortably below earlier highs in the week (post the US CPI print above 1251), but still up for the week, which would be the 7th straight run of weekly gains.

- USD strength coincided earlier with Fed Bostic comments, which helped US yields firm a touch. The Fed official stated that he wants more certainty in the inflation fight before cutting rates. He added he projects 2 rates cut this year, which is obviously well short of what markets are pricing (close to 90bps). The comments don't appear a departure from what Bostic has said previously though.

- US yields are 1.5-2.5bps firmer across the benchmarks, the 10yr last near 4.25%.

- USD/JPY dipped in early trade to 149.83, but is back to 15.30/35 this afternoon just off session highs. Comments by BoJ Governor Ueda in parliament were in line with recent rhetoric, while FinMin Suzuki warned about FX, but again the language used didn't appear to a departure from what we have seen recently around intervention risks.

- AUD/USD and NZD/USD are also lower, albeit outperforming JPY at the margins. AUD/USD was last 0.6510/15, while NZD is back sub 0.6100. The positive regional equity tone (MSCI Asia Pac up 1%), may be providing some offset to the firmer US yield backdrop.

- Earlier RBNZ Governor Orr stated that more needs to be done to anchor inflation expectations, but didn't touch on the rates outlook in his speech.

- Looking ahead, UK retail sales data headlines the European docket on Friday before focus turns to US PPI figures and building permits. Preliminary UMich consumer sentiment and inflation expectations will round off the week.

Hong Kong/China Equites: Hong Kong Equities Surge Higher, MLF Sunday

Hong Kong and China equities surge higher to continue their winning streak post the LNY break, as investors hope for a MLF cut this weekend, while China consumer spending is picking up with a surge in travel spending during the LNY break.

- As we break for Asia lunch Hong Kong equity markets are surging higher, with hope for a MLF cut and consumer spending picking up, while any weakness in equities over the past week or so has been met with swift buying. It has been light on for market moving headlines today. While looking more closely at the market, the China Mainland Property Index is 4.81% higher today, this is after property developer Redsun was issued with a Wind-Up noticed yesterday. The HS Tech index trades 3.41% higher, supported by positive US tech earnings, while the HS China Enterprise Index, which tracks Chinese companies listed on the Hong Kong exchange, is up 2.44% and finally the HSI is 2.20%

- In headlines, US Secretary Of State will meet with China's Wang Yi later today, while Chinese builder Logan gets respite as a Hong Kong court dismisses petitions to wind up the business, stock is 10% higher, while bonds in the company are changed trading in the 10/12 area

- Looking ahead note that China markets return on Monday. Sunday is slated for the MLF announcement. No change is expected by the consensus in terms of the current 1yr rate at 2.50%, although some forecasters are penciling in a 10bps cut.

ASIA PAC EQUITIES: Regional Asian Equities Hit 2022 Highs

Regional Asian equities continue their march higher today BBG APAC Index is heading for it's highest levels since march 2022, after Japanese equities edge close to hitting all time highs not seen since 1989. Tech stocks are the top performers in the region after US semiconductor equipment manufacturer Applied Materials posted a bullish revenue forecast.

- Japan equities are higher today following the another record high close for the US market on Thursday, while the weaker yen continues to support the market. The Nikkei 225 continues to edge closer to all time highs of 38,915.87, while demand for March options betting on the Nikkei 225 to break to 40,000 soar today to levels not since June. Currently the Nikkei 225 is 1.53% higher, while Topix is 1.66% higher.

- Taiwan equities are lower today, under-performing the wider Asian markets as investors look to book profits, after equities surged 3.46% yesterday. Currently the Taiex is down 0.10%.

- South Korea equities edge higher again today, led by tech names. Foreign buying of SK stock has slow in the past week with just $42m of inflows today as the 5-day moving average decreased to 252.1m below the 20-day average of $288.5m. Currently the Kospi is 1.14% higher.

- Australia equities closed higher today led by Miners and Financials as CBA, up 1.75% contributes most to the index gain. Elsewhere Australia's stock exchange the ASX fell 4.00% after the company misses estimates. The ASX 200 is up 0.67%.

- Indonesian equities continue their moves higher post presidential election, while Global fund buying of Indonesian stock hit a 2 month high with $174.6m of inflows on Thursday. Currently the Jakarta Comp is 0.63% higher.

- Elsewhere in SEA, NZ up 0.73%, Singapore up 1.41%, Philippines up 0.36%, while Thailand lags trading unchanged for the day.

OIL: Largely Holding Thursday's Gains, Firmer For The Week

Oil benchmarks have largely drifted sideways in the first part of Friday trade. The front month Brent contract sits at $82.75/bbl in recent dealings, down slightly from end Thursday levels. We are marginally higher versus end levels from last week ($82.19/bbl). For WTI we are holding above $78/bbl, with a firmer rise in the past week compared to Brent (+1.6%). Dips sub $78/bbl have been supported so far today.

- The benchmarks are largely holding impressive gains from Thursday's session, although we haven't seen a test of Thursday highs.

- This may reflect broader risk trends, which are positive in the equity space, but the USD has edged higher, providing an offset.

- While risk tones are positive, Thursday's IEA report suggested some caution around the demand/supply balance in 2024.

- Focus will remain on the Middle East where the Houthi's vowed to continue attacks on Red Sea shipping.

- US President Biden spoke to Israeli leader Netanyhu and again urged restraint around a potential assault on the southern Gaza city of Rafah.

GOLD: Rebound After Weaker Than Expected US Retail Sales

Gold is little changed in the Asia-Pac session, after closing 0.6% higher at $2004.40 on Thursday.

- After falling earlier in the week in the wake of Tuesday’s hotter-than-anticipated inflation reading, the yellow metal climbed back over the $2,000 threshold on softer-than-expected retail sales (-0.8% m/m vs. -0.2% est. and 0.6% prior). Overall, the contraction in retail sales pointed to the weakest report since March 2023.

- According to the MNI technicals team, technical conditions for spot gold may be limiting the advance, following the prior breach this week of $2001.9, the Jan 17 low and a key short-term support.

- That breach highlighted a resumption of the bear leg that started Dec 28. A continuation lower would open $1973.2, the Dec 13 low and the next key support. On the upside, the yellow metal would need to clear resistance at $2065.5, the Feb 1 high, to reinstate a bullish theme.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/02/2024 | 0700/0700 | *** |  | UK | Retail Sales |

| 16/02/2024 | 0700/0800 | ** |  | SE | Unemployment |

| 16/02/2024 | 0745/0845 | *** |  | FR | HICP (f) |

| 16/02/2024 | 0845/0945 |  | EU | ECB's Schnabel lecture at EMU Lab | |

| 16/02/2024 | 1300/0800 |  | US | Richmond Fed's Tom Barkin | |

| 16/02/2024 | 1330/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/02/2024 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 16/02/2024 | 1330/0830 | *** |  | US | PPI |

| 16/02/2024 | 1330/0830 | *** |  | US | Housing Starts |

| 16/02/2024 | 1410/0910 |  | US | Fed Vice Chair Michael Barr | |

| 16/02/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 16/02/2024 | 1710/1210 |  | US | San Francisco Fed's Mary Daly | |

| 16/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 16/02/2024 | 1940/1940 |  | UK | BOE's Pill panellist at 40th NABE Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.