MNI EUROPEAN OPEN: Equities Jump On US NFP, Yen Eyes 150.00

EXECUTIVE SUMMARY

- THE EUROPEAN CENTRAL BANK WILL “QUITE PROBABLY” CUT INTEREST RATES AT NEXT MEETING - BBG AT NEXT MEETING - BBG

- CHINA’S TOP ECONOMIC PLANNER WILL HOLD A PRESS BRIEFING ON TUESDAY TO DISCUSS A PACKAGE OF POLICIES AIMED AT BOOSTING ECONOMIC GROWTH - BBG

- BIG TAXES WILL BE IMPOSED ON IMPORTS OF ELECTRIC VEHICLES FROM CHINA TO THE EU - BBG

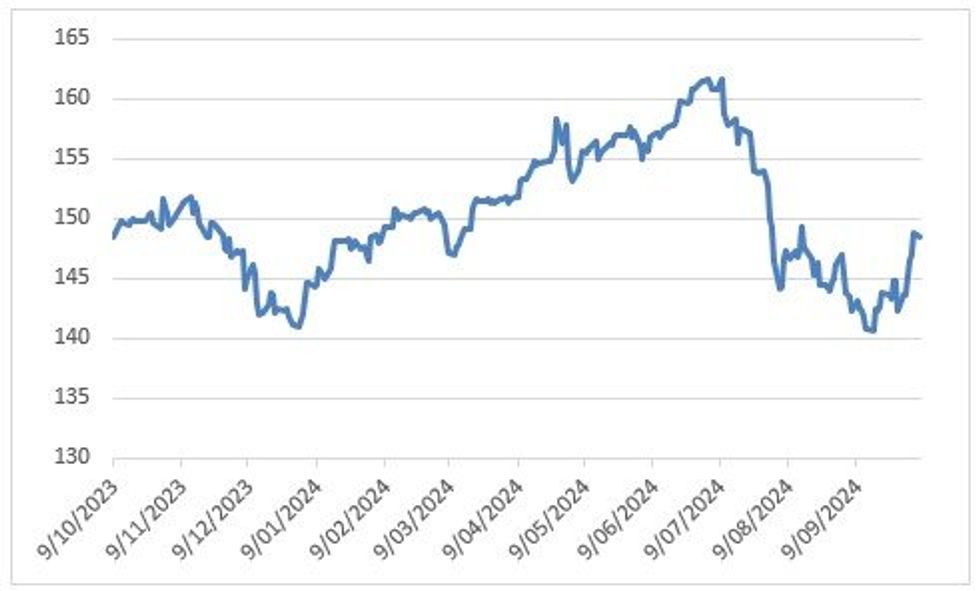

Fig. 1: USD/JPY Jumps, Eyes 150.00

Source: MNI - Market News/Bloomberg

UK

POLITICS (BBC): “Sue Gray has quit her role as Prime Minister Sir Keir Starmer's chief of staff, saying she "risked becoming a distraction". She had been caught up in rows over pay, after the BBC's political editor revealed her salary was higher than Sir Keir's, and donations from Lord Waheed Alli.”

FISCAL (RTRS): “British finance minister Rachel Reeves said she will introduce "guardrails" to ensure that extra borrowing for investment in her first budget is not excessive as she seeks to reassure investors about an expected rise in public debt.”

EU

ECB (BBG): “The European Central Bank will “quite probably” cut interest rates at its next meeting later this month, according to Governing Council member Francois Villeroy de Galhau. Inflation fell below the ECB’S 2% target in September and the core measure of price increases should gradually recede close to that level in 2025, the Bank of France chief said in an interview with La Repubblica.”

TRADE (BBC): “Big taxes will be imposed on imports of electric vehicles from China to the EU after the majority of member states backed the plans.”

GERMANY (RTRS): “Germany's economy ministry plans to downgrade its 2024 economic growth forecast, expecting Europe's largest economy to shrink by 0.2%, newspaper Sueddeutsche Zeitung reported on Sunday.”

FRANCE (BBC): “French President Emmanuel Macron called for a halt on arms deliveries to Israel for use in Gaza on Saturday, prompting swift criticism from Israeli Prime Minister Benjamin Netanyahu.”

ISRAEL (RTRS): “Israeli Prime Minister Benjamin Netanyahu spoke by telephone with French President Emmanuel Macron on Sunday, his office said, and told him that placing restrictions on Israel will just serve Iran and its proxies.”

UKRAINE (RTRS): “Dutch Defence Minister Ruben Brekelmans said on a surprise visit to Kyiv on Sunday that his country will invest 400 million euros ($440 million) in advanced drone development with Ukraine and deliver more F-16s in the coming months.”

UKRAINE (POLITICO): “Kyiv will present its victory plan — outlining “clear, concrete steps” to end the war with Russia — at a meeting of allies next week, Ukrainian President Volodymyr Zelenskyy said on Saturday. Ukraine will discuss the plan at an Oct. 12 meeting of its allies.”

NATO (POLITICO): “Slovak Prime Minister Robert Fico vowed on Sunday to block Ukraine from joining NATO for as long as he is head of the country's government. NATO's leadership wants Ukraine to join the military alliance after its war with Russia ends in order to deter further aggression from Moscow, but Fico's declaration highlights the political difficulties that are likely to arise in pursuing that aim.”

AUSTRIA (RTRS): “The head of Austria's far-right Freedom Party, which won this week's parliamentary election, urged other parties on Saturday to accept that he should lead the next government and warned them against forming a "coalition of losers".”

US

FISCAL (BBG): “President Joe Biden on Friday asked Congress to speed authorization of about $1.6 billion for the Small Business Administration so it can properly respond to the devastation wrought by Hurricane Helene and other disasters.”

TRADE (RTRS): “Republican U.S. presidential candidate Donald Trump on Sunday said he would slap tariffs as high as 200% on vehicles imported from Mexico as he ratchets up his protectionist trade rhetoric ahead of the Nov. 5 election.”

MIDDLE EAST (BBC): “The US military says it has launched strikes on the Iranian-backed Houthi group in Yemen, hitting 15 targets.”

ISRAEL (BBG): “Vice President Kamala Harris said she won’t stop pressuring Israel to end its military campaign in the Middle East, emphasizing that the US still has a critical role in the region as the conflict reaches the one-year mark.”

FLORIDA (BBC): “The National Hurricane Centre confirmed that Milton - currently off the coast of Mexico - had intensified into a Category 1 hurricane on Sunday and could pose "life-threatening hazards" for parts of Florida's west coast.”

OTHER

JAPAN, KOREA (BBG): “Japan and Korea will explore ways to cooperate on securing supplies of liquefied natural gas, their governments said Sunday, citing the risk of disruptions caused by geopolitics and weather events.”

INDONESIA (BBG): “Indonesia’s central bank says it’s ready to intervene in spot, domestic non-deliverable forward, and bond markets to ensure FX supply and demand balance is well-maintained, says Edi Susianto, executive director for monetary management.”

ISRAEL (BBG): “A day before it marks a year since the deadly Oct. 7 attacks by Hamas, Israel is locked into a multi-front war with no clear end, sending troops back to northern Gaza and keeping up intense aerial attacks and a limited ground maneuver in Lebanon.”

IRAN (RTRS/VOA): “Iran's aviation body announced Sunday the cancelation of flights at some of the country's airports, citing "operational restrictions," state media reported as Israel vows to retaliate for an Iranian missile strike.”

IRAN (POLITICO): “Iran has offered to support efforts to reach a cease-fire in Lebanon but on the highly unlikely condition that Israel halts its military campaign in Gaza.”

LEBANON (AA): “Hamas in Lebanon confirmed on Saturday morning the death of a senior commander from its military wing, the al-Qassam Brigades, in an Israeli airstrike on his residence in the Beddawi refugee camp in northern Lebanon.”

MEXICO (MNI): “The Central Bank of Mexico looks set to maintain a gradual and continuous monetary easing cycle through next year, former Banxico economist David Tapia told MNI, likely delivering another 25 basis point interest rate cut in November. “

CHINA

CHINA (BBG): “China’s top economic planner will hold a press briefing on Tuesday to discuss a package of policies aimed at boosting economic growth, as investors look for more stimulus measures from President Xi Jinping’s government.”

MARKET DATA

AUSTRALIA MI INFLATION GAUGE SEPT +0.1% M/M & 2.6% Y/Y; PRIOR -0.1% & 2.5%

JAPAN AUG. COINCIDENT INDEX 113.5; EST. 113.6; PRIOR 117.2

JAPAN AUG. LEADING INDEX 106.7; EST. 106.9; PRIOR 109.3

MARKETS

US TSYS: Tsys Futures Trade At Session Lows, As Volumes Jumps

- Tsys Futures have seen very strong volumes today as investors look to position following much stronger-than expected NFP on Friday. Ranges have remained narrow although we trade below Friday's lows and now at session lows across the curve. TU is - 01+ at 103-15⅝ while TY is currently trading -01+ at 112-25+.

- There was earlier some decent size buying of TY put ratios, with TYX4 112.75 / 112.00 1x2 Put Spread bought for -1 and 0 x25,000

- Cash tsys curves have flattened throguhout the session with yields now flat to 3bps higher. The 2yr is +3bps at 3.951%, while the 10yr is +1.2vps at 3.977%, the 2s10s dropped 1.789 to 2.342.

- Fed Funds futures are now pricing in just 24.6bps of cuts at the November 7 meeting, down from 33.8bps prior to NFP.

- The calendar is empty for the session, focus turns to CPI and PPI inflation measures on Thursday and Friday respectively while we also have Wednesday's September FOMC minutes release.

JGBS: Cheaper Following Rinban Operations, Yields At Month Highs

- JGBs continue to sell-off, with yields now 2-5bps cheaper. The 5yr has seen the bulk of the move trading +5bps to 0.527% now back at Aug 5 levels.

- The JGB curve is flatter, with better selling seen through the belly of the curve with the moves coming following Rinban results

- Elsewhere Japanese Finance Minister Kato spoke earlier where he emphasized the need for careful monitoring of sudden currency fluctuations, which he said negatively impact businesses and households. Kato reiterated the government's stance that monetary policy specifics should be left to the BOJ while expecting careful communication from the central bank to manage policy toward achieving its 2% inflation target.

BoJ dated OIS has firmed slightly throughout the session with Dec'24 now pricing in 7.2bps of hike priced, up from 6.5bps this morning.

NZGBs: Closed Cheaper, Ranges Narrow Ahead Of RBNZ Wednesday

NZGBs closed just off session's worst levels, yields were 2-6bps cheaper. The moves were largely just on the back of the sell-off in US tsys following Friday's much stronger-than-expected US Non-farm payrolls. RBNZ dated OIS firmed throughout the session.

- There was no economics data out of the region today, with all eyes turning to the RBNZ on Wednesday, BBG consensus is for a 50bps cut, in line with current OIS pricing.

- RBNZ's Governor Orr has made some comments about the 2023-24 Annual report, “Core inflation and most measures of inflation expectations have declined, and the risks to the inflation outlook have become more balanced” and reiterated the annual CPI is expected to return to the 1-3% target range by year-end. So far the report doesn't seem to have been released publicly.

- New Zealand's official reserve assets slightly declined to NZ$32.54b in September from NZ$32.57b in August. Foreign currency reserves, including other reserve assets, fell to NZ$24.7b from NZ$25.18b, while reserves held in the Treasury increased to NZ$7.84b from NZ$7.4b. The country's special drawing rights also dipped to NZ$4.62b in September from NZ$4.65b in August, per RBNZ.

- NZGB curve has bear-flattened today with most of the move coming on the open, we traded in narrow ranges throughout the session and with Sydney out for a Public Holiday volumes were low. The 2yr closed +5.5bps at 3.838%, while the 10yr closed +4.6bps at 4.299%

- RBNZ Dated OIS is pricing 42.8bps of cuts or a 71% chance of a 50bps cut on Wednesday and 92.5bps of cuts by the November 27th meeting.

- Swaps are 6-8.5bps higher across the curve with the 2-3yr tenors underperforming.

EQUITES: Asian Equities Higher, Tracking Gains In The US, China Returns Tomorrow

Asian stocks advanced broadly on Monday, buoyed by optimism following stronger-than-expected U.S. job data. The U.S. labor market's resilience has raised hopes for a soft landing and fueled Wall Street's rally, which spilled over into Asian markets.

- Goldman Sachs upgraded Chinese equities to "overweight," projecting an additional 15%-20% rise in key indices like the MSCI China and CSI 300, assuming Beijing follows through on its stimulus policies. With mainland Chinese markets reopening on Tuesday, foreign investors are expected to increase buying through the stock connect program.

- Japanese equities have jumped higher driven by gains exporters and financials. The yen hit a lows of 149.13 vs USD before comments from the Currency Chief saw some support for the currency, it currently trades 0.16% at 148.46. Financials rallied after Japan's 10-year bond yield hit a one-month high following Rinban operations and comments from Japan's FinMin where he said monetary policy specifics should be left to the BOJ. The Nikkei is +2.15%, slightly outperforming the TOPIX +1.90%

- HSI is +1.15%, with equity turnover elevated due to expectations of strong inflows when mainland China markets reopen. Property stocks have struggled today with the Mainland Property Index -1.30%, while most other sectors trade higher.

- SK & Taiwan equities both trade higher with their respective Large-cap tech stocks outperforming, led by SK Hynix +5.20% although Foreign investors have again been better sellers of SK equities in particular Tech stocks.

- Elsewhere, Australia's ASX 200 +0.65% and Philippines PSEi +1.80% are the top performers.

ASIA STOCKS: Foreign Investors Rotate Into China Equities

Asian equities saw decent size outflows last week as investors looked to rotate in Chinese equities.

- South Korea: Saw inflows of $90m Friday, with the past 5 sessions reaching -$299m, while YTD flows are + $10.41b. The 5-day average is -$60m, which is above the 20-day average of -$294m but below the 100-day average of -$45m.

- Taiwan: Saw outflows of -$666m Friday, with the past 5 sessions netting -$1.02b, while YTD flows are -$12.87b. The 5-day average is -$204m, below both the 20-day average of -$159m and the 100-day average of -$131m.

- India: Saw outflows of -$1.85b Thursday, with the past 5 sessions netting -$2.17b, while YTD flows are + $21.57b. The 5-day average is -$798m, below the 20-day average of + $128m, and the 100-day average of + $92m.

- Indonesia: Saw outflows of -$33m Friday, with the past 5 sessions netting -$319m, while YTD flows are + $3.14b. The 5-day average is -$64m, below the 20-day average of + $58m, but above the 100-day average of + $30m.

- Thailand: Saw outflows of -$31m Friday, with the past 5 sessions totaling -$360m, while YTD flows are -$2.91b. The 5-day average is -$72m, below the 20-day average of + $4m, and the 100-day average of -$9m.

- Malaysia: Saw outflows of -$76m Friday, with the past 5 sessions netting -$263m, while YTD flows are + $605m. The 5-day average is -$53m, below both the 20-day average of -$13m and the 100-day average of + $8m.

- Philippines: Saw inflows of $11m Friday, with the past 5 sessions totaling + $35m, while YTD flows are + $56m. The 5-day average is + $7m, below both the 20-day average of + $18m and the 100-day average of + $4m.

Table 1: EM Asia Equity Flows

OIL: Crude Down Slightly As Waits For Israel’s Response To Iran’s Attack

Oil prices are slightly lower today as markets watch and wait for Israel’s response to Iran’s missile attack. Earlier Iran cleared its airspace but has since opened some airports. The US is urging Israel to avoid Iran’s oil infrastructure. WTI is down 0.3% to $74.19/bbl off the intraday low of $73.62 and Brent is -0.4% to $77.74 after falling to $77.23. The USD index is little changed.

- Iran is an OPEC member and its October 1 attack on Israel has increased the chance of a strike on its oil facilities and also of a regional war that would impact both oil and gas supplies. The Middle East produces around a third of the world’s crude. As a result, many market participants are now covering short positions.

- Goldman Sachs estimates that Brent could increase to the $90s if Iranian oil production was hit, according to Bloomberg.

- Israel continued to strike targets in Lebanon and Gaza over the weekend. Commemorations for October 7 victims have begun in Israel.

- Saudi Arabia increased the crude premium for shipments to Asia by more than expected but cut it for cargoes to Europe and the US.

- Oil markets have received support from China’s recent stimulus announcements. On Tuesday the head economic planner will hold a press conference and further government spending will be hoped for.

- The Fed’s Bowman, Kashkari, Bostic and Musalem appear later today and in terms of data there are only US August consumer credit, German August factory orders and euro area retail sales.

GOLD: Bullion Trends Lower Following Stronger US Payrolls

Gold prices have trended lower to be down 0.3% to $2645.60/oz during APAC trading today, as risk assets generally strengthened. The BBDXY USD index is off its intraday low to be flat. Bullion fell sharply following the better-than-expected US payrolls on Friday reaching a low of $2632.09, as the data encouraged economic optimism and reduced Fed cut expectations which drove the USD higher. Gold recovered to $2653.60 though to be down only 0.1% on the day.

- Geopolitics continue to provide support for bullion with the situation in the Middle East deteriorating further over the weekend as Iran shut its airspace in preparation for a retaliatory strike from Israel and Israel continued to strike targets in Lebanon and Gaza.

- Gold remains in consolidation mode and recent declines are seen as corrective. Moving average studies are in a bull mode and signal positive market sentiment. Initial resistance is at $2685.60, September 26 high, with support at $2624.80, September 30 low. The yellow metal is up 3.4% since the Fed cut rates 50bp on September 18.

- China’s gold reserves were unchanged at 72.8mn ounces at the end of September.

- The Fed’s Bowman, Kashkari, Bostic and Musalem appear later today and in terms of data there are only US August consumer credit, German August factory orders and euro area retail sales.

LNG: Middle East Escalation Pushes Gas Prices Higher

European LNG prices rose 2.1% on Friday to EUR 40.75, just below the intraday high of EUR 41.18, to be up 5.6% last week. Geopolitics remain a market driver with the situation in the Middle East deteriorating further but European storage levels at 94% is partially offsetting this. Events over the weekend indicate an escalation in tensions as Iran shut its airspace in preparation for a retaliatory strike from Israel and Israel continued to target Lebanon.

- Israeli PM Netanyahu has promised a “strong” response to Iran’s missile attack on Israel last week and hasn’t ruled out attacking its oil and nuclear infrastructure. US President Biden discouraged strikes on Iran’s oil. The main risk is if Iran becomes more involved in the conflict and blocks the Strait of Hormuz which Qatar relies on for its LNG exports.

- US natural gas fell 4.7% to $2.83 to be down 2.5% on the week. It has started today lower at $2.80. Milton has been classed as a hurricane and while Florida is preparing, it is not expected to threaten gas infrastructure. Other storms in the Gulf of Mexico and Atlantic currently look likely to also miss gas facilities.

- US lower-48 gas production fell 1.4% y/y on Friday and demand rose only 0.3% y/y. The west is forecast to be warmer into mid-October, while the east should be cooler, according to the Commodity Weather Group.

- North Asian gas prices followed Europe higher rising 1.5% on Friday to be up 1.3% last week and also include a geopolitical risk premium.

FOREX: DM FX Rallies In APAC Trading While EM Weakness Continues

DM APAC FX strengthened against the US dollar, while most of EM weakened as the BBDXY USD index weakened slightly after rising 0.4% on Friday following stronger-than-expected US payrolls. The data reduced Fed easing expectations, which generally weighs on EM currencies.

- USDJPY is down 0.2% to 148.44 after rising to $149.13 early in the session. Japan’s finance minister Kato said FX moves will continue to be monitored and that they have both positive and negative effects but sudden moves hurt the economy. The yen strengthened moderately following the comments.

- USDKRW is slightly lower at around 1347.35.

- Aussie is also stronger with AUDUSD up 0.2% to 0.6810, close to the intraday high. It received support from the risk on move seen today which also boosted iron ore prices to over $110/t. AUDJPY is up 0.1% to 101.08 after a high of 101.42.

- NZDUSD is 0.1% higher at 0.6167 ahead of Wednesday’s RBNZ decision. Consensus is expecting a 50bp cut. AUDNZD is up 0.1% to 1.1042, close to the intraday high.

- European currencies are little changed with EURUSD at 1.0972 and GBPUSD at 1.3128.

- The ringgit, rupiah and baht saw the largest moves today. USDIDR is up 1.2% to 15668, USDMYR +1.3% to 4.2738 and USDTHB +1.2% to 33.44.

- Bank Indonesia said that it was prepared to intervene in the spot, bond and domestic non-deliverable forwards markets to defend the IDR. The announcement and the rupiah weakness is increasing speculation that BI will be on hold at its October 16 meeting to preserve FX stability.

- The Fed’s Bowman, Kashkari, Bostic and Musalem appear later today and in terms of data there are only US August consumer credit, German August factory orders and euro area retail sales.

UP TODAY (TIMES GMT/LOCAL)

Date | ET | Impact | Period | Release | Prior | Consensus | |

07/10/2024 | 1130 | * | 11-Oct | 3M Auction | -- | -- | |

07/10/2024 | 1130 | * | 11-Oct | 6M Auction | -- | -- | |

07/10/2024 | 1500 | * | Aug | Consumer Credit m/m | 25.452 | -- | USD (b) |