-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: European CBs Point To Need For Continued Tightening

EXECUTIVE SUMMARY

- FED MAY SLOW PACE OF RATE HIKES SOON: BRAINARD (RTRS)

- ECB WILL WARN OF MARKET CORRECTION RISK THIS WEEK, GUINDOS SAYS (BBG)

- ECB WILL PROBABLY KEEP RAISING RATES BEYOND 2% LEVEL – VILLEROY (RTRS)

- ‘LEAVE IT TO MARKET:’ RBA BACKFLIPS ON GUIDANCE AFTER CRITICISM (BBG)

- SWISS NATIONAL BANK CHAIRMAN FLAGS HIGH PROBABILITY OF RATE RISE (RTRS)

- CHINESE ECONOMIC ACTIVITY DATA DISAPPOINTS

- PBOC TWEAKS LIQUIDITY APPROACH

- G-20 DIPLOMATS AGREE ON DRAFT STATEMENT DESPITE RIFTS ON RUSSIA (BBG)

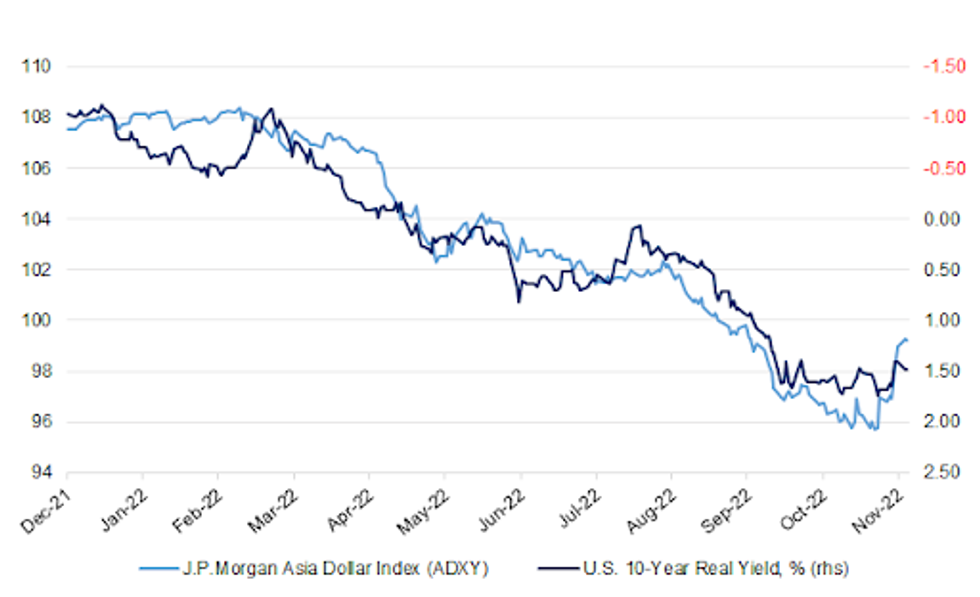

Fig. 1: J.P.Morgan Asia Dollar Index (ADXY) Vs. U.S. 10-Year Real Yield

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Rishi Sunak has dropped his strongest hint yet that the pensions triple lock will be kept as government policy, which would mean millions of pensioners avoiding a real-term cut. (Telegraph)

FISCAL: UK Chancellor Jeremy Hunt is considering a new 40% windfall tax on the “excess returns” of electricity generators as part of his sprawling package of tax rises and spending cuts this week, according to a person familiar with the proposal. (BBG)

FISCAL: Council tax will surge past £2,000 for the average household under plans drawn up by Rishi Sunak. (Telegraph)

FISCAL: Two of England’s largest Tory-run local authorities have warned the prime minister, Rishi Sunak, that they will be forced to declare bankruptcy within the next few months because of the unprecedented financial crisis enveloping both councils. (Guardian)

ECONOMY: Rishi Sunak will announce a significant rise in the national living wage and give eight million households cost of living payments worth up to £1,100 as he prioritises support for the poorest over universal measures. (The Times)

BOE/POLITICS: The Bank of England Governor has denied having any part in the downfall of Liz Truss. In an interview with Sky News, Andrew Bailey said that he "vehemently disagrees" with allegations that the Bank's actions precipitated the departure of the former prime minister. (Sky)

EUROPE

ECB: The European Central Bank’s semi-annual assessment of financial stability this week will highlight how threats to the region have increased yet again, Vice President Luis de Guindos said. (BBG)

ECB: The European Central Bank (ECB) will probably continue to raise interest rates beyond 2%, but "jumbo" rate hikes will not become a new habit, France's central bank chief said in a speech in Tokyo on Tuesday. (RTRS)

GERMANY: German authorities are stepping up preparations for emergency cash deliveries in case of a blackout to keep the economy running, four people involved said, as the nation braces for possible power cuts arising from the war in Ukraine. (RTRS)

SPAIN: Spanish Economy Minister Nadia Calvino on Monday said "everything points out" that the country's gross domestic product in 2022 will grow above the 4.4% rate predicted in the government's latest outlook. (RTRS)

SNB: There is a "great probability" that the Swiss National Bank will need to tighten monetary policy further as inflation is likely to remain elevated for a while, SNB Chairman Thomas Jordan said on Monday. He also said nominal appreciation of the Swiss franc is helping guard against inflationary pressure. (RTRS)

U.S.

FED: The Federal Reserve will likely soon slow its interest rates hikes, Fed Vice Chair Lael Brainard signaled on Monday, as the U.S. central bank tries to figure out how high borrowing costs need to go and how long they should stay there to bring down inflation. (RTRS)

FED: Michael Barr, the Federal Reserve's top regulatory official, said Monday the U.S. central bank is watching for any stresses to the financial system amid a weakening economy, and signaled that stiffer oversight of cryptocurrency is in the offing. (RTRS)

EQUITIES: Apple Inc. is trying to spur Mac sales with a rare promotional deal for small businesses that buy computers in bulk, an effort to cope with a slowdown during the holiday quarter. (BBG)

OTHER

U.S./CHINA: The face-to-face meeting between US President Joe Biden and Chinese President Xi Jinping was a powerful signal to the rest of the world that both leaders can manage ties, according to US trade chief Katherine Tai. (BBG)

U.S./CHINA/TAIWAN: Chinese President Xi Jinping raised the country's anti-secession law in talks on Taiwan with U.S. President Joe Biden at the G20 Summit on Monday, the Chinese foreign minister said in a statement. (RTRS)

G20: Group of 20 diplomats agreed on a proposed communique to put to their leaders when they meet Tuesday in Bali, Indonesia, after a tense day of negotiations to overcome differences on how hard to criticize Russia for its war in Ukraine, according to officials familiar with the matter. (BBG)

RBA: Australia’s central bank is prepared to pause its tightening cycle or return to larger interest-rate increases if the economy requires it, according to minutes of the Nov. 1 policy meeting when it lifted the benchmark by a quarter percentage point. (BBG)

RBA: Australia’s central bank said money markets are a better guide to the trajectory of interest rates after an assessment of pandemic-era forward guidance found its use presented “substantial” communication challenges. (BBG)

RBA: Former Reserve Bank board member and economist Warwick McKibbin has called for central banks to dump inflation targeting in favour of nominal income measuring, as the global economy enters a period of more frequent supply, climate, and commodity price shocks. (AFR)

BOC: The leader of Canada’s largest private-sector union accused the central bank and its governor, Tiff Macklem, of class warfare, ratcheting up its criticism of aggressive interest-rate increases to tame inflation. (BBG)

MEXICO: Mexico’s central bank sees an option to break from its pattern of interest rate hikes in tandem with the US Federal Reserve if economic variables improve, Deputy Governor Galia Borja said Monday. (BBG)

BRAZIL: Brazil President-elect Luiz Inacio Lula da Silva’s transition team will weigh a more conservative alternative to finance next year’s social outlays as investors eagerly await spending details, according to two people with knowledge of the matter. (BBG)

RUSSIA: In his address to world leaders gathered in Bali, Volodymyr Zelenskiy has outlined a series of conditions needed to end the war Ukraine. (Guardian)

OIL: Oil output in the Permian Basin is set to hit another record of 5.499 million barrels per day in December, but production is rising very slowly in the biggest U.S. shale oil basin even though U.S. prices have surged in 2022. (RTRS)

CHINA

CORONAVIRUS: China will “firmly implement the general policy of ‘dynamic clearing’,” People’s Daily, the flagship newspaper of the Communist Party, said in an editorial Tuesday. (BBG)

POLICY: Senior executives across China’s $58 trillion financial system are facing additional pay cuts as firms from investment banks to mutual funds weigh options to comply with President Xi Jinping’s “common prosperity” drive. (BBG)

YUAN: The growth of China’s yuan as a reserve currency is being driven by its use in a developing industrial chain based on cheap Russian raw materials and southeast Asian labour, as the yuan will not be completely convertible for the foreseeable future, one of the country’s most prominent experts on the subject told MNI. (MNI)

CHINA MARKETS

PBOC TWEAKS LIQUIDITY FOCUS

The People's Bank of China (PBOC) on Tuesday conducted CNY172 billion via 7-day reverse repos and CNY850 billion 1-year medium-term lending facilities with the rate unchanged at 2.00% and 2.75%, respectively. The operation has led to a net injection of CNY20 billion after offsetting the maturity of CNY2 billion reverse repos and CNY1 trillion MLFs today, according to Wind Information.

- The operation aims to offset the impact of tax season and the operation has fully met the meets from financial institutions, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9022% at 9:32 am local time from the close of 1.8403% on Monday.

- The CFETS-NEX money-market sentiment index closed at 57 on Monday vs 45 on Friday. (MNI)

- The central bank said in a statement it injected 320 billion yuan of medium-to-long-term liquidity by via Pledged Supplemental lending and re-lending to the tech sector this month. (BBG)

PBOC SETS YUAN CENTRAL PARITY AT 7.0421 TUES VS 7.0899 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0421 on Tuesday, compared with 7.0899 set on Monday.

OVERNIGHT DATA

CHINA OCT INDUSTRIAL PRODUCTION +5.0% Y/Y; MEDIAN +5.3% SEP +6.3%

CHINA OCT INDUSTRIAL PRODUCTION +4.0% YTD Y/Y; MEDIAN +4.0% SEP +3.9%

CHINA OCT RETAIL SALES -0.5% Y/Y; MEDIAN +0.7% SEP +2.5%

CHINA OCT RETAIL SALES +0.6% YTD Y/Y; MEDIAN +0.8% SEP +0.7%

CHINA OCT PROPERTY INVESTMENT -8.8% YTD Y/Y; MEDIAN -8.3% SEP -8.0%

CHINA OCT FIXED ASSETS EX RURAL +5.8% YTD Y/Y; MEDIAN +5.9%; SEP +5.9%

CHINA OCT RESIDENTIAL PROPERTY SALES -28.2% YTD Y/Y; SEP -28.6%

CHINA OCT SURVEYED UNEMPLOYMENT RATE 5.5%; MEDIAN 5.5%; SEP 5.5%

JAPAN Q3, P GDP -0.3% Q/Q; MEDIAN +0.3%; Q2 +1.1%

JAPAN Q3, P GDP ANNUALISED -1.2% Q/Q; MEDIAN +1.2%; Q2 +4.6%

JAPAN Q3, P GDP NOMINAL -0.5% Q/Q; MEDIAN +0.2%; Q2 +0.8%

JAPAN Q3, P GDP DEFLATOR -0.5% Y/Y; MEDIAN +0.6%; Q2 -0.4%

JAPAN Q3, P PRIVATE CONSUMPTION +0.3% Q/Q; MEDIAN +0.3%; Q2 +1.2%

JAPAN Q3, P BUSINESS SPENDING +1.5% Q/Q; MEDIAN +2.2%; Q2 +2.4%

JAPAN Q3, P GDP INVENTORY CONTRIBUTION -0.1% Q/Q; MEDIAN 0.0%; Q2 -0.2%

JAPAN Q3, P GDP NET EXPORTS CONTRIBUTION -0.7% Q/Q; MEDIAN -0.3%; Q2 +0.2%

JAPAN SEP, F INDUSTRIAL OUTPUT -1.7% M/M; PRELIMINARY -1.6%

JAPAN SEP, F INDUSTRIAL OUTPUT +9.6% Y/Y; PRELIMINARY +9.8%

JAPAN SEP CAPACITY UTILISATION -0.4% M/M; AUG +1.2%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 80.8; PREV 78.7

Consumer confidence edged up 2.7% last week, its first weekly increase since late September. The subindices that capture the prospects over the next year drove the increase, with 31% (+1.3ppt) of respondents expecting to be ‘better off’ financially this time next year and 8% (+1.4ppt) expecting ‘good times’ for the economy over the next year. (ANZ)

NEW ZEALAND OCT REINZ HOUSE SALES -34.7% Y/Y; SEP -10.9%

NEW ZEALAND OCT REINZ MEDIAN HOUSE PRICE -7.5% Y/Y; SEP +2.0%

While October sees an increase in enquiry and open home attendance in some regions, rising interest rates have caused hesitancy amongst buyers across Aotearoa New Zealand. The national median price showed improvement on September. Still, prices continue to ease, sales activity remains down and properties are taking longer to sell than in October 2021, according to the latest data and insights from the Real Estate Institute of New Zealand (REINZ), home of the most complete, accurate and up-to-date real estate data in New Zealand. (REINZ)

NEW ZEALAND SEP NET MIGRATION +2,176; AUG +1,343

SOUTH KOREA SEP M2 MONEY SUPPLY 0.0% M/M; AUG +0.7%

SOUTH KOREA SEP L MONEY SUPPLY +0.3% M/M; AUG +0.6%

MARKETS

SNAPSHOT: European CBs Point To Need For Continued Tightening

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 51.04 points at 28013.71

- ASX 200 down 4.743 points at 7139.4

- Shanghai Comp. up 47.622 points at 3122.576

- JGB 10-Yr future up 12 ticks at 149.37, yield up 0.4bp at 0.247%

- Aussie 10-Yr future up 1.5 ticks at 96.235, yield down 1.3bp at 3.756%

- U.S. 10-Yr future down 0-02+ at 112-01+, yield up 1.69bp at 3.8724%

- WTI crude down $0.47 at $85.36, Gold up $1.76 at $1770.76

- USD/JPY up 36 pips at Y140.42

- FED MAY SLOW PACE OF RATE HIKES SOON: BRAINARD

- ECB WILL WARN OF MARKET CORRECTION RISK THIS WEEK, GUINDOS SAYS (BBG)

- ECB WILL PROBABLY KEEP RAISING RATES BEYOND 2% LEVEL – VILLEROY (RTRS)

- ‘LEAVE IT TO MARKET:’ RBA BACKFLIPS ON GUIDANCE AFTER CRITICISM (BBG)

- SWISS NATIONAL BANK CHAIRMAN FLAGS HIGH PROBABILITY OF RATE RISE (RTRS)

- CHINESE ECONOMIC ACTIVITY DATA DISAPPOINTS

- PBOC TWEAKS LIQUIDITY APPROACH

- G-20 DIPLOMATS AGREE ON DRAFT STATEMENT DESPITE RIFTS ON RUSSIA (BBG)

US TSYS: Block Flow Applies Light Pressure Overnight

Cash Tsys run 0.5-2.0bp cheaper across the curve into London hours. Meanwhile, TYZ2 sits -0-02 at 112-02, 0-01+ off the base of a narrow 0-06+ range.

- Ranges were contained, with a modest bid linked to a slight tweak in liquidity focus from the PBoC unwound. The light cheapening was aided by block sales in TY futures (-5K & -~3.8K).

- G20-related communique, including comments from Chinese President Xi & source reports pointing to continued differences re: the Russia-Ukraine war, albeit with a draft statement seemingly in the offing, failed to provide any meaningful impetus from the space.

- The same held true for softer than expected monthly economic activity data out of China.

- Finally, there were no headlines released surrounding the latest appearance from NY Fed President Williams, who moderated a panel at the Economic Club.

- PPI data, the Empire m’fing survey and Fedspeak from Cook, Barr & Harker will cross in NY hours on Tuesday.

JGBS: Long End Supported By Soft GDP Data

Cash JGBs run ~1bp cheaper to 3.5bp richer as the curve twist flattens.

- JGB futures added to their modest overnight bid, which was linked to the post-Tokyo move in U.S. Tsys and some Monday richening in the likes of the German FI market, with softer than expected domestic GDP data providing further support.

- That left the contract +17 into the bell, just shy of early session highs.

- The bid in the long end was relatively sticky, also linked to the previously outlined moves in the wider core global space in post-Tokyo Monday trade and the soft domestic data.

- Headlines covering comments from Japanese Economy Minister Nishimura & BoJ Governor Kuroda were not market movers.

- 5-Year JGB supply was fairly non-descript, with average internal metrics observed.

- Looking ahead, Wednesday will see the release of core machine orders data.

JGBS AUCTION: 5-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.0308tn 5-Year JGBs:

- Average Yield: 0.060% (prev. 0.081%)

- Average Price: 100.19 (prev. 100.09)

- High Yield: 0.064% (prev. 0.083%)

- Low Price: 100.17 (prev. 100.08)

- % Allotted At High Yield: 80.1910% (prev. 21.5292%)

- Bid/Cover: 3.306x (prev. 3.993x)

AUSSIE BONDS: Curve Twist Flattens, After Downtick From Early Highs

YM finished -2.0, with XM +0.5 at the bell, as the wider ACGB curve twist flattened, with a pivot around 10s.

- It seemed that the ACGB space struggled on the back of spill over from (limited) weakness in different bond markets during Wednesday’s Sydney session, which manifested into some ACGB underperformance on the day.

- Some trans-Tasman weakness, linked to NZGB supply, provided weakness in the early rounds of Sydney dealing, with a subsequent post-syndication rally in NZGBs doing little for the space.

- This saw ACGBs pull away from early session highs linked to overnight session moves in futures/Monday’s light post-Sydney bid in U.S. Tsys.

- Some modest cheapening in U.S. Tsys then applied some light pressure.

- In local news, RBA communique included the minutes from the latest monetary policy meeting, which failed to provide anything fresh and meaningful owing to post-meeting appearances from Governor Lowe & Deputy Governor Bullock.

- We also got the Bank’s review of its forward guidance scheme, which pointed to a preference towards a more qualitative brand of forward guidance, when appropriate, in the RBA’s future.

- Bills were -2 to +1 through the reds, twist flattening.

- Wednesday’s docket will see the release of Q3 WPI data, the Westpac leading index & A$900mn of ACGB Nov-33 supply.

NZGBS: Early NZGB Cheapening More Than Reversed As Supply Goes Well

NZGBs finished 4.5-6.5bp richer across the curve, with swap spreads running mixed as longer dated swap spreads tightened and shorter dated swap spreads ran flat to a touch wider.

- The early cheapening in the space more than reversed as the pressure from the pricing of the green NZGB May-34 syndication ebbed, with the amount issued at the top end of the pre-prescribed range, while pricing was at the tighter end of the initial guidance. Most of the paper went offshore (56%), with a relatively even split allotted to Australia, Europe & North America (16-17% apiece).

- Solid demand at the auction and the removal of supply-related pressure seemed to underpin the space through the remainder of the day, even as core global FI moved off firmest levels of the session.

- Long end receiver side flow in swaps would have aided the bid further.

- Local news flow saw REINZ house price data pull lower as the housing market continues to adjust to the rapidly increasing interest rate environment.

- Elsewhere, there wasn’t much to flag in the way of movement surrounding household inflation expectations data released by the RBNZ.

- RBNZ dated OIS pricing of the terminal OCR remained little changed on the day, hovering a little shy of 5.10%, with a steady ~65bp of tightening priced for next week’s RBNZ gathering.

- Non-resident bond holdings data headlines the domestic docket on Wednesday.

EQUITIES: China/HK Sentiment Continues To Recover

The focus remains on China/HK trends, which have remained positive today, despite weaker October activity data for China. Trends elsewhere have been more mixed, although losses haven't been large in markets which are down. US futures have mostly tracked higher (+0.40/+0.60%) for the major indices, offsetting part of the negative lead from overnight.

- The HSI is up over 3.5% at this stage, now clear of the 18000 level, while the tech sub-index is +8%. Developer, Country Garden, has weighed, with shares in the company down sharply, after announcing it will place shares to raise funds for offshore debt payments.

- Still, the Shanghai property sub-index is still up a further 1.12%, the 8th straight session of gains. The CSI 300 is +1.47% at this stage.

- Some thawing in tensions between the US and China, post the meeting between the two presidents late yesterday in Bali, has likely aided broader sentiment. October activity data was weaker across the board, but hasn't impacted market sentiment too much.

- The Taiex is up 2.4%, led by TSMC gains, as it was revealed Berkshire Hathaway added shares of the company during Q3. The Kospi has been around flat levels for most of the session.

- The ASX 200 is down smalls (-0.1%), but is away from worst levels as better HK/China equity sentiment spilled over this afternoon.

OIL: Prices Range Bound Close To November Lows, IEA Report Published Later

Oil prices have been trading in a very narrow range close to the November lows after falling over 3% overnight. Supply concerns are currently slightly outweighing tight supply as there has been little additional energy news. WTI has traded between $85-$86/bbl and is now just under $85.50 while Brent’s range has been $92.50-$93.50 and is now about $92.90.

- The weaker-than-expected October economic data out of China plus a growing number of Covid infections weighed on sentiment in the oil market today.

- News had not been good for either supply and demand with OPEC revising down oil demand expectations again for Q4, while for the first time in 2 years, the US fracked fewer wells than they had drilled. (Bloomberg)

- The International Energy Agency publishes its Oil Market Report for November later and any material change to its supply and demand forecasts could move the market. US API inventory data is also published tonight. Last week it showed a 5.6mn barrel inventory build.

GOLD: Holding Near Recent Highs

Gold is holding near recent highs, last close to $1771, down slightly on NY closing levels ($1771.40). Upside impetus has been curbed to a degree by slightly firmer USD levels, although this is mostly evident against JPY at this stage.

- The precious metal has had very modest changes in recent sessions, largely sticking to a $1750/$1775 range, although the bias appears more to the upside rather than the downside.

- Gold continues to outperform US real yields, but is generally moving in line with USD momentum from a trend standpoint.

- Note we are already through the 200-day EMA ($1760.05), but the simple 200-day MA comes in at $1803.90, which like remains an upside target for bulls.

FOREX: Yen Goes Offered On Japan's Surprise GDP Contraction, Uptick In U.S. Tsy Yields

The yen was the worst G10 performer after preliminary data showed a surprise contraction in the Japanese economy, with higher U.S. Tsy yields adding pressure to Asia's main safe haven currency. Gotobi Day flows may have exacerbated JPY weakness.

- Japan's economy shrank 1.2% Y/Y in Q3 versus expectations of a 1.2% growth, according to preliminary data from the Cabinet Office, as the historic yen sell-off sent import costs soaring. The yen was unfazed in the first minutes after the release, but weakened gradually as the session progressed.

- U.S. Tsy yields sit 0.6-1.5bp higher at typing, with 10-year U.S./Japan yield spread 1bp wider as a result. Expectations of continued tightening from the Fed stands in contrast with the BoJ's ultra-dovish resolve.

- Offshore yuan showed a limited reaction to a slew of China's economic activity indicators, which were broadly weaker than forecast. CNY fixing bias was closed to neutral today, with the reference rate set just shy of the expected level.

- The kiwi dollar caught a bid on the back of better risk sentiment, with U.S. e-minis and Chinese/HK benchmarks tracking higher. AUD/NZD traded on a heavier footing, ignoring a round trip in Australia/New Zealand 2-year swap spread.

- There's a wealth of economic data coming up after Asia hours, including flash EZ GDP, German ZEW Survey, UK unemployment, Swedish CPI, as well as U.S. Empire M'fing & PPI. Comments are due from Fed's Barr, Cook & Harker, ECB's Villeroy & Elderson, as well as Riksbank's Floden.

FX OPTIONS: Expiries for Nov15 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9935-55(E1.2bln), $1.0075(E844mln), $1.0175-00(E1.2bln)

- USD/JPY: Y139.00($500mln), Y140.00($663mln)

- AUD/NZD: N$1.1000(A$511mln)

- USD/CNY: Cny7.0000($1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/11/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 15/11/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 15/11/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/11/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/11/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 15/11/2022 | 1000/1100 | * |  | EU | Employment |

| 15/11/2022 | 1000/1100 | *** |  | EU | GDP First Estimates |

| 15/11/2022 | 1130/1130 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 15/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 15/11/2022 | 1330/0830 | *** |  | US | PPI |

| 15/11/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/11/2022 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 15/11/2022 | 1400/0900 |  | CA | BOC Deputy Kozicki moderates panel on diversity | |

| 15/11/2022 | 1400/0900 |  | US | Fed Governor Lisa Cook | |

| 15/11/2022 | 1500/1000 |  | US | Fed Vice Chair for Supervision Michael Barr | |

| 15/11/2022 | 1730/1830 |  | EU | ECB Elderson Speech at Euro Finance Week |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.