-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fallout From BoJ Still Under Microscope

EXECUTIVE SUMMARY

- DE GUINDOS: ECB'S MIGHT RAISE INTEREST RATES AT CURRENT PACE FOR A WHILE (RTRS)

- ECB’S CENTENO: DATA INDICATE INFLATION IS REACHING PEAK IN Q4 (BBG)

- UK FELL DEEPER INTO RECESSION IN FOURTH QUARTER, CBI SURVEY SAYS (BBG)

- BIDEN TELLS ZELENSKIY US TO BACK UKRAINE ‘AS LONG AS IT TAKES’ (BBG)

- WEAK YEN CONCERNS BEHIND BOJ'S SHOCK YIELD SHIFT (MNI)

- NIPPON LIFE WEIGHS MORE JAPAN BOND PURCHASES AS BOJ LIFTS YIELDS (BBG)

- PBOC RATE CUTS NEEDED AS LEVERAGE SET TO RISE (MNI)

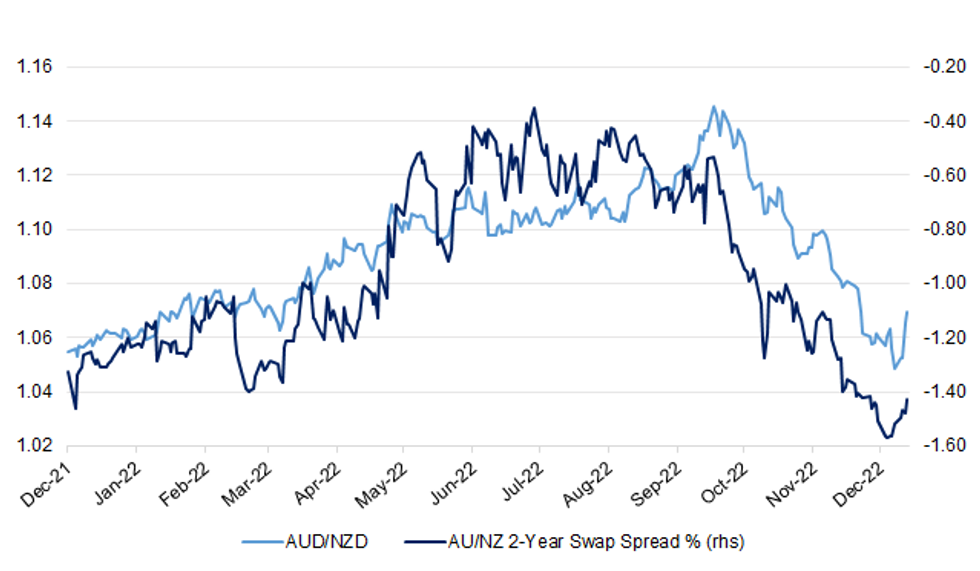

Fig. 1: AUD/NZD Vs. Australia/New Zealand 2-Year Swap Spread

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The UK economy probably tumbled deeper into recession in the final three months of the year as output in the private sector slowed sharply, a leading business group said. (BBG)

FISCAL: Striking NHS workers will be offered a fast-tracked pay deal next year in a government attempt to break the deadlock with health unions. (Telegraph)

BREXIT: A significant number of firms are still struggling to increase sales or grow their business under the UK-EU trade deal, the British Chambers of Commerce (BCC) has warned. (Sky)

EUROPE

ECB: The European Central Bank might raise interest rates at its current pace for a period of time to curb inflation, said Vice-President Luis de Guindos. (RTRS)

ECB: European Central Bank Governing Council Member Mario Centeno said “all the data” indicate that inflation is reaching its peak in the euro area in the fourth quarter of 2022. (BBG)

GERMANY: Germany's finance ministry expects activity in Europe's biggest economy to remain subdued during the fourth quarter of this year and first quarter of next and sees declining inflation rates during 2023, it said in its monthly report. (RTRS)

SPAIN: The Spanish Senate gave the final approval to a windfall tax on banks and large energy companies on Wednesday, designed to alleviate the cost of living crisis, although largely leaving out smaller local lenders and foreign banks' units in Spain. (RTRS)

U.S.

FED: US Senator Pat Toomey and other Republican lawmakers introduced legislation that would more than halve the number of Federal Reserve regional banks and add more political oversight to the selection process for bank presidents. (BBG)

OTHER

GLOBAL TRADE: A Luxembourg-based provider of ship insurance said it will exclude claims arising from Russia’s war in Ukraine, the most stark indication yet that vessels may struggle for cover when calling at ports linked to the conflict next year. (BBG)

BOJ: Concerns the yen would weaken as commodity prices rally on hopes for a Chinese economic recovery next year fed into the Bank of Japan's decision to lift the upper band on its 10-year yield target, MNI understands. (MNI)

JAPAN: Japan's government revised up on Thursday its growth forecast for the next fiscal year on prospects for higher business expenditure and substantial wage hikes that are seen underpinning consumption. (RTRS)

JAPAN: The Tokyo metropolitan government plans to raise its warning for the Covid-19 medical situation to the highest level on its 4-point scale, public broadcaster NHK reports, citing an unidentified person. (BBG)

JAPAN/JGBS: Japan's Ministry of Finance plans to sell 190 trillion yen ($1.44 trillion) worth of Japanese government bonds (JGB) in the fiscal year beginning April 1, with cuts in the amount of short-term debt sold, showed a draft of the plan obtained by Reuters. The plan would compare to the previous year's 198.6 trillion yen, with JGB issuance having been bloated by extra bonds sold to fund efforts to cope with COVID-19-induced economic downturn. (RTRS)

BRAZIL: Brazil’s congress approved a proposal that gives President-elect Luiz Inacio Lula da Silva an additional 168 billion reais ($32 billion) to spend next year, allowing him to pay for social welfare programs and other campaign promises. (BBG)

BRAZIL: The new fiscal framework will be credible and reliable, future Finance Minister Fernando Haddad told reporters in Brasilia. (BBG)

BRAZIL: Economist Esther Dweck was tapped by the Brazil President-elect Luiz Inacio Lula da Silva as Minister of Management, reports newspaper Estado de S.Paulo, citing members of the transition team. (BBG)

RUSSIA: President Joe Biden promised Volodymyr Zelenskiy unwavering US support as Ukraine’s effort to beat back Russia’s invasion nears its 11th month even as support from Republicans poised to take control of the House wanes. (BBG)

RUSSIA: The Biden administration has been working with Congress over the last several months on legislation that would formally designate Russia as an “aggressor state,” sources familiar with the deliberations told CNN. (CNN)

RUSSIA: The Biden administration on Wednesday unveiled new curbs on technology exports to Russia's Wagner military group, in a bid to further choke off supplies to the contractor over its role in the Russian invasion of Ukraine. (RTRS)

PERU: Peru’s government wants to defuse the unrest that erupted after the impeachment of President Pedro Castillo by providing near- term economic relief and stepping up services, new Prime Minister Alberto Otarola said in a streamed press conference alongside several other members of the cabinet. (BBG)

ISRAEL: Israel's longest-serving prime minister Benjamin Netanyahu said on Wednesday he had secured a deal to form a new government after weeks of unexpectedly tough negotiations with religious and far-right coalition partners. (RTRS)

BONDS: Japan’s largest insurer may rejig its portfolio in favor of domestic bonds after a policy move by the central bank bolstered the debt’s appeal. (BBG)

OIL: Environmental groups sued the Biden administration on Wednesday to block a sale of oil and gas drilling rights off the coast of Alaska that is scheduled for next week. (RTRS)

CHINA

PBOC: The People’s Bank of China should cut its policy rates to lower the cost of new government borrowing needed to fund additional spending, with an increase in China’s macro-leverage ratio justified by the need to support annual GDP growth of 5-5.5% in 2023, a senior policy adviser told MNI. (MNI)

FISCAL: China is expected to increase its budget deficit-to-GDP ratio above its 3% “red line” next year, as the central government issues more Treasury bonds to support domestic demand and lift growth at a time when debt-burdened local governments are constrained in their ability to add leverage, advisers told MNI. (MNI)

YUAN: The Chinese currency is expected to get support as more corporates are likely to sell dollar before the Lunar New Year holiday in January, the Shanghai Securities News reports, citing analysts. (BBG)

ECONOMY: Efforts should be made to maintain strong supply and price stability during festival season, China’s State Council said at an executive meeting. (MNI)

PROPERTY: China’s real estate market is expected to have a soft landing following recent policies supporting financing, with rates of decline in home starts and construction slowing, Yicai.com reported citing Sheng Songcheng, former director of the surveys and statistics department at the People’s Bank of China. (MNI)

PROPERTY: The China Securities Regulatory Commission (CSRC) said it will support the transformation of the real estate development model, according to a statement posted on its website. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY155 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY4 billion via 7-day reverse repos, and CNY153 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY155 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operations aim to keep year-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9608% at 9:24 am local time from the close of 1.6407% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Wednesday vs 48 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9713 THURS VS 6.9650 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9713 on Thursday, compared with 6.9650 set on Wednesday.

OVERNIGHT DATA

JAPAN OCT, F LEADING INDEX 98.6; PRELIM 99.0; SEP 98.2

JAPAN OCT, F COINCIDENT INDEX 99.6; PRELIM 99.9; SEP 100.8

SOUTH KOREA NOV PPI +6.3% Y/Y; OCT +7.3%

MARKETS

SNAPSHOT: Fallout From BoJ Still Under Microscope

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 135.43 points at 26523.07

- ASX 200 up 37.409 points at 7152.5

- Shanghai Comp. up 7.61 points at 3076.017

- JGB 10-Yr future up 59 ticks at 146.35, yield down 7.6bp at 0.404%

- Aussie 10-Yr future down 8.5 ticks at 96.170, yield up 8.0bp at 3.806%

- U.S. 10-Yr future up 0-04+ at 113-22+, yield down 0.93bp at 3.6527%

- WTI crude up $0.42 at $78.71, Gold up $5.97 at $1820.36

- USD/JPY down 71 pips at Y131.75

- ECB’S CENTENO: DATA INDICATE INFLATION IS REACHING PEAK IN Q4 (BBG)

- UK FELL DEEPER INTO RECESSION IN FOURTH QUARTER, CBI SURVEY SAYS (BBG)

- BIDEN TELLS ZELENSKIY US TO BACK UKRAINE ‘AS LONG AS IT TAKES’ (BBG)

- WEAK YEN CONCERNS BEHIND BOJ'S SHOCK YIELD SHIFT (MNI)

- NIPPON LIFE WEIGHS MORE JAPAN BOND PURCHASES AS BOJ LIFTS YIELDS (BBG)

- PBOC RATE CUTS NEEDED AS LEVERAGE SET TO RISE (MNI)

US TSYS: A Touch Firmer Overnight On Broader Inputs

A bid in JGBs and a block buy in TY futures (+1,896) supported Tsys overnight, although some cheapening in ACGBs and a pullback from best levels in the JGB space probably capped the bid.

- That leaves cash Tsys ~1-2bp richer across the major benchmarks, with intermediates outperforming at the margin after lagging during Wednesday’s relatively modest (at least based on net daily change) rally. TYH3 is +0-06 at 113-24, 0-00+ off the peak of its 0-05 range, on volume of ~64K.

- There was a lack of meaningful macro headline flow overnight, outside of U.S. President Biden pledging to back Ukraine for “as long as it takes” re: the conflict with Russia. This left the aforementioned cross-market direction and block flow at the fore. We also believe that U.S. Tsys may have benefitted from spread based demand vs. ACGBs (as we have covered elsewhere).

- Looking ahead, weekly jobless claims data, revised Q3 GDP readings and the Kansas City Fed m’fing index are due in NY hours. We will also get 5-Year TIPS supply.

JGBS: Firmer, But Off Best Levels At The Bell

JGB futures extended on their overnight session gains during the Tokyo morning, with short covering perhaps playing a part.

- The contract has since eased back from best levels after gapping higher at the afternoon open, closing +49. Note that bulls failed to challenge the contract’s post-BoJ high of 146.74, with the vol. continuing.

- An early bull flattening impetus gave way to outperformance in 10s, with the major cash JGB benchmarks running flat to 8bp richer into the close.

- Low offer to cover ratios in the details of the latest round of BoJ Rinban purchases (after the Bank stuck with its focus on the 3- to 10-Year zone, as it looks to facilitate the functioning of its new YCC settings) helped underpin intermediates, resulting in the post-lunch break richening. Reports pointing to a downtick in JGB issuance in the next FY also helped that bid, before the aforementioned fade from best levels., which lacked a clear catalyst.

- Twist steepening on the swap curve may have also been a limiting factor, resulting in mixed swap spread performance (tighter to little changed in the front end of the curve, with a widening theme then extending the further out the curve you look).

- Tomorrow’s local docket is headlined by national CPI data and the outdated minutes from the BoJ’s Oct meeting.

AUSSIE BONDS: Bucking The Trend, Likely Weighed By Cross Market Flows

Thursday’s weakness in ACGBs was somewhat peculiar, given the general core FI richening theme and a lack of idiosyncratic news flow.

- This (once again) leads us to conclude that cross-market flows were at the fore, with the AU/U.S. 10-Year yield spread resuming its recent widening, hitting the widest level seen since October, perhaps aided by some exits from crowded compression trade positioning in that spread. AU/NZ cross-market flows may also have been at work, given the relative resilience in NZGBs and movement in AUD/NZD.

- That left YM -6.0 and XM -7.0 at the close, while the wider cash ACGB benchmarks were 4.5-8.0bp cheaper, with bear steepening in play.

- Swap flow seemed to aid the general trajectory, with EFPs a little wider on the day. This came as the Bill curve ran steeper, finishing 1-11bp cheaper through the reds. Meanwhile terminal cash rate pricing in the RBA dated OIS strip nudged higher, finishing a little shy of 3.80%, aiding the cheapening & swap paying dynamics.

NZGBS: Early, Light Richening Holds

NZGBs held on to their early richening, even as their Antipodean counterparts faltered on the back of what seems like cross-market flow-driven moves (which perhaps underpinned NZGBs further).

- That left the major NZGB benchmarks running flat 2.5-4.0bp richer across the curve at the close, with some light bull steepening seen after NZGBs looked to Wednesday’s bid in U.S. Tsys for early support.

- Swap rates are essentially unchanged across the curve.

- The front end of the RBNZ dated OIS strip was flat, with ~71bp of tightening priced for the Feb ’23 gathering and a terminal OCR of ~5.55% currently baked in.

- Broader inputs will shape the NZGB space on Friday, although activity is likely to be limited, unless we get major macro headline flow, with the local docket empty and participants eying the exits ahead of the Christmas holiday.

EQUITIES: HSI Leads Regional Move Higher, As China Authorities Pledge More Policy Support

Asia Pac equities are higher across the board (except Indonesia/India). The HSI and China Enterprise Index lead gains, while US/EU futures are also higher (+0.30/+0.40%), providing further support to the regional backdrop.

- The HSI is +2.70%, with the underlying tech index +4.60%. The China Enterprise index is +3.15%. A measure of property developers surged in early trade, amid calls late yesterday from the PBoC Governor for more support for the sector. We are away from best levels though, last around +1.45% for the session.

- Mainland stocks are also higher, the CSI last at +0.76%. State TV reported that the authorities urged the implementation of policies to support the economy and utilize existing policies more effectively, after a state council meeting yesterday. The Shanghai Composite is up a more modest 0.34%.

- Japan stocks are higher, +0.50% for the Nikkei 225, the first gain for the index since last Wednesday. The Kospi (+0.80%) and Taiex (+1.30%) have risen more, supported by major tech index gains during the Wednesday US session.

- Indonesian stocks are down slightly, -0.18%, we do have the BI decision later, +25bps expected. Indian stocks have also opened up weaker, down 0.35% at this stage.

GOLD: Prices Higher As USD Softens

Gold prices are up about 0.3% to around $1819.75/oz after falling 0.2% on Wednesday. It is currently trading just under its intraday high of $1820.15. Bullion has found support from a weaker USD (DXY -0.3%). Fed expectations will shape the 2023 outlook for gold.

- Trend conditions for gold remain bullish and the bull trigger is at $1824.50, the December 13 high. Key short-term support is at $1765.90, the December 5 low, and a break of this would signal a deeper retracement. It’s currently in a pattern of higher highs and higher lows.

- Later today there are US jobless claims and the Chicago and Kansas Fed indices. The focus is on Friday’s personal consumption data which includes the Fed’s preferred measure of inflation for November, the core PCE – price index. There is also Michigan consumer confidence for December and November durable goods data on Friday.

OIL: Prices Continue To Rally But A Lot Of Uncertainty Going Into 2023

Oil prices are up around 0.5% on yesterday’s NY close, as US EIA data showed a drawdown in crude stocks, but have been trading in tight ranges. WTI is trading around $78.70/bbl and during today’s session reached its highest since early December. Brent is around $82.60 just below the intraday high of $82.71. DXY is down 0.3%.

- WTI conditions remain bearish but are in an upward corrective cycle and have traded today above the 20-day EMA of $76.80. The next level to watch on the upside is $79.79, the 50-day EMA. On the downside, the bear trigger is $70.31, the December 9 low. Brent has also broken through its 20-day EMA of $82.03.

- The US EIA reported a 5.89mn bbl drawdown in crude inventories after a 10.23mn build the previous week, which was the lowest at this time of year since 2014.

- There is a lot of uncertainty going into 2023, due to recession fears, the reopening of China, the effect of sanctions on Russian oil supplies and how OPEC will respond to these factors.

- Later today there are US jobless claims and the Chicago and Kansas Fed indices. The focus is on Friday’s personal consumption data which includes the Fed’s preferred measure of inflation for November, the core PCE – price index.

FOREX: USD Index Edging Closer To December Lows, A$ Surges On Cross-Asset Support

USD losses have continued, with the BBDXY now off by ~0.30%, last tracking under 1252. Through December the index has found support around the 1250 level, see the chart below. The set up for the DXY is a little less adverse but this index is also down by a similar amount for the session (last around 103.85/90).

- Similar drivers of USD weakness appear are still in play that were evident earlier (firmer equities/lower US cash Tsy yields). The bigger shift has come from gains seen for regional equities, particularly in Hong Kong.

- The A$ has jumped ahead of the yen to be the leader of G10 moves. AUD/USD is now +0.80% for the day, near 0.6760. Higher AU government bond yields are helping, +5/+7bps across the curve. Firmer commodity prices are as well (copper +0.80% CMX basis), although iron ore has moved down from recent highs, last around $111.50/tonne.

- NZD/USD has been dragged higher, back to 0.6320. The AUD/NZD cross is still rising though. The pair got to 1.0700, fresh highs back to the start of the month, before selling interest emerged. The above-mentioned yield momentum is also likely to be biasing AUD higher.

- USD/JPY hit a low of 131.65, but we are now back to 131.80/85. Still 0.50% higher for the yen so far. Yesterday's low in the pair came around the 131.50 region.

- GDP revisions for the UK and US dominate the data calendar later on, with US jobless claims also due.

Fig 1: BBDXY Approaching December Lows

FX OPTIONS: Expiries for Dec22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E614mln), $1.0550(E1.5bln), $1.0630(E575mln), $1.0675-80(E496mln)

- USD/JPY: Y130.00($1.9bln), Y132.50($1.9bln), Y134.30-50($750mln), Y137.00($560mln), Y137.50-60($1.0bln)

- AUD/USD: $0.6650-70(A$696mln), $0.6810(A$831mln)

- USD/CAD: C$1.3480-00($965mln), C$1.3660-75($903mln)

- USD/CNY: Cny6.9000($883mln), Cny6.9500($900mln), Cny7.0900($600mln), Cny7.2000($1.5bln), Cny7.2500($1.2bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/12/2022 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 22/12/2022 | 0700/0800 | ** |  | SE | PPI |

| 22/12/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 22/12/2022 | 0720/0220 |  | ID | Indonesia Central Bank Rate Decision | |

| 22/12/2022 | 0745/0845 | * |  | FR | Retail Sales |

| 22/12/2022 | 0900/1000 | * |  | NO | Norway Unemployment Rate |

| 22/12/2022 | 1000/1100 | ** |  | IT | PPI |

| 22/12/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 22/12/2022 | - |  | UK | House of Commons Recess Starts | |

| 22/12/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 22/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 22/12/2022 | 1330/0830 | *** |  | US | GDP (3rd) |

| 22/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 22/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.