-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI BRIEF: Japan Oct Real Wages Unchanged Y/Y

MNI EUROPEAN OPEN: Fed Focused On Tightening Financial Conditions

EXECUTIVE SUMMARY

- TOP US GENERAL WARNS IRAN TO STAY OUT OF CONFLICT - FT

- BOE’S MANN CALLS FOR ‘AGGRESSIVE’ POLICY TO TACKLE INFLATION - BBG

- CHINA SEES SEPT. CREDIT GROWTH, MORE MONETARY EASING AHEAD - CSJ/BBG

- AUSTRALIA BUSINESS CONDITIONS STAY RESILIENT AMID CONSUMER GLOOM - BBG

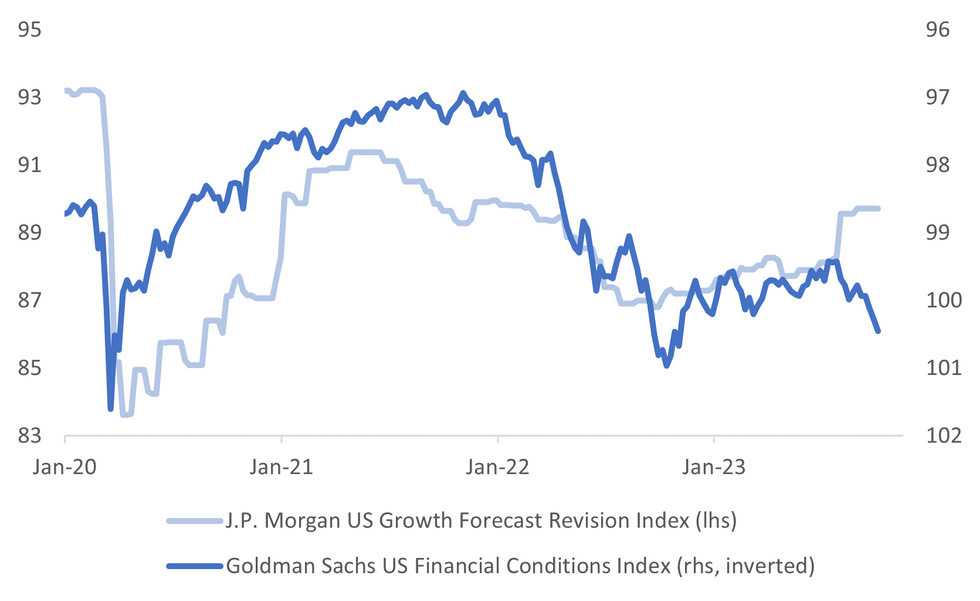

Fig. 1: Goldman Sachs US FCI (Inverted) & JPM US Growth Forecast Revision Index

Source: MNI - Market News/Bloomberg

U.K:

BOE: “Bank of England policymaker Catherine Mann has raised concerns that the current prolonged period of above-target inflation could fuel expectations of future price increases.” (BBG)

FISCAL: “Mark Carney, the former Bank of England governor, has backed Rachel Reeves to be the next chancellor in a surprise endorsement revealed at the Labour party conference.” (TELEGRAPH).

RETAIL: “UK retailers reported sluggish sales in September as squeezed consumers cut back on big-ticket spending and unseasonably warm weather delayed purchases of winter clothing.” (BBG)

EUROPE:

ECB: “Piero Cipollone, who’s nominated to join the European Central Bank’s Executive Board, cleared a key hurdle in the process by winning the backing of lawmakers in the European Parliament.” (BBG)

ITALY: “Italian Premier Giorgia Meloni’s government needs to tread carefully when it comes to spending to avoid increasing borrowing costs and compromising its already fragile financial situation, a Bank of Italy official said.” (BBG)

EU: “The European Union said late Monday that it’s urgently reviewing the bloc’s assistance to the Palestinians after several member states protested an earlier announcement that aid would be suspended.” (BBG)

U.S.

US/MIDDLE EAST: “The chairman of the US Joint Chiefs of Staff, General Charles Q. Brown Jr., warned Iran to “not get involved” in the Israel-Hamas conflict, the Financial Times reported.” (FT)

POLITICS: “President Joe Biden was interviewed over two days as part of the special counsel investigation into classified material found at a former private office and one of his homes in Delaware, the White House said Monday.” (BBG)

POLITICS: “Representative Kevin McCarthy said he’s willing to return as US House speaker, calling out extreme members of both parties for focusing on petty politics while Israel is under attack.” (BBG)

POLITICS: “Robert F. Kennedy Jr., the scion of one of America’s most prominent Democratic families, is dropping out of the race for the 2024 Democratic presidential nomination and instead running as a third-party candidate.” (BBG)

LABOR: “Union workers at Volvo Group-owned Mack Trucks went on strike on Monday after overwhelmingly rejecting a proposed five-year contract, the United Auto Workers said, the latest tentative labor agreement in the U.S. to be voted down.” (RTRS)

OTHER

SOUTH KOREA: “A government official in Seoul said the decision settled a trade issue that threatened to impede the China operations of Samsung and SK Hynix.” (NYT)

HONG KONG: ‘Hong Kong is close to announce details of a new Capital Investment Entrant Scheme, a talent attraction plan announced in Budget in February, Hong Kong Economic Times reports in a column, citing unidentified people.” (BBG)

AUSTRALIA: “Australian business conditions showed ongoing resilience to elevated price pressures while consumer confidence remained in “deeply pessimistic” territory, highlighting the contrasting responses of firms and households to tighter monetary policy.” (BBG)

CHINA

LOANS: New yuan loans are expected to continue to pick up in September as pro-growth policies kick in, while coupled with the increase in government bond issuance, total social financing is also likely to achieve y/y growth. New loans are estimated to rise further to CNY2.6 trillion, as bill interest rates surged higher during the month, said Sun Binbin, analyst at Tianfeng Securities. (China Securities Journal)

DEBT: Six provincial governments including Inner Mongolia, Tianjin, Liaoning, Chongqing, Yunnan, and Guangxi have released plans to issue a total of CNY320 billion refinancing bonds to swap out implicit debts. The authorities have approved the debt swapping plan to mitigate local-debt risks and assigned quota to different provinces, which will exceed CNY1 trillion in total and tilt towards 12 debt-strapped provinces. (21st Century Business Herald)

CAPITAL FLOWS: “China warned mainland bank depositors flocking to Hong Kong for higher returns on products pegged to the dollar of currency risks as Fed hikes may be coming to an end, the China Securities Journal reported.” (CSJ)

PROPERTY: “Chinese developer Country Garden Holdings Co. ramped up warnings that it’s set for its first-ever default and hired advisers, the strongest indications yet the company is headed for a restructuring that would be one of the nation’s biggest.” (BBG)

CHINA MARKETS

MNI: PBOC Drains Net 311 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY67 billion via 7-day reverse repo on Tuesday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY311 billion after offsetting the maturity of CNY378 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:27am local time from the close of 1.8074% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 49 on Monday, compared with the close of 28 on the last trading day before golden week holiday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1781 Tuesday Vs 7.1789 Monday..

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1781 on Tuesday, compared with 7.1789 set on Monday. The fixing was estimated at 7.2776 by Bloomberg survey today.

MARKET DATA

UK SEPTEMBER BRC SALES LIKE-FOR-LIKE Y/Y 2.8%; PRIOR 4.3%

AUSTRALIA OCTOBER WESTPAC CONSUMER CONFIDENCE M/M 2.9%; PRIOR -1.5%

AUSTRALIA OCTOBER WESTPAC CONSUMER CONFIDENCE INDEX 82.0; PRIOR 79.7

AUSTRALIA SEPTEMBER NAB BUSINESS CONFIDENCE 1; PRIOR 1

AUSTRALIA SEPTEMBER NAB BUSINESS CONDITIONS 11; PRIOR 14

JAPAN AUGUST BOP CURRENT ACCOUNT BALANCE ¥2279.7BN; MEDIAN ¥2972BN; PRIOR ¥2771.7BN

JAPAN AUGUST BOP CURRENT ACCOUNT ADJUSTED ¥1634.9BN; MEDIAN ¥2407.6BN; PRIOR ¥2766.9BN

JAPAN AUGUST TRADE BALANCE BOP BASIS -¥749.5BN; MEDIAN -¥708.4BN; PRIOR ¥68.2BN

JAPAN SEPTEMBER ECO WATCHERS SURVEY CURRENT SA 49.9; MEDIAN 53.2; PRIOR 53.6

JAPAN SEPTEMBER ECO WATCHERS SURVEY OUTLOOK SA 49.5; MEDIAN 51.3; PRIOR 51.4

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 107-25, -0-02, a 0-08 range has been observed on volume of 155k.

- Cash tsys sit 12-16bps cheaper across the major benchmarks, the belly and the long end are leading the bid.

- TY firmed in early dealing, however Monday's highs remained intact and Tsys ticked away from session highs.

- The move lower didn't follow through and tsys held in narrow ranges for the remainder of the Asian session.

- Flow wise a block buyer in TY (5k lots) was the highlight.

- There is a thin docket in Europe on Tuesday, further out we have Wholesale Inventories and NY Fed 1-Yr Inflation Expectations.

- There are a slew of Fed speakers due including Gov Waller and Minneapolis Fed President Kashkari. The latest 3-Year Supply is due.

JGBS: Futures Richer & At Tokyo Session Highs, Twist Flattening Of JGB Curve

JGB futures are richer and near the Tokyo session high of 145.27, +50 compared to settlement levels, after yesterday’s holiday. The push to a fresh session high in the Tokyo afternoon session is consistent with the results of this morning's BoJ Rinban operations, which saw negative spreads and generally lower offer cover ratios across the various JGB buckets.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined August current account and trade balance data. Later today sees the release of the September Eco Watchers Survey.

- Accordingly, local participants are also likely to have eyed the re-opening of cash US Tsys after yesterday’s holiday. Cash US Tsys sit 12-17bps richer across the major benchmarks, with the curve flatter.

- The cash JGB curve has twist-flattened. The benchmark 10-year yield is 3.8bps lower at 0.767% versus the cycle high of 0.814%, set late last week.

- The swaps curve has bull-flattened, with rates 0.9bp to 5.6bps lower. Swap spreads are tighter across all maturities.

- Tomorrow, the local calendar is relatively light, with Machine Tool Orders as the only release. That said, the MOF plans to sell Y2.5tn of 5-year JGBs.

AUSSIE BONDS: Richer With Haven Flows But At Sydney Session Cheaps

ACGBs (YM +3.0 & XM +7.5) are richer but at or near Sydney session lows after dealing in a relatively narrow range.

- There hasn’t been much on the newsflow front other than the previously outlined consumer and business confidence data.

- Hence, it seems that the course of the local market has been influenced by US Tsys, which, in a chain reaction, have been affected by safe-haven flows amid the escalating conflict in the Middle East.

- US Tsy futures are holding slightly weaker in Asia-Pac dealings, but there has been little follow-through on the initial move lower. Cash US Tsys sit 12-17bps richer across the major benchmarks after yesterday's Columbus Day holiday.

- Cash ACGBs are 3-7bps richer, with the 3/10 curve flatter. The AU-US 10-year yield differential is at -19bps.

- Swap rates are 2-6bps lower, with EFPs 1-2bps wider.

- The bills strip has bull-flattened, with pricing flat to +3.

- RBA-dated OIS pricing is 1-4bps softer for ’24 meetings, with Nov’24 leading. Terminal rate expectations have softened by 2bps to 4.19%.

- Tomorrow, the local calendar sees CBA Household Spending data, along with a Bloomberg address from RBA Assistant Governor (Financial Markets) Christopher Kent.

- Tomorrow, the AOFM plans to sell A$800mn of the 2.75% 21 November 2027 bond.

NZGBS: Held Haven Bid Into The Close

NZGBs have held the Middle East conflict-induced haven bid for global bonds into the close, with benchmark yields 6-7bps lower, after dealing in a narrow range for the local session. With the local calendar empty today, local participants have been on headlines and US Tsys watch.

- US Tsys are holding close to session lows, however, there has been little follow-through on the initial move lower as of yet. There has been little in the way of meaningful macro news flow. Cash US Tsys sit 13-15bps richer across the major benchmarks after yesterday's Columbus Day holiday.

- Swap rates are 6-9bps lower, with the 2s10s curve slightly steeper.

- RBNZ dated OIS pricing is 1-5bps softer across meetings, with Jul'24 leading. Terminal OCR expectations soften to 3.70% from 3.73%.

- Bloomberg reports that NZ will change its dairy export quota allocations to be based on each company’s share of volume, says Agriculture Minister Damien O’Connor. (See link)

- Tomorrow, the local calendar sees Net Migration data, ahead of Food Prices on Thursday and Business NZ Mfg PMI and Card Spending on Friday.

FOREX: Narrow Ranges In Asia

The greenback has observed narrow ranges in Asia today, BBDXY briefly breached Monday's lows however losses were erased and the USD is flat. US Tsy Yields reopened lower, the 10 Year Yield is down ~17bps. Regional equities and US Equity futures are higher, WTI has trimmed yesterday's gains falling ~0.5%.

- Yen is unchanged, USD/JPY is see-sawing around the ¥148.50 handle in narrow ranges. Technically the pair is still in an uptrend, key support is at ¥147.43 the low from Oct 3 and resistance is at ¥150.16 high from Oct 3 and bull trigger.

- AUD/USD is up ~0.1% and last prints at $0.6415/20. Westpac consumer confidence rose 2.9% to 82 in October, the highest since April when the RBA paused its tightening cycle for the first time. Technically the trend remains bearish, support comes in at $0.6287 2.00 projection of the Jun 16-Jun 29-Jul 13 price swing. Resistance is at $0.6501, high from Sep 29.

- Kiwi is little changed from opening levels, NZD/USD briefly breached Monday's high before paring gains. The pair last printed at $0.6020/25.

- Elsewhere in G-10 CHF is the strongest performer in the space however liquidity is generally poor in Asia.

- The data docket is thin today, there are a number of Fed speakers including Gov Waller and Minneapolis Fed President Kashkari.

EQUITIES: Lower US Yields Boost Equity Sentiment

Most regional equity markets are tracking higher, with China the main exception. Japan equities are the standout, while Hong Kong markets are also firmer. US futures have ticked higher, albeit with overall moves fairly modest. Eminis sit near 4372, just under +0.1% higher, while Nasdaq futures are up by around 0.15% at this stage.

- US yields have fallen sharply as cash Tsy markets re-opened. Slightly dovish Fed rhetoric from Monday's session has weighed on yields, likely aiding equity sentiment, although the USD is relatively steady.

- Japan's move higher has been led by the electric appliances sector. The Nikkei 225 is up 2.30%, while the Topix is +2.0%.

- At the break, the HSI is up nearly 1.3% in Hong Kong. The tech sub index has firmed, while the HS China Enterprise index is +1.3% higher as well. Risk of property developer Country Garden going into default hasn't impacted these broader indices,

- In contrast, China mainland shares are down modestly. The CSI 300 off 0.50% at the break, with the Shanghai Composite off by a similar amount. PetroChina and Sinopec are among the weights on the index.

- The Kospi opened up strongly, amid tech export waivers to China (from the US) for Samsung and SK Hynix, but after being up over 1%, we now sit around 0.30% higher.

- In SEA, all markets are higher, although gains are generally less than 1% at this stage.

OIL: Crude Down Slightly, Geopolitical Tensions Increase Market Uncertainty

Oil prices are slightly lower during APAC trading today but have held onto most of Monday’s gains driven by increased geopolitical risks. WTI is down 0.4% to $86.03/bbl after reaching a peak of $86.53 earlier, while Brent is also 0.4% lower at $87.82 down from a high of $88.21. The USD index is flat.

- The impact of events in Israel on oil flows is currently highly uncertain and may result in a risk premium added to oil prices. Iran denies any involvement in the Hamas attack but its possible connection potentially adds to market risks. If sanctions are increased on the country, Iran could close the Strait of Hormuz which sees 17mbd of crude pass through. It has helped to increase global supply this year as OPEC+ cut output.

- Later Fed’s Perli, Bostic, Waller, Kashkari and Daly speak. There is also US NFIB small business optimism and NY Fed 1-yr inflation expectations. The IMF’s World Economic Outlook is published.

GOLD: Steady After The Largest 1-Day Gain Since May

Gold has steadied in the Asia-Pac session, after closing 1.5% higher on Monday, the largest gain since May, as the conflict in the Middle East drove haven demand.

- The surge in precious metal prices can also be attributed to an emerging change in the sentiment regarding the Federal Reserve's policy outlook. There is a growing consensus among US policymakers that the recent spike in US Treasury yields, which reversed course on Monday, could potentially serve as an alternative to implementing further hikes in the Fed funds rate. It's worth noting that higher interest rates typically have a negative impact on gold, which doesn't yield interest.

- On Monday, Fed Vice Chair Jefferson said, “I am particularly attentive to upside risks to inflation, such as those associated with the economy and labour market remaining too strong to achieve further disinflation, as well as risks associated with unexpected increases in energy prices.”

- According MNI’s technicals team, the bearish theme in gold remains intact despite recent strength. The recent sell-off resulted in a break of support at $1901.1 and this was followed by a breach of $1884.9, the Aug 21 low. This confirmed a resumption of the downtrend that started in early May. The focus is on $1804.9, the Feb 28 low and a key support. On the upside, firm resistance is at $1878.2, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/10/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 10/10/2023 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 10/10/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 10/10/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 10/10/2023 | 0930/1030 |  | UK | BOE PFC minutes | |

| 10/10/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/10/2023 | - | *** |  | CN | Money Supply |

| 10/10/2023 | - | *** |  | CN | New Loans |

| 10/10/2023 | - | *** |  | CN | Social Financing |

| 10/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/10/2023 | 1300/0900 |  | US | New York Fed's Roberto Perli | |

| 10/10/2023 | 1330/0930 |  | US | Atlanta Fed's Raphael Bostic | |

| 10/10/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 10/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/10/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 10/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 10/10/2023 | 1700/1300 |  | US | Fed Governor Christopher Waller | |

| 10/10/2023 | 1730/1330 |  | US | Fed Governor Christopher Waller | |

| 10/10/2023 | 1900/1500 |  | US | Minneapolis Fed's Neel Kashkari | |

| 10/10/2023 | 2200/1800 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.