-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Minutes & Murky Australian Labour Market Report Dominate In Asia

EXECUTIVE SUMMARY

- FOMC MINUTES: FED ON COURSE TO TAPER BEFORE YEAR-END (MNI)

- FED'S BULLARD LOOKING FOR RUNOFF SOON AFTER TAPER (MNI)

- AUSTRALIAN LABOUR MARKET REPORT MASKED BY SAMPLE PERIOD

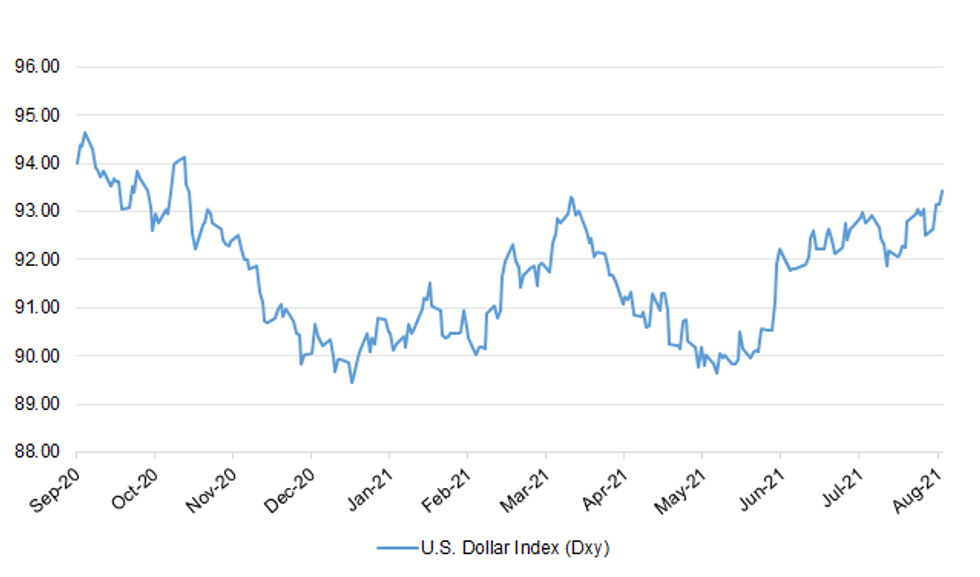

- DXY HITS HIGHEST LEVEL SINCE NOV '20

Fig. 1: U.S. Dollar Index (Dxy)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Schools should consider moving classes and assemblies outside this autumn if just five pupils test positive for Covid-19, according to new government guidance designed to curb fresh outbreaks. In a move dismissed as a "total fudge" by critics, the Department for Education issued the recommendation, which also includes exercise, as one of several steps that heads could take if a cluster of staff and students contract the virus. (Telegraph)

ECONOMY: MNI DATA BRIEF: UK May-July Pay Awards Steady At 2% - XpertHR

- The UK median basic pay award steadied at 2% in the three months to July, unchanged from the second quarter. However, 52% of award were higher than in the same period a year earlier while just 25% were lower and 21% unchanged. In the same period of 2020, 61% of awards were lower. In the 12 months to July, the median award across industry hit 1.5%., matching the outturn for the private sector over the same period. Public sector pay awards hit 2.0%, down from 2.5% "for the past couple of years," according to Xpert - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

U.S.

FED: MNI BRIEF: Fed On Course to Taper Before Year-End: Minutes

- The Federal Reserve is on course to begin winding down its USD120 billion monthly asset purchase program before the year is out despite some officials' concerns the labor market recovery has lagged, according to an account of the FOMC's July meeting published Wednesday. "Most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year because they saw the Committee's "substantial further progress" criterion as satisfied with respect to the price-stability goal and as close to being satisfied with respect to the maximum-employment goal," the minutes said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Bullard Looking for Runoff Soon After Taper

- St. Louis Fed President James Bullard expects the U.S. central bank to run off some balance sheet assets soon after it completes tapering early next year, while dismissing the chance for outright selling. "You would want to let the market pricing sort of come back in and one way to do that would be to allow the runoff in the balance sheet," said Bullard, citing concerns about an "incipient" housing bubble. "Usually markets don't react that much to that and I'd expect that this time around" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: San Francisco Fed President Daly tweeted the following on Wednesday: "Overreacting to what is likely a temporary inflation surge isn't free. It can short-circuit our recovery, ultimately undermining both full employment and price stability. Prudent risk management requires balancing ALL the costs, present and future." (MNI)

CORONAVIRUS: Top U.S. health officials are dismissing criticism from the World Health Organization over the plan to offer COVID-19 booster shots to vaccinated Americans while some parts of the world are still struggling to get access to coronavirus vaccines. The Biden administration on Wednesday formally introduced recommendations that Americans over the age of 18 who received the Moderna and Pfizer vaccines should get a third booster shot eight months after receiving their second dose. Booster shots will be available on Sept. 20, pending approval from the Food and Drug Administration. (Yahoo News)

CORONAVIRUS: Intensive-care wards across Texas are rapidly filling and some regions have no space available for the sickest virus patients, state health department figures showed. Almost two-thirds of Texas's 22 trauma-service areas reported open ICU beds in the single digits or at zero, according to the data. In the service regions that include the state's two largest metro areas -- Houston and San Antonio -- hospitals have just 111 ICU beds to cover a combined population of about 10 million. Meanwhile, new cases soared by more than 20,000 for a second straight day, the first time that's happened since the depths of the previous wave in mid January, state figures showed. (BBG)

CORONAVIRUS: President Joe Biden said authorities should ensure kids are wearing masks in schools and criticized governors who are trying to block mask mandates in school, threatening them with legal action. (BBG)

EXCHANGE NEWS: Shares of Cboe Global Markets Inc. rose 1.5% in afternoon trading, but pulled back sharply, after CME Group Inc. CME, denied that it had any discussions regarding a buyout of the rival exchange. Just prior to the denial, was up about 8.4%. CME shares was recently down 2.7%, paring a pre-denial decline of about 4.1%. "The company has not had any discussions with Cboe whatsoever," CME said in a statement. "While the company does not typically comment on rumor or speculation, today's inaccurate information required correction." CME was referring to a report in the Financial Times that said CME was making an all-stock bid valued at $16 billion to buy Cboe, which sent Cboe shares surging and knocked CME shares lower. Cboe had said it didn't comment on "rumors or speculation." (MarketWatch)

OTHER

GLOBAL TRADE: Rare-earth metals were added on Wednesday to Japan's list of industries subject to tougher restrictions on foreign investment, as Tokyo attempts to shield a potential weak point in its supply chains. (Nikkei)

U.S./CHINA: The U.S. Transportation Department on Wednesday said it will limit some Chinese air carrier flights to 40% passenger capacity for four weeks after the Chinese government imposed similar limits on four United Airlines flights. (RTRS)

U.S./CHINA/TAIWAN: As long as China grows in strength and prepares fully for military struggles and has a firm will to unify, there is no doubt the U.S. is doomed to eventually abandon Taiwan, the Global Times said in an editorial after National Security Advisor Jake Sullivan reaffirmed U.S. commitment to protecting Taiwan after its Afghanistan pullout rattled Taiwan. There is no official document in the U.S. requiring it to use troops to defend Taiwan, the nationalist newspaper said. China is a nuclear power with full preparedness for an offshore military struggle, which makes the U.S. unsure of a victory in a cross-Straits war, and the US military and academic communities are pessimistic about the result of a cross-Straits war, the newspaper said. (MNI)

CORONAVIRUS: J&J will share new data shortly on boosting with its Covid-19 vaccine. Says data it shared in July showed that the durability of the immune response was strong, with no waning for at least eight months, the length of time that had been evaluated to date. (BBG)

CORONAVIRUS: Two doses of the Pfizer/BioNTech vaccine appears to have greater effectiveness initially against new Covid-19 infections associated with the Delta variant when compared to the Oxford/AstraZeneca jab, but its efficacy also declines faster, preliminary research suggests. Scientists from the University of Oxford have said that after four to five months, the level of protection offered by both vaccines is similar, with the AstraZeneca jab maintaining its effectiveness throughout the duration. The findings, which have not yet been peer reviewed, also suggest that those infected with the Delta variant after their second jab had similar peak levels of virus to unvaccinated people. (Press Association)

BOJ: MNI INSIGHT: BOJ Vigilant Despite July Real Export Index Rise

- Bank of Japan officials remain vigilant on the outlook for automobile exports and production due to parts shortages in Southeast Asia but await data later this month after gains in real exports in July, MNI understands

AUSTRALIA: Australia suffered its worst day since the start of the Covid-19 pandemic as an outbreak of delta variant cases spreads. New South Wales recorded 681 new cases, Premier Gladys Berejiklian told reporters on Thursday in Sydney, where stay-at- home orders have been enforced for almost two months. Meanwhile, Victoria state recorded 57 new infections -- more than double from the previous day, and its highest tally since September -- as Melbourne endures its sixth lockdown since the pandemic began. Regional New South Wales will remain in lockdown until at least Aug. 28, in line with Sydney, Berejiklian said. (BBG)

AUSTRALIA: The lockdown for the Greater Darwin area has been lifted, but the Katherine lockdown has been extended for 24 hours, the Chief Minister has announced. Michael Gunner said the Katherine lockdown was "on track" to end at 12:00pm on Friday. (ABC)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern said officials are confident they have discovered how the delta strain of the virus entered the country. Current positive cases are a close match to a recent returnee from Sydney who arrived on Aug. 7, Ardern told a press briefing Thursday in Wellington. This was a "significant development," she said. Ardern put the country into a three-day lockdown this week after just one positive case was found in the community. Auckland and the nearby Coromandel region that the positive case visited were placed into lockdown for seven days. Case numbers have now grown to 21, will 11 new infections reported Thursday. (BBG)

RBNZ: New Zealand central bank governor Adrian Orr has rebuffed accusations that he over-stimulated the economy and drove house prices to unsustainable levels with ultra-low interest rates during the pandemic. In a fiery exchange with politicians on the Finance and Expenditure select committee Thursday in Wellington, Orr was asked whether the Reserve Bank's underestimation of house-price gains had led it to run a monetary policy that was too loose. (BBG)

NORTH KOREA: North Korea had declared a no-sail zone for ships off the east coast earlier this week, sources said Thursday, indicating that it had plans to launch missiles amid an ongoing combined exercise between South Korea and the United States. The navigational warning was issued for Sunday through Monday for northeastern regions in the East Sea, according to the military sources. Such an advisory is usually issued ahead of missile launches or other weapons tests to warn vessels to stay clear of certain areas expected to be affected. But no actual ballistic missile launches or artillery firings took place during the period, according to officials at Seoul's Joint Chiefs of Staff (JCS). (Yonhap)

CANADA: MNI: Cost of Living Woes May Bring Canada Election Stalemate

- Liberal and Conservative leaders are struggling to respond to top voter concerns about the rising cost of living on Canada's campaign trail, making it harder for either to win a clear mandate in the Sept. 20 election, former prime ministerial adviser Elly Alboim told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: The deputy speaker of Brazil's lower house of Congress, Marcelo Ramos, said an income tax reform that introduces a 20% tax on company dividends is unlikely to pass because most Brazilians oppose it, even businesses. He lamented in an interview on Wednesday that Brazil has abandoned its fiscal austerity policies due to President Jair Bolsonaro's focus on increasing spending to win re-election next year. (RTRS)

BRAZIL: Brazil central bank directors questioned economists about the CPI projections for 2022, which are running higher than official estimates, in a meeting with market participants on Wednesday, according to three people with direct knowledge of the matter. It was noteworthy that director Fabio Kanczuk asked for a more detailed explanation of the reasons for the difference, according to two of the meeting's participants, who asked not to be named because they are not authorized to speak about the topic. (BBG)

BRAZIL: Brazil Treasury Secretary Bruno Funchal said on Wednesday that, with the economy growing, the debt to GDP ratio is projected to stabilize around 81.2%. Speaking to the congressional budget committee, Funchal said 2021 was a tough year, but Brazil's fiscal situation is evolving positively now. The challenge he said, will be to keep public debt stable with higher interest rates. The Treasury is paying more than 10% interest on the issuance of 10-year bonds, which reflects the cost to Brazil risk and is higher than in other emerging country, he said. "Our fiscal situation still requires constant work to continue a consolidation process," he said in a committee hearing. (RTRS)

AFGHANISTAN: President Joe Biden says U.S. troops will stay in Afghanistan until all Americans are evacuated out of the country, even if they must remain past the Aug. 31 deadline previously set. "If there are American citizens left, we're going to stay to get them all out," Biden told ABC's George Stephanopoulos in an interview. (BBG)

AFGHANISTAN: The Pentagon on Wednesday acknowledged that it does not currently have the capability to safely escort Americans in Kabul to the airport for evacuation as the Taliban consolidate control in Afghanistan's capital. "I don't have the capability to go out and extend operations currently into Kabul," Defense Secretary Lloyd Austin said when asked about those who cannot reach the gates of Hamid Karzai International Airport in Kabul because they are behind Taliban checkpoints. "And where do you take that? How far can you extend into Kabul and how long does it take to flow those forces in to be able to do that," Austin said. (CNBC)

AFGHANISTAN: The Taliban is reportedly blocking Afghans from reaching Kabul's international airport to flee the country, breaking their commitments to the U.S., a Biden administration official said Wednesday. That acknowledgement at a press briefing came shortly after the U.S. Embassy in Kabul alerted people there that it "cannot ensure safe passage" to the airport for the capital city, where Islamist militants had overthrown the U.S.-backed Afghan government with astonishing speed. (CNBC)

AFGHANISTAN: Turkey continues talks on assuming a role at Kabul's Hamid Karzai International Airport based on "new circumstances" following Taliban's victory, President Recep Tayyip Erdogan says in live interview on TVNet. "We are pleased with Taliban's moderate statements regarding Turkey." Taliban is "more sensitive" about its relations with Turkey. (BBG)

OIL: A U.S. offshore regulator on Wednesday said efforts to resume a federal oil and gas leasing program are underway and would soon bear results following a court decision ending a suspension. The Biden administration this week challenged the court decision, arguing the program does not adequately consider climate impacts. But it will proceed with new leases as its appeal grinds through the courts. It had halted the program in January to as part of its efforts to combat the effects of climate change. (RTRS)

CHINA

POLICY: China's regional governments are accelerating infrastructure and low-carbon projects and urging better use of special-purpose bonds to ensure economic targets in the second half are met, the Economic Information Daily reported citing regional National Development Reform Commission officials. Investments are crucial as virus outbreaks have slowed consumption while exports are more uncertain due to the global resurgence of the pandemic, the newspaper said citing chief economist Lian Ping of Zhixin Investment Research Institute. China needs more policy support for growth and employment as growth drivers, manufacturing and consumption continue to weaken, the newspaper said. (MNI)

RISKS: Property market and local hidden debts are the two major risks that need to be prevented in China, the Securities Daily reports, citing multiple experts. High inventories and leverage among property developers and the sector's close co-relationship with other industries are posing a risk to the financial system, according to Luo Zhiheng, chief macro analyst at Yuekai Securities. Hidden local government debts could cause systemic risks as the debts are closely connected with local commercial banks. China should also guard against the spillover effect from U.S. fiscal and monetary policy as well as cross-border capital flows, says Liu Xiangdong, an official with the China Center for Economic Exchanges. (BBG)

CORONAVIRUS: China's latest Covid outbreak is almost contained as the daily number of infections continues to come down. The country reported five local confirmed cases and zero asymptomatic infections on Thursday. One case was found in a suburb of Shanghai, escalating the area "middle-risk" status. The world's most populous country managed to deploy an even more intense approach to control the more contagious delta variant as the nation sticks to its Covid-zero strategy. Eastern Yangzhou city, the most hit region in this outbreak, has rolled out as many as 12 rounds of mass testing. (BBG)

CORONAVIRUS: Scientists from Institute of Microbiology under Chinese Academy of Sciences and other institutions are developing a new antibody that may be effective against coronavirus and variant strains. Stopped the virus from replicating and sickening laboratory animals, the study in the journal Nature showed. The antibody effectively prevented and treated infections from coronavirus and its variants, the institute says in a statement in WeChat account. (BBG)

BONDS: The PBOC issued a guideline to promote the high-quality development of corporate bonds on Wednesday, restricting excessive bond issuance by highly leveraged companies, strengthen the management of bond-raised funds and prohibit underwriters from using the third-party to subscribe for the bonds issued by itself, the China Securities Journal reported citing a document on PBOC website. Bond issuance should conform to the country's macroeconomic development and industrial policies, and match the needs of the real economy, the newspaper said. The guideline also urges to accelerate the reform of local government financing vehicles to prevent the spread of hidden debt risks, while local government must not raise debts via corporate bonds or provide guarantees or repaid corporates' maturing debts, the newspaper said. (MNI)

OVERNIGHT DATA

AUSTRALIA JUL EMPLOYMENT +2.2K; MEDIAN -43.1K; JUN 29.1K

AUSTRALIA JUL FULL-TIME EMPLOYMENT -4.2K; +51.6K

AUSTRALIA JUL PART-TIME EMPLOYMENT +6.4K; -22.5K

AUSTRALIA JUL JOBLESS RATE 4.6%; MEDIAN 5.0%; JUN 4.9%

AUSTRALIA JUL PARTICIPATION RATE 66.0%; MEDIAN 66.0%; JUN 66.2%

SOUTH KOREA Q2 SHORT-TERM EXTERNAL DEBT $178.0BN; Q1 $165.7BN

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS THURS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1466% at 09:29 am local time from the close of 2.0109% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 54 on Wednesday vs 42 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4853 THURS VS 6.4915 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4853 on Thursday, compared with the 6.4915 set on Wednesday.

MARKETS

SNAPSHOT: Fed Minutes & Murky Australian Labour Market Report Dominate In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 181.34 points at 27402.43

- ASX 200 down 38.249 points at 7463.9

- Shanghai Comp. down 24.909 points at 3460.377

- JGB 10-Yr future down 3 ticks at 152.3, yield up 0.1bp at 0.021%

- Aussie 10-Yr future up 3.5 ticks at 98.905, yield down 3.9bp at 1.101%

- U.S. 10-Yr future up 0-04 ticks at 134-08+, yield up 0.17bp at 1.26%

- WTI crude down $1.05 at $64.41, Gold down $10.19 at $1777.65

- USD/JPY up 40 pips at Y110.17

- FOMC MINUTES: FED ON COURSE TO TAPER BEFORE YEAR-END (MNI)

- FED'S BULLARD LOOKING FOR RUNOFF SOON AFTER TAPER (MNI)

- AUSTRALIAN LABOUR MARKET REPORT MASKED BY SAMPLE PERIOD

- DXY HITS HIGHEST LEVEL SINCE NOV '20

BOND SUMMARY: Tight Ranges For Core FI In Asia

T-Notes clung to a tight 0-03+ range in Asia-Pac hours, with a lack of notable macro news headlines and market flow evident. The contract prints +0-02+ at 134-07 on volume of ~66K ahead of European hours. The major cash Tsy benchmarks sit unchanged to 1.0bp cheaper across the curve. Looking to Thursday's U.S. docket, weekly jobless claims data, the latest Philly Fed survey and 30-Year TIPS supply will be eyed.

- Aussie bond futures initially drew support from an uptick in the new COVID case count in Victoria, as well as another record high in NSW's daily case count. The latest Australian monthly labour market report was skewed by the sample period (mid-July) which provided a much more optimistic round of releases than the current reality reflects (notably, a fresh lockdown in Victoria has gone into play since then). The fact that the sample period caught Victoria emerging from a lockdown resulted in a surprise uptick in headline employment (+2.2K), which when combined with the fall in participation resulted in a downtick in the unemployment rate. Hours worked were -0.2% in the month, but once again skewed by the sample dynamics, with much of the headwinds in NSW offset by the sampling issues outlined above.

- JGB futures held a narrow range and last trade -4, with the major cash JGB benchmarks little changed across the curve. There wasn't much change in the underlying dynamics witnessed in the most recent off-the-run 15.5- to 39-Year JGB liquidity enhancement auction vs. the prior offering.

EQUITIES: Asia-Pac Markets Drop, US Futures Pick Up From Closing Lows

Stocks in Asia came under heavy selling pressure, taking a negative lead from the US. The MSCI Asia-Pac index hit the lowest since December. The Hang Seng was down 1.70%, weighed by Alibaba which hit record lows during the session, the tech selloff in China's technology giants has continued as the government continues its crackdown. In Mainland China indices were down by around 1%, Tencent's earnings disappointed as the firm warned of regulatory curbs, Markets in Japan were down by around 0.8%, while emerging market indices endured hefty losses with the Kospi and Taiex both down over 1.8%. Risk off sentiment saw the greenback hit the highest levels since November 2020. In the US futures picked up slightly after plunging into the close on Wednesday.

GOLD: Asia Reaction To FOMC Minutes Pressures Bullion

The bullish price action in the USD witnessed during Asia-Pac hours (which resulted in the DXY printing at the firmest levels witnessed since Nov '20) weighed on bullion, with regional participants focusing on the passage in the FOMC's July meeting minutes which pointed to most of the U.S. Fed being of the opinion that a tapering move will come later in '21. Still, spot gold continues to stick to familiar territory, after last week's sell off and subsequent recovery rejigged the downside technical parameters. Spot last deals $8/oz or so softer around $1,780/oz, a little off worst levels of the session.

OIL: Crude Futures On Track To Decline For Sixth Straight Session

Crude futures continued to decline in the Asia-Pac session on Thursday, WTI is down $1.16 from settlement at $64.30/bbl while Brent is down $1.02 4 at $67.19/bbl; these levels for oil denote the lowest since May. Markets continue to assess the weekly DoE crude oil inventories which showed a surprisingly large build in gasoline inventories - with stockpiles rising by 696,000 bbls, against an expected draw of over 2.3mln bbls. This countered both the crude oil and distillates headlines, which both showed larger draws on inventories than forecast. Oil was also pressured by a stronger greenback, the dollar index hit the highest since November 2020.

FOREX: Dollar Index Hits Highest Since Nov 2020

Despite a lack of significant newsflow during the session the greenback managed to rise to the highest levels since 2020 which helped catalyse moves in major pairs. It was hard to identify a fresh cue for the move, though proximity to the FOMC minutes could suggest Asia-Pac participants are looking the Fed's July meeting minutes from a different perspective.

- AUD/USD heads into Europe hovering around the 0.7200 handle, near the lowest since November 2020 with losses of around 30 pips. Data showed that the labour market unexpectedly gained jobs which took the pair off its lows, but the breakdown of the data was weak and the move lower resumed. There was also a pickup in Victoria coronavirus cases which added to negative sentiment.

- NZD/USD is down 39 pips. There were 11 new cases of coronavirus, taking the community total to 21. RBNZ Governor Orr spoke earlier and stressed that the Bank's strong view is to continue to reduce stimulus given the strong position of the NZ economy, Orr also noted that the Bank would have likely lifted the OCR yesterday in the absence of lockdown/COVID cases.

- USD/JPY is up 40 pips. Driven mainly by the move in USD. The Reuters Tankan manufacturing survey rose to 33 from 25 previously.

- Offshore yuan is weaker, USD/CNH is up 133 pips, the PBOC fixed USD/CNY at 6.4953, in line with sell side estimates. As a reminder markets look to the PBOC's LPR announcement tomorrow.

- Oil continued its decline which saw USD/CAD rise 35 pips, while EUR/USD and GBP/USD both fell around 40 pips.

- Upcoming data includes weekly US employment data, the labour market is seen as key for the Fed taper after the FOMC minutes yesterday.

FOREX OPTIONS: Expiries for Aug19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-10(E610mln), $1.1650(E656mln), $1.1670-90(E2.9bln), $1.1700(E2.3bln), $1.1750(E2.0bln), $1.1780-00(E4.0bln), $1.1850(E1.3bln)

- USD/JPY: Y108.15($500mln), Y108.50-70($612mln), Y109.00-20($1.3bln), Y109.35-50($752mln), Y109.65-80($1.4bln), Y110.00($512mln), Y110.50-60($1.6bln), Y111.50($606mln)

- GBP/USD: $1.3800(Gbp720mln)

- EUR/GBP: Gbp0.8500-20(E691mln)

- AUD/USD: $0.7250(A$2.0bln), $0.7320-35(A$1.3bln), $0.7350-60(A$1.4bln)

- NZD/USD: $0.6800(N$1.4bln)

- USD/CAD: C$1.2575-85($1.6bln)

- USD/CNY: Cny6.4720($750mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.