-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Remains Laser Focused On CPI

EXECUTIVE SUMMARY

- FED’S HARKER IS PREPARED TO DO MORE IF NEEDED TO CURB INFLATION (BBG)

- FED'S KASHKARI: RECESSION POSSIBLE, BUT HIGH INFLATION WOULD BE WORSE (RTRS)

- FED’S GOOLSBEE CAUTIOUS ON RATE HIKES, REJECTS PRE-EMPTIVE CUT (MNI)

- BIG BANKS THAT SHORED UP FIRST REPUBLIC PUSHED TO BOOST RESERVES (BBG)

- ECB’S VILLEROY: EURO ZONE INFLATION AT RISK OF GETTING ENTRENCHED (RTRS)

- MELONI UNVEILS ITALY 2023 BUDGET WITH TOUCH OF EXTRA STIMULUS (BBG)

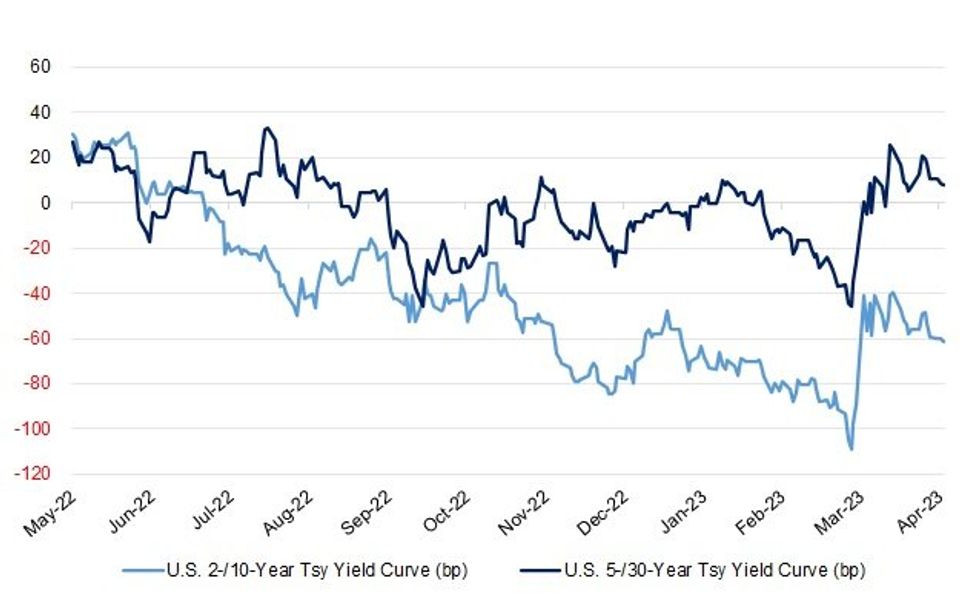

Fig. 1: U.S. 2-/10- & 5-/30-Year Tsy Yield Curves

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The overall supply of candidates for jobs has increased for the first time in more than two years, a survey of recruiters suggests. While the rise in the availability of workers in March was "modest", it marks the first such upturn in the UK since February 2021, a report from the Recruitment and Employment Confederation (REC) and KPMG said. (Sky)

HOUSING: British homes sales recovered to within a whisker of pre-pandemic levels in March, representing a recovery from September when the failed economic plan of former prime minister Liz Truss sparked turmoil across markets, a survey showed on Wednesday. (RTRS)

EUROPE

ECB: Euro zone inflation is at risk of getting entrenched above 2% so the European Central Bank will keep fighting excessive price growth, even as its policy response is shifting gears, French central bank chief Francois Villeroy de Galhau said. (RTRS)

FRANCE: The Bank of France raised its estimate for first-quarter economic expansion as stronger-than-expected activity early in the year more than offset the drag in March from strikes and pension protests. (BBG)

ITALY: Italian premier Giorgia Meloni unveiled a slightly more expansive fiscal outlook for this year, aiming for an extra sliver of economic growth through tax cuts. (BBG)

ITALY: Italy's ruling coalition on Tuesday failed to clinch a deal on key appointments at state-controlled companies, two people familiar with the matter told Reuters, as negotiations continue within the government. (RTRS)

SWITZERLAND/BANKS: The lower house of Switzerland's parliament voted late on Tuesday to retrospectively reject the 109 billion Swiss francs of financial guarantees the government gave to Credit Suisse as part of a hastily cobbled-together rescue package. (RTRS)

U.S.

FED: Federal Reserve Bank of Philadelphia President Patrick Harker said he’s been disappointed that US inflation hasn’t slowed by more and was ready to take further steps to bring it down if necessary. (BBG)

FED: Minneapolis Federal Reserve Bank President Neel Kashkari on Tuesday said the Fed's interest-rate hikes and a possible pullback in lending after two bank failures last month could trigger a recession, but allowing inflation to stay high would be even worse for the labor market. (RTRS)

FED: Chicago Fed President Austan Goolsbee said Tuesday he's inclined to keep raising interest rates cautiously to restrain inflation, and rejected the idea of pre-emptively cutting to appease investors worried about tensions in the banking system. (MNI)

ECONOMY: US Treasury Secretary Janet Yellen said she believes the American economy remains strong and its banking system is resilient despite some recent turmoil among regional financial institutions. (CNN)

BANKS: The biggest US banks are planning to bolster reserves in a move tied to their unusual effort to shore up ailing lender First Republic Bank last month. (BBG)

OTHER

GLOBAL TRADE: No ships were inspected on Tuesday under the Ukraine Black Sea grain deal "as the parties needed more time to reach an agreement on operational priorities," the United Nations said, adding that routine inspections were due to resume on Wednesday. (RTRS)

GLOBAL TRADE: TSMC has told some suppliers and building contractors to delay their works by 6 months to a year as the company is slowing down its expansion plans in Taiwan, Taipei-based DigiTimes reports, citing unidentified people in the supply chain. (BBG)

U.S./CHINA: The House of Representatives is set to vote next week on a bill to crack down on Chinese telecommunications companies Huawei and ZTE Corp that have been deemed security threats by the U.S. government. (RTRS)

EU/CHINA: Chinese and Dutch officials held consultations on international and regional security, arms control and non-proliferation in Beijing on Tuesday, China's foreign ministry said in a statement. (RTRS)

GEOPOLITICS: Russia risks becoming an "economic colony" of China as its isolation from the West deepens following the invasion of Ukraine, U.S. CIA Director William Burns said on Tuesday. (RTRS)

GEOPOLITICS: President Luiz Inacio Lula da Silva’s trip to China will include a tour of Huawei’s innovation center in Shanghai, a stop that may irk the US which alleges the technology company poses a threat to its national security. (BBG)

GEOPOLITICS: China is negotiating a compromise plan with other major creditors that could help break a logjam in multibillion-dollar debt-relief talks for struggling developing nations, people familiar with the talks said. (WSJ)

GEOPOLITICS: World Bank President David Malpass on Tuesday called for urgent moves to finalize a debt restructuring plan for Zambia, and said the size of its debt was so small it could not pose a financial burden to China, now the world's largest sovereign creditor. (RTRS)

CHINA/TAIWAN: Taiwan President Tsai Ing-wen said on Wednesday that her recent overseas trip, which included the United States, showed the world Taiwan's determination to defend freedom and democracy, even as the prompted China to stage war games around the island. (RTRS)

BOJ: The Bank of Japan may revise or even abandon its targeting of long-term interest rates by the end of September if conditions are right, an executive at leading Japanese banking group MUFG tells Nikkei. (Nikkei)

BOJ: The Bank of Japan could help prevent abrupt policy changes later by allowing more flexibility in its bond yield curve control, the International Monetary Fund said in its global financial stability report released on Tuesday. (RTRS)

ASIA/IMF: Asia faces the biggest potential fallout from rising geopolitical tensions, according to a senior regional official at the International Monetary Fund, after China held military drills around Taiwan. (BBG)

BRAZIL: Brazil's Finance Minister Fernando Haddad said on Tuesday that there will be space for interest rate cuts with "increased confidence in the country's fiscal framework and a fiscal consolidation path consistently affecting inflation expectations". (RTRS)

BRAZIL: Americanas and certain financial creditors have agreed to temporarily suspend their ongoing legal disputes in order to allow the parties involved to focus their efforts on negotiating a judicial recovery plan that is acceptable to most of the company’s creditors and that makes the operational future of Americanas possible, company said in a filing. (BBG)

RUSSIA: The Strategic Missile Forces have carried out a test-launch of the intercontinental ballistic missile from the Kapustin Yar training ground in Russia’s Astrakhan Region, the Defense Ministry reported on Wednesday. (TASS)

RUSSIA: More than a year since the start of the Ukraine war, hundreds of millions of dollars' worth of U.S.-made semiconductors are flowing into Russia despite Washington's sanctions on the country, a Nikkei investigation has found. (Nikkei)

RUSSIA: U.S. Secretary of State Antony Blinken said on Tuesday Russia's detention of Evan Gershkovich and denial of consular access to the Wall Street Journal reporter sends a message that people around the world should "beware of even setting foot" in Russia. (RTRS)

RUSSIA: Russia's central bank said on Tuesday that it was maintaining its forecast of structural liquidity surplus at the end of 2023 of 2.8 trillion roubles to 3.4 trillion roubles ($34.17 billion-41.50 billion). (RTRS)

CHILE/METALS: Chile’s government delivered further concessions to its copper royalty bill on Tuesday, while stopping short of meeting industry demands to keep the effective tax rate in line with rival nations. (BBG)

SOUTH AFRICA: South Africa's electricity minister told Reuters that this month the cabinet would choose between his proposals to end rolling power blackouts but that he believed the government should not shy away from spending to address the crisis. (RTRS)

CHILE: Chile’s Congress on Tuesday overwhelmingly approved a bill to reduce the work week from 45 to 40 hours over five years, a decision hailed by the left-wing government as a breakthrough for workers’ rights. (AP)

CHILE/METALS: Chile’s government delivered further concessions to its copper royalty bill on Tuesday, while stopping short of meeting industry demands to keep the effective tax rate in line with rival nations. (BBG)

IMF: The International Monetary Fund reached record high lending of close to $300 billion about 10 days ago, but still has ample space to lend, Managing Director Kristalina Georgieva said on Tuesday. Georgieva said the fund was still seeing strong demand, primarily from mid-sized and smaller countries. (RTRS)

IMF: International Monetary Fund Managing Director Kristalina Georgieva and UN and COP28 climate leaders on Tuesday pledged to work to accelerate public-private finance to help raise the trillions of dollars needed to meet emissions reduction goals, a statement issued by the IMF said. (RTRS)

WORLD BANK: The World Bank is ready to play its role in rebuilding Ukraine after the devastation of Russia's invasion, but the numbers are too large for international financial institutions alone and Western European countries will have to chip in, World Bank President David Malpass said on Tuesday. (RTRS)

OIL: Non-OPEC countries will account for a higher percentage of oil production gains this year and next, a reversal of the last two years, the U.S. Energy Information Administration predicted on Tuesday. (RTRS)

CHINA

PBOC: Authorities will likely not cut China's LPR due to satisfactory Q1 GDP and credit growth, and subdued CPI, according to Yicai. Experts said the central bank has room to support the economy if needed, but will be more inclined to cut the reserve rate requirement (RRR) or increase its targeted lending, rather than launching a policy cut when rates are at historic lows due to concerns about financial risk. (MNI)

INFLATION: Low food prices were responsible for the weaker than expected CPI rate in March, according to the Securities Daily. (MNI)

CREDIT: China’s strong credit growth may last into 2Q, leading to ample liquidity for the full year, Shanghai Securities News reported, citing analysts it didn’t name. (MNI)

PROPERTY: Multiple children families in the Fangshan district of Beijing could have property purchase restrictions relaxed, as the local government looks to implement a “one district, one policy” approach, according to proposals submitted by the Beijing Municipal Commission of Housing and Urban-Rural Development. (MNI)

EQUITIES: Technology platform companies are entering a new stage of development and facing new opportunities following the end of a regulatory crackdown on monopolistic behaviors and other malpractices, Economic Daily says in a front-page commentary Wednesday. (BBG)

EQUITIES: The Chinese government should step up continuous and joint efforts to tighten supervision of algorithms used by tech companies, according to a commentary in the Communist Party mouthpiece People’s Daily. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY7 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY7 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY7 billion as no reverse repos manuring today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 09:22 am local time from the close of 1.9845% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday, compared with the close of 47 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8854 WEDS VS 6.8882 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8854 on Wednesday, compared with 6.8882 set on Tuesday.

OVERNIGHT DATA

JAPAN MAR PPI +7.2% Y/Y; MEDIAN +7.1%; FEB +8.3%

JAPAN MAR PPI 0.0% M/M; MEDIAN 0.0%; FEB -0.3%

JAPAN MAR BANK LENDING INCL. TRUSTS +3.0% Y/Y; FEB +3.3%

JAPAN MAR BANK LENDING EXCL. TRUSTS +3.3% Y/Y; FEB +3.6%

JAPAN FEB CORE MACHINE ORDERS -4.5% M/M; MEDIAN -6.3%; JAN +9.5%

JAPAN FEB CORE MACHINE ORDERS +9.8% M /M; MEDIAN +4.6%; JAN +4.5%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 79.3; PREV. 78.2

Consumer confidence rose 1.1pts after the RBA kept the cash rate on hold at its April meeting. Unsurprisingly, this was the most positive result following an RBA meeting since before rate hikes began in May last year, with the gain led by those paying off their mortgage (+3.9pts). This was also the first time confidence had increased for three consecutive weeks since November 2022, with a cumulative rise of 2.8pts since mid-March. But overall confidence is still very weak, stuck below 80pts for a sixth consecutive week. Household inflation expectations dropped 0.6ppt to 5.1%, the lowest since mid-February, with a range of data confirming Australia has passed peak annual inflation. (ANZ)

NEW ZEALAND MAR RETAIL CARD SPENDING +0.7% M/M; FEB -0.1%

NEW ZEALAND MAR TOTAL CARD SPENDING +3.1% M/M; FEB -1.8%

SOUTH KOREA MAR UNEMPLOYMENT RATE 2.7%; MEDIAN 2.8%; FEB 2.6%

MARKETS

US TSYS: Marginally Cheaper In Asia, CPI In View

TYM3 deals at 115-13+, +0-01+, a narrow 0-03 range has been observed in Asia on volume of ~41k.

- Cash tsys sit flat to 1bp cheaper across the major benchmarks.

- Tsys have dealt in narrow ranges with little follow through on moves in the Asian session as Asia-Pac participants remain focused on today's CPI print.

- Some light cheapening was observed as the USD came off session lows, which held through the latter half of the session.

- Fedspeak from Philadelphia Fed President Harker crossed early in the session, he noted that he is watching data to see if more action is needed on inflation.

- Minneapolis Fed President Kashkari also crossed in Asia, he noted that he does not see the build up of the kind of risks that took down SVB building up across the wider banking sector. He also noted that he sees inflation at middle 3% by the end of this year and closer to 2% next year.

- Today's CPI print, our preview is here, is the highlight of today's session. We also have the minutes from the March FOMC meeting, matters north of the border will be in focus as the Bank of Canada delivers their latest monetary policy decision.

- Fedspeak from Richmond Fed President Barkin and SF Fed President Daly will cross. We also have the latest 10-Year Supply.

JGBS: Weakness In Futures Results In Humped Yield Move

JGB futures show just below late morning levels as we head towards the bell, last -20, after recovering from their early Tokyo base and then meandering through the session (initial cheapening was largely driven by spill over from weakness in wider core global FI on Tuesday).

- The wider cash JGB pattern observed in morning trade continues to hold (light cheapening in 7s & 10s owing to futures vs. some richening elsewhere, with super-long paper outperforming).

- Swap rates are flat to ~1.5bp higher, with the 7- to 10-Year zone seeing the biggest move, while super-long swap rates pulled back from early highs on the aforementioned richening in the corresponding JGBs. Swap spreads are wider across the curve and have been all day.

- A Nikkei interview with an MUFG executive revealed a downtick in the average duration of the firm’s JGB holdings, while he suggested that he would only have any real willingness to add to longs in the 10-Year zone of the curve when 10s reached 0.8% or above in yield terms.

- Money stock & weekly international security flow data headline the domestic data docket tomorrow, with the latest liquidity enhancement auction covering off-the-rum 15.5- to 39-Year JGBs also due.

AUSSIE BONDS: At Session Cheaps, Narrow Range for US Tsys

ACGBs sit at session cheaps (YM -4.0 & XM -4.0) with US Tsys little changed in a narrow range ahead of US CPI data and FOMC Minutes later today. There has been little meaningful macro news flow in today’s Asian session.

- With the local calendar light today, the highlight is likely to be RBA Deputy Governor Bullock's appearance on the WEAI Monetary Panel, which has just commenced. So far across the wires, Bullock has stated that the RBA doesn’t use rates to dial up or down financial stability and that the RBA had underestimated fiscal-monetary power during the pandemic. There hadn't been any market reaction to her comments at the time of writing.

- Cash ACGBs are 3-4bp cheaper with the curve 1bp flatter and the AU-US 10-year yield differential +1bp at -17bp.

- Swap rates are 6bp higher with EFPs 2bp wider.

- Bills strip pricing is -6 to -10 with early whites the weakest.

- RBA dated OIS pricing firms 4-8bp for meetings beyond June. A 25% chance of a 25bp hike in May is priced with year-end easing expectations at 17bp versus 29bp ahead of the Easter holiday.

- The market’s focus now shifts to the release of US CPI and FOMC Minutes later today.

AUSSIE BONDS: ACGB Apr-29 Auction Results

The Australian Office of Financial Management (AOFM) sells A$800mn of the 3.25% 21 April 2029 bond, issue #TB138:

- Average Yield: 3.0282 % (prev. 3.1922%)

- High Yield: 3.0325% (prev. 3.1975%)

- Bid/Cover: 2.3700x (prev. 3.7800x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 19.1% (prev. 95.0%)

- Bidders 40 (prev. 42), successful 20 (prev. 10), allocated in full 14 (prev. 6)

NZGBS: Twist Steepen Ahead of NZGB Supply Tomorrow

NZGB cash curve twist steepens, with the 2-year benchmark 1bp richer and the 10-year benchmark 4bp cheaper at the close. This movement was linked to the weekly supply announcement from the NZ Treasury. Implied long-end swap spread narrowed with swap rates 1-2bp lower at the close.

- The NZ Treasury plans to sell NZ$200mn of the May-28 bond, NZ$150mn of the Apr-33 bond and NZ$50mn of the May-51 bond tomorrow.

- The NZGB auctions on April 6th also resulted in a steepening of the curve, with stronger demand seen for short-end supply, likely due to concerns of over-tightening by the RBNZ.

- Today's price action may also have been influenced by RBNZ's recent decision statement, which expressed concerns about the inflation risks associated with fiscal spending financed through borrowing, as opposed to re-prioritisation or spending deferrals.

- RBNZ dated OIS pricing is flat to 4bp firmer across meetings with 20bp of tightening priced for May.

- With Total Card Spending in March (+3.1% M/M, 16.1% Y/Y) suggesting very little deceleration in retail sales values in Q1, the RBNZ is unlikely to find any comfort in today’s data.

- The market’s focus now shifts to the release of US CPI and FOMC Minutes later today.

GOLD: Bullion Stronger Again Today, Waiting For US CPI & FOMC Minutes

Gold prices are higher again during the APAC session today ahead of US CPI data. Bullion is 0.7% higher to around $2017.65/oz after rising 0.6% on Tuesday on the back of a weaker dollar. The USD index has been range trading on Wednesday.

- Gold has been trending higher since the banking turmoil in the US began. It is currently trading close to its intraday high of $2019.42 and is heading towards resistance at $2032.10, the April 5 high, but is still some way off it. On Tuesday the high was $2009.52.

- The focus later today is on US CPI data for March, as markets look for direction on the Fed. While the headline is expected to ease to 5.1% from 6%, core is forecast to rise 0.1pp to 5.6% (see U.S. CPI Preview: April 2023). In terms of the Fed, the FOMC minutes for March 22 are published and there are also a number of speakers including Kashkari, Barkin and Daly.

OIL: Crude Close To Tuesday’s Highs Ahead of US CPI Data

During APAC trading today crude is holding onto Tuesday’s gains ahead of the release of the US CPI later, but it is in a narrow range. Both Brent and WTI have been moving sideways after rising around 2% and are currently around $85.62/bbl and $81.51 respectively. They are close to intraday highs, which are slightly above Tuesday’s highs.

- Bloomberg tanker tracking data showed that Russian output is finally softening with shipments below 3mbd. Also on the supply-side, pipeline flows from Iraqi Kurdistan remain stalled.

- Futures contract spreads are showing that the oil market is tightening following OPEC’s output cut decision.

- The EIA releases official US inventory data on Wednesday. On Tuesday the API reported a 400k build in crude stocks in the latest week and 500k in gasoline but a 2mn drawdown in distillate, according to Bloomberg from people familiar with the data.

- The focus later today is on US CPI data for March, as markets look for direction on the Fed. While the headline is expected to ease to 5.1% from 6%, core is forecast to rise 0.1pp to 5.6% (see U.S. CPI Preview: April 2023). In terms of the Fed, the FOMC minutes for March 22 are published and there are also a number of speakers including Kashkari, Barkin and Daly. The BoC also meets.

FOREX: USD/JPY Briefly Tops ¥134 In Otherwise Muted Asian Session

USD/JPY briefly dealt above ¥134 in the Asian session, printing the pairs highest level since mid March. Elsewhere in G-10 ranges have been narrow with little follow through on moves.

- Yesterday's uptick in Oil prices and modest pro-USD gyrations in the U.S./Japan 2- & 10-Year yield spreads have also supported the cross. The breach of Monday's high in USD/JPY has opened ¥134.75, 61.8% retracement of the Mar 8-24 bear leg, for bulls. March PPI printed in line with expectations at 0.0% M/M whilst the Y/Y measure was a touch above estimates at 7.2%.

- AUD is the strongest performer in the G10 space at the margins. AUD/USD is up ~0.2% last printing at $0.6665/70. The next target for bulls is $0.6697, the 20-Day EMA.

- Kiwi is a touch firmer however NZD/USD has observed narrow ranges with $0.62 capping rallies and support seen below $0.6180.

- Cross asset wise; BBDXY is little changed as are e-minis. 2 Year US Treasury Yields are ~1bp firmer.

- Today's US CPI print, our preview is here, is the highlight of today's session. We also have the minutes from the March FOMC meeting, as well as the latest monetary policy decision from the Bank of Canada.

FX OPTIONS: Expiries for Apr12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900-10(E2.7bln), $1.0940-50(E640mln)

- USD/JPY: Y132.00($732mln), Y132.15-25($863mln), Y134.10-15($1.1bln)

- GBP/USD: $1.2300(Gbp692mln)

- EUR/GBP: Gbp0.8755-70(E480mln), Gbp0.8795-10(E595mln)

- AUD/USD: $0.6700(A$545mln), $0.6750(A$1.2bln)

- USD/CAD: C$1.3800($582mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 12/04/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 12/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 12/04/2023 | 1230/0830 | *** |  | US | CPI |

| 12/04/2023 | 1230/1430 |  | EU | ECB de Guindos at Asociacion para el Progreso de Direccion Event | |

| 12/04/2023 | 1300/1400 |  | UK | BOE Bailey Remarks at Institute of International Finance | |

| 12/04/2023 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 12/04/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 12/04/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 12/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/04/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 12/04/2023 | 1600/1200 |  | US | San Francisco Fed's Mary Daly | |

| 12/04/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2023 | 1800/1400 | * |  | US | FOMC Statement |

| 12/04/2023 | 1915/2015 |  | UK | BOE Bailey Speaks at IMF Governor Talks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.