-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Whisperer Flags Scope For Higher For Longer Rates, Russia Suspends Ukraine Grain Deal

EXECUTIVE SUMMARY

- CASH-RICH CONSUMERS COULD MEAN HIGHER INTEREST RATES FOR LONGER (WSJ)

- ECB’S LAGARDE SAYS BEATING INFLATION IS MISSION, MANTRA, MANDATE (BBG)

- ECB'S NEXT RATE MOVE LIKELY BETWEEN 50 AND 75 BPS, KNOT SAYS (RTRS)

- RUSSIA SUSPENDS UKRAINE GRAIN EXPORT DEAL; BIDEN SLAMS MOVE (BBG)

- CHINESE OFFICIAL PMIS PRINT IN CONTRACTIONARY TERRITORY

- CHINA CENTRAL BANK REAFFIRMS IT WILL STEP UP SUPPORT FOR REAL ECONOMY (RTRS)

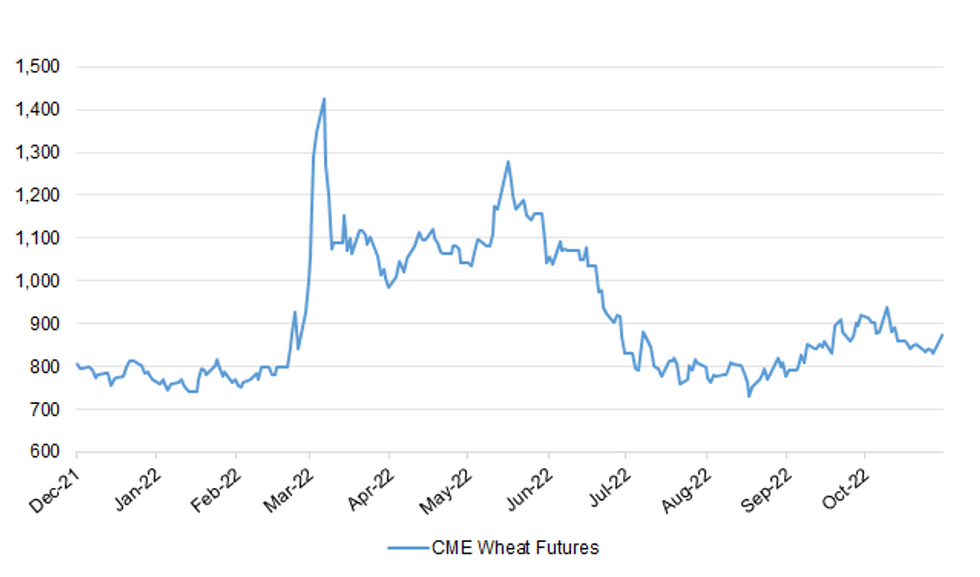

Fig. 1: CME Wheat Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Rishi Sunak is considering freezing Britain’s foreign aid budget for an extra two years in a bid to balance Britain’s books. (Telegraph)

FISCAL: UK prime minister Rishi Sunak is examining a U-turn on another of his predecessor’s energy policies by scrapping a revenue cap on low-carbon electricity generators in favour of a more straightforward windfall tax. (FT)

FISCAL: The windfall tax on energy companies could be raised to 30 per cent and extended by three years, amid internal government predictions that oil and gas prices will not return to normal levels for the rest of the decade. (Sunday Times)

FISCAL: The government last night quashed suggestions that it is considering a windfall tax on banks as one of the measures to plug a hole in its finances at next month’s budget. (Sunday Times)

FISCAL: Capital spending and Liz Truss’s plans for “investment zones” are among the areas facing cuts in the government’s autumn statement, as chancellor Jeremy Hunt seeks public spending reductions and tax rises worth up to £50bn a year. (FT)

FISCAL: Struggling household energy suppliers have been thrown a financial lifeline by a key player in the market, reducing the risk that taxpayer bailouts will be needed in a boost for Rishi Sunak. (Telegraph)

ECONOMY: Corporate insolvencies rose by 40 per cent between July and September compared with a year ago, amid economic strife and the phasing out of pandemic support. (The Times)

ECONOMY/POLITICS: Rishi Sunak and the Conservatives have overturned Labour’s lead in terms of who voters trust most to manage the economy, a new poll for the Observer has revealed. (Observer)

POLITICS: Clamour for a general election is growing among voters, as Rishi Sunak’s allies warned “bitter” Tory MPs opposed to his leadership against any moves which could bring down the government. (Independent)

POLITICS: Michael Gove has defended cabinet colleague Suella Braverman's controversial reappointment, describing her as a "first-rate, front-rank politician". (Sky)

NORTHERN IRELAND: Sinn Féin's Conor Murphy has said his party will meet the Northern Ireland secretary on Tuesday to discuss when a Stormont election will happen. (BBC)

NORTHERN IRELAND: Another Northern Ireland Assembly election will not break the deadlock and restore devolved government, DUP leader Sir Jeffrey Donaldson has said. (Sky)

NORTHERN IRELAND: Political deadlock in Northern Ireland, which has led London to announce it will call fresh elections there, shows the region’s governance system is “not fit for purpose” and should be reformed, according to Ireland’s prime minister. (FT)

PROPERTY: Demand for homes has plunged by a third in the five weeks since Kwasi Kwarteng’s mini-budget, research by Zoopla shows. (The Times)

EUROPE

ECB: European Central Bank President Christine Lagarde renewed her pledge to tame consumer-price growth, saying that “defeating inflation is our mantra, our mission, our mandate. (BBG)

ECB: The European Central Bank (ECB) could hike its interest rates by 75 basis points again at its next policy meeting in December, ECB governing council member Klaas Knot said on Sunday. (RTRS)

FISCAL: Germany’s finance minister has rejected common borrowing by the EU as a way to address the bloc’s energy crisis, saying it was cheaper for individual states to raise debt by themselves given the higher interest rates faced by the European Commission. (FT)

GERMANY: The German government is likely to insist companies that benefit from a planned "brake" on gas prices meet conditions, such as staying in the country or preserving 90% of the jobs they provide for a year, sources familiar with matter told Reuters. (RTRS)

ITALY: Italy’s new Prime Minister Giorgia Meloni is set to break from the policies of her predecessor, Mario Draghi, as soon as Monday, when her government meets to reverse course on the management of the pandemic and on justice. (BBG)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Fitch upgraded Portugal to BBB+; Outlook Stable

- S&P affirmed Sweden at AAA; Outlook Stable

- DBRS Morningstar confirmed Italy at BBB (high), Stable Trend

BANKS: Credit Suisse Group AG has invited at least 20 banks to join the syndicate for a 4 billion francs ($4 billion) rights issue that should help the lender finance another multi-year restructuring program, according to people familiar with the plan. (BBG)

U.S.

FED: Washington’s response to the pandemic left household and business finances in unusually strong shape, with higher savings buffers and lower interest expenses. It could also make the Federal Reserve’s job of taming high inflation more difficult. (WSJ)

FED: Federal Reserve officials are considering when to start slowing the pace of rate hikes from 75 basis points per meeting, but Chair Jerome Powell will be reluctant to lock in such an outcome for December at his press conference next week, former Fed officials and a current outside adviser told MNI. (MNI)

INFLATION: The Trimmed Mean PCE inflation rate over the 12 months ending in September was 4.7 percent. According to the BEA, the overall PCE inflation rate was 6.2 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 5.1 percent on a 12-month basis. (Dallas Fed)

POLITICS: New plling shows Republicans hold an edge over Democrats just over a week before midterm elections that will decide control of the US legislative branch, with voters fixated on high inflation and the risk of recession. (FT)

EQUITIES/ECONOMY: Elon Musk has begun laying the groundwork for a round of layoffs at Twitter Inc. days after taking ownership of the social media platform. (BBG)

OTHER

GLOBAL TRADE: Russia said it’s suspending the deal to allow Ukrainian grain exports from Black Sea ports after drone strikes against its naval vessels, in a move that threatens to exacerbate the global food crisis and send prices soaring again. (BBG)

GLOBAL TRADE: Turkey is holding talks with Russia after Moscow pulled out of the July agreement to allow Ukrainian crop shipments, a pact seen as critical to alleviate the global hunger crisis. (BBG)

GLOBAL TRADE: U.N. Secretary-General Antonio Guterres is "deeply concerned" about the Ukraine Black Sea grain deal and has delayed his travel to Algiers for the Arab League Summit by a day to focus on the issue, a U.N. spokesperson said on Sunday. (RTRS)

GLOBAL TRADE: The US has raised with European allies the idea of drawing upon lessons from the export control regime they’re using to punish Russia to target China, according to people familiar with the matter. (BBG)

GLOBAL TRADE: The threat of a trade war between the EU and the US over the Biden administration’s $370bn climate legislation has stepped up, as France estimated it would lose €8bn as businesses were given incentives to shift to the US. (FT)

U.S./CHINA: U.S. Secretary of State Antony Blinken spoke with China's Foreign Minister Wang Yi on a call on Sunday and discussed Russia's war against Ukraine and the threats it poses to global security and economic stability, the U.S. Department of State said in a statement. (RTRS)

GEOPOLITICS: The China-Russia Comprehensive Strategic Partnership of Coordination in the New Era has maintained a momentum of high-level development, Chinese President Xi Jinping said in a congratulatory message to the 65th anniversary of founding of China-Russia Friendship Association on Saturday, state broadcaster CCTV reports. (BBG)

RBNZ: New Zealand Finance Minister Grant Robertson has sought advice on whether the central bank should be asked to achieve its inflation and employment targets within a more specific time-frame, according to a Treasury Department document. (BBG)

RBNZ: New Zealand’s banks would be well-placed to withstand an extreme scenario where house prices fell by 47 per cent and unemployment rose to 9.3 per cent, although it would reduce the level of capital they held as a buffer. (NZ Herald)

BOC: Bank of Canada Governor Tiff Macklem was quoted in a published report on Sunday saying that he feels no threat to the institution's independence, even as it comes under intense scrutiny from politicians, economists and even the general public. (RTRS)

BOC: The Bank of Canada must be cautious about further rate hikes that could torpedo the economy after already misreading the early pandemic rebound, a Senate Banking Committee member who will question Governor Tiff Macklem at a hearing Tuesday told MNI. (MNI)

CANADA: Prime Minister Justin Trudeau’s government raised the bar that foreigners must clear to join Canada’s critical minerals industry, saying any attempt by a state-owned enterprise to purchase assets in the sector can now trigger Part IV.1 of the Investment Canada Act (ICA), which could require an extended review of any deal on grounds that it could be “injurious to national security.” (Financial Post)

CANADA: Canada’s government is targeting individual investors with a new triple-A rated bond to help Ukraine and is asking bond dealers to make significant efforts to market it to them, according to a memo from the finance department. (BBG)

BRAZIL: Brazil's Supreme Electoral Court (TSE) on Sunday said the country's presidential election was "mathematically defined" with former President Luiz Inacio Lula da Silva taking more votes than incumbent Jair Bolsonaro. (RTRS)

RUSSIA: Russia, in its military planning, will take into account the modernisation of U.S. nuclear bombs deployed in Europe, RIA news agency cited Russian Deputy Foreign Minister Alexander Grushko. (RTRS)

RUSSIA: Russian accusations that Britain participated in attacks against the Nord Stream gas pipeline and Russian navy ships in Crimea are without foundation, France's foreign ministry said on Sunday. (RTRS)

RUSSIA: The government is facing calls for an investigation into newspaper allegations that a personal phone used by Liz Truss while she was foreign secretary was hacked by foreign agents suspected of working for Russia. (FT)

SOUTH AFRICA: Eskom will implement stage 2 blackouts from 5AM from Monday. (eNCA)

COLOMBIA: Colombia’s central bank ignored complaints from President Gustavo Petro and raised interest rates to the highest level in more than two decades, while also deciding against intervention in the currency market. (BBG)

ARGENTINA: Argentina reached a deal to restructure some $1.97 billion it owes the Paris Club, Argentina's government and the creditor group said on Friday, which will push repayments back as far as 2028 and bring relief of some $248 million to the country. (RTRS)

METALS: As the London Metal Exchange agonizes over what to do about supplies from Russia, some metal buyers in the biggest market for commodities have been voting with their wallets. (BBG)

ENERGY: Iranian Oil Minister Javad Owji will travel to Russia on Monday to discuss a $40 billion agreement with Gazprom to develop oil and gas fields in Iran, the semi-official Tasnim news agency reported. (BBG)

OIL: Russia ramped up seaborne Urals oil exports to Asia to 50% of the total over the Oct. 1-20 period ahead of a December EU embargo on the state's oil and products, according to traders and Refinitiv Eikon data. (RTRS)

OIL: Big Oil’s record profits are a huge hit on Wall Street but increasingly provocative in the corridors of power from Washington to London as politicians lash out against executives for funneling windfall profits to investors. (BBG)

CHINA

PBOC: China's central bank will step up credit support for the real economy while keeping the yuan basically steady, Governor Yi Gang said in comments published on Sunday, reaffirming the bank's existing policy objectives. (RTRS)

PBOC: The People’s Bank of China should focus on reviving the economy to support the yuan rather than simply intervening or using its counter-cyclical factor unless speculative factors are driving the market, the Securities Times reported, citing Zhang Bin, deputy director of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences. (MNI)

POLICY: China should increase counter-cyclical policies and cross-cyclical polices - which link short and long-term growth - through the rest of this year and into next year to consolidate the momentum of economic recovery, wrote Guan Tao, a former foreign exchange official and now chief economist of BOC International in an article published by Yicai.com. (MNI)

POLITICS: A long-time confidant of Chinese President Xi Jinping has been named the country’s new intelligence chief, the latest in a series of challenging jobs assigned to the Zhejiang native. (SCMP)

POLITICS: China should introduce a number of targeted policies to support the development of the platform economy and innovative enterprises, as the platform economy requires new measures to revive growth after the government's recent round of reforms, Yicai.com reported citing analysts. (MNI)

CORONAVIRUS: Foxconn Technology Group is scrambling to contain a weekslong Covid-19 outbreak at an iPhone factory in central China, trying to appease frightened and frustrated workers during a crucial period for smartphone orders. (WSJ)

CORONAVIRUS: Shanghai Disney Resort said on Monday it had closed the whole resort including Shanghai Disney from Oct. 31 due to COVID-19 prevention requirements in the city, according to a company statement. (RTRS)

CORONAVIRUS: China's immigration bureau said mainland residents will be able to travel to Macau from Nov. 1 using an online visa system rather than in-person applications, a move that could increase travel to the world's largest gambling hub. (RTRS)

CHINA MARKETS

PBOC NET INJECTS CNY68 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday injected CNY70 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY68 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9551% at 9:45 am local time from the close of 1.9658% on Friday.

- The CFETS-NEX money-market sentiment index closed at 50 on Friday vs 49 on Thursday.

CHINA SETS YUAN CENTRAL PARITY AT 7.1768 MON VS 7.1698 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1768 on Monday, compared with 7.1698 set on Friday.

OVERNIGHT DATA

CHINA OCT OFFICIAL MANUFACTURING PMI 49.2; MEDIAN 49.8; SEP 50.1

CHINA OCT OFFICIAL NON-MANUFACTURING PMI 48.7; MEDIAN 50.1; SEP 50.6

CHINA OCT OFFICIAL COMPOSITE PMI 49.0; SEP 50.9

JAPAN SEP, P INDUSTRIAL OUTPUT -1.6% M/M; MEDIAN -0.8%; AUG +3.4%

JAPAN SEP, P INDUSTRIAL OUTPUT RISES 9.8% Y/Y; MEDIAN +10.5%; AUG +5.8%

JAPAN SEP RETAIL SALES +1.1% M/M; MEDIAN +0.8%; AUG +1.3%

JAPAN SEP RETAIL SALES +4.5% Y/Y; MEDIAN +4.1%; AUG +4.1%

JAPAN SEP DEPARTMENT STORE & SUPERMARKET SALES +4.1% Y/Y; MEDIAN +4.4%; AUG +3.8%

JAPAN OCT CONSUMER CONFIDENCE INDEX 29.9; MEDIAN 30.5; SEP 30.8

JAPAN SEP HOUSING STARTS +1.0% Y/Y; MEDIAN +2.4%; AUG +4.6%

JAPAN SEP ANNUALIZED HOUSING STARTS 0.857MN; MEDIAN 0.865MN; AUG 0.903MN

AUSTRALIA SEP RETAIL SALES +0.6% M/M; MEDIAN +0.5%; AUG +0.6%

AUSTRALIA SEP PRIVATE SECTOR CREDIT +0.7% M/M; MEDIAN +0.7%; AUG 0.8%

AUSTRALIA SEP PRIVATE SECTOR CREDIT +9.4% Y/Y; MEDIAN +9.4%; AUG +9.3%

AUSTRALIA OCT MELBOURNE INSTITUTE INFLATION +5.2% Y/Y; SEP +5.0%

AUSTRALIA OCT MELBOURNE INSTITUTE INFLATION +0.4% M/M; SEP +0.5%

SOUTH KOREA SEP INDUSTRIAL OUTPUT -1.8% M/M; MEDIAN -0.8%; AUG -1.4%

SOUTH KOREA SEP INDUSTRIAL OUTPUT +0.8% Y/Y; MEDIAN +1.0%; AUG +1.5%

SOUTH KOREA SEP RETAIL SALES +7.5% Y/Y; AUG +15.4%

SOUTH KOREA SEP DEPARTMENT STORE SALES +8.5% Y/Y; AUG +24.8%

SOUTH KOREA SEP DISCOUNT STORE SALES -0.3% Y/Y; AUG +9.9%

SOUTH KOREA SEP CYCLICAL LEADING INDEX -0.1 M/M; AUG -0.2

UK OCT LLOYDS BUSINESS BAROMETER +15; SEP +16

MARKETS

SNAPSHOT: Fed Whisperer Flags Scope For Higher For Longer Rates, Russia Suspends Ukraine Grain Deal

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 436.41 points at 27541.61

- ASX 200 up 77.78 points at 6863.5

- Shanghai Comp. down 3.984 points at 2911.942

- JGB 10-Yr future up 6 ticks at 148.83, yield down 0.8bp at 0.24%

- Aussie 10-Yr future down 1.5 tick at 96.240, yield up 1.5bp at 3.75%

- U.S. 10-Yr future down 0-05 at 110-27, yield up 1.27bp at 4.025%

- WTI crude down $0.44 at $87.46, Gold down $0.21 at $1644.69

- USD/JPY up 25 pips at Y147.86

- CASH-RICH CONSUMERS COULD MEAN HIGHER INTEREST RATES FOR LONGER (WSJ)

- ECB’S LAGARDE SAYS BEATING INFLATION IS MISSION, MANTRA, MANDATE (BBG)

- ECB'S NEXT RATE MOVE LIKELY BETWEEN 50 AND 75 BPS, KNOT SAYS (RTRS)

- RUSSIA SUSPENDS UKRAINE GRAIN EXPORT DEAL; BIDEN SLAMS MOVE (BBG)

- CHINESE OFFICIAL PMIS PRINT IN CONTRACTIONARY TERRITORY

- CHINA CENTRAL BANK REAFFIRMS IT WILL STEP UP SUPPORT FOR REAL ECONOMY (RTRS)

US TSYS: Curve Twist Flattens, Off Early Lows That Were Inspired By Latest WSJ Fed Whisperer Piece

Early Asia-Pac trade saw participants digest the latest article from WSJ Fed whisperer Timiraos which pointed to some support for the Fe’s higher for longer interest rate mantra.

- Inflation worries surrounding Russia indefinitely suspending the Ukrainian grain export deal also factored into early price action.

- Block sales in TY (-3K, -2.5K & -2.5K) as well as screen-based flow drove the contract through Friday’s base, although the 26 Oct low (110-16) was not tested on the move.

- The space then regained some poise before turning bid on the back of the latest round of soft official PMI data out of China.

- There has been a fresh, albeit modest round of cheapening as we head into London hours, with TY getting nowhere near closing the opening gap lower.

- The contract trades -0-08 at 110-24 as a result, just below the middle of its 0-11 range, on solid volume of ~126K.

- Cash Tsys run 5bp cheaper to 1bp richer across the curve, twist flattening, with 3s providing the weakest point on the curve and a pivot observed around the 20-Year point.

- MNI Chicago PMI data and the latest Dallas Fed m’fing activity survey headline Monday’s local docket. Eurozone CPI data set to provide some interest in pre-NY trade, although most of the focus is already on Wednesday’s FOMC decision.

JGBS: Curve Twist Flattens On BoJ Rinban Tweak

The early twist flattening move in JGBS has held, with the major JGB benchmarks running 1bp cheaper to 4.5bp richer, pivoting around 7s. The long end is off of firmest levels of the session.

- The move came as Tokyo reacted to Friday’s after hours move from the BoJ, which saw the Bank alter the frequency of its scheduled Rinban operations covering 10- to 25- & 25+-Year JGBs to 3x per month from the prior 2x (after upsized and unscheduled purchases were conducted in recent weeks) as the Bank looks to step up the defence of its YCC mechanism.

- JGBs tested overnight session lows in early Tokyo trade, before moving into positive territory in the afternoon, printing +1 ahead of the close.

- Domestic headline flow was limited at best, with mixed local data failing to provide any impetus for the space.

- Final manufacturing PMI data and 10-Year JGB supply headline Tuesday’s domestic docket.

AUSSIE BONDS: Close To Neutral After Offshore Matters Push The Space Around

Offshore matters were in the driving seat on Monday, with trans-Tasman spill over from a rally in NZGBs (see earlier bullets for more detail on that matter) allowing Aussie bond futures to more than unwind losses witnessed during the final overnight session of last week.

- The space then corrected from best levels as U.S. Tsys came under some early pressure, before softer than expected official PMI data out of China and a move away from session lows for U.S. Tsys allowed the space to stabilise during the Sydney afternoon.

- Virtually in line with expected local data had no impact on the space.

- That leaves YM -1.0 & XM -2.0 at the bell, while wider cash ACGB trade sees 1-2bp of cheapening across the curve, with a lack of month-end index extension demand evident (in line with the sub-average nature of most desk estimates).

- 3- & 10-Year EFPS were a little over 3bp wider on the day, while Bills finished flat to 7bp cheaper through the reds, steepening.

- Looking ahead, the latest RBA monetary policy decision headlines on Tuesday, with a 25bp rate hike widely expected and ~30bp of tightening priced into the OIS strip. See our full preview of that event here: https://roar-assets-auto.rbl.ms/documents/19945/RBA%20Preview%20-%20November%202022.pdf

NZGBS: Imminent WGBI Index Inclusion Supports NZGBs

The NZGB curve bull flattened on Monday, with the early cheapening more than unwound, as the imminent inclusion of NZGBs in the FTSE Russell WGBI was seemingly in the driving seat during Monday’s NZ session.

- That left cash NZGBs flat to 6.5bp richer across the curve, with swap spreads tightening as the swap curve twist flattened.

- Softer than expected official PMI data out of China would have added some incremental support to the bid that already developed pre-data.

- Terminal OCR pricing nudged higher on the day, last printing just below 5.20% after operating closer to 5.10% in the early rounds of trade.

- Building permits data headlines the domestic docket on Tuesday, with participants also set to be on the lookout for any trans-Tasman spill over from the latest RBA decision.

EQUITIES: Mostly In The Green, Mainland China Stocks Lagging

Major Asia Pac equities are in the green, with China mainland stocks the exception. US futures have spent much of the session in negative territory, but are away from worst levels and this follows 2-3% gains through Friday's session for cash equities.

- The HSI opened lower, but we are now back in positive territory (last up 0.90%). Tech sentiment is better (the sub index up close to 3.5%). Macau gaming stocks are higher, (+4%) following reports China mainland residents will be able to visit from Nov 1 via the smart visa process (per Reuters reports). This offset the negative weekend news around mass testing due to a covid outbreak.

- At this stage, the CSI 300 is down -0.15%, while the Shanghai composite is close to flat. Official PMI prints disappointed, both manufacturing and services slipping into contractionary territory. Rising covid case numbers is also causing concern amid a further rise in total case numbers.

- The Nikkei 225 is up +1.7%, likewise for the Kospi +1% and Taiex up +1.30%. This follows the strong lead from tech stocks through Friday offshore trading.

- The ASX 200 is up +1%, led mainly by financial names, with materials/resource companies still lagging to a degree on the back of recent commodity price softness.

OIL: China Weighs On Prices But Likely To Gain On The Month

Oil prices are down so far today by about 0.5% with WTI trading just under $87.50 and Brent around $95/bbl. WTI is still above its 20- and 50-day moving averages. It looks like oil is heading for its first monthly gain since May, possibly of over 10%, due to OPEC+ announcing production cuts to occur in November.

- Prices were lower today due to weak PMI data from China showing that the economy has contracted in October. This added to existing concerns that demand for commodities out of China is slowing due to its Zero-Covid Policy. But supply concerns are still supporting oil as OPEC+ cuts are imminent, the northern hemisphere winter approaches and European sanctions on Russian oil are due to come in on December 5.

- USD developments in the wake of Wednesday’s Fed meeting will also drive oil prices at the start of November, as a lower dollar reduces the cost in local currencies.

- In other news, Iranian oil minister Owji has gone to Moscow to discuss Russian investment in Iran’s oil and gas sector, according to Bloomberg.

GOLD: On Track For 7th Straight Monthly Loss

Gold is not too far away from Friday's session lows. The precious metal has been unable to gain much traction above $1645 through the first part of trading today, last around $1644, down slightly on closing levels from last week.

- This follows a 1.11% dip on Friday's session, which was enough to unwind gains for the week. Gold is also on track to fall again this month. This would be the 7th straight monthly fall, which commenced in April.

- A firmer USD, coupled with a bounce in nominal UST yields (real yields were unchanged) were headwinds through Friday and this remains the case today.

- There is some support sub $1640, beyond that is the October 21 lows just under $6120. On the topside, last week's gains above $1670 proved unsustainable.

FOREX: Yen Underperforms Amid Wider U.S./Japan Yield Spreads

The yen weakened in the interim between the BoJ's monetary policy decision last Friday and this Wednesday's Fed meeting. Japan's central bank left all main parameters of its ultra-loose stance unchanged and reinforced its dovish messaging by upping the frequency of bond-purchase operations used to enforce the YCC framework. By contrast, the FOMC is expected to raise the fed funds rate by another 75bp this week.

- Spot USD/JPY ran as high as to Y148.28 before trimming gains to last change hands at Y147.81. One-week option skews held gains registered last Friday in a strong rebound from near-cyclical lows. U.S./Japan yield differentials expanded, with 2-year gap last 3.0bp wider & 10-year spread 1.9bp wider.

- The pullback in USD/JPY may have been facilitated by worse than expected official Chinese PMI outturns, with the non-manufacturing gauge unexpectedly plunging into contractionary territory. Spot USD/CNH fluctuated in positive territory as the session progressed and last deals ~210 pips better off.

- The Antipodeans traded on a firmer footing ahead of the RBA's cash rate target decision tomorrow, defying the negative lead from China's PMI figures.

- Eurozone GDP & CPI data, German retail sales & U.S. MNI Chicago PMI will take focus on the data front today. ECB's Visco & Lane are set to speak.

FX OPTIONS: Expiries for Oct31 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E1.4bln), $1.0000(E2.4bln)

- EUR/JPY: Y140.00($825mln)

- USD/CAD: C$1.3900($630mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/10/2022 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/10/2022 | 0730/0830 | ** |  | CH | retail sales |

| 31/10/2022 | 0800/0900 |  | ES | Retail Sales | |

| 31/10/2022 | 0900/1000 | *** |  | IT | GDP (p) |

| 31/10/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/10/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 31/10/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 31/10/2022 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 31/10/2022 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 31/10/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/10/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/10/2022 | 1500/1600 |  | EU | ECB Lane Speech at Danmarks Nationalbank Conference | |

| 31/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/10/2022 | 1900/1500 |  | US | Treasury Financing Estimates | |

| 01/11/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.