-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Q3 Capex Up Q/Q; GDP Revised Lower

MNI BRIEF: China November PMI Rises Further Above 50

MNI EUROPEAN OPEN: Fiscal Focus Into Year End

EXECUTIVE SUMMARY

- FED CHOOSES QE GUIDANCE OVER EXPANDING IT

- ECB'S WEIDMANN: ECB STIMULUS RISKS HURTING MARKET DISCIPLINE (BBG)

- ECB'S VILLEROY: ECB STANDS READY TO OFFSET EXCHANGE RATE IMPACT ON INFLATION (RTRS)

- MCCONNELL SAYS WILL GET THERE ON COVID RELIEF, SPENDING BILL (BBG)

- RBA GETS 2 NEW BOARD MEMBERS

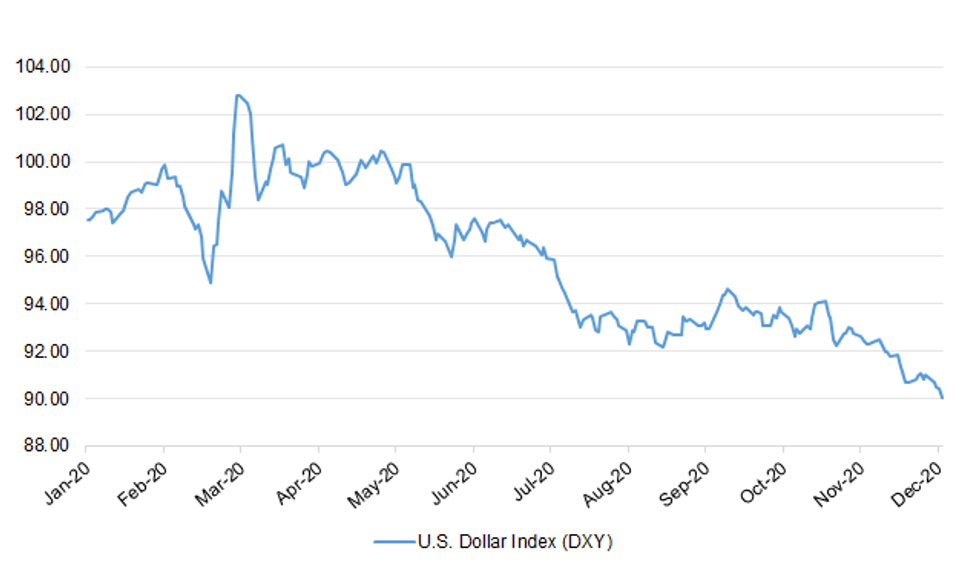

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: A reporter with The Mirror tweeted the following on Wednesday: "Brussels source tells me the UK side is going "so slowly" in the trade deal negotiations - but it isn't clear whether we're dragging our feet deliberately or just being careful." (MNI)

BREXIT: MNI BRIEF: UK Upper Chamber In Xmas Recess, Can Be Recalled

- The UK upper chamber of Parliament starts its Christmas recess at close of business on December 17, returning January 5, the government announced Wednesday. However, the House of Lords can be recalled at any time to debate an EU trade deal, so the Christmas closure is not an indicator on the likely timing of any deal. The lower chamber, the House of Commons, could follow suit but business managers have stressed they will not allow the timing of parliamentary recess to stand in the way of a deal - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BREXIT: The UK has signed a customs agreement with the US, ensuring trade between the countries is not disrupted after the Brexit transition ends at the end of the month. The bilateral Customs Assistance Agreement will allow customs authorities to continue to cooperate, including sharing data, to tackle customs fraud. (City AM)

BREXIT: Britain's retailers and food manufacturers have called on lawmakers to urgently investigate ongoing disruption at UK ports, warning that delays were hurting their plans to build stocks ahead of Christmas and the Dec. 31 end of the Brexit transition period. (RTRS)

BOE: Preview - December 2020: Where's the Bottom of the Bucket?

- The Bank of England had been hoping that much of the uncertainty that had clouded the November Monetary Policy Meeting would have been resolved by the December meeting. Indeed, the UK has started rolling out the first Covid-19 vaccinations and there is more clarity on the timing of the wider rollout to the population. However, the outcome of Brexit trade negotiations remains unclear at present although it does appear as though some progress is starting to be made. Recent activity is also likely to have been hit harder than the Bank's latest forecasts as they were made before the announcement of the English November lockdown (albeit they were known by the time of the publication of the MPR), and more regions are now in the highest Tier 3 (including Greater London) which is likely to hit economic activity in Q4 even more. With this in mind. We would favour a 21-24 month minimum maturity for the short-dated bucket (or potentially 18 months for ease of communication). We discuss our rationale for this in the preview - on email now - for more details please contact sales@marketnews.com.

BOE: The Bank of England should keep policy unchanged this week and let the government steer the economy through the latest stage of the crisis, The Times panel of top economists says. (The Times)

ECONOMY: MNI BRIEF: UK Pay Awards Unchanged in November

- UK headline pay awards were muted in the three months to November, coming in unchanged on the previous month's 2.0%, data published by XpertHR Thursday showed. The survey revealed that more than a quarter of pay settlements in the rolling three-month period resulted in no increase for employees - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: The Chancellor has declared he must rein in government borrowing next year and signalled his opposition to a one-off wealth tax to pay for the coronavirus crisis. (Telegraph)

CORONAVIRUS: The number of people in the strictest tier of coronavirus restrictions looked set to grow on Wednesday evening, setting ministers on course for a fresh row with local leaders over the measures. Great swathes of southern England in areas such as East Sussex and Surrey are on course to enter Tier 3 on Saturday, with limited loosening on restrictions in the North. As ministers met on Wednesday evening to review the allocations for each area of England, officials suggested the sum total of the changes would result in more people living under the harshest measures. One Whitehall source said: "This virus is still out there and we don't just want to flatten the curve, we want to keep driving it down and we want Tier 3 to be really getting those numbers down." "The direction of travel is important but the number of cases is also important, and those numbers are still very high." (Telegraph)

EUROPE

ECB: The European Central Bank's recent decision to boost its emergency bond-buying program risks weakening market discipline, Governing Council member Jens Weidmann said. The Bundesbank president, who was a key holdout during policy makers' recent stimulus deliberations, said that there was a clear need for the central bank to act in response to the weakening outlook brought about by the pandemic. However, it's "crucial" that the amount of government bonds held by the ECB doesn't become too large. "Otherwise we run the risk of gaining dominant market influence and levelling out the differences in the risk premiums of government bonds. This further weakens market discipline," he said in a virtual speech on Wednesday. "This problem has been exacerbated in particular by the recent increase in the Pandemic Emergency Purchase Program."

ECB: The European Central Bank stands ready to offset the impact of the foreign exchange rate on inflation, ECB policymaker Francois Villeroy de Galhau said in excerpts of an interview released on Wednesday. ECB policymakers have grown concerned about the exchange rate as the euro has risen to its highest level against the dollar since April 2018, which can push down the prices of imported goods and weigh on already weak inflation. "The ECB does not have an exchange rate target. But as (ECB President) Christine Lagarde said we are and will be very vigilant about the effects of the exchange rate on inflation," Villeroy, who is also governor of the French central bank, told French magazine Alternatives Economiques. (RTRS)

CORONAVIRUS: European authorities are pushing for a compressed approval timeline for the Covid-19 vaccine from Pfizer Inc. and BioNTech SE, according to people familiar with the plan, which could enable a rollout on the continent before Christmas. Should the vaccine win the backing of a key drugs oversight committee on Monday, the European Commission is planning for a sign-off as soon as the same day, two people said. That would enable shipping the first shots to vaccine centers as early as Dec. 23, one of the people said. (BBG)

FRANCE: People in France could start receiving the COVID-19 vaccine developed by Pfizer/BioNTech in the last week of December if European Union authorities approve it next week, French Prime Minister Jean Castex said on Wednesday. (RTRS)

SPAIN: Spain granted regional administrations the power to further restrict movement and limit the size of Christmas gatherings, as new cases rose to the highest in almost a month. "We are concerned by the increase in recent days," Health Minster Salvador Illa told reporters Wednesday, following a meeting with his counterparts from Spain's 17 regions. Although gatherings are allowed, Illa said citizens should "stay at home and not move" over the holidays. (BBG)

IRELAND: Ireland Chief Medical Officer Tony Holohan warned of "significant and concerning indicators that this disease in moving in the wrong direction" after figures Wednesday showed daily cases rising about a third to 431. Health authorities will meet Thursday to consider the renewed surge, which came after Ireland reopened non-essential stores, restaurants and some bars even as many governments across Europe tighten restrictions over Christmas. "These trends are all the more troubling because of the delicate and precarious situation we are in -- as a country, we are heading into a period of potential widespread inter- household and inter-generational mixing," Holohan said. (BBG)

IRELAND: Ireland's economy will grow strongly this year despite the coronavirus shock as multinational exports surge in the face of "catastrophic" damage to domestic sectors that closed in the lockdown, the country's leading think-tank has forecast. A new report from the Economic & Social Research Institute suggests Irish gross domestic product will advance 3.4 per cent this year and 4.9 per cent in 2021, even after hundreds of thousands of job losses when the government shut large parts of the domestic economy to tackle the pandemic. The 2021 forecast assumes a Brexit trade deal will be struck before the end of the UK's transition period on December 31, but GDP growth would drop to 1.5 per cent in 2021 if the talks failed. "There would be a major impact if there is a no-deal scenario," said Conor O'Toole, ESRI senior research officer. (FT)

NORGES BANK: Preview - December 2020: Steeper Path Possible

- When collating their September rate path projections, the Norges Bank followed the WHO's assumption that a vaccine would be in widespread use globally by "autumn 2021". It's clear today that this timeline has been greatly accelerated. Having come to an agreement with Sweden (Sweden will be over-procuring several vaccines via EU programmes and selling these on to Norway), Norway now expect to have inoculated close to a quarter of their population by the end of the first quarter. This should greatly reduce the threat posed by the Coronavirus to those most at risk, with the general population to follow shortly afterwards. This makes the Bank's September assumptions well out of date. In their most recent monetary policy report they wrote: "If a vaccine is found quickly, growth will likely turn out higher than currently projected." As such, it seems likely a positive revision will be made to both growth and inflation projections this month, both of which will add upward pressure to the rate path - on email now - for more details please contact sales@marketnews.com.

SNB: Preview - December 2020: No Need for Action Now

- While the fall in CPI rates appear to have bottomed, inflation remains deep in negative territory, with prices continuing to decline at an annual rate of 0.7%. This is unlikely to phase the SNB, however, with the Bank likely satisfied with their current expansionary policy. Downside pressure on EUR/CHF has alleviated and EUR rates markets are signalling little chance of a further cut to the ECB's deposit rate, lessening the pressure on the SNB to take any near-term policy action to maintain the rate differential. Throughout 2020, the Bank have made clear that they still have room to manoeuvre on interest rates. But, it's clear that – for the time being - this suite of tools has succeeded in containing financial market fragmentation. As such, the Bank will likely reaffirm their vigilance this quarter, stressing that the CHF is "even more highly valued", but decline to cut rates or expand their current toolkit amid a calmer market outlook - on email now - for more details please contact sales@marketnews.com.

U.S.

FED: MNI REVIEW: Fed Chooses QE Guidance Over Expanding It

- The Federal Reserve on Wednesday left benchmark rates near zero and committed to buy at least USD120 billion a month of debt until the economic recovery makes "substantial further progress," declining to ease further by boosting purchases or shifting them toward the longer end of the yield curve. The decision wraps an extraordinary year of actions to bolster the economy battered by Covid-19. Despite record-high and still rising caseloads and death rates, new vaccines have convinced policymakers the economy will resume solid growth next year - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Congress Drafts Bill to Remove 13-3 Cash For Good

- Congress may nail the door closed for the Treasury and the Federal Reserve to use any of the USD429 billion in Cares Act funding on any revived Main Street Lending Program or other 13(3) lending facilities, according to draft legislation viewed by MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Congressional leaders have floated the idea of a stopgap funding bill to keep the government open while they wrap up legislative work this weekend, but lawmakers and aides are still hoping they don't have to resort to that. House Minority Leader Kevin McCarthy (R-Calif.) said that negotiators were down to "the fine details that we've got to get done, but those are the most important ones." "We're gonna get there," declared Senate Majority Leader Mitch McConnell (R-Ky.) as he left the Capitol on Wednesday evening. (POLITICO)

CORONAVIRUS: The US recorded more coronavirus deaths on Wednesday than on any other day during the pandemic, as hospitalisations remained at a record level. There were 3,400 additional deaths attributed to Covid-19, higher than the 3,164 fatalities tallied on December 9. The US has had 298,775 coronavirus deaths since the pandemic began, according to the Covid Tracking Project. (FT)

CORONAVIRUS: Iowa will loosen restrictions on restaurants and eliminate a cap on the size of social gatherings, after a sustained decline in new coronavirus infections and hospitalisations. (FT)

CORONAVIRUS: The United States could return to some semblance of normality by mid-fall next year if enough people are vaccinated against Covid-19, White House coronavirus advisor Dr. Anthony Fauci told CNBC's Meg Tirrell during a special edition of "Healthy Returns." That means people could resume dining inside at restaurants, go to the movies and return to school safely, he said. To get there, however, Fauci said between 75% and 85% of the population will need to to get inoculated against Covid-19. That would create an "umbrella" of immunity to prevent further spread of the virus. (CNBC)

CORONAVIRUS: Dr. Scott Gottlieb expressed concerns Wednesday about the smooth administration of Covid-19 vaccines next year, when shots become available for Americans who are not health-care workers or residents of long-term care facilities. The former Food and Drug Administration commissioner pointed to the challenges that have been reportedly experienced around administering antibody drugs to Americans, suggesting those difficulties could portend similar difficulties for vaccines. (CNBC)

CORONAVIRUS: New York's non-essential businesses may be forced to close again in January if the state doesn't clamp down on escalating coronavirus cases, which have soared in recent weeks to record levels not seen since the spring, Gov. Andrew Cuomo said Wednesday. "Of course a shutdown in January is possible," Cuomo said at a press conference in Albany. "But there's a big but," he said, spelling the word out one letter at a time "B-U-T." (CNBC)

CORONAVIRUS: New York State could begin vaccinating certain members of the general public in late January, pending federal deliveries, Governor Andrew Cuomo said Wednesday. The state will issue a directive requiring insurance companies to cover the cost of the vaccine for all New Yorkers, Cuomo said. (BBG)

POLITICS: President-elect Joe Biden on Wednesday said that he is confident Hunter Biden did nothing wrong as his son faces a criminal tax probe by federal prosecutors in their home state of Delaware. Biden's statement appears to be the first time that the Democratic former vice president has publicly said he believes Hunter Biden is innocent of criminal wrongdoing. Hunter Biden has not been charged by prosecutors. (CNBC)

EQUITIES: Boeing CEO David Calhoun on CNBC Wednesday shot down speculation that the company could turn to a massive stock sale to knock off debt from its balance sheet. (CNBC)

EQUITIES: Google is facing a new antitrust lawsuit from a group of state attorneys general led by Texas, this time targeting its advertising technology services. The lawsuit claims Google unlawfully acquired, attempted to acquire or maintained a monopoly in several steps of the online ad market including both buy and sell-sides. It also alleges Google has engaged in unlawful tying arrangements between its ad products so publishers had to use another Google tool if they chose to operate on its ad exchange. (CNBC)

OTHER

GLOBAL TRADE: President-elect Joe Biden should keep pressing China to stick to the "Phase 1" trade deal and use tariffs as leverage, U.S. Trade Representative Robert Lighthizer told Reuters, adding that Beijing has done a "reasonably good job" implementing parts of the deal. (RTRS)

GLOBAL TRADE: The United States and Europe should agree to cooperate in opposing any future "hurtful" subsidies used by China to build up its commercial aircraft industry, U.S. Trade Representative Robert Lighthizer told Reuters in an interview. Lighthizer said he was working to settle a 16-year-old dispute between Washington and Brussels over past government aid to aircraft manufacturers, but expressed frustration that current World Trade Organization rules would not prevent future subsidies by the European Union or China. "If this plays out, they can start a new subsidy tomorrow, and drag out that litigation for five or six years, and there's nothing under the WTO that you can do about it at all," Lighthizer said in a rare interview late on Tuesday. He said he had made several proposals to settle the matter before the Trump administration leaves office on Jan. 20. (RTRS)

GLOBAL TRADE: Germany's ambassador to the United States on Wednesday called for quick action to resolve a U.S.-European dispute over aircraft subsidies, calling it a distraction from issues such as climate change and the pandemic that require joint action by the historic allies. Emily Haber, speaking during an online event hosted by the embassy, said it was important to settle the long-standing dispute, especially given the harmful impact of the pandemic on aircraft manufacturers in both regions and moves by China to develop its own commercial aircraft. (RTRS)

U.S./CHINA: The U.S. military on Wednesday slammed China for failing to appear at virtual, senior-level meetings slated for this week, with the top U.S. admiral for the Asia-Pacific saying it was "another example that China does not honor its agreements." "This should serve as a reminder to all nations as they pursue agreements with China going forward," Admiral Phil Davidson, the commander for U.S. Indo-Pacific Command, said in a statement. China had been expected to participate in Dec. 14-16 meetings related to the Military Maritime Consultative Agreement and which are focused on maritime safety, the command said. (RTRS)

CORONAVIRUS: Pharmacists have found a way to squeeze extra doses out of vials of Pfizer's vaccine, potentially expanding the nation's scarce supply by up to 40 percent. The Food and Drug Administration said late Wednesday that those extra doses could be used, clearing up confusion that had caused some pharmacists to throw away leftover vaccine for fear of violating the rules the agency set last week. "Given the public health emergency, FDA is advising that it is acceptable to use every full dose obtainable," an agency spokesperson told POLITICO, mirroring language that a federal health official sent to state vaccine providers Wednesday morning. The federal government has not publicly announced the guidance; Pfizer learned of the change this afternoon. (POLITICO)

CORONAVIRUS: A health care worker in Alaska had a serious allergic reaction after getting Pfizer's coronavirus vaccine on Tuesday, symptoms that emerged within minutes and required an overnight hospital stay. (New York Times)

CORONAVIRUS: A team of 10 international scientists will travel to the Chinese city of Wuhan next month to investigate the origins of Covid-19, the World Health Organization (WHO) has said. Beijing has been reluctant to agree to an independent inquiry and it has taken many months of negotiations for the WHO to be allowed access to the city. (BBC)

HONG KONG: Hong Kong Monetary Authority will continue to monitor market developments and maintain monetary and financial stability in accordance with the linked exchange rate system, it says in an emailed statement in response to U.S. Fed's rate decision. (BBG)

JAPAN: The Tokyo Metropolitan Government raised its warning on the city's medical system to "under strain", the highest of four levels, for the first time since the alert system was laid out in July. (BBG)

JAPAN: Japan has forecast a rise of around 4% in the country's gross domestic product for fiscal 2021, up from its prediction of 3.4% growth in July, Nikkei has learned. (Nikkei)

RBA: The Morrison government has appointed Coca-Cola Amatil managing director Alison Watkins and CSL director Carolyn Hewson as members of the Reserve Bank board for a five-year period. Treasurer Josh Frydenberg said the appointments would mean the first time in the history the central bank has had a gender balance on the board. There are now four women on the central bank board. (AFR)

AUSTRALIA: Treasurer Josh Frydenberg has revealed the federal deficit has been revised down by $23.9 billion since the October budget and is now expected to come in at $197.7 billion. Mr Frydenberg said the budget update confirmed Australia's economy was rebounding strongly with consumer and business confidence already at pre-COVID levels and 640,000 fewer individuals on JobKeeper in the December quarter than was projected. He added Australia was outperforming all advanced economies with its faster than expected rebound since the beginning of the pandemic and revealed the nation's unemployment rate would reach pre-COVID levels by mid-2024. (Sky)

AUSTRALIA: Australia's largest city Sydney is battling to prevent an outbreak of Covid-19 after five new cases in the past two days ended a more than month-long run with limited community transmission in New South Wales. (BBG)

AUSTRALIA/CHINA: Australia should treat its WTO complaint on China's barley tariffs as a real trade dispute rather than politicizing the issue and planning a counterattack on China through the iron ore trade, the Global Times said in an editorial. Australia has been destroying its relations with China to show its loyalty and commitment to its alliance with the U.S., but China is confident it can disregard relations with Australia and win the barley dispute at the WTO, the newspaper said. (MNI)

AUSTRALIA/RATINGS: Rising debt among Australia's state governments will be factored into Fitch Ratings' assessments of the country's sovereign rating as it emerges from the coronavirus pandemic shock. (Fitch)

NEW ZEALAND: New Zealand aims to begin vaccinating its entire population against Covid-19 in the second half of next year in its largest-ever immunization program, Prime Minister Jacinda Ardern said. The government has secured two additional vaccines from pharmaceutical companies AstraZeneca and Novavax and will have enough for all 5 million New Zealanders, Ardern said Thursday in Wellington. If proven to be safe and effective, immunization will begin with border workers and essential staff in the second quarter of 2021 followed by the general population in the second half, she said. The vaccines will be free to the public. (BBG)

NEW ZEALAND: New Zealand's government is focused on giving first-time buyers access to the housing market, Finance Minister Grant Robertson said, suggesting he's unlikely to allow the central bank to add debt-to-income ratios to its toolkit. The government is "obliged" to consider the Reserve Bank's request for DTIs "but that doesn't automatically translate to approving it," Robertson said in an interview with Bloomberg Thursday in Wellington. The last time the RBNZ asked for the tool, "there were concerns raised by the previous government around affordability issues, particularly for first-home buyers and those on lower incomes, so that would be a factor that I will take into consideration," he said. (BBG)

SOUTH KOREA: South Korea's daily new coronavirus cases surpassed the 1,000 mark Thursday for the second day in a row as an alarming increase in cluster infections across the country continued, prompting health authorities to seriously consider adopting the toughest virus curbs. The country added 1,014 more COVID-19 cases, including 993 local infections, raising the total caseload to 46,453, according to the Korea Disease Control and Prevention Agency (KDCA). The KDCA said the country reported another daily high of 22 COVID-19 deaths, sharply up from 13 a day earlier, raising the total caseload to 634, indicating that the rising number of seriously ill virus patients may lead to more deaths down the road. (Yonhap)

SOUTH KOREA: South Korea's government forecasts the economy to rebound strongly next year on brisk exports and stimulus after its weakest growth in more than two decades this year amid the global pandemic. Gross domestic product in Asia's fourth-largest economy is expected to grow 3.2% in 2021 after contracting 1.1% in 2020, the Ministry of Economy and Finance said in a semiannual report released Thursday. The forecast contraction in GDP this year would mark the country's worst performance since the 1997-1998 Asian financial crisis. Inflation is projected to accelerate to 1.1% in 2021 from an estimated 0.5% in 2020, falling short of the central bank's 2% target. Growing global trade, especially in semiconductors, and stimulus efforts will likely help boost both exports and domestic consumption in the country, the ministry said. (Dow Jones)

SOUTH KOREA: resident Moon Jae-in said Thursday that South Korea should overcome the COVID-19 crisis and achieve a "grand transformation" of its economy in the coming year. "We will have to turn 2021 into a period of great transformation of South Korea's economy. The beginning is to clearly overcome the coronavirus crisis," he said during an expanded session of the National Economic Advisory Council. (Yonhap)

BRAZIL: Brazil's federal government decided to buy the Coronavac vaccine, developed by China's Sinovac and produced by Butantan Institute, G1 website reported, citing a person familiar with talks between Health Minister Eduardo Pazuello and Governor Joao Doria. (BBG)

BRAZIL: Brazil must cut spending and mandatory obligations to avoid a "recession like in the lost decade of the 1980s," according to a study conducted by the Organization for Economic Co-operation and Development. With debt levels soaring following the government's pandemic-driven aid package, sustained growth hinges on fiscal adjustments and compliance with public expenditure rules, the OECD warned in an economic survey of Brazil published Wednesday. "Without strong action financing costs could rise substantially, jeopardizing fiscal sustainability and depressing investment," the Paris-based organization said. (BBG)

RUSSIA: The White House has convened urgent meetings of officials across multiple agencies to address a breach of U.S. government computer systems attributed to Russia, according to a person familiar with the matter. (BBG)

OVERNIGHT DATA

AUSTRALIA NOV EMPLOYMENT CHANGE +90.0K; MEDIAN +40.0K; OCT +180.4K

AUSTRALIA NOV FULL-TIME EMPLOYMENT CHANGE +84.2K; OCT +98.7K

AUSTRALIA NOV PART-TIME EMPLOYMENT CHANGE +5.8K; OCT +81.7K

AUSTRALIA NOV UNEMPLOYMENT RATE 6.8%, MEDIAN 7.0%; OCT 7.0%

AUSTRALIA NOV PARTICIPATION RATE 66.1%, MEDIAN 65.9%%; OCT 65.8%

NEW ZEALAND Q3 GDP +14.0% Q/Q; MEDIAN +12.9%; Q2 -11.0%

NEW ZEALAND Q3 GDP +0.4% Y/Y; MEDIAN -1.8%; Q2 -11.3%

CHINA

YUAN: The yuan may be on a continuing phase of appreciation against the dollar given China's strong exports and monetary policies, the China Securities Journal reported citing analysts. The yuan continues to derive support from the stronger economy while the dollar index has weakened since Dec. 9, the Journal said. The PBOC's recent MLF operations and peripheral adjustments may slow but not reverse the overall rising trend, the report said. (MNI)

BONDS: The number of defaults on SOE-issued bonds may rise as the government encourages market-based solutions for troubled companies, the Securities Daily reported citing Li Chang, an analyst from S&P Global Ratings. The widening spreads on new bonds issued by SOEs could raise the financing costs for weaker SOEs, who could potentially default amid a period of tightening monetary policy, Li said. (MNI)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with rates unchanged at 2.2% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

PBOC SETS YUAN CENTRAL PARITY 6.5362 THURS VS 6.5355 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate slightly higher at 6.5362 on Thursday, compared with the 6.5355 set on Wednesday.

MARKETS

SNAPSHOT: Fiscal Focus Into Year End

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 78.82 points at 26835.87

- ASX 200 up 77.473 points at 6756.7

- Shanghai Comp. up 25.358 points at 3392.341

- JGB 10-Yr future down 5 ticks at 152.04, yield down 0bp at 0.01%

- Aussie 10-Yr future down 2.5 ticks at 98.960, yield up 2.6bp at 0.987%

- US 10-Yr future down 0-01 at 137-27+, yield up 0.66bp at 0.9229%

- WTI crude up $0.51 at $48.33, Gold up $2.52 at $1867.3

- USD/JPY down 12 pips at Y103.35

- FED CHOOSES QE GUIDANCE OVER EXPANDING IT

- ECB'S WEIDMANN: ECB STIMULUS RISKS HURTING MARKET DISCIPLINE (BBG)

- ECB'S VILLEROY: ECB STANDS READY TO OFFSET EXCHANGE RATE IMPACT ON INFLATION (RTRS)

- MCCONNELL SAYS WILL GET THERE ON COVID RELIEF, SPENDING BILL (BBG)

- RBA GETS 2 NEW BOARD MEMBERS

BOND SUMMARY: Core FI Biased A Touch Lower

U.S. Tsys came under modest pressure in post-FOMC Asia-Pac trade, with focus on the continued positive musings around the fiscal situation in DC evident, although there was little in the way of solid progress on that front. T-Notes stuck to a 0-05 range, with the contract last -0-00+ at 137-28, while the cash curve is back from session steeps, as Tsys sit unchanged to 0.5bp cheaper across the curve. Downside TY block plays drove matters on the flow side in Asia.

- JGB futures sit 7 ticks below settlement levels but haven't challenged the overnight low. Cash JGBs have generally cheapened across the curve, but still sit within 1.0bp of closing levels, with participants keeping an eye on matters surrounding JGB issuance plans.

- Aussie bonds traded lower in the wake of a firmer than expected domestic labour market report, with the state of Victoria driving jobs growth post-lockdown. YM & XM both sit 2.5 ticks below settlement levels as we move towards the close.

EQUITIES: A Little Firmer In Asia

The major regional Asia-Pac equity indices were little changed to higher during Thursday trade, with positive mood music surrounding the fiscal situation in DC in focus, while there was little in the way of lasting fallout from the final FOMC decision of '20.

- A solid showing for the materials sector facilitated some outperformance for the ASX 200.

- Meanwhile, e-minis edged higher as we worked out way through the overnight session.

- Nikkei 225 +0.2%, Hang Seng +0.1%, CSI 300 +0.9%, ASX 200 +1.0%

- S&P 500 futures +7, DJIA futures +57, NASDAQ 100 futures +28.

GOLD: Well Defined Lines

Little has changed for gold in the wake of the final FOMC decision of '20. Spot continues to sit within well defined technical lines in the sand, last dealing little changed around the $1,865/oz mark. U.S. fiscal matters are now set to dominate into Christmas, with the DXY operating at cycle lows.

OIL: New Highs

WTI & Brent sit $0.50 above settlement levels, building on yesterday's modest gains, extending to fresh multi-month highs during Asia-Pac trade as the USD traded to fresh cycle lows.

- Wednesday saw the weekly DoE inventory report reveal a deeper than expected headline drawdown in crude stocks vs. a surprise build in the API readings, with marginal builds seen in distillate, gasoline and Cushing inventories.

- There was little else of note for the space, with broader focus falling on the final FOMC decision of the calendar year and the fiscal situation in DC.

FOREX: US Dollar Downtrend Resumes As AUD & NZD Bid In Asia

Central banks and data dominated headline flows. The final FOMC decision of 2020 was ultimately in line with expectations, with new asset purchase guidance but no change to the asset purchase program itself. The decision and optimistic-looking summary of economic projections initially saw the US dollar strengthen before moving back to pre-announcement levels.

- US dollar is seeing some softness in Asia after US Representative Hoyer, a member of the House Democratic leadership, said a fiscal aid deal could be imminent. Though other Congressional leaders have tempered this optimism suggesting negotiations could run into the weekend. All indications remain that both sides are keen to do a deal. President-elect Joe Biden said there would be need for additional measures by February.

- Employment data from Australia was stronger than expected, 90k jobs were added in November against expectations of a gain of 50k, the unemployment rate dropped to 6.8%, while the participation rate also rose to 66.1% from 65.8%.

- AUD/USD has been bid after the release, hitting fresh cycle highs of 0.7592 and rising above 0.7583, the Jun 14, 2018 high. Officials continue to highlight risks over tensions with China, while the budget update forecasted a deficit of AUD 197.7bn in 2020/21

- NZD/USD also moved higher, catching a fresh bid after FinMin Robertson said New Zealand were not concerned with NZD at these levels. Elsewhere Q3 GDP came in above expectations

- USD/JPY has trended lower through the session, mostly on the back of US dollar weakness. Markets await the BoJ rate decision tomorrow, no change is expected.

- GBP/USD has moved higher, gaining around 30 pips on the session, focus continues to fall on Brexit negotiation back and forth. European Commission President Ursula von der Leyen said yesterday that "there is a path to an agreement now", increasing the probability of a deal being reached before the hard deadline of December 31.

- The PBOC fixed USD/CNY at 6.5362, 7 pips higher than the previous fix. USD/CNH continued its move lower, touching 6.50 before rebounding to 6.5112, down 13 pips on the session. The 6.50 barrier was last breached on December 9.

FOREX OPTIONS: Expiries for Dec17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1875-80(E1.1bln), $1.2000(E1.2bln), $1.2050(E543mln), $1.2100-15(E841mln), $1.2200-05(E508mln)

- USD/JPY: Y102.95-103.00($500mln-USD puts), Y103.75-90($1.0bln), Y104.15-20($633mln), Y104.30($610mln)

- AUD/USD: $0.7300(A$541mln), $0.7350(A$531mln), $0.7550(A$609mln-AUD puts)

- USD/CNY: Cny6.50($1.2bln-USD puts), Cny6.55($755mln-USD puts)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.