-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fresh All-Time Lows For Cable, With Further UK Fiscal Support Eyed

EXECUTIVE SUMMARY

- POWELL SAYS ECONOMY MAY BE ENTERING ‘NEW NORMAL’ AFTER PANDEMIC (BBG)

- FED’S BOSTIC SAYS US COULD HAVE A ‘RELATIVELY ORDERLY’ SLOWDOWN (BBG)

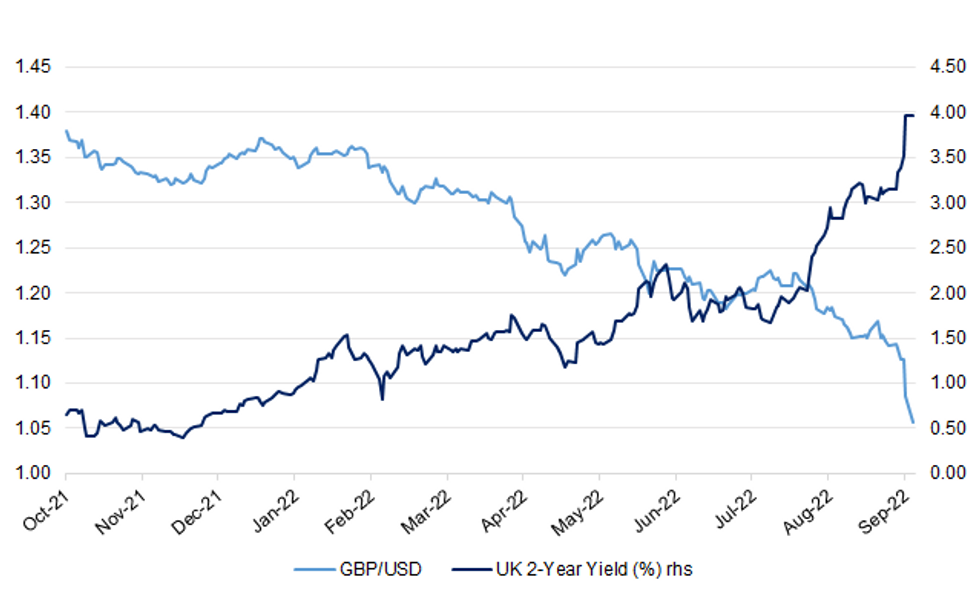

- GBP/USD PRINTS FRESH ALL-TIME LOW ON WORRY RE: UK FISCAL POLICY

- KWARTENG: I WANT TO KEEP CUTTING TAXES (BBC)

- ITALY'S MELONI CALLS FOR UNITY AFTER ELECTION VICTORY (RTRS)

- CHINA REINSTATES RISK RESERVES FOR DERIVATIVES TO SUPPORT YUAN (BBG)

Fig. 1: GBP/USD vs. UK 2-Year Yield

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Chancellor Kwasi Kwarteng has said he wants to keep cutting taxes as part of an effort to boost UK economic growth. After announcing a massive shake-up of taxation on Friday, Mr Kwarteng told the BBC there was "more to come". (BBC)

FISCAL: Liz Truss is planning to continue her tax-cutting spree in a new year Budget that will include further reductions in income tax, and discounts for savers and child benefit claimants. (Telegraph)

FISCAL/MARKETS: British finance minister Kwasi Kwarteng said on Sunday that he was focused on boosting longer-term growth, not on short-term market moves, when challenged over the sharp fall in sterling and bond prices following his first fiscal statement. (RTRS)

FISCAL/STERLING: Liz Truss faces a rebellion from Tory backbenchers against her tax cuts if the pound falls below the dollar, The Telegraph can reveal. (Telegraph)

GILTS: The UK is again targeting the short-end of the sterling bond market curve to fund the additional borrowing required to cover the Government’s recent spending plans, taking advantage of the liquidity offered by in part by overseas investors, Debt Management Office head Robert Stheeman told MNI in an interview Friday. (MNI)

FISCAL/POLITICS: Britain's main opposition party leader Keir Starmer said on Sunday he would reintroduce the top rate of income tax to 45% after the government abolished the rate in a mini-budget. (RTRS)

POLITICS: Labour is on course for a 56-seat majority at the next election and would take Boris Johnson's seat, new polling has suggested. (Telegraph)

POLITICS: Liz Truss is being warned that she risks abandoning a winning coalition of voters in the “red wall” as she pursues “cavalier” tax cuts, amid revelations that her giveaway package disproportionately benefits more traditional Conservative heartlands. (Observer)

BREXIT: Britain is still seeking a negotiated solution with the European Union to resolve a stand-off over the Northern Ireland protocol, a part of the Brexit divorce deal that Britain has attempted to override, Prime Minister Liz Truss said. (RTRS)

BREXIT: Ireland’s ambassador to the UK has stressed the need to find a negotiated solution to the problems surrounding Northern Ireland’s post-Brexit arrangements. (Belfast Telegraph)

EUROPE

ECB: The European Central Bank needs to keep raising interest rates and should also stop bond purchases when they have fulfilled their purpose, Bundesbank President Joachim Nagel said on Friday. (RTRS)

ECB: The European Central Bank’s newest policy maker has plenty to say on the danger of consumer prices running out of control during a war. (BBG)

GERMANY: German Finance Minister Christian Lindner criticized the gas levy planned to help the country stave off a collapse of its energy sector. (BBG)

GERMANY: German utility RWE has signed a deal with Abu Dhabi National Oil Company (ADNOC) to deliver liquefied natural gas to Europe's largest economy by the end of December, RWE announced on Sunday. (RTRS)

FRANCE: France plans to raise the retirement age as part of a second attempt by President Emmanuel Macron to reform the pension system, a top minister told Le Journal du Dimanche. (BBG)

ITALY: Giorgia Meloni, head of the nationalist Brothers of Italy party, said on Monday Italian voters had given a clear mandate to the right to form the next government and called for unity to help confront the country's many problems. (RTRS)

SNB: The Swiss National Bank is ready to take further steps to fight inflation despite price rises in Switzerland being relatively modest compared to international peers, SNB Chairman Thomas Jordan said on Friday. (RTRS)

SWITZERLAND: Swiss voters backed a plan to reform the state pension system, which includes women working longer and higher sales taxes. (BBG)

RATINGS: Rating reviews of note from after hours on Friday include:

- S&P affirmed Germany at AAA; Outlook Stable

- DBRS Morningstar confirmed the European Union at AAA, Stable Trend

- DBRS Morningstar confirmed Finland at AA (high), Stable Trend

ENERGY: The European Union’s plan to contain the energy crunch will give member states leeway to cut electricity consumption less than currently proposed, Corriere della Sera reported, citing a draft document. (BBG)

U.S.

FED: Federal Reserve Chair Jerome Powell said the US economy may be entering a “new normal” following disruptions from the Covid-19 pandemic. (BBG)

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said the strong US job market suggests the economy could slow down in “a relatively orderly way” as the central bank bears down on inflation by raising interest rates. (BBG)

FED: The Federal Reserve's aggressive monetary tightening campaign has made scant difference in easing or narrowing U.S. inflation pressures so far, Atlanta Fed research director David Altig told MNI Friday. (MNI)

EQUITIES: Investors are buying record amounts of insurance contracts to protect themselves from a sell-off that has already wiped trillions of dollars off the value of US stocks. (FT)

OTHER

TAIWAN: U.S. Vice President Kamala Harris will discuss Taiwan security during bilateral meetings with the leaders of Japan and South Korea when she visits the region next week, a senior administration official said on Friday. (RTRS)

TAIWAN: China has accused the United States of sending “very wrong, dangerous signals” on Taiwan after the U.S. secretary of state told his Chinese counterpart on Friday that the maintenance of peace and stability over Taiwan was vitally important. (RTRS)

JAPAN: Japanese Finance Minister Shunichi Suzuki issued a fresh warning on Monday about the weakening yen, saying that authorities stood ready to respond to speculative moves behind the currency's falls. (RTRS)

JAPAN: Japan likely won't intervene in the currency market to defend a line-in-the-sand such as 145 yen versus the dollar, and instead limit any further action to smoothing operations aimed at taming volatility, former top currency diplomat Naoyuki Shinohara said. (RTRS)

AUSTRALIA/CHINA: China’s Foreign Minister Wang Yi says Beijing is willing to work with Australia to resolve the differences between the two countries, following a bilateral meeting on the sidelines of the UN General Assembly. (Australian Financial Review)

BOK: South Korea's consumer prices are likely to stay in the 5-6 percent range for a considerable period of time amid high energy and food prices and the local currency's sharp weakness against the U.S. dollar, the chief of the country's central bank said Monday. (Yonhap)

SOUTH KOREA: South Korea's finance minister said the government would prepare more measures to stabilise the foreign exchange market, while downplaying the need for a currency swap arrangement with the United States. (RTRS)

NORTH KOREA: North Korea fired an unspecified ballistic missile toward the East Sea on Sunday, South Korea's military said, two days after a nuclear-powered U.S. aircraft carrier arrived here for allied drills. (Yonhap)

HONG KONG: Hong Kong can’t remove all travel restrictions at this stage of the Covid pandemic, though there is room to quickly relax local social distancing rules, the city’s health chief said. (BBG)

RUSSIA: Russia's top diplomat on Saturday said regions of Ukraine where widely-derided referendums are being held would be under Russia's "full protection" if they are annexed by Moscow, amid fears Russia could further escalate the conflict and even use nuclear weapons. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskyy said Russia's threat of nuclear weapons use "could be a reality," in an interview with CBS' "Face the Nation" Sunday. (CNBC)

RUSSIA: The United States has warned Russia privately of "catastrophic" consequences if it uses nuclear weapons as part of the Ukraine invasion, top U.S. officials said. (AFP)

RUSSIA: The United States is prepared to impose additional economic costs on Russia in conjunction with U.S. allies if Moscow moves forward with Ukraine annexation, the White House said on Friday. (RTRS)

RUSSIA: The European Union is united in seeking to extend economic sanctions against Russia, Croatian Prime Minister Andrej Plenkovic said. (BBG)

RUSSIA: China supports all efforts conducive to the peaceful resolution of the "crisis" in Ukraine, its foreign minister Wang Yi told the United Nations General Assembly on Saturday, adding that the pressing priority was to facilitate peace talks. (RTRS)

RUSSIA: Russian Finance Ministry expects 939b rubles ($16.2b) of extra oil and gas revenue next year, this amount may be allocated to FX-purchases under new budget rule, Vedomosti reports, citing copies of budget documents and unidentified people. (BBG)

SOUTH AFRICA: South Africa’s struggling state-owned utility Eskom will extend power interruptions on the national grid until Thursday, the company said on Twitter. (BBG)

IRAN: Iran must deal decisively with protests which have swept the country after the death in custody of a woman detained by the Islamic Republic's morality police, President Ebrahim Raisi said on Saturday. (RTRS)

IMF: The IMF’s lending to economically troubled countries has hit a record high as the world’s lender of last resort battles simultaneous crises that have pushed at least five countries into default, with more expected to follow. (FT)

METALS: Maike Metals International is selling assets and studying a broader restructuring as it battles to survive a liquidity crisis, said chair He Jinbi in an interview with the Financial Times. (FT)

OIL: Vitol will need buy-in from governments and will also need to hear from its customers before deciding on whether to participate in the G-7 price cap, CEO Russell Hardy said at the APPEC 2022 oil conference hosted by S&P Global Commodity Insights on Monday. (BBG)

OIL: Russia's offline primary oil refining capacity was revised down by 3.6% for September from the previous plan to 4.233 million tonnes, according to sources and Reuters calculations. (RTRS)

CHINA

PBOC: The market expects the People's Bank of China to ease policy further over coming months, the Securities Times reported citing a survey of 76 industry insiders. (MNI)

PBOC/YUAN: China brought back a tool to make it more expensive to bet against the yuan via onshore derivatives, after the currency edged close to the weak end of its trading band. (BBG)

YUAN: The yuan has surpassed the Japanese yen to become the fourth most used payment currency in the world, with its share of international payments rising to a record high of 3.2% in January 2022, the Shanghai Securities News reported citing the central bank’s RMB Internationalization Report 2022. (MNI)

FISCAL: New infrastructure construction is the focus of China’s recent pro-growth measures and the country will accelerate the launch of a batch of projects to expand domestic demand, National Development and Reform Commission’s official Zhang Zhihua says at a briefing. (BBG)

PROPERTY: China Construction Bank will set up a rental housing fund worth CNY30 billion that will transform real estate developers’ unsold housing into long-term, affordable rental housing. (MNI)

FDI: Authorities at local levels will focus on implementation of various support measures for foreign investment, strengthen communications with foreign companies, solve their problems in a timely manner and accelerate construction of landmark foreign-funded projects in the manufacturing sector, according to a statement from Ministry of Commerce after a meeting held on Sept. 22 on the subject. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY133 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday injected CNY42 billion via 7-day reverse repos and CNY93 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operations have led to a net injection of CNY133 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at quarter-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8330% at 09:45 am local time from the close of 1.5554% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Friday vs 47 on Thursday.

CHINA SETS YUAN CENTRAL PARITY AT 7.0298 MON VS 6.9920 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a seventh trading day at 7.0298 on Monday, compared with 6.9920 set on Friday, marking the weakest fixing since July 7, 2020.

OVERNIGHT DATA

JAPAN SEP, P JIBUN BANK FLASH MANUFACTURING PMI 51.0; AUG 51.5

JAPAN SEP, P JIBUN BANK SERVICES PMI 51.9; AUG 49.5

JAPAN SEP, P JIBUN BANK COMPOSITE PMI 50.9; AUG 49.4

We’re still seeing a volatile trend in PMI data for Japan as COVID-19 restrictions continue to impede parts of the economy. A further loosening of restrictions aided an expansion in September, but overall growth remains subdued as inflationary pressures and deteriorating global economic growth weigh on activity in both the manufacturing and services sectors. Typhoon Nanmodol has also caused significant disruption and is likely to leave an economic impact in its wake. (S&P Global)

UK SEP RIGHTMOVE HOUSE PRICE INDEX +0.7% M/M; AUG -1.3%

UK SEP RIGHTMOVE HOUSE PRICE INDEX +8.7% Y/Y; AUG +8.2%

MARKETS

SNAPSHOT: Fresh All-Time Lows For Cable, With Further UK Fiscal Support Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 712.95 points at 26441.8

- ASX 200 down 84.533 points at 6491.7

- Shanghai Comp. down 2.604 points at 3085.765

- JGB 10-Yr future down 60 ticks at 148.09, yield up 1.6bp at 0.253%

- Aussie 10-Yr future down 3.0 ticks at 96.025, yield up 3.4bp at 3.944%

- U.S. 10-Yr future -0-13+ at 112-06+, yield up 6.39bp at 3.7485%

- WTI crude down $0.41 at $78.33, Gold down $5.9 at $1638.0

- USD/JPY up 74 pips at Y144.05

- POWELL SAYS ECONOMY MAY BE ENTERING ‘NEW NORMAL’ AFTER PANDEMIC (BBG)

- FED’S BOSTIC SAYS US COULD HAVE A ‘RELATIVELY ORDERLY’ SLOWDOWN (BBG)

- GBP/USD PRINTS FRESH ALL-TIME LOW ON WORRY RE: UK FISCAL POLICY

- KWARTENG: I WANT TO KEEP CUTTING TAXES (BBC)

- ITALY'S MELONI CALLS FOR UNITY AFTER ELECTION VICTORY (RTRS)

- CHINA REINSTATES RISK RESERVES FOR DERIVATIVES TO SUPPORT YUAN (BBG)

US TSYS: Weaker On UK Fiscal & Italian Political Mix

TYZ2 prints around the base of its 0-18+ overnight range into London hours, on volume of ~115K. Cash Tsys sit 4-7.5bp cheaper, with intermediates leading the weakness.

- Regional reaction to Friday’s Gilt-driven weakness in core global FI markets and the prospect of further fiscal support in the UK applied pressure during the early rounds of Asia-Pac dealing.

- The victory of the centre-right coalition in the Italian election, alongside the inability of that faction to secure a super majority (the most market “unfriendly” outcome), added further pressure.

- 2- & 3-Year yields have registered fresh cycle highs after the previous extremes limited weakness in the space earlier in the day.

- The 5-/30-Year yield spread has printed a fresh cycle low, while the 2-/10-Year yield curve is little changed, hovering a little above its own cycle extremes (J.P.Morgan have recommended initiating 2-/10-Year flatteners).

- Flow was headlined by a block sale of FV futures (-10K) and block buy of the TYX2 110.00/114.00 strangle (+10K).

- Dallas & Chicago Fed activity data, 2-Year Tsy supply and Fedspeak from Mester, Bostic, Collins & Logan headline domestic matters on Monday.

- Gilt reaction to fiscal-related weekend rhetoric and any European reaction to the Italian election will be eyed in pre-NY dealing.

JGBS: Curve Notably Steeper, Futures Lower But Not Challenging Recent Base

Futures hit the lunch bell -54 vs. Thursday’s settlement, with the bulk of the movement coming during the early rounds of Tokyo trade.

- Wider FI market dynamics in the driving seat, as opposed to idiosyncratic matters.

- Last week’s low (147.94) in the contract wasn’t tested and continues to provide initial technical support.

- Cash JGB trade saw the major benchmarks run 1.0-.7.5bp cheaper, with 10-Year yields being capped by the upper limit of the BoJ’s YCC mechanism.

- 20s and 40s have registered fresh cycle highs on the move.

- Familiar language was deployed by Japanese Finance Minister Suzuki, which failed to impact JPY, as you would expect.

- BoJ Rinban operations drew the following offer/cover ratios:

- 1- to 3-Year: 2.74x (prev. 1,73x)

- 3- to 5-Year: 2.15x (prev. 1.66x)

- 5- to 10-Year: 2.13x (prev. 3.27x)

- Offer/cover levels remain contained, even with 10-Year yields challenging the upper limit of the BoJ’s YCC.

AUSSIE BONDS: Holding Flatter, OIS Moves Higher Again

Aussie bond futures have stuck to relatively tight ranges during Sydney dealing, failing to probe their respective overnight session bases, leaving YM -9.5 and XM -3.0 as we move towards the Sydney close.

- Wider cash ACGB trade sees the major benchmarks running 9bp cheaper to little changed, with the flattening impetus maintained through the session.

- Bills run 8-18bp cheaper through the reds, with RBA dated OIS adjusting higher in early Sydney trading.

- OIS now price ~45bp of tightening for next month’s RBA, while terminal rate expectations sit at ~4.30%, a little shy of session highs, but still ~15bp firmer on the day.

- The 3-/10-Year EFP box has flattened, with payside flows/hedging linked to the aforementioned OIS repricing likely helping 3-Year EFP push ~6bp wider, while 10-Year EFP is ~1bp wider.

- The lack of meaningful domestic headline flow and scope of the moves in core global FI markets left broader drivers at the fore.

- Tomorrow’s domestic docket is slim, with I/L supply from the AOFM the only point of note.

EQUITIES: Growth Sensitive Equities Falter

Outside of China and Hong Kong, broader equity market sentiment has been weak. US futures are in the red (-0.60%), with negative spill-over from a stronger USD (particularly against GBP) evident in the equity space today. The risk averse tone from late last week has persisted, particularly in relation to growth sensitive stocks (tech/commodities).

- The HSI is in positive territory (last +0.17%), with tech shares (+2.33%) jumping, albeit from very depressed levels, while Macau casinos are up on a report mainland tours could resume as soon as November.

- Mainland China shares are also trading resiliently. Early impetus came from property developers after a report that China Construction Bank will buy assets off developers. However, we are now away from best levels, while the aggregate Shanghai composite index is down smalls.

- Growth/rate sensitive markets in South Korea and Taiwan have faltered. The Kospi is off by around 3%, the Taiex -2.25%.

- Australian shares are down by around 1.35%, with mining related stocks seeing the sharpest falls.

OIL: Can't Escape Broader Risk Aversion/Demand Concerns

Brent crude's earlier spike above $87/bbl quickly gave way to fresh selling pressure. There is still support evident around $85.50 though, with crude not dipping below this support level, which was also evident through the Friday offshore session as well. We last tracked just above this level at $86.65. WTI is around $78.30 currently, displaying similar trends.

- Oil headwinds continue to persist from the broader demand standpoint, particularly as major central banks tighten policy to curb inflation pressures, which is taking precedence over any growth concerns.

- On the supply front, Iran looks boost capacity to 5.7mn barrels per day over the medium term and is seeking outside investment even without a fresh nuclear deal with the US.

- Elsewhere though, at the Singapore Asia Pac Petroleum Conference, the focus is on OPEC+ supply and when the organization might respond to weaker demand conditions as we move into Q4.

- There is also a tropical storm off the coast of Florida, which will be eyed for potential supply disruptions later in the week.

GOLD: Fresh Lows Back To 2020

Gold has seen little support today, despite fresh risk aversion flows in the market. The precious metal last tracked just under $1639 (-0.30% for the session). On-going USD strength, particularly against the pound, has been the main driver of sentiment today.

- We dipped below $1630 briefly in earlier trade today, before rebounding. We have since not drifted too far away from the $1638/$1642 region, although the bias remains skewed to the downside.

- Lows close to $1600 from early April 2020 around $1610 are the likely next target.

- We continue to see higher core yields. To the extent this weighs on broader equity market sentiment further could benefit gold at some stage but with this could be countered by further on-going USD strength.

FOREX: UK Fiscal Outlook Sends Cable To Record Lows, PBOC Slaps 20% Risk RRR On FX Forward Sales

Aggressive sterling sales resumed Monday morning as PM Truss' government stood by its mini-budget which inspired sharp depreciation in the exchange rate last Friday. In the weekend round of interviews, Chancellor Kwarteng played down the initial market reaction to his fiscal plans and doubled down on his pledge to cut taxes and boost spending, while refusing to commit to any limit on borrowing.

- The Telegraph reported that Truss could face a rebellion from Tory backbenchers if cable falls to parity, while the pound's sharp depreciation has raised questions about the likelihood of BoE action to rescue the beleaguered currency.

- GBP/USD tumbled to an all-time low of $1.0350 before stabilising near the $1.0500 mark in a volatile session. Implied volatilities were sharply higher across the maturity curve, with one-month tenor printing best levels since the outbreak of the COVID-19 pandemic.

- EUR/GBP surged to its highest point since Sep 2020, taking out the GBP0.9100 figure in the process. The single currency showed little in the way of outright reaction to the preliminary results of Italy's general election, with the right-wing bloc on track for an absolute majority.

- Sterling weakness underpinned USD outperformance as the BBDXY index advanced to a new record high of 1,355. The greenback drew additional support from higher U.S. Tsy yields as cash trading resumed in Tokyo after Japan's long weekend.

- USD strength pushed USD/JPY towards the Y144.00 mark, even as Japanese officials rattled the intervention sabre. FinMin Suzuki expressed concern about "speculative moves" and vowed readiness to step in if needed.

- Offshore yuan got some brief reprieve as the PBOC slapped a 20% risk reserve requirement on FX forward sales, but spot USD/CNH promptly resumed its uptrend, with the USD/CNY mid-point set above CNY7.0 for the first time since 2020.

- The central bank speaker slate is tightly packed today. President Lagarde headlines a parade of ECB members, while comments are also due from Fed's Bostic, Mester & Logan, as well as BoE's Tenreyro & BoJ's Kuroda. German Ifo survey takes focus on the data front.

FX OPTIONS: Expiries for Sep26 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700-20(E701mln), $0.9800(E594mln), $0.9900-10(E1.7bln), $1.0000-20(E563mln)

- USD/JPY: Y140.00($1.0bln)

- GBP/USD: $1.1500(Gbp513mln)

- AUD/USD: $0.6550(A$966mln)

- USD/CAD: C$1.3600($704mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/09/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 26/09/2022 | 0700/0900 |  | EU | ECB de Guindos Speaks with AED in Madrid | |

| 26/09/2022 | 0730/0930 |  | EU | ECB Panetta Speaks at Bundesbank | |

| 26/09/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 26/09/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 26/09/2022 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 26/09/2022 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 26/09/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/09/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 26/09/2022 | 1600/1700 |  | UK | BOE Tenreyro Speaks on Climate Change | |

| 26/09/2022 | 1630/1230 |  | US | Dallas Fed's Lorie Logan | |

| 26/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2022 | 2000/1600 |  | US | Cleveland Fed's Loretta Mester | |

| 27/09/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/09/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/09/2022 | 1015/0615 |  | US | Chicago Fed's Charles Evans | |

| 27/09/2022 | 1100/1200 |  | UK | BOE Pill Panels CEPR Barclays Monetary Policy forum | |

| 27/09/2022 | 1130/1330 |  | EU | ECB Lagarde in Panel at Banque de France | |

| 27/09/2022 | 1130/0730 |  | US | Fed Chair Jerome Powell | |

| 27/09/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/09/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/09/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/09/2022 | 1300/1500 |  | EU | ECB de Guindos Speaks at Barclays-CEPR Forum | |

| 27/09/2022 | 1355/0955 |  | US | St. Louis Fed's James Bullard | |

| 27/09/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 27/09/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/09/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/09/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 27/09/2022 | 0035/2035 |  | US | San Francisco Fed's Mary Daly | |

| 28/09/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/09/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/09/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/09/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/09/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/09/2022 | 0715/0915 |  | EU | ECB Lagarde at Frankfurt Forum Discussion | |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/09/2022 | 0815/0915 |  | UK | BOE Cunliffe Keynote at AFME Conference | |

| 28/09/2022 | 0900/1100 | * |  | IT | Industrial Orders |

| 28/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/09/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/09/2022 | 1235/0835 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/09/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/09/2022 | 1410/1010 |  | US | St. Louis Fed's James Bullard | |

| 28/09/2022 | 1415/1015 |  | US | Fed Chair Jerome Powell | |

| 28/09/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 28/09/2022 | 1500/1700 |  | EU | ECB Elderson Intro at Greens/EFA Event | |

| 28/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 28/09/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/09/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 28/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/09/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 28/09/2022 | 1800/1900 |  | UK | BOE Dhingra Chairs Panel at LSE | |

| 29/09/2022 | 0700/0900 |  | EU | ECB Panetta Intro at ECOFIN Hearing | |

| 29/09/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/09/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/09/2022 | 0800/1000 |  | EU | ECB de Guindos Speech at BIS/Bank of Lithuania | |

| 29/09/2022 | 0800/1000 |  | IT | PPI | |

| 29/09/2022 | 0815/1015 |  | EU | ECB Elderson Speech at Nederlandsche Bank & OMFIF | |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/09/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 29/09/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 29/09/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/09/2022 | 0930/1130 |  | EU | ECB de Guindos Opens ECB Research Workshop | |

| 29/09/2022 | 1130/1230 |  | UK | BOE Ramsden Panels Lithuania CB/BIS Conference | |

| 29/09/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/09/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 29/09/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 29/09/2022 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 29/09/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 29/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 29/09/2022 | 1500/1600 |  | UK | BOE Tenreyro Panellist at Centre for Economic Policy Research | |

| 29/09/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester | |

| 29/09/2022 | 1700/1900 |  | EU | ECB Lane Panels ECB/Cleveland Fed Conference | |

| 29/09/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

| 29/09/2022 | 2045/1645 |  | US | San Francisco Fed's Mary Daly | |

| 30/09/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 30/09/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/09/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/09/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/09/2022 | 0645/0845 | ** |  | FR | PPI |

| 30/09/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/09/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 30/09/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/09/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 30/09/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/09/2022 | 1100/1300 |  | EU | ECB Elderson in Discussion at Uni Amsterdam | |

| 30/09/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/09/2022 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 1300/0900 |  | US | Fed Vice Chair Lael Brainard | |

| 30/09/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/09/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 30/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 30/09/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/09/2022 | 1530/1730 |  | EU | ECB Schnabel Panels La Toja Forum | |

| 30/09/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 30/09/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 2015/1615 |  | US | New York Fed's John Williams | |

| 03/10/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 03/10/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/10/2022 | 1305/0905 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/10/2022 | 1800/1900 |  | UK | BOE Mann Panellist at CD Howe Institute | |

| 04/10/2022 | 0130/1230 | ** |  | AU | Lending Finance Details |

| 04/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/10/2022 | 0900/1100 | ** |  | EU | PPI |

| 04/10/2022 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 04/10/2022 | 1315/0915 |  | US | Cleveland Fed's Loretta Mester | |

| 05/10/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/10/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/10/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/10/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/10/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/10/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/10/2022 | 1230/0830 | * |  | CA | Building Permits |

| 05/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/10/2022 | 2000/1600 |  | US | Atlanta Fed's Raphael Bostic | |

| 06/10/2022 | 0130/1230 | ** |  | AU | Trade Balance |

| 06/10/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/10/2022 | 0900/1100 | ** |  | EU | retail sales |

| 06/10/2022 | 1230/0830 | * |  | CA | Ivey PMI |

| 06/10/2022 | 1535/1135 |  | CA | BOC Governor Macklem speech | |

| 06/10/2022 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 06/10/2022 | 1700/1300 |  | US | Chicago Fed's Charles Evans | |

| 06/10/2022 | 2200/1800 |  | US | Cleveland Fed's Loretta Mester | |

| 07/10/2022 | 0645/0845 | * |  | FR | Current Account |

| 07/10/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/10/2022 | 1025/1125 |  | UK | BOE Ramsden Speech at Securities Industry Conference | |

| 07/10/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/10/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 08/10/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 10/10/2022 | 1200/0800 |  | US | Chicago Fed's Charles Evans | |

| 10/10/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/10/2022 | 1600/1200 |  | US | Fed Vice Chair Lael Brainard | |

| 11/10/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 11/10/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 11/10/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 11/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 11/10/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/10/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/10/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/10/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/10/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/10/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/10/2022 | 0900/1100 | ** |  | EU | industrial production |

| 12/10/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 13/10/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 14/10/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 14/10/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 17/10/2022 | 2301/0001 | * |  | UK | Rightmove House Prices Index |

| 17/10/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/10/2022 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 17/10/2022 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 17/10/2022 | 2000/1600 |  | CA | BOC Deputy Rogers panel talk at Toronto Centre | |

| 18/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/10/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 19/10/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/10/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/10/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/10/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/10/2022 | 1230/0830 | *** |  | CA | CPI |

| 19/10/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 20/10/2022 | 0130/1230 | *** |  | AU | Labor force survey |

| 20/10/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/10/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 21/10/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/10/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/10/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/10/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/10/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 25/10/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/10/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 26/10/2022 | 0130/1230 | *** |  | AU | CPI inflation |

| 26/10/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/10/2022 | 0800/1000 | ** |  | EU | M3 |

| 26/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/10/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/10/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 26/10/2022 | 1500/1100 |  | CA | BOC Governor Press Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.