-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasuries Sit Firmer Ahead of June Jobs

MNI (LONDON) - Highlights:

- Treasuries sit firmer ahead of June jobs report

- Markets expect 190k jobs added, but devil's in the details

- UK election in line with expectations, with transition of government unlikely to trigger S/T changes

US TSYS: Steadily Richer Ahead Of Payrolls

- Cash Treasuries trade firmer after Independence Day, steadily rallying since the Asia open with the front end pushing towards Wednesday’s highs and the longer end through respective highs.

- Cash yields sit 2-3bp lower, led by the belly, whilst 2s10s at -34.6bps broadly consolidates Wednesday's flattening having previously lurched 23bp higher in the space of a week to -27.4bps

- TYU4 has climbed to 110-04 to match Wednesday’s high, where it's met some resistance ahead of payrolls. Initial firm resistance is seen at 110-16 (Jun 28 high) but the bear threat is still present with support at 109-02+ (Jul 1 low) just above the key support at 109-00+ (Jun 10 low).

- J.P.Morgan warn that Tsy yield reaction to NFP surprises during the July 4 week are around 90% larger than what is seen on a typical NFP Friday (based on historical data, assessing fixed magnitudes of surprise), best explained by liquidity impairment.

- Data: Payrolls (0830ET) – see the MNI Preview here.

- Fedspeak: Monetary Policy Report (historically 1100ET)

STIR: September Cut Odds Build Ahead Of Payrolls, Mon Pol Report Later Today

- Fed Funds implied rates have dipped a little after Independence Day to leave them at the bottom of Thursday’s dovish data driven range, with September pricing of note at it shifts closer to a cut ahead of nonfarm payrolls.

- Cumulative cuts from 5.33% effective: 2.5bp Jul, 20.5bp Sep, 30bp Nov, 48bp Dec and 62bp.

- NY Fed’s Williams (voter) is currently speaking at a RBI event in Mumbai after non-market moving prepared remarks which noted that inflation progress has been “significant” but the job is not done. Full text here.

- Williams is technically today’s only scheduled speaker but the Fed’s Monetary Policy Report will be published today (historically at 1100ET) ahead of Powell’s Congressional appearances next week. It can help set the tone for Powell’s remarks but ultimately his prepared remarks will be published on Tuesday on the day of his Senate testimony.

UK: Sunak To Step Down As Conservative Leader; Change Of Gov't Taking Place

Rishi Sunak has delivered his final address as PM from outside 10 Downing St following the historic loss for his Conservative party in the 4 July election. During his speech he apologised for the party's catastrophic performance, saying "I have heard your anger, disappointment and I take responsibility for this loss," He confirmed that he would resign as party leader, but not immediately. Instead, like John Major in 1997 he will remain in position until the contest to decide his successor has taken place. Says that incoming PM Sir Keir Starmer is a #"decent public-spirited man who I respect".

- Sunak is now at Buckingham Palace offering his resignation to the King. Starmer will then travel to meet with the King himself where the sovereign will invite the Labour leader to form a gov't in his name. Starmer will then travel to Downing St. as prime minister. The change in gov't will take place in a matter of minutes, in stark contrast to most other nations that see lengthy demissionary or 'lame duck' periods for outgoing gov'ts or presidents.

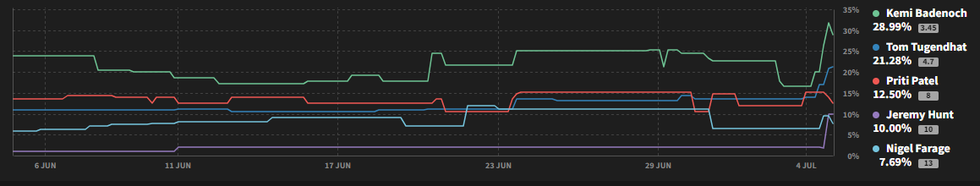

- With Sunak's resignation there will be a scramble among the few remaining Conservative MPs for the party leadership. While not market relevant, given the party will now sit in opposition for five years (at least), whether the Conservatives tack towards the pro-business centre-right or populist anti-immigration right could determine whether the party has a chance of winnng back power in 2029 or is destined for a decade or more in the wilderness.

Chart 1. Political Betting Market Implied Probability of Next Conservative Leader, %

Source: Smarkets

Source: Smarkets

UK: Election Analyst Views Round-Up

In the aftermath of the centre-left Labour party’s historic victory in the 4 July general election, below we highlight some of the more interesting and pertinent views from analyst research notes.

Full article PDF attached below:

MNIPOLITICALRISK–UKElectionAnalystViews.pdf

FRANCE DATA: France Industrial Production Y/Y Lowest Since October 2022

France Industrial Production disappointed on both a yearly and monthly basis in May making it the lowest since October 2022 after reaching the highest level seen since November 2023 last month in Y/Y terms. Industrial Production printed at -2.1%Y/Y (vs -1.1% consensus, 1.1% revised prior from 0.9%) and -3.1% M/M (vs -0.5% consensus, 0.6% revised prior from 0.5%).

- The deterioration was driven by manufacturing production (which accounts for over 80% of industrial production). This component fell 2.7% M/M (vs growth of 0.5% in April). As a result on a Y/Y basis, it saw its weakest reading since February 2021 printing at -3.9% Y/Y (vs 1.4% prior).

- Within manufacturing production, 4 of 5 sub components deteriorated. In particular, 'Other industrial products' decreased 3.5% M/M (vs 0.9% growth in April) - making it the largest fall since April 2020 during the Covid pandemic. In addition, Capital goods declined 4.6% M/M (vs a 2.8% rise in April) - the weakest level since December 2023. This was followed by Agri-food industries seeing production fall 0.6% M/M (vs -0.7% last month) and Transport equipment production falling 0.7% M/M (vs -2.4% M/M prior).

- Outside manufacturing, the main extractive industries, energy and water production area saw its third consecutive monthly improvement of +1.1% M/M (vs +1.3% revised prior).

- The press release highlights "Production over the last three months (March to May 2024) is lower than that of the same three months of the previous year in the manufacturing industry (-0.5%) as in the industry as a whole (-0.4%)."

- The press release also continues to state that due to higher energy costs relative to Q2-21 (i.e. before they were impacted by the Russian invasion of Ukraine), production in energy-intensive manufacturing is much lower. Most notably for steel (-26.0%) and basic chemicals (-14.7%).

UK Election Results Stick to Expectations, GBP/USD Bounce Persists

- UK election results came and went with little market reaction. As expected over the past few weeks and months, the opposition Labour party won a sizeable majority in the Commons, and will form the next government, displacing the Conservatives and ousting the PM Sunak. GBP has proved relatively unresponsive, and is broadly flat against the rest of G10. This keeps the technical parameters in EUR/GBP unchanged, with the 0.8456-0.8499 range the consolidative range after the rally off June lows.

- JPY outperforms, extending its correction off the multi-decade lows posted earlier this week. USD/JPY has opened a near 150 pip gap with the 161.95 level, leaving focus on the US jobs data later today to provide the next leg for the pair.

- Despite the proximity to the NFP report, implied vols across G10 FX remain well subdued, suggesting a likely muted intraday response to today's jobs release, absent a major surprise. MXN, BRL and GBP are posting vol premiums of just over 5 points apiece, which falls short of the prevailing levels before the other jobs prints this year, and could suggest a more muted reaction this month. USD/JPY breakevens, for example, price a ~60 pip swing into the Friday cut, vs. The 50-55 pip YTD average.

- The US and Canadian jobs reports are due, with markets expecting the US to have added 190k jobs over the month, keeping the unemployment rate unchanged at 4.0%. However Canada's unemployment rate is seen ticking higher by 0.1ppts to 6.3%. Central bank speakers are set to include Fed's Williams and ECB's Lagarde.

Expiries for Jul05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E816mln), $1.0715-25(E812mln), $1.0763-70(E787mln), $1.0800(E2.5bln)

- AUD/USD: $0.6750(A$699mln)

- USD/CAD: C$1.3685-00($985mln)

- USD/CNY: Cny7.2900($1.1bln), Cny7.3150($2.1bln), Cny7.3400($1.0bln)

E-Mini S&P Trading at Weekly High, Trend Conditions Bullish

Eurostoxx 50 futures have traded higher this week. Attention is on resistance at 5039.84, 61.8% retracement of the May 16 - Jun 14 sell-off. Clearance of this level would be a positive development and suggest scope for an extension of the bull cycle that started Jun 14. This would open 5082.32, the 76.4% retracement point. On the downside, a reversal would refocus attention on 4846.00, Apr 19 low and a key support. The trend condition in S&P E-Minis remains bullish. Resistance at 5430.75, the May 23 high and bull trigger, has recently been cleared. This break confirmed a resumption of the primary uptrend. The move higher this week confirms a recent bull flag formation on the daily scale. This is a continuation pattern and reinforces bullish conditions. Sights are on the 5600.00 handle. Support to watch is 5505.46, the 20-day EMA.

- Japan's NIKKEI closed lower by 1.28 pts or 0% at 40912.37 and the TOPIX ended 14.29 pts lower or -0.49% at 2884.18.

- Elsewhere, in China the SHANGHAI closed lower by 7.634 pts or -0.26% at 2949.933 and the HANG SENG ended 228.67 pts lower or -1.27% at 17799.61.

- Across Europe, Germany's DAX trades higher by 152.24 pts or +0.83% at 18603.91, FTSE 100 higher by 16.4 pts or +0.2% at 8257.91, CAC 40 up 20.95 pts or +0.27% at 7717.65 and Euro Stoxx 50 up 21.26 pts or +0.43% at 5009.34.

- Dow Jones mini up 13 pts or +0.03% at 39646, S&P 500 mini up 2 pts or +0.04% at 5592.25, NASDAQ mini up 25.25 pts or +0.12% at 20437.

Gold Extends Recovery From Late-June Lows, Below Initial Resistance

A bull cycle in WTI futures remains in play and the contract is holding on to its recent gains. The recent breach of $80.11, the May 29 high and a key resistance, strengthened a bullish theme. Note too that $82.24, 76.4% of the Apr 12 - Jun 4 bear leg, has been cleared. Moving average studies are in a bull-mode set-up too. Sights are on $85.27, the Apr 12 high and a bull trigger. Initial firm support to watch is $79.37, the 50-day EMA. Gold has traded higher but, price remains inside a range - for now. A bear threat is present and the sell-off on Jun 7 reinforced a S/T bearish theme. Price has pierced the 50-day EMA, at 2322.2. A clear break of this average would confirm a resumption of the reversal from May 20 and open $2277.4, May 3 low. Initial firm resistance is $2387.8, Jun 7 high. A clear break would be a bullish development. Key resistance is at $2450.1, the May 20 high.

- WTI Crude up $0.21 or +0.25% at $84.14

- Natural Gas down $0.05 or -2.07% at $2.37

- Gold spot up $8.97 or +0.38% at $2366.09

- Copper up $8.4 or +1.85% at $461.65

- Silver up $0.18 or +0.58% at $30.587

- Platinum up $9.72 or +0.97% at $1010.262

| Date | GMT/Local | Impact | Country | Event |

| 05/07/2024 | 1215/1415 | ECB's Elderson in Panel on data culture at DiFoR Conference | ||

| 05/07/2024 | 1230/0830 | *** | Employment Report | |

| 05/07/2024 | 1230/0830 | *** | Labour Force Survey | |

| 05/07/2024 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 05/07/2024 | 1400/1000 | * | Ivey PMI | |

| 05/07/2024 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 05/07/2024 | 1715/1915 | ECB's Lagarde speech at Les Rencontres Economiques d'Aix-en-Provence 2024 | ||

| 07/07/2024 | - | Second round election |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.