-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Friday The 13th Proves Unlucky For The BoJ

EXECUTIVE SUMMARY

- FED'S BOSTIC: NEW INFLATION DATA GIVES 'COMFORT' FOR SMALLER RATE HIKES (CBS)

- BOE'S MANN DOES NOT SEE RISK OF RAISING RATES TOO HIGH (RTRS)

- UK AND EU AIM FOR DEAL TO END BREXIT CLASH IN FRESH TALKS (BBG)

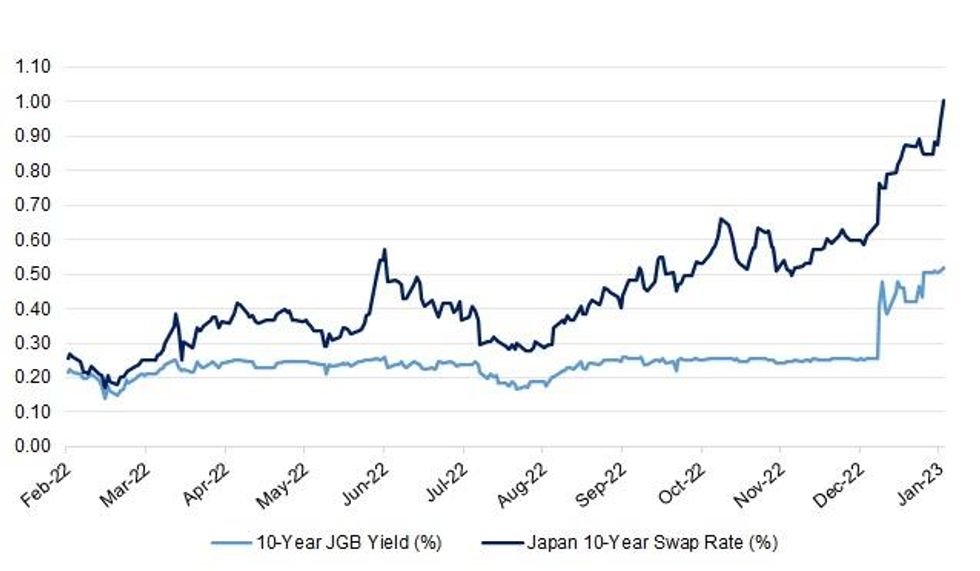

- BOJ’S YCC CAP BREACHED AHEAD OF NEXT WEEK’S MEETING

- BOJ WATCHERS SEE EARLIER POLICY SHIFT AFTER DECEMBER’S SURPRISE (BBG)

- CHINA TO ISSUE US$15BN PLAN TO SUPPORT RENTAL HOUSING LOANS (XINHUA)

Fig. 1: 10-Year JGB Yield Vs. Japan 10-Year Swap Rate

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England is not at the point in its interest rate-rising cycle where it needs to worry about the risk of over-tightening, Monetary Policy Committee member Catherine Mann said on Thursday. (RTRS)

ECONOMY/PROPERTY: UK mortgage payments have risen to their highest level since the 2008 financial crisis, hitting homeowners’ budgets and making it harder for Britons to buy a first property, according to the mortgage provider Nationwide. (FT)

BREXIT: Britain and the European Union have not yet entered a more intense phase of negotiations - the so-called negotiating "tunnel" - in their talks to amend post-Brexit trade rules for Northern Ireland, Irish Prime Minister Leo Varadkar said. (RTRS)

BREXIT: The European Union and the UK are preparing to enter an intense phase of negotiations starting next week aimed at overcoming the dispute over the post-Brexit trading relationship well ahead of the anniversary of Northern Ireland’s peace agreement in April, according to people familiar with the matter. (BBG)

FISCAL/POLITICS: Steve Barclay has privately conceded he will have to increase his pay offer to NHS staff, in a U-turn that may help to end the growing wave of strikes. (Guardian)

POLITICS: Boris Johnson could agree not to challenge Rishi Sunak's leadership after the local elections in exchange for a safe seat, close allies have claimed. (Sky)

RATINGS: Potential sovereign rating reviews of note slated for after hours on Friday include

- DBRS Morningstar on the United Kingdom (current rating: AA (high) Ratings Under Review With Negative Implications)

EUROPE

FISCAL: Italy's Prime Minister Giorgia Meloni on Thursday renewed her criticism of the euro zone bailout fund, a 500-billion-euro ($541.55 billion) facility held back by Rome's reluctance to ratify its recently-adopted reform. (RTRS)

ITALY: Prime Minister Giorgia Meloni’s government agreed to aid Italian households if oil prices increase significantly, potentially easing her refusal to extend a fuel-tax cut after a broad public outcry. (BBG)

ITALY/BTPS: Italy is targeting a return to the dollar funding market in 2023 after more than a year, but officials are carefully monitoring conditions and would need to see a closer alignment between BTP costs and those in U.S. currency, sources close to the matter told MNI. (MNI)

RATINGS: Potential sovereign rating reviews of note slated for after hours on Friday include

- Fitch On Luxembourg (current rating: AAA; Outlook Stable)

- Moody’s on Spain (current rating: Baa1; Outlook Stable)

- DBRS Morningstar on Ireland (current rating: AA (low), Stable Trend)

U.S.

FED: Data showing inflation slowed in December "was really welcome news" that may allow the U.S. Federal Reserve to scale back to quarter point rate increases at its upcoming meeting, Atlanta Federal Reserve Bank president Raphael Bostic said on Thursday. (RTRS)

FED: Richmond Fed President Thomas Barkin said Thursday he's supportive of a "shallower, potentially longer and potentially higher" path for the fed funds rate. (MNI)

FED: St. Louis Fed President James Bullard said Thursday he favors raising interest rates faster than some of his colleagues who want a stepdown in the pace to a quarter point. (MNI)

FED: The Federal Reserve says it is too early to think about cutting interest rates this year. Investors are growing more convinced that is exactly what the central bank is going to do. (WSJ)

FED: The Federal Reserve is likely to lift its benchmark interest rate above 5% to restrain inflation as long as the job market remains overheated, even with consumer prices falling in December for the first time since early 2020, former officials told MNI. (MNI)

FED: U.S. Senator Warren tweeted the following on Thursday: “Inflation has been slowing down for six months now. Families are getting relief. So before the Fed decides to jack up interest rates again and risk throwing millions of Americans out of work, they should take a look at the data.” (MNI)

FISCAL: The US government’s budget deficit widened by 12% for the first quarter of the fiscal year, presaging what’s set to be an intense political battle over fiscal policy. (BBG)

POLITICS: U.S. Attorney General Merrick Garland announced Thursday he was appointing Robert Hur to serve as a special counsel to review classified material found in President Joe Biden's Delaware residence and a Washington office he used. (NBC)

EQUITIES: Apple Inc. is cutting Chief Executive Officer Tim Cook’s compensation by more than 40% to $49 million in 2023, citing investor guidance and a request from Cook himself to adjust his pay. (BBG)

EQUITIES: Tesla has slashed prices on its top-selling electric vehicles for the U.S. market, the automaker's website showed, after it recently cut prices in China and missed Wall Street estimates for fourth quarter deliveries. (RTRS)

OTHER

GLOBAL TRADE: President Joe Biden will discuss cooperation on limiting China’s access to semiconductor technology in back-to-back visits to Washington by leaders of Japan and the Netherlands in the coming days. (BBG)

GLOBAL TRADE: Global smartphone makers are pessimistic as inventory digestion hasn’t improved from three months ago, Taipei-based Economic Daily News reports, citing Largan Chairman Lin En-ping. (BBG)

U.S./CHINA: China's Commerce Minister Wang Wentao said China is willing to listen to the opinions of foreign companies including U.S. firms, a ministry statement said on Friday. (RTRS)

UK/CHINA/HONG KONG: China's foreign ministry branch in Hong Kong urged the British government to stop its "so-called half-yearly report on Hong Kong", state media reported on Friday. (RTRS)

GEOPOLITICS: Japan and the U.S. paved the way to start planning specific ways to deploy counterstrike capabilities in their joint defense and foreign policy talks Wednesday, including through sharing intelligence from spy satellites. (Nikkei)

BOJ: International Monetary Fund Managing Director Kristalina Georgieva on Thursday said the Bank of Japan was conducting an appropriate review of its monetary policy stance, but should keep policy accommodative because the country faces low inflationary pressures. (RTRS)

JAPAN: The Japanese government's top economic policy panel will invite eight economists, including an expert on inflation in Japan, to its upcoming special sessions to discuss the country's long-term policies, Economy Minister Shigeyuki Goto said on Friday. The special meetings of the Council on Economic and Fiscal Policy will invite University of Tokyo professor Tsutomu Watanabe, a former Bank of Japan (BOJ) official known for his analysis of Japan's price trends and monetary policy responses, among others. Goto told a news conference that the sessions were not meant to discuss the BOJ's exit strategy from monetary easing or craft a new policy accord between the BOJ and the government. (RTRS)

BOJ: Bank of Japan watchers see a policy shift coming much sooner than previously thought, following December’s yield band adjustments that rocked global financial markets. (BBG)

BOK: South Korea's central bank delivered a quarter percentage-point interest rate hike Friday as it focuses on tackling persistently high inflation despite mounting worries over an economic slowdown. (Yonhap)

BOC: The Bank of Canada has little scope to cut interest rates amid inflation uncertainty and continued fiscal stimulus, former adviser to the prime minister and finance minister Robert Asselin told MNI. (MNI)

CANADA: Canada’s banking industry regulator will consider limiting how much firms are able to lend to riskier homebuyers as part of a review intended to safeguard the financial system from a housing slump. (BBG)

BRAZIL: Congressional Democrats added to pressure on President Joe Biden to kick Jair Bolsonaro out of the country, even as US officials stick to a wait-and-see approach in hopes that the former president of Brazil will make good on a promise to return home on his own. (BBG)

BRAZIL: Brazilian Finance Minister Fernando Haddad announced on Thursday a package of measures to increase revenue and cut spending in order to reduce an estimated primary deficit of 232 billion reais ($46 billion) in this year's budget. (RTRS)

RUSSIA: A Russia-linked ransomware gang was behind the Royal Mail cyber attack that forced it to suspend international postal deliveries leaving more than half a million parcels and letters stuck in limbo, The Telegraph can disclose. (Telegraph)

IMF: The International Monetary Fund is not expected to downgrade its forecast for 2.7% growth in 2023, the head of the global lender said on Thursday, noting that concerns about an oil price spike had failed to materialize and labor markets remained strong. (RTRS)

IRAN: The EU is considering fresh sanctions against nearly 40 Iranian individuals and entities, according to draft documents seen by POLITICO. (POLITICO)

PERU: Peru's central bank increased its benchmark interest rate by 25 basis points to 7.75% on Thursday, as monetary policymakers in the copper-producing Andean nation battle the highest inflation in a quarter of a century. (RTRS)

CHINA

PBOC: China looks set to inject medium-term cash to its financial system as upcoming traveling and gift-giving ahead of the Lunar New Year holidays are expected to drain some $148 billion from it. (BBG)

ECONOMY: China’s economy has momentum towards recovery, but support must be given to boost employment and consumption, Premier Li Keqiang said at a recent symposium. (MNI)

ECONOMY:China’s urban surveyed unemployment rate would drop below 5.5% should its GDP manage to reach 5% in 2023, the 21st Century Business Herald reported citing experts. (MNI)

PROPERTY: China’s regulators have further eased refinancing controls and have allowed more developers to issue new debt in a bid to ensure house delivery, China Business Network reported on Friday. (MNI)

PROPERTY: Chinese authorities will in the near-term issue further policies to support the rental housing market, which will include a 100 billion yuan ($14.86 billion) plan to support rental housing loans, the official Xinhua news agency reported on Friday. (RTRS)

EQUITIES/POLICY: China is moving to take “golden shares” in local units of Alibaba and Tencent as Beijng formalises a greater role in overseeing the country’s powerful tech groups. (FT)

EQUITIES/POLICY: Chinese authorities are set to allow Didi Global's ride-hailing and other apps back on domestic app stores as soon as next week, five sources told Reuters, in yet another signal that their two-year regulatory crackdown on the technology sector is ending. (RTRS)

CHINA MARKETS

PBOC NET INJECTS CNY130 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) on Friday conducted CNY55 billion via 7-day reverse repos and CNY 77 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY130 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable before Chinese New Year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 9:31 am local time from the close of 1.9865% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday, compared with the close of 47 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7292 FRI VS 6.7680 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7292 on Friday, compared with 6.7680 set on Thursday.

OVERNIGHT DATA

CHINA DEC TRADE BALANCE +US$78.01BN; MEDIAN +US$76.90BN; NOV +US$69.25BN

CHINA DEC EXPORTS (US$) -9.9% Y/Y; MEDIAN -11.1%; NOV -8.9%

CHINA DEC IMPORTS (US$) -7.5% Y/Y; MEDIAN -10.0%; NOV -10.6%

CHINA DEC TRADE BALANCE +CNY550.11BN; NOV +CNY494.33CNY

CHINA DEC EXPORTS (CNY) -0.5% Y/Y; NOV +0.9%

CHINA DEC IMPORTS (CNY) +2.2% Y/Y; NOV -1.1%

JAPAN DEC M2 MONEY STOCK +2.9% Y/Y; NOV +3.1%

JAPAN DEC M3 MONEY STOCK +2.5% Y/Y; NOV +2.7%

AUSTRALIA NOV HOME LOANS -3.7% M/M; MEDIAN -2.0%; OCT -2.8%

AUSTRALIA NOV OWNER-OCCUPIER HOME LOANS -3.8% M/M; OCT -3.1%

AUSTRALIA NOV INVESTOR HOME LOANS -3.6% M/M; OCT -2.3%

SOUTH KOREA DEC EXPORT PRICE INDEX +3.1% Y/Y; NOV +8.3%

SOUTH KOREA DEC EXPORT PRICE INDEX -6.0% M/M ; NOV -5.4%

SOUTH KOREA DEC IMPORT PRICE INDEX +9.1% Y/Y; NOV +14.0%

SOUTH KOREA DEC IMPORT PRICE INDEX -6.2% M/M ; NOV -5.5%

MARKETS

US TSYS: Cheaper, JGB Matters Dominate Asian Session

TYH3 deals at 115-03, -0-04+, at the lower end of its 0-09 range on volume of ~101K.

- Cash Tsys are 1-3bp cheaper across the curve, with 10s leading the move.

- Tsys were mixed in early dealing before being pressured as weakness in JGBs spilled over, with 10-Year JGB bond yields showing above the BoJ's permitted 0.50% ceiling.

- Tsys continued to feel the pressure as JGBs moved lower still and Japanese swap spreads widened. Although the move in Japanese fixed income has moderated from session extremes into the Tokyo close, presumably on at least some short cover ahead of next week's BoJ meeting, which has allowed Tsys to find a base.

- Fedspeak from Atlanta Fed President Bostic ('24 voter) hit the wires early in the session. There was little reaction in the space as he reiterated themes observed in recent communique, noting that the slowdown in inflation could facilitate shifting the hiking pace to 25bps from next month.

- Block flow was see across the futures curve in Asia-Pac hours, while the most notable flow came via a 30K lift of the TYG3 112/111 put spread.

- UK GDP and French CPI data headline the European session. Further out UofMich Sentiment provides the highlight in NY. There is Fedspeak from Minneapolis Fed President Kashkari and Philadelphia Fed President Harker.

JGBS: Firming Into The Close, Futures Still Comfortably Lower On The Day

JGB futures are -60 into the bell after extending on the weakness observed in the overnight session.

- A peculiar bid has developed into the close, led by the longer end and presumably some short cover, with the major benchmarks now showing 1bp cheaper to 5bp richer on the day, flattening. The smooth passage of 5-Year supply helped steady the ship earlier in the Tokyo afternoon.

- 2 rounds of unscheduled BoJ Rinban operations helped the space at the margin.

- This came after futures registered a fresh cycle low as speculation re: another BoJ policy tweak intensified, with the next technical levels to watch at vol. band support, situated at 144.14 and 144.02. The contract found a low just above the former in the Tokyo morning.

- 10-Year JGB yields printed above the BoJ’s 0.50% YCC cap, showing as high at 0.568% on the BBG price feed. The measure hovers around 0.510% into the bell.

- 10-Year swap rates (a tool of preference for those testing the BoJ’s will re: YCC) have printed above 1.00% for the first time in over a decade today, and the measure is set to close above that level. Some BoJ watchers have started to tout the potential for a removal of the Bank’s YCC programme as soon as next week, although this is by no means a consensus view. Swap spreads were wider across the curve.

- The BoJ monetary policy meeting headlines next week’s domestic docket.

JGBS AUCTION: 5-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.0316tn 5-Year JGBs:

- Average Yield: 0.393% (prev. 0.121%)

- Average Price: 99.55 (prev. 99.90)

- High Yield: 0.399% (prev. 0.125%)

- Low Price: 99.52 (prev. 99.88)

- % Allotted At High Yield: 81.0659% (prev. 18.5385%)

- Bid/Cover: 3.661x (prev. 3.579x)

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.87737tn 3-Month Bills:

- Average Yield -0.1283% (prev. -0.1169%)

- Average Price 100.0320 (prev. 100.0282)

- High Yield: -0.1182% (prev. -0.1057%)

- Low Price 100.0295 (prev. 100.0255)

- % Allotted At High Yield: 16.9445% (prev. 52.6588%)

- Bid/Cover: 3.239x (prev. 2.938x)

NZGBS: Off Best Levels As JGB Weakness Takes Edge Off Feed Through From U.S. CPI

NZGBs cheapened away from firmest levels of Friday trade on the back of spill over from weakness in JGBS, leaving the major benchmarks running ~7bp richer at the bell, in what was a parallel shift across the curve.

- This came after an initial round of richening tied to catch up to Thursday’s U.S. CPI print.

- Swap rates were 5-7bp lower across the major benchmarks, leaving swap spreads a touch wider to unchanged.

- RBNZ dated OIS came in at the margins, with ~63bp of tightening priced for the Feb 23 meeting, alongside terminal OCR pricing showing between 5.40-5.45%, aided by the post-CPI reaction in U.S. Fed pricing.

- Local headline flow remained subdued at best, as has been the case for most of early ’23, leaving the wider macro cues at the fore.

- Looking ahead, next week’s local docket includes REINZ house price data, card spending readings, non-resident bond holdings and the latest manufacturing PMI survey.

EQUITIES: Major Indices Mostly Higher (ex Japan)

Asia Pac equities haven't seen the same uniformly positive tone that was evident earlier in the week, but there are pockets of strength today. US equity futures are down, which has likely taken some of the gloss off end of week proceedings. We are away from worst levels but still sit comfortably in the red (eminis -0.25% to 3993/94, while Nasdaq futures are down around -0.36%).

- China shares are tracking higher. The CSI 300 +0.80% at this stage. The FT reported the authorities are moving to take 'golden shares' in certain tech companies (stake of 1%) to maintain sufficient oversight.

- Didi apps could also be allowed to return to app stores as soon as next week, in a further sign of reduced regulatory crackdown for the sector.

- The HSI is also higher, but a more modest +0.2% at this stage.

- Japan stocks are lower, with the Nikkei 225 off over 1%, while the Kospi (+0.90%) and Taiex (+0.75%) have maintained gains, but are down from early session highs.

- The ASX200 continues to rally, +0.66%, with firmer commodity prices continuing to support.

GOLD: Can't Sustain Move Above $1900, But On Track for 4th Straight Weekly Gain

Gold is struggling to stay in positive territory through today's Asia Pac session. We currently sit just above $1896.50, slightly down relative to NY closing levels. The early move above $1900 ran out of momentum, as the USD recouped earlier losses. Still, the metal is on track for its fourth weekly gain, +1.65% at this stage.

- Through Thursday's US session we saw volatile trade around the CPI release, but ultimately a test above the $1900 level. The high near $1901.50 couldn't be sustained though.

- Upside targets look for a move to $1909.8 (May 5, 2022 high).

OIL: Down From Highs, But China Optimism Ensures Strong Weekly Gain

Brent crude is off slightly for the session, last near $83.70/bbl. This is line with a slightly more risk-off tone in the cross asset space. Still, Brent is tracking +6.5% higher for the week. Technically, we have cleared the 20-day EMA ($81.99/bbl) but resistance remains around the 50-day at $84.41/bbl. WTI is close to $78.20 currently.

- Today's China trade figures will have given oil bulls some optimism, as oil import volumes remained strong in Dec, despite the domestic Covid wave. The China re-opening theme is a key driver of the stronger oil outlook this year, with oil consumption expected to hit fresh record highs this year.

- Elsewhere the US won't rule out the further releases from the SPR to curb domestic prices. The US House also voted to ban oil reserve sales to China, but the bill is unlikely to be taken up by the Democrat controlled Senate.

- Next week sees the World Economic FOrum kick off in Davos on Monday. On Tuesday, the Dec run of monthly activity data for China, along with Q4 GDP is due (which is expected to be negative q/q). The OPEC monthly report is also due on Tuesday. Wednesday delivers the IEA monthly report. Note the EIA weekly oil inventory report is due Thursday, delayed one day due to a holiday in the US on Monday.

FOREX: USD Rises From Fresh Lows, JPY Outperforms

Early USD selling had little follow through, with the USD BBDXY now back to 1228.30, +0.15% firmer for the session. A firmer US cash Tsy yield backdrop has helped (+2.5bps for the 10yr), while US equity futures have also faltered weighing on higher beta plays. Still the BBDXY is down 1.34% for the week and not too far off fresh lows.

- USD/JPY hit fresh lows sub 128.70 in the first part of trading, but has rebounded back above 129.00 and has spent the rest of the session above this level (last 129.20/25). The yen has outperformed the rest of the G10 though, with markets keeping one eye on next week's BoJ meeting.

- AUD/USD is back under 0.6950, around 0.30% down from NY closing levels. We haven't drifted too far away from this level, with higher iron ore prices (near $125/ton) providing some offset. China commodity import data showed softness (ex oil), but trends are expected to be better in 2023.

- NZD/USD has been the worst performer in the space so far today, off 0.50% to the low 0.6360 region. 0.6400 remains a resistance point for now.

- Coming up UK monthly GDP is due, while in the US U. Of Mich. Sentiment is out, along with Fedspeak from Kashkari and Harker.

FX OPTIONS: Expiries for Jan13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.5bln), $1.0600(E1.8bln), $1.0645-60(E2.0bln), $1.0670-80(E2.6bln), $1.0685-00(E2.3bln), $1.0750(E2.4bln), $1.0770-75(E1.2bln), $1.0800(E1.5bln), $1.0820-25(E740mln), $1.0850(E1.5bln)

- GBP/USD: $1.2000(Gbp1.1bln)

- EUR/GBP: Gbp0.8900(E791mln)

- USD/JPY: Y131.00($597mln), Y131.95-00($776mln), Y133.85-00($1.0bln), Y134.40($542mln)

- AUD/USD: $0.6950(A$1.5bln), $0.7000(A$1.3bln), $0.7125(A$1.9bln)

- USD/CAD: C$1.3295-05($560mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/01/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 13/01/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 13/01/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 13/01/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 13/01/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 13/01/2023 | 0700/0800 | *** |  | SE | Inflation report |

| 13/01/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 13/01/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 13/01/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 13/01/2023 | 0900/1000 |  | DE | GDP 2022 | |

| 13/01/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 13/01/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 13/01/2023 | - | *** |  | CN | Trade |

| 13/01/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 13/01/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 13/01/2023 | 1500/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 13/01/2023 | 1520/1020 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.