-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: GDP Revisions Show Japan Avoided H2 2023 Recession

EXECUTIVE SUMMARY

- BIDEN WARNS ISRAEL AGAINST INVADING RAFAH AS RAMADAN BEGINS - BBG

- PORTUGAL JOINS EUROPE'S SHIFT TO THE RIGHT AS CHEGA PARTY SURGES - BBG

- JAPAN Q4 GDP REVISED UP TO SLIGHT EXPANSION, ECONOMY AVOIDS RECESSION - RTRS

- CHINA FEBRUARY CPI RISES TO 1-YEAR HIGH - MNI BRIEF

- RBA REFORM BILL HITS IMPASSE AMID POLITICAL DISPUTE OVER BOARDS - BBG

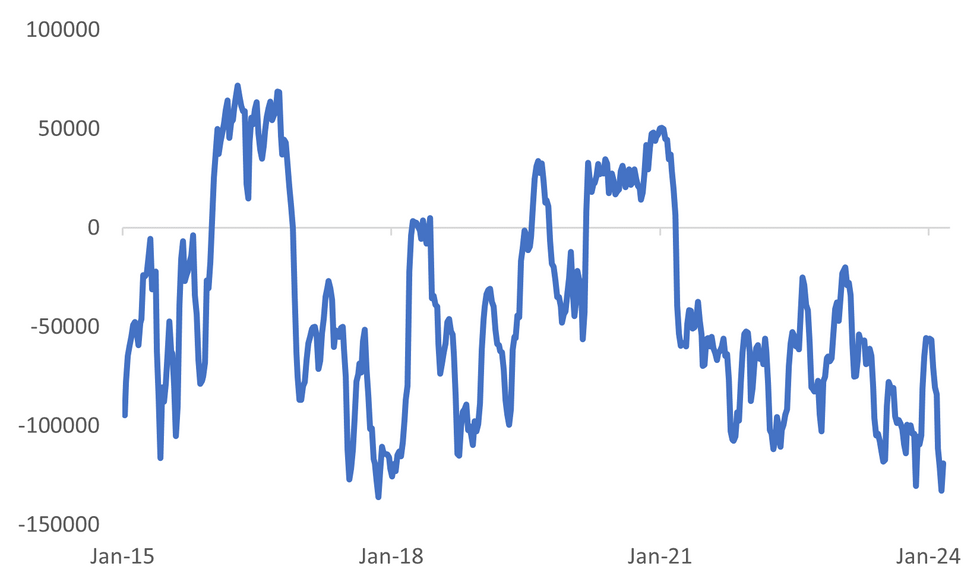

Fig. 1: JPY Net Non-Commercial Futures Positions

Source: MNI - Market News/Bloomberg

U.K.

FISCAL (BBG): UK Prime Minister Rishi Sunak is considering curbs to welfare spending to fund the government’s ambition of further tax cuts, according to The Sunday Times.

EUROPE

PORTUGAL (BBG): The rapid growth of right-wing political forces across Europe hit Portugal on Sunday as the Chega party surged in support and quadrupled its seats in parliament.

UKRAINE (RTRS): Ukraine on Sunday rebuffed Pope Francis's call to negotiate an end to the war with Russia, with President Volodymyr Zelenskiy saying the pontiff was engaging in "virtual mediation" and his foreign minister saying Kyiv would never capitulate.

GERMANY (BBG): The Netherlands is closing in on a deal to sell Tennet Holding BV’s power grid in Germany to the government in Berlin after months of protracted negotiations, according to people familiar with the matter.

GERMANY (BBG): Germany braced for another wave of travel disruptions after unions representing Deutsche Lufthansa AG’s cabin crew and train drivers announced more walkouts, adding to a string of travel chaos that hit Europe’s largest economy over the past months.

U.S.

MIDEAST (BBG): - US President Joe Biden warned Israel against an invasion of the city of Rafah in southern Gaza as cease-fire talks between Israel and Hamas remained deadlocked.

ECONOMY (MNI POLICY): A real-time indicator of U.S. retail sales from the Federal Reserve Bank of Chicago showed the surprise drop in retail sales for January turned more moderate into February, while inflation for retail goods and food services excluding autos picked up -- signs of slowing momentum in consumer spending as goods prices rebounded after falling in the latter half of 2023.

OTHER

JAPAN (RTRS): Japan's economy avoided a technical recession, revised government data showed on Monday, even though the upward change in the fourth quarter was weaker than expected and highlighted concerns about the sluggish economic recovery.

HONG KONG (BBG): Hong Kong’s 10 biggest estates saw transaction volume rise to the highest in three years this weekend, according to Centaline Property Agency Ltd. There were 37 transactions this weekend, up 48% from last week. Hong Kong property buyers have been rushing to snap up homes after the government removed cooling last month in an effort to boost the market.

TAIWAN (RTRS): Taiwan's top security official told parliament on Monday that China runs "joint combat readiness patrols" near the democratic island every 7-10 days on average, saying Chinese forces were trying to "normalise" drills near Taiwan.

SAUDI ARABIA (BBG): Aramco raised its dividend despite a retreat in energy prices and lower production, a boost for Saudi Arabia as it faces a widening budget deficit.

SOUTH AFRICA (BBG): Support for South Africa’s ruling African National Congress has fallen below 40%, a new opinion poll shows. The finding suggests the country “will almost certainly” have a coalition government after elections on May 29, with the ANC losing ground to a new party founded by former President Jacob Zuma and the main opposition Democratic Alliance, according to the survey by the Brenthurst Foundation and the SABI Strategy Group.

AUSTRALIA (BBG): Australia’s Labor government and opposition coalition are at an impasse over the composition of the Reserve Bank’s new monetary policy committee, potentially derailing legislation needed to underpin changes to the institution.

AUSTRALIA (BBG): Risks to the Australian financial system from lending to households warrants close attention but remains contained for the time being, Council of Financial Regulators says in quarterly statement released Monday.

AUSTRALIA (BBG): Treasurer Jim Chalmers comments in Q&A after speech at Australian Financial Review summit in Sydney on Monday. Says the government is still trying to get the budget repaired in a meaningful, ongoing way. Says it can’t ignore the slowdown in the economy, adding that inflation is the primary focus but not the sole focus.

CHINA

INFLATION (MNI BRIEF): China's Consumer Price Index rebounded more than expected by 0.7% y/y in February, reversing the consecutive declines since October last year as prices, especially in travel services, rose amid the Chinese New Year holiday, data from the National Bureau of Statistics showed Saturday.

HOUSING (BBG): China reiterated a stance that homes are for residents to live in, and not for speculation, keeping to its longstanding position even as a property crisis weighs on demand.

PROPERTY (RTRS): Chinese regulators recently met financial institutions to discuss state-backed property developer China Vanke where they asked large banks to enhance financing support and asked private debt holders to discuss maturity extension, two sources said.

CHINA MARKETS

MNI: PBOC Conducts CNY10 Bln Via OMO Mon; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY10 billion via 7-day reverse repo on Monday, with the rates unchanged at 1.80%. The reverse repo operation has led to no change to the liquidity after offsetting CNY10 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8393% at 09:48 am local time from the close of 1.8628% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Friday, compared with the close of 47 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0969 on Monday, compared with 7.0978 set on Friday. The fixing was estimated at 7.1879 by Bloomberg survey today.

MARKET DATA

MNI JAPAN Q4 GDP REV +0.1% Q/Q; PRELIM -0.1%; MEDIAN +0.3%JAPAN Q4 ANNUALIZED GDP REV +0.4%; PRELIM -0.4%; MEDIAN +1.1%

JAPAN Q4 CAPEX REV +2.0% Q/Q; PRELIM -0.1%; MEDIAN +2.5%

MARKETS

US TSYS: Cash Curve Slightly Flatter In Today’s Asia-Pac Session, CPI Data On Tuesday

TYM4 is trading at 111-27+, +0-04 from NY closing levels on Friday.

- Cash US tsys are dealing 1bp cheaper to 1bp richer in today’s Asia-Pac session, with a flattening bias.

- News flow has been light so far today.

- After Friday’s mixed Employment Report, the market’s focus now turns to Tuesday's CPI release, the last key data point ahead of the March FOMC meeting (19-20 March).

- (Bloomberg) -- Investors should consider selling 10-year Treasuries as the resilience of the world’s largest economy makes the recent US bond rally look overdone, according to Barclays Plc. (See link)

JGBS: Futures Off Lows But Still Cheaper, PPI Data Tomorrow

JGB futures are holding weaker, -15 compared to settlement levels, but higher than overnight closing levels seen on Friday.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined 4Q GDP (final) and M2 & M3 Money Stock data. Machine Tool Orders are due later today.

- (Bloomberg) -- The Bank of Japan is widely expected to scrap the world’s last negative interest rate in the coming weeks, marking the closing act of global central banks’ grand experiment with unorthodox policies. Governor Kazuo Ueda is forecast to raise the short-term rate from -0.1% either next week or in April in what would be the first rate hike in Japan since 2007, according to economists and bond traders. (See link)

- Cash US tsys are dealing 1bp cheaper to 1bp richer in today’s Asia-Pac session, with a flattening bias. News flow has been light.

- The cash JGB curve has bear-steepened, with yields flat to 4bps higher across benchmarks. The benchmark 10-year yield is 2.8bps higher at 0.763% after earlier testing the highest level for the year at 0.772%.

- The swaps curve has twist-steepened, pivoting at the 10s, with rates 2bps lower to 3bps higher. Swap spreads are tighter.

- Tomorrow, the local calendar sees PPI and BSI Business Conditions data, along with 5-year supply.

AUSSIE BONDS: Little Changed, Light Local Calendar, Narrow Ranges

In roll-impacted trading, ACGBs (YM +1.4 & XM +1.5) are slightly richer after dealing in narrow ranges in today’s Sydney session. Without domestic data catalysts, local participants appear to have been content to use US tsy dealings in today’s Asia-Pac session for directional guidance. Cash US tsys are dealing 1bp cheaper to 1bp richer, with a flattening bias.

- Cash ACGBs are 1-2bps richer, with the AU-US 10-year yield differential unchanged at -11bps.

- Swap rates are 1-2bps lower, with the 3s10s curve flatter.

- The bills strip is 2-3bps richer.

- RBA-dated OIS pricing is flat to 4bps softer across meetings, with late-24 leading. A cumulative 48bps of easing is priced by year-end.

- Tomorrow, the local calendar will see NAB Business Confidence, along with Panel Participation by RBA Assistant Governor (Economics) Sarah Hunter at the AFR Business Summit.

- Tomorrow, the AOFM plans to sell A$150mn of 0.25% Nov-32 inflation-linked bond.

- (AFR) Interest rates may be heading lower as inflationary pressures sparked by the pandemic recede, but they are unlikely to stay there as major geopolitical and macroeconomic forces will push them higher. (See link)

NZGBS: Closed On A Strong Note

NZGBs closed on a strong note, with benchmark yields 5-6bps lower. In the absence of domestic drivers, the local market drifted stronger through the session in line with US tsy dealings in today’s Asia-Pac session.

- Cash US tsys are dealing flat to 1bp richer, with a flattening bias. News flow has been light.

- (Bloomberg) -- RBNZ opened a public consultation on a new Business Expectations Survey. The survey will help it “to better understand the economic outlook including the inflation expectations of key decision makers”. (See link)

- Swap rates closed 3-5bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is flat to 8bps softer across meetings, with November leading. A cumulative 63bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Card Spending data for February.

- On Thursday, the NZ Treasury plans to sell NZ$275mn of the 0.25% May-28 bond and NZ$225mn of the 2% May-32 bond.

FOREX: USD Up From Earlier Lows, AUD Weakens Against Yen Amid Equity Losses

FX trends have been more subdued as the Monday Asia Pac session unfold. The BBDXY sits lower, but only marginally, last near 1228.75, with yen still slightly up for the session.

- Cross asset sentiment has seen a generally weaker equity tone, with US futures lower, led by the tech space. Regional equities are also lower outside of China/HK. US yields sit mixed.

- Earlier USD/JPY got close to Friday intra-session lows just under 146.50, but we couldn't test these levels. The pair is back to 146.90/95 in recent dealings.

- Q2 GDP revisions weren't as strong as expected, but still demonstrated that the economy avoided a technical recession in H2 of last year, thanks in large part to higher business Capex. This should help, albeit at the margin, the case for the BoJ to exit NIRP. Such speculation was very strong late last week. Note the next BoJ meeting is next week on the 19th of March.

- AUD/USD sits lower, last near 0.6610, around 0.2% weaker for the session. A better China/HK equity mood hasn't helped sentiment, with weaker commodity prices, particularly in terms of iron ore, weighing. AUD/JPY is down but hasn't tested the 100-day MA near 97.00 yet.

- NZD/USD is also down, but modestly outperforming the AUD. We were last near 0.6170. The AUD/NZD cross was last back near 1.0710.

- Looking ahead, it is a quiet start to the week data wise, with most focus on US CPI tomorrow. We do have some ECB and BoE speak later.

ASIA EQUITIES: Sharp Japan Pull back, Amid Stronger Yen, HK & China Outperforming

Asia stocks are mixed to start the week. Japan markets are down sharply, the Topix off more than 2.6%, while the Nikkei 225 is down almost 2.6%. A combination of a stronger yen (particularly post the onshore close on Friday), coupled with weaker tech trends are weighing. The electric appliances sector is the main drag on the Topix.

- There are firmer trends for Hong Kong and China markets. The HSI is up around 1.3% at this stage. The properties sub index is higher, amid a further rise in weekend property transactions (to a 3yr high, per BBG). Also aiding sentiment is a Reuters report, which stated that China regulators asked large banks to support troubled property developer Vanke. Earlier the company fully repaid notes due with a $647m deposit (BBG).

- The CSI 300 was last around 0.80% higher. Hopes that the stronger consumer inflation report from Saturday is a sign of better consumer demand is being cited as support. Some sell-side names have shifted their views on rate cuts though. The 1yr MLF is expected to be held steady at 2.50% this Friday.

- Elsewhere, the Kospi and Taiex are down modestly, around 0.40% each. We had a negative lead from US tech stocks on Friday, which is likely at the margins.

- The ASX 200 is down over 1.8%, weighed by the materials sector. Iron ore prices are lower, while other commodity indices were down on Friday. Financials are also weaker.

- Trends in SEA are mostly weaker, with Philippines stocks off 1.00%, among the weakest performers.

OIL: Tracking Lower Amid Positive Supply Signs, Key Oil Reports Due This Week

Brent crude (K4) sits just up off session lows, last near $81.60/bbl. We are down 0.60% for Monday trading so far, after a 1.06% fall on Friday. Earlier lows were at $81.35. For WTI (J4), we are down 0.65%, last near $77.50/bbl.

- Demand concerns from both China and the US appear to be near term headwinds in the space. Rising supply is being cited. The OPEC+ alliance pumped 41.21mbpd of oil in February, unchanged in the month. Several members such as Iraq and Kazakhstan continued exceeding their quotas: Platts.

- Iran's oil exports have also reached their highest levels since 2018 (BBG).

- Note though US oil and gas rigs fell by seven on the week to 622, according to Baker Hughes March 8. Oil rigs were down 2 to 504.

- This week we have a number of reports will be in focus, including OPEC's monthly report on Tuesday, the IEA releases its outlook on Thursday. The US EIA is also releasing its short term outlook this week.

- For Brent, we are close to lows for March to date. Support is likely to evident on any further pull backs towards $80/bbl. Recent highs rest at $84.34 (from Mar 1).

GOLD: Steady After Setting A Fresh All-Time High On Friday

Gold is steady in today's Asia-Pac session, after closing 0.9% higher at $2178.95 on Friday. Earlier on Friday bullion had achieved a fresh all-time at $2195.15 in a delayed move following the US payrolls report.

- Gains on Friday were supported by US data showing the jobless rate at a two-year high, which helped push the dollar and 10-year Treasury yields lower.

- Bullion rallied almost 5% last week on expectations the US Federal Reserve will move to cut interest rates this year as inflation cools.

- A test for the market will come this week with US inflation data due for release on Tuesday. A hotter-than-expected reading — as happened last month — would likely prove to be a setback for further gains in the precious metal.

- According to MNI’s technicals team, Friday's high marked yet another new resistance after which now lies $2206.6 (Fibo projection). Short-term conditions are overbought; however, this does not appear to be a concern for bulls - for now.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/03/2024 | 0001/0001 | ** |  | UK | KPMG/REC Jobs Report |

| 11/03/2024 | 0700/0800 | *** |  | NO | CPI Norway |

| 11/03/2024 | 0800/0900 |  | EU | ECB's Cipollone in Eurogroup meeting | |

| 11/03/2024 | - | *** |  | CN | Money Supply |

| 11/03/2024 | - | *** |  | CN | New Loans |

| 11/03/2024 | - | *** |  | CN | Social Financing |

| 11/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/03/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/03/2024 | 1700/1700 |  | UK | BOE's Mann panellist for MonPol ebook launch |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.