-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Global Growth Concerns Weighing On Risk Appetite

EXECUTIVE SUMMARY

- BIDEN, MCCARTHY DEBT CEILING MEETING POSTPONED, SPENDING CUTS ON TABLE (RTRS)

- EU’s GENTILONI: DECOUPLING FROM CHINA DANGEROUS FOR GLOBAL ECON (BBG)

- WITH UK FOOD PRICE INFLATION AT 46-YR HIGH, LAWMAKERS LAUNCH PROBE (RTRS)

- CHINESE FOREIGN MINISTER TO VISIT AUSTRALIA (SCMP)

- NZ 2-YR INFLATION EXPECTATIONS EASE TO WITHIN RBNZ TARGET BAND (BBG)

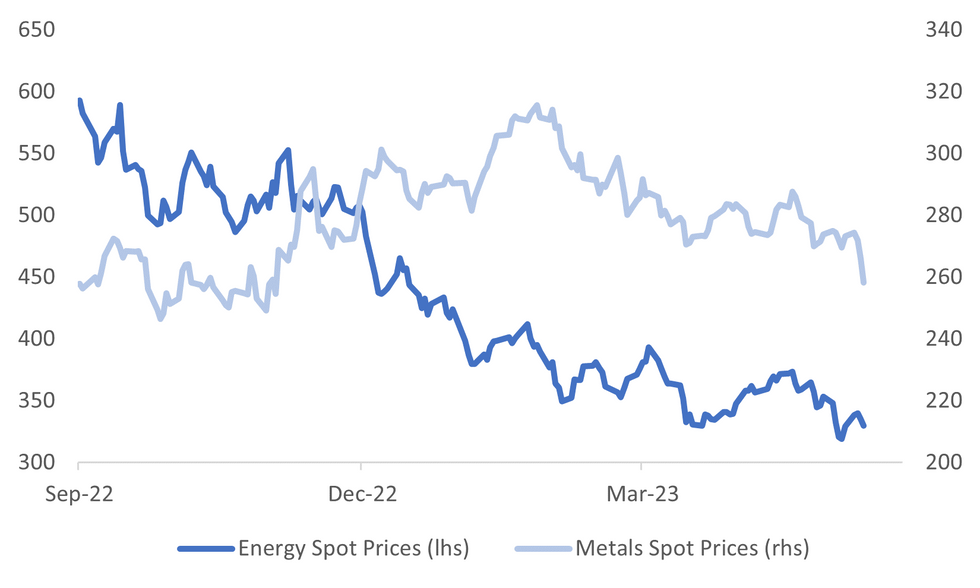

Fig. 1: Metal & Energy Prices Under Pressure

Source: MNI - Market News/Bloomberg

U.K.

INFLATION: British lawmakers launched an investigation on Friday into the fairness of the country's food supply chain, seeking to understand why households are facing the highest levels of food price inflation since the 1970s. (RTRS)

BoE: The past three months have not been kind to monetary policymakers at the Bank of England. In February, the central bank set interest rates at 4 per cent and suggested this level might well be the peak because its forecasts had inflation falling sharply, dropping below the central bank’s 2 per cent target at the start of 2024. (FT)

STRIKES: Two days of strikes will bring much of Britains rail network to a standstill as workers escalate a protest over pay. (BBG)

EUROPE:

G7: Germany is pushing for G7 leaders to endorse public investment in the gas sector at their summit next week, setting up a clash with countries that argue such support is incompatible with global climate goals. Tensions have flared in pre-summit discussions as nations including the UK and France reject Germany’s demands to include support for public investments in gas in the meeting’s final document, said several people briefed on the talks. (FT)

EU/CHINA: Decoupling from China presents a very dangerous risk for the global economy especially for the EU, says Paolo Gentiloni, the bloc’s economy commissioner. (BBG)

U.S.

DEBT: A debt limit meeting between U.S. President Joe Biden and top lawmakers that had been scheduled for Friday has been postponed, and the leaders agreed to meet early next week, a White House spokesperson said on Thursday. (RTRS)

DEBT: Republican Speaker of the House Kevin McCarthy accused US president Joe Biden of not wanting a deal on the debt ceiling, as a meeting at the White House involving the two leaders was postponed until next week. (FT)

DEBT: Treasury Secretary Janet Yellen will meet with top Wall Street bankers in Washington next week as the Biden administration and Republican leaders scramble to reach a deal to avoid a debt default. Treasury said Yellen will talk with JPMorgan Chase CEO Jamie Dimon, Citigroup CEO Jane Fraser and other board members of the Bank Policy Institute, a lobbying group, to discuss the impasse over raising the government’s borrowing limit. (POLITICO)

OTHER

AUSTRALIA: Chinese Foreign Minister Qin Gang is expected to visit Australia in July as diplomatic relations between the two trading partners stabilise, The South China Morning Post reported and an Australia academic said. The visit, which has not been officially announced, would take place in July, citing a source "close to the Chinese government" and an Australian academic, The South China Morning Post reported on Friday. (SCMP)

AUSTRALIA: - Reserve Bank of Australia (RBA) researchers believe the use of high-frequency yield data has limitations when measuring the impact of monetary policy and its communication. (MNI)

NZ: New Zealand two-year ahead inflation expectations fell to 2.79% in the second quarter from 3.30% in the first, according to survey of businesses published by Reserve Bank. (BBG)

THAILAND: Army chief Gen Narongpan Jittkaewtae on Thursday provided assurances that no coups will take place while he is in charge, saying the word "coup" should not exist in anyone's vocabulary.(Bangkok Post)

SOUTH KOREA: South Korea's finance ministry said Friday the country's domestic consumption has been showing a steady recovery, but the economy has continued to slow due to sluggish exports and facility investment. (KOREA Herald)

SOUTH KOREA: South Korea's finance ministry said Friday the government will issue a set of coupons for local accommodations and tour packages in line with efforts to boost domestic consumption. (Korea Herald)

G7: G7 Finance Chiefs are set to propose a new partnership on supply chains. (BBG)

CHINA

US/CHINA: China confirms that its top diplomat Wang Yi and US National Security Adviser Jake Sullivan discussed “removing obstacles” and stabilizing the bilateral ties from deterioration on Wednesday and Thursday in Vienna. (BBG)

INFLATION: China’s CPI increased by 0.1% y/y in April which shows economic confidence remains subdued and the economy needs fiscal policy support to boost domestic demand, according to analysts interviewed by 21st Century Herald. Consumption has led the recovery, but the service sector requires policy support to ensure the expansion of employment and raise incomes, according to one analyst. Several regions have begun major projects but are mostly focused on high-end manufacturing industries such as new energy and chips. The government needs to address weak prices, which hurts firms profits and private investment, Yicai said. (MNI)

BONDS: China’s economy will experience continued low production and weak demand recovery in H2, as the government has not given any indication it will change policy, leading to low bond yields, according to analysts interviewed by 21st Century Herald. The economy has shown positive signs of recovery in Q1, but bond yields have remained down. The mid- to long-term growth trajectory, given the uneven rebound, has analysts concerned. The central bank has not began tightening rates and investment firms have increased bond allocations as residents' financing needs have not yet recovered, which has contributed to falling yields and divergence with fundamentals, the news outlet said. (MNI)

INFLATION: China’s inflation will likely experience a V-shape rebound in the second half as the economy recovers and base effects fade, Shanghai Securities News says in a report Friday, citing analysts. (BBG)

ECONOMY: China’s electricity consumption will grow faster in 2Q as economy improves and summer comes, Shanghai Securities News says in a report Friday, citing industry analysis. (BBG)

ECONOMY: China’s Vice Premier Ding Xuexiang appealed for help for colleague graduates to find jobs or start their own businesses, the official Xinhua reports, citing his comments at a national meeting on the issue. (BBG)

PROPERTY: A Chinese property developer whose default in 2021 has since fed into a broader industry rout is facing resistance to its restructuring plan from a major shareholder. Fantasia Holdings Group Co.’s second-biggest shareholder TCL Industries Holdings Co. opposes the terms of the debt-to-equity swaps, a key part of the restructuring proposal that would dilute shareholders’ stakes, according to people familiar with the matter who asked not to be identified discussing private matters. TCL is seeking equitable treatment between minority investors and the controlling shareholder, one of the people said. (BBG)

PROPERTY: China’s housing market is regressing after a brief recovery, underscoring the challenges facing the economy. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY1BN VIA OMOs FRIDAY

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY1 billion after setting off the maturity of CNY3 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8666% at 09:46 am local time from the close of 1.7703% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 50 on Thursday, compared with the close of 52 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 6.9481 FRI VS 6.9101 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9481 on Friday, compared with 6.9101 set on Thursday.

OVERNIGHT DATA

NZ APR BUSINESSNZ MANUFACTURING PMI 49.1; PRIOR 48.1

NZ MAR NET MIGRATION SA 12108; PRIOR 12609

NZ 2Q 2YR INFLATION EXPECTATION 2.79%; PRIOR 3.30%

JAPAN APR MONEY STOCK M2 Y/Y 2.5%; PRIOR 2.6%

JAPAN APR MONEY STOCK M3 Y/Y 2.1%; PRIOR 2.1%

SOUTH KOREA MONEY SUPPLY L SA M/M 0.4%; PRIOR 0.6%

SOUTH KOREA MONEY SUPPLY M2 SA M/M -0.2%; PRIOR 0.3%

MARKETS

US TSYS: Marginally Firmer In Asia

TYM3 deals at 116-06+, +0-05, a touch off the top of the 0-05+ range on volume of ~55k.

- Cash tsys sit ~2bps richer across the major benchmarks.

- Asia-Pac participants faded the move seen late in the NY session, as tsys were pressured into the close, perhaps focusing on the ongoing US regional bank concerns. However moves have been limited with little follow through in Asia today.

- A 1.5% fall from peak to trough in WTI futures in todays Asian session added a layer of support.

- Flow wise a TU (3.25k lots) UXY (1.205k lots) block steepener was the highlight.

- In Europe we have preliminary print of Q1 UK GDP, further out UofMich Consumer Sentiment crosses. Fedspeak from SF Fed President Daly, Fed Governor Jefferson and St Louis Fed President Bullard is on the wires.

JGBS: Futures Through Overnight Highs, Within Striking Distance of Mar 22 High

In afternoon Tokyo trade, JGB futures have surged past the overnight high and are now at +21 versus settlement levels. JBM3 has reached 149.08, its highest level since March 27 and is close to the March 22 high of 149.53. According to MNI's technical analysis, exceeding the March 22 high would signal the continuation of the upward trend.

- There haven't been any significant domestic drivers to impact the market, with previously mentioned money supply data having minimal impact. As a result, the local market has followed the lead of US tsys, which have continued their richening trend from Thursday in Asia-Pac trade.

- Cash JGBs are experiencing gains across the curve, except for the 1-year zone which is 0.4bp cheaper on the day. The yield curve has flattened with yields ranging between 0.7 to 3.1bp lower. The benchmark 10-year yield has dropped by 1.9bp to 0.379%, which is well below the BoJ's YCC limit of 0.50%. Meanwhile, the benchmark 30-year yield is down by another 2.6bp to 1.207%, following a 5bp decline yesterday, which came after a strong auction result.

- Swap rates are lower across the curve with swap spreads wider except for the 1-year zone.

- The local calendar is relatively heavy next week with PPI data on Monday and Q1 GDP (preliminary) on Wednesday as the highlights.

- 5- and 20-year JGB supply is scheduled for Monday and Wednesday, respectively, along with BoJ Rinban operations covering 1-10-year and 25-Year+ JGBs.

AUSSIE BONDS: At Session Bests Aided By US Tsys and NZGBs

In Asia-Pac trade, ACGBs are stronger (YM +7.0 & XM +9.5) and at session highs as US tsys extend their gains from Thursday. With a light economic calendar and domestic headlines, local traders have been happy to follow US tsys. Currently, cash US tsy yields are 1-2bp lower, and the curve is flatter. Additionally, the sharp richening in NZGBs after the release of RBNZ inflation expectations data is likely to have contributed to the ACGB's move to session highs.

- Cash ACGBs are 8-10bp richer with the 3/10 curve 2bp flatter and the AU-US 10-year yield differential -4bp at -7bp.

- Swap rates are 6-7bp lower with EFPs 2-3bp wider.

- The bills strip twist flattens with pricing -1 to +5.

- RBA dated OIS pricing is mixed with pricing 1bp firmer for June but 2-5bp softer for meetings beyond August.

- The local calendar is light until the RBA Minutes for May are released early next week.

- The AOFM announced a relatively low round of nominal ACGB issuance for next week with the sale A$700mn of the 2.75% 21 June 2025 bond on Wednesday, 17 May. AOFM issuance is set to remain light for the FY ahead with between A$1-1.5bn per week on average.

NZGBS: At Bests, Curve Bull Steepens, Infl. Expectations Decline

NZGBs 2/10 cash curve bull steepens, with benchmark yields 10-13bp lower, after RBNZ’s 1- and 2-year inflationary expectations data for Q2 respectively fall to 4.28% and 2.79% versus 5.11% and 3.3% in Q1. The 2- and 10-year yields were respectively 6bp and 4bp lower after the data. A richening in US tsys in Asia-Pac trade assisted the move to session bests by the close, although NZGBs outperformed the $-bloc with the NZ/US and NZ/AU 10-year differentials both 2bp lower on the day.

- Swap rates are 6-14bp lower with the implied swap spread box steeper.

- Inflation expectations have decreased following a drop in actual inflation to 6.7%. Despite the softening of expectations, inflation remains high, and the RBNZ still has work to do since expectations remain above the target midpoint of 2%.

- RBNZ dated OIS shunts softer after the data with pricing 3-11bp softer across meetings by the close. Tightening expectations for the May 24 meeting decline to 20bp.

- NZ net migration data for March showed +12k for a net gain of 65.4k for the year ended March 31. This was the largest gain since August 2020. April Manufacturing PMI increased to 49.1 from 48.1.

- The NZ calendar is relatively light ahead of the Budget on Thursday.

EQUITIES: Most Regional Markets Tracking Lower, Japan Outperforming

Regional equity markets are mixed today, with Japan the main positive story, but a lot of the other major indices have struggled to maintain positive momentum. China and HK bourses sit lower. US futures has mostly been firmer, with eminis last +0.20% and near 4152. Nasdaq futures are slightly higher at +0.30%.

- The HSI was higher at the open but couldn't sustain these gains. We were last -0.13% to 19718, after getting as high as 19850 not long after the open. Tech is outperforming, with the sub-index +1.20%. We saw a strong Thursday rally for the Golden Dragon Index in US trade, after senior US/China officials met in Vienna Wed/Thurs. E commerce company JD.com is also tracking higher after surging Q1 earnings.

- Mainland China shares are also down, the CSI 300 off by nearly -0.60% at this stage. Weaker data outcomes this week have taken the shine off the recovery theme.

- Japan stocks are doing better, the Topix +0.5%, with the electric appliances sector the main driver of gains.

- The Kospi is down 0.35%, while the Taiex is close to flat, in line with some tech related weakness during US trade on Thursday.

- Thai shares are down 1.00% ahead of Sunday's election. We remain comfortably above early May lows though near 1500. Philippines stocks are also weaker, down nearly 1%.

FOREX: Kiwi Pressured In Asia

Kiwi is pressured in Asia today, NZD/USD is down ~0.6%. 2 Year inflation expectations fell to 2.79% in Q2 from 3.3% in Q1. 1-Year Inflation Expectations sit at 4.28% in Q2 vs 5.11% in Q1. Earlier in the session April BusinessNZ Manufacturing PMI which printed at 49.1 ticking higher from 48.1 prior.

- NZD/USD sits at $0.6260/65. The pair has found support ahead of the 20-Day EMA and sits at its lowest level since 4 May. A break through the 20-Day EMA opens the low from May 1 at $0.6161.

- AUD is marginally pressured as weakness in the kiwi spills over. AUD/USD prints at $0.6690/95, down ~0.2%. Resistance comes in at $0.6818 high from May 10 and support is at $0.6689 yesterday's low.

- USD/JPY has dealt in a narrow ~30 pip range in Asia with little follow through on moves. Support is at ¥133.50 low from May 4 and resistance is at ¥135.47 high from May 10.

- Elsewhere in G-10 ranges have been narrow with little follow through on moves. CHF is marginally outperforming however liquidity is generally poor for the Franc in Asia.

- Cross asset wise; e-minis are 0.1% firmer, US Treasury Yields are ~2bps lower across the curve. BBDXY is little changed from opening levels.

- In Europe we have preliminary print of Q1 UK GDP, further out UofMich Consumer Sentiment crosses.

OIL: Maintaining Downside Bias

Brent crude has continued to track lower in the first part of Friday trading. We are around $74.50/bbl currently, just above session lows of $74.34/bbl. We have lost a further ~0.70% so far today (Wed/Thur trade we lost over 3%), while for the week we sit slightly down on closing levels from last Friday. Next support would be seen at $71.28/bbl (May 4 low). WTI is following a similar trajectory, last near $70.40/bbl.

- Demand concerns from both China and the US have weighed on the outlook this week. Data momentum has faltered in both economies over recent sessions.

- There is evident in terms of other commodities, with metals notable underperformers this week, although copper and iron ore are firmer today.

- On the supply side., Iraq is planning to resume oil exports (450k barrels per day) to the market through the port of Ceyhan in Turkey from Saturday. This appeared to offset reports that the US will start refilling its Strategic Petroleum Reserves after June.

GOLD: Slightly Weaker In Asia-Pac Trade

In early Asia-Pacific trading, gold has continued to decline, following a 0.8% drop on Thursday, and is currently at 2010.63, down by 0.2%. Meanwhile, the USD index remains steady at 102.05.

- MNI's technical team reports that gold is still on an uptrend, marked by a series of higher highs and higher lows. Moving average studies are also indicating a bullish setup. Investors are closely monitoring the March 8 high of $2070.4, which is the immediate target before the all-time high of $2075.5. Meanwhile, the key support level remains at $1969.3, which was the low point recorded on April 19th.

- Gold prices have remained above $2000 for the month of May, as investors anticipate the end of the Federal Reserve's tightening cycle. Concerns about the impasse over the US debt ceiling have also contributed to a bullish market sentiment.

- Earlier in the week, gold prices hit $2048.19 per ounce after the release of US CPI data, which was accompanied by a decline in US tsy yields. Although yields have continued to decline and reached new weekly lows following the release of PPI data, gold prices have not returned to the post-CPI high.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/05/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/05/2023 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 12/05/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 12/05/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/05/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 12/05/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/05/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 12/05/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/05/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/05/2023 | 0800/1000 |  | EU | ECB de Guindos Lecture at Academia Europea Leadership | |

| 12/05/2023 | 1115/1215 |  | UK | BOE Pill & Shortall Monetary Policy Report National Agency Briefing | |

| 12/05/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/05/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/05/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/05/2023 | 1820/1420 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.