-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Kim Continues To Push The Envelope With Missile Tests

EXECUTIVE SUMMARY

- FED'S KASHKARI: NOT STOPPING RATE HIKES UNTIL INFLATION PEAKS (RTRS)

- JEREMY HUNT TO DEFEND AUTUMN STATEMENT AMID WARNING OF RECORD FALL IN LIVING STANDARDS (SKY)

- ITALY’S MELONI IS READY TO PRESENT €30 BILLION BUDGET TO CABINET (BBG)

- SNB'S MAECHLER: RATES WILL BE RAISED IF INFLATION FORECAST ABOVE TARGET (RTRS)

- CHINA SHOULD SET 2023 ECONOMIC GROWTH TARGET NO LOWER THAN 5% - CENTRAL BANK ADVISER (RTRS)

- NORTH KOREA FIRES SUSPECTED INTERCONTINENTAL BALLISTIC MISSILE, LANDS NEAR JAPAN (RTRS)

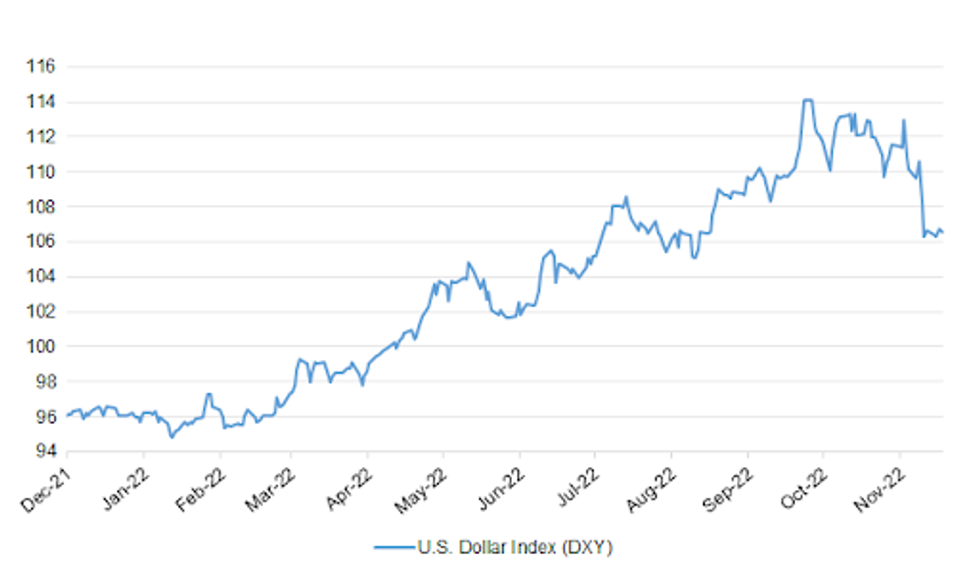

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Jeremy Hunt will continue to defend his autumn statement today as experts warn of a record fall in living standards across the country. (Sky)

FISCAL: A shift in UK government debt issuance from the long end of the curve comes partly because of weaker structural demand from pension funds, Debt Management Office head Sir Robert Stheeman told MNI. (MNI)

EUROPE

ITALY: Giorgia Meloni’s government will devote about €30 billion ($31 billion) for extra spending in her first budget law as Italian prime minister, according to people familiar with the matter. (BBG)

SNB: The Swiss National Bank will raise interest rates further if it sees inflation projections above its target level, SNB governing board member Andrea Maechler said on Thursday. "Our mandate is to bring down inflation and we will use the tools we have to do so," she told a financial markets event in Geneva. (RTRS)

RATINGS: Potential sovereign rating reviews of note slated for after hours on Friday include:

- Fitch on Italy (current rating: BBB; Outlook Stable) & Sweden (current rating: AAA; Outlook Stable).

- Moody’s on Malta (current rating: A2; Outlook Negative) & Portugal (current rating: Baa2; Outlook Stable).

- S&P on Ireland (current rating: AA-; Outlook Stable) & Slovakia (current rating: A+; Outlook Negative).

- DBRS Morningstar on Lithuania (current rating: A (high), Stable Trend).

U.S.

FED: It's hard to know how high the U.S. central bank will need to raise interest rates, Minneapolis Federal Reserve Bank President Neel Kashkari said on Thursday, but it should not stop until it's clear that inflation has peaked. (RTRS)

FED: The U.S. economy may be shifting into an environment where sky-high inflation is finally poised to turn lower, led by softening core goods prices, San Francisco Fed economist Adam Shapiro told MNI. (MNI)

FED: The Federal Reserve will downshift in December to deliver a 50-basis-point interest rate hike, but economists polled by Reuters say a longer period of U.S. central bank tightening and a higher policy rate peak are the greatest risks to the current outlook. (RTRS)

ECONOMY/POLITICS: President Joe Biden’s top economic adviser, Brian Deese, is expected to leave the White House next year, part of a broader reshuffle that will offer Biden a chance to make over his coterie of aides on an issue central to an expected reelection bid. (BBG)

POLITICS: Nancy Pelosi, the first female speaker of the House, who helped shape many of the most consequential laws of the early 21st century, said Thursday that she will step down after two decades as the Democratic Party’s leader in the chamber. (NBC)

POLITICS: U.S. House Majority Leader Steny Hoyer will step down from the Democratic leadership but will remain in Congress, Punchbowl News reported on Thursday, adding that Hoyer will back Representative Hakeem Jeffries to lead House Democrats. (RTRS)

PROPERTY: Mortgage rates dropped nearly half a percentage point this week. The 30-year fixed-rate mortgage is averaging 6.61% for the week ending November 17, decreasing by 0.47 percentage points from a week ago, according to Freddie Mac. The week-over-week change in rate is the largest since this summer. (Money)

ECONOMY/EQUITIES: Amazon.com Inc. Chief Executive Officer Andy Jassy said the e-commerce giant will be cutting jobs into 2023 as it adjusts to business conditions, his first public comments about the cost-reduction plans roiling Amazon since reports that it planned to wipe out about 10,000 jobs. (BBG)

EQUITIES: Twitter has told employees that the company's office buildings will be temporarily closed, effective immediately. (BBC)

OTHER

GEOPOLITICS: China and the US are seeking to win over nations to their vision for the region at the Asia-Pacific Economic Cooperation (APEC) summit in Bangkok on Friday, the final meeting in a week of international meetings in Southeast Asia this week. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Friday that it is necessary for wages to continuously rise about 3% to achieve the bank's 2% price target in a stable and sustainable manner. (MNI)

RBNZ: New Zealand's central bank will hike rates by 75 basis points for the first time ever on Wednesday to cool multi-decade high inflation, ramping up the speed of an already-aggressive monetary tightening campaign, a Reuters poll found. (RTRS)

SOUTH KOREA: South Korea will make best efforts to stabilize commercial paper market via close communication with market participants and improving speed of purchases of facilities, Financial Services Commission says in statement. (BBG)

SOUTH KOREA: South Korea to ask major public institutional investors, including pension funds, to adjust their overseas investment plans, in an effort to help stabilize FX demand and supply, Vice Finance Minister Bang Ki-sun says in a meeting. (BBG)

NORTH KOREA: North Korea fired a suspected intercontinental ballistic missile on Friday that landed just 200 kilometres (130 miles) off Japan and had sufficient range to reach the mainland of the United States, Japanese officials told reporters. (RTRS)

TURKEY/RATINGS: Potential sovereign rating reviews of note slated for after hours on Friday include:

- Fitch on Turkey (current rating: B, Outlook Negative).

MEXICO: The International Monetary Fund (IMF) has concluded that Mexico still meets the eligibility criteria for a flexible credit line, the Mexican central bank said on Thursday. Mexico's Foreign Exchange Commission has decided to maintain access equivalent to around $47 billion, the bank said in a statement issued with the country's finance ministry. (RTRS)

MEXICO: Mexico’s Finance Ministry said in a statement it signed an agreement with the superior auditor of the federation, known as ASF, to review the allocation and impact report of sovereign bonds linked to the UN’s sustainable development goals. (BBG)

BRAZIL: Brazil's incoming government will be fiscally responsible, Vice President-elect Geraldo Alckmin said Thursday, promising a budget surplus and reduction in public debt in effort to quell market unrest over a proposed welfare plan. (RTRS)

BRAZIL: Brazil's Economy Ministry on Thursday lowered its forecast for economic growth in 2023 to 2.1% from 2.5% in September. The ministry kept its 2022 GDP growth outlook at 2.7%. (RTRS)

SOUTH AFRICA: South African households and businesses are left in the lurch after Eskom indefinitely implemented stage 4 load shedding "until further notice" from Friday morning. (EWN)

SOUTH AFRICA/RATINGS: Potential sovereign rating reviews of note slated for after hours on Friday include:

- S&P on South Africa (current rating: BB-; Outlook Positive).

METALS: An Indonesian proposal to create an OPEC-like group of nickel suppliers has raised eyebrows among Australian miners. Indonesian Investment Minister Bahlil Lahadalia floated the idea of an alliance that he said would help to unite government policies on the in-demand battery metal -- and push the development of the downstream industry -- at the Group of 20 Summit in Bali this week. The plan has been discussed with both Canada and Australia. (BBG)

ENERGY: Delay to restarting Freeport LNG facility is “highly possible,” Masataka Fujiwara, President of Osaka Gas Co., said to press on Friday. (BBG)

OIL: The U.S. government plans to issue guidance in coming days on a Russian oil price cap taking effect on Dec. 5 and is ready for some "hiccups" in its implementation, a State Department official said on Thursday. (RTRS)

OIL: Germany has warned of local oil shortages when the EU-wide ban on Russian oil comes into force in January, in a further sign of the disruption Europe’s energy crisis is wreaking on the continent’s largest economy. (FT)

CHINA

PBOC: China should set its economic growth target no lower than 5% for 2023, Liu Shijin, a policy adviser to the People's Bank of China, said on Friday. (RTRS)

PBOC: No immediate reserve ratio cut doesn’t mean China’s monetary policy is shifting directions, and the current structural liquidity support for the real economy is likely to continue, the Securities Times wrote in a front page editorial article. (BBG)

PBOC: The People’s Bank of China is less likely to cut reserve requirement ratios or interest rates by the end of the year, as it watches for signs of rising inflation as flagged in its Q3 Monetary Policy Report, Securities Daily reported citing Wang Qing, chief analyst of Golden Credit Rating. (MNI)

PBOC: China needs to be vigilant and avoid high inflation as M2 growth has been relatively high over the past two years and pressure from imported inflation remains, said 21st Century Business Herald in an editorial. (MNI)

PROPERTY: Property developers are accelerating the delivery of unfinished housing projects, though they still remain cautious about kicking off new projects amid sluggish demand, Caixin reported. The decline in completed projects had been narrowing rapidly on a year-on-year basis. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY9 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) on Friday injected CNY21 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY9 billion after offsetting the maturity of CNY12 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 9:41 am local time from the close of 1.8630% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 44 on Thursday vs 46 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1091 FRI VS 7.0655 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1091 on Friday, compared with 7.0655 set on Thursday.

OVERNIGHT DATA

JAPAN OCT CPI +3.7% Y/Y; MEDIAN +3.6%; SEP +3.0%

JAPAN OCT CPI EX-FRESH FOOD +3.6% Y/Y; MEDIAN +3.5%; SEP +3.0%

JAPAN OCT CPI EX-FRESH FOOD & ENERGY +2.5% Y/Y; MEDIAN +2.4%; SEP +1.8%

UK NOV GFK CONSUMER CONFIDENCE -44; MEDIAN -46; OCT -47

UK consumer confidence edged higher in November, but it was more an expression of hope' that the economic outlook might avoid further deterioration than a pointer to a sharp upturn in coming months, Joe Staton, the head of GFK's Client Strategy told MNI Thursday. (MN)

MARKETS

SNAPSHOT: Kim Continues To Push The Envelope With Missile Tests

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 43.12 points at 27887.06

- ASX 200 up 16.15 points at 7151.8

- Shanghai Comp. down 1.121 points at 3114.086

- JGB 10-Yr future down 11 ticks at 149.39, yield up 0.4bp at 0.25%

- Aussie 10-Yr future up 0.5 ticks at 96.385, yield down 0.5bp at 3.611%

- US 10-Yr future up 0-01+ at 112-21+, yield down 0bp at 3.7657%

- WTI crude up $0.67 at $82.31, Gold up $1.99 at $1762.51

- USD/JPY down 24 pips at Y139.96

- FED'S KASHKARI: NOT STOPPING RATE HIKES UNTIL INFLATION PEAKS (RTRS)

- JEREMY HUNT TO DEFEND AUTUMN STATEMENT AMID WARNING OF RECORD FALL IN LIVING STANDARDS (SKY)

- ITALY’S MELONI IS READY TO PRESENT €30 BILLION BUDGET TO CABINET (BBG)

- SNB'S MAECHLER: RATES WILL BE RAISED IF INFLATION FORECAST ABOVE TARGET (RTRS)

- CHINA SHOULD SET 2023 ECONOMIC GROWTH TARGET NO LOWER THAN 5% - CENTRAL BANK ADVISER (RTRS)

- NORTH KOREA FIRES SUSPECTED INTERCONTINENTAL BALLISTIC MISSILE, LANDS NEAR JAPAN (RTRS)

US TSYS: A Touch Firmer As North Korean Missile Test Helps Unwind Early Downtick

TYZ2 prints +0-02+ at 112-22+, 0-01 off the peak of its 0-08 overnight range, on volume of ~71K. Cash Tsys run flat to 1.5bp richer into London hours.

- A block buy in TY futures (+1,750) and news that the latest North Korean missile test resulted in an ICBM falling into Japanese waters (with no damage to Japanese assets reported) allowed the space to unwind the modest downtick that came in early Asia-Pac trade, after regional participants initially followed Thursday’s cheapen, albeit in a limited manner.

- The 2-/10-Year yield spread continues to hover within a couple of bp of the deepest levels of inversion witnessed during the current cycle (which printed on Thursday, in lieu of hawkish rhetoric from St. Louis Fed President Bullard).

- Outside of the aforementioned block buy of TY futures, Asia-Pac trade also saw some buying of the TYZ2 112.00/111.50 1x2 put spread on screen.

- Looking ahead, NY hours will bring existing home sales data and Fedspeak from Collins. We will also see a joint round of comments from President Biden & Tsy Sec Yellen.

JGBS: Twisting Flatter, No Lasting Reaction To North Korean Missile Launch

Cash JGBs run 2bp cheaper to 0.5bp richer across the curve, with only 40s firming on Friday. Influence from Thursday’s wider core global FI trade seemingly crept in. Meanwhile, futures print -10 ahead of the bell and have struggled to turn bid all day.

- Domestic CPI data may also have had some minor impact on price action. The 3 major CPI metrics all topped consensus estimates by 0.1ppt, as the major Y/Y inflation rates moved 0.6-0.7ppt higher vs. previous readings. The readings won’t be a gamechanger for the BoJ, with the Bank committed to maintaining its ultra-loose policy settings, as it looks to foster meaningful wage growth in a bid to develop demand-pull, not cost-push, inflation.

- The home bias of Japanese investors that we have discussed previously will likely have aided the flattening move.

- There wasn’t much in the way of tangible, lasting reaction to the latest North Korean missile test, which saw an ICBM fall in the sea which is covered by Japan’s EEZ (there was no damage reported re: Japanese assets). Language from Japanese, South Korean & U.S. leadership has condemned the action, as you would expect.

- Elsehwere, policymaker rhetoric failed to inspire anything in the way of meaningful price action, offering little new for participants to trade off.

- Looking ahead, BoJ Rinban operations covering 1- to 10-Year JGBs headlines domestic matters on Monday.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.87594tn 3-Month Bills:

- Average Yield -0.1165% (prev. -0.1113%)

- Average Price 100.0313 (prev. 100.0299)

- High Yield: -0.1117% (prev. -0.1061%)

- Low Price 100.0300 (prev. 100.0285)

- % Allotted At High Yield: 55.6309% (prev. 29.3383%)

- Bid/Cover: 3.757x (prev. 3.607x)

AUSSIE BONDS: Firmer In The Second Half, Lowe’s Speech Now Eyed

There was little in the way of idiosyncracies to drive the Aussie bond space ahead of the weekend, leaving futures to meander through the final Sydney session of the week, with YM closing -2.0, in line with late overnight levels, while XM was +0.5, as the flattening impetus from wider core FI trade on Thursday was maintained. Wider cash ACGBs run 2bp cheaper to 5.5bp richer, pivoting around 10s.

- EFPs were essentially unchanged on the day.

- Early rounds of trade were driven by reaction to Thursday’s cheapening in wider core global FI markets, before the latest North Korean missile test (which saw the ICBM fall into the sea covered by Japan’s EEZ) provided a bid.

- The latest round of ACGB Nov-29 supply went well.

- Next week’s AOFM issuance slate is pretty vanilla, with ACGB Apr-25 & ACGB May-32 set to come to market.

- Bills finished +1 to -2 through the reds, with some light twist steepening seen.

- Looking ahead, next week’s local docket is lacking when it comes to major economic releases, with the flash S&P Global PMI prints providing the only real point of note. That means that it will be Governor Lowe’s Tuesday dinner address (on “Price Stability, the Supply Side and Prosperity”) that headlines the domestic docket.

AUSSIE BONDS: ACGB Nov-29 Auction Results

The Australian Office of Financial Management (AOFM) sells A$700mn of the 2.75% 21 November 2029 Bond, issue #TB154:

- Average Yield: 3.5318% (prev. 2.1648%)

- High Yield: 3.5350% (prev. 2.1650%)

- Bid/Cover: 4.3114x (prev. 3.7700x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 14.9% (prev. 62.1%)

- Bidders 38 (prev. 37), successful 17 (prev. 10), allocated in full 11 (prev. 1)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 22 November it plans to sell A$150mn of the 2.50% 20 September 2030 Indexed Bond.

- On Wednesday 23 November it plans to sell A$900mn of the 1.25% 21 May 2032 Bond.

- On Thursday 24 November it plans to sell A$500mn of the 24 February 2023 Note, A$1.0bn of the 10 March 2023 Note & A$1.0bn of the 26 May 2023 Note.

- On Friday 25 November it plans to sell A$700mn of the 3.25% 21 April 2025 Bond.

NZGBS: Cheaper Ahead Of Weekend, Pre-RBNZ Hedging May Have Weighed

Cash NZGBs were cheaper ahead of the weekend, with the early uptick in yields seeing a modest extension through the day, as the major benchmarks finished the final session of the week 3.5-5.0bp cheaper. The curve came under some light bear flattening pressure.

- This came even as U.S. Tsys richened incrementally during Asia-Pac hours, with payside swap flow in the front end of the NZ curve seemingly aiding the cheapening, as both 2- & 5-Year swap spreads widened, while swap spreads further out the curve were little changed to a touch tighter.

- This payside flow may have been a case of participants putting some pre-RBNZ hedges into place, with RBNZ dated OIS now pricing 65bp of tightening for next week’s meeting, alongside a terminal cash rate of just below 5.10%, with both moving incrementally higher on the day.

- The aforementioned RBNZ decision headlines next week’s domestic docket, with 10 of the 14 surveyed by BBG looking for a super-sized 75bp step from the Bank, after a run of consecutive 50bp moves.

- Elsewhere, the monthly credit card spending, trade balance and ANZ consumer confidence data is slated, with Q3 retail sales volume also due.

EQUITIES: Early Optimism Doesn't Have Much Follow Through

Early positive impetus in the equity space has given way to a more cautious tone in regional equities as the session has progressed. Most markets are away from best levels, with some markets slipping into negative territory. US equity futures have struggled to stay in positive territory as well.

- HSI opened up firmer, buoyed by China tech stock gains in the US overnight. The market was pleased with Alibaba's buyback plan, while China gaming stocks rallied on fresh approvals from regulators on new games.

- The HSI tech sub-index is up around 3.40% currently, although down from session highs. The broader HSI index is up a more modest 0.56%. There hasn't been much positive impetus from headlines that the Biontech Bivalent covide vaccine has approved for emergency use.

- China stocks are around flat, with the CSI 300 +0.07%, but Shanghai Composite slightly down. A PBoC advisor stated China's growth target should be at least 5% next year, with higher levels possible if Covid restrictions are lifted in the first half.

- The Kospi opened up firmer, buoyed by a Goldman Sach's upgrade, but has trimmed gains as the session progressed. We currently sit +0.20%, just under 2448, we were above 2470 in the first part of the session. North Korea's reported ICBM test has likely taken the shine of South Korean assets, although the impact doesn't look large.

- Moves elsewhere have been mixed, the Nikkei 225 couldn't hold early gains (last at -0.10%), while the Taiex is down -0.25% at this stage. The ASX 200 is up modestly, last +0.20%.

OIL: Back-To-Back Weekly Losses

Brent crude is back above $90/bbl, +0.90% on NY closing levels. Still, at this stage we are -5.65% lower for the week, which follows last week's -2.62% decline. Brent is below all key MAs and is not too far away from mid-October lows (just under $89/bbl). WTI sits close to $82.50/bbl currently, but traded below mid-October lows overnight.

- Forward curves are generally indicating reduced supply pressure rather than tighter markets. Supply pressures were generally seen as getter tighter in the lead up to the northern hemisphere winter, but that hasn't materialized yet. The Brent prompt spread is back to early September lows.

- The other factor is that optimism around China shifting away from its CZS may take time to generate stronger physical oil demand.

- Looking ahead the oil calendar is fairly light for the week ahead, outside of the weekly inventory reports. Focus is likely to rest on Wednesday round of preliminary PMI prints for the EU area and the US, as an update on the global demand picture.

GOLD: On Track For First Weekly Loss Since End October

Gold is tracking higher for the first time since Tuesday, after dropping over 1% through the middle part of this week. The precious metal was last close to $1764, still on track for a modest weekly loss, which would be the first since late October.

- We are currently +0.20% higher from NY closing levels, which is in line with pull back in USD sentiment, the BBDXY is down 0.2% so far for the session.

- Note the 200-day EMA comes in at $1760.4 level, which could act as a support point. We broke through this level overnight but managed to close higher (lows were just under $1755).

- US yields are holding close to overnight highs, which may limit gold's upside in the near term. Highs for the week sit around the $1785 region.

FOREX: Yen Outperforms Safe Haven Peers, Yuan Stages Firm Rebound

The yen was resilient amid risk-on flows elsewhere in the G10 FX space, with the Antipodeans leading gains, while the USD and CHF lagged behind. Spot USD/JPY rejected intraday resistance from Y140.50 and gave back initial gains. Reports of a North Korean missile test involving an ICBM capable of reaching U.S. mainland failed to provoke any broader flip in market sentiment.

- The yen initially found Japan's CPI report uninspiring, albeit garnered some strength as the session progressed. Core consumer inflation picked up to +3.6% Y/Y in October from +3.0% prior, beating the median estimate of +3.5%, which is unlikely to persuade the BoJ to change tack. After the release, central bank Governor Kuroda said that the current inflation situation isn't sustainable.

- USD/CNH snapped a three-day winning streak, potentially on the back of headlines that Hong Kong has approved emergency use of the BioNTech Bivalent vaccine. Bloomberg cited trader sources flagged dollar sales by Chinese state-owned banks as a factor behind yuan rebound.

- Gains for offshore yuan spilled over into the outperforming Antipodeans, prompting them to refresh session highs. AUD/NZD extended its losing streak to five consecutive days.

- Looking ahead, focus on the data front turns to U.S. existing home sales, UK retail sales and Norwegian GDP. Comments are due from ECB's Lagarde, Nagel & Knot, Fed's Collins, as well as BoE's Mann & Haskel.

FX OPTIONS: Expiries for Nov18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0200(E739mln), $1.0225-50(E1.3bln), $1.0300(E836mln), $1.0450(E2.6bln)

- USD/JPY: Y138.00($770mln), Y138.90-00($615mln), Y139.45($567mln), Y140.50($1.3bln)GBP/USD: $1.1700(Gbp560mln)

- AUD/USD: $0.6650-60(A$1.1bln)

- USD/CAD: C$1.3325($1.2bln)

- USD/CNY: Cny7.0500($3.3bln), Cny7.1500($3.0bln), Cny7.2000($2.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/11/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 18/11/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 18/11/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 18/11/2022 | 0830/0930 |  | EU | ECB Lagarde Speech at European Banking Congress | |

| 18/11/2022 | - |  | EU | COP 27 Ends | |

| 18/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 18/11/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/11/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/11/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/11/2022 | 1715/1715 |  | UK | BOE Haskel Panels Ditchley Economics Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.