-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Steady Ahead Of US Data

EXECUTIVE SUMMARY

- IT’S ANOTHER BIG UK DATA WEEK WITH LABOUR MARKET DATA TUESDAY, INFLATION WEDNESDAY, ACTIVITY DATA (INCLUDING Q2 GDP) ON THURSDAY, AND RETAIL SALES FRIDAY - MNI

- DONALD TRUMP AND ELON MUSK HELD A WARM, BUT GLITCH-DELAYED CONVERSATION ON X - BBG.

- THE US BELIEVES AN IRANIAN ATTACK AGAINST ISRAEL HAS GROWN EVEN MORE LIKELY - BBG

- US CPI PREVIEW: LARGE MISS NEEDED FOR FED TO GUIDE 50BP CUTS - MNI

- SHARE TRANSACTIONS IN CHINA SHRANK TO THEIR LOWEST LEVEL IN OVER FOUR YEARS - BBG.

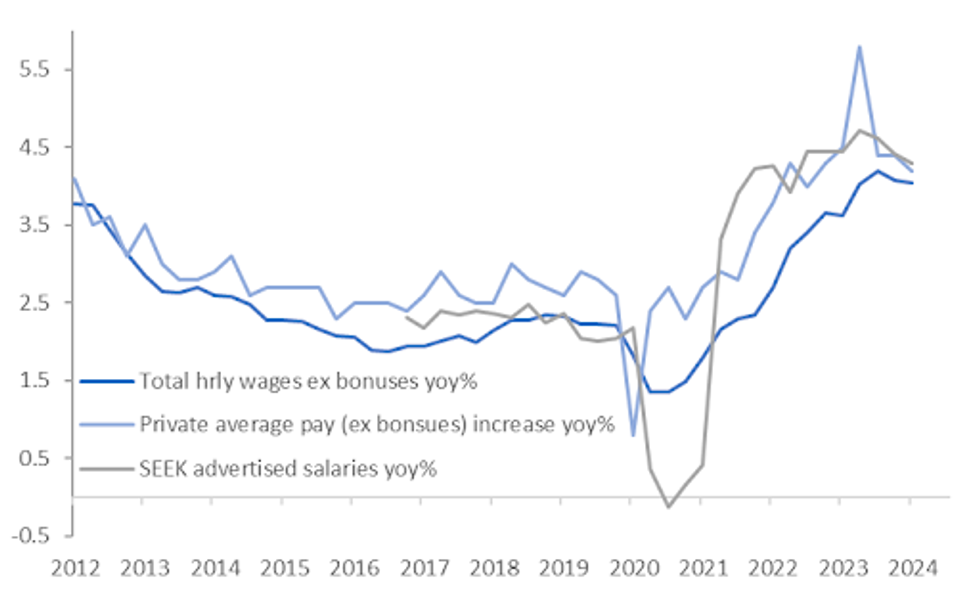

Fig. 1: Australia: Wages Growth Ex Bonuses

Source: MNI - Market News/Bloomberg

UK

ECONOMY (MNI): “It’s another big UK data week with labour market data Tuesday, inflation Wednesday, activity data (including Q2 GDP) on Thursday and retail sales Friday.”

EUROPE

GERMANY (BBG): “Germany’s sagging construction sector should face an upswing thanks to additional European Central Bank interest-rate cuts, according to Vice Chancellor Robert Habeck.”

UKRAINE (BBC): “Ukraine's top commander has said Kyiv's forces control 1,000 sq km of Russian territory as they press their biggest cross-border incursion in two-and-a-half years of full-scale war.”

RUSSIA (ECONOMIST): “On Tuesday the Moscow Conference on International Security opens in Russia’s capital. It is a chance for the Kremlin to present its version of geopolitics to a sympathetic (or at least non-aligned) audience of delegates from some 70 countries.”

US

TRUMP (BBG): Donald Trump and Elon Musk held a warm, but glitch-delayed conversation on X that saw the tech mogul pitch a role for himself should the Republican nominee win a second White House term, but otherwise rehashed the notes that Trump routinely strikes at his campaign rallies.

ECONOMY (MNI): US CPI Preview: Large Miss Needed For Fed To Guide 50bp Cuts

ECONOMY (MNI): The U.S. government posted a USD244 billion budget deficit in July and has rang up a deficit of USD1.517 trillion in the first ten months of the fiscal year, the Treasury Department reported Tuesday.

OTHER

WAGES (BBG): Australian wages grew by slightly less than expected in the second quarter, but concerns about the overall pace of wage hikes against a backdrop of stalled productivity growth are likely to keep the Reserve Bank of Australia cautious about cutting rates.

ISRAEL/IRAN (BBG): The US believes an Iranian attack against Israel has grown even more likely and may come as soon as this week, officials said, as allied leaders sought to head off all-out war and the Pentagon deployed more forces to the region.

ISRAEL (BBG): “Israel’s sovereign debt was cut by one notch by Fitch Ratings, which kept a negative outlook on the credit as continued military conflict weighs on the country’s public finances. The ratings firm lowered the country’s score to A from A+, citing “continued war” and geopolitical risk as drivers, according to a statement Monday.”

COPPER (BBG): “BHP Group and union leaders at the Escondida operation in Chile are sitting down for one last session of mediated wage talks in a bid to avoid a strike at the world’s biggest copper mine. In a tense final day of mediation, BHP delivered its sweetened wage offer — including a $28,900 bonus — directly to workers and the labor regulator.”

IRON ORE (BBG): Iron ore fluctuated around $100 a ton ahead of data this week that’ll shed light on Chinese steel output as mills in the biggest market battle slumping product prices and challenged domestic demand.

CHINA

MARKETS (BBG): Chinese authorities will step up policies to foster long-term investors in the country’s stock markets, China Securities Journal reports, citing analysts and unnamed industry insiders.

EQUITIES (BBG): Share transactions in China shrank to their lowest level in over four years, as a local bond rally hit fever pitch in a weakening economy.

EMPLOYMENT (BBG): “General Motors Co. has been laying off staff in China and will soon meet with local partner SAIC to plan a larger structural overhaul of its operations there, a recognition the Detroit automaker is unlikely to see its sales return to 2017 peak levels.”

BANKING (SECURITIES DAILY): The banking sector could further cut deposit rates causing depositors to seek higher returns from financial management products, Securities Daily reported citing Wang Qing, analyst at Golden Credit Rating.

GOVERNMENT (YICAI): Local government use of treasury and special treasury bonds has suffered from irregular management, delayed construction and idle funds, recent audits revealed.

INFLATION (YICAI): Analysts expect pork prices to rise further as demand for pork increases during the peak Q3 consumption period, according to Yicai news outlet.

CHINA MARKETS

The People's Bank of China (PBOC) conducted CNY385.7 billion via 7-day reverse repo on Tuesday, with rate unchanged at 1.70%. The operation has led to a net injection of CNY385.08 billion after offsetting the CNY0.62 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7461% at 09:50 am local time from the close of 1.9114% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Monday, compared with the close of 51 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The PBOC started setting daily central parity rates on Jan 4, 2007. On July 21, 2005, China switched to a managed-float formula against a basket of currencies, weakening the yuan's peg to the dollar Since March 17, 2014, the yuan has been allowed to move 2% in a range on either side of the daily fixing against the dollar.

MARKET DATA

AUSTRALIA Q2 WAGE PRICE INDEX +4.1% Y/Y; EST. +4.0%; PRIOR 4.1%

AUSTRALIA Q2 WAGE PRICE INDEX +0.8% Q/Q; EST. +0.9%; PRIOR +0.9%

AUSTRALIA AUGUST WESTPAC CONSUMER CONFIDENCE +2.8% M/M; PRIOR -1.1%

AUSTRALIA AUGUST WESTPAC CONSUMER CONFIDENCE RISES TO 85; PRIOR 82.7

AUSTRALIA JULY NAB BUSINESS CONDITIONS +6; PRIOR +4

AUSTRALIA JULY NAB BUSINESS CONFIDENCE +1; PRIOR +3

NEW ZEALAND JUNE NET MIGRATION ESTIMATE +2,710; PRIOR +3,430 (PRE 1,410)

NEW ZEALAND Q3 RBNZ HOUSEHOLD MEDIAN 2-YEAR INFLATION EXPECTATION 3%; PRIOR 3.0%

NEW ZEALAND Q3 RBNZ HOUSEHOLD MEDIAN 1-YR INFLATION EXPECTATION 3.5%;PRIOR 4.0%

JAPAN JULY PRODUCER PRICES +0.3% M/M; EST. +0.3%; PRIOR +0.2%

JAPAN JULY PRODUCER PRICES +3.0% Y/Y; EST. +3.1%; PRIOR +2.9%

SOUTH KOREA EXPORT PRICES JULY +12.9% Y/Y; PRIOR +12.1%

SOUTH KOREA IMPORT PRICES JULY +9.8% Y/Y; PRIOR +9.6%

SOUTH KOREA JUNE ADJUSTED M2 MONEY SUPPLY +0.6% M/M; PRIOR 0.0%

MARKETS

US TSYS: Tsys Future Steady Ahead Of PPI & Bostic To Speak

- It has been another very slow Asian session for US Tsys, ranges have been tight while volumes are below average, this follows the US session were many saying it felt like summer holiday volumes. Investors look to be on the sidelines ahead of a busy end of the week for data. Earlier Musk, hosting Trump on X spaces, although there was little spoken in the way of new policy updates.

- TUU4 is -0-00+ at 103-07⅞, while TYU4 is -0-01 at 113-06+.

- The cash treasury curve is slightly steeper today, yields are -0.5bps to +1bps. There has been slightly better selling through the belly, the 2yr is -0.3bp at 4.015%, the 7yr is +1bp at 3.8% while the 10yr is +0.8bp at 3.911%.

- Overnight at the treasury bill auctions buyers favored 3m bills over 6m bills due to increasing bets on Federal Reserve rate cuts. The 3m bills were sold at 5.07%, below the expected yield, while 6m bills were sold at 4.795%, slightly above expectations. The six-month auction saw a lower-than-average bid-to-cover ratio of 2.73.

- Projected rate cut pricing into year end looks marginally higher vs. early morning levels (*): Sep'24 cumulative -39.8bp (-38.1bp), Nov'24 cumulative -70.4bp (-69.7bp), Dec'24 -101.8bp (-100.6bp).

- Today, PPI data while Richmond Fed Bostic will discuss his economic outlook.

ACGBS: Richer, Narrow Ranges, WPI Failed To Move Market

ACGBs (YM +4.0 & XM +4.5) are richer but little changed after today’s data drop (Q2 Wage Price Index, consumer sentiment and business confidence).

- Cash US tsys are slightly richer in today’s Asia-Pac session, ahead of US PPI data. PPI data will be scrutinised for categories that feed through to the Fed’s preferred inflation gauge, the PCE Deflator.

- US CPI is due for release on Wednesday. Consensus sees core CPI at 0.2% m/m in July after the far softer than expected 0.065% m/m in June, with a mild skew towards a “low” 0.2% per MNI’s compilation of sell-side previews. (See MNI CPI Preview here)

- Cash ACGBs are 4-5bps richer on the day, with the AU-US 10-year yield differential at +9bps.

- Swap rates are 4-5bps lower.

- The bills strip is slightly richer, with pricing +2 to +3.

- RBA-dated OIS pricing is flat to slightly softer across meetings. A cumulative 21bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty apart from the AOFM’s planned sale of A$800mn of the 3.50% 21 December 2034 bond. A$700mn of the 2.25% 21 May 2028 bond is due to be sold on Friday.

- The RBNZ Policy Meeting is tomorrow. 12 of 21 economists surveyed by Bloomberg expect no change, with 9 expecting a 25bp cut.

NZGBS: Twist-Flattening Of Curve Ahead Of US PPI & RBNZ Policy Decision

NZGBs closed around session bests. The 2/10 curve has twist-flattened, with benchmark yields 1bp higher to 2bps lower.

- The long end was supported by a slight richening in cash US tsys in today’s Asia-Pac session. Tuesday’s focus in the US will be on US PPI data and Richmond Fed Bostic. PPI data will be scrutinised for categories that feed through to the Fed’s preferred inflation gauge, the personal consumption expenditures price index.

- The short end, however, was more focused on tomorrow’s RBNZ Policy Meeting.

- We expect the RBNZ to discuss a rate cut at the August meeting but opt to keep monetary policy unchanged. Nevertheless, we expect the bank to communicate its intention to ease before year-end through its statement, press conference and updated staff forecasts. It is a close call with 9 of 23 forecasters on Bloomberg expecting a cut. See here for the full preview.

- Swap rates closed 2bps lower to 2bps higher, with the 2s10s curve flatter.

- RBNZ dated OIS pricing is 1-2bps firmer across meetings today. The market attaches a 58% chance of a 25bp cut this week versus 69% on Friday and 43% before RBNZ inflation expectations data last week. A cumulative 47bps of easing is priced for the October meeting, with 87bps of cuts by year-end.

JGBS: Bear-Flattener Remains But Early Yield Rise Has Been Pared

JGB futures are stronger, +10 compared to the settlement levels on Friday.

- (Reuters, ICYMI) Japan's parliament plans to hold a special session on Aug. 23 to discuss the central bank's decision last month to raise interest rates. The special session, to be conducted by the lower house financial affairs committee, is likely to ask BoJ Governor Ueda to attend, said the sources, who declined to be identified.

- Outside of the previously outlined PPI data, there hasn't been much in the way of domestic drivers to flag. Machine Tool Orders data (prelim) is due later today.

- Cash US tsys are little changed in today’s Asia-Pac session. Tuesday’s focus in the US will be on US PPI data and Richmond Fed Bostic. PPI data will be scrutinised for categories that feed through to the Fed’s preferred inflation gauge, the personal consumption expenditures price index.

- The cash JGB curve continues to hold a slight bear-flattening but yield movements have been pared in the afternoon session. Yields currently sit flat to 2bps higher. The benchmark 10-year yield is 0.4bps higher at 0.857%.

- Swaps rates are ~1bp lower out to the 10-year zone, and 1-6bps higher beyond. Swap spreads are tighter out to the 10-year.

- Tomorrow, the local calendar is empty apart from 5-year supply.

ASIA STOCKS: Japanese Equities Jump Post Holiday, Regional Markets Mixed

Asian markets are trading mostly higher today, with Japanese stocks leading the way. The Nikkei 225 and the Topix both gained over 2%, buoyed by a weaker yen which supports exporters. MSCI’s Asia-Pacific gauge rose by up to 1%, recovering from last week's losses. China & Hong Kong markets are little changed today, as the market awaits data due out on Thursday. US equity futures are modestly higher, and US 10-year Treasury futures are flat Oil prices remain around $80 amid concerns about potential Iranian attacks on Israel, which also led Fitch Ratings to downgrade Israel’s debt. Market focus will now shift to upcoming US inflation data to assess its impact on Federal Reserve policy and potential rate cuts. Meanwhile, Chinese regulators are taking measures to cool down domestic bond market rallies.

- Japanese equities have recovered to levels seen before the sharp 12% drop on August 5, with the Nikkei 225 up 2.50% with the market rebounding after a long weekend, supported by a weaker yen, which benefited exporters like automakers and tech firms. Technology stocks, including Tokyo Electron, gained following a boost in U.S. semiconductor stocks. Despite the recent recovery, both the Nikkei 225 and Topix are still down around 9% since the end of July. On Monday there were comments from an ex-BoJ board member suggesting that the BoJ may not raise rates again this year, due to the impact it has had on the markets. The Topix is 1.85% higher today, with Banks leading the way.

- South Korea has erased early gains, with the KOSPI now down 0.10%, while the KOSDAQ is off 1.65%. The market showed mixed performance among major stocks, with Samsung Electronics up 0.70% and SK hynix gaining 2.00%, benefiting from the recent strength in U.S. AI chip stocks like Nvidia. However, key battery makers, including LG Energy Solution and Samsung SDI, saw declines of 1% and 2%, respectively. Investors are cautious as they await critical U.S. economic data, including the consumer price index and retail sales figures, which could provide further direction for the global markets.

- Taiwan equities are slightly lower today, the Taiex has been swinging between gains and losses. TSMC is also unchanged today underperforming other semiconductors names in the region. We have seen the past two sessions of inflows into Taiwan's markets, with the past 5 session now seeing a slight inflow, ending weeks of heavy selling by foreign investors.

- Australian equities are slightly higher today, there has been some tier 2 data out with Consumer Confidence rising to 2.8% in August to 85.00 from 82.7 in July, wages rose to 4.1% in 2Q slightly beating estimates at 4%, while we also had NAB business surveys, with confidence in July dropping to 1 from 3, while conditions rose to 6 from 4. The ASX 200 is 0.10% higher. In New Zealand, the NZX50 is 0.20%.

- Asia EM is mixed today, with Malaysia's KLCI down 0.11%, Thailand SET is 0.25% lower, India's Nifty 50 is 0.12% lower, while Singapore's Straits Times is 0.85% higher, Philippines PSEi is 0.80% higher & Indonesia's JCI 0.75% higher

ASIA STOCKS: Foreign Investors Slowly Coming Back To Taiwan Equities

- South Korea: South Korean equities saw an outflow of $56m yesterday with an outflow of $527m over the past five trading days. The 5-day average outflow is $105m, compared to the 20-day average outflow of $140m and the 100-day average inflow of $86m. Year-to-date, South Korea has had substantial inflows totaling $16.743b.

- Taiwan: Taiwan recorded an inflow of $537m yesterday, with a net inflow of $311m over the past five trading days. There at least in the short term seems to be foreign investors returning to the local market, TSMC which represents between 25-30% of the Taiex has reported strong July revenue figures and is up 15% from the Aug 5 lows. The 5-day average inflow is $62m, compared to the 20-day average outflow of $730m and the 100-day average outflow of $190m. Year-to-date, Taiwan has experienced outflows totaling $10.933b.

- India: Indian equities saw an outflow of $138m Friday, with a net outflow of $1.216b over the past five trading days. The 5-day average outflow is $243m, compared to the 20-day average inflow of $15m and the 100-day average outflow of $47m. Year-to-date, India has seen inflows totaling $2.297b (up to August 9th).

- Indonesia: Indonesian equities recorded an inflow of $31m yesterday, resulting in a net inflow of $132m over the past five trading days. The 5-day average outflow is $26m, compared to the 20-day average inflow of $17m and close to the 100-day average outflow of $10m. Year-to-date, Indonesia has had inflows totaling $169m.

- Thailand: Thai equities saw an inflow of $1m Friday leading to a net inflow of $12m over the past five trading days. Thailand was out for a public holiday on Monday. The 5-day average inflow is $2m, in line with the 20-day average of $0m, but better than the 100-day average outflow of $24m. Year-to-date, Thailand has experienced outflows amounting to $3.324b.

- Malaysia: Malaysian equities had an outflow of $17m yesterday, resulting in a 5-day net outflow of $114m. The 5-day average outflow is $23m, which is worse than the 20-day average outflow of $7m and the 100-day average outflow of $1m. Year-to-date, Malaysia has experienced outflows totaling $55m.

- Philippines: The Philippines recorded an inflow of $4m yesterday, but a net outflow of $15m over the past five trading days. The 5-day average outflow is $3m, compared to the 20-day average inflow of $1m and the 100-day average outflow of $8m. Year-to-date, the Philippines has seen outflows totaling $497m.

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -56 | -527 | 16743 |

| Taiwan (USDmn) | 537 | 311 | -10933 |

| India (USDmn)* | -138 | -1216 | 2297 |

| Indonesia (USDmn) | 31 | 132 | 169 |

| Thailand (USDmn) | 1 | 12 | -3324 |

| Malaysia (USDmn) | -17 | -114 | -55 |

| Philippines (USDmn) | 4 | -15 | -497 |

| Total | 362 | -1417 | 4400 |

| * Up to 9th August |

GOLD: Solid Gain On Brewing Geopolitical Tensions

Gold is 0.4% lower in today’s Asia-Pac session, after closing 1.7% higher at $2472.90, its highest level since Aug 1, on Monday.

- Bullion was supported by brewing tension in the Middle East where Israel in on full alert ahead of an expected attack from Iran/Hamas. Additionally, fighting continues in Eastern Europe after Ukraine took control of over 1,000 square miles of Russian territory in a counter-offensive that kicked off over the weekend.

- Tuesday’s focus will be on US PPI data and Richmond Fed Bostic, who will discuss his economic outlook. PPI data will be scrutinised for categories that feed through to the Fed’s preferred inflation gauge, the personal consumption expenditures price index.

- US CPI is due for release on Wednesday. Consensus sees core CPI at 0.2% m/m in July after the far softer than expected 0.065% m/m in June, with a mild skew towards a “low” 0.2% per MNI’s compilation of sell-side previews. MNI feels that moving away from a base case of the Fed cutting in 25bp clips will take further downside surprises.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, attention is on $2,483.7, the Jul 17 high and a bull trigger. Clearance of this hurdle would resume the uptrend.

OIL: Crude Lower Following OPEC Demand Revision, IEA Report Out Later Today

Oil prices are lower during APAC trading today after rising sharply yesterday on worries of a further escalation of issues in the Middle East. Markets have been driven lower by OPEC’s downward revision to its demand forecasts in its report published on Monday. The IEA’s is out later today as well as US inventory data. The USD index is down slightly.

- Benchmarks are off their intraday lows but are still down today. WTI is 0.6% lower at $79.61/bbl after a trough of $79.31. It rose 3.7% on Monday. Brent is down 0.6% to $81.80/bbl following a low of $81.50.

- OPEC’s monthly report showed a reduction in 2024 demand growth expectations by 135kbd, but the increase is still well above the IEA’s, whose report is out today. The adjustment was due to actual outcomes and softer expectations for China, the world’s largest crude importer. The group is due to reduce its output cuts from October.

- A strike from Iran or Hezbollah on Israel is expected soon. Israel’s IDF has been put on “peak alert”, according to the WSJ, and the US is increasing its presence in the region. Jordan and Saudi Arabia have refused to allow Iran to use their air space for an attack. US Secretary of State Blinken is scheduled to travel to the region later today, according to Axios. Gaza ceasefire talks are on Thursday. Another vessel was attacked in the Red Sea today.

- EIA US crude inventories have recorded six consecutive drawdowns but some refiners have announced a reduction in output. Industry data is released today with the EIA’s on Wednesday and both are likely to be monitored closely.

- Later the Fed’s Bostic speaks on the economy and US July PPI and small business confidence print. There’s also UK labour market data and euro area August ZEW.

FOREX: Risk-Sensitive AUD and NZD Outperform

Risk-averse currencies struggled today with risk-sensitive Aussie and kiwi outperforming in the G10 with most equity markets higher on the day but commodities weaker and geopolitical worries at the fore. USDJPY rose a further 0.3% to 147.70, close to its intraday high. The BBDXY USD index is off its intraday low to be little changed.

- NZDUSD has been one of today’s biggest movers up 0.3% to 0.6036 ahead of Wednesday’s RBNZ meeting. Views are split as to whether there will be a cut and the market has over a 60% chance priced in.

- AUDUSD has trended higher since data showing a pickup in consumer confidence and elevated wage inflation. The pair is now up 0.2% to 0.6596, struggling to break above 66c. AUDNZD is down 0.1% to 1.0929 but has been range trading.

- Like the yen, the Swiss franc has weakened while USDEUR is slightly stronger leaving EURCHF up 0.3% at 0.9487. USDGBP is moderately higher at 1.2777.

- Today’s USDCNY fixing was slightly up on yesterday’s at 7.1458, USDCNH trended higher thereafter to a peak of 7.1831 but has come back to be little changed today at 7.1788.

- Asian currencies have been quiet during Tuesday’s session with most currencies flat on the day. IDR and PHP were moderately weaker off 0.3% and 0.2% respectively. INR approaching 84.00 following weaker-than-expected CPI with some analysts now moving to forecast a rate cut.

- Later the Fed’s Bostic speaks on the economy and US July PPI and small business confidence print. There’s also UK labour market data and euro area August ZEW.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/08/2024 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 13/08/2024 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/08/2024 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/08/2024 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/08/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/08/2024 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/08/2024 | 1230/0830 | *** |  | US | PPI |

| 13/08/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/08/2024 | 1715/1315 |  | US | Atlanta Fed's Raphael Bostic | |

| 14/08/2024 | - |  | NZ | Reserve Bank of New Zealand Meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.