-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Mixed Fed Messaging Creeps In, Although Dovish Voice Is Departing

EXECUTIVE SUMMARY

- FED'S BARKIN - PRICES MAY FORCE HIGHER RATES PEAK (MNI)

- FED'S KASHKARI - TALK OF PIVOT ‘ENTIRELY PREMATURE’ (MNI)

- CHICAGO FED’S EVANS SAYS IT’S TIME TO SLOW PACE OF RATE HIKES (BBG)

- RUSSIA'S PUTIN WILL NOT ATTEND G20 SUMMIT IN BALI (RTRS)

- BIDEN PLANS TO LAY OUT 'RED LINES,' NOT MAKE CONCESSIONS TO CHINA'S XI (RTRS)

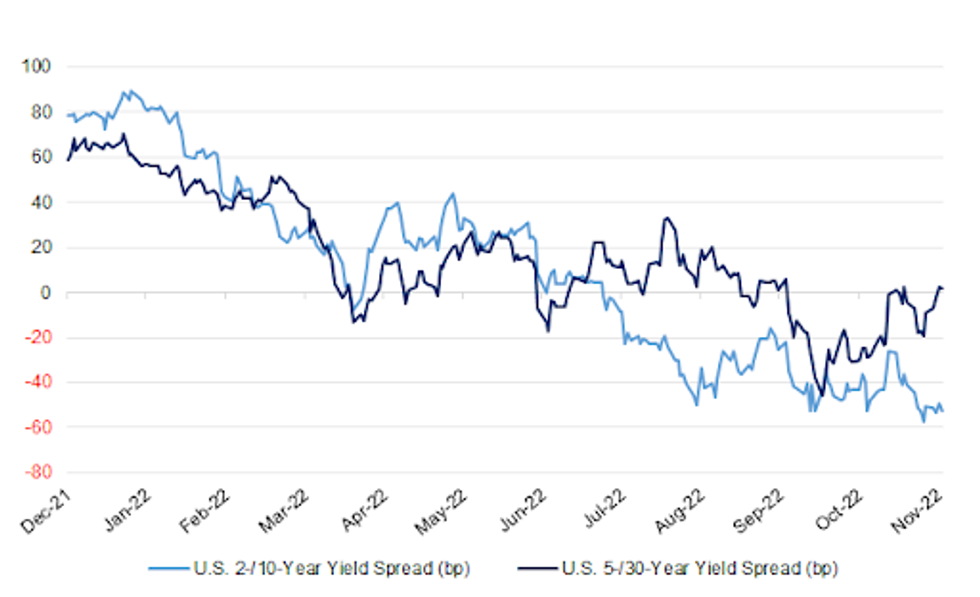

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Five former Bank of England rate setters have attacked their old employer for going soft on inflation despite hiking borrowing costs last Thurday to a 14-year high. (BBG)

FISCAL/BANKS: Chancellor of the Exchequer Jeremy Hunt plans to cut a surcharge on UK bank profits, effectively shielding them from the bulk of an increase in the country’s corporate tax rate as the government tries to preserve the competitiveness of Britain’s finance industry. (BBG)

ECONOMY: UK wage growth and hiring activity fell in October, as the prospect of a recession prompted fresh caution among employers and cooled the job market. (BBG)

EUROPE

FRANCE: The French economy will likely keep growing at a meager pace in the final quarter of this year, staving off a recession that economists expect to engulf Europe as the energy crisis deepens during winter, a Bank of France survey showed. (BBG)

BANKS: Credit Suisse was set to raise a total of $5 billion from two debt sales on Wednesday but was forced to pay up to attract investors after a string of scandals and a broader rise in market borrowing costs. (RTRS)

U.S.

FED: U.S. interest rates "may well” peak higher than the Fed has anticipated until now if inflation doesn't slow and the labor market remains tight, even as officials shift to smaller hikes to minimize the risk of overtightening, Federal Reserve Bank of Richmond President Thomas Barkin said in an interview Wednesday. (MNI)

FED: It’s far too soon for the Federal Reserve to contemplate the monetary policy “pivot” that markets have been yearning for because inflation is far too high while unemployment is at historic lows, Minneapolis Fed President Neel Kashkari said Wednesday. (MNI)

FED: Charles Evans, the outgoing president of the Federal Reserve Bank of Chicago, said it’s time for the central bank to begin slowing down its blistering pace of interest-rate increases given how high they’ve already gone, even if inflation data continue surprising to the upside in the coming months. “I do think there’s benefits to adjusting the pace as soon as we can,” Evans said Wednesday in an interview at the Chicago Fed. (BBG)

ECONOMY: U.S. President Joe Biden on Wednesday said he believed the U.S. economy would have a soft landing and avert recession. (RTRS)

INFLATION: The boost to CPI inflation from housing is likely to accelerate further before reversing course even though the rental market from which such measures are computed has started to soften, Cleveland Fed economist Randal Verbrugge told MNI. (MNI)

POLITICS: Wisconsin Republican Sen. Ron Johnson will win reelection, CNN projects, defeating Mandela Barnes in a race that Democrats saw as one of their best flip opportunities in the midterm elections. (CNN)

POLITICS: Control of the U.S. Senate may once again be decided in Georgia, weeks after Election Day as a tight race between Democratic incumbent Raphael Warnock and Republican challenger Herschel Walker was headed to a Dec. 6 runoff. (RTRS)

POLITICS: President Joe Biden said Wednesday he is eager to work with congressional Republicans after the midterm elections, but stressed he would not compromise on issues like abortion rights and Social Security. (CNBC)

POLITICS: President Joe Biden said he still plans to seek re-election -- and that he’d likely make an official call early next year -- after Democrats staved off worst-case-scenario congressional losses in Tuesday’s midterm elections. (BBG)

OTHER

GLOBAL TRADE: Top U.N. officials will meet a senior Russian delegation in Geneva on Friday to discuss extending a Ukraine Black Sea grain export deal and efforts to smooth shipments of Russian food and fertilizers to global markets, the United Nations said. (RTRS)

U.S./CHINA: U.S. President Joe Biden said on Wednesday that he is not willing to make any fundamental concessions when he meets with Chinese leader Xi Jinping in Asia. (RTRS)

G20: The G20 will struggle to reach an agreement on a final communique at its leaders' summit next week in Indonesia, with sherpas still wrangling over many points including wording on the Ukraine war, a German government official said on Wednesday. (RTRS)

BOJ: Bank of Japan (BOJ) Governor Haruhiko Kuroda said on Thursday any future debate on an exit from ultra-loose monetary policy will centre on the pace of increase in short-term interest rates and adjustments in the bank's massive balance sheet. (RTRS)

JAPAN: The Japanese government won’t ask for restrictions on activity even if infections in the next coronavirus wave exceed the previous one, FNN reports, citing an unidentified official. (BBG)

JAPAN: A majority of Japanese firms plan to focus their capital spending on technology next year, with investment plans largely unaffected by a plunge in the yen, a Reuters monthly poll showed. (RTRS)

JAPAN: Bank of Japan policy may become the most crucial element in deciding the nation’s creditworthiness, S&P Global Ratings said, suggesting the central bank’s action has the potential to trigger its first sovereign credit rating change in years. (BBG)

RBA: The Reserve Bank has defended its aggressive raising of interest rates to curb inflation, but deputy governor Michele Bullock says she has sympathy for people who made financial decisions based on the bank’s repeated claims that interest rates would likely stay at a record low for years. (Sydney Morning Herald)

AUSTRALIA: Queensland residents have been asked to wear masks on public transport and crowded indoor areas as the state’s fourth COVID wave approaches. Premier Annastacia Palaszczuk said health advice suggested the state shift from green to amber under the new traffic-light system launched almost two weeks ago. (Brisbane Times)

RBNZ: The New Zealand central bank's dramatic easing in monetary policy was largely warranted over the COVID-19 pandemic, but with hindsight policy tightening should have occurred earlier in 2021, an internal report released by the bank on Thursday found. (RTRS)

SOUTH KOREA: South Korea will carry out eased lending rules for first-time homebuyers and owners of one home next month as the once-hot housing market appears to be entering a downturn amid rising interest rates, the land ministry said Thursday. (Yonhap)

BRAZIL: A long-awaited report by Brazil's armed forces on the security of the country's electronic voting system did not mention any specific problems with last month's vote, but said there were vulnerabilities in the code that could potentially be exploited. (RTRS)

BRAZIL: Brazil President-elect Luiz Inacio Lula da Silva said he will only start considering cabinet appointments later this month after returning from a trip to Egypt, toning down expectations of imminent announcements about his government’s configuration. (BBG)

RUSSIA: Russian President Vladimir Putin will not attend a gathering of leaders from the Group of 20 (G20) nations in Bali next week, an Indonesian government official told Reuters on Thursday. (RTRS)

RUSSIA: The Biden administration won’t give Ukraine advanced drones despite pleas from Kyiv and a bipartisan group of members of Congress, a reflection of the limit of the kinds of weaponry Washington is willing to provide for Ukraine’s defense. (WSJ)

RUSSIA: U.S. President Joe Biden on Wednesday said he expects U.S. aid to Ukraine to continue without interruption despite skepticism expressed by Republicans who appear poised to take control of the U.S. House of Representatives. (RTRS)

RUSSIA: MSCI said it’ll discontinue all indexes containing only securities classified in Russia effective March 1, 2023 given the extended lack of accessibility in the Russian equity market. (BBG)

ENERGY: The European Union’s executive plans to advance talks on Friday on how to rein in an unprecedented energy crisis and outline a mechanism to contain soaring natural gas prices, a controversial issue that divides member states. (BBG)

CHINA

FISCAL: The Ministry of Finance has front-loaded some of next year’s quota of local government bonds to stimulate investment, which is one month earlier than last year, Securities Daily reported citing local finance departments. (MNI)

PROPERTY: The scope and scale of debt financing support for private property developers is expected to be expanded as the financing environment shows signs of recovery, China Securities Journal reported. (MNI)

FISCAL: The latest directive from China’s Ministry of Finance (MoF) will likely prompt local and regional governments (LRGs) to resort to incremental debt funding, including issuing more special purpose bonds, to tackle a widening funding gap resulting from a significant drop in land concession revenue and a growing need for countercyclical measures to support the economy, says Fitch Ratings. (Fitch)

CORONAVIRUS: Party chief of southwestern Chinese city of Chongqing Chen Min’er said the city’s Covid outbreak situations are “very severe” and Covid controls are the “top priority” for the city. (BBG)

CORONAVIRUS: Leading nucleic acid testing companies face a surge in accounts receivable as financially pressured local governments default on fees payable to testing companies after prolonged periods of testing, Caixin reported. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY2 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY9 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY2 billion after offsetting the maturity of CNY7 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 9:41 am local time from the close of 1.8517% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Wednesday vs 45 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.2422 THURS VS 7.2189 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2422 on Thursday, compared with 7.2189 set on Wednesday.

OVERNIGHT DATA

JAPAN OCT M2 MONEY STOCK +3.1%; MEDIAN +3.2%; SEP +3.3%

JAPAN OCT M3 MONEY STOCK +2.6%; MEDIAN +2.8%; SEP +2.8%

JAPAN OCT, P MACHINE TOOL ORDERS -5.4% Y/Y; SEP +4.3%

JAPAN OCT TOKYO AVG OFFICE VACANCIES 6.44; SEP 6.49

AUSTRALIA NOV CONSUMER INFLATION EXPECTATIONS +6.0% Y/Y; OCT +5.4%

UK OCT RICS HOUSE PRICE BALANCE -2%; MEDIAN +19%; SEP +30%

MARKETS

SNAPSHOT: Mixed Fed Messaging Creeps In, Although Dovish Voice IS Departing

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 272.29 points at 27444.2

- ASX 200 down 35.296 points at 6964

- Shanghai Comp. down 12.175 points at 3035.847

- JGB 10-Yr future up 27 ticks at 149.12, yield down 0.2bp at 0.251%

- Aussie 10-Yr future up 16.0 ticks at 96.280, yield down 15.6bp at 3.709%

- U.S. 10-Yr future up 0-14 at 110-24+, yield down 2.86bp at 4.0637%

- WTI crude down $0.03 at $85.80, Gold up $3.89 at $1710.63

- USD/JPY down 36 pips at Y146.11

- FED'S BARKIN - PRICES MAY FORCE HIGHER RATES PEAK (MNI)

- FED'S KASHKARI - TALK OF PIVOT ‘ENTIRELY PREMATURE’ (MNI)

- CHICAGO FED’S EVANS SAYS IT’S TIME TO SLOW PACE OF RATE HIKES (BBG)

- RUSSIA'S PUTIN WILL NOT ATTEND G20 SUMMIT IN BALI (RTRS)

- BIDEN PLANS TO LAY OUT 'RED LINES,' NOT MAKE CONCESSIONS TO CHINA'S XI (RTRS)

US TSYS: Light Twist Flattening In Pre-CPI Asia Trade

Cash Tsys twist flattened in Asia-Pac hours, running 0.5bp cheaper to 2bp richer across the curve, pivoting around 3s, with 7s outperforming. TYZ2 looked through Wednesday’s high, before backing off to deal +0-12 at 110-22+, 0-03 off the peak of its 0-08 range, on solid volume of ~95K.

- Some idiosyncracies in the Antipodean rates space helped support Tsys overnight.

- Comments from Minneapolis Fed President Kashkari (’23 voter) pushed back against the idea of an impending pivot, suggesting any conflict within the central bank’s dual mandate is some way down the line while underscoring the need to combat inflation.

- This came after a late NY rally in which Tsys richened to fresh session highs, aided by continued liquidity issues and industry contagion worry surrounding one of the major cryptocurrency exchanges and comments from Chicago Fed President Evans (who retires in early ’23), who pointed to the benefits of slowing the pace of rate hikes “as soon as we can.”

- Looking ahead, the latest CPI print presents the key risk event on Thursday (see our full preview of that release here: https://enews.marketnews.com/ct/x/pjJscAaBlO0I6aljJh5yGA~k1zZ8KXr-kA8x6jBU5WlpokPj-kWeg ). CPI data will be supplemented by weekly jobless claims data, 30-Year Tsy supply (which comes in the wake of yesterday’s soft 10-Year auction) and a deluge of Fedspeak.

JGBS: Futures Hold Firm While Long End Bid Reverses & More

The JGB curve has twist steepened today, with the early bid in the long end giving way, probably in light of the extent of the move witnessed since yesterday’s solid round of 30-Year JGB supply.

- That leaves the major benchmarks running 1bp richer to 3.5bp cheaper, with the curve pivoting around 20s.

- 7s outperform on the curve given the bid in futures (after a firm overnight session, alongside a rally in wider core global FI markets), which came back in during the Tokyo afternoon alongside an uptick in wider core FI markets, leaving the contract +25 into the bell.

- Local headline flow has been limited, with BoJ Governor Kuroda providing familiar rhetoric, while comments from some of the major sovereign rating agencies re: Japanese policy settings had no tangible impact on the space.

- PPI data and the latest liquidity enhancement auction for 5- to 15.5-Year JGBs headline the domestic docket on Friday.

AUSSIE BONDS: Firmer On RBA Speak, Wednesday Catch Up & NZGB Bid

ACGBs have continued to squeeze higher into the bell, running 13-16bp richer across the curve. YM & XM both finished +15.0. The 3-/10-Year EFP box pushed wider as 10s pushed wider. Bills were 4-21bp richer across the curve.

- The bid was aided by RBA Deputy Governor Bullock stating the probable need for interest rates “to go up a little bit further” in front of the Senate Economics Legislation Committee, as she highlighted the idea that Bank is getting closer to a level whereby it could pause to assess the tightening implemented.

- Elsewhere, catch up to Wednesday’s bid in U.S. Tsys, some trans-Tasman spill over from the bid in NZGBS and a move in the COVID warning level in the state of Queensland provided upside impetus ahead of Bullock’s comments.

- The COVID situation in China, with tighter COVID restrictions deployed in a couple of districts in the city of Chongqing, would also have been supportive.

- Melbourne Institute inflation expectations data nudged higher in the latest print, but remained shy of their cycle peak.

- The release of the weekly AOFM issuance slate headlines a light domestic docket on Friday, with post-U.S. CPI adjustment set to dominate the early rounds of Friday’s Sydney trade.

NZGBS: Strong Demand At Auctions Helps Early NZGB Bid Extend

NZGBs firmed further as we moved through Thursday’s session, with the major benchmarks running ~15bp richer on the day come the close. Swap spreads were flat to a touch wider.

- The bid in NZGBs was aided by strong demand at the weekly round of NZGB auctions (covering NZGB-25, -32 & -37).

- Terminal OCR pricing in RBNZ dated OIS came in a touch, to print just below 5.30%. at the local close

- A reminder that the RBNZ published the review of its monetary policy settings in the 2017-2022 window. RBNZ chief economist Conway noted that “the current heightened level of inflation could have been lessened at the margin by an earlier tightening in monetary policy in 2021. However, while we are facing some serious economic challenges, the New Zealand economy has weathered the economic storm created by pandemic and war relatively well. Inflation and unemployment are both low compared to the vast majority of OECD countries.” The release is backwards looking in nature, so fails to provide much in the way of meaningful insight into the future of monetary policy.

- A subsequent address by RBNZ Governor Orr went over old ground.

- Looking ahead, Friday’s domestic docket will see the release of food price data and the latest Business NZ manufacturing survey, although early price action is set to be dominated by post-U.S. CPI adjustments.

EQUITIES: Covid Headwinds Continue To Weigh on China/HK Indices

Most regional markets are lower, following the negative lead from US markets overnight. Losses have mostly been in the -1% to -2% range. A modestly firmer tone to US futures hasn't provided much of an offset, although gains are fairly limited (+0.20+ 0.30%) ahead of the all important US CPI print tonight. Stress in the crypto space will be the other watch point, with Bitcoin up +3.2% so far today, but this follows a 25.5% drop in the previous 2 sessions.

- China's domestic covid news has generally been negative. Total daily case numbers have continued to climb, near 8.5k, versus 7.7k reported yesterday. Two districts in the Chongqing region also tightened covid related restrictions further.

- The CSI 300 is off by around 1% at this stage, while the Shanghai Composite is down 0.50%. The property sub-index continues to recovery, up a further 0.50%, building on yesterday's +2% rise, which came on the back of additional funding support for the sector.

- The HSI is off close to 1.90%, with Alibaba weighing. Citi reported that Singles Day sales spending is likely to be soft given China's weaker macro backdrop (per Bloomberg reports). Note also the Golden Dragon Index fell 6.65% overnight.

- The rebound in the Kospi has stalled, the index off 0.70%, with offshore investors unloading -$176mn shares so far today. The Taiex is also down 1%, while the Nikkei 225 is down a little over 1%. Broader tech indices weakened overnight, weighing on sentiment in the space today.

OIL: Range Trading As Tentative Signs Of Market Easing

Oil appears to be in a holding pattern ahead of US data after falling overnight with the deterioration in risk appetite. Both WTI and Brent are currently very close to yesterday’s close around $85.80/bbl and $92.70. They have been in a tight range during the session awaiting US CPI to be released later.

- The EIA reported a larger-than-expected 3.925mn build in crude inventories in the US in the latest week, its highest level since July 2021, after a 3.115mn drawdown the previous week. Importantly, production rose 200 kbd, tentatively suggesting a slight easing of supply conditions. But gasoline stocks fell 900k and distillate fell 500k barrels.

- Further Covid restrictions in the manufacturing centre of Guangzhou in China darkened the oil demand outlook.

- The WTI prompt spread has narrowed since the start of the month suggesting some easing of supply conditions.

GOLD: Consolidates Above $1700 Ahead US CPI

Gold continues to consolidate above $1700, the precious metal last just above $1709, +0.15% for the session. This is line with a softer USD backdrop, with the DXY off close to 0.30% for the session.

- Trading ranges haven't gone much beyond $1700-$1720 since Tuesday's surge higher during the US session. Dips towards the $1700 level are still supported, but upside moves above $1715 can't be sustained.

- The simple 100-day MA comes in at $1715.17, which could be acting as a resistance point.

- Focus tonight will be firmly on the US CPI print. The recent bounce in gold has outperformed US real yields but is following broader USD trends fairly closely.

FOREX: China's COVID-19 Situation Weighs On Risk, Greenback Slips Ahead Of U.S. CPI

Risk sentiment soured as a worsening COVID-19 outbreak in China's manufacturing hub of Guangzhou resulted in tighter curbs across the country, dampening hopes for a sooner re-opening. Against this backdrop, participants were wary of taking more risk ahead of the release of U.S. CPI data, today's key risk event.

- Fed's Kashkari said that the Fed would do what's needed to bring inflation under control but "monetary policy acts with a lag." Today's CPI data has the potential to move the needle on Fed outlook, with analysts in a Bloomberg survey expecting headline consumer inflation to have eased to +7.9% Y/Y in October from +8.2% prior.

- The BBDXY index ground lower, giving back some of yesterday's gains. The index has now shed 0.35% from the previous day's peak and is testing session lows at typing, with U.S. Tsy yields sitting slightly lower across the curve.

- The Antipodeans went offered amid cautious mood even as USD/CNH retreated on the back of broader dollar weakness. RBA Dep Gov Bullock said that interest rates need to go up a "little bit" further but are close to the level where the Board could take time to evaluate the impact.

- USD/JPY faltered thanks to lower U.S. Tsy yields, with the latest set of comments from BoJ Gov Kuroda offering little new. The official underscored the need for continued deployment of ultra-loose monetary policy, adding that one-sided, rapid yen decline has paused for now.

- Sterling outperformed in G10 FX space, with the cable returning above the $1.1400 mark. The broader European FX bloc was generally firmer, with SEK lagging regional peers.

- Apart from U.S. inflation figures, today's data highlights include U.S. jobless claims & Norwegian CPI. There is plenty of central bank inbound, from Fed, ECB & BoE officials.

FX OPTIONS: Expiries for Nov10 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.3bln), $0.9800(E1.7bln), $0.9860-75(E1.2bln), $0.9900(E1.3bln), $0.9950-55(E1.1bln), $0.9990-00(E2.5bln), $1.0050-70(E968mln), $1.0090-00(E1.7bln)

- USD/JPY: Y144.30-50($1.1bln), Y145.00($1.0bln), Y146.00-05($665mln), Y147.00($1.3bln), Y150.00($1.9bln)

- GBP/USD: $1.1225-30(Gbp586mln), $1.1450(Gbp787mln), $1.1600(Gbp969mln)

- EUR/GBP: Gbp0.8790-00(E620mln)

- AUD/USD: $0.6500(A$651mln)

- USD/CNY: Cny7.1500($3.0bln), Cny7.2000($2.0bln), Cny7.2700($6.5bln), Cny7.2820($4.5bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/11/2022 | 0700/0200 |  | US | Fed Governor Christopher Waller | |

| 10/11/2022 | 0700/0800 | * |  | NO | CPI Norway |

| 10/11/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 10/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/11/2022 | - |  | UK | House of Commons Recess Starts | |

| 10/11/2022 | 1300/1400 |  | EU | ECB Schnabel Discussion at at Bank of Slovenia | |

| 10/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/11/2022 | 1330/0830 | *** |  | US | CPI |

| 10/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 10/11/2022 | 1435/0935 |  | US | Dallas Fed's Lorie Logan | |

| 10/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/11/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 10/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/11/2022 | 1650/1150 |  | CA | BOC Gov Macklem speech, "The evolution of Canadian labour markets" | |

| 10/11/2022 | 1730/1230 |  | US | Fed Governor Loretta Mester | |

| 10/11/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/11/2022 | 1830/1330 |  | US | Kansas City Fed's Esther George | |

| 10/11/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/11/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 10/11/2022 | 2335/1835 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.